|

Newsletter

Seminar Material

Biz:

China

Hong

Kong Hawaii

What people

said about us

China

Earthquake Relief

Tax &

Government

Hawaii Voter Registration

Biz-Video

Biz-Video

Hawaii's

China Connection Hawaii's

China Connection

CDP#1780962

CDP#1780962

Doing Business in

Hong Kong & China

Doing Business in

Hong Kong & China

| |

Biz Opportunities - Hong Kong

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our

event page to find out more!

Wine-Biz - Hong

Kong Wine-Biz - Hong

Kong

Brand Hong Kong

Video

Brand Hong Kong

Video

Major

Exhibitions & Conferences in Hong Kong

Basic Law of Hong Kong SAR Guaranteed One Country Two System for 50 Years

HK Leaders & Basic Law

HK Leaders & Basic Law

Top China's Students Attend HK Universities

Top China's Students Attend HK Universities

HK School of Creative Media,

Entertainment & Tech Industries

HK School of Creative Media,

Entertainment & Tech Industries

1997

Hong Kong Handover to China - Flag Ceremony Video 1997

Hong Kong Handover to China - Flag Ceremony Video

Hong

Kong 10 Years History Slide Show (1997 - 2007) Hong

Kong 10 Years History Slide Show (1997 - 2007)

HK

10 Years - Economy (1997 - 2007) HK

10 Years - Economy (1997 - 2007)

HK

10 Years - Life (1997-2007) HK

10 Years - Life (1997-2007)

Lan

Kwai Fong tops HK nightlife Lan

Kwai Fong tops HK nightlife

Mission

successful: PLA Garrison in HK Mission

successful: PLA Garrison in HK

HK

10 Years - Safety (1997 - 2007) HK

10 Years - Safety (1997 - 2007)

HK

10 Years - Fashion (1997 - 2007) HK

10 Years - Fashion (1997 - 2007)

Horse

racing remains most popular sports in HK Horse

racing remains most popular sports in HK

HK

10 Years - Stars (1997 - 2007) HK

10 Years - Stars (1997 - 2007)

HK

10 Year - Donald Tsang (1997 - 2007) HK

10 Year - Donald Tsang (1997 - 2007)

HK

economy looking forward to better future HK

economy looking forward to better future

Born

on the 1st of July, growing with the HKSAR - The little

girl Leung Sum Mui was born right on July the first, 1997. Born

on the 1st of July, growing with the HKSAR - The little

girl Leung Sum Mui was born right on July the first, 1997.

Hong

Kong Handover - Jiang Zemin's speech June 30 1997 Hong

Kong Handover - Jiang Zemin's speech June 30 1997

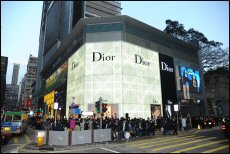

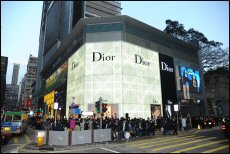

Dining

and shopping paradise for travelers Dining

and shopping paradise for travelers

HK

Businessmen in Beijing HK

Businessmen in Beijing

Prince

Charles and former Hong Kong Governor Christopher Francis Patten leave HK after

the handover ceremony in 1997 Prince

Charles and former Hong Kong Governor Christopher Francis Patten leave HK after

the handover ceremony in 1997

|

|

Listen to MP3 “Business

Beyond the Reef” to discuss the problems with imports from China, telling

all sides of the story and then expand the discussion to revitalizing

Chinatown -

Special Guest:

Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii Chamber of

Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading |

http://www.directory.gov.hk/

http://www.directory.gov.hk/

Hong Kong

Businesses Achieves before 2008 Share

2009 - 2010

Mainland and Hong

Kong Closer Economic Partnership Arrangement (CEPA)

http://www.tid.gov.hk/english/cepa/index.html

Mainland and Hong

Kong Closer Economic Partnership Arrangement (CEPA)

http://www.tid.gov.hk/english/cepa/index.html

AmCham Shanghai launches latest Viewpoint - U.S. Export

Competitiveness in China - on the 2010 Washington, D.C. Doorknock - Please

download report in PDF format:

http://www.hkchcc.org/viewpointusexport.pdf

AmCham Shanghai launches latest Viewpoint - U.S. Export

Competitiveness in China - on the 2010 Washington, D.C. Doorknock - Please

download report in PDF format:

http://www.hkchcc.org/viewpointusexport.pdf

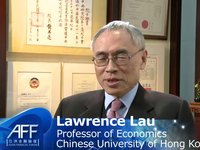

Hong Kong - China's Global Financial Center

Sundeep Bhandari, Managing Director, Regional Head, Global Markets North East Asia and Co-Head Wholesale Banking, Standard Chartered Bank. Sundeep Bhandari, Managing Director, Regional Head, Global Markets North East Asia and Co-Head Wholesale Banking, Standard Chartered Bank.

Simon Galpin, Director-General, InvestHK Simon Galpin, Director-General, InvestHK

Victor L.L. Chu, Chairman, First Eastern Investment Group Mr. Chu is Chairman of First Eastern Investment Group, a leading Hong Kong-based direct investment firm and a pioneer of private equity investments in China. He is also Chairman of First Eastern Investment Bank Limited in Dubai and Evolution Securities China Limited in London. Mr. Chu is a main board member of Zurich Insurance. Mr. Chu has served as Director and Council Member of the Hong Kong Stock Exchange, Member of the Hong Kong Takeovers and Mergers Panel, Advisory Committee Member of the Securities and Futures Commission, and part-time member of Hong Kong Government's Central Policy Unit. He is currently a Foundation Board Member of the World Economic Forum and co-chairs the Forum's International Business Council. He is also Chairman of the Paris-based ICC Commission on Financial Services and Insurance. Victor L.L. Chu, Chairman, First Eastern Investment Group Mr. Chu is Chairman of First Eastern Investment Group, a leading Hong Kong-based direct investment firm and a pioneer of private equity investments in China. He is also Chairman of First Eastern Investment Bank Limited in Dubai and Evolution Securities China Limited in London. Mr. Chu is a main board member of Zurich Insurance. Mr. Chu has served as Director and Council Member of the Hong Kong Stock Exchange, Member of the Hong Kong Takeovers and Mergers Panel, Advisory Committee Member of the Securities and Futures Commission, and part-time member of Hong Kong Government's Central Policy Unit. He is currently a Foundation Board Member of the World Economic Forum and co-chairs the Forum's International Business Council. He is also Chairman of the Paris-based ICC Commission on Financial Services and Insurance.

Professor K C Chan, Secretary for Financial Services and the Treasury Government of the Hong Kong SAR (HKSARG) Professor K C Chan is the Secretary for Financial Services and the Treasury, the Government of the Hong Kong Special Administrative Region. Before assuming the post, he was Dean of Business and Management of the Hong Kong University of Science and Technology (HKUST). Prior to joining the HKUST Business School in 1993, he spent nine years teaching at Ohio State University. He received his bachelor's degree in economics from Wesleyan University and both his M.B.A. and Ph.D. in finance from the University of Chicago. He specializes in assets pricing, evaluation of trading strategies and market efficiency and has published numerous articles on these topics. Professor K C Chan, Secretary for Financial Services and the Treasury Government of the Hong Kong SAR (HKSARG) Professor K C Chan is the Secretary for Financial Services and the Treasury, the Government of the Hong Kong Special Administrative Region. Before assuming the post, he was Dean of Business and Management of the Hong Kong University of Science and Technology (HKUST). Prior to joining the HKUST Business School in 1993, he spent nine years teaching at Ohio State University. He received his bachelor's degree in economics from Wesleyan University and both his M.B.A. and Ph.D. in finance from the University of Chicago. He specializes in assets pricing, evaluation of trading strategies and market efficiency and has published numerous articles on these topics.

Hong Kong Budget 2011 Hong Kong Financial Secretary John Tsang will dish out nearly HK$44 billion (US$5.6 billion) to taxpayers

from Surplus

HK$6,000 will be given to each holder of a valid Hong Kong Permanent Identity Card HK$6,000 will be given to each holder of a valid Hong Kong Permanent Identity Card

Hong Kong Business Name Search

香港政府公司註冊處綜合資訊系統

(ICRIS) 的網上查冊中心可以英文或中文進行聯線查冊,客戶可查閱由公司註冊處處長登記和備存的公司現況資料,以及文件的影像紀錄。

The Hong Kong Government Cyber Search Centre of the Integrated Companies Registry Information System

(ICRIS) enables you to conduct searches online in either English or Chinese on the current data of registered companies and the image records of documents registered and kept by the Registrar of Companies. Hong

Kong Company Registery - HKSAR Government HK Trademark Registration HK Trademark Online Search

Hong Kong http://en.wikipedia.org/wiki/Hong_Kong Hong Kong http://en.wikipedia.org/wiki/Hong_Kong

November

18 2011

Share

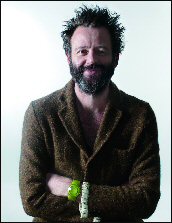

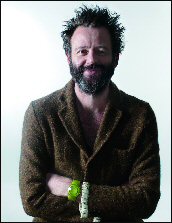

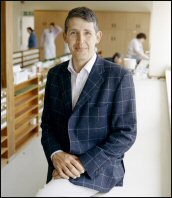

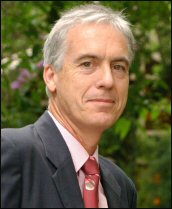

Culture Builder - Michael Lynch: Hong Kong's $3 billion (US$387 million) champion of arts

After a distinguished career in arts administration, serving as Chief Executive of the Sydney Opera House from 1998 to 2002, then leading the rejuvenation of London’s Southbank Centre as Chief Executive from 2002 to 2009, Michael Lynch was contemplating a quieter life. That was until he was approached to head Hong Kong’s West Kowloon Cultural District (WKCD) project. It was a challenge the Australian, who has been awarded both an Order of Australia and Commander of the British Empire for his services to the arts, found too tempting to refuse.

You’ve had high-profile jobs before, in London and Australia. Why were you keen to take on the WKCD project?

I’d gone back to Australia in 2009, after seven years in the UK and had been contemplating retirement when I was approached by the West Kowloon Cultural Authority. The job seemed too exciting to resist. I realised that WKCD would make a special place in the world as a state-of-the-art cultural landmark. And it’s in Hong Kong – with its centrality to Asia, and all the extraordinary things that are happening here in connection with China. I’d be an idiot if I didn’t do it.

How would you describe the importance of this project for Hong Kong?

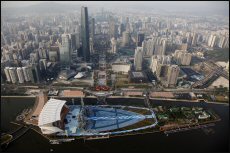

It’s unbelievably important. The project comprises a 23-hectare city park, 15 performing arts venues, a museum, exhibition centre, piazza areas and commercial and residential developments along the waterfront of Victoria Harbour, with the first stage to be completed by 2015. It will provide a real opportunity for Hong Kong to do something within a concentrated period of time that will have positive consequences.

What about on the global scale?

WKCD will redefine the perception of Hong Kong in terms of the rest of the world. It will showcase Hong Kong as not only being an international financial centre, with great shopping and dining, but also sophistication. Its venues will give exposure to artists and arts from Hong Kong and around the world, and become a vibrant and different part of the city’s tourist offer. This project is fantastic artistically, culturally and creatively. It will focus more attention on Hong Kong as one of the great cities of the world.

What do you think of the talent that exists in Hong Kong?

Hong Kong is a dynamic place, with fantastic things happening in it, but one thing people used to say was that it was a bit of a cultural desert. Not true. Where Hong Kong now sits in the visual arts world is very exciting. We’ve got the Hong Kong Art Fair, the Gagosian Gallery, White Cube and more big, successful shows presented here than people give Hong Kong credit for. I’ve met a lot of creative people and artists working in the city, including many who have come back to Hong Kong after distinguishing themselves in other parts of the world.

But Hong Kong is still emerging in this area.

There is a lot happening, and it is really important that this project is realised. In the visual arts world, there is some real progress to be made. We hope that M+ [West Kowloon's art museum] will be an internationally competitive institution. Some existing venues do need attention. But we are creating state-of-the-art venues across all areas of creativity and expect this will be a catalyst for change in Hong Kong, and help to build confidence in the city.

Having been appointed as WKCD Chief Executive Officer in July, you’re now approaching your first 100 days. Does one key achievement stand out?

I believe there is a tangible shift in public perception of this project. It is going to happen. The dreams and aspirations of the people who have been working on it are going to be

realized. I notice increasing support from the community. We have a good opportunity to get the plan in by end of this year, gain approval by 2012, and start digging by 2013. It’s a big vision, and we need to make sure we can encompass the sale of the dream to meet public expectations.

I am energized by Hong Kong and excited by the opportunities WKCD provides, in terms of what we are able to do for Hong Kong itself and, more broadly, in the region and internationally. For a man who was contemplating retirement, this is incredibly exciting.

November

17 2011

Share

Writing the wrongs - Former lawmaker and international businessman Paul Cheng Ming-fun feels China is misunderstood by the US and hopes to dispels many myths with his new book

By Gary Cheung

Paul Cheng was a lawmaker (top right) and Chamber of Commerce chairman (bottom right).

Why would a 75-year-old businessman spend 20 months of his retirement writing a book on a sweeping topic like the relationship between China and the West?

Paul Cheng Ming-fun, a former Legco member and ex-head of the Hong Kong General Chamber of Commerce, who attended college in the United States and worked for US companies for more than two decades, felt it was his mission to explain his native country to Americans.

"Citizens of the West, particularly in the United States, need to know more about China, which is a rising power," he said. "In fact, even what they think they know may be fuelled by misconceptions and misunderstanding. I hope my book can help clear up misunderstandings about China held by some Americans."

That book, On Equal Terms: Redefining China's Relationship with America and the West, was published this week by John Wiley & Sons (Asia), the American publisher's Singapore-based subsidiary.

Cheng, who published the book under his pinyin name in Putonghua, Zheng Mingxun, says his background makes him an ideal interpreter between the two worlds.

"Having worked for major American multinationals in the US and Asia, I have lived with a foot in both worlds," he said. "I have many friends from the United States and get along with them very well. The tension between the US and China stems from US politics, not its people."

In his book, Cheng disputes some beliefs widely held in the West, for example that the US lost jobs and suffered a huge trade imbalance because American companies relocated production to China.

According to Cheng, most products exported from China are manufactured using materials from around the world; they are assembled in China and then shipped to markets in the West.

"America's trade deficit is with many countries around the world, not just China," he writes. "In fact, the value added in China is marginal; it is not nearly as significant a part of the overall GDP as some may think.

"Consider a product that sells for US$100 in the United States; I would calculate that no more than 10 per cent of that would be likely to stay in China - representing labour for assembling the product - while perhaps another 10 per cent would represent materials imported from various parts of the world."

He says "assembled in China", rather than "made in China", would better describe the products that many Americans find it difficult to do without in their daily lives. "China tends to be merely the final stop in many a multinational's vast global production network," he says. "The most inexpensive link in this chain takes place in southern China, where workers are typically paid less than a dollar an hour to do the soldering, assembling and packaging. If they didn't do it, would it create jobs in the United States?"

Surprisingly, perhaps, for a man who feels so warmly toward America, Cheng offers a vigorous defence of China's one-party rule.

He takes issue with the many Western thinkers who believe every country should adopt a democratic political system, regardless of the nation's history, saying China should not be judged solely on Western values and standards.

In his book, he states: "When the financial crisis first surfaced in the US a few years ago, party politics got in the way of decisions and made that government slow to react. Imagine, a nation such as China with more than a billion people speaking what amount to different languages and living in widely varying circumstances around the country. A proliferation of political parties would result in total chaos nationwide."

But Cheng does see room for subtle change in China, such as allowing more freedom of speech. "Compared with what I witnessed during my visit to China in 1972 - the first after I left the mainland in the late 1940s - the degree of freedom of expression in recent years is much better. You can't expect China to turn into full democracy overnight," he said.

Cheng believes the Chinese government should be more statesmanlike when responding to perceived international provocation as this would help improve Western perceptions of China.

Cheng was born in 1936 in Gulangyu , an island off Xiamen in Fujian . After the Japanese army invaded China the following year, his grandfather took the entire family to Hong Kong.

Cheng was sent to Tianjin after the second world war to attend primary school before returning to Hong Kong to attend high school. He studied at Lake Forest College, a liberal arts institution north of Chicago, in the mid-1950s, then went on to work with US multinationals in New York, Singapore, Bangkok and Hong Kong.

In 1987 he joined Inchcape Pacific, a long-standing British trading company, as an executive director and in 1992 became its chairman. He served as a member of the Legislative Council from 1988 to 1991 and from 1995 to 1998 and was chairman of the Hong Kong General Chamber of Commerce in the intervening years from 1992 to 1994.

In 2005, he was appointed chairman of The Link Management, which operates a listed portfolio of shopping malls and car parks it took over from the Housing Authority. He resigned in January 2007 in protest over actions by the Children's Investment Fund Management of Britain, then the largest investor in The Link, pressuring management to kick out small tenants in favour of large chain stores to obtain higher rents.

Today Cheng is deputy chairman of fashion company Esprit Holdings (SEHK: 0330) and active in a private-equity fund business. He is also co-chair of the foundation board of the East-West Centre, a Honolulu research organisation that promotes relationships between Asia and the US.

Despite the countless articles and books describing the shift of power from West to East and proclaiming that the 21st century belongs to China, Cheng is sceptical.

"Being as familiar as I am with America, I would not write off that country just yet, he said. "All one has to do is attend a National Football League game or college football game to feel the spirit. The American dream is still very much alive, but it is politics that appears to be in the way.

"China is not a military threat [to the US]. It is a tough economic competitor, yes, but Americans are also born competitors."

Cheng said China and the US could join hands to form a dream team for the interests of future generations. In 2010, the US was estimated to have spent US$636 billion on defence, more than eight times China's US$78 billion expenditure.

"Imagine, if the US and China took the lead and rallied other countries to join them in cutting defence spending," he writes. "These funds could be used to address poverty, starvation, disease and climate change - all issues we must address for the sake of future generations."

So does he think his 20 months of hard toil paid off?

"Some of my US friends agreed after reading my book that we [US and China] may not agree on everything, but it's good to have a more balanced view," he said.

November

11 2011

Share

Hong Kong is offering business

opportunities to Hawaii and the United States ("Hong Kong Reception" at the

APEC 2011 - 5:30 pm - 7:00 pm at Hilton Waikiki on KUHIO (2500 Kuhio

Ave., Waikiki Beach) - Mr.

Gregory So -Secretary for Commerce and Economic Development and Hong Kong CE

Donald Tsang

Hong Kong Chief Executive Donald Tsang has asked the US to grant visa-free access to Hong Kong SAR passport holders.

Hong Kong CE

Donald Tsang Propose VISA FREE for HK Passport Holders http://vimeo.com/32082553 Hong Kong CE

Donald Tsang Propose VISA FREE for HK Passport Holders http://vimeo.com/32082553

Rounding up his US trip in Hawaii on November 13, Mr Tsang said he made the suggestion to US Secretary of State Hillary Clinton, who reacted positively, however, no timetable has been agreed so far.

He has also talked about the possibility of abolishing double taxation for Hong Kong-US businesses.

Meanwhile, also at the Asia-Pacific Economic Co-operation meeting, Mr Tsang met with New Zealand Deputy Prime Minister Bill English to discuss the progress of the country's free-trade agreement signed with Hong Kong last year, and the memorandum on education co-operation.

At Mr Tsang's meeting with Chilean President Sebastian Pinera, both sides agreed to enter a free trade agreement to be signed early next year.

Hong Kong Reception Video http://vimeo.com/32022331 Hong Kong Reception Video http://vimeo.com/32022331

Hong Kong Reception Video - HK Commerce Secretary Gregory So http://vimeo.com/32083195 Hong Kong Reception Video - HK Commerce Secretary Gregory So http://vimeo.com/32083195

Overseas promotion: Secretary for Commerce

& Economic Development Gregory So (left) hosts a reception for Hong Kong

executives and local leaders in Honolulu.

The Secretary for Commerce and Economic

Development, Mr Gregory So speaks at a reception hosted for Hong Kong business

heavyweights and local leaders in Honolulu, Hawaii today (November 11, Honolulu

time). The Chief Executive, Mr Donald Tsang (centre) joins Mr So (second left)

in proposing a toast. Also joining the toasting ceremony are the Under Secretary

for Security, Mr Lai Tung-kwok (second right); Commissioner for Economic and

Trade Affairs, USA, Mr Donald Tong (first right); and Director of the Hong Kong

Economic and Trade Office, San Francisco, Mr Jeff Leung (first left).

November

10 2011

Share

Hong Kong's economy helps create jobs in US: HK Chief Executive Donald Tsang

Hong Kong leader Donald Tsang said the city's financial sector has helped the United States' recovery and created jobs in the largest economy in the world.

Tsang, who is the chief executive of Hong Kong, said on Wednesday that the city's "irreplaceable" role in China's economic reform provided "an additional monetary resource that will help address some of the imbalances that have surfaced here in the US and more lately in Europe".

"We have been given a spearhead role in the internationalization of the renminbi, which in turn will help our country to continue with the reforms and opening-up of its banking and financial services sectors," Tsang said, who had visited New York City and Boston during a recent trip to the US.

The special administration region's top leader said Hong Kong will serve as a "gateway" to improve Sino-US trade. He added that Hong Kong has an expanded economic role in China's 12th Five-Year Plan (2011-2015) with the goal of becoming an international asset management and an offshore renminbi business center.

Tsang said Hong Kong will continue to be the global center of finance and banking, logistics, business services and tourism, which in turn will benefit the city's US partners investing in the metropolis.

The US is Hong Kong's second-largest trading partner and a major investor in the city's economy.

"The Hong Kong dollar maintains its linked exchange rate to the US dollar, as it has done since 1983. We have a long-standing, strong and broad-based relationship, and it is one that I believe will continue to grow," Tsang said.

US exported $27 billion in goods to Hong Kong last year, creating the largest US trade surplus with any single partner that year. There are currently 1,330 US companies based in Hong Kong, of which 840 are regional operations. The number of US companies based in Hong Kong over the past decade has increased 65 percent from 2001.

More than 50,000 American citizens live in Hong Kong and tens of thousands of Hong Kong residents have studied in the US, Tsang said.

"Hong Kong has a pivotal role to play in the future China-US relations," said Martin Indyk at the Brookings Institution, which co-hosted Tsang's visit to Washington.

Donald Tsang will head to Honolulu, Hawaii, to attend the Asia-Pacific Economic Cooperation summit from Nov 11-13.

October

26 2011

Share

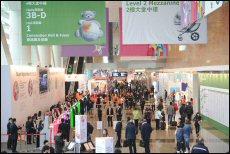

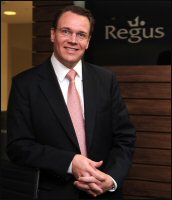

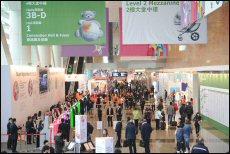

MICE in the Big Cheese in Hong Kong

It’s the height of trade fair season, but the flurry of business activity in Hong Kong right now is no flash in the pan. As the pendulum of international business swings East, savvy operators know that Hong Kong is the place where deals are done.

Hong Kong Tourism Board (HKTB) figures show that meetings, incentives, conventions and exhibitions (MICE) arrivals to Hong Kong reached 725,779 in the first six months of 2011, a year-on-year increase of 10.3 per cent.

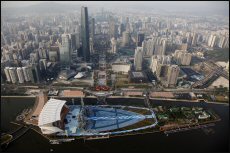

HKCEC, located in Hong Kong’s central business district, ended its fiscal year 2010-2011 with record attendance

Trade fair attendances reflect that. The Hong Kong Convention and Exhibition Centre (HKCEC) drew almost six million trade visitors in the fiscal year 2010-2011 – a record number, and a surge of 25 per cent over the previous year. Many fairs expanded – some by as much as 83 per cent – and new ones debuted.

Cliff Wallace, Managing Director, Hong Kong Convention and Exhibition Centre (Management) Ltd (HML), described these results as “a remarkable achievement.”

“Over its 23 years of operation, the HML team has hosted 39,606 events and has collectively served about 70 million buyers, exhibitors, visitors and guests. These events have contributed significant economic benefits to Hong Kong by generating beneficial spin-offs for related industries, created numerous jobs and business opportunities for SMEs, and raised Hong Kong’s international image and reputation,” Mr Wallace said.

Economic Fillip

Allen Ha, CEO of AsiaWorld-Expo Management (left) and Thomas Stanley, Partner (Transactions & Restructuring), KPMG Transaction Advisory Services, announce the results of a study on the venue’s economic benefits to Hong Kong

The economic benefits of trade fairs are quantified in a new Economic Contribution Assessment Report by professional services firm KPMG Transaction Advisory Services for AsiaWorld-Expo. It reveals that exhibition and conference events held at AsiaWorld-Expo alone contributed about HK$13.4 billion to the local economy in 2010 – a 25 per cent increase over 2009.

The report found this economic fillip generated more than 26,000 full-time jobs, not only in the MICE industry, but across many supporting sectors, including retail, hotel and leisure, food and beverage, stand design and construction, and logistics and freight forwarding.

Allen Ha, CEO, AsiaWorld-Expo Management Ltd, said that particularly noteworthy in the KPMG report is the finding that Chinese mainland exhibition visitors typically have among the highest per-visit spend of all regions (US$2,154), about 110 per cent of the average in 2010.

A growing number of overnight international exhibition visitors to Hong Kong are from the mainland, where the economy continues to grow and local buyers are increasingly seeking to source from abroad. Latest HKTB data shows 42.8 per cent of MICE arrivals this year came from the mainland, a 15 per cent jump on last year.

Exhibit and They Will Come

Hong Kong Electronics Fair, the world's biggest electronics event, held at the HKCEC in October, drew a record number of buyers

HKTB Executive Director Anthony Lau expects overnight MICE arrivals will continue to grow in the second half of this year. He said one of the factors fostering this upward trend is the staging of some large-scale conventions and exhibitions, including the recent 2011 Asian Seafood Exposition (held at HKCEC in September), and the upcoming SIGGRAPH Conference and Exhibition on Computer Graphics and Interactive Techniques in Asia, which is expected to draw several thousand participants in December.

“In addition, sustained growth of the mainland economy and exchange rates favourable to major currencies against the Hong Kong dollar are going to bring more meetings and incentive travel activities to Hong Kong, especially from the mainland and other short-haul markets,” Mr Lau said.

Dean Winter, General Manager of Swire’s Upper House and EAST hotels

He added that, through various channels, the MEHK (Meetings and Exhibitions Hong Kong) Office of the HKTB will continue actively attracting more MICE events and activities to the city and providing customised support to event organisers.

Hotels are clearly benefiting from this trend, with high occupancy the talk of the town. Dean Winter, General Manager of Swire Hotels’ Upper House hotel at Pacific Place, Admiralty, and EAST in Quarry Bay, said last year had been “phenomenal” for business, and that this year was proving even better.

“Our timing was very good,” he said. “Coming out of the global recession, we benefited from substantial changes in sentiment.”

Arriving from All Corners

Simon Yip, Regional Director of Marketing, The Peninsula Hong Kong

With his two hotels targeting different market sectors, Mr Winter has noticed that both corporate travellers and entrepreneurs are coming to Hong Kong to do business. “Hong Kong being so regionally well-placed draws short-haul travellers here to hold meetings. Long-haul corporate travellers are transiting through Hong Kong on their way to establish offices in premier Chinese cities, or to look for potential production partners in the second-tier cities. It’s clear that Hong Kong is still very much the gateway to China.”

A trend among overseas entrepreneurs looking to start up in Hong Kong is also apparent in the current economy, Mr Winter added. “Hong Kong’s location and its links to China offer them many benefits.”

Mr. Winter said it’s not just Swire hotels that have had a great couple of years in Hong Kong. “All our competitors are saying so, too.”

Simon Yip, Regional Director of Marketing-China, at The Peninsula Hong Kong agreed. “China attracts many business travellers to this part of the world as one of the few strong performers in the current global economic environment. As a key gateway to China, Hong Kong also benefits from its proximity to this growing market. As a result, many hotels in Hong Kong benefit when there are trade fairs, especially the China sourcing fairs, in town.”

October

23 2011

Share

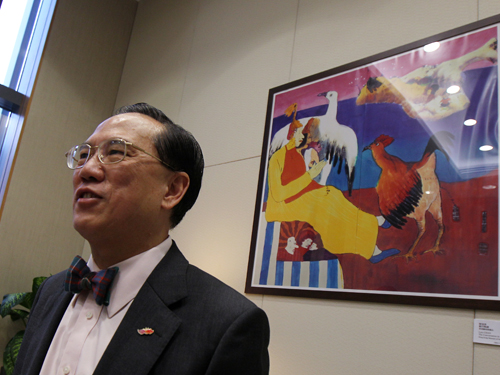

Agony and the ecstasy - Donald Tsang says he has had a tough time navigating the politics of office while striving to achieve his goals, but as his term winds down, he savours two achievements that gave him moments of bliss

By Gary Cheung

Former Singaporean prime minister Lee Kuan Yew once mused that being Hong Kong's chief executive was a "thankless job".

If that's true, Donald Tsang Yam-kuen should be thankful for any moment of satisfaction.

The veteran civil servant-turned-politician says that he has had two such moments - both when major policy initiatives were passed by the legislature.

With barely eight months left as chief executive, Tsang insists he has accomplished almost everything he set out to do. A man known for taking pains with details, he said he had delivered most of his pledges since his re-election in 2007.

"If you count it carefully, there were 173 pledges made, and so far I have delivered 169 of them."

One yet to be fulfilled is cutting the profits tax to 15 per cent, a tax break he now considers inappropriate when another global recession looks possible.

His biggest achievements?

"I have felt moments of bliss. I felt nearly heavenly on two occasions, if I may say so," he said in an interview this week. "One was when the Legislative Council eventually passed the legislation on the electoral arrangement for 2012. The second was when it passed the law on a statutory minimum wage. For me, they were some of the high moments of this term."

Despite growing doubts about the governance of his administration after a series of embarrassing U-turns, Tsang vigorously rejected criticism that the government had trouble governing effectively.

"While any governmental process with democracy and openness will have to face the sort of difficulties we do here, I would challenge you to the end regarding the effectiveness of this government to govern.

"In terms of the delivery of services to the public, in terms of managing all the things we have to manage, I think perhaps it is one of the most effective governments on earth.

"With a very highly democratic system in America, or in the United Kingdom, they have difficulties pushing through government policy. It is equally or more difficult with ourselves.

"Look at the sort of things what President Barack Obama is facing, or the problem the UK government is facing, what the heads of most of the governments in Europe are facing in implementing the policies - you have got riots in the street and so on. Are you saying all these are very effective governments?"

In one of his first interviews since moving into his new office in Tamar, Admiralty, the chief executive agreed there was a need for a political alliance to secure stable support for government policies.

"I think for delivery of policies, you need an alliance - a political alliance. For us, it is very difficult," he said. "The chief executive is not a member of a political party and we have a system following the presidential system. We have a direct separation of legislature and the executive. So we always have this tension between the two.

"In the US it's demonstrated in the party system of the Democratic Party and the Republican Party, so at least you can ensure you have a certain amount of support for the policies you put through. The problem we have is when we formulate a policy it must be a very popular policy which will have the majority support from the people. Then the policy is put to the Legco in terms of a law or a proposal for resources with a lot of public backing. Otherwise we are in trouble."

As a way to stabilise support for government initiatives, veteran politicians Allen Lee Peng-fei and Chung Sze-yuen have suggested forming coalition governments consisting of politicians from pro-government and pan-democratic parties.

Currently, representatives of the Democratic Alliance for the Betterment and Progress of Hong Kong and the Federation of Trade Unions have seats in the Executive Council. But some non-official Exco members have raised concerns about a lack of input in the early stages of policy formulation.

The administration was forced into making U-turns when both the budget and the bill to scrap Legco by-elections were threatened by some government-friendly legislators.

Tsang defended the government's controversial decision in March to give HK$6,000 to all adult permanent residents by saying the administration had no better way of dealing with the surplus after its original proposal to inject money into people's Mandatory Provident Fund accounts came under heavy criticism.

"You can see how this is being embraced. People are lining up to register for the HK$6,000," he said.

The chief executive recognises the challenges posed by vocal minorities.

"If a policy can receive 70 per cent support it will be a marvellous policy," Tsang said. "But that means you have 30 per cent opposition and that is translated to over two million people. And some of them may have their own way of coming out with a very, very strong voice against it.

"So we have to accept that this is part of the problem of politics, but I agree with you that we have to think hard in the future.

"Political alliances will have to be made, otherwise things will get bogged down - not because of lack of reasons, not because of lack of justification, and not even the lack of sufficient public interest, but rather simply politics."

Tsang will step down as chief executive in June, spelling the end of his 45-year public service. What was his toughest time as chief executive? "I will tell you later, not now," he said.

Financial secretary during the Asian financial crisis in 1997-98, Tsang is always vigilant about the risks of global financial turmoil. "I personally look at the performance in Europe and in America every day and every night and early every morning. I wake up at 4am to look at how the markets have fared."

The chief executive said the government was always prepared for another global recession: "If you look back at what I said at two question-and-answer sessions in Legco, I warned about a recession. I was laughed out of court at the time. 'Oh, a silly man, how could be there a recession'. I still maintain the risk is increasing."

Tsang, who has acknowledges he sometimes looks stern and his smile a bit stiff, showed he has a sense of humour when talking about a modern Chinese painting entitled Conversation in Two Parts, that was hanging on the wall of the room where he was interviewed. Was it an oblique reference to tensions between government and media?

"It's a little joke I play on my guests as well," he said. "By listening to what you said, I am trying to answer every question. I don't think we are just chickens and ducks talking in different dialects."

October

22 2011

Share

An honest public servant who just wants a quiet life

By Tanna Chong

When Donald Tsang Yam-kuen completes his tenure as chief executive on June 30 next year, he'll have notched up 16,240 days as a public servant - 2,567 of them in the 'pressure cooker' office of the chief executive.

That is almost half a century. It is hardly surprising, then, that the man they call "Bowtie" - because of his trademark choice of neckwear - is planning a quiet retirement.

Switching to a lucrative job in the private sector is a route well travelled by many civil servants, but that option is out for Tsang, who says he wants a more private life after he takes his final bow.

"After my retirement, I will certainly not engage in any commercial activities. I do not want any directorships," said Tsang in the drawing room of the new Chief Executive's Office at Tamar.

"I have a lot of hobbies which I want to pursue more seriously. I want to do more photography and I want to see my grandchild more often than now and play with her. I want to learn something - new things."

Tsang's younger brother, former police commissioner Tsang Yam-pui, became a managing director of NWS Holdings (SEHK: 0659) (now a listed company) and a chairman of Newton Resources after retiring in 2004.

Tsang's former colleague Frederick Ma Si-hang, who resigned as secretary for commerce and economic development in 2008 because of a brain tumour, joined the listed China Strategic Holdings a year later as its chairman.

Tsang said learning the importance of being silent would be his retirement task, and he would leave public life to do just that.

"I must leave for a while so that I won't be grilled by people like you and others ... I don't want to comment on anything done by my successor. Mr Tung [Chee-hwa] has set a very good example and I will do the same," said Tsang, referring to his predecessor.

However, he added: "I will be living in Hong Kong. My home is here."

Proposing the "Guangdong Scheme" in his last policy address, which allows elderly Hongkongers to claim their old age allowance while residing in Guangdong, the 67-year-old said that might be a good choice for his retirement as well.

"Good idea. But I am not qualified for the old age allowance yet," said Tsang, who will have to wait two more years before he can claim the benefit, which is not means-tested.

Asked what he would like to be remembered for after 45 years as a public servant, "honesty" was all he would ask for. Let the public decide the rest, he said.

"On the internet, there are tonnes of materials written about me, and there is YouTube as well. It is very difficult for people to forget me," he said. "So how exactly I will be remembered will be a matter for people to decide. All I want is [to be remembered as] a public servant, an honest public servant of Hong Kong."

September

15 2011

Share

HKMA: banking outlook remains bright with overseas collaboration

The future of Hong Kong's banking industry remains bright if local lenders are willing to collaborate with overseas banks in offshore yuan trading, said Norman Chan Tak-lam, chairman of the Hong Kong Monetary Authority.

Local lenders must think about how to work with their foreign counterparts in providing yuan products and services, Chan said in an interview after attending an investment forum in London earlier this week.

"Not all overseas companies are willing and able to manage offshore yuan accounts," he said. "How do we access the market for small- and medium-sized companies? They may go to banks in London. If the banks in Hong Kong work with their counterparts in London in providing the yuan capital, then our catchment is enlarged."

Hong Kong boosts the largest off-shore yuan capital pool, with deposits of more than 570 billion yuan (HK$695.8 billion) in July - a more than eightfold surge from 62.7 billion yuan in 2009.

Yuan deposits in Hong Kong are expected to continue rising, albeit at a slower rate after a period of rapid expansion in the last two years, Chan said.

However, he stressed that no single market, including Hong Kong, can dominate the offshore yuan business, given the geographic diversity of the international offshore yuan market.

Nevertheless, prospects for the city's banking sector remain "attractive" despite recent job cuts as Hong Kong exploits the yuan's internationalisation, he said.

The yuan's internationalisation has accelerated because of the debt crisis in Europe and America, Chan said. Between January and August, 52 Asian and European firms - such as Unilever, Volkswagen and Tesco - had issued 55.7 billion yuan worth of yuan-denominated bonds in Hong Kong.

The finance ministry had issued 20 billion yuan of bonds in the same period.

That should speed up the development of the yuan bond market in Hong Kong, as it should provide a reference for a benchmark yield curve in the bond market, Chan said.

September

9 2011

Share

Hong Kong IPO Reforms Build Bridges made Japanese companies listing at Hong Kong Stock Exchange possible

Hong Kong Stock Exchange is flying the flag for Japanese IPOs after reforms have made listings possible

Japanese online financial services firm SBI Holdings launched on the Hong Kong Stock Exchange (HKEx) in April, marking another milestone for the world’s busiest bourse by market value. It was the first time a Japanese company had been able to list in Hong Kong.

The listing resulted from a series of regulatory breakthroughs, which experts say should pave the way for more listings of Japanese companies on the HKEx. International law firm Freshfields Bruckhaus Deringer calls the launch “trailblazing.” Deloitte sees it as an example for others.

Freshfields advised SBI on its US$167 million global offering of Hong Kong Depository Receipts (HDRs) and its secondary listing in Hong Kong. SBI, which also listed on the Tokyo and Osaka stock exchanges, primarily operates in five core business segments, including asset management, brokerage and investment banking, financial services, and housing and real estate.

Significant Milestone

Teresa Ko, China Managing Partner, Freshfields Bruckhaus Deringer

Teresa Ko, Freshfields’ China Managing Partner, said the listing marked a significant milestone in Hong Kong's goal to attract foreign incorporated companies to list on its exchange. “SBI is the first Japanese incorporated company to list on the HKEx. Whilst a secondary listing, SBI raised fresh capital by being the first company ever to have offered HDRs in Hong Kong.”

The regulatory breakthroughs that enabled the launch should pave the way for more listings of Japanese companies on the HKEx, Ms Ko continued.

'We feel honoured to have helped SBI complete its fundraising and listing against uncertainty and market volatility following the recent earthquake and tsunami in Japan. Under the sponsorship of Daiwa Capital Markets, SBI has blazed a trail, which we hope will inspire and encourage other companies to list in Hong Kong.”

Junzaburo Kiuchi, partner in Freshfields’ Tokyo office, said there are very few companies with dual listings in Japan as many international issuers have left the market. “These deals are tough because two very different sets of rules have to be made to work together.”

CEO Endorsement

Junzaburo Kiuchi, Partner, Freshfields’ Tokyo office

At a media briefing in April, Yoshitaka Kitao, SBI’s CEO, said he had been preparing for the Hong Kong offering for more than a year. The Japanese market had been one of the worst performers in the past decade, whereas Hong Kong was more efficient and yielded greater returns, he said. “I would rather be listed in Hong Kong than in Japan and I know a lot of Japanese companies that also want to list here,” Mr Kitao told reporters.

The successful listing of SBI in Hong Kong has also marked the recognition of Accounting Principles Generally Accepted in Japan (JGAAP) in the Hong Kong market. Edward Au, National Co-leader of Public Offering Group, Deloitte China, said this sets “an important example for similar listings in Hong Kong in the future.”

He explained that, until now, barriers were in the way. “Japanese companies, in general, are interested in listing in Hong Kong but most of them remain cautious given the difference in rules and regulations. In the past, they worried that the cost of a Hong Kong listing was higher because of the GAAP difference and bilingual disclosure requirement. They also worried that the IPO process of a secondary listing in Hong Kong would be as lengthy as a primary listing.”

Paving the Way

Yoshitaka Kitao, CEO, SBI Holdings

While the Accounting Standard Board of Japan, the pacesetter in Japan's accounting standards, is working on the convergence of JGAAP with International Financial Reporting Standards (IFRS), it is expected that the mandatory use of IFRS as the basis for consolidated financial statements by listed companies in Japan may not start until 2015 at the earliest, Mr Au said.

Deloitte has paved the way by being the first accounting firm in Hong Kong to map out and bridge the different accounting requirements between the Japan and Hong Kong bourses.

“We served as the bridge between the issuer and HKEx. We assisted the company to identify and list the material differences between IFRS and JGAAP,” Mr Au said.

“We also provided lectures to Japanese companies in assisting them to understand the difference between IFRS and JGAAP and the disclosure requirements under the rules of HKEx.”

Edward Au, National Co-leader of Public Offering Group, Deloitte China

Mr Au said Japanese companies want to list in Hong Kong because of its robust IPO market. Now, they can realise the benefits.

“The successful listing of SBI in Hong Kong has set the scene for Japanese companies tapping into one of the most liquid capital venues in the world. By listing in Hong Kong, Japanese companies can gain access to the deep capital pool, not only at the time of listing, but also at the later stages from follow-on offerings. According to statistics from HKEx, the total amount of follow-on offerings in the first half of 2011 was US$17 billion.

“Also, China is currently the second largest economy in the world. International companies with a China nexus will opt for a listing in Hong Kong as it can raise the brand eminence on the mainland, if not, in Asia. And that may result in a further business expansion in the China market.”

Deloitte expects more Japanese companies will list on the HKEx by the end of the year. It says these companies “are mainly from the consumer and retail as well as mass market sector.”

Healthy Pipeline

Noting the overseas companies to have listed on the HKEx this year – Samsonite, Prada and Glencore to name a few – Deloitte says it is obvious the local market continues to attract and welcome overseas listings.

“However, we remain cautiously optimistic on the performance of the Hong Kong IPO market in the second half of 2011 since challenges arising from the global economy cannot be overlooked.

“We have to keep an eye on inflation and the tightening policies in China, the European debt crisis and the condition of the US economy after QE2.”

September

6 2011

Share

Chateau Lafite Sale Tops $500,000 By Jake Lee

A phone bidder from China took home 300 bottles of Château Lafite-Rothschild, the most expensive single lot this year.

Bundled into a single lot, 300 bottles of Château Lafite-Rothschild sold over the weekend for $539,280 to an anonymous Chinese phone bidder at a Christie’s auction in Hong Kong, making it the most expensive single lot this year and boding well for a slew of autumn sales in the city.

While normal lots in top-tier wine auctions are typically made up of around a case, Lot 44 comprised 25 cases of Lafite from every year between 1981 and 2005, averaging around $1,800 a bottle. The entire two-day sale raised $7.6 million, with Burgundy’s Domaine de la Romanée-Conti, Moët & Chandon champagne from 1911, and Bordeaux’s ultra-rare 1982 Le Pin making up other top slots.

“It was an extraordinary Lafite collection, and the seller actually trades wine for a living,” said Christie’s Charles Curtis, head of wine for Asia, who estimated the vendor received a 20% premium by selling it as a multi-year collection, or vertical. “We had several bidders, and they were all from China, and they are just getting into wine.”

Zachys kicks off next with a two-day sale this weekend at the Mandarin Hotel, forecast to raise $10 million, and joins Christie’s in selling verticals (also called instant collections), albeit on a lesser scale than the 300-bottle Lafite extravaganza. Examples include a set of 48 bottles from various years of Bordeaux’s Château La Mission Haut Brion, and 28 bottles plus a magnum from Napa Valley’s Shafer Vineyards.

These bottles can be used to “host a lavish evening with an incredible wine tasting, expand your palate into truly understanding the depth and breadth of some of the best wineries, or highlight these verticals as a centerpiece in your collection,” says Zachys.

Acker Merrall & Condit is holding a two-day, $10 million-plus sale on Sept. 16 and 17, with Burgundy wines ranking as the most expensive lots. It will sell an extensive array from Champagne’s tiny producer Salon, including a single 1955 bottle valued at up to $3,000 — an unusual offer for Hong Kong, which tends to prefer red wines.

The auction house is also selling sets of highly collectable Château Mouton Rothschild, which selects different artists each year to design its label. Lot 799 offers a single bottle from almost every year between 1958 and 2007, for a top estimate of $45,000.

Similar to other auctions, a champagne brunch awaits bidders attending the Grand Hyatt for Spectrum Wine Auctions’ sale on Sept. 23 and 24, featuring Bordeaux and Burgundy.

Ending the monthlong series of sales is Sotheby’s two-day, $11 million sale in early October, with highlights including a sale of Bordeaux’s “Ultimate Nine” that uses the “Five Star Provenance” system — wines directly from the châteaux, stored in professional storage throughout their lifetime, and kept in original wooden cases with tamper-proof seals.

September

1 2011

Share

Creative Collective - Hong Kong is a magnet for Western creative professionals looking to tap Asia’s booming economy

VIDEO http://www.vimeo.com/28490574 VIDEO http://www.vimeo.com/28490574

Creative types have long been drawn to Hong Kong’s dynamism, and with a job market that is vibrant across a wide range of sectors, the city is more appealing than ever.

To date, about 32,000 ventures related to creative industries have been established in Hong Kong, employing 176,000 practitioners. Such businesses range from those involved with film, television, music, design and architecture, to those creating comics, animation, games and digital animation.

Initiatives such as Create Hong Kong, a government office launched in 2009 to promote the growth of creative industries, have furthered the sector’s development in recent years. The office is responsible for the administration and management of various funding schemes related to creative industries, among them CreateSmart, DesignSmart and the Film Guarantee Fund. As at end of May 2010, projects worth HK$43 million had been approved for funding.

Hong Kong is a magnet for Western creative professionals looking to tap Asia’s booming economy

Among the early movers to identify Hong Kong’s potential was American advertising agency Leo Burnett. The firm was established in Hong Kong in 1965 “with a handful of staff and one client,” according to Lilian Leong, Managing Director of Leo Burnett Hong Kong. Today, the operation has 208 full-time employees. The company is growing at a double-digit rate, delivering creative services not only to the Hong Kong market, but across Greater China and the Asia-Pacific region.

Ms Leong said creative professionals looking to expand their careers are targeting the city because it is at the centre of the world’s most vibrant economy.

“Hong Kong is fortunate enough to be at the intersection of the most important economic forces in the world right now,” she said. “On the one hand, the United States and Europe are battling with recession and debt,” noting that Europe faces the added threat in Portugal, Italy, Greece and Spain.

“The effects from these problems are certainly felt in Hong Kong, but mainland China’s economic future has far more upside. Its continuing development is also helping bring prosperity to a host of other economies in the Asia-Pacific region. “Overall, there’s a sense of positive sentiment and dynamism about the Hong Kong economy that other developed economies are not experiencing.”

Healthy Competition

Lilian Leong, Managing Director, Leo Burnett Hong Kong

In the current economic climate, upping the ante in terms of marketing and branding has become a commercial imperative of any business, Ms Leong continued. This has been good news for Hong Kong’s advertising sector in particular.

“As the city has developed rapidly over the past 20 years, the advertising industry has grown with it. We’ve seen the scale of the economy grow, bringing more money, more brands, more competition. That’s incredibly healthy.

“We’ve also seen more creative advertising that changes human behaviour. Campaigns are better put together now than they have ever been. The messages have more finesse and more substance. Campaigns now have real appeal on a very human level. There’s a lot of world-class work being done in Hong Kong.”

“An Exciting Market”

Michael Hoare, Reputation Director, Greater China Region, Leo Burnett

The current vibrancy of the industry drew Australian Michael Hoare to switch from journalism to advertising. The Perth expatriate joined Leo Burnett Hong Kong in April 2011.

“I was attracted to the opportunity to take up a regional role, and to work in a developing market where there is real potential,” Mr Hoare said.

“Professionally, the scope is vast. In my career across Australia, Singapore and Europe, I have never come across such a bunch of go-getters as I found in Hong Kong. Things happen here. It’s a city populated by people who want to get ahead, and are career-driven. Particularly for a white-collar professional from abroad, Hong Kong is an exciting market to be in.”

Mr Hoare said the Hong Kong experience “certainly benefits” his career, especially as a stepping stone to opportunities around the region.

“Hong Kong attracts a lot of blue-chip, top-tier companies that have a global footprint, which you wouldn’t normally have exposure to elsewhere. Hong Kong experience is invaluable in dealing with multinational companies and the lifestyle afforded to expatriates is amazing. It’s a privilege to have this opportunity.”

Big Fish in Small Pond

Candace Campos, Founder, Candace Collective

American designer Candace Campos took advantage of Hong Kong’s “hot opportunities” to start her own business. “I never intended to move to Hong Kong,” explained Ms Campos, founder of Candace Collective, an interiors and graphics business.

“I travelled here three times a year for business, and during those trips people started asking if I would freelance,” Ms Campos said. “I came for a few months to test the market, and had so many job requests I decided to incorporate my business here.”

She moved from California in 2008, and success soon followed. “My first interior renovation made it on the cover of Home Journal and 15 other publications after that.”

Ms Campos believes overseas designers are in demand because the US and European markets are “saturated” with Western design, whereas in Hong Kong, customers can’t get enough. “I bring my influence from the US and it is very well received. I think my interior design style is something fresh and different for the Hong Kong market.”

Noting that she “can’t keep up with the demand,” Ms Campos says she is able to choose which jobs to accept. “In Hong Kong, I feel like a big fish in a small pond – I can stand out with my style. In New York or Los Angeles, I would get lost among everyone else.”

Hong Kong projects on Ms Campos’s resume also help to build her global brand. “When I travel back to the US, people are impressed by what I have created in Hong Kong. The city has clout internationally.”

Her business is primarily interior design, which is where Hong Kong delivers another plus. “Being so close to production in the Chinese mainland means I have access to every material you can think of, and a very short lead time for production. This helps with cost as well.”

Drawn to the Light

Michael Young, Founder, Michael Young Ltd British product designer Michael Young says intuition brought him to Hong Kong. He said he came to the city in 2006 intending to use Hong Kong as an industrial base “because I realised that everything was here.”

“I landed there one day and stayed at the Peninsula hotel. I was in the pool and looking at the neon signs and it was just obvious to me this was the place to be.”

Since then, Mr Young has collaborated with up-and-coming companies in Hong Kong, as well as international brands that are keen to sell to Asia.

“I love the people and the technology and the speed. I’m fast in my way of working, and Hong Kong offers me all of that.”

August

31 2011

Share

Hong Kong: China’s RMB Center

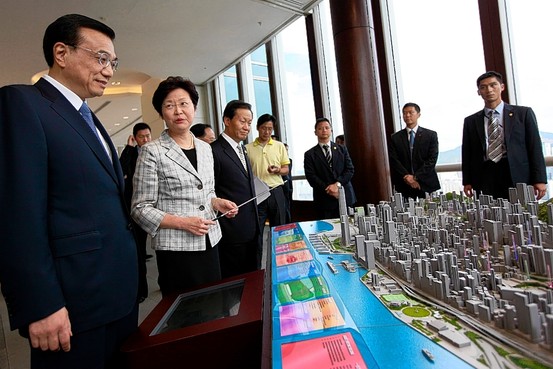

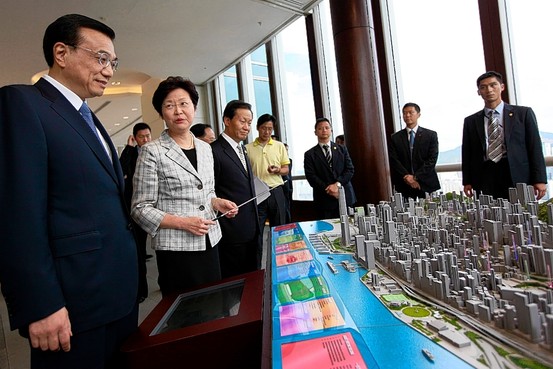

Speaking at a forum on China’s 12th Five-Year Program, China’s Vice

Premier of the State Council Li Keqiang unveils new economic initiatives to

strengthen Hong Kong’s developing role as the mainland’s renminbi center

Beijing has unveiled a raft of new economic measures to boost Hong Kong’s

status as an international financial centre, and help Hong Kong companies gain a

stronger foothold into the Chinese mainland market. The mainland’s Vice

Premier of the State Council Li Keqiang announced the latest Central Government

initiatives during a visit to Hong Kong earlier this month. Mr Li said it was in

the interests of all concerned that Hong Kong continue “to bring out the

unique advantages it has developed over the years and play its irreplaceable

role in the mainland’s reform, opening-up and modernization drive.”

The new initiatives will further open up the mainland market to Hong Kong’s

services industry. It will also upgrade Hong Kong’s standing as an

international financial capital, expanding Hong Kong’s role as an offshore

renminbi centre.

Green Light for Mainland Equity Investors

More mainland companies will be allowed to sell renminbi bonds in Hong Kong

under new measures announced by the Central Government

Of the measures unveiled, 12 are related to financial services and the

development of the offshore renminbi market. One will allow mainland investors

to invest in Hong Kong stocks through the long-awaited index-tracking Exchange

Traded Fund, which will be launched this year. Another scheme, allowing

companies to settle trade in renminbi in 20 provinces, will be expanded

nationwide.

More mainland companies will also be allowed to sell renminbi bonds in Hong

Kong. Mr Li, during his visit, officiated at the launch of the third issuance of

Rmb20 billion worth of mainland sovereign bonds in Hong Kong, the largest to

date.

Industry representatives believe the move will reinforce Hong Kong’s role as

China’s renminbi centre. “Encouraging more mainland enterprises to issue

yuan bonds in Hong Kong will help diversify yuan-denominated products in the

city,” Standard Chartered Bank (Hong Kong) Chief Executive Benjamin Hung was

quoted in The Standard, a Hong Kong daily newspaper.

“China is speeding up its pace of internationalising the currency by these new

measures,” Andrew Fung, head of treasury and investment at the Hang Seng Bank,

told the South China Morning Post. “Most importantly, the Vice-Premier has

confirmed Hong Kong’s role as an offshore yuan trading centre for China.”

Free Trade by 2015

Vice Premier Li Keqiang checks out the day’s trading results during a visit

to the Hong Kong Stock Exchange

In addition, the latest supplement of the Hong Kong-mainland Closer Economic

Partnership Arrangement, expected to be signed in October, will broaden Hong

Kong’s access to mainland services industries. “The target is to realise

free service trade with Hong Kong by the end of the 12th five-year period,” Mr

Li said at a Hong Kong forum on China’s 12th Five-Year Program. Sectors to be

opened up include banking and insurance, allowing Hong Kong companies to set up

across the border.

“Taken as a whole, this comprehensive range of new measures will provide

substantial opportunities across a wide spectrum of Hong Kong business

activity,” said Hong Kong Chief Executive Donald Tsang. “This will help us

maintain economic growth at a time when global economic conditions are

fragile.”

Services Advantage

Financial Secretary John Tsang said that moves to open up the mainland services

industry offer huge advantages to Hong Kong companies. He noted that Hong

Kong’s services industry makes up 93 per cent of the city’s GDP.

“China lags far behind developed countries by 20 per cent, where the service

industry on average accounts for about 70 per cent,” he said. “For those

companies that want to tap the mainland’s market and help lift the industry

standards higher, there is a huge and long-term opportunity for Hong Kong, as

the services sector is one of our strengths.”

August 20 2011

Share

星島社論: 北京挺港大禮兼重民生特色

中國國務院副總理李克強送給香港一籃子大禮,連串政策和措施,特色是盡量照顧到香港上中下階層,由長遠發展策略重中之重的人民幣離岸中心、惠及中小企和專業人士的開放市場,到與小市民生活息息相關的肉類和蔬果供應,惠及層面廣泛、直接和全面。

身為「十二五」旗手之一的李克強,十七日在公開論壇上,指出香港擁有的種種優勢,在國家「十二五」時期發展的進程中將顯出重要價值。他宣布的三十六項支持香港經濟社會發展的政策措施,大部分都是利用香港的優勢與內地互補,謀求互利雙贏。

此中最明顯的是透過逐步放寬香港和內地人民幣資金的流通、建立在港發行國債的常設機制等連串措施,大幅擴展香港的人民幣離岸中心業務,壯大香港在全球三大國際金融中心中不易取代的特色。香港金融及相關行業明顯受惠,內地則可以利用香港這個較易控制風險的平台,推進人民幣國際化。

對於中小企和專業人士來說,北京以四年後的「十二五」末期,作為內地對香港基本實現服務貿易自由化的目標時間,而今後對外商談自由貿易區時,會更多兼顧香港的利益和訴求。透過這些措施,北京不但進一步向港商和專業人士開放內地市場,為內地引進優質服務,還會協助港商鞏固和發展海外市場,令香港不致因缺乏談判自由貿易區的籌碼而被邊緣化。

連同其他金融和經貿政策措施,李克強今次送的大禮豐富多采。北京早前通過「十二五」規劃綱要,雖然特設專章論及香港,但香港社會並不清楚當中所涉及的廣度和深度。李克強利用這次訪港的機會,權威性闡述「十二五」規劃為港商及港人提供的各方面機遇。

值得注意的是,北京今次宣布的惠港措施,不只涉及長遠重要策略層面,還具體觸及基層民生。這包括確保向香港穩定供應糧食、肉類、蔬果,有助紓緩食品加價壓力;「西氣東輸」提前到明年向港供應天然氣,有助減輕發電空氣污染;讓更多內地高校免試招收香港學生。這些都是可以直接惠及市民的項目。

北京過去的挺港大禮,以開放內地居民到港自由行,最能夠立竿見影讓基層感受到當中的好處。一些策略性項目,例如建立兩地更緊密經貿安排,對香港經濟發展可能更加重要,但是首先受惠的是商界和專業人才,逐漸透過財富的滴漏效應,增加就業機會,惠及基層大眾,要一段時日才見效。

今次李克強的送禮特色,則是盡量照顧各階層的利益,希望升斗市民都能夠直接感受到好處。這次北京在港發行二百億元人民幣國債,就符合這個特色。純粹從經濟效益來計算,北京根本毋須向散戶發債,北京仍然另留五十億元,以一厘六的息率供散戶認購,明顯是不欲讓財團獨享利益,小市民自然樂於可以即時分享到發展人民幣離岸中心的好處。

「十二五」規劃的主要目標是發展經濟,改善民生。香港與北京尋求合作,當然是抓大放小,集中爭取重要領域突破和可以創造互利雙贏的方案,反而北京今次提出的措施,設想的範圍廣泛,反映領導人並非只是被動回應香港訴求,還經過細心研判,比以往注重讓基層分享到國家經濟發展的成果,這些禮物的金錢價值比不上金融上的互利合作,但產生的社會效果,卻隨時會有過之而無不及。

Sing Tao Editorial: Beijing's Gift to Hong Kong focus on the people's livelihood (Chinese to English via Google translate)

Chinese Vice Premier Li Keqiang gift basket sent to Hong Kong, a series of policies and measures, special care of Hong Kong as far as possible on the middle and lower classes, the most important long-term development strategy for the renminbi offshore center for the benefit of SMEs and professionals open market to ordinary people's lives, with meat and vegetables supply for the benefit of the broad direct and comprehensive.

As a "five-second" standard-bearer, one of Li Keqiang, 17 in an open forum, pointed out that Hong Kong has many advantages in the state, "1025" period will show the process of developing an important value. He announced thirty-six support Hong Kong's economic and social development policies and measures, most of them are the use of complementary advantages of Hong Kong and the Mainland, to seek mutual benefit and win-win situation.

Herein the most obvious is through the gradual relaxation of Hong Kong and the flow of renminbi funds, government bonds issued in Hong Kong to establish a permanent mechanism, a series of measures to substantially expand Hong Kong's renminbi offshore center operations, growth of Hong Kong in the three largest international financial center features easy to replace. Hong Kong's financial and related industries benefit significantly, Hong Kong, the mainland can be easier to control risk to use the platform to promote the internationalization of the RMB.

For SMEs and professionals, Beijing to four years after the "five-second" end, as the Mainland to Hong Kong trade in services liberalization, the basic goal of time, and discuss the future of foreign free trade zone, it will further take into account Hong Kong interests and aspirations. Through these measures, Beijing not only to businessmen and professionals to further open the mainland market, the introduction of quality service for the Mainland, Hong Kong will help to consolidate and develop overseas markets, Hong Kong will not negotiate free trade area due to lack of chips have been marginalized.

Together with other financial and trade policy measures, Li Keqiang, this colorful gift sent. Beijing earlier through the "five-second" Plan, although the special chapter deals to Hong Kong, Hong Kong is not clear which covered the breadth and depth. Li Keqiang advantage of this opportunity to visit and authoritative exposition, "second Five-Year Plan" for the Hong Kong and the Hong Kong people of various opportunities.

It is noteworthy that Beijing announced that the benefits of this port measures, involving not only an important long-term strategic level, but also specifically touches the grass-roots people's livelihood. This includes ensuring a steady supply of food to Hong Kong, meat, fruits and vegetables can help to ease pressure on food fare; "natural gas" to Hong Kong early next year, the supply of natural gas will help reduce the generation of air pollution; exemption to allow more mainland colleges and universities to recruit Hong Kong students. These are the people can directly benefit the project.

Beijing last Tinggang gift to open the free exercise of mainland residents to Hong Kong, most of them can feel the immediate benefits to the grassroots. A number of strategic projects, such as the two places closer economic and trade arrangements, Hong Kong's economic development may be more important, but the first to benefit of the business community and professionals, and gradually drip through

财富 effect, increasing employment opportunities and benefit the grassroots, to a time was effective.

Li Keqiang, the gift of this feature, it is best to look after the interests of all strata, hopes ordinary people can directly feel the benefits. The Beijing twenty billion yuan in treasury bonds issued in Hong Kong, on line with this feature. From a purely economic terms, Beijing did not issue bonds to retail investors, Beijing still leave another 55 billion to an interest rate determined for six retail subscription, obviously do not want to let the consortium exclusive interests, ordinary people can naturally be happy to immediately sharing the benefits of renminbi offshore center.

"Twelve Five Year Plan" the main objective is to develop economy and improve people's livelihood. To seek co-operation between Hong Kong and Beijing, of course, encounter, and focus on breakthroughs in key areas for mutually beneficial win-win solution can be created, but Beijing has proposed measures, envisaged a wide range, reflecting not just passively respond to the leaders of Hong Kong demands, but also carefully judged, more than ever to pay attention to the grassroots level to share the results of national economic development, the monetary value of these gifts not as financially beneficial cooperation, but the social effects, but it is worse than at any time.

August 19 2011

Share

Chinese Vice Premier Li Keqiang stuns university with promise to let 1,000 more students and academics study on the mainland

By Ng Kang-chung and Peter So

HKU gets wider path to mainland

China - Vice-Premier Li Keqiang (center) waves yesterday during an appearance at Hong Kong University's centenary celebration.

HKU was the University attended by the founding father of the Modern China Dr

Sun Yat-sen where he obtained his medical degree

Vice-Premier Li Keqiang (center) waves yesterday during an appearance at Hong Kong University's centenary celebration.

Beijing surprised Hong Kong University during its 100th birthday celebration yesterday with a new

program to dramatically expand opportunities for its students and professors to study on the mainland.

The plan - announced by presumptive premier-in-waiting Li Keqiang during a speech to commemorate the university's centennial - would allow as many as 1,000 students and academics to participate annually in exchange

programs and research projects with mainland educational institutions.

"The central government will set up specific funds to support 1,000 students and teachers of the University of Hong Kong yearly to go to the mainland to study, exchange, and launch scientific research," Li told 600 guests gathered in Loke Yew Hall.

"What is more, the country will also support the launch of comprehensive and in-depth co-operation between other Hong Kong and mainland higher education institutions in order to help teachers and students get a better understanding of the mainland and

familiarize them with the situations of the country," the vice-premier added.

The program, which Li said would start next year, appeared to catch everyone in attendance unaware, even HKU administrators.

Pro-Vice-Chancellor Professor Amy Tsui Bik-may said the university was not given advance word of the announcement. She called it a pleasant surprise because local professors often had difficulty even applying for mainland funds.

"There are already many exchange programs for students and academic staff," Tsui said. "This time, it includes research collaboration. It is also a recognition of the achievements of Hong Kong scholars in scientific research."

The speech was also notable for Li's occasional use of English between praise for the university, where most classes are taught in the language of its British colonial founders. Mainland leaders rarely speak in any tongue other than Chinese.

"HKU is for Hong Kong, attracting talent and educating people to promote Hong Kong's prosperity

(SEHK: 0803) ," said Li, who is widely expected to succeed Premier Wen Jiabao after a 2013 leadership shuffle. "HKU is for China. It has become a key higher-education institution in China, playing an increasingly important role in China's development and its integration with the world."

Li said that he had gained a deeper understanding of Hong Kong by the end of his three-day visit.

"Hong Kong's role in the mainland's economic reform and opening up is irreplaceable," he said, praising Hongkongers as "dedicated and professional", and Hong Kong society as "open, pluralistic and vibrant".

August 19 2011

Share

China's Vice Premier Li Keqiang Unveils Hong Kong Yuan Measures

By Chester Yung and Fiona Law

In Beijing's latest move to increase its currency's standing internationally, top Chinese leaders unveiled measures to bolster Hong Kong's status as a yuan-trading center.

On an official visit to Hong Kong, Chinese Vice Premier Li Keqiang on Wednesday announced several initiatives aimed at easing the flow back into mainland China of so-called offshore yuan traded in Hong Kong. He also announced plans to launch funds that would let mainland Chinese investors trade Hong Kong stocks. China's central bank governor, Zhou Xiaochuan, said the range of Chinese companies able to issue yuan debt in the territory would be expanded.

Analysts said the measures could generate even more demand for yuan-denominated assets in Hong Kong, which is part of China but operates under its own laws and with its own currency.

Mr. Li, who was joined in Hong Kong by Mr. Zhou and other high-ranking mainland officials, is widely seen as a leading contender to succeed Premier Wen Jiabao in 2013.

Currently China keeps strict controls on the yuan, also called the renminbi. By serving as a center for trading the yuan outside mainland China, Hong Kong has become a key player in China's push to give its currency more international presence.

Several of Wednesday's initiatives were expected, and it was unclear how quickly any would be implemented. For example, businesses and bankers eagerly await rules allowing proceeds from yuan debt offerings to be plowed back easily into China. Mr. Li suggested Beijing intends to follow through, but didn't say when.

Still, the latest move from China "takes yuan internationalization to the next stage," HSBC Holdings PLC said in a note Wednesday.

"This is the strongest endorsement yet of using Hong Kong as the platform for the increased use of renminbi internationally," said Julia Leung, Hong Kong's undersecretary for financial services and the treasury.

The measures come at a time of uncertain economic outlook for Hong Kong, whose recovery from the 2008 financial crisis has slowed in recent months amid volatility in the U.S. and European markets, compounded by surging inflation and intensifying competition with financial centers elsewhere in Asia.

In recent years, China's central government has implemented a number of policies that have helped boost Hong Kong's economy, in what some critics in Hong Kong call an attempt to quiet demands for greater democracy.

"Political reform is the most pressing issue in Hong Kong," said Albert Ho, chairman of the city's biggest opposition party. "It's a shame we didn't get to hear their thoughts on this front" during the officials' visit.

In his address Wednesday morning, Mr. Li said financial firms in Hong Kong will be allowed to buy domestic Chinese securities with the offshore yuan they hold. The total limit will be 20 billion yuan (US$3.13 billion)—small given the more than 500 billion yuan on deposit in Hong Kong's banking system as of June—but analysts believe it could be increased in the future

Mr. Li also announced plans to allow exchange-traded funds holding Hong Kong-listed stocks to be sold in mainland China, making it easier for mainland investors to gain exposure to Hong Kong's equities market.

"This is significant as, for the first time, a high-ranking Chinese official is endorsing a channel for domestic funds to invest in Hong Kong stocks, which could support the city as a wealth-management center and reinforce its financial-hub status," said Raymond Yeung, senior economist at ANZ Banking Group. It wasn't clear when the Hong Kong ETFs, which have been expected for some time, would actually launch.

Also on Wednesday, People's Bank of China Gov. Zhou Xiaochuan said China will allow nonfinancial companies from China to issue "dim sum" bonds, or yuan bonds issued in Hong Kong. The total issuance allowed for financial and nonfinancial companies this year will be 50 billion

yuan.

August 18 2011

Share

Investment Magnet

Hong Kong is the world’s third-largest recipient of foreign direct investment, at US$76 billion, according to the latest World Investment Report