|

Newsletter

Seminar Material

Biz:

China

Hong

Kong Hawaii

What people

said about us

China

Earthquake Relief

Tax &

Government

Hawaii Voter Registration

Biz-Video

Biz-Video

Hawaii's

China Connection Hawaii's

China Connection

CDP#1780962

CDP#1780962

Doing Business in

Hong Kong & China

Doing Business in

Hong Kong & China

| |

Hong Kong, China & Hawaii Biz*

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our event page to find out more!

After

attended a China/Hong Kong Business/Trade Seminar in Hawaii...still unsure what

to do next, contact us, our Officers, Directors and Founding Members are

actively engaged in China/Hong Kong/Asia trade - we can help!

Are you ready to export your product or

service? You will find out in 3 minutes with resources to help you -

enter

to give it a try

China Central TV - live webcast

China Central TV - live webcast

Skype - FREE

Voice Over IP Skype - FREE

Voice Over IP

View Hawaii's China Connection

Video Trailer

View Hawaii's China Connection

Video Trailer

Direct link

PDF file

Direct link

PDF file

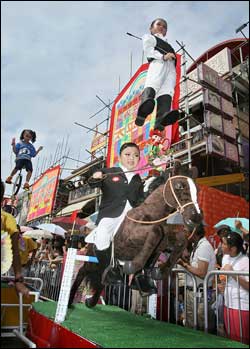

Year of the Pig - February 18, 2007

Year of the Pig - February 18, 2007

May 31, 2007

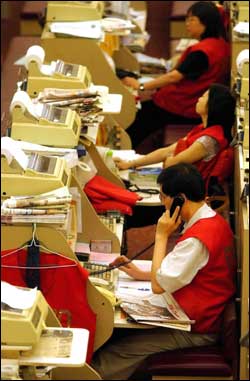

Hong Kong:

Green Futures (Hong Kong) Limited, a leading Chinese mainland-based financial

group Tuesday announced that it becomes the first mainland futures starting

business in Hong Kong after receiving permission from Hong Kong Securities and

Futures Commission. Analysts believe, Green Futures, the first out of 180

futures companies in the Chinese mainland, with its expanding business to Hong

Kong is the fruit of the recently expanded Closer Economic Partnership

Arrangement III (CEPA III), the provisions of the free trade between Hong Kong

and Chinese Mainland, which allow for Chinese mainland securities and futures

companies to run businesses in Hong Kong. Wang Shuan-hong, Chairman and

President of the Green Group, believe its establishment in Hong Kong will

provide a strong platform for the group to speed up alignment with international

markets. While the Director-General of Investment Promotion at Invest Hong Kong,

Mike Rowse, echoed that Hong Kong, aiming at strengthening its role of financial

center of the region, wants to offer a highly mature financial market for

qualifying mainland companies to develop closer ties with their Hong Kong and

overseas counterparts and clients. Hong Kong:

Green Futures (Hong Kong) Limited, a leading Chinese mainland-based financial

group Tuesday announced that it becomes the first mainland futures starting

business in Hong Kong after receiving permission from Hong Kong Securities and

Futures Commission. Analysts believe, Green Futures, the first out of 180

futures companies in the Chinese mainland, with its expanding business to Hong

Kong is the fruit of the recently expanded Closer Economic Partnership

Arrangement III (CEPA III), the provisions of the free trade between Hong Kong

and Chinese Mainland, which allow for Chinese mainland securities and futures

companies to run businesses in Hong Kong. Wang Shuan-hong, Chairman and

President of the Green Group, believe its establishment in Hong Kong will

provide a strong platform for the group to speed up alignment with international

markets. While the Director-General of Investment Promotion at Invest Hong Kong,

Mike Rowse, echoed that Hong Kong, aiming at strengthening its role of financial

center of the region, wants to offer a highly mature financial market for

qualifying mainland companies to develop closer ties with their Hong Kong and

overseas counterparts and clients.

A prospective buyer views an oil on

canvas painting by Chinese artist Xu Beihong entitled "Portrait of a Lady". Two

contemporary Chinese works of art sold Sunday for record prices at auction in

Hong Kong, underlining a growing demand for modern Asian art. An abstract

painting by Zhao Wuji entitled "14.12.59" set a record for the artist when it

went under the hammer for 29.44 million Hong Kong dollars (3.78 million US

dollars). And two hulking brass sculptures called "Taiji Series -- Big Sparring"

by Ju Ming also set a record for the artist at 14.89 million dollars. The two

items were among hundreds of lots worth more than a billion dollars that are

going under the hammer at the Christie's Spring sale of Asian art over the next

four days. Although the identity of the buyers was not revealed, Eric Chang,

senior vice-president of 20th century Chinese art at Christie's, said all buyers

were Asia-based. Among other big sellers was the elegant "Portrait of a Lady" by

Xu Beihong, the current darling of the Asian art world, which fetched nearly 30

million dollars with fees taken into account. Xu's "Put Down That Whip" sold

earlier this year for 72 million dollars -- the highest price commanded for a

Chinese painting at auction. Also on Sunday, the stark "Scenery of Northern

China" by Wu Guangzhong sold for 31.68 million dollars. Christie's and its rival

Sotheby's have been holding twice-yearly sales in Hong Kong since the mid-1990s

as growing wealth in China has fuelled a bonanza in the Asian art market. Some

art historians have criticized the recent explosion in the prices for Asian art,

which 10 years ago was struggling to attract any interest, and have criticized

over-exuberant first-time buyers for sending prices sky-high.

A prospective buyer views an oil on

canvas painting by Chinese artist Xu Beihong entitled "Portrait of a Lady". Two

contemporary Chinese works of art sold Sunday for record prices at auction in

Hong Kong, underlining a growing demand for modern Asian art. An abstract

painting by Zhao Wuji entitled "14.12.59" set a record for the artist when it

went under the hammer for 29.44 million Hong Kong dollars (3.78 million US

dollars). And two hulking brass sculptures called "Taiji Series -- Big Sparring"

by Ju Ming also set a record for the artist at 14.89 million dollars. The two

items were among hundreds of lots worth more than a billion dollars that are

going under the hammer at the Christie's Spring sale of Asian art over the next

four days. Although the identity of the buyers was not revealed, Eric Chang,

senior vice-president of 20th century Chinese art at Christie's, said all buyers

were Asia-based. Among other big sellers was the elegant "Portrait of a Lady" by

Xu Beihong, the current darling of the Asian art world, which fetched nearly 30

million dollars with fees taken into account. Xu's "Put Down That Whip" sold

earlier this year for 72 million dollars -- the highest price commanded for a

Chinese painting at auction. Also on Sunday, the stark "Scenery of Northern

China" by Wu Guangzhong sold for 31.68 million dollars. Christie's and its rival

Sotheby's have been holding twice-yearly sales in Hong Kong since the mid-1990s

as growing wealth in China has fuelled a bonanza in the Asian art market. Some

art historians have criticized the recent explosion in the prices for Asian art,

which 10 years ago was struggling to attract any interest, and have criticized

over-exuberant first-time buyers for sending prices sky-high.

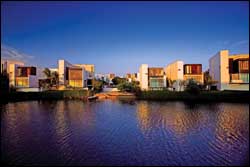

Two plots of land went under the

hammer in Hong Kong on Tuesday, fetching a total of HK$1.74 billion (US$223

million), at the lower end of analysts expectations.

Riyo Mori, Miss Japan 2007, right, reacts as she wins the Miss Universe 2007

title in Mexico City, early on Tuesday (HK time) as Zuleyka Rivera, Miss

Universe 2006, looks on.

Riyo Mori, Miss Japan 2007, right, reacts as she wins the Miss Universe 2007

title in Mexico City, early on Tuesday (HK time) as Zuleyka Rivera, Miss

Universe 2006, looks on.

The tax on wine should be cut

further, to less than 20 per cent, to help make Hong Kong an international

wine-selling hub, Liberal Party chairman James Tien Pei-chun said yesterday.

China was on course to catch up with

the United States and join the front ranks of world economic powers but that was

little cause for concern, even among Americans, according to a global survey

released on Monday. But the same poll showed there was generally as much

distrust of the United States as there was of China to "act responsibly" in

world affairs. Most respondents in 13 countries agreed it was "likely that

someday China's economy will grow to be as large as the US economy", according

to the opinion poll by the Chicago Council on Global Affairs and

WorldPublicOpinion.org. "What is particularly striking is that despite the

tectonic significance of China catching up with the US, overall the world

public's response is low key - almost philosophical," said Steven Kull, editor

of WorldPublicOpinion.org. In no country was there a majority who felt that

China's economic rise would be mostly negative, but that was not because China

was particularly trusted, the pollsters said. Majorities in 10 out of 15

countries said they did not trust China "to act responsibly in the world". But

the same number also said they distrusted the US. "Though people are not

threatened by the rise of China, they do not appear to be assuming that it will

be a new benign world leader," Mr Kull said. "They seem to have a clear-eyed

view that China is largely acting on its own interests." The Chinese themselves

are among the more sceptical populations, with only half saying that their

economy will catch up with that of the US. Among Americans, the percentage was

60 per cent. Only in India and the Philippines did a plurality of respondents

say the US would always remain a bigger economy than China. The highest level of

concern about the implications of China's economic march was in the US, where

one in three is worried. But 54 per cent of Americans said that its rise would

be "neither positive nor negative" while one in 10 said it would be mostly

positive. Only in Iran did a majority - 60 per cent - say that it would be

"mostly positive for China to catch up". "Their favourable outlook may stem in

part from heavy Chinese investment in Iranian oil as well as Iranian desires to

have a counterweight to American power," the pollsters said. The survey included

18 countries: Australia, Argentina, Armenia, China, France, India, Iran, Israel,

Mexico, Peru, the Philippines, Poland, Russia, South Korea, Thailand, Ukraine,

and the US, plus the Palestinian territories. Not every question of the poll was

asked in each country, so that the results for some questions covered less than

18 countries.

China: China

has allowed its currency, the yuan, to appreciate by more than 7.5 percent

against the U.S. dollar since it scrapped the yuan-dollar peg in July 2005, said

the country's central bank.

China: China

has allowed its currency, the yuan, to appreciate by more than 7.5 percent

against the U.S. dollar since it scrapped the yuan-dollar peg in July 2005, said

the country's central bank.

Visiting Chinese Commerce Minister Bo Xilai in Ottawa

Monday held talks with Canada's International Trade Minister David Emerson on

ways to boost bilateral trade.

Tianjin FAW

Toyota Motor Co., LTD. holds the unveiling ceremony for its third plant and

Corolla at Tianjin Economic and Technological Development Zone on Monday. The

plant occupies 400,000 square meters, with an annual output capacity of 200,000

popular sedans. Tianjin FAW

Toyota Motor Co., LTD. holds the unveiling ceremony for its third plant and

Corolla at Tianjin Economic and Technological Development Zone on Monday. The

plant occupies 400,000 square meters, with an annual output capacity of 200,000

popular sedans.

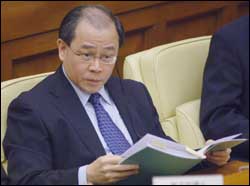

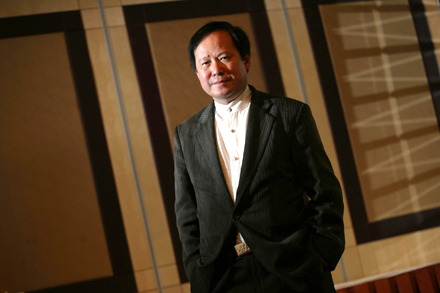

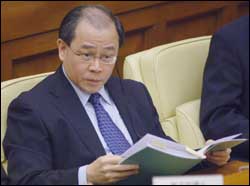

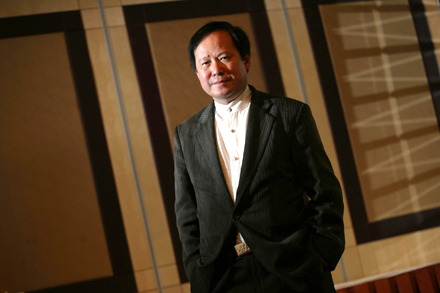

Zheng Xiaoyu,

former director of China's State Food and Drug Administration (SFDA), was

sentenced to death by a Beijing court Tuesday morning. Zheng, 63, was convicted

of taking bribes and dereliction of duty, according to the first instance

hearing of the Beijing Municipal No. 1 Intermediate People's Court. He received

the death penalty on the graft charge and 7 years in imprisonment for the charge

of dereliction of duty. All Zheng's personal property was confiscated and he was

deprived of his political rights for life. The death sentence was appropriate,

according to the court, given the "huge bribes involved and the great damage

inflicted on the country and the public by Zheng's dereliction of duty". The

bribes taken by Zheng, including cash and gifts, were worth more than 6.49

million yuan (about 850,000 U.S. dollars), according to the court. The bribes

were given either directly or through his wife and son. The court said Zheng

"sought benefits" for eight pharmaceutical companies by approving their drugs

and medical devices during his tenure as China's chief drug and food official

from June 1997 to December 2006. "(Zheng's acts) greatly undermined the

uprightness of an official post and the efficiency of China's drug monitoring

and supervision, endangered public life and health and had a very negative

social impact," the court said. Zheng violated reporting rules and

decision-making processes when approving medicines from 2001 to 2003. He failed

to make careful arrangements for the supervision of medicine production, which

is of critical importance to people's lives, said the court. The consequences of

Zheng's dereliction of duty have proved extremely serious. Six types of medicine

approved by the administration during that period were fake medicines. Some

pharmaceutical companies used false documents to apply for approvals, the court

said. It is not yet known whether Zheng will appeal. Zheng Xiaoyu,

former director of China's State Food and Drug Administration (SFDA), was

sentenced to death by a Beijing court Tuesday morning. Zheng, 63, was convicted

of taking bribes and dereliction of duty, according to the first instance

hearing of the Beijing Municipal No. 1 Intermediate People's Court. He received

the death penalty on the graft charge and 7 years in imprisonment for the charge

of dereliction of duty. All Zheng's personal property was confiscated and he was

deprived of his political rights for life. The death sentence was appropriate,

according to the court, given the "huge bribes involved and the great damage

inflicted on the country and the public by Zheng's dereliction of duty". The

bribes taken by Zheng, including cash and gifts, were worth more than 6.49

million yuan (about 850,000 U.S. dollars), according to the court. The bribes

were given either directly or through his wife and son. The court said Zheng

"sought benefits" for eight pharmaceutical companies by approving their drugs

and medical devices during his tenure as China's chief drug and food official

from June 1997 to December 2006. "(Zheng's acts) greatly undermined the

uprightness of an official post and the efficiency of China's drug monitoring

and supervision, endangered public life and health and had a very negative

social impact," the court said. Zheng violated reporting rules and

decision-making processes when approving medicines from 2001 to 2003. He failed

to make careful arrangements for the supervision of medicine production, which

is of critical importance to people's lives, said the court. The consequences of

Zheng's dereliction of duty have proved extremely serious. Six types of medicine

approved by the administration during that period were fake medicines. Some

pharmaceutical companies used false documents to apply for approvals, the court

said. It is not yet known whether Zheng will appeal.

China will release the country's first regulation on food

recall by the end of this year as part of efforts to improve food safety, a

senior official has said. The move by the General Administration of Quality

Supervision, Inspection and Quarantine comes in response to a recent spate of

food safety scandals. Wu Jianping, director general of the food production and

supervision department of the administration, told China Daily that the recall

system mainly targets potentially dangerous and unapproved food products. The

regulation - whose final draft will be ready by the end of the year and will be

in line with international practices - stipulates that food production and sales

companies should take back their products which are confirmed to endanger

people's health, Wu said. "All domestic and foreign food producers and

distributors will be obliged to follow the system," he said. Till now, only one

section in a regulation on product inspection - issued in 2002 - touches upon

food recall and the need for such a system. Among major food recall cases are

enterobacter sakazakii-affected Wyeth milk powder in 2002 and Sudan-red related

products in 2005. "Implementing the recall system for all food products will be

a gradual process," Wu emphasized. Despite tainted-food scandals in recent

years, the official said the quality of food products in China has been on the

rise, especially after the country set standards for food-related products in

2002. To date, more than 525 kinds of food products in 28 categories, and more

than 80,000 food enterprises have acquired market access permits. This year,

another seven categories, such as food utensils, additives, detergents and

disinfectants, will be required to get market permits. In a related development,

the State Food and Drug Administration (SFDA) plans to blacklist food producers

which break rules; and serious violators could be barred from the market. The

SFDA yesterday launched a nationwide campaign on drug safety inspection. From

May 28 to June 8, a total of 90 officials will be sent to 15 provinces.

Residents

dressed as cartoon characters parade during the opening of the Jinlv traditional

cultural festival in Suzhou, East China's Jiangsu Province May 29, 2007. Residents

dressed as cartoon characters parade during the opening of the Jinlv traditional

cultural festival in Suzhou, East China's Jiangsu Province May 29, 2007.

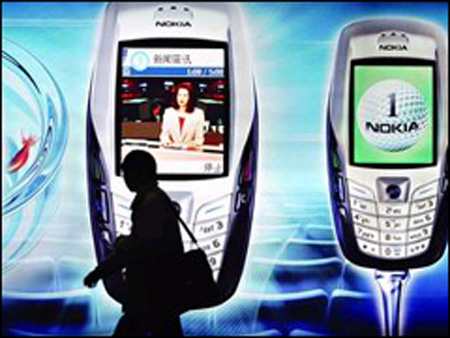

A girl is listening to cell phone music in Beijing

International High-tech Expo May 27, 2007. Up to the end of April, the country's

cell phone penetration ratio has hit 35.3%, according to the latest statistics

from the Ministry of Information Industry. The number of China's cell phone

users amounted to 480.43 million by the end of April, increasing 26.35 million

from the end of last year. About 182.6 billion short messages were sent in April

with a 38.1 percent growth year-on-year.

A girl is listening to cell phone music in Beijing

International High-tech Expo May 27, 2007. Up to the end of April, the country's

cell phone penetration ratio has hit 35.3%, according to the latest statistics

from the Ministry of Information Industry. The number of China's cell phone

users amounted to 480.43 million by the end of April, increasing 26.35 million

from the end of last year. About 182.6 billion short messages were sent in April

with a 38.1 percent growth year-on-year.

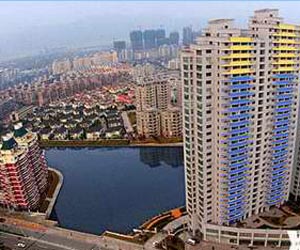

Hitachi is to build a new elevator factory in Shanghai

with an annual output capacity of 10,000 units, according to company sources.

Hitachi, which already has elevator factories in Guangzhou and Tianjin, expects

the completion of the Shanghai facility in January. It involves a registered

capital of 40 million U.S. dollars and covers a 185,000-square-meter site.

Completion of the facility will boost Hitachi's annual elevator production

capacity in China to 35,000 units, the company said. China's elevator market saw

an annual growth rate of 25 percent since 2000. The country became the largest

elevator market, buying more than 150,000 units in 2006, sources said. The

upcoming Beijing Olympic Games, Shanghai's World Expo and Guangzhou's Asia Games

were bound to expand the market, analysts said.

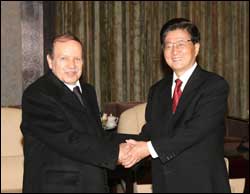

China's Commerce Minister Bo Xilai (R) reacts

after being presented with a 2010 Vancouver Olympic Winter Games jacket by

Canada's International Trade Minister David Emerson before the start of a

meeting in Ottawa May 28, 2007.

China's Commerce Minister Bo Xilai (R) reacts

after being presented with a 2010 Vancouver Olympic Winter Games jacket by

Canada's International Trade Minister David Emerson before the start of a

meeting in Ottawa May 28, 2007.

May 30, 2007

Hong Kong:

The Hong Kong Monetary Authority, the city's de-facto central bank, warned

Monday that excessive liquidity in the mainland has led to soaring property

prices and feverish activity in the stock market. Such signs, it said, could

affect the local equity market as there is "a higher degree of volatile

transmission" from the frenzied Chinese stocks. "The February fall is an example

of contagion via market sentiment changes," the HKMA said in its briefing notes

to the Legislative Council Panel on Financial Affairs, which meets June 4. The

Hang Seng Index fell 1,157.72 points in the last four trading days of February

as the plunge in Chinese stock markets triggered a massive selloff globally. The

mainland bourses recorded the sharpest drop in a decade February 27, tumbling

8.84 percent when investors were worried Beijing would cool down the stock

market. HKMA chief executive Joseph Yam Chi-kwong said a decline of domestic

demand in the mainland could reduce exports to China as well as outbound tourist

traffic. "The local equity market will be resilient to mainland shocks, although

investor sentiment could be affected through the financial market channel," the

briefing notes said. "The impact of [yuan] appreciation on inflation is likely

to be modest." Analysts have said a rising Chinese currency could bring more

consumers from the mainland into Hong Kong as the local dollar remains weak,

partly because of a potential carry trade using the unit by currency traders.

Yam said Hong Kong's economy remains sound as the environment is largely

favorable for businesses. He attributed his optimism to "robust growth,

declining unemployment, a benign inflation outlook, renewed fiscal strength and

normal behavior of property and stock markets." He had suggested in February

that Beijing's tightening measures may lead to "consequences beyond

imagination." Its recent measures to raise interest rates, widen the currency

trading band and increase the reserve requirement ratio for domestic banks have

all failed to deter investors. Yam also said there are concerns in the US

economy that could affect the macroeconomic environment. "A sudden and sharp

depreciation of the US dollar, the disoderly unwinding of global imbalances and

a spillover of US housing market weakness are external risks to the currency

stability in Hong Kong," Yam said. "Financial instability and volatile capital

flows are induced by an increased risk aversion of market participants and

higher market volatility and the destabilizing activities of hedge funds." He

said the HKMA's foreign exchange reserves have already been aggressive enough as

it has a 23 percent composition of stocks in its portfolio. Hong Kong:

The Hong Kong Monetary Authority, the city's de-facto central bank, warned

Monday that excessive liquidity in the mainland has led to soaring property

prices and feverish activity in the stock market. Such signs, it said, could

affect the local equity market as there is "a higher degree of volatile

transmission" from the frenzied Chinese stocks. "The February fall is an example

of contagion via market sentiment changes," the HKMA said in its briefing notes

to the Legislative Council Panel on Financial Affairs, which meets June 4. The

Hang Seng Index fell 1,157.72 points in the last four trading days of February

as the plunge in Chinese stock markets triggered a massive selloff globally. The

mainland bourses recorded the sharpest drop in a decade February 27, tumbling

8.84 percent when investors were worried Beijing would cool down the stock

market. HKMA chief executive Joseph Yam Chi-kwong said a decline of domestic

demand in the mainland could reduce exports to China as well as outbound tourist

traffic. "The local equity market will be resilient to mainland shocks, although

investor sentiment could be affected through the financial market channel," the

briefing notes said. "The impact of [yuan] appreciation on inflation is likely

to be modest." Analysts have said a rising Chinese currency could bring more

consumers from the mainland into Hong Kong as the local dollar remains weak,

partly because of a potential carry trade using the unit by currency traders.

Yam said Hong Kong's economy remains sound as the environment is largely

favorable for businesses. He attributed his optimism to "robust growth,

declining unemployment, a benign inflation outlook, renewed fiscal strength and

normal behavior of property and stock markets." He had suggested in February

that Beijing's tightening measures may lead to "consequences beyond

imagination." Its recent measures to raise interest rates, widen the currency

trading band and increase the reserve requirement ratio for domestic banks have

all failed to deter investors. Yam also said there are concerns in the US

economy that could affect the macroeconomic environment. "A sudden and sharp

depreciation of the US dollar, the disoderly unwinding of global imbalances and

a spillover of US housing market weakness are external risks to the currency

stability in Hong Kong," Yam said. "Financial instability and volatile capital

flows are induced by an increased risk aversion of market participants and

higher market volatility and the destabilizing activities of hedge funds." He

said the HKMA's foreign exchange reserves have already been aggressive enough as

it has a 23 percent composition of stocks in its portfolio.

David Eldon,

former chairman of the influential Hong Kong General Chamber of Commerce,

published an article in the chamber newsletter urging the government to further

simplify its immigration procedures for foreign employees of local businesses.

His view is a reflection of the strong demand for foreign talent by local

businesses. It is part of coping with economic restructuring to meet rising

competition from various mainland cities, particularly Shanghai. Many business

leaders in Hong Kong are beginning to realize that the biggest talent pool

waiting to be tapped lies on the mainland. This was not obvious in the past.

Mainland business executives and professionals were seen by many Hong Kong

business people as unsuitable for a fast changing and highly competitive

business environment which rewards only those with initiative and daring. But

this bias against mainland managers is fast melting away. Rapid economic

development and the opening of the mainland market have produced a new crop of

mainland managers and professionals. They have shown that they can be as

adaptable to a competitive environment as their Hong Kong counterparts. This

change is anything but subtle. In our office in Shanghai, I have the pleasure of

watching the transformation of a few young and timid interns, fresh out of

college, into hard-charging, inquisitive and thoughtful reporters full of

self-confidence. All they needed was a bit of guidance, encouragement and, more

importantly, a keen sense of competitiveness not only with reporters on the

rival papers but also with their colleagues in other bureaus. My personal

judgment was confirmed when I had dinner with a senior expatriate editor in

Beijing the other evening. He asked me about a reporter in the Shanghai bureau

whom he thought was particularly outstanding on her beat. He was hugely

surprised when I told him that this reporter joined us about six months ago and

had never worked at any foreign media as he had assumed. She is simply more

combative than others. To survive in a work environment where rewards are

closely tied to individual performance, most young Hong Kong executives learn

the lesson of competitiveness early on. Such a lesson has taught them to be

efficient, adaptive and innovative, the common traits widely attributed to Hong

Kong people. There is, of course, a less flattering side to the stereotype. Hong

Kongers, who are also characterized as needlessly aggressive, inconsiderate to

the point of rudeness, uncaring and impatient. But on balance, most Hong Kong

people feel pretty comfortable about how they are seen by outsiders. Based on my

experience in working with young reporters on the mainland, I believe that most

young mainland executives will have no problem picking up the lesson on

competitiveness very quickly if they have a chance to work in Hong Kong. This

would be an excellent opportunity for them to gain the exposure to a free

international marketplace that is so close to home. It appears that a growing

number of Hong Kong business owners are keen on recruiting talent from the

mainland. To satisfy their needs, it may make sense for the Chamber of Commerce,

one of Hong Kong's more powerful business groups, to take the initiative of

setting up recruitment offices in Beijing, Shanghai and some other major cities

to publicize employment opportunities in Hong Kong and to build a data base of

qualified talent willing to work in Hong Kong. David Eldon,

former chairman of the influential Hong Kong General Chamber of Commerce,

published an article in the chamber newsletter urging the government to further

simplify its immigration procedures for foreign employees of local businesses.

His view is a reflection of the strong demand for foreign talent by local

businesses. It is part of coping with economic restructuring to meet rising

competition from various mainland cities, particularly Shanghai. Many business

leaders in Hong Kong are beginning to realize that the biggest talent pool

waiting to be tapped lies on the mainland. This was not obvious in the past.

Mainland business executives and professionals were seen by many Hong Kong

business people as unsuitable for a fast changing and highly competitive

business environment which rewards only those with initiative and daring. But

this bias against mainland managers is fast melting away. Rapid economic

development and the opening of the mainland market have produced a new crop of

mainland managers and professionals. They have shown that they can be as

adaptable to a competitive environment as their Hong Kong counterparts. This

change is anything but subtle. In our office in Shanghai, I have the pleasure of

watching the transformation of a few young and timid interns, fresh out of

college, into hard-charging, inquisitive and thoughtful reporters full of

self-confidence. All they needed was a bit of guidance, encouragement and, more

importantly, a keen sense of competitiveness not only with reporters on the

rival papers but also with their colleagues in other bureaus. My personal

judgment was confirmed when I had dinner with a senior expatriate editor in

Beijing the other evening. He asked me about a reporter in the Shanghai bureau

whom he thought was particularly outstanding on her beat. He was hugely

surprised when I told him that this reporter joined us about six months ago and

had never worked at any foreign media as he had assumed. She is simply more

combative than others. To survive in a work environment where rewards are

closely tied to individual performance, most young Hong Kong executives learn

the lesson of competitiveness early on. Such a lesson has taught them to be

efficient, adaptive and innovative, the common traits widely attributed to Hong

Kong people. There is, of course, a less flattering side to the stereotype. Hong

Kongers, who are also characterized as needlessly aggressive, inconsiderate to

the point of rudeness, uncaring and impatient. But on balance, most Hong Kong

people feel pretty comfortable about how they are seen by outsiders. Based on my

experience in working with young reporters on the mainland, I believe that most

young mainland executives will have no problem picking up the lesson on

competitiveness very quickly if they have a chance to work in Hong Kong. This

would be an excellent opportunity for them to gain the exposure to a free

international marketplace that is so close to home. It appears that a growing

number of Hong Kong business owners are keen on recruiting talent from the

mainland. To satisfy their needs, it may make sense for the Chamber of Commerce,

one of Hong Kong's more powerful business groups, to take the initiative of

setting up recruitment offices in Beijing, Shanghai and some other major cities

to publicize employment opportunities in Hong Kong and to build a data base of

qualified talent willing to work in Hong Kong.

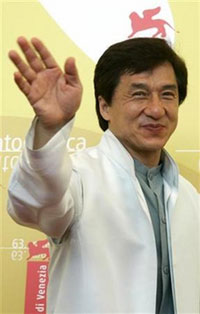

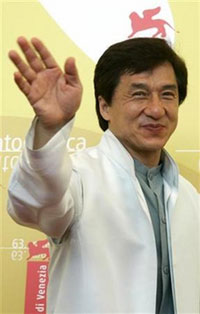

Cast member Jackie Chan attends a photocall to introduce

his film 'Rob-B-Hood' at the Venice Film Festival September 8, 2006. Jackie

Chan's production company has sold the remake rights for the action-comedy

"Enter the Phoenix" to a producer of "The Bourne Ultimatum." The 2004

Cantonese-language original was directed and co-written by its star, Stephen

Fung. The plot centers on the gay son of a boss whose dying wish is that he take

over the family business. Chan was one of the producers. Hollywood remakes of

Asian films are hot, with such properties as "The Grudge" and "The Ring"

storming the box office. Earlier this year "The Departed," Martin Scorsese's

remake of Hong Kong box office winner "Infernal Affairs," won four Oscars,

including best picture and director. Andrew Tennenbaum will produce the remake,

according to a statement from his L.A.-based Flashpoint Entertainment. "This is

my first Asian film remake and I couldn't be more excited," said Tennenbaum, who

also helped make "The Bourne Supremacy." He said he was meeting with writers and

directors to create the adaptation.

Cast member Jackie Chan attends a photocall to introduce

his film 'Rob-B-Hood' at the Venice Film Festival September 8, 2006. Jackie

Chan's production company has sold the remake rights for the action-comedy

"Enter the Phoenix" to a producer of "The Bourne Ultimatum." The 2004

Cantonese-language original was directed and co-written by its star, Stephen

Fung. The plot centers on the gay son of a boss whose dying wish is that he take

over the family business. Chan was one of the producers. Hollywood remakes of

Asian films are hot, with such properties as "The Grudge" and "The Ring"

storming the box office. Earlier this year "The Departed," Martin Scorsese's

remake of Hong Kong box office winner "Infernal Affairs," won four Oscars,

including best picture and director. Andrew Tennenbaum will produce the remake,

according to a statement from his L.A.-based Flashpoint Entertainment. "This is

my first Asian film remake and I couldn't be more excited," said Tennenbaum, who

also helped make "The Bourne Supremacy." He said he was meeting with writers and

directors to create the adaptation.

Nicholas

Sallnow-Smith, chairman of the controversy-laden Link REIT (0823), has accepted

a job as regional chief executive for northeast Asia at Standard Chartered

(2888) - less than two months after he took over the politically charged helm at

the real estate investment trust. He will assume his new position at Standard

Chartered July 1, the lender announced Monday. While Sallnow-Smith plans to hold

down both posts, market watchers are dubious. "It may send signals that he may

not see his employment with The Link as a long-term relationship," said Phillip

Securities director Louis Wong Wai-kit. "Already, for The Link, the reshuffle at

the senior level has undermined confidence in the investor community." Fulbright

Securities general manager Francis Leung Sheung-nim said: "He wants to work for

a bigger company. Basically, he's getting the best of both worlds." His

independent, non-executive role at The Link has drawn fire from lawmakers and

public housing residents. "I think it's quite hard to take up two important

jobs," said Tung Tai Securities director Kenny Tang Sing-hing. "I think

eventually he may need to give up one job, maybe The Link." Sallnow-Smith became

chairman at Link REIT April 1 after Paul Cheng Ming-fun resigned for personal

reasons. It was then expected that Sallnow- Smith's extensive experience as

chairman of Hongkong Land could help improve returns at The Link. "Apparently,

people will be very disappointed," said Lun. "They placed their faith in the

wrong person." Three senior executives have left Link REIT since the beginning

of the year amid repeated demands from the largest shareholder, British hedge

fund The Children's Fund Investment Management, for significant rent increases.

Sallnow-Smith, whose Standard Chartered position will be based in Hong Kong,

will oversee governance, strategy and financial performance in northeast Asia

for the emerging- markets lender. Nicholas

Sallnow-Smith, chairman of the controversy-laden Link REIT (0823), has accepted

a job as regional chief executive for northeast Asia at Standard Chartered

(2888) - less than two months after he took over the politically charged helm at

the real estate investment trust. He will assume his new position at Standard

Chartered July 1, the lender announced Monday. While Sallnow-Smith plans to hold

down both posts, market watchers are dubious. "It may send signals that he may

not see his employment with The Link as a long-term relationship," said Phillip

Securities director Louis Wong Wai-kit. "Already, for The Link, the reshuffle at

the senior level has undermined confidence in the investor community." Fulbright

Securities general manager Francis Leung Sheung-nim said: "He wants to work for

a bigger company. Basically, he's getting the best of both worlds." His

independent, non-executive role at The Link has drawn fire from lawmakers and

public housing residents. "I think it's quite hard to take up two important

jobs," said Tung Tai Securities director Kenny Tang Sing-hing. "I think

eventually he may need to give up one job, maybe The Link." Sallnow-Smith became

chairman at Link REIT April 1 after Paul Cheng Ming-fun resigned for personal

reasons. It was then expected that Sallnow- Smith's extensive experience as

chairman of Hongkong Land could help improve returns at The Link. "Apparently,

people will be very disappointed," said Lun. "They placed their faith in the

wrong person." Three senior executives have left Link REIT since the beginning

of the year amid repeated demands from the largest shareholder, British hedge

fund The Children's Fund Investment Management, for significant rent increases.

Sallnow-Smith, whose Standard Chartered position will be based in Hong Kong,

will oversee governance, strategy and financial performance in northeast Asia

for the emerging- markets lender.

Spiraling pork prices in the mainland have fanned prices of food and

agricultural products as well as shares of companies listed in Hong Kong with no

direct link to the sector. Shares of China Yurun Food (1068), the mainland pork

distributor and meat processor that is also a wholesale supplier to Hong Kong,

hit a high of HK$9.52 Wednesday. They eased 0.85 percent to close at HK$9.37

Monday. However, edible oil trader Aptus Holdings (8212) and edible oil refiner

Hop Hing Holdings (0047) started the week with surges of about 30 percent.

Shares of CP Pokphand (0043), which mainly trades agricultural products as well

as operate feedmills and poultry farms, also drove up 17.11 percent to close at

HK$0.445. Analysts said investors believe pork prices will continue to rise for

at least six to nine months and that the increases will spill over into other

food categories, causing speculative buying. According to Ministry of Commerce

data, wholesale pork prices in 36 major cities jumped 43.1 percent in the first

three weeks of this month from a year earlier, or 17 percent up from March.

"Pork accounted for about 5-6 percent of the mainland CPI basket in the past

but, with the price gains, it now makes up more than 20 percent," Chen Xindong,

senior economist at BNP Paribas Securities, told The Standard. With the surge in

pork prices, economists said, inflation in the coming months will surpass the 3

percent target set by Premier Wen Jiabao in March. The price increases came as

Beijing was having initial success in inflation, with the consumer price index

dipping to 3 percent last month following a 3.3 percent increase in March over a

year earlier.

Spiraling pork prices in the mainland have fanned prices of food and

agricultural products as well as shares of companies listed in Hong Kong with no

direct link to the sector. Shares of China Yurun Food (1068), the mainland pork

distributor and meat processor that is also a wholesale supplier to Hong Kong,

hit a high of HK$9.52 Wednesday. They eased 0.85 percent to close at HK$9.37

Monday. However, edible oil trader Aptus Holdings (8212) and edible oil refiner

Hop Hing Holdings (0047) started the week with surges of about 30 percent.

Shares of CP Pokphand (0043), which mainly trades agricultural products as well

as operate feedmills and poultry farms, also drove up 17.11 percent to close at

HK$0.445. Analysts said investors believe pork prices will continue to rise for

at least six to nine months and that the increases will spill over into other

food categories, causing speculative buying. According to Ministry of Commerce

data, wholesale pork prices in 36 major cities jumped 43.1 percent in the first

three weeks of this month from a year earlier, or 17 percent up from March.

"Pork accounted for about 5-6 percent of the mainland CPI basket in the past

but, with the price gains, it now makes up more than 20 percent," Chen Xindong,

senior economist at BNP Paribas Securities, told The Standard. With the surge in

pork prices, economists said, inflation in the coming months will surpass the 3

percent target set by Premier Wen Jiabao in March. The price increases came as

Beijing was having initial success in inflation, with the consumer price index

dipping to 3 percent last month following a 3.3 percent increase in March over a

year earlier.

Local

companies sending spam e-mails have been warned of the stiff penalties when the

anti-spam law comes into effect Friday, but the telecoms watchdog says it may be

difficult to deal with overseas firms involved in the practice.

Greenpeace activists turn the Golden

Bauhinia into a symbolic energy-efficient light bulb to demand stronger action

on climate change. The three-day International Conference on Climate Change has

brought hundreds of representatives from 26 nations to Hong Kong. Greenpeace activists turn the Golden

Bauhinia into a symbolic energy-efficient light bulb to demand stronger action

on climate change. The three-day International Conference on Climate Change has

brought hundreds of representatives from 26 nations to Hong Kong.

Hong Kong has been urged by a

leading international environmental scientist to set its own target for reducing

greenhouse gas emissions, even though Beijing has yet to set any national

targets.

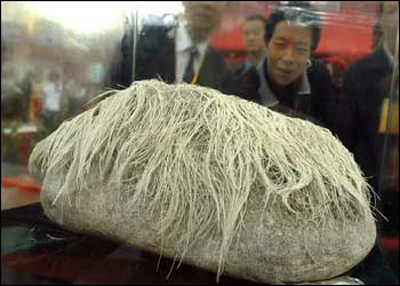

Hong Kong Heritage Museum staff check the

mounting of Bronze Mask with Protruding Pupils, which will be on display at the

museum from June 6. The piece, dated 1200 BC, is among 120 treasures on display

from the Sanxingdui Museum, Chengdu Museum and Sichuan Provincial Institute of

Archaeology, all in Sichuan. Hong Kong Heritage Museum staff check the

mounting of Bronze Mask with Protruding Pupils, which will be on display at the

museum from June 6. The piece, dated 1200 BC, is among 120 treasures on display

from the Sanxingdui Museum, Chengdu Museum and Sichuan Provincial Institute of

Archaeology, all in Sichuan.

China: The

Beijing Traffic Management Bureau announced on May 26th that Beijing's motor

vehicles have exceeded three million, and Beijing has become a city built on an

"car's wheels." One in every five residents owns a vehicle, and the proportion

of private car ownership reaches over eighty percent. With these three million

cars, Beijing will endure pressure from heavy traffic and traffic jams,

environmental damage, and parking availability. However, the relevant department

of government expressed that Beijing has the confidence to meet these new

challenges. Data shows that it took twenty-nine years for Beijing's motor

vehicle ownership to increase from 2,300 in 1949 to 77,000 in 1978; but it took

only six years to increase from one million to two million. Many Beijing drivers

still remembered the August of 2003 when the Beijing Traffic Management Bureau

announced that "Beijing's motor vehicles had reached two million." There was

much surprise. Although feelings of surprise still exist, the number of motor

vehicles has already exceeded three million. A chief member of the Beijing

Traffic Management Bureau said that from May 26th to the end of this year,

Beijing's traffic may most likely go through a tough period: motor vehicle

ownership will continue to grow rapidly. The construction project that will

cover the roads cannot be completed in a short time; the new subways are not put

into use yet; and the organization of bus lines are still adjusting. However, it

was reported that, " Beijing already has plenty of experience in dealing with

traffic jams; although the number of vehicles has increased by one million, the

situation of traffic jams is not as aggravating as they were in 2003."

China: The

Beijing Traffic Management Bureau announced on May 26th that Beijing's motor

vehicles have exceeded three million, and Beijing has become a city built on an

"car's wheels." One in every five residents owns a vehicle, and the proportion

of private car ownership reaches over eighty percent. With these three million

cars, Beijing will endure pressure from heavy traffic and traffic jams,

environmental damage, and parking availability. However, the relevant department

of government expressed that Beijing has the confidence to meet these new

challenges. Data shows that it took twenty-nine years for Beijing's motor

vehicle ownership to increase from 2,300 in 1949 to 77,000 in 1978; but it took

only six years to increase from one million to two million. Many Beijing drivers

still remembered the August of 2003 when the Beijing Traffic Management Bureau

announced that "Beijing's motor vehicles had reached two million." There was

much surprise. Although feelings of surprise still exist, the number of motor

vehicles has already exceeded three million. A chief member of the Beijing

Traffic Management Bureau said that from May 26th to the end of this year,

Beijing's traffic may most likely go through a tough period: motor vehicle

ownership will continue to grow rapidly. The construction project that will

cover the roads cannot be completed in a short time; the new subways are not put

into use yet; and the organization of bus lines are still adjusting. However, it

was reported that, " Beijing already has plenty of experience in dealing with

traffic jams; although the number of vehicles has increased by one million, the

situation of traffic jams is not as aggravating as they were in 2003."

Chinese Premier Wen Jiabao looks

through the exercise book of a boy Yang Saike in a village of Xingping City,

North China's Shaanxi Province, May 26, 2007. Yang Saike, whose parents were

working in the coastal province of Fujian, thousands of kilometers away, was

cared for by his grandparents. His parents fail to go home even once a year. Wen

has extended greetings to the "left-behind" children of rural migrant workers in

cities ahead of the Children's Day, which falls on June 1.

Chinese Premier Wen Jiabao looks

through the exercise book of a boy Yang Saike in a village of Xingping City,

North China's Shaanxi Province, May 26, 2007. Yang Saike, whose parents were

working in the coastal province of Fujian, thousands of kilometers away, was

cared for by his grandparents. His parents fail to go home even once a year. Wen

has extended greetings to the "left-behind" children of rural migrant workers in

cities ahead of the Children's Day, which falls on June 1.

Mainland

piped-gas distributor China Gas Holdings (0384) will invest 1.2 billion yuan

(HK$1.23 billion) in a second gas liquefaction plant in the northeast of Sichuan

province.

Tingyi

(Cayman Islands) Holding (0322), China's biggest packaged- food maker, reported

first-quarter net profit jumped 20.6 percent year on year while market share for

the group's core products continued to climb.

Shanghai reappointed Mayor Han Zheng

as a Communist Party deputy secretary yesterday, indicating he will remain in

the city for now after a corruption case that led to the sacking of the city's

previous party secretary.

Despite official efforts to counter

the soaring price of pork on the mainland, shoppers were still concerned

yesterday that the price of other everyday necessities would follow the rising

cost of the meat.

A former employee of BNP Paribas

allegedly bribed a mainland official to gain an underwriting contract for the

country's first euro-denominated foreign bonds, according to a mainland media

report.

Bank of China is planning to tap the

Hong Kong debt market by selling as much as three billion yuan worth of bonds

denominated in the Chinese currency, the lender said.

May 29, 2007

Hong Kong:

The controversial issue of Hong

Kong being required to communicate with the central government over its chief

executive candidates will go public when Basic Law Committee director Qiao

Xiaoyang arrives in the SAR for a Basic Law seminar in mid-June. Hong Kong:

The controversial issue of Hong

Kong being required to communicate with the central government over its chief

executive candidates will go public when Basic Law Committee director Qiao

Xiaoyang arrives in the SAR for a Basic Law seminar in mid-June.

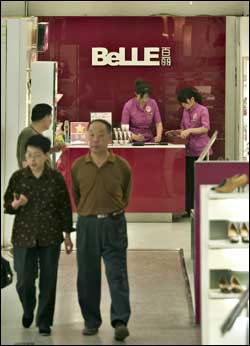

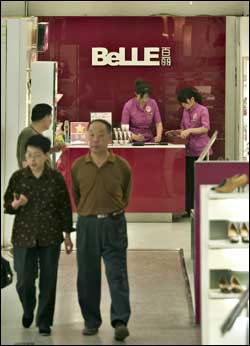

Walker Group, Hong Kong shoe maker with growing business both in Hong Kong and

Chinese mainland, Sunday announced its initial public offering plan of 150

million shares starting from Monday. It said the listing on the Main Board of

the Stock Exchange of Hong Kong is to raise approximately 665.9 million HK

dollars (85.4 million U.S. dollars) for its business expansion. About 90 percent

of the offering will be for placing and 10 percent will be offered to the public

with the price range between 3.86 HK dollars to 3.18 HK dollars. The placing

offer has attracted two institutional investors -- ITOCHU Corporation, a

Japanese conglomerate and Gaoling Yali Fund, a investing fund indirectly owned

by Yale University. The public offering will last from Monday to Thursday and

start trading on June 7.

Walker Group, Hong Kong shoe maker with growing business both in Hong Kong and

Chinese mainland, Sunday announced its initial public offering plan of 150

million shares starting from Monday. It said the listing on the Main Board of

the Stock Exchange of Hong Kong is to raise approximately 665.9 million HK

dollars (85.4 million U.S. dollars) for its business expansion. About 90 percent

of the offering will be for placing and 10 percent will be offered to the public

with the price range between 3.86 HK dollars to 3.18 HK dollars. The placing

offer has attracted two institutional investors -- ITOCHU Corporation, a

Japanese conglomerate and Gaoling Yali Fund, a investing fund indirectly owned

by Yale University. The public offering will last from Monday to Thursday and

start trading on June 7.

Hong Kong will continue to strengthen its role as China's

international financial center, although the stock exchange will not be the sole

beneficiary of mainland policies, a senior executive said. Ronald Arculli,

chairman of Hong Kong Exchanges and Clearing (0388), told The Standard the

exchange is ready to play a greater role in China's economic development, while

also aiming to become a leading regional market by attracting more overseas

listings. Arculli said the exchange could not depend entirely on the mainland to

develop further despite the expansion of the qualified domestic institutional

investor scheme. The move, announced May 11, helped to drive turnover May 14 up

to HK$94.99 billion and lifted the Hang Seng Index to a record closing high of

20,979.24 points. "QDII is not only designed for the Hong Kong market. It is a

measure to give mainlanders more investment choices," he said. "[The quotas] may

be enlarged, but we can't absorb it all." Arculli said the news that about US$7

billion (HK$54.6 billion) would be made available for investment propelled daily

turnover to a record and that it meant the bourse would be swamped with huge

capital flows if all of the mainland's financial policies were to be decided in

favor of Hong Kong. And as the bourse evolves, the exchange is strengthening its

market infrastructure. "Our trading system is ready. It can handle more than 1.5

million transactions per day, while the current daily average is only 400,000

transactions." Since the 1970s, Hong Kong has played an important role in

China's economic development, contributing to and benefiting from the country's

robust economic growth, Arculli said. Now, 10 years after the handover, Hong

Kong should look at the bigger picture and develop a tighter relationship with

the nation, Arculli said. "China has upcoming macro plans. Areas such as

railways development, customs cooperation and financial market convergence are

areas in which Hong Kong has a role. This will be long term and might need more

than three to five years to be implemented. The central government has clearly

said Hong Kong's status as an international financial center is irreplaceable.

Their support for us will not change." He said the bourse is eager to become the

region's leading financial center. "We have been focused on attracting mainland

enterprises to use Hong Kong as a platform for overseas fund raising. And now

our goal is to be the time zone's regional financial center, like London or New

York," Arculli said. "We do not fear competition from our mainland peers.

Competition is not only from the mainland but also from overseas counterparts

such as Nasdaq." Overseas exchanges such as the New York Stock Exchange, Nasdaq

and Deutsche Borse are planning to set foot in China with the aim of attracting

major issuers. Rules allowing them to open offices take effect July 1.

Hong Kong will continue to strengthen its role as China's

international financial center, although the stock exchange will not be the sole

beneficiary of mainland policies, a senior executive said. Ronald Arculli,

chairman of Hong Kong Exchanges and Clearing (0388), told The Standard the

exchange is ready to play a greater role in China's economic development, while

also aiming to become a leading regional market by attracting more overseas

listings. Arculli said the exchange could not depend entirely on the mainland to

develop further despite the expansion of the qualified domestic institutional

investor scheme. The move, announced May 11, helped to drive turnover May 14 up

to HK$94.99 billion and lifted the Hang Seng Index to a record closing high of

20,979.24 points. "QDII is not only designed for the Hong Kong market. It is a

measure to give mainlanders more investment choices," he said. "[The quotas] may

be enlarged, but we can't absorb it all." Arculli said the news that about US$7

billion (HK$54.6 billion) would be made available for investment propelled daily

turnover to a record and that it meant the bourse would be swamped with huge

capital flows if all of the mainland's financial policies were to be decided in

favor of Hong Kong. And as the bourse evolves, the exchange is strengthening its

market infrastructure. "Our trading system is ready. It can handle more than 1.5

million transactions per day, while the current daily average is only 400,000

transactions." Since the 1970s, Hong Kong has played an important role in

China's economic development, contributing to and benefiting from the country's

robust economic growth, Arculli said. Now, 10 years after the handover, Hong

Kong should look at the bigger picture and develop a tighter relationship with

the nation, Arculli said. "China has upcoming macro plans. Areas such as

railways development, customs cooperation and financial market convergence are

areas in which Hong Kong has a role. This will be long term and might need more

than three to five years to be implemented. The central government has clearly

said Hong Kong's status as an international financial center is irreplaceable.

Their support for us will not change." He said the bourse is eager to become the

region's leading financial center. "We have been focused on attracting mainland

enterprises to use Hong Kong as a platform for overseas fund raising. And now

our goal is to be the time zone's regional financial center, like London or New

York," Arculli said. "We do not fear competition from our mainland peers.

Competition is not only from the mainland but also from overseas counterparts

such as Nasdaq." Overseas exchanges such as the New York Stock Exchange, Nasdaq

and Deutsche Borse are planning to set foot in China with the aim of attracting

major issuers. Rules allowing them to open offices take effect July 1.

As the mainland continues to reform

its economy to align its business environment with international standards, it

will become one of the top three epicenters for private equity money. Gene

Donnelly, global managing partner, advisory and tax, at PricewaterhouseCoopers,

said there will soon be "three epicenters of private equity in the world - New

York, London, and we think China is going to be the third." He told The Standard

private equity activity in the mainland is "booming." "There are too many firms

to mention that are opening." Changes in the tax law that take effect from the

start of next year provide a high degree of certainty. The unified tax system, a

major part of the mainland's accession to the World Trade Organization, provides

a clarity that will help foreign investors such as private equity firms manage

their risks better. At the moment, foreign-funded enterprises get preferential

tax treatment - 15 percent on average as opposed to 25 percent for domestic

companies. "I think this tax change is a good example of how China is quickly

conforming to the rules of the game around the world," Donnelly said. Private

equity firms have so far been taking smaller stakes in mainland deals, than in

other markets. As they adapt to the culture, however, big value deals will

become possible. "Learning the new culture, learning how to get along with

regulators, who the regulators are, is all part of the natural evolution of

private equity as it moves into new markets," Donnelly said. Private equity

players still have a lot to learn about doing deals in China.

As the mainland continues to reform

its economy to align its business environment with international standards, it

will become one of the top three epicenters for private equity money. Gene

Donnelly, global managing partner, advisory and tax, at PricewaterhouseCoopers,

said there will soon be "three epicenters of private equity in the world - New

York, London, and we think China is going to be the third." He told The Standard

private equity activity in the mainland is "booming." "There are too many firms

to mention that are opening." Changes in the tax law that take effect from the

start of next year provide a high degree of certainty. The unified tax system, a

major part of the mainland's accession to the World Trade Organization, provides

a clarity that will help foreign investors such as private equity firms manage

their risks better. At the moment, foreign-funded enterprises get preferential

tax treatment - 15 percent on average as opposed to 25 percent for domestic

companies. "I think this tax change is a good example of how China is quickly

conforming to the rules of the game around the world," Donnelly said. Private

equity firms have so far been taking smaller stakes in mainland deals, than in

other markets. As they adapt to the culture, however, big value deals will

become possible. "Learning the new culture, learning how to get along with

regulators, who the regulators are, is all part of the natural evolution of

private equity as it moves into new markets," Donnelly said. Private equity

players still have a lot to learn about doing deals in China.

Shanghai Fosun Group, one of the largest privately owned conglomerates in the

mainland and parent of developer Shanghai Forte (2337), is looking to raise US$1

billion (HK$7.8 billion) in a listing in Hong Kong.

The People's Liberation Army's 8-1 Parachute Brigade will make its debut in Hong

Kong June 28 as part of celebrations marking the 10th anniversary of the

handover. Carrying the national, HKSAR and PLA flags, members of the brigade

will descend from 2,000 meters during a free 40-minute performance at the Happy

Valley racecourse. The brigade, a nationally renowned team, has won about 240

championships so far and broken the world record eight times with its

spectacular shows. The team performed at the Macau handover ceremony in 1999,

but this is the first time for it to visit Hong Kong. Cheng Yiu-tong, convenor

of the Hong Kong Celebrations Preparatory Association, said team members have

visited the racecourse and are satisfied the ground is suitable for landing. The

brigade will put on another show at the "Together We Grow, Together We Dream"

July 1 parade. Cheng said he expects more than 20,000 people to watch the

racecourse event, which will also include a flag- raising ceremony by the city's

PLA garrison and marches. The parade will start from the racecourse at noon, to

be followed by performances by the parachute brigade and garrison. It will pass

through Tin Lok Lane and Hennessy Road and end at Southorn Playground in Wan

Chai. Four performance zones will be set up along the route to allow spectators

to take a closer look at the performers. Program director Lee Fung-king said the

parade will include about 5,000 participants from organizations in Hong Kong and

the mainland. "We already have 14 groups of performers from various mainland

provinces," Lee said. "We're still contacting other parties who may be

interested in taking part in the parade." The groups will perform lion dances,

juggling and other traditional Chinese skills. About 30 children born July 1,

1997, have been invited to accompany a huge birthday cake during the parade. The

children cut a cake with Secretary for Home Affairs Patrick Ho Chi- ping at a

press conference Sunday to mark the start of the celebrations. Animals and vets

from the Society for the Prevention of Cruelty to Animals will also participate

in the parade. Apart from the parade and performances, a fireworks display will

light up Victoria Harbour at night from July 1 to July 8. More details of

tickets and performances to mark the handover will be released later. Cheng said

he hopes senior officials from the mainland will attend the activities, but he

is not sure who will be coming. He said the organizers will spend about HK$2

million on the parade and another HK$8 million on the fireworks displays. Asked

whether the parade will clash with the democrats' planned annual march, Cheng

said the event will end at about 3pm.

Nine thousand children take part in a

mass drum-banging rehearsal at the Hong Kong Coliseum, for the Dragon Jamboree.

The students will join hundreds of others from the mainland, Taiwan and Macau

for a 10,000-strong event on June 30 in an attempt to set a Guinness world

record for the largest simultaneous percussion performance. Nine thousand children take part in a

mass drum-banging rehearsal at the Hong Kong Coliseum, for the Dragon Jamboree.

The students will join hundreds of others from the mainland, Taiwan and Macau

for a 10,000-strong event on June 30 in an attempt to set a Guinness world

record for the largest simultaneous percussion performance.

Longhu Real Estate, a Chongqing-based

luxury developer, is planning an initial public offering of up to US$1 billion

in Hong Kong this year, capitalising on investors' appetite for mainland

property plays.

China: Wang

Liqin shut the last non-Chinese out of the world table tennis championships on

Sunday, ensuring China's clean sweep of gold and silver medals for the third

time.

China: Wang

Liqin shut the last non-Chinese out of the world table tennis championships on

Sunday, ensuring China's clean sweep of gold and silver medals for the third

time.

Chinese Premier Wen Jiabao (C) talks with

customers on the pork prices at a supermarket in Xi'an, capital of northwest

China's Shaanxi Province, May 26, 2007. Wen visited Shaanxi Saturday for an

investigation into pig-raising and pork market. Chinese Premier Wen Jiabao (C) talks with

customers on the pork prices at a supermarket in Xi'an, capital of northwest

China's Shaanxi Province, May 26, 2007. Wen visited Shaanxi Saturday for an

investigation into pig-raising and pork market.

Nasdaq is working closely with the

Chinese authorities to open a representative office in Beijing, said Nasdaq's

chief representative of China Xu Guangxun on Sunday.

Nasdaq is working closely with the

Chinese authorities to open a representative office in Beijing, said Nasdaq's

chief representative of China Xu Guangxun on Sunday.

The Shanghai Stock Exchange (SSE) on

Monday ordered all Special Treatment (ST) companies to publicize a biweekly

report to inform investors about possible risks, according to a statement on its

website.

April saw the value of total exports

of goods in Hong Kong rise to 212.6 billion HK dollars (27. 2 U.S. dollars), up

12.6 percent on the same month last year, official figures indicated Monday. The

figures came after a year-on-year rise of 6.9 percent in March, according to

figures released by the Census and Statistics Department of the Hong Kong

Special Administrative Region. Within this total, the value of re-exports grew

14.3 percent to 204 billion HK dollars, while the value of domestic exports fell

16.1 percent to 8.6 billion HK dollars. The value of imports of goods rose 14.7

percent to 233.2 billion HK dollars, after a year-on-year increase of 11.1

percent in March. A visible trade deficit of 20.6 billion HK dollars, equivalent

to 8.8 percent of the value of imports of goods, was recorded in April. For the

first four months of the year, the value of total exports of goods rose 10

percent over the same period last year. Within this total, the value of

re-exports grew 12.5 percent, while the value of domestic exports dropped 29.3

percent. The department said the trade prospects in the near term will continue

to hinge on the global economic situation, in particular the demand in the US.

Also of crucial significance to Hong Kong's trade outlook is continued strength

in the Mainland economy and its vibrant trade flow. (One U.S. dollar equals

7.813 HK dollars).

Xi Jinping

was elected secretary of the Communist Party of China (CPC) Shanghai Municipal

Committee on Monday.

Chinese

actress Zhang Ziyi (L) and movie director Feng Xiaogang react after they throw

paper flowers to wish the success of their movie "the Banquet" at its Japanese

premiere in Tokyo May 28, 2007.

Chinese

actress Zhang Ziyi (L) and movie director Feng Xiaogang react after they throw

paper flowers to wish the success of their movie "the Banquet" at its Japanese

premiere in Tokyo May 28, 2007.

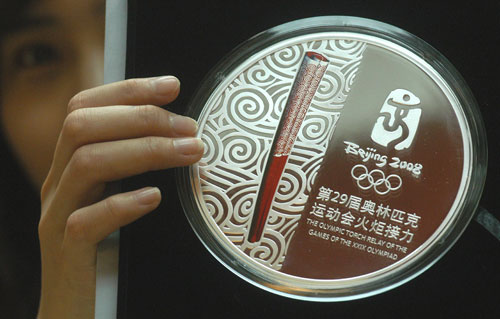

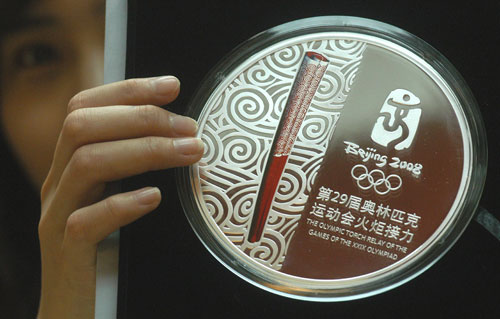

For

paraplegic Wu Runling, visiting a doctor in Beijing is like climbing Qomolangma

(Mt. Everest). Wu, paralyzed since the age of two, went to have a leg illness

checked out last month but found a huge set of stairs blocking his way from the

parking lot to the hospital's registration room. "For healthy people, those

stairs are just a few steps," said Wu, who runs an NGO providing services for

people with disabilities. "But for crutch users, they are like Qomolangma." Next

year, thanks to a raft of changes being implemented ahead of the 2008 Beijing

Games, life will become easier for Wu and China's 83-million disabled

population. One of the keynote changes involves a partial makeover to the

country's most famous landmark, the Great Wall. "A vertical lift will be

installed at the Badaling section of the Wall. It is being designed now so that

disabled people can have better access," Wang Bingyang, a senior member of the

organizing committee for the Beijing Paralympics, told China Daily. Badaling

lies 70km northwest of Beijing and welcomes over 5 million tourists each year.

"Now there are several designs, but the government wants to see more. They hope

the lift will be ready for the 2008 Beijing Games but they don't want to damage

the Great Wall, so they are looking for the perfect design," said Wang. With $40

billion promised by Beijing, the 2008 Games which includes the Olymics and

Paralympics, are set to be the most expensive ever and leave the biggest

legacies behind. Billed as a "Games of Equal Splendor," the Paralympics will run

from September 6-17 in Beijing, Qingdao and Hong Kong, one month after the

Olympic Games. The planned arrival of 4,000-plus disabled athletes has breathed

new life into urban renovation projects. For some officials, Beijing faces a

race against time if it hopes to meet their transport requirements. "I worry

more about the public transport," said Shen Zhifei,, vice-president of the China

Disabled Persons' Federation (CDPF). "You cannot have all the athletes and

special athletes staying in the Olympic Village all the time. The biggest

challenge is the subway system, because few of the existing lines have any

lifts." More special alleyways for the blind, retractable slopes on bus doors

and a growing awareness of the needs of the disabled are just some of the

changes taking place in the Chinese capital. Wheelchair ramps have been added at

the Summer Palace and an elevating ramp at the Noon Gate of the Forbidden City.

Beijing is currently building six new subway lines to complement the existing

three as a way of overhauling a public transport network that has not kept pace

with the city's explosive growth. The difference is that each of the new lines

will include barrier-free facilities. "In the last two decades, Beijing has

built a lot of accessible facilities, but after we were awarded the 2008 Olympic

Games, it accelerated construction, especially in the last five years," said

Wang, deputy director of the Paralympic Games Department of the Beijing

Organizing Committee for the Games of the XXIX Olympiad (BOCOG). "Now, when they

are planning urban construction, they take into account the needs of the

disabled." International Paralympic Committee President Philip Craven likened

the Great Wall makeover to the accessibility of the Acropolis at the Athens

Games in 2004.

For

paraplegic Wu Runling, visiting a doctor in Beijing is like climbing Qomolangma

(Mt. Everest). Wu, paralyzed since the age of two, went to have a leg illness

checked out last month but found a huge set of stairs blocking his way from the

parking lot to the hospital's registration room. "For healthy people, those

stairs are just a few steps," said Wu, who runs an NGO providing services for

people with disabilities. "But for crutch users, they are like Qomolangma." Next

year, thanks to a raft of changes being implemented ahead of the 2008 Beijing

Games, life will become easier for Wu and China's 83-million disabled

population. One of the keynote changes involves a partial makeover to the

country's most famous landmark, the Great Wall. "A vertical lift will be

installed at the Badaling section of the Wall. It is being designed now so that

disabled people can have better access," Wang Bingyang, a senior member of the

organizing committee for the Beijing Paralympics, told China Daily. Badaling

lies 70km northwest of Beijing and welcomes over 5 million tourists each year.

"Now there are several designs, but the government wants to see more. They hope

the lift will be ready for the 2008 Beijing Games but they don't want to damage

the Great Wall, so they are looking for the perfect design," said Wang. With $40

billion promised by Beijing, the 2008 Games which includes the Olymics and

Paralympics, are set to be the most expensive ever and leave the biggest

legacies behind. Billed as a "Games of Equal Splendor," the Paralympics will run

from September 6-17 in Beijing, Qingdao and Hong Kong, one month after the

Olympic Games. The planned arrival of 4,000-plus disabled athletes has breathed

new life into urban renovation projects. For some officials, Beijing faces a

race against time if it hopes to meet their transport requirements. "I worry

more about the public transport," said Shen Zhifei,, vice-president of the China

Disabled Persons' Federation (CDPF). "You cannot have all the athletes and

special athletes staying in the Olympic Village all the time. The biggest

challenge is the subway system, because few of the existing lines have any

lifts." More special alleyways for the blind, retractable slopes on bus doors

and a growing awareness of the needs of the disabled are just some of the

changes taking place in the Chinese capital. Wheelchair ramps have been added at

the Summer Palace and an elevating ramp at the Noon Gate of the Forbidden City.

Beijing is currently building six new subway lines to complement the existing

three as a way of overhauling a public transport network that has not kept pace

with the city's explosive growth. The difference is that each of the new lines

will include barrier-free facilities. "In the last two decades, Beijing has

built a lot of accessible facilities, but after we were awarded the 2008 Olympic

Games, it accelerated construction, especially in the last five years," said

Wang, deputy director of the Paralympic Games Department of the Beijing

Organizing Committee for the Games of the XXIX Olympiad (BOCOG). "Now, when they

are planning urban construction, they take into account the needs of the

disabled." International Paralympic Committee President Philip Craven likened

the Great Wall makeover to the accessibility of the Acropolis at the Athens

Games in 2004.

Volunteers from University of International Business and Economics gave