|

Newsletter

Seminar Material

Biz:

China

Hong

Kong Hawaii

What people

said about us

China

Earthquake Relief

Tax &

Government

Hawaii Voter Registration

Biz-Video

Biz-Video

Hawaii's

China Connection Hawaii's

China Connection

CDP#1780962

CDP#1780962

Doing Business in

Hong Kong & China

Doing Business in

Hong Kong & China

| |

Hong Kong, China & Hawaii Biz*

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our event page to find out more!

After

attended a China/Hong Kong Business/Trade Seminar in Hawaii...still unsure what

to do next, contact us, our Officers, Directors and Founding Members are

actively engaged in China/Hong Kong/Asia trade - we can help!

Are you ready to export your product or

service? You will find out in 3 minutes with resources to help you -

enter

to give it a try

China Central TV - live webcast

China Central TV - live webcast

Skype - FREE

Voice Over IP Skype - FREE

Voice Over IP

View Hawaii's China Connection

Video Trailer

View Hawaii's China Connection

Video Trailer

Direct link

PDF file

Direct link

PDF file

Year of the Pig - February 18, 2007

Year of the Pig - February 18, 2007

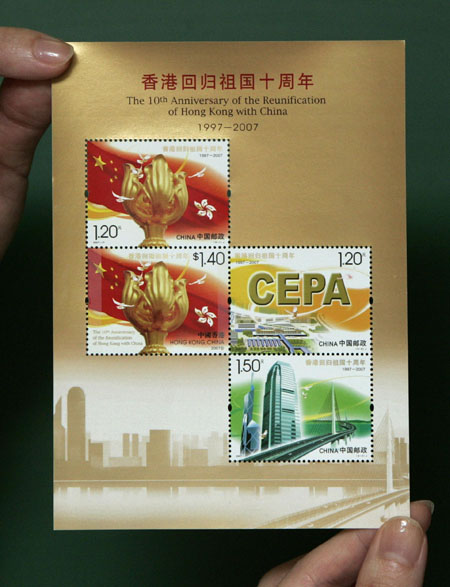

June 30, 2007

Hong Kong:

Hong Kong has remained as before a

magnet since it returned to China 10 years ago, and it will surely witness a

"more splendid" future in the embrace of the motherland, Chinese President Hu

Jintao said Wednesday. Hong Kong:

Hong Kong has remained as before a

magnet since it returned to China 10 years ago, and it will surely witness a

"more splendid" future in the embrace of the motherland, Chinese President Hu

Jintao said Wednesday.

Chinese president Hu Jintao

Wednesday visits an exhibition in Beijing on Hong Kong's achievements in the

decade since its return. Hong Kong has remained as before a magnet since it

returned to China 10 years ago, and it will surely witness a "more splendid"

future in the embrace of the motherland, Chinese President Hu Jintao said

Wednesday.

President Hu Jintao (C) visits the exhibition on

Hong Kong's achievements in a decade in Beijing's Capital Museum on June 27,

2007. As part of celebrations marking the 10th anniversary of Hong Kong's return

to the motherland, the exhibition presents Hong Kong's achievements in the forms

of photos, videos, models and other installations. Hu made the remarks when

visiting an exhibition in Beijing on Hong Kong's achievements in the decade

since its return. Hong Kong's role as a free port and an international finance,

trade and shipping center has remained unchanged under the "one country, two

systems" policy, which has secured the consistency of the social and economic

systems since the special administrative region (SAR) was established there in

1997, Hu said. The president also said that Hong Kong compatriots has become

real masters on their soil as the SAR is witnessing more prosperous economy and

the compatriots there enjoying better living and gradually progressing democracy

since 1997. As part of celebrations marking the 10th anniversary of Hong Kong's

return to the motherland, the exhibition held in the Capital Museum presented

Hong Kong's achievements in the forms of photos, videos, models and other

installations. Hu, accompanied by SAR Chief Executive Donald Tsang, highly

praised the achievements that Hong Kong has accomplished. "With the compatriots'

united efforts and the solid support from the motherland, I firmly believe Hong

Kong will have a more splendid future," Hu said. Vice-President Zeng Qinghong

unveiled the exhibition. Top legislator Wu Bangguo, Premier Wen Jiabao and the

other members of the Standing Committee of the Political Bureau of the Communist

Party of China Central Committee Jia Qinglin, Wu Guanzheng, Li Changchun and Luo

Gan also visited the exhibition Wednesday. Chinese president Hu Jintao

Wednesday visits an exhibition in Beijing on Hong Kong's achievements in the

decade since its return. Hong Kong has remained as before a magnet since it

returned to China 10 years ago, and it will surely witness a "more splendid"

future in the embrace of the motherland, Chinese President Hu Jintao said

Wednesday.

President Hu Jintao (C) visits the exhibition on

Hong Kong's achievements in a decade in Beijing's Capital Museum on June 27,

2007. As part of celebrations marking the 10th anniversary of Hong Kong's return

to the motherland, the exhibition presents Hong Kong's achievements in the forms

of photos, videos, models and other installations. Hu made the remarks when

visiting an exhibition in Beijing on Hong Kong's achievements in the decade

since its return. Hong Kong's role as a free port and an international finance,

trade and shipping center has remained unchanged under the "one country, two

systems" policy, which has secured the consistency of the social and economic

systems since the special administrative region (SAR) was established there in

1997, Hu said. The president also said that Hong Kong compatriots has become

real masters on their soil as the SAR is witnessing more prosperous economy and

the compatriots there enjoying better living and gradually progressing democracy

since 1997. As part of celebrations marking the 10th anniversary of Hong Kong's

return to the motherland, the exhibition held in the Capital Museum presented

Hong Kong's achievements in the forms of photos, videos, models and other

installations. Hu, accompanied by SAR Chief Executive Donald Tsang, highly

praised the achievements that Hong Kong has accomplished. "With the compatriots'

united efforts and the solid support from the motherland, I firmly believe Hong

Kong will have a more splendid future," Hu said. Vice-President Zeng Qinghong

unveiled the exhibition. Top legislator Wu Bangguo, Premier Wen Jiabao and the

other members of the Standing Committee of the Political Bureau of the Communist

Party of China Central Committee Jia Qinglin, Wu Guanzheng, Li Changchun and Luo

Gan also visited the exhibition Wednesday.

The exhibition on Hong Kong's

achievements in a decade opens in Beijing's Capital Museum on June 27, 2007. As

part of celebrations marking the 10th anniversary of Hong Kong's return to the

motherland, the exhibition presents Hong Kong's achievements in the forms of

photos, videos, models and other installations.

The exhibition on Hong Kong's

achievements in a decade opens in Beijing's Capital Museum on June 27, 2007. As

part of celebrations marking the 10th anniversary of Hong Kong's return to the

motherland, the exhibition presents Hong Kong's achievements in the forms of

photos, videos, models and other installations.

Fashion retailer

Esprit Holdings Ltd, the best- performing stock in Hong Kong's benchmark index

in the past five years, plans to spend $1 billion to acquire an international

luxury brand by next year to boost sales of high-margin clothing. "I would like

to integrate such a brand as a better sister of Esprit and as a role model to

access good designers who normally wouldn't want to work for Esprit," Chief

Executive Officer Heinz Krogner said in Hong Kong. "It doesn't need to be a huge

company and it should not dilute earnings. We aim to buy knowledge of the luxury

segment, not revenue." A luxury brand may boost Hong Kong-based Esprit in

Europe, where it earns most of its revenue selling mass-market products such as

jeans for about 70 euros ($94) and T-shirts for 20 euros. Esprit sells clothes

in more than 40 nations and aims to open a new store, including franchised

outlets, every day in the year from July. "Buying a luxury brand makes sense

because Esprit wants to position itself in Germany at the higher end," said

Erica Poon Werkun, a Hong Kong-based analyst at UBS AG. "Although Esprit targets

the mass market, its products are more expensive than those of its competitors.'

Kroger has previously expressed interest in Donna Karan International Inc. LVMH

Moet Hennessy Louis Vuitton SA, the world's biggest luxury-goods company, bought

Donna Karan in 2001 for $243 million. Esprit's profit in the six months ended

Dec. 31 surged 28 percent to HK$2.4 billion ($307 million) on 25 percent more

sales from Europe. Of the Hang Seng Index's current 39 constituents, Esprit is

the best performing in the past 10 years. Since joining the benchmark in

December 2002, the company's shares have surged 1,660 percent. Fashion retailer

Esprit Holdings Ltd, the best- performing stock in Hong Kong's benchmark index

in the past five years, plans to spend $1 billion to acquire an international

luxury brand by next year to boost sales of high-margin clothing. "I would like

to integrate such a brand as a better sister of Esprit and as a role model to

access good designers who normally wouldn't want to work for Esprit," Chief

Executive Officer Heinz Krogner said in Hong Kong. "It doesn't need to be a huge

company and it should not dilute earnings. We aim to buy knowledge of the luxury

segment, not revenue." A luxury brand may boost Hong Kong-based Esprit in

Europe, where it earns most of its revenue selling mass-market products such as

jeans for about 70 euros ($94) and T-shirts for 20 euros. Esprit sells clothes

in more than 40 nations and aims to open a new store, including franchised

outlets, every day in the year from July. "Buying a luxury brand makes sense

because Esprit wants to position itself in Germany at the higher end," said

Erica Poon Werkun, a Hong Kong-based analyst at UBS AG. "Although Esprit targets

the mass market, its products are more expensive than those of its competitors.'

Kroger has previously expressed interest in Donna Karan International Inc. LVMH

Moet Hennessy Louis Vuitton SA, the world's biggest luxury-goods company, bought

Donna Karan in 2001 for $243 million. Esprit's profit in the six months ended

Dec. 31 surged 28 percent to HK$2.4 billion ($307 million) on 25 percent more

sales from Europe. Of the Hang Seng Index's current 39 constituents, Esprit is

the best performing in the past 10 years. Since joining the benchmark in

December 2002, the company's shares have surged 1,660 percent.

China:

Beijing has detained 28 officials

following a national audit for their role in misusing more than 46.88 billion

yuan (HK$48.08 billion) in government funds last year, the top auditor said

Wednesday.

China:

Beijing has detained 28 officials

following a national audit for their role in misusing more than 46.88 billion

yuan (HK$48.08 billion) in government funds last year, the top auditor said

Wednesday.

The European aircraft maker Airbus said on Thursday it

planned to deliver 300 A320 planes from an assembly line in north China's port

city Tianjin by 2016 to satisfy the demand in the country. The assembly plant is

a joint venture between Airbus and Tianjin Zhongtian Aviation Industry

Investment Co., a Chinese alliance of China Aviation Industry Corp I, China

Aviation Industry Corp II and Tianjin Bonded Zone Investment Co.

Beijing's

Silk Market (or Xiushui Street) recently expended almost 3 million Yuan (400,000

US dollars) from the "intellectual property rights (IPR) protection fund" to

dissuade 90 shops which may easily take part in infringement acts. This is to

ensure the quality of the top-notch specialized silk area. Picture displays an

old-fashioned brand shop in the Silk Market. Beijing's

Silk Market (or Xiushui Street) recently expended almost 3 million Yuan (400,000

US dollars) from the "intellectual property rights (IPR) protection fund" to

dissuade 90 shops which may easily take part in infringement acts. This is to

ensure the quality of the top-notch specialized silk area. Picture displays an

old-fashioned brand shop in the Silk Market.

Employees assemble the wings to the

body of an ARJ-21, China's first wholly-made airplane in a hangar in Shanghai,

June 28, 2007. The final assembly began on May 30 this year, and the jetliner

will come off the production line by the end of 2007 and start test flights in

March 2008.

Employees assemble the wings to the

body of an ARJ-21, China's first wholly-made airplane in a hangar in Shanghai,

June 28, 2007. The final assembly began on May 30 this year, and the jetliner

will come off the production line by the end of 2007 and start test flights in

March 2008.

A boy selects online game

software. China's online game market is seen growing 35% to hit $1.3 billion

this year amid strong growth in Internet users, launches of high-quality games

and yuan appreciation. A boy selects online game

software. China's online game market is seen growing 35% to hit $1.3 billion

this year amid strong growth in Internet users, launches of high-quality games

and yuan appreciation.

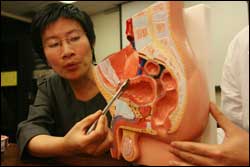

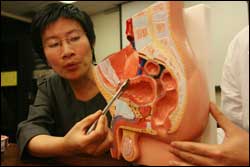

China says it will further modernize

traditional Chinese medicine (TCM) in the next 20 years to improve its appeal at

home and overseas as an effective alternative to Western medicine. In

modernizing TCM, efforts will be made to improve standards, study new

applications and standardize planting, production and processing of medicinal

herbs, according to the report of the China National Center for Biotechnology

Development. The government will also work to form a healthcare system where TCM

and western medicine complement each other and build TCM into an industry with

an annual output value of 400 billion yuan (US$52.6 billion), according to the

center, which is under the Ministry of Science and Technology. "China will work

to make sure that a TCM-based health system serves as an important pillar to

people's health, and a healthcare service is established through which 85

percent of the country's rural population have access to TCM," said the report,

released at an international conference on bio-economy. Currently, about 3,000

hospitals in China provide TCM treatments, with patient visits amounting to

nearly 234 million each year.

Beijing poised to launch US$200b

global fund - Mainland seeks better returns for US$1.2 trillion reserves.

Beijing has moved a step closer to launching its huge state investment company,

detailing plans for a US$200 billion reserve fund that could bankroll the

nation's efforts to become a key force in international financial markets. The

Ministry of Finance yesterday formally submitted a proposal for the bond issue

to the National People's Congress, signalling the authorities want better

returns for the country's US$1.2 trillion in foreign exchange reserves and at

the same time raise "China Inc's" profile. While Beijing is increasingly moving

to bring its rising economic power to bear on global markets, it is also trying

to tame a flood of liquidity and runaway growth that has sent domestic stock

markets soaring. The top legislature is today expected to endorse a bill that

would scrap or reduce tax on interest income from personal bank savings to deter

funds flowing into the equity markets. To fund the new investment company, the

finance ministry will issue 1.55 trillion yuan of tradable special treasury

bonds to buy US$200 billion of foreign reserves. The bonds would have a 10-year

term or longer.

June 29, 2007

Hong Kong:

Horse still to race on and even more joyously! What has been the genuine effect

in a decade after Hong Kong's return to Chinese sovereignty? This question has

arrested not only the attention of people across China, but given rise to a

flurry of discussion around the world. Hong Kong will soon mark the tenth

anniversary of its return to China. The Times magazine of the United States has

carried a cover story on Hong Kong to the denial of a pessimistic and incorrect

prediction of sister publication Forbes a decade ago that Hong Kong would

gradually die after its return. The Times story cites Hong Kong as more vigorous

today than anytime in history. Meanwhile, the New York Time noted in an article

that the vestiges of British rule in Hong Kong will vanish and yet no one feels

it sorrowful. Even the last Hong Kong Governor Chris Patten, who also served as

Chancellor of Oxford University and the former EU Commissioner for foreign

affairs, said recently: "Overall, Hong Kong remains a very special place 10

years after its proper and inevitable return to Chinese sovereignty." Such

optimistic, affirmative appraisals have strong evidences to back up. The "fine

and sturdy steed" of Hong Kong still races on and even more joyously. To date,

it has acceded to the 190-plus international organizations in the name of "Hong

Kong, China" and 134 countries and regions have granted it an entry visa

exemption treatment. The number of aliens having immigrated to Hong Kong rose by

a 60-fold in the past decade. Hong Kong's economy has revived with its best

performance recorded over the past two decades, and its potential competitive

edge ranks the first among the top 50 global economic entities, acknowledged a

report from Japan. "Chinese sovereignty" and "Hong Kong way of life" best

epitomizes what it looks like after a decade following it return to China most

succinctly. Louis Cha, a Chinese scholar and an ace roving knight tales writer,

depicts the present situation with a popular simile that Hong Kongers today are

still under the thumbs of their wives instead of their regional government. A

couple of media moguls, who are known for their free speech on their own, note

they now enjoy much more rights to the job of editing over the past 20 years.

Hong Kongers' demand for a unique social system, the way of life and core values

has been retained and carried on without any "alterations". Many local residents

were not sure whether or not to immigrate elsewhere overseas as they had felt

that they dwelled on a tract of "borrowed" or leased land prior to Hong Kong's

return to the motherland and, after the return, they have turned more and more

resolved to take root in the city. The outcome of varied polls or social surveys

conducted recently show that Hong Kong people have greatly increasing the

recognition of their homeland and a growing number of locals turn to the

interior region as their reliable rear area. With regard of a few crises in Hong

Kong over recent years, the central government has exerted its utmost to help

tide over their and resolve the related thorny problems there in cases of the

Asian financial storms of 1997-98, the fight against SARS of 2003, forging CEPA

and opening the "free accesses to travel' in early and mid of the first decade

at the turn of the new century. Mr. Li Ka Shing, a wise Hong Kong businessman,

was fair and square when he said Hong Kong did not need to cover any national

revenue. On the contrary, central authorities has always taken to heart the

interest of Hong Kong, so local people should valuate the priceless support of

the motherland. Hong Kong's road ahead, nevertheless, is full of both

opportunities and challenges. How to shape and enhance its competition edge, how

to resolve the widening income gap, how to dissolve social bias and

discrimination, and how to spur and carry forward democracy orderly and

steadily? ¨C All these questions call for great wisdom and talents for the

solution. Fortunately, People in Hong Kong know clearly what they need most and

their society is more mature. Hong Kong has the type of people with the best

intelligence and a most ideal pioneering spirit. Chief Executive Donald Tsang

Yam-kuen has spurred himself on not to be reconciled to mediocre but to pursue

things preeminent. In the incoming decade, Hong Kongers, with an utter devotion

coupled with an all-out effort, will not have to simply repeat what they had

accomplished over the past 10 years, and so the "superb Hong Kong spirit" is

sure to re-emerge and demonstrate to the entire world vividly and distinctly. Hong Kong:

Horse still to race on and even more joyously! What has been the genuine effect

in a decade after Hong Kong's return to Chinese sovereignty? This question has

arrested not only the attention of people across China, but given rise to a

flurry of discussion around the world. Hong Kong will soon mark the tenth

anniversary of its return to China. The Times magazine of the United States has

carried a cover story on Hong Kong to the denial of a pessimistic and incorrect

prediction of sister publication Forbes a decade ago that Hong Kong would

gradually die after its return. The Times story cites Hong Kong as more vigorous

today than anytime in history. Meanwhile, the New York Time noted in an article

that the vestiges of British rule in Hong Kong will vanish and yet no one feels

it sorrowful. Even the last Hong Kong Governor Chris Patten, who also served as

Chancellor of Oxford University and the former EU Commissioner for foreign

affairs, said recently: "Overall, Hong Kong remains a very special place 10

years after its proper and inevitable return to Chinese sovereignty." Such

optimistic, affirmative appraisals have strong evidences to back up. The "fine

and sturdy steed" of Hong Kong still races on and even more joyously. To date,

it has acceded to the 190-plus international organizations in the name of "Hong

Kong, China" and 134 countries and regions have granted it an entry visa

exemption treatment. The number of aliens having immigrated to Hong Kong rose by

a 60-fold in the past decade. Hong Kong's economy has revived with its best

performance recorded over the past two decades, and its potential competitive

edge ranks the first among the top 50 global economic entities, acknowledged a

report from Japan. "Chinese sovereignty" and "Hong Kong way of life" best

epitomizes what it looks like after a decade following it return to China most

succinctly. Louis Cha, a Chinese scholar and an ace roving knight tales writer,

depicts the present situation with a popular simile that Hong Kongers today are

still under the thumbs of their wives instead of their regional government. A

couple of media moguls, who are known for their free speech on their own, note

they now enjoy much more rights to the job of editing over the past 20 years.

Hong Kongers' demand for a unique social system, the way of life and core values

has been retained and carried on without any "alterations". Many local residents

were not sure whether or not to immigrate elsewhere overseas as they had felt

that they dwelled on a tract of "borrowed" or leased land prior to Hong Kong's

return to the motherland and, after the return, they have turned more and more

resolved to take root in the city. The outcome of varied polls or social surveys

conducted recently show that Hong Kong people have greatly increasing the

recognition of their homeland and a growing number of locals turn to the

interior region as their reliable rear area. With regard of a few crises in Hong

Kong over recent years, the central government has exerted its utmost to help

tide over their and resolve the related thorny problems there in cases of the

Asian financial storms of 1997-98, the fight against SARS of 2003, forging CEPA

and opening the "free accesses to travel' in early and mid of the first decade

at the turn of the new century. Mr. Li Ka Shing, a wise Hong Kong businessman,

was fair and square when he said Hong Kong did not need to cover any national

revenue. On the contrary, central authorities has always taken to heart the

interest of Hong Kong, so local people should valuate the priceless support of

the motherland. Hong Kong's road ahead, nevertheless, is full of both

opportunities and challenges. How to shape and enhance its competition edge, how

to resolve the widening income gap, how to dissolve social bias and

discrimination, and how to spur and carry forward democracy orderly and

steadily? ¨C All these questions call for great wisdom and talents for the

solution. Fortunately, People in Hong Kong know clearly what they need most and

their society is more mature. Hong Kong has the type of people with the best

intelligence and a most ideal pioneering spirit. Chief Executive Donald Tsang

Yam-kuen has spurred himself on not to be reconciled to mediocre but to pursue

things preeminent. In the incoming decade, Hong Kongers, with an utter devotion

coupled with an all-out effort, will not have to simply repeat what they had

accomplished over the past 10 years, and so the "superb Hong Kong spirit" is

sure to re-emerge and demonstrate to the entire world vividly and distinctly.

A set of tower-shaped porcelain

lights are seen during the trial period of a lantern fair in Nanjing, capital of

east China's Jiangsu Province on June 26, 2007. The fair is part of the city's

celebrations of the 10th anniversary of Hong Kong's return to China.

A set of tower-shaped porcelain

lights are seen during the trial period of a lantern fair in Nanjing, capital of

east China's Jiangsu Province on June 26, 2007. The fair is part of the city's

celebrations of the 10th anniversary of Hong Kong's return to China.

A dragon boat-shaped light is seen during the trial

period of a lantern fair in Nanjing, capital of east China's Jiangsu Province on

June 26, 2007. The fair is part of the city's celebrations of the 10th

anniversary of Hong Kong's return to the motherland.

A dragon boat-shaped light is seen during the trial

period of a lantern fair in Nanjing, capital of east China's Jiangsu Province on

June 26, 2007. The fair is part of the city's celebrations of the 10th

anniversary of Hong Kong's return to the motherland.

Lan Kwai Fong tops HK nightlife - As

the World City of Asia, Hong Kong is known for its vibrant 24-hour lifestyle.

And when the sun goes down, Lan Kwai Fong is the place to party, with its

collection of bars, pubs, and restaurants. Lan Kwai Fong, Hong Kong's trendiest

nightlife street. And it's probably the most westernized place in town, drawing

thousands of tourists, expatriates, and locals every day. Lan Kwai Fong is a

Hong Kong icon. It's a place where people of different cultures can meet, and

find good food and drinks and late night fun. As the saying goes, if you work

hard, you've got to play hard. And Lan Kwai Fong is just the right place to do

it. Dutch tourist, said, "People here are friendly, open, welcoming. I feel like

home." Australian tourist, said, "It's quite a bazaar with everybody outside

drinking, dancing, standing." Many bar owners and customers here are foreign

nationals. And no matter where they come from, Lan Kwai Fong has become part of

their life. Mr. Fox came to Hong Kong over 20 years ago from California in the

United States. At Lan Kwai Fong, he found a place that reminds him of home --

the California Restaurant. For the past 20 years, he's sat in this seat almost

every day. Customer, Lan Kwai Fong, said, "I came here every…my second

family…second child" 27 years ago, a young Canadian, Allan Zeman, opened the

first restaurant in Lan Kwai Fong. It was he who later transformed the area into

a dazzling bar street. And his name is now linked to many other Hong Kong

successes besides the world-renowned entertainment zone. Allan Zeman said, "If

the walls can tell the story, …so many different events happening in Lan Kwai

Fong…became the meeting place where from all the world….They really made me the

father of Lan Kwai Fong." Now Allan Zeman owns 17 restaurants in Lan Kwai Fong.

After Hong Kong's return in 1997, he brought Lan Kwai Fong to Shanghai. And

Zeman says his next stop will be China's capital city, Beijing.

One of the thrills for visitors to Hong

Kong is one of its most popular sports--horse racing. Why does the sport hold

such a special place in the hearts of local residents? And how has horse racing

retained its characteristics over the many years? For over a century, horse

racing has thrilled Hong Kong people, providing first-class entertainment to a

highly enthusiastic public. Here at the Sha Tin race course, jockeys from

different countries are making the final preparations. With a seating capacity

of up to 85,000, Sha Tin is always packed during the race season. Mao Xuzhi, Sha

Tin racecourse, HK, said, "Gambling is illegal here in Hong Kong, except for

lotteries and horse racing. Their horse comes in first." This old punter, Mr.

Huo, has been betting on horses for over 3 decades. Like all his fellow punters

here, he enjoys studying the traits and performance of the horses. Mr. Huo says

he loves to watch the jockeys in action. Another horse racing fan, Mr. Lee, says

the sport has become a symbol of Hong Kong. That explains in part why

horse-racing has been a big industry for the past 150 years. Winfried

Engelbrecht-Bresges, CEO, the HK Jockey club, said, "Horse racing in Hong Kong

is a life style. People of HK are very competitive. They like things fast. They

like to be risky. Deng Xiaoping said horse-racing and dancing continue in HK.

This is definitely the way what has continued here." Behind these gambling-mad

crowds and the world-class horses and jockeys is the controller of all Hong Kong

horse racing, the Jockey Club. It's also the city's biggest tax payer and

charity donor. It gives about 1 billion Hong Kong dollars each year to

charitable causes. Thanks to the central government's commitment and support

after Hong Kong's return, the Jockey Club is still a winner after 10 years. And

it's convinced that Hong Kong's special system will provide a solid guarantee

for the future of the racing industry. One of the thrills for visitors to Hong

Kong is one of its most popular sports--horse racing. Why does the sport hold

such a special place in the hearts of local residents? And how has horse racing

retained its characteristics over the many years? For over a century, horse

racing has thrilled Hong Kong people, providing first-class entertainment to a

highly enthusiastic public. Here at the Sha Tin race course, jockeys from

different countries are making the final preparations. With a seating capacity

of up to 85,000, Sha Tin is always packed during the race season. Mao Xuzhi, Sha

Tin racecourse, HK, said, "Gambling is illegal here in Hong Kong, except for

lotteries and horse racing. Their horse comes in first." This old punter, Mr.

Huo, has been betting on horses for over 3 decades. Like all his fellow punters

here, he enjoys studying the traits and performance of the horses. Mr. Huo says

he loves to watch the jockeys in action. Another horse racing fan, Mr. Lee, says

the sport has become a symbol of Hong Kong. That explains in part why

horse-racing has been a big industry for the past 150 years. Winfried

Engelbrecht-Bresges, CEO, the HK Jockey club, said, "Horse racing in Hong Kong

is a life style. People of HK are very competitive. They like things fast. They

like to be risky. Deng Xiaoping said horse-racing and dancing continue in HK.

This is definitely the way what has continued here." Behind these gambling-mad

crowds and the world-class horses and jockeys is the controller of all Hong Kong

horse racing, the Jockey Club. It's also the city's biggest tax payer and

charity donor. It gives about 1 billion Hong Kong dollars each year to

charitable causes. Thanks to the central government's commitment and support

after Hong Kong's return, the Jockey Club is still a winner after 10 years. And

it's convinced that Hong Kong's special system will provide a solid guarantee

for the future of the racing industry.

Hong Kong by day shines just as

brightly. The city has a well-deserved reputation as a dining and shopping

paradise. It serves up some of the best Chinese cuisine in the world, and the

shops have visitors from all over opening their wallets. Dining is certainly one

of the highlights of Hong Kong. Outstanding Chinese cuisine can be easily found

here, like roast goose. Traditional cooking methods are well preserved, as well

as authentic flavors. The momentum of the Hong Kong economy in recent years has

ensured the local catering industry handsome profits. Kan Kun-Sing, owner Yung

Kee restaurant, said, "Our business in the past decade was much better than

before because Hong Kong remains a financial center and the economy is pretty

good. Besides, more tourists are coming from the mainland and that has been

really good for business." Dim Sum is another Hong Kong specialty. Steamed prawn

dumplings, sponge cake and pork dumplings are just a few of the delicious

mouthfuls. Western cuisine also has a place on Hong Kong tables. The huge flow

of people and the wealth they bring have attracted many of the world's finest

chefs and restaurants. Kevin NG, asst. general manager Sir Hudson, Italian

restaurant, said, "We have seen great potential at present and also in the

future for Italian food in Hong Kong. There are many factors, like people in

Hong Kong, they are very willing to try new style, new design, also the spending

power is extremely high." Equally amazing are the city's shopping options. From

department stores and shopping malls to small boutiques and bargain stalls,

there's something for everyone. Hong Kong's position of an international free

trade hub enables the city to provide global shoppers the most diversified,

quality merchandise at competitive prices. And it's not just the ladies who go

on spending sprees. Australian shopper, said, "I have been here for two weeks

and I have been shopping everyday and I can spend a year shopping, I think. (Q:

How much have you spent?) Probably, some 6,000 US dollars. (Q: What did you

buy?) Clothes, shoes, gifts for wife and everything." A pleasant shopping

experience helps bring customers back again and again. According to the Hong

Kong SAR government, the total revenue in the retail sector reached nearly 21

billion Hong Kong dollars in 2006, just over a fifth of the total of the entire

tourism industry. Hong Kong remains one of the top destinations for dining and

shopping in the world, but one thing has changed--the main driving force behind

the growth. Last year, the Chinese mainland accounted for more than half of the

visitors to Hong Kong. And they have tremendous purchasing power. This shows a

close economic connection with the mainland is vital for Hong Kong's business

prosperity.

China Mobile, the country's biggest

mobile-telephone operator, yesterday surpassed HSBC Holdings to become Hong

Kong's largest company by market capitalization as investors bet the red chip

will launch a mainland listing as soon as August. The top spot, reached only

days before the 10th anniversary of Hong Kong's handover, underscores the

ascendancy of mainland companies in the city as well as investor demand for

shares likely to benefit from a surge in the nation's stock market. China Mobile

rose 0.65 per cent to close at a new high of HK$84.80, bringing its market

capitalization to HK$1.7 trillion. HSBC fell 0.07 per cent to HK$144.10,

lowering its market capitalization to HK$1.69 trillion.

The first issuance of China's yuan-

denominated bonds in Hong Kong by China Development Bank will be available for

retail subscription starting today with the minimum investment set at HK$20,000.

As the coupon of the bonds is set at 3 percent - much higher than the typical

0.8 percent rate offered by local banks on yuan deposits - the response is

expected to be robust. The retail order book will be closed on July 6. Hong Kong

Monetary Authority chief executive Joseph Yam Chi-kwong said after the launch

ceremony Tuesday that the second issuance of yuan bonds may come soon. "The

management arrangement for issuing yuan bonds in Hong Kong by mainland financial

institutions is already in place. There is actually nothing to stop them from

coming," Yam told reporters. The Export-Import Bank of China, a fully

government-owned policy bank under the direct leadership of the State Council,

is believed to be the second mainland financial institution preparing to issue

yuan bonds in Hong Kong. The bank said earlier its board had approved the

issuance, and will proceed with the sale here after obtaining approval from the

People's Bank of China. The first issuance of China's yuan-

denominated bonds in Hong Kong by China Development Bank will be available for

retail subscription starting today with the minimum investment set at HK$20,000.

As the coupon of the bonds is set at 3 percent - much higher than the typical

0.8 percent rate offered by local banks on yuan deposits - the response is

expected to be robust. The retail order book will be closed on July 6. Hong Kong

Monetary Authority chief executive Joseph Yam Chi-kwong said after the launch

ceremony Tuesday that the second issuance of yuan bonds may come soon. "The

management arrangement for issuing yuan bonds in Hong Kong by mainland financial

institutions is already in place. There is actually nothing to stop them from

coming," Yam told reporters. The Export-Import Bank of China, a fully

government-owned policy bank under the direct leadership of the State Council,

is believed to be the second mainland financial institution preparing to issue

yuan bonds in Hong Kong. The bank said earlier its board had approved the

issuance, and will proceed with the sale here after obtaining approval from the

People's Bank of China.

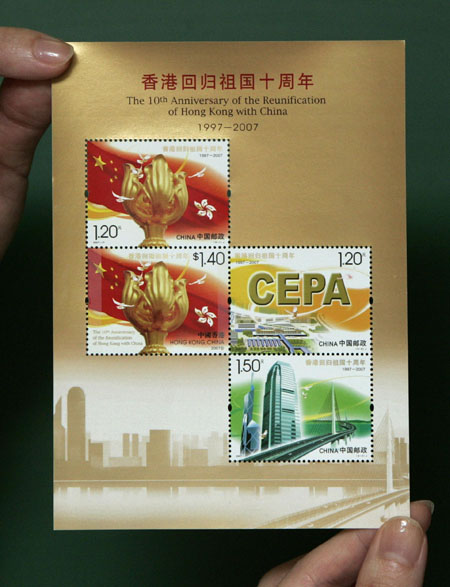

President Hu Jintao will lead a delegation of senior central government

officials for a three-day visit to Hong Kong from Friday to Sunday to celebrate

the 10th anniversary of the establishment of the HKSAR. He will also officiate

at the swearing-in ceremony of the chief executive and the principal officials

of the third- term government Sunday. It will be Hu's first visit to Hong Kong

as president, though he first visited the SAR in 1999. None of those

accompanying Hu on the trip are from the Politburo Standing Committee. Chief

Executive Donald Tsang Yam-kuen has also invited the governors of nine mainland

provinces, as well as Macau Chief Executive Edmund Ho Hau-wah. Among the

mainland leaders coming are Minister of Commerce Bo Xilai and State Development

and Reform Commission director Ma Kai, who is expected to announce the further

liberalization of Hong Kong professional services practice in the mainland under

Phase IV of the Closer Economic Partnership Arrangement. As anticipated by local

medical institutions, the new CEPA concessions will give medical practitioners

more opportunities to practice and set up clinics in the mainland. In a brief

announcement of Hu's visit, Tsang said: "At this historic moment to mark the

10th anniversary since the handover, we are greatly honored to have central

leaders to attend the inauguration ceremony of the third term of the SAR

government and relevant celebration activities in Hong Kong. "On behalf of the

people of Hong Kong and the SAR government, I extend our warmest welcome and

deepest gratitude to them." In the interests of security, Hu's itinerary was not

announced. However, it is known Hu is keen to meet the local community and

expected to visit the home of a local family after his arrival Friday morning.

He is then expected be taken on a private sightseeing tour to familiarize

himself with Hong Kong's latest developments as an international financial hub

and shipping center. In the evening, he will attend a private dinner hosted by

Tsang at Government House. Hu will have a full program Saturday. As chairman of

the Chinese Communist Party Central Military Commission, Hu will first inspect

the People's Liberation Army Hong Kong Garrison at Stonecutters Island. He will

then go to Ocean Park to open the panda habitat where the new pair of giant

pandas, Ying Ying and Le Le, will be making their public debut. The pandas were

a gift from the central government to mark the 10th anniversary of the handover.

Hu will also visit the Commission of Foreign Ministry before stopping for lunch.

President Hu Jintao will lead a delegation of senior central government

officials for a three-day visit to Hong Kong from Friday to Sunday to celebrate

the 10th anniversary of the establishment of the HKSAR. He will also officiate

at the swearing-in ceremony of the chief executive and the principal officials

of the third- term government Sunday. It will be Hu's first visit to Hong Kong

as president, though he first visited the SAR in 1999. None of those

accompanying Hu on the trip are from the Politburo Standing Committee. Chief

Executive Donald Tsang Yam-kuen has also invited the governors of nine mainland

provinces, as well as Macau Chief Executive Edmund Ho Hau-wah. Among the

mainland leaders coming are Minister of Commerce Bo Xilai and State Development

and Reform Commission director Ma Kai, who is expected to announce the further

liberalization of Hong Kong professional services practice in the mainland under

Phase IV of the Closer Economic Partnership Arrangement. As anticipated by local

medical institutions, the new CEPA concessions will give medical practitioners

more opportunities to practice and set up clinics in the mainland. In a brief

announcement of Hu's visit, Tsang said: "At this historic moment to mark the

10th anniversary since the handover, we are greatly honored to have central

leaders to attend the inauguration ceremony of the third term of the SAR

government and relevant celebration activities in Hong Kong. "On behalf of the

people of Hong Kong and the SAR government, I extend our warmest welcome and

deepest gratitude to them." In the interests of security, Hu's itinerary was not

announced. However, it is known Hu is keen to meet the local community and

expected to visit the home of a local family after his arrival Friday morning.

He is then expected be taken on a private sightseeing tour to familiarize

himself with Hong Kong's latest developments as an international financial hub

and shipping center. In the evening, he will attend a private dinner hosted by

Tsang at Government House. Hu will have a full program Saturday. As chairman of

the Chinese Communist Party Central Military Commission, Hu will first inspect

the People's Liberation Army Hong Kong Garrison at Stonecutters Island. He will

then go to Ocean Park to open the panda habitat where the new pair of giant

pandas, Ying Ying and Le Le, will be making their public debut. The pandas were

a gift from the central government to mark the 10th anniversary of the handover.

Hu will also visit the Commission of Foreign Ministry before stopping for lunch.

China: China

has banned the production of chlorofluorocarbons (CFCs) in line with global

agreements to phase out the use of ozone layer-depleting products, the country's

environmental watchdog said in a statement.

China: China

has banned the production of chlorofluorocarbons (CFCs) in line with global

agreements to phase out the use of ozone layer-depleting products, the country's

environmental watchdog said in a statement.

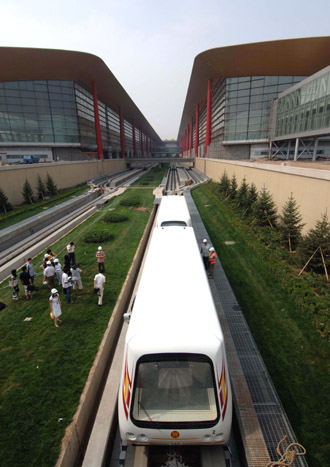

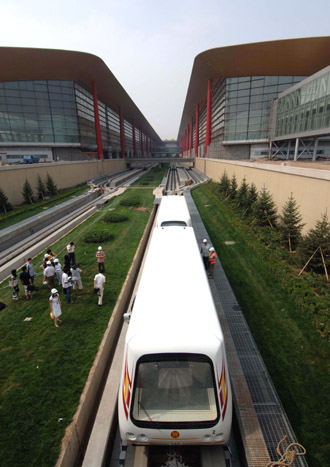

A

self-controlled train moves for a test run as it makes its debut at the Beijing

Capital Airport in Beijing, June 26, 2007. The passenger train will be running

between terminals of the airport after the third terminal is put to use before

the Olympic Games. A

self-controlled train moves for a test run as it makes its debut at the Beijing

Capital Airport in Beijing, June 26, 2007. The passenger train will be running

between terminals of the airport after the third terminal is put to use before

the Olympic Games.

China's Yan Zi gestures

during her singles match against Italy's Tathiana Garbin at the Wimbledon tennis

championships in London June 27, 2007. China's Yan Zi gestures

during her singles match against Italy's Tathiana Garbin at the Wimbledon tennis

championships in London June 27, 2007.

Theme song for Chow's

"Secret" debuts earlier than film - Taiwan pop king Jay Chow (L) promotes his

directorial debut "Secret Cannot Be Told" with his lead actress Guey Lun-mei.

Although the post-production work on pop king Jay Chow's directorial debut,

"Secret", is yet to be finished, the themed song of the film has been scheduled

for release in Asia on Thursday. The Beijing News reported on Wednesday. Chow's

long-time partner Vincent Fang took charge of the lyrics for the song, which has

been described by Chow as "a shining point" of the film. According to Chow, this

time he tried to emulate Britpop in composing the song - quite a different

approach from his other film music hits, such as "Ju Hua Tai", the theme song of

"Curse of Golden Flower" and another song he made for Jet Li's kungfu film "Huo

Yuan Jia". Theme song for Chow's

"Secret" debuts earlier than film - Taiwan pop king Jay Chow (L) promotes his

directorial debut "Secret Cannot Be Told" with his lead actress Guey Lun-mei.

Although the post-production work on pop king Jay Chow's directorial debut,

"Secret", is yet to be finished, the themed song of the film has been scheduled

for release in Asia on Thursday. The Beijing News reported on Wednesday. Chow's

long-time partner Vincent Fang took charge of the lyrics for the song, which has

been described by Chow as "a shining point" of the film. According to Chow, this

time he tried to emulate Britpop in composing the song - quite a different

approach from his other film music hits, such as "Ju Hua Tai", the theme song of

"Curse of Golden Flower" and another song he made for Jet Li's kungfu film "Huo

Yuan Jia".

Hollywood legend

Robert DeNiro, seen here in 2006, is the co-founder of the Tribeca film festival

which is heading to China despite strict movie censorship in the communist

nation. The Tribeca film festival, co-founded by Hollywood legend Robert DeNiro,

is heading to China next month despite strict movie censorship in the communist

nation. The festival, which was set up in New York in 2002 as a response to the

previous year's September 11 World Trade Center attacks, will appear in

Beijing's artistic 798 quarter on July 10-11, Xinhua news agency said. The

festival hopes to promote independent US and Chinese films, organisers said.

"With films from China having played a major role in the Tribeca Film Festival's

first six years -- and having won several of our major awards in the bargain --

we're happy to begin this new international collaboration," said Peter Scarlet,

artistic director of the Tribeca Film Festival. Tribeca has screened 18

feature-length and short films from Chinese filmmakers since 2002, four of which

have scooped festival awards, Xinhua said. The Beijing edition will open with an

outdoor screening of Planet B-Boy, a documentary by Korean-American director

Benson Lee about the resurgence of break-dancing. "Never in my wildest dreams

could I have predicted that we would be showing Planet B-boy to an audience of

7,000 people... at the World Trade Center area, let alone at another outdoor

screening on the other side of the world in Beijing," said Lee, according to

Xinhua. Tribeca, named after the area of New York where it is based, was set up

by De Niro, producer Jane Rosenthal and philanthropist Craig Hatkoff to try to

help breathe life back into the downtown area following the 2001 attacks. In

China, foreign and domestic movies often suffer at the hands of the government's

censors. Only a handful of international films make it to national distribution

each year, and those that do are often cut. China's film censors recently cut

out large sections of the latest "Pirates of the Caribbean" film, cutting in

half actor Chow Yun-Fat's role because it allegedly humiliated the Chinese

people. The Oscar-winning "The Departed" faced a ban on the mainland this year. Hollywood legend

Robert DeNiro, seen here in 2006, is the co-founder of the Tribeca film festival

which is heading to China despite strict movie censorship in the communist

nation. The Tribeca film festival, co-founded by Hollywood legend Robert DeNiro,

is heading to China next month despite strict movie censorship in the communist

nation. The festival, which was set up in New York in 2002 as a response to the

previous year's September 11 World Trade Center attacks, will appear in

Beijing's artistic 798 quarter on July 10-11, Xinhua news agency said. The

festival hopes to promote independent US and Chinese films, organisers said.

"With films from China having played a major role in the Tribeca Film Festival's

first six years -- and having won several of our major awards in the bargain --

we're happy to begin this new international collaboration," said Peter Scarlet,

artistic director of the Tribeca Film Festival. Tribeca has screened 18

feature-length and short films from Chinese filmmakers since 2002, four of which

have scooped festival awards, Xinhua said. The Beijing edition will open with an

outdoor screening of Planet B-Boy, a documentary by Korean-American director

Benson Lee about the resurgence of break-dancing. "Never in my wildest dreams

could I have predicted that we would be showing Planet B-boy to an audience of

7,000 people... at the World Trade Center area, let alone at another outdoor

screening on the other side of the world in Beijing," said Lee, according to

Xinhua. Tribeca, named after the area of New York where it is based, was set up

by De Niro, producer Jane Rosenthal and philanthropist Craig Hatkoff to try to

help breathe life back into the downtown area following the 2001 attacks. In

China, foreign and domestic movies often suffer at the hands of the government's

censors. Only a handful of international films make it to national distribution

each year, and those that do are often cut. China's film censors recently cut

out large sections of the latest "Pirates of the Caribbean" film, cutting in

half actor Chow Yun-Fat's role because it allegedly humiliated the Chinese

people. The Oscar-winning "The Departed" faced a ban on the mainland this year.

June 28, 2007

Hong Kong:

President Hu Jintao will visit Hong Kong this week for celebrations marking the

10th anniversary of the handover, state media reported on Tuesday. Mr Hu will

arrive in Hong Kong on Friday and stay until Sunday July 1 “to attend a mass

gathering marking the 10th anniversary of Hong Kong’s return to the mainland,”

Xinhua reported. This will be Mr Hu’s first visit to the city. The report did

not say whether he would come with any other state leaders. Xinhua said Mr Hu

would also attend the inaugural ceremony of the third-term Hong Kong Special

Administrative Region government during the visit. Hong Kong:

President Hu Jintao will visit Hong Kong this week for celebrations marking the

10th anniversary of the handover, state media reported on Tuesday. Mr Hu will

arrive in Hong Kong on Friday and stay until Sunday July 1 “to attend a mass

gathering marking the 10th anniversary of Hong Kong’s return to the mainland,”

Xinhua reported. This will be Mr Hu’s first visit to the city. The report did

not say whether he would come with any other state leaders. Xinhua said Mr Hu

would also attend the inaugural ceremony of the third-term Hong Kong Special

Administrative Region government during the visit.

China Development Bank (CDB)

announced Tuesday that it will issue five billion yuan (US$657 million) RMB bond

in Hong Kong, and this is the first Chinese currency bond to be launched outside

the Chinese mainland. The two-year bond, which will be synchronously sold to

institutions and individual investors from June 27 to July 6, yields three

percent annually. The return is relatively high compared to the 0.7 percent

interest rate for six-month deposit here, with the anticipation of RMB

appreciation. The minimum subscription for an individual investor is 20,000

yuan, and at least one billion yuan of the bond is targeting at retail

investors. The joint lead managers and bookrunners for the bond issue are Bank

of China (Hong Kong) and The Hong Kong and Shanghai Banking Corporation Limited.

The distributors comprise of 14 placing banks with branches in Hong Kong,

including Bank of Communications, China Construction Bank (Asia), Dah Sing Bank,

and The Bank of East Asia. The bond did not apply for independent ratings. CDB

Governor Chen Yuan explained that despite the bank's on-going market- oriented

reform, CDB will adhere to its mission of helping to achieve the government's

goals, and "our debt rating will also remain intact." CDB is China's largest

policy bank and solely owned by the Ministry of Finance. It has been raising

capital by issuing bonds since 1998, and has been given sovereign ratings by

Moody's, Standard and Poor's and Fitch Ratings. Analysts say both Hong Kong and

the mainland could benefit from floating RMB outside the mainland. "The issuance

of RMB bonds here will strengthen Hong Kong's status as an international

financial center," Ma Delun, assistant governor of the People's Bank of China,

said at the launch ceremony of the bond. The issuance of renminbi bonds in Hong

Kong signifies the city' s role as the country's premier international finance

center, giving local investors more choice, said Henry Tang, financial secretary

of the Hong Kong Special Administrative Region government, when addressing the

ceremony. "The arrangement is a fresh step in Hong Kong-Mainland co- operation,"

he said.

Hong Kong the best business partner

for Vietnam enterprises - Hong Kong is Vietnam's best partner for capturing

business opportunities arising from the country's recent accession to the World

Trade Organization, Mr Peter Woo, chairman of the Hong Kong Trade Development

Council, told more than 200 business executives in Ho Chi Minh City today. Mr.

Woo, who is leading a 17-member Hong Kong business delegation to Vietnam, said

that Hong Kong is an ideal conduit for Vietnamese businesses. Through Hong Kong,

they can get all the services support and contacts they need to connect with

world markets. The TDC delegation visited Hanoi, the Vietnamese capital, on

Monday and Tuesday before going on to Ho Chi Minh City. In Hanoi, the delegation

met with the Vietnamese Prime Minister, Mr. Nguyen Tan Dung, who welcomed Hong

Kong businesses to invest in Vietnam. Mr. Nguyen said that overseas investment

was an integral component of Vietnam's economic development. He added that his

government would provide favorable conditions to help Hong Kong investors do

more business in the country, particularly in the financial, banking, insurance,

securities, shipping and manufacturing sectors. The Prime Minister also agreed

that Hong Kong has the infrastructure, as well as the international experience

and contacts, to serve as a useful platform for Vietnamese companies looking to

connect with world markets. Earlier, the delegation was briefed by Minister of

Trade Mr Truong Dinh Tuyen and Vice-minister of Planning and Investment Mr

Nguyen Bich Dat on the latest developments in Vietnam, including laws recently

introduced to create a more effective business environment in the country.

Hong Kong the best business partner

for Vietnam enterprises - Hong Kong is Vietnam's best partner for capturing

business opportunities arising from the country's recent accession to the World

Trade Organization, Mr Peter Woo, chairman of the Hong Kong Trade Development

Council, told more than 200 business executives in Ho Chi Minh City today. Mr.

Woo, who is leading a 17-member Hong Kong business delegation to Vietnam, said

that Hong Kong is an ideal conduit for Vietnamese businesses. Through Hong Kong,

they can get all the services support and contacts they need to connect with

world markets. The TDC delegation visited Hanoi, the Vietnamese capital, on

Monday and Tuesday before going on to Ho Chi Minh City. In Hanoi, the delegation

met with the Vietnamese Prime Minister, Mr. Nguyen Tan Dung, who welcomed Hong

Kong businesses to invest in Vietnam. Mr. Nguyen said that overseas investment

was an integral component of Vietnam's economic development. He added that his

government would provide favorable conditions to help Hong Kong investors do

more business in the country, particularly in the financial, banking, insurance,

securities, shipping and manufacturing sectors. The Prime Minister also agreed

that Hong Kong has the infrastructure, as well as the international experience

and contacts, to serve as a useful platform for Vietnamese companies looking to

connect with world markets. Earlier, the delegation was briefed by Minister of

Trade Mr Truong Dinh Tuyen and Vice-minister of Planning and Investment Mr

Nguyen Bich Dat on the latest developments in Vietnam, including laws recently

introduced to create a more effective business environment in the country.

Hong Kong will be the main

beneficiary when the Hong Kong-Zhuhai-Macau Bridge is up and running, a senior

official of the mainland's top planning body said yesterday. National

Development and Reform Commission deputy chairman Zhang Xiaoqiang said a

mainland study showed Hong Kong would enjoy 64 per cent of the economic benefit

brought by the long-awaited bridge. But an academic who has studied the issue

said his conclusions were exactly the opposite and the Pearl River Delta cities

of Zhuhai , Zhongshan and Jiangmen would be the big winners. The 29km bridge is

still at the planning stage despite a decade of negotiations. Mr Zhang said the

mainland study, which projected the economic gain brought by an expected

increase in cross-border traffic, also estimated that Guangdong would secure 26

per cent of the benefits and Macau 10 per cent. "The bridge will be effective in

helping Hong Kong expand its hinterland," he said. But Mr Zhang said this did

not necessarily mean Hong Kong should invest more in the bridge's construction

because it would be up to companies interested in the project to negotiate a

stake. "Under the principle of attracting more private investment, it will be up

to the companies to decide who will contribute more," he said, adding that the

governments would be responsible for financing checkpoints and links. Mr Zhang

is also head of a special taskforce set up by the State Council late last year

after the plan became bogged down by disputes over issues such as the location

of checkpoints and the sharing of the construction costs, estimated at US$3.7

billion. He said some consensus had been achieved after several meetings between

representatives from the three governments, but there was still no timetable.

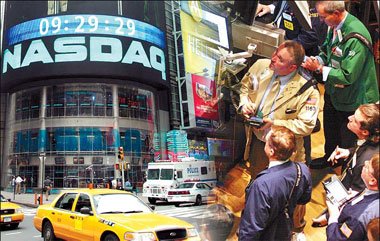

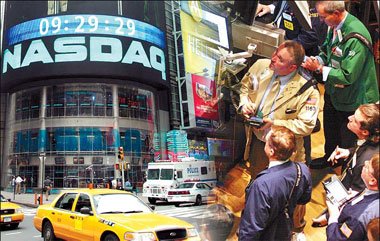

M & A activity heats up in China -

Mergers and acquisitions in China has soared to a record high in the first half

of this year demonstrating the Mainland's budding affinity with investors and

bankers. According to Thomson Financial, M & A deals have witnessed a surge in

58.3% to US$39.1 billion, slightly more as compared to the second half of last

year. Despite a busy launch, the M&As in the first half of 2007 is still lagging

behind its highest ever semi-annual figures of US$44.7 billion that was

witnessed in the second half of 2000. Violet Chung, a senior portfolio manager

at Pacific Capital Management, speculated that the M&A rise and fall cycle will

be powered by a combination of low interest rates, especially in Japan, as well

as high liquidity. A combination of factors such as a thriving stock market and

a clamor for stakes in Chinese firms have made China into Asia's most dazzling

platform for investment banking. China also radiates a growing allure for share

sales, trailing behind the U.S. in global equity issuance in the first half of

this year. Some of the largest money-making deals this year include the Rowsley

purchase of solar energy company Perfect Field Investment, the Chinese

government's US$3 billion investment in Blackstone Group as well as Dongfang

Electrical Machine's US$2.8 billion offer for Dongfang Boiler. Marco Mak, the

head of research at Taifook Securities, expressed confidence that the situation

would remain upbeat for as long as companies are still in the process of

restructuring and purchasing assets from parent firms. It is revealed that the

technology sector is a haven for foreign investors, while the preferences of

Mainland companies lie with foreign operations in the business sector. Mainland

companies are also scrambling for IPOs. China CITIC Bank Corp's US$5.9 billion

dual listing in Hong Kong and Shanghai was the world's second-largest initial

public offering so far this year. This has propelled China to own 15.2% share of

the global market, runner-up to the US in terms of IPO activity. To top it off,

an icing on the cake is the number of Mainland firms going public on U.S.

exchanges. With 10 companies raising US$2.2 billion on the New York Stock

Exchange and Nasdaq Stock Market, a new record high has been set, doubling last

year's full-year total. M & A activity heats up in China -

Mergers and acquisitions in China has soared to a record high in the first half

of this year demonstrating the Mainland's budding affinity with investors and

bankers. According to Thomson Financial, M & A deals have witnessed a surge in

58.3% to US$39.1 billion, slightly more as compared to the second half of last

year. Despite a busy launch, the M&As in the first half of 2007 is still lagging

behind its highest ever semi-annual figures of US$44.7 billion that was

witnessed in the second half of 2000. Violet Chung, a senior portfolio manager

at Pacific Capital Management, speculated that the M&A rise and fall cycle will

be powered by a combination of low interest rates, especially in Japan, as well

as high liquidity. A combination of factors such as a thriving stock market and

a clamor for stakes in Chinese firms have made China into Asia's most dazzling

platform for investment banking. China also radiates a growing allure for share

sales, trailing behind the U.S. in global equity issuance in the first half of

this year. Some of the largest money-making deals this year include the Rowsley

purchase of solar energy company Perfect Field Investment, the Chinese

government's US$3 billion investment in Blackstone Group as well as Dongfang

Electrical Machine's US$2.8 billion offer for Dongfang Boiler. Marco Mak, the

head of research at Taifook Securities, expressed confidence that the situation

would remain upbeat for as long as companies are still in the process of

restructuring and purchasing assets from parent firms. It is revealed that the

technology sector is a haven for foreign investors, while the preferences of

Mainland companies lie with foreign operations in the business sector. Mainland

companies are also scrambling for IPOs. China CITIC Bank Corp's US$5.9 billion

dual listing in Hong Kong and Shanghai was the world's second-largest initial

public offering so far this year. This has propelled China to own 15.2% share of

the global market, runner-up to the US in terms of IPO activity. To top it off,

an icing on the cake is the number of Mainland firms going public on U.S.

exchanges. With 10 companies raising US$2.2 billion on the New York Stock

Exchange and Nasdaq Stock Market, a new record high has been set, doubling last

year's full-year total.

Regulator to ease

limits on domestic investments to HK - The China Banking Regulatory Commission

will soon relax existing regulations on overseas investments by domestic

investors, The Standard reported Monday, citing a mainland source. The Standard,

citing the source, said the mainland regulator will soon allow domestic

investors to invest about 70 percent of their funds in Hong Kong stocks, up from

the current limit of 50 percent, under the Qualified Domestic Institutional

Investor (QDII) program. Hong Kong is so far the only market approved for

overseas investments under the QDII scheme. The minimum amount of money required

for an investor to buy a product under the program will drop to less than

100,000 yuan (US$13,130) and could be as low as 10,000 yuan, the newspaper said.

The new minimum investment represents a dramatic drop from the previous entry

fee of 300,000 yuan for a single investment, it said. There have been

discussions to allow trust funds to be included in the scheme, the source told

the newspaper, without specifying the parties involved in the talks. Regulator to ease

limits on domestic investments to HK - The China Banking Regulatory Commission

will soon relax existing regulations on overseas investments by domestic

investors, The Standard reported Monday, citing a mainland source. The Standard,

citing the source, said the mainland regulator will soon allow domestic

investors to invest about 70 percent of their funds in Hong Kong stocks, up from

the current limit of 50 percent, under the Qualified Domestic Institutional

Investor (QDII) program. Hong Kong is so far the only market approved for

overseas investments under the QDII scheme. The minimum amount of money required

for an investor to buy a product under the program will drop to less than

100,000 yuan (US$13,130) and could be as low as 10,000 yuan, the newspaper said.

The new minimum investment represents a dramatic drop from the previous entry

fee of 300,000 yuan for a single investment, it said. There have been

discussions to allow trust funds to be included in the scheme, the source told

the newspaper, without specifying the parties involved in the talks.

HSBC Holdings (0005) group chairman

Stephen Green said Monday the lender's US subprime mortgage division will not be

affected by last week's news that Bear Stearns, one of the largest global

investment banks, will have to bail out two of its hedge funds that had bet

heavily on subprime mortgage assets.

A HK$3 billion bid from Wheelock

Properties (0049) has triggered an auction for a Wong Tai Sin residential site,

where analysts believe developers could face potential uncertainty over the plot

ratio.

Shares of refiner China Petroleum &

Chemical Corp (0386), better known as Sinopec, tumbled Monday as investors

rattled by the news of chairman Chen Tonghai's resignation dumped the stock.

Standard Chartered (2888), the

British bank that makes most of its money in Asia, said it will introduce

private banking services in eight to 10 more mainland cities by 2010 as the

number of wealthy people soars.

RREEF, the property investment arm

of Deutsche Bank and manager of the recently listed RREEF China Commercial Trust

REIT (0625), is teaming up with a private equity firm to build more than 25

hotels in the mainland under the Hilton Garden Inn brand in a US$550 million

(HK$4.29 billion) deal.

Hospital

Authority chief executive Shane Solomon has apologized and retracted comments he

made hours earlier accusing frontline doctors and their unions of leaking

information on medical mishaps to bolster their demands for better pay. After

attending Monday's meeting of the Legislative Council's health services panel,

Solomon said: "I think the political purpose is to put pressure on the Hospital

Authority and say that we have a crisis in medical staffing." His comments

provoked an outcry from a legislator as well as the Frontline Doctors' Union,

forcing him to backtrack. "I would like to apologize for the confusion and

frustration that may have been caused to the parties concerned with my remarks

made after the health services panel this morning," he said. "I'd like to

clarify that the political motives which I mentioned were totally unrelated to

the recent request for salary adjustment by Hospital Authority doctors and their

unions. As these remarks may have created concerns on the legitimacy of their

intention and recent actions, I've decided to withdraw them." Hospital

Authority chief executive Shane Solomon has apologized and retracted comments he

made hours earlier accusing frontline doctors and their unions of leaking

information on medical mishaps to bolster their demands for better pay. After

attending Monday's meeting of the Legislative Council's health services panel,

Solomon said: "I think the political purpose is to put pressure on the Hospital

Authority and say that we have a crisis in medical staffing." His comments

provoked an outcry from a legislator as well as the Frontline Doctors' Union,

forcing him to backtrack. "I would like to apologize for the confusion and

frustration that may have been caused to the parties concerned with my remarks

made after the health services panel this morning," he said. "I'd like to

clarify that the political motives which I mentioned were totally unrelated to

the recent request for salary adjustment by Hospital Authority doctors and their

unions. As these remarks may have created concerns on the legitimacy of their

intention and recent actions, I've decided to withdraw them."

The controversy

over the Hong Kong Institute of Education has taken a fresh twist, with its

ruling council ordering Paul Morris to go on immediate leave as its president,

and deciding not to keep him on as a teacher when his term ends in September.

The council said yesterday's decision to send him on leave would enable the

institute to "turn a new leaf". Professor Morris condemned it as unnecessary.

Lawmakers, staff and student representatives called it unreasonable and

irrational. Some lawmakers called it revenge for his part in the recent

commission of inquiry into interference in the institute's autonomy, whose

findings led former chief education civil servant Fanny Law Fan Chiu-fun to quit

as anti-graft chief. Professor Morris said a council subcommittee had issued a

directive saying: "With the president becoming a central character in the

committee of inquiry, the committee has requested that the president be directed

to take leave immediately and that he be directed not to make any public

statement in relation to the HKIEd while on leave." He said: "I hope this

decision doesn't send the wrong message to the academic community about the

value the council places on academic freedom." The institute's ruling council

made the decision at a meeting to discuss whether or not to offer Professor

Morris a four-year professorship at the end of his term as president in

September. The body, which is dominated by political appointees, voted 13 to

five against offering him the job. Council vice-chairman Eddie Ng Hak-kim said

Professor Morris had been sent on leave to allow a new management team to take

over as soon as possible. Academic vice-president Lee Wing-on will serve as

acting president. Mr Ng said the professor's contract stated he would be offered

a professorship until 2011 if his performance as president was satisfactory.

Council members felt there was some room for improvement in the president's

performance, but said individual members had their own reasons for the decision.

Speaking in a personal capacity as he was about to fly to Britain, Professor

Morris said he was surprised the subcommittee set up to review the inquiry

findings had come to the conclusion he should be sent on immediate leave and not

be allowed to make any public statements. The controversy

over the Hong Kong Institute of Education has taken a fresh twist, with its

ruling council ordering Paul Morris to go on immediate leave as its president,

and deciding not to keep him on as a teacher when his term ends in September.

The council said yesterday's decision to send him on leave would enable the

institute to "turn a new leaf". Professor Morris condemned it as unnecessary.

Lawmakers, staff and student representatives called it unreasonable and

irrational. Some lawmakers called it revenge for his part in the recent

commission of inquiry into interference in the institute's autonomy, whose

findings led former chief education civil servant Fanny Law Fan Chiu-fun to quit

as anti-graft chief. Professor Morris said a council subcommittee had issued a

directive saying: "With the president becoming a central character in the

committee of inquiry, the committee has requested that the president be directed

to take leave immediately and that he be directed not to make any public

statement in relation to the HKIEd while on leave." He said: "I hope this

decision doesn't send the wrong message to the academic community about the

value the council places on academic freedom." The institute's ruling council

made the decision at a meeting to discuss whether or not to offer Professor

Morris a four-year professorship at the end of his term as president in

September. The body, which is dominated by political appointees, voted 13 to

five against offering him the job. Council vice-chairman Eddie Ng Hak-kim said

Professor Morris had been sent on leave to allow a new management team to take

over as soon as possible. Academic vice-president Lee Wing-on will serve as

acting president. Mr Ng said the professor's contract stated he would be offered

a professorship until 2011 if his performance as president was satisfactory.

Council members felt there was some room for improvement in the president's

performance, but said individual members had their own reasons for the decision.

Speaking in a personal capacity as he was about to fly to Britain, Professor

Morris said he was surprised the subcommittee set up to review the inquiry

findings had come to the conclusion he should be sent on immediate leave and not

be allowed to make any public statements.

China: Mexico

and China Assess Bi-lateral Trade Relationship - Chinese and Mexican trade

officials met on 29 May in Mexico City to discuss several aspects of their

growing bi-lateral relationship. Mexico's Secretary of the Economy Eduardo Sojo

said that the two countries need to develop a relationship based on dialogue and

co-operation in order to better understand each other's interests and concerns.

Mexican officials expressed concern about the mounting trade deficit with China,

which reached an estimated US$22,700 million in 2006, and reiterated

longstanding industry worries about China's enforcement of intellectual property

rights, China's subsidization of export activities and the illegal transshipment

of Chinese products through third countries. Sojo also highlighted the

importance of finding ways to expand market access opportunities for Mexican

agricultural products in China, including by enhancing bi-lateral co-operation

in sanitary matters. Like other countries in the region, Mexico is trying to

achieve a delicate balance in its relationship with China that seeks to attract

Chinese investment and increase exports of industrial and agricultural