|

Newsletter

Seminar Material

Biz:

China

Hong

Kong Hawaii

What people

said about us

China

Earthquake Relief

Tax &

Government

Hawaii Voter Registration

Biz-Video

Biz-Video

Hawaii's

China Connection Hawaii's

China Connection

CDP#1780962

CDP#1780962

Doing Business in

Hong Kong & China

Doing Business in

Hong Kong & China

| |

Hong Kong, China & Hawaii Biz*

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our event page to find out more!

After

attended a China/Hong Kong Business/Trade Seminar in Hawaii...still unsure what

to do next, contact us, our Officers, Directors and Founding Members are

actively engaged in China/Hong Kong/Asia trade - we can help!

Are you ready to export your product or

service? You will find out in 3 minutes with resources to help you -

enter

to give it a try

China Central TV - live

Webcast

China Central TV - live

Webcast

Skype - FREE

Voice Over IP Skype - FREE

Voice Over IP

View Hawaii's China Connection

Video Trailer

View Hawaii's China Connection

Video Trailer

Direct link

PDF file

Direct link

PDF file

Year of the Pig - February 18, 2007

Year of the Pig - February 18, 2007

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

October 31, 2007

Hong Kong:

A cross-border delivery-versus-payment link between Hong Kong's U.S. dollar real

time gross settlement system and Malaysia's Ringgit real time gross settlement

system has been launched. The Monetary Authority of Hong Kong said on Monday

that the link will help eliminate settlement risk of U.S. dollar bonds issued

and traded in Malaysia by ensuring simultaneous delivery of U.S. dollars in Hong

Kong and U.S. dollar bonds in Malaysia. As part of the initiatives to promote

Malaysia as an Islamic financial center and Hong Kong as an international

financial center, the delivery-versus-payment settlement services provide the

necessary settlement infrastructure to support potential issuance of U.S. dollar

bonds in Malaysia. The link is operated in Malaysia by Bank Negara Malaysia and

in Hong Kong by Hong Kong Interbank Clearing, said the authority. Hong Kong:

A cross-border delivery-versus-payment link between Hong Kong's U.S. dollar real

time gross settlement system and Malaysia's Ringgit real time gross settlement

system has been launched. The Monetary Authority of Hong Kong said on Monday

that the link will help eliminate settlement risk of U.S. dollar bonds issued

and traded in Malaysia by ensuring simultaneous delivery of U.S. dollars in Hong

Kong and U.S. dollar bonds in Malaysia. As part of the initiatives to promote

Malaysia as an Islamic financial center and Hong Kong as an international

financial center, the delivery-versus-payment settlement services provide the

necessary settlement infrastructure to support potential issuance of U.S. dollar

bonds in Malaysia. The link is operated in Malaysia by Bank Negara Malaysia and

in Hong Kong by Hong Kong Interbank Clearing, said the authority.

Photo taken on October 29, 2007 shows

the champion Grace Cheung Ka Ying (C) from Hong Kong, runner-up Choi Ju Hee (R)

from South Korea and the second runner-up, Hubei girl Sun Chen of the Miss Asia

2007 Competition which was held in Hong Kong. Photo taken on October 29, 2007 shows

the champion Grace Cheung Ka Ying (C) from Hong Kong, runner-up Choi Ju Hee (R)

from South Korea and the second runner-up, Hubei girl Sun Chen of the Miss Asia

2007 Competition which was held in Hong Kong.

Shares in Golden Harvest, one of the best

known names in the Hong Kong film biz, were suspended from trading Friday.

Announcement to the Hong Kong Stock Exchange said that the company had requested

the suspension "pending an announcement relating to the changes in the

substantial shareholder and the directors of the company which the board of the

company considers to be price sensitive information." Move is understood to mean

that veteran chairman Raymond Chow Ting-hsing is planning to sell his shares in

the company he co-founded in 1970. Chow and his associates own 24% of the

company, which became synonymous with Cantonese-language action movies and the

discovery of Bruce Lee. In recent years, the company quit production to focus

almost exclusively on exhibition and distribution. Stock market insiders point

to Chinese production shingle and talent agency Chengtian, as the buyer of a 20%

Golden Harvest stake. Japanese music, talent and film giant Avex has a 20%

interest in Chengtian. Suspension comes only a week after Golden Harvest

announced good-looking results that were boosted by exceptional gains from asset

disposals. For the year to June 2007, company announced net profits of $96.5

million ($12.5 million), compared with only $673,000 in 2006. But total included

a $15 million boost from the sale of its stake in the Golden Village cinema

circuit in Malaysia. Operating losses from Golden Harvest's distribution and

exhibition increased despite revenue gains in both divisions and finance costs

soared. In its recent results statement, management said that the company is

being refocused to concentrate on the Chinese exhibition market and that it is

expanding its digital screen advertising business into the mainland's key city

markets. It will also be stepping up acquisition of non-Chinese movies for

distribution. Chow aside, Golden Harvest's other substantial shareholders

include billionaire Li Ka-shing with 17%, EMI and Norman Cheng Tung-hon with 12%

and Jackie Chan with 5%. Shares in Golden Harvest, one of the best

known names in the Hong Kong film biz, were suspended from trading Friday.

Announcement to the Hong Kong Stock Exchange said that the company had requested

the suspension "pending an announcement relating to the changes in the

substantial shareholder and the directors of the company which the board of the

company considers to be price sensitive information." Move is understood to mean

that veteran chairman Raymond Chow Ting-hsing is planning to sell his shares in

the company he co-founded in 1970. Chow and his associates own 24% of the

company, which became synonymous with Cantonese-language action movies and the

discovery of Bruce Lee. In recent years, the company quit production to focus

almost exclusively on exhibition and distribution. Stock market insiders point

to Chinese production shingle and talent agency Chengtian, as the buyer of a 20%

Golden Harvest stake. Japanese music, talent and film giant Avex has a 20%

interest in Chengtian. Suspension comes only a week after Golden Harvest

announced good-looking results that were boosted by exceptional gains from asset

disposals. For the year to June 2007, company announced net profits of $96.5

million ($12.5 million), compared with only $673,000 in 2006. But total included

a $15 million boost from the sale of its stake in the Golden Village cinema

circuit in Malaysia. Operating losses from Golden Harvest's distribution and

exhibition increased despite revenue gains in both divisions and finance costs

soared. In its recent results statement, management said that the company is

being refocused to concentrate on the Chinese exhibition market and that it is

expanding its digital screen advertising business into the mainland's key city

markets. It will also be stepping up acquisition of non-Chinese movies for

distribution. Chow aside, Golden Harvest's other substantial shareholders

include billionaire Li Ka-shing with 17%, EMI and Norman Cheng Tung-hon with 12%

and Jackie Chan with 5%.

"The Home Song Stories" by Australian scripter-helmer Tony Ayres won the

Halekulani Golden Orchid for best feature at the 27th Hawaii Intl. Film

Festival. Awards were announced Thursday. An autobiographical drama based on

Ayres' difficult childhood migration to Australia, pic stars Joan Chen who also

received the fest's Achievement in Acting award. Feature documentary award was

presented to Hawaii-based co-helmers Don King and Julianne King for "Beautiful

Son," a chronicle of their efforts to help their autistic child. The Network for

the Promotion of Asian Cinema award was taken home by Stepane Gauger's verite-style

"Owl and the Sparrow," a Vietnam-U.S. co-production in which a young orphan

escapes to Ho Chi Minh City and is befriended by a zookeeper and an airline

stewardess. Pic previously won trophies at the Los Angeles and Heartland film

fests.

"The Home Song Stories" by Australian scripter-helmer Tony Ayres won the

Halekulani Golden Orchid for best feature at the 27th Hawaii Intl. Film

Festival. Awards were announced Thursday. An autobiographical drama based on

Ayres' difficult childhood migration to Australia, pic stars Joan Chen who also

received the fest's Achievement in Acting award. Feature documentary award was

presented to Hawaii-based co-helmers Don King and Julianne King for "Beautiful

Son," a chronicle of their efforts to help their autistic child. The Network for

the Promotion of Asian Cinema award was taken home by Stepane Gauger's verite-style

"Owl and the Sparrow," a Vietnam-U.S. co-production in which a young orphan

escapes to Ho Chi Minh City and is befriended by a zookeeper and an airline

stewardess. Pic previously won trophies at the Los Angeles and Heartland film

fests.

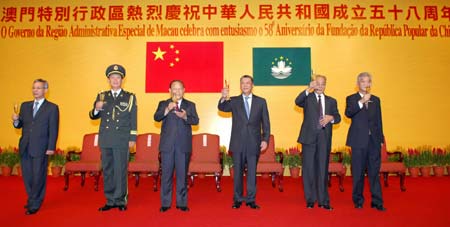

A

mainland salesman became the king of baccarat yesterday when he won HK$15

million in a Macau gaming competition. Yan Jun, a Hubeinese who often visits

Macau, beat eight other contestants in the last round of competition, which

distributed a record HK$20 million in prize money. Five of the contestants were

from China, with the others from Hong Kong, Macau, the United States and

Holland. The Hong Kong participant, Edward Ng Wing Biu, came fourth. Yan's

winning tip is to bet boldly. "If your bet is not big enough, you cannot win."

He added:"I go to Macau quite often, and usually bet about several thousand

[Macau] dollars to more than a hundred thousand each time." Yan, who is a

salesman in the mainland, won HK$470,000 in the baccarat competition himself.

Players had HK$100,000 as principal for the final session, of which HK$50,000

was self funded and HK$50,000 provided by the organizer. A

mainland salesman became the king of baccarat yesterday when he won HK$15

million in a Macau gaming competition. Yan Jun, a Hubeinese who often visits

Macau, beat eight other contestants in the last round of competition, which

distributed a record HK$20 million in prize money. Five of the contestants were

from China, with the others from Hong Kong, Macau, the United States and

Holland. The Hong Kong participant, Edward Ng Wing Biu, came fourth. Yan's

winning tip is to bet boldly. "If your bet is not big enough, you cannot win."

He added:"I go to Macau quite often, and usually bet about several thousand

[Macau] dollars to more than a hundred thousand each time." Yan, who is a

salesman in the mainland, won HK$470,000 in the baccarat competition himself.

Players had HK$100,000 as principal for the final session, of which HK$50,000

was self funded and HK$50,000 provided by the organizer.

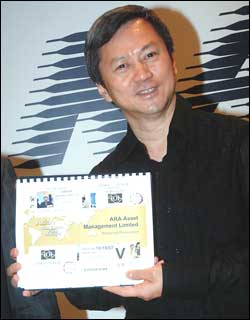

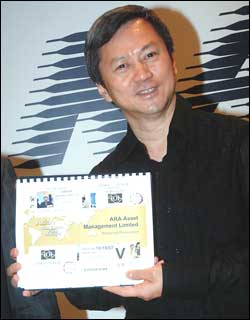

Real estate fund manager ARA Asset

Management, in which Cheung Kong Holdings (0001) has a 30-percent indirect

interest, said the institutional tranche of its public offering was about 30

times oversubscribed. It is set to list on the main board of Singapore on

Friday. Of the 205.2 million shares offered, 181.9 million will be for

institutional subscription, while 15 million are for retail investors. The

remaining 8.3 million will be reserved for management of ARA and related

companies. If necessary, underwriters Credit Suisse and DBS can exercise the

over- allotment option of issuing an additional 36 million shares. Market

sources said buyers from Dubai, Kuwait and Abu Dhabi have subscribed to the

issue. The 205.2 million shares issued, comprised of 73 million new shares and

132.2 million existing shares, will be sold at S$1.15 (HK$6.12) each, raising

S$235.98 million. Real estate fund manager ARA Asset

Management, in which Cheung Kong Holdings (0001) has a 30-percent indirect

interest, said the institutional tranche of its public offering was about 30

times oversubscribed. It is set to list on the main board of Singapore on

Friday. Of the 205.2 million shares offered, 181.9 million will be for

institutional subscription, while 15 million are for retail investors. The

remaining 8.3 million will be reserved for management of ARA and related

companies. If necessary, underwriters Credit Suisse and DBS can exercise the

over- allotment option of issuing an additional 36 million shares. Market

sources said buyers from Dubai, Kuwait and Abu Dhabi have subscribed to the

issue. The 205.2 million shares issued, comprised of 73 million new shares and

132.2 million existing shares, will be sold at S$1.15 (HK$6.12) each, raising

S$235.98 million.

Ample liquidity in the capital

market will mean Hong Kong will remain a leading international financial center

for fund-raising activity, although there will be fewer listings of mainland

companies in the remainder of the year, said Thomas Schnettler, vice chairman

and chief financial officer of US investment bank Piper Jaffray.

China:

China's Renminbi (RMB) broke the 7.48 mark to reach a new central parity rate of

7.4718 yuan to one U.S. dollar on Monday, according to the Chinese Foreign

Exchange Trading System.

China:

China's Renminbi (RMB) broke the 7.48 mark to reach a new central parity rate of

7.4718 yuan to one U.S. dollar on Monday, according to the Chinese Foreign

Exchange Trading System.

Zhang Jingchu to Star in China's "Schindler" Movie - Chinese mainland actress

Zhang Jingchu has been confirmed as the female lead in a war movie John Rabe.

Cast member Zhang Jingchu arrives at the premiere of Rush Hour 3 at the Mann's

Chinese theatre in Hollywood, California on July 30, 2007. Chinese mainland

actress Zhang Jingchu has been confirmed as the female lead in a war movie John

Rabe. The production began shooting in Shanghai on Saturday. The actress will

play a women's college student whose family suffers due to the Japanese invasion

of China during World War II. It is reported that the director, Germany's

Florian Gallenberger, was impressed by Zhang Jingchu's acting in Peacock, winner

of the Berlin Bear. German actor Ulrich Tukur will play the title role in John

Rabe. John Rabe (1882-1950) was a German businessman who worked as the Siemens

Corporation representative in China's Nanjing from 1931 to 1938. He helped

protect the lives of nearly 250,000 Chinese refugees from the Japanese invaders'

massacre. He has been praised as the "Schindler of Nanjing". The movie boasts a

budget of about 20 million U.S. dollars and an international cast of actors from

China, Germany, France and the United States.

Zhang Jingchu to Star in China's "Schindler" Movie - Chinese mainland actress

Zhang Jingchu has been confirmed as the female lead in a war movie John Rabe.

Cast member Zhang Jingchu arrives at the premiere of Rush Hour 3 at the Mann's

Chinese theatre in Hollywood, California on July 30, 2007. Chinese mainland

actress Zhang Jingchu has been confirmed as the female lead in a war movie John

Rabe. The production began shooting in Shanghai on Saturday. The actress will

play a women's college student whose family suffers due to the Japanese invasion

of China during World War II. It is reported that the director, Germany's

Florian Gallenberger, was impressed by Zhang Jingchu's acting in Peacock, winner

of the Berlin Bear. German actor Ulrich Tukur will play the title role in John

Rabe. John Rabe (1882-1950) was a German businessman who worked as the Siemens

Corporation representative in China's Nanjing from 1931 to 1938. He helped

protect the lives of nearly 250,000 Chinese refugees from the Japanese invaders'

massacre. He has been praised as the "Schindler of Nanjing". The movie boasts a

budget of about 20 million U.S. dollars and an international cast of actors from

China, Germany, France and the United States.

Shanghai GDP to hit record US$160b

this year - Shanghai's gross domestic product is expected to reach a record 1.2

trillion yuan (US$160 billion) this year, keeping a double-digit growth for 16

straight years, said Mayor Han Zheng yesterday during a forum. In the first nine

months this year, Shanghai's economy swelled 13.4 percent, Han said at the 19th

International Business Leaders' Advisory Council for the Mayor of Shanghai. The

city's fixed-assets investment grew 7.4 percent to 311.89 billion yuan through

September. Consumer spending expanded 14.3 percent to 285.32 billion yuan while

combined value of imports and exports soared 20.9 percent in the same period.

Han expected the city's value of trade this year will surpass US$500 billion for

the first time. "Shanghai's economy has kept a stable growth. We are confident

that Shanghai is on the way to achieve a development balanced with fast growth

of productivity, prosperity of people's lives and an ecologically sound

environment," said Han. IBLAC, set up in 1989 as a platform to pool insights

from global business leaders, focused this year on building a

resource-conserving and environmentally friendly city. To address this year's

theme, Han said Shanghai will continue to develop its service industry, which

produces less pollution, to build the city into an economic, financial, trade

and shipping hub. Han estimated the service industry will contribute 52 percent

to Shanghai's GDP this year, based on its growth momentum so far. The IBLAC

meeting has become an annual gala for top global executives to gather in

Shanghai. Thirty-eight members of the 40 attended this year's meeting, including

Stephen Green, chairman of HSBC Holdings Plc, Siemens AG President Peter

Loescher, Chairman of Bombardier Inc Laurent Beaudoin, and Chairman of Investor

AB Jacob Wallenberg. "We will fully support the goals for Shanghai's economic

development," said Samuel A. DiPiazza Jr, chief executive officer of

Pricewaterhouse- Coopers International Ltd, who will chair next year's meeting.

Shanghai signed 2,662 foreign-direct-investment contracts valued at US$9.33

billion through August this year. The number of contracts grew 2.5 percent from

a year earlier.

"The Western Trunk Line," a Chinese movie telling a story in a remote town at

the end of 1970s, won Special Jury Prize at the 20th Tokyo International Film

Festival on Sunday. "I have been thinking to make such a move since 1994," said

director Li Jixian at the awarding ceremony at Shibuya's Bunkamura, Tokyo. "I

met quite some challenges in making screenplay, but I never thought of

quitting."

"The Western Trunk Line," a Chinese movie telling a story in a remote town at

the end of 1970s, won Special Jury Prize at the 20th Tokyo International Film

Festival on Sunday. "I have been thinking to make such a move since 1994," said

director Li Jixian at the awarding ceremony at Shibuya's Bunkamura, Tokyo. "I

met quite some challenges in making screenplay, but I never thought of

quitting."

The roof of the

main building of the third-phase construction project in Guomao, or China World

Trade Center, a major business area in Chaoyang District, Beijing, has been

capped on Monday November 29, 2007. The 330-meter-high building, with 74 storeys

on the ground and 4 underground, is expected to become the highest in the

Chinese capital city upon completion in 2009 The roof of the

main building of the third-phase construction project in Guomao, or China World

Trade Center, a major business area in Chaoyang District, Beijing, has been

capped on Monday November 29, 2007. The 330-meter-high building, with 74 storeys

on the ground and 4 underground, is expected to become the highest in the

Chinese capital city upon completion in 2009

Photo taken on October

29, 2007 shows the second runner-up of Miss Asia 2007 Competition, Sun Chen (C),

from Central China's Hubei Province. Photo taken on October

29, 2007 shows the second runner-up of Miss Asia 2007 Competition, Sun Chen (C),

from Central China's Hubei Province.

Former France's

women's soccer team coach Elisabeth Loisel meets the press at the news

conference to announce her appointment to coach China's women's team in Beijing

October 28, 2007. China's former coach Marika Domanski-Lyfors from Sweden

quitted last week after China's quarter-final elimination at last month's

Women's World Cup. Former France's

women's soccer team coach Elisabeth Loisel meets the press at the news

conference to announce her appointment to coach China's women's team in Beijing

October 28, 2007. China's former coach Marika Domanski-Lyfors from Sweden

quitted last week after China's quarter-final elimination at last month's

Women's World Cup.

China's top legislature yesterday approved the

Cabinet nomination of Meng Jianzhu as minister of public security, the country's

top police official. Meng, former leader of the Communist Party of eastern

Jiangxi province, replaces Zhou Yongkang. Zhou had been named to the Politburo

Standing Committee. More personnel changes are expected - including the two men

likely to succeed President Hu Jintao and government head Premier Wen Jiabao. Xi

Jinping and Li Keqiang were also lifted into the new nine-member Standing

Committee. Two members have been expelled from the National People's Congress.

Xinhua News Agency named them as Wang Xiaojin, board chairman of the Gujing

Group, one of China's largest distilleries based in Anhui province, and Wang

Dingguo, former board chairman of the Qingjiang River Hydropower Development in

Hubei province.

October 30, 2007

Hong Kong:

Property stocks led Hong Kong's benchmark index into its second consecutive day

of record close Friday, on hopes of another U.S. interest rate cut next week.

The blue-chip Hang Seng Index rose 1.8 percent to a record close of 30,405.22,

after trading between 29,932.64 and an all- time intraday high of 30,562.63

during the session. Turnover totaled 157.38 billion HK dollars (20.33 billion

U.S. dollars), down from 165.18 billion HK dollars (21.34 billion U.S. dollars)

Thursday. All the four categories gained ground. The property jumped 5 percent,

followed by the Commerce and Industry at 2.66 percent, the Utilities at 0.95

percent and the Finance at 0.49. Sino Land, the biggest blue-chip gainer, surged

12.6 percent to 24.65 HK dollars. Henderson Land climbed 4.9 percent to 64.85 HK

dollars. Sun Hung Kai Properties rose 4 percent to 153.60 HK dollars. Tycoon Li

Ka-shing's property flagship Cheung Kong gained 5.2 percent to 145.50 HK

dollars. Bucking the downward trend of China-related stocks, Industrial and

Commercial Bank of China rose 2.1 percent to 7.16 HK dollars, after target price

upgrades by investment banks. PetroChina fell 0.52 percent to 19.02 HK dollars.

On Chinese telecom stocks front, heavyweight China Mobile was up 0.92 percent,

while Netcom up 1.74 percent, China Unicom up 5. 06 percent, and China Telecom

up 1.26 percent. ICBC that subscribed for a 20 percent stake in the Standard

Bank added 2.14 percent. Bank of China proposing to expand its retail banking

business in UK through mergers and acquisitions climbed 1.52 percent. Insurance

stocks put in mixed shows. Ping An was down 1.84 percent despite a 3.5-time

three-month profit growth, while China Life was up 0.49 percent, PICC P&C down

0.12 percent, and China Insurance up 2.04 percent. Hong Kong:

Property stocks led Hong Kong's benchmark index into its second consecutive day

of record close Friday, on hopes of another U.S. interest rate cut next week.

The blue-chip Hang Seng Index rose 1.8 percent to a record close of 30,405.22,

after trading between 29,932.64 and an all- time intraday high of 30,562.63

during the session. Turnover totaled 157.38 billion HK dollars (20.33 billion

U.S. dollars), down from 165.18 billion HK dollars (21.34 billion U.S. dollars)

Thursday. All the four categories gained ground. The property jumped 5 percent,

followed by the Commerce and Industry at 2.66 percent, the Utilities at 0.95

percent and the Finance at 0.49. Sino Land, the biggest blue-chip gainer, surged

12.6 percent to 24.65 HK dollars. Henderson Land climbed 4.9 percent to 64.85 HK

dollars. Sun Hung Kai Properties rose 4 percent to 153.60 HK dollars. Tycoon Li

Ka-shing's property flagship Cheung Kong gained 5.2 percent to 145.50 HK

dollars. Bucking the downward trend of China-related stocks, Industrial and

Commercial Bank of China rose 2.1 percent to 7.16 HK dollars, after target price

upgrades by investment banks. PetroChina fell 0.52 percent to 19.02 HK dollars.

On Chinese telecom stocks front, heavyweight China Mobile was up 0.92 percent,

while Netcom up 1.74 percent, China Unicom up 5. 06 percent, and China Telecom

up 1.26 percent. ICBC that subscribed for a 20 percent stake in the Standard

Bank added 2.14 percent. Bank of China proposing to expand its retail banking

business in UK through mergers and acquisitions climbed 1.52 percent. Insurance

stocks put in mixed shows. Ping An was down 1.84 percent despite a 3.5-time

three-month profit growth, while China Life was up 0.49 percent, PICC P&C down

0.12 percent, and China Insurance up 2.04 percent.

China Shenhua has been added to the Hang

Seng China AH Index Series which comprises the largest and most liquid Chinese

mainland companies with both A-share and H-share listings. China Shenhua has been added to the Hang

Seng China AH Index Series which comprises the largest and most liquid Chinese

mainland companies with both A-share and H-share listings.

A senior banking

executive has called on the Hong Kong government to begin discussions on

changing the currency peg that has lasted more than two decades. HSBC (0005)

executive director Peter Wong Tung-shun told The Standard the yuan is on course

to become a freely convertible currency within 10 years. "As the Chinese economy

develops at a faster pace than before, that widens the difference between Hong

Kong and the US economy," Wong said. His comments come nearly two weeks after

President Hu Jintao told the Communist Party Congress that the mainland will

improve the yuan exchange rate regime and gradually make the currency

convertible under the capital account. Wong believes the Hong Kong dollar should

be linked to a currency which better reflects the city's economic reality.

"Don't ask me when the delinkage should take place. I can only say, when you see

the yuan becoming a freely convertible currency, then it's time for change,"

Wong suggested. "The right thing should be done at the right time." Earlier this

year, the yuan strengthened against the Hong Kong dollar for the first time in

13 years, reigniting a debate whether the time has come to scrap the 23-year-old

US-dollar peg. The yuan gained to 1.0004 per Hong Kong dollar and also climbed

to 7.7949 to the US dollar in Shanghai trading in early January. The Hong Kong

Monetary Authority said at the time, there is "no intention to change the linked

exchange rate system." The Hong Kong dollar is pegged at 7.8 to the greenback

and is allowed to trade between 7.75 and 7.85. A senior banking

executive has called on the Hong Kong government to begin discussions on

changing the currency peg that has lasted more than two decades. HSBC (0005)

executive director Peter Wong Tung-shun told The Standard the yuan is on course

to become a freely convertible currency within 10 years. "As the Chinese economy

develops at a faster pace than before, that widens the difference between Hong

Kong and the US economy," Wong said. His comments come nearly two weeks after

President Hu Jintao told the Communist Party Congress that the mainland will

improve the yuan exchange rate regime and gradually make the currency

convertible under the capital account. Wong believes the Hong Kong dollar should

be linked to a currency which better reflects the city's economic reality.

"Don't ask me when the delinkage should take place. I can only say, when you see

the yuan becoming a freely convertible currency, then it's time for change,"

Wong suggested. "The right thing should be done at the right time." Earlier this

year, the yuan strengthened against the Hong Kong dollar for the first time in

13 years, reigniting a debate whether the time has come to scrap the 23-year-old

US-dollar peg. The yuan gained to 1.0004 per Hong Kong dollar and also climbed

to 7.7949 to the US dollar in Shanghai trading in early January. The Hong Kong

Monetary Authority said at the time, there is "no intention to change the linked

exchange rate system." The Hong Kong dollar is pegged at 7.8 to the greenback

and is allowed to trade between 7.75 and 7.85.

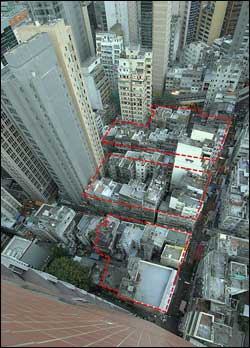

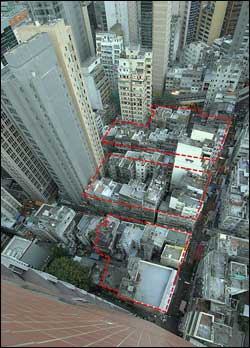

Residents of two Sai Ying Pun

buildings that have to make way for the construction of the Mass Transit

Railway's HK$8.9 billion West Island Line are worried about rehousing as they

fear compensation to be offered will not be enough to buy new homes.

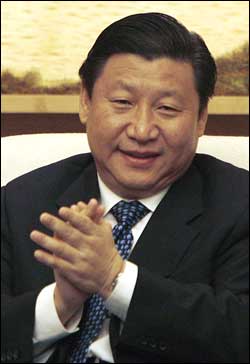

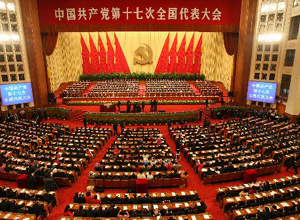

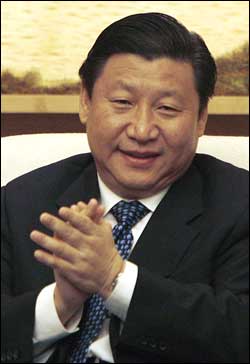

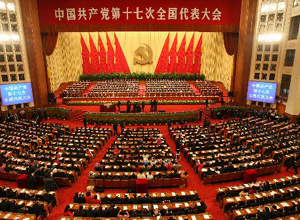

Rising political star Xi Jinping has been

named to head the 18-strong working group overseeing Hong Kong and Macau affairs

as well as state vice- president, The Standard has learned. Xi's appointment

follows his promotion to the elite Politiburo Standing Committee earlier this

week at the close of the 17th Chinese Communist Party national congress. He will

succeed retiring Vice President Zeng Qinghong, who was dropped from both the

party Central Committee and the Politburo Standing Committee. Sources in Beijing

have confirmed that Xi, 54, who is also Shanghai party chief and the eldest son

of Xi Zhongxun - a former revolutionary and former vice-premier who helped

pioneer China's special economic zones - was given the new posts after intensive

closed-door discussions. Liao Hui - a vice-chairman of the Chinese People's

Political Consultative Conference and incumbent director of the Hong Kong and

Macao Affairs Office - will stay on as deputy head of the working group

responsible for Hong Kong affairs. Chen Zuo'er, vice director of the Hong Kong

and Macao Affairs Office, will retire before March next year. Another key

appointment concerning Hong Kong is that of Peng Qinghua, who was elected party

chief for the HKSAR three months ago. He will succeed the retiring Gao Siren as

director of the Central Government's Liaison Office in Hong Kong. Besides Xi,

two other new faces in the nine-member Politburo Standing Committee - Li Keqiang

and He Guoqiang - have been allocated new portfolios. Li, 52, who ranks seventh

in the Standing Committee who is also Liaoning party boss, will replace the late

Huang Ju in overseeing the country's economic, financial and energy policies as

a vice premier. He Guoqiang will take over from retiring Wu Gangzheng as head of

the Central Commission for Disciplined Actions, while Jiangsu party chief Li

Yuanchao, 57, will succeed He as head of the Organization Department, according

to Xinhua news agency. Li's post as Liaoning provincial chief has gone to

62-year-old Jiangsu provincial governor Liang Baohua. Jiangsu party chief Meng

Jianzhu has been tipped to replace new Standing Committee member Zhou Yongkang

as public security minister. His appointment is expected to be approved by the

National People's Congress Standing Committee on Sunday. Wang Shaoguang, chair

professor at the Chinese University of Hong Kong's department of government and

public administration, said the new leadership lineup of Xi and Li has ensured a

stable succession at the top in the next 15 years. "The leadership succession

problem over the next 15 years has now been more or less resolved, as whoever

wins the contest for the top job in 2012 - Xi or Li - will probably serve

another 10 more years, and thus party policies will be entrenched," Wang said. Rising political star Xi Jinping has been

named to head the 18-strong working group overseeing Hong Kong and Macau affairs

as well as state vice- president, The Standard has learned. Xi's appointment

follows his promotion to the elite Politiburo Standing Committee earlier this

week at the close of the 17th Chinese Communist Party national congress. He will

succeed retiring Vice President Zeng Qinghong, who was dropped from both the

party Central Committee and the Politburo Standing Committee. Sources in Beijing

have confirmed that Xi, 54, who is also Shanghai party chief and the eldest son

of Xi Zhongxun - a former revolutionary and former vice-premier who helped

pioneer China's special economic zones - was given the new posts after intensive

closed-door discussions. Liao Hui - a vice-chairman of the Chinese People's

Political Consultative Conference and incumbent director of the Hong Kong and

Macao Affairs Office - will stay on as deputy head of the working group

responsible for Hong Kong affairs. Chen Zuo'er, vice director of the Hong Kong

and Macao Affairs Office, will retire before March next year. Another key

appointment concerning Hong Kong is that of Peng Qinghua, who was elected party

chief for the HKSAR three months ago. He will succeed the retiring Gao Siren as

director of the Central Government's Liaison Office in Hong Kong. Besides Xi,

two other new faces in the nine-member Politburo Standing Committee - Li Keqiang

and He Guoqiang - have been allocated new portfolios. Li, 52, who ranks seventh

in the Standing Committee who is also Liaoning party boss, will replace the late

Huang Ju in overseeing the country's economic, financial and energy policies as

a vice premier. He Guoqiang will take over from retiring Wu Gangzheng as head of

the Central Commission for Disciplined Actions, while Jiangsu party chief Li

Yuanchao, 57, will succeed He as head of the Organization Department, according

to Xinhua news agency. Li's post as Liaoning provincial chief has gone to

62-year-old Jiangsu provincial governor Liang Baohua. Jiangsu party chief Meng

Jianzhu has been tipped to replace new Standing Committee member Zhou Yongkang

as public security minister. His appointment is expected to be approved by the

National People's Congress Standing Committee on Sunday. Wang Shaoguang, chair

professor at the Chinese University of Hong Kong's department of government and

public administration, said the new leadership lineup of Xi and Li has ensured a

stable succession at the top in the next 15 years. "The leadership succession

problem over the next 15 years has now been more or less resolved, as whoever

wins the contest for the top job in 2012 - Xi or Li - will probably serve

another 10 more years, and thus party policies will be entrenched," Wang said.

Christie's Hong Kong displayed

Chinese works of art inspired by the west alongside important ceramics that will

be on sale in its autumn auction in a media preview here Friday. The two

auctions, named respectively Reflections: Chinese Art Inspired by the West, and

Important Chinese Ceramics and Works of Art, will take place on November 27. It

will showcase 15 creations that blend the essence of Chinese artistry and

innovative western conceptions, as well as 200 pieces of Chinese ceramics that

are altogether expected to realized in excess of 300 million Hong Kong dollars

(38.75 million U.S. dollars) A magnificent Imperial Beijing enamel glass

brushpot, Qianlong mark and of the period (1736-1795), is estimated at 30

million HK dollars (about 3.85 million U.S. dollars). The brushpot is one of the

finest and rarest examples of enamels on glass made for the Qianlong Emperor of

Qing dynasty, and the only perfect glass burshpot of this form and decoration

known to exist. Also featured at the preview is a Ming blue and white "Boys" jar

of the Jiajing period (1522-1566, estimated at 30 million Hong Kong dollars

(about 3.85 million U.S. dollars). The jar is exquisitely painted in under

glaze-blue of brilliant deep purplish tone with a continuous garden landscape

scene of 16 boys in various lively pursuits. Another prized offering is a

magnificent and large bronze figure of Guanyin from the 14th century, late

Yuan-early Ming dynasty. It is expected to fetch over 30 million Hong Kong

dollars(about 3.85 million U.S. dollars).

The chief executive of the Hong Kong Monetary Authority,

Joseph Yam Chi- Kwong, will work one more year before retiring from the position

he has held since 1993, a source said. The Monetary Authority has sold Hong Kong

dollars for the second time last week as heavy demand pushed it to the upper

limit of its trading band against the US dollar.

The chief executive of the Hong Kong Monetary Authority,

Joseph Yam Chi- Kwong, will work one more year before retiring from the position

he has held since 1993, a source said. The Monetary Authority has sold Hong Kong

dollars for the second time last week as heavy demand pushed it to the upper

limit of its trading band against the US dollar.

In a move seen as damage control, the Democratic Party has

decided to publish an announcement in newspapers on Saturday, setting out its

position on Martin Lee Chu-ming's recent article, including the party's support

for Beijing hosting next year's Olympic Games. It is not an apology, but a clear

declaration of what we stand for," said chairman Albert Ho Chun-yan. "We are of

the same mind as Lee," Ho said, adding that the party plans to spell out its

position on the Games and the mainland human rights situation. The party's

position on the issues is essentially the same as Lee's, but "some of the

wording [in Lee's Wall Street Journal article] will be avoided in order to avoid

further misunderstanding." Chief Secretary for Administration Henry Tang

Ying-yen was the latest to join the controversy, saying "the Olympics should not

be politicized." Lee reiterated there was nothing in his article urging the Bush

administration or other countries to boycott the Games. "Even the Foreign

Ministry did not specify my name when it said those who try to pressure China

with the help of external forces is bound to fail," he said. But Tsang Hin-chi,

a National People's Congress Standing Committee member, said in Beijing that

Lee's "bad behavior has never changed." Tsang added: "Is he blind, mute or deaf?

How is it he cannot see the progress that China has made in recent years? He

asked foreign countries to impose sanctions on China. Isn't that what only

traitors will do?" Pro-Beijing lawmakers on Friday also continued with their

attack on Lee.

In a move seen as damage control, the Democratic Party has

decided to publish an announcement in newspapers on Saturday, setting out its

position on Martin Lee Chu-ming's recent article, including the party's support

for Beijing hosting next year's Olympic Games. It is not an apology, but a clear

declaration of what we stand for," said chairman Albert Ho Chun-yan. "We are of

the same mind as Lee," Ho said, adding that the party plans to spell out its

position on the Games and the mainland human rights situation. The party's

position on the issues is essentially the same as Lee's, but "some of the

wording [in Lee's Wall Street Journal article] will be avoided in order to avoid

further misunderstanding." Chief Secretary for Administration Henry Tang

Ying-yen was the latest to join the controversy, saying "the Olympics should not

be politicized." Lee reiterated there was nothing in his article urging the Bush

administration or other countries to boycott the Games. "Even the Foreign

Ministry did not specify my name when it said those who try to pressure China

with the help of external forces is bound to fail," he said. But Tsang Hin-chi,

a National People's Congress Standing Committee member, said in Beijing that

Lee's "bad behavior has never changed." Tsang added: "Is he blind, mute or deaf?

How is it he cannot see the progress that China has made in recent years? He

asked foreign countries to impose sanctions on China. Isn't that what only

traitors will do?" Pro-Beijing lawmakers on Friday also continued with their

attack on Lee.

China:

The Fourth China-ASEAN Exposition opened here on Sunday morning in the southern

China city of Nanning. Political figures and business leaders of China and the

ten countries of the Association of Southeast Asian Nations were present at the

opening ceremony of the four-day event.

China:

The Fourth China-ASEAN Exposition opened here on Sunday morning in the southern

China city of Nanning. Political figures and business leaders of China and the

ten countries of the Association of Southeast Asian Nations were present at the

opening ceremony of the four-day event.

PetroChina, the nation's largest oil

producer, has attracted a record 3.3 trillion yuan in subscriptions for its

A-share listing on the Shanghai Stock Exchange.

The gross domestic product (GDP) of Guangdong Province exceeded 2 trillion yuan

in the first three quarters, its statistics bureau said. Guangdong's GDP from

January to September was 2.15 trillion yuan, up by 14.7 percent from the same

period last year. The figure is almost equal to the full-year GDP of 2.17

trillion yuan in 2005. In the first nine months, the provincial government

enacted a series of policies to adjust Guangdong's investment structure, promote

consumption and reduce the trade surplus. "The figures prove the policies are

working," said Bu Xinmin, director of the provincial statistics bureau.

Investment in fixed assets saw a moderate rise and the consumer market was

brisk, he said. Guangdong's foreign trade has slowed since a new export tax

rebate was introduced. From July to September, export growth in the province was

26 percent, 18.9 percent and 16.9 percent. Earnings in the petroleum and power

industries rose sharply in the period.

Buddhists attend a lighting ceremony

for the lying Buddha statue of Shuanglin rock cave in Xinchang county of east

China’s Zhejiang Province, Oct. 27, 2007. Buddhists attend a lighting ceremony

for the lying Buddha statue of Shuanglin rock cave in Xinchang county of east

China’s Zhejiang Province, Oct. 27, 2007.

Taiwan actor

Zhang Zhen (R) and actress Hsu Chi walk on the red carpet at the16th China

Golden Rooster and Hundred Flowers Film Festival in Suzhou of eastern China’s

Jiangsu Province October 27, 2007. Taiwan actor

Zhang Zhen (R) and actress Hsu Chi walk on the red carpet at the16th China

Golden Rooster and Hundred Flowers Film Festival in Suzhou of eastern China’s

Jiangsu Province October 27, 2007.

Chinese actress Yuan

Quan poses on the red carpet at the 16th China Golden Rooster and Hundred

Flowers Film Festival in Suzhou of eastern China’s Jiangsu Province October 27,

2007. Chinese actress Yuan

Quan poses on the red carpet at the 16th China Golden Rooster and Hundred

Flowers Film Festival in Suzhou of eastern China’s Jiangsu Province October 27,

2007.

Hong Kong

actor Tony Leung (R) and actress Liu Jialing walk on the red carpet at the 16th

China Golden Rooster and Hundred Flowers Film Festival in Suzhou of eastern

China’s Jiangsu Province October 27, 2007. Hong Kong

actor Tony Leung (R) and actress Liu Jialing walk on the red carpet at the 16th

China Golden Rooster and Hundred Flowers Film Festival in Suzhou of eastern

China’s Jiangsu Province October 27, 2007.

Hong Kong

actor Jet Li (L) and China’s mainland actress Li Bingbing pose together on the

red carpet at the 16th China Golden Rooster and Hundred Flowers Film Festival in

Suzhou of eastern China’s Jiangsu Province October 27, 2007. Hong Kong

actor Jet Li (L) and China’s mainland actress Li Bingbing pose together on the

red carpet at the 16th China Golden Rooster and Hundred Flowers Film Festival in

Suzhou of eastern China’s Jiangsu Province October 27, 2007.

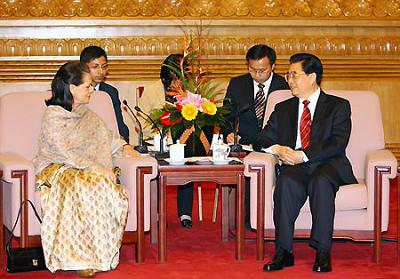

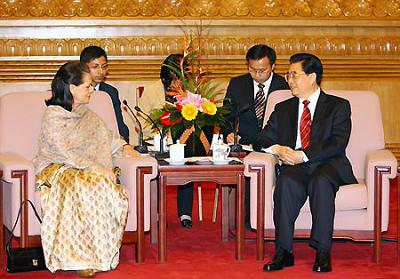

Chinese President Hu Jintao (R) meets with Indian Congress Party President Sonia

Gandhi (L) at the Great Hall of the People in Beijing, capital of China on Oct.

26, 2007. China and India voiced their commitment to handle bilateral relations

at a strategic level and step up the partnership to a higher level.

Chinese President Hu Jintao (R) meets with Indian Congress Party President Sonia

Gandhi (L) at the Great Hall of the People in Beijing, capital of China on Oct.

26, 2007. China and India voiced their commitment to handle bilateral relations

at a strategic level and step up the partnership to a higher level.

Local residents view the

2008-meter-long dragon in Shuangfeng township of Taicang city, east China's

Jiangsu Province, Oct. 26, 2007. The dragon dance performance held in the town

to greet the Beijing 2008 Olympic games attracted many local residents on

Friday, during which a giant dragon waved by 1010 people was the most

remarkable. Local residents view the

2008-meter-long dragon in Shuangfeng township of Taicang city, east China's

Jiangsu Province, Oct. 26, 2007. The dragon dance performance held in the town

to greet the Beijing 2008 Olympic games attracted many local residents on

Friday, during which a giant dragon waved by 1010 people was the most

remarkable.

China Unicom Ltd, the nation's

second-biggest mobile-phone operator, more than doubled third-quarter profit,

beating analysts' estimates, by winning customers with reduced rates. Net income

rose to 2.98 billion yuan (398 million U.S. dollars) from 1.39 billion yuan a

year earlier. China Unicom Ltd, the nation's

second-biggest mobile-phone operator, more than doubled third-quarter profit,

beating analysts' estimates, by winning customers with reduced rates. Net income

rose to 2.98 billion yuan (398 million U.S. dollars) from 1.39 billion yuan a

year earlier.

Shen Guojun (first from right),

president of property developer China Yintai Holdings Ltd, and Chan Yue-kwong

(second from right), chairman of Hong Kong-based restaurant chain Cafe de Coral

Holdings Ltd, at a press conference in Beijing on Friday. Shen and Chan are two

of the 11 winners of the Ernst & Young Entrepreneurs of the Year China 2007

awards. Shen Guojun (first from right),

president of property developer China Yintai Holdings Ltd, and Chan Yue-kwong

(second from right), chairman of Hong Kong-based restaurant chain Cafe de Coral

Holdings Ltd, at a press conference in Beijing on Friday. Shen and Chan are two

of the 11 winners of the Ernst & Young Entrepreneurs of the Year China 2007

awards.

China's three biggest insurers are

expected to invest more than 10 billion yuan (HK$10.36 billion) each in a new

state-controlled company that will build the country's high-speed railway from

Beijing to Shanghai, sources familiar with the investments said on Friday.

October 29, 2007

Hong Kong:

Beijing loyalists launched a tirade

against veteran democrat lawmaker Martin Lee Chu-ming yesterday, calling him a

"running dog" and a "traitor" for urging the United States and other countries

to use next year's Beijing Olympics to force China to improve its human-rights

record. Hong Kong:

Beijing loyalists launched a tirade

against veteran democrat lawmaker Martin Lee Chu-ming yesterday, calling him a

"running dog" and a "traitor" for urging the United States and other countries

to use next year's Beijing Olympics to force China to improve its human-rights

record.

Pollution fell below national air

quality standards at all monitoring stations across Guangdong and Hong Kong in

the first half of the year, caused by "unfavorable" weather conditions.

Hong Kong blue chips jumped 1.8 per cent on Friday, staying firmly above the key

30,000 level for the first time, with property stocks hitting records, stoked by

a weak US dollar and speculation of a rate cut by the Federal Reserve, which

meets next week. Conglomerate Hutchison Whampoa (SEHK: 0013) also rallied, as

investors bid up the underplayed stock to highs unseen since March 2001. Blue

chips hardly looked back after easily sailing past the key 30,000-point barrier

at the open. Investors switched into Hong Kong blue chips and out of mainland

plays amid expectations that the central government would raise interest rates

following strong macro data a day earlier. The benchmark Hang Seng Index closed

550.73 points higher at 30,405.22, setting an intraday high at 30,562.63 and

notching a 3.2 per cent gain for the week. The index of Hong Kong-listed

mainland companies shook off earlier losses as mainland-listed shares rebounded.

The index ended nearly unchanged at 19,548.49 to post a weekly 0.9 per cent

loss. Main-board turnover was HK$157.4 billion compared with Thursday’s HK$165.2

billion. As the US dollar weakened, the Hong Kong Monetary Authority sold HK$775

million worth of the local currency for US dollars to curb a strengthening Hong

Kong dollar. “The market has been very rotational,” said William Fong, fund

manager at Baring Asset Management. “When the US dollar depreciates, people look

for shelter in hard assets. China plays are having a consolidation but in the

near-term, I see strong liquidity coming from [the Qualified Domestic

Institutional Investor programme], so I’m not worried,” he said. Hutchison was

the day’s most traded stock after PetroChina (SEHK: 0857, announcements, news) ,

bolting nearly 6 per cent to HK$90.75. Property shares resumed their record run,

with the Hang Seng property sub-index rising 5 per cent to a peak for a second

straight day. Sino Land was the sector’s top gainer amid its recent land

acquisition spree, rallying nearly 17 per cent at one point in heavy trade

before settling at HK$24.65, up 12.6 per cent. Cheung Kong (SEHK: 0001) shot up

5.2 per cent to HK$145.5 and MTR, which will have the city’s largest land bank

pending its merger with KCRC, leapt 6.2 per cent to HK$25.75. ICBC (SEHK: 0349)

was a standout among mainland names, rising 2.1 per cent to HK$7.16 a day after

it reported a 76 per cent rise in third-quarter profit. The mainland’s top

lender also has agreed to buy 20 per cent of Standard Bank Group, South Africa’s

largest bank. Merrill Lynch raised its target price for ICBC shares to HK$8.40,

and JPMorgan raised its target price to HK$8.80. Hutchison Telecommunications

International (SEHK: 2332) tumbled 5.7 per cent to HK$10.66 after Orascom

Telecom Holding was selling up to 143.4 million shares in the emerging markets

telecom play at between HK$10.70 to HK$10.95, according to a term sheet seen by

Reuters. PetroChina shed 0.5 per cent to HK$19.02, a day after China’s top oil

producer set an indicative price range for its domestic IPO that was below

expectation.

Hong Kong blue chips jumped 1.8 per cent on Friday, staying firmly above the key

30,000 level for the first time, with property stocks hitting records, stoked by

a weak US dollar and speculation of a rate cut by the Federal Reserve, which

meets next week. Conglomerate Hutchison Whampoa (SEHK: 0013) also rallied, as

investors bid up the underplayed stock to highs unseen since March 2001. Blue

chips hardly looked back after easily sailing past the key 30,000-point barrier

at the open. Investors switched into Hong Kong blue chips and out of mainland

plays amid expectations that the central government would raise interest rates

following strong macro data a day earlier. The benchmark Hang Seng Index closed

550.73 points higher at 30,405.22, setting an intraday high at 30,562.63 and

notching a 3.2 per cent gain for the week. The index of Hong Kong-listed

mainland companies shook off earlier losses as mainland-listed shares rebounded.

The index ended nearly unchanged at 19,548.49 to post a weekly 0.9 per cent

loss. Main-board turnover was HK$157.4 billion compared with Thursday’s HK$165.2

billion. As the US dollar weakened, the Hong Kong Monetary Authority sold HK$775

million worth of the local currency for US dollars to curb a strengthening Hong

Kong dollar. “The market has been very rotational,” said William Fong, fund

manager at Baring Asset Management. “When the US dollar depreciates, people look

for shelter in hard assets. China plays are having a consolidation but in the

near-term, I see strong liquidity coming from [the Qualified Domestic

Institutional Investor programme], so I’m not worried,” he said. Hutchison was

the day’s most traded stock after PetroChina (SEHK: 0857, announcements, news) ,

bolting nearly 6 per cent to HK$90.75. Property shares resumed their record run,

with the Hang Seng property sub-index rising 5 per cent to a peak for a second

straight day. Sino Land was the sector’s top gainer amid its recent land

acquisition spree, rallying nearly 17 per cent at one point in heavy trade

before settling at HK$24.65, up 12.6 per cent. Cheung Kong (SEHK: 0001) shot up

5.2 per cent to HK$145.5 and MTR, which will have the city’s largest land bank

pending its merger with KCRC, leapt 6.2 per cent to HK$25.75. ICBC (SEHK: 0349)

was a standout among mainland names, rising 2.1 per cent to HK$7.16 a day after

it reported a 76 per cent rise in third-quarter profit. The mainland’s top

lender also has agreed to buy 20 per cent of Standard Bank Group, South Africa’s

largest bank. Merrill Lynch raised its target price for ICBC shares to HK$8.40,

and JPMorgan raised its target price to HK$8.80. Hutchison Telecommunications

International (SEHK: 2332) tumbled 5.7 per cent to HK$10.66 after Orascom

Telecom Holding was selling up to 143.4 million shares in the emerging markets

telecom play at between HK$10.70 to HK$10.95, according to a term sheet seen by

Reuters. PetroChina shed 0.5 per cent to HK$19.02, a day after China’s top oil

producer set an indicative price range for its domestic IPO that was below

expectation.

Taxi groups unite against discount ideas - A leading taxi group has mobilised

major taxi unions to speak out against proposals that could lead to the legal

discounting of fares. The Motor Transport Workers' General Union - the largest

of the 27 taxi associations in Hong Kong - insisted the only effective way to

combat illegal touting activities was to penalise passengers who bargain on

fares. The government released a pamphlet as part of a public consultation that

began on Monday, asking drivers and passengers if they would prefer to vary

fares, provided there was a ceiling. In one of the two suggested models - based

on overseas examples - the maximum fares would be set by the operators, and in

the other, the upper limits would be decided by the government, and the

operators would have to apply for permission to charge less. Both models forbid

drivers to offers further discounts. But the union's taxi director, To Sun-tong,

said that would not eliminate unfair competition by the so-called discount taxi

gangs. "You set the price lower, [the gangs] set it even lower, and in the end

it would only trigger a throat-cutting race among drivers for lower fares. The

trade would not be able to survive," he said. Mr To said if the government would

make it illegal for passengers to bargain, the whole problem would be settled.

It is now illegal for drivers to offer discounts. The union and its 22 allied

taxi associations would protest outside the headquarters of the Transport and

Housing Bureau in Central today. The trade had proposed various options that

would lower fares for long-haul trips, but they were voted down by the union and

its allies in a meeting with the Transport Department in July. Kwok Chi-piu,

chairman of an independent taxi driver union, said many groups who claim to be

victims of the discount taxi gangs were offering discounts themselves. "Drivers

who are snatching others' business by offering discounts, of course, hope the

practice would not be legalised, because they would then lose their edges," he

said. Hong Kong Taxi and Public Light Bus Association chairman Brandon Tong

Yeuk-fung said the proposals were not likely to be welcomed by taxi owners

either, because a reduction in fares may eventually lead to lower rental charges

for the taxi and thus push down the price of a taxi licence - which has remained

steady at about HK$3.5 million in the past few years.

Taxi groups unite against discount ideas - A leading taxi group has mobilised

major taxi unions to speak out against proposals that could lead to the legal

discounting of fares. The Motor Transport Workers' General Union - the largest

of the 27 taxi associations in Hong Kong - insisted the only effective way to

combat illegal touting activities was to penalise passengers who bargain on

fares. The government released a pamphlet as part of a public consultation that

began on Monday, asking drivers and passengers if they would prefer to vary

fares, provided there was a ceiling. In one of the two suggested models - based

on overseas examples - the maximum fares would be set by the operators, and in

the other, the upper limits would be decided by the government, and the

operators would have to apply for permission to charge less. Both models forbid

drivers to offers further discounts. But the union's taxi director, To Sun-tong,

said that would not eliminate unfair competition by the so-called discount taxi

gangs. "You set the price lower, [the gangs] set it even lower, and in the end

it would only trigger a throat-cutting race among drivers for lower fares. The

trade would not be able to survive," he said. Mr To said if the government would

make it illegal for passengers to bargain, the whole problem would be settled.

It is now illegal for drivers to offer discounts. The union and its 22 allied

taxi associations would protest outside the headquarters of the Transport and

Housing Bureau in Central today. The trade had proposed various options that

would lower fares for long-haul trips, but they were voted down by the union and

its allies in a meeting with the Transport Department in July. Kwok Chi-piu,

chairman of an independent taxi driver union, said many groups who claim to be

victims of the discount taxi gangs were offering discounts themselves. "Drivers

who are snatching others' business by offering discounts, of course, hope the

practice would not be legalised, because they would then lose their edges," he

said. Hong Kong Taxi and Public Light Bus Association chairman Brandon Tong

Yeuk-fung said the proposals were not likely to be welcomed by taxi owners

either, because a reduction in fares may eventually lead to lower rental charges

for the taxi and thus push down the price of a taxi licence - which has remained

steady at about HK$3.5 million in the past few years.

China:

U.S. Trade Representative and Treasury Secretary Discuss U.S.-China Relations -

On Tuesday at the third meeting of the George Bush China-U.S. Relations

Conference, U.S. Trade Representative Susan Schwab and Treasury Department

Secretary Henry Paulson delivered remarks on U.S.-China relations. “Over the

past 15 years, bilateral trade in goods between our two countries has increased

by 1200 percent! Over the past six alone, bilateral goods trade has nearly

tripled and services trade has more than doubled. Investment flows remain

strong,” said Ambassador Schwab. “In this time of rapid change and closer

integration of participants in the global trading system, it is imperative for

veteran trading powers such as the United States and major new actors, such as

China, to champion the benefits of the free and fair flow of commerce.” Schwab

continued, “If the United States seems at times impatient with the velocity and

magnitude of the reforms China has undertaken to become a member of the global

trading community, it is because China’s impact on trade, and indeed on all

human endeavors, has also increased in its velocity and magnitude. Given its

vast size and the enormous energy and dynamism of its people, China has an

urgent task to move forward on embracing market principles. The Chinese people

and the other five billion people who share this planet are all stakeholders in

a strong, stable China.” Paulson remarked, “China’s re-emergence on the global

stage is one of the most consequential geopolitical events of recent times.

China’s global influence is expanding. A cooperative, constructive and candid

U.S.-China relationship is central to understanding and responding to China’s

re-emergence, in all its possible manifestations. The United States must manage

our disagreements with China, foster greater bilateral cooperation and improve

our ability to work constructively with China across all dimensions of national

power.” “The economic and geopolitical landscape of the 21st century will be

greatly influenced by the way in which the United States and China work

together. That emerging future requires a distinct vision and effective

mechanisms to achieve it. The SED has allowed both the United States and China

to begin to write the next chapter of our strategic economic relationship,”

concluded Paulson.

China:

U.S. Trade Representative and Treasury Secretary Discuss U.S.-China Relations -

On Tuesday at the third meeting of the George Bush China-U.S. Relations

Conference, U.S. Trade Representative Susan Schwab and Treasury Department

Secretary Henry Paulson delivered remarks on U.S.-China relations. “Over the

past 15 years, bilateral trade in goods between our two countries has increased

by 1200 percent! Over the past six alone, bilateral goods trade has nearly

tripled and services trade has more than doubled. Investment flows remain

strong,” said Ambassador Schwab. “In this time of rapid change and closer

integration of participants in the global trading system, it is imperative for

veteran trading powers such as the United States and major new actors, such as

China, to champion the benefits of the free and fair flow of commerce.” Schwab

continued, “If the United States seems at times impatient with the velocity and

magnitude of the reforms China has undertaken to become a member of the global

trading community, it is because China’s impact on trade, and indeed on all

human endeavors, has also increased in its velocity and magnitude. Given its

vast size and the enormous energy and dynamism of its people, China has an

urgent task to move forward on embracing market principles. The Chinese people

and the other five billion people who share this planet are all stakeholders in

a strong, stable China.” Paulson remarked, “China’s re-emergence on the global

stage is one of the most consequential geopolitical events of recent times.

China’s global influence is expanding. A cooperative, constructive and candid

U.S.-China relationship is central to understanding and responding to China’s

re-emergence, in all its possible manifestations. The United States must manage

our disagreements with China, foster greater bilateral cooperation and improve

our ability to work constructively with China across all dimensions of national

power.” “The economic and geopolitical landscape of the 21st century will be

greatly influenced by the way in which the United States and China work

together. That emerging future requires a distinct vision and effective

mechanisms to achieve it. The SED has allowed both the United States and China

to begin to write the next chapter of our strategic economic relationship,”

concluded Paulson.

Sales of China-made

autos expected to hit 8.5 mln in 2007 - Sales of China-made autos hit 6.46

million units in the first nine months this year, an increase of 24.5 percent

over the same period last year, China's auto industry association said on

Tuesday. During the period, output of domestic autos rose by 22.8 percent to

6.51 million units while the sales are expected to hit 8.5 million by the year

end, according to statistics released by the China Association of Automobile

Manufacturers. Of the total, sales of passenger vehicles hit 4.58 million units,

up 23.8 percent, and commercial vehicles reached 1.88 million units, up 26

percent. Followed by China FAW Group Corporation and Dongfeng Motor Corporation,

Shanghai Automotive Industry Corporation ranked first in sales volume, selling

1.13 million units. Meanwhile, sales of the top ten companies account for 83

percent of the total, according to the auto association. Sales of China-made

autos expected to hit 8.5 mln in 2007 - Sales of China-made autos hit 6.46

million units in the first nine months this year, an increase of 24.5 percent

over the same period last year, China's auto industry association said on

Tuesday. During the period, output of domestic autos rose by 22.8 percent to

6.51 million units while the sales are expected to hit 8.5 million by the year

end, according to statistics released by the China Association of Automobile

Manufacturers. Of the total, sales of passenger vehicles hit 4.58 million units,

up 23.8 percent, and commercial vehicles reached 1.88 million units, up 26

percent. Followed by China FAW Group Corporation and Dongfeng Motor Corporation,

Shanghai Automotive Industry Corporation ranked first in sales volume, selling

1.13 million units. Meanwhile, sales of the top ten companies account for 83

percent of the total, according to the auto association.

The

gold models and the silver models of the National Stadium, dubbed the "Bird’s

Nest," were unveiled in Beijing on October 24, 2007. The models are made of pure

gold and pure silver. There will be a limited number for sale. The commemorative

models are issued by China Gold Coin Incorporation and authorized by the Beijing

Organizing Committee. The

gold models and the silver models of the National Stadium, dubbed the "Bird’s

Nest," were unveiled in Beijing on October 24, 2007. The models are made of pure

gold and pure silver. There will be a limited number for sale. The commemorative

models are issued by China Gold Coin Incorporation and authorized by the Beijing

Organizing Committee.

Income growth of rural residents outstripped that of their

urban counterparts in China in the first nine months of this year, according to

official statistics. A survey of 68,000 rural households nationwide showed that

average cash income per person reached 3,321 yuan (442 U.S. dollars) for the

first three quarters of this year. After taking into account inflation, it rose

14.8 percent over the same period last year, the National Bureau of Statistics (NBS)

announced on Friday. The NBS also found that after sampling 59,000 urban

households, the per-capita disposable income of the country's urban residents

grew by 13.2 percent in real terms to 10,346 yuan over the first three quarters

of this year. This comes against a background of a widening gap between rich and

poor in China. Statistics released in September showed that the average annual

income of urban residents in 2006 was 3.28 times that of their rural

counterparts, up from 3.22 in 2005 and 3.21 in 2004. An NBS official said a wage

increase for non-farming jobs and price rises of farm products are major factors

fuelling income growth for rural residents. According to NBS figures, both the

per-capita wage income and the income from selling farm products for rural

residents rose around 20 percent in the first nine months. The country has been

increasing investment in rural areas to narrow the income gap between rural and

urban residents.

Housing prices in

70 large and medium-sized Chinese cities rose by 8.9 percent year-on-year in

September, the National Bureau of Statistics (NBS) said Friday. The rising trend

shows no sign of stopping, according to a report jointly released by the NBS and

the National Development and Reform Commission. Housing prices in

70 large and medium-sized Chinese cities rose by 8.9 percent year-on-year in

September, the National Bureau of Statistics (NBS) said Friday. The rising trend

shows no sign of stopping, according to a report jointly released by the NBS and

the National Development and Reform Commission.

PetroChina attracted about 3.3 trillion yuan in

subscriptions to its Shanghai initial public offering, a record for a domestic

IPO, a source familiar with the offering told Reuters on Friday.

Heavy fog forced Airbus to cancel a

demonstration flight of its Airbus A380 over Beijing on Friday, as thousands of

passengers on regular air services were delayed. Heavy fog forced Airbus to cancel a

demonstration flight of its Airbus A380 over Beijing on Friday, as thousands of

passengers on regular air services were delayed.

October 27-28, 2007

Hong Kong:

Foreign, HK staff see wages slide - Professionals from Hong Kong and overseas

working on the mainland have seen their wages slump as local workers become more

competitive, a survey by the Hong Kong Baptist University and Hong Kong People

Management Association has said. In the special administrative region (SAR),

however, salaries for professionals have continued to rise, increasing by 7.4

percent last year and 7.9 percent this year. Of the 85 companies surveyed in 10

mainland cities, 38 employed Hongkongers as managers, 26 as supervisors and

seven as general staff. Between the second half of 2006 and first half of this

year, managers' salaries fell 15.4 percent from 674,465 yuan ($90,000) to

570,841 yuan, while supervisors' wages were down 25.3 percent from 353,013 yuan

to 263,620 yuan. The average wage for general staff rose 25.7 percent over the

same period, from 211,225 yuan to 265,504 yuan. In the same period, the 183

overseas staff employed by 13 mainland companies also saw their salaries

decline. Managers took an average pay cut of 14.8 percent, from 1.05 million

yuan to 894,719 yuan, while supervisors saw their pay fall 25.5 percent, from

569,956 yuan to 424,656 yuan. Pauline Chung, vice-president of the Hong Kong

People Management Association, said the nation's rapid development had resulted

in improved manpower resources, which meant mainland firms were no longer so

reliant on Hong Kong and expatriate staff. "There are more overseas educated

mainlanders returning to the country. "They have good English skills and their

professional knowledge is on a par with Hong Kong people. Mainlanders have

received higher education and are quick to learn new things," she said. Hong Kong:

Foreign, HK staff see wages slide - Professionals from Hong Kong and overseas

working on the mainland have seen their wages slump as local workers become more

competitive, a survey by the Hong Kong Baptist University and Hong Kong People

Management Association has said. In the special administrative region (SAR),

however, salaries for professionals have continued to rise, increasing by 7.4

percent last year and 7.9 percent this year. Of the 85 companies surveyed in 10

mainland cities, 38 employed Hongkongers as managers, 26 as supervisors and

seven as general staff. Between the second half of 2006 and first half of this

year, managers' salaries fell 15.4 percent from 674,465 yuan ($90,000) to

570,841 yuan, while supervisors' wages were down 25.3 percent from 353,013 yuan

to 263,620 yuan. The average wage for general staff rose 25.7 percent over the

same period, from 211,225 yuan to 265,504 yuan. In the same period, the 183

overseas staff employed by 13 mainland companies also saw their salaries

decline. Managers took an average pay cut of 14.8 percent, from 1.05 million

yuan to 894,719 yuan, while supervisors saw their pay fall 25.5 percent, from

569,956 yuan to 424,656 yuan. Pauline Chung, vice-president of the Hong Kong

People Management Association, said the nation's rapid development had resulted

in improved manpower resources, which meant mainland firms were no longer so

reliant on Hong Kong and expatriate staff. "There are more overseas educated

mainlanders returning to the country. "They have good English skills and their

professional knowledge is on a par with Hong Kong people. Mainlanders have

received higher education and are quick to learn new things," she said.

Hong Kong's exports grew at a

faster-than- expected pace last month on increased trade with the mainland and

other Asian markets, which helped offset slowing demand in the United States.

Next year promises

to be the best for wage earners in a decade - with salaries projected to go up

by an average of more than 4 percent. The increases, however, still lag those in

the mainland, where workers can expect pay rises of between 7.4 and 8.5 percent

next year as a result of rapid economic development, according to a joint survey

conducted by the Hong Kong People Management Association and Hong Kong Baptist

University. The survey, which was carried out between June 2006 and June this

year, interviewed 95 local small and medium-sized companies employing more than

66,000 people. Sixty-two percent of the firms had 300 employees or fewer, while

nearly 18 percent had between 300 and 1,000 workers, and 20 percent had more

than 1,000 employees. The companies included those engaged in the construction,

food and beverage, retail, and sales and marketing sectors. According to the

poll, Hong Kong workers stand to receive pay adjustments averaging 4.3 to 4.7

percent next year. This compares with increases of between 2.9 and 3.6 percent

from July 2006 to June this year, with the retail and sales sectors recording

the biggest increases of about 7 percent. Association president Felix Yip

yesterday urged employers to offer generous pay increments for staff in order to

retain talent. "Civil servants have already been given pay rises this year, so

the private sector has to follow suit," he said. Next year promises

to be the best for wage earners in a decade - with salaries projected to go up

by an average of more than 4 percent. The increases, however, still lag those in

the mainland, where workers can expect pay rises of between 7.4 and 8.5 percent

next year as a result of rapid economic development, according to a joint survey