|

Newsletter

Seminar Material

Biz:

China

Hong

Kong Hawaii

What people

said about us

China

Earthquake Relief

Tax &

Government

Hawaii Voter Registration

Biz-Video

Biz-Video

Hawaii's

China Connection Hawaii's

China Connection

CDP#1780962

CDP#1780962

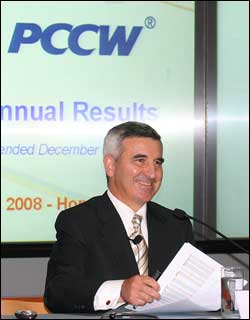

Doing Business in

Hong Kong & China

Doing Business in

Hong Kong & China

| |

Hong Kong, China & Hawaii Biz*

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our event page to find out more!

After

attended a China/Hong Kong Business/Trade Seminar in Hawaii...still unsure what

to do next, contact us, our Officers, Directors and Founding Members are

actively engaged in China/Hong Kong/Asia trade - we can help!

Are you ready to export your product or

service? You will find out in 3 minutes with resources to help you -

enter

to give it a try

China Central TV - live

Webcast

China Central TV - live

Webcast

Skype - FREE

Voice Over IP Skype - FREE

Voice Over IP

View Hawaii's China Connection

Video Trailer

View Hawaii's China Connection

Video Trailer

Direct link

PDF file

Direct link

PDF file

Year of the Pig - February 18, 2007

Year of the Pig - February 18, 2007

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

Holidays Greeting from President Obama &

Johnson Choi

Holidays Greeting from President Obama &

Johnson Choi

http://www.youtube.com/watch?v=pNk4Z4lUV-k

http://www.youtube.com/watch?v=pNk4Z4lUV-k

http://www.facebook.com/video/video.php?v=219896871983&ref=mf

http://www.facebook.com/video/video.php?v=219896871983&ref=mf

Wine-Biz - Hong Kong

Wine-Biz - Hong Kong

Brand Hong Kong

Video

Brand Hong Kong

Video

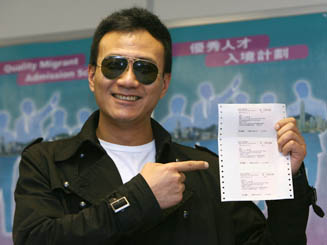

March 31, 2008

Hong Kong:

China's State Council, or cabinet, appointed Simon Peh Yun-lu as the Director of

Immigration of the Hong Kong Special Administrative Region (HKSAR) government

here on Friday. The State Council also ended the term of Lai Tung-kwok as the

Director of Immigration. Lai was named to the position last June. The decision

was made based on the nomination and suggestion by Donald Tsang Yam-kuen, chief

executive of the HKSAR government. Hong Kong:

China's State Council, or cabinet, appointed Simon Peh Yun-lu as the Director of

Immigration of the Hong Kong Special Administrative Region (HKSAR) government

here on Friday. The State Council also ended the term of Lai Tung-kwok as the

Director of Immigration. Lai was named to the position last June. The decision

was made based on the nomination and suggestion by Donald Tsang Yam-kuen, chief

executive of the HKSAR government.

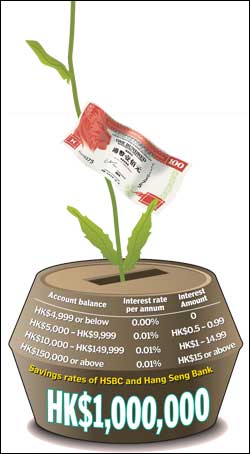

If the government introduced a congestion charge today it would have to sting

drivers for HK$90 for each trip to Central - and that would deter only one in

five from making the journey by road. But drivers would need pay only HK$40 to

HK$50 if the scheme were launched in 2016, when the Central-Wan Chai bypass has

been built. Those are among the findings of the second study of the feasibility

of electronic road pricing. A senior government source called the HK$90 charge

huge and said: "We do not think people will be willing to pay such a high

price." Congestion charging has been on the agenda since the 1980s. A

consultancy study finished in 2000 was not released in full. The source said

officials were looking at the second study's findings and considering how and

when to release them. The source said the difference between the charges was so

high because, without a bypass, drivers unwilling to pay would have almost no

alternative route. "They would have to pay and go to Central because there was

no other choice, thus only a huge charge can deter traffic coming to Central.

With the bypass, drivers going to Sheung Wan and Western could skip Central

without paying a charge. Without the bypass, motorists who don't want to pay

would be pushed to Mid-Levels and that would be a nightmare." The source added:

"The bypass is an essential part of the road pricing scheme." Tim Hau Doe-kwong,

a University of Hong Kong transport expert, said the figures showed the

significance of giving drivers a second option. "A mere increase in costs to

suppress demand without the provision of an alternative would result in public

chaos," he said. The Transport Department's 2006 annual traffic census shows the

average number of vehicles entering and leaving the city's central business

district each day was 491,320. Other cities have reported dramatic results from

congestion charging. Singapore's Land Transport Authority says the number of

vehicles entering the city centre fell by more than 70 per cent when road

pricing was introduced in 1997. Transport for London, which oversees congestion

charging in the British capital, says that in 2006, the number of vehicles

entering the central zone where the charge applies was down 21 per cent on the

number in 2002, a year before it began charging drivers. The Hong Kong

government's third comprehensive transport study, in 2003, showed average speeds

had dropped to 16km/h on major roads in the central business district. If

nothing was done by 2011, it said, that would drop to 5.3km/h. The Council for

Sustainable Development polled 80,000 people last year and found more than 40

per cent support for electronic road pricing. What other cities charge:

Singapore charges between S$0.25 and S$10 (HK$1.40 to HK$56) per road Monday to

Saturday from 7am to 10.30pm. Rates change every 20 minutes. London charges £8

(HK$125) to enter the city centre between 7am and 6pm on weekdays and 6pm to 7am

at weekends and holidays. Discounts are offered to some categories of driver.

Stockholm levies between 10 and 60 krona (HK$13 to HK$78) on vehicles using

roads in the congestion zone between 6.30am and 6.30pm. There is no charge at

night, during weekends and public holidays or in July. Dubai charges between 4

dirham and 24 dirham (HK$8.50 to HK$51) when drivers pass toll gates at the

entrance to the emirate's congestion charging zone. New York has proposed

levying congestion charges of between US$7 and US$21 on vehicles entering the

Manhattan business district from 6am to 6pm.

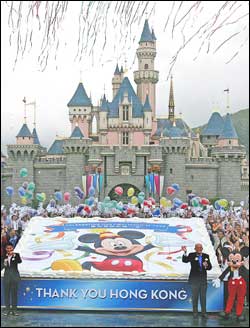

Hong Kong's flying dragon logo, seen

on posters, brochures and Cathay Pacific flights, has been successful since it

was unveiled seven years ago as part of a city image promotion program, a senior

official said Friday. The image incorporating the letters HK and the Chinese

characters for Hong Kong, often together with the phrase "Asia's world city,"

has been a successful example of branding, said John Tsang, financial secretary

of the Hong Kong Special Administrative Region (HKSAR) government, comparing it

with Canada's trademark maple leave. "The Hong Kong Brand has become known

overseas since it (the logo) was launched some seven years ago. Hong Kong is

regarded as a vibrant, multi-cultural city with plenty of opportunities for

those who dare to take the plunge," Tsang told a forum Friday. The strategic

objective of the Brand Hong Kong initiative, launched by the HKSAR government in

2001 and run by the Information Services Department, was to communicate the

city's competitive positioning, values and culture, the HKSAR government said.

The HKSAR government has carried out massive promotion under the program. The

visual identity can now be seen across Hong Kong, from the skyline to the

airport. It even had an official website of its own. The phrase "Asia's world

city' has become part of the regional lexicon and many organizations and

individuals were applying for authorization to use the Brand Hong Kong logo, the

website said. The ideas, hard work and passion of Hong Kong residents formed the

foundation for Brand Hong Kong's success both at home and overseas, Frederick

Ma, secretary for commerce and economic development, said at a workshop earlier.

The HKSAR government is in the middle of public consultation, begun with

Wednesday's workshop to review the Brand Hong Kong program. Tsang called for

updated public services, among others, as he asked people to consider whether

Hong Kong's competitive positioning was still relevant today. "Given the many

changes around us, since its issuance some seven years ago, we are now in the

process of reviewing its relevance and applicability through an extensive public

engagement exercise, " he said, urging for revitalization of Brand Hong Kong.

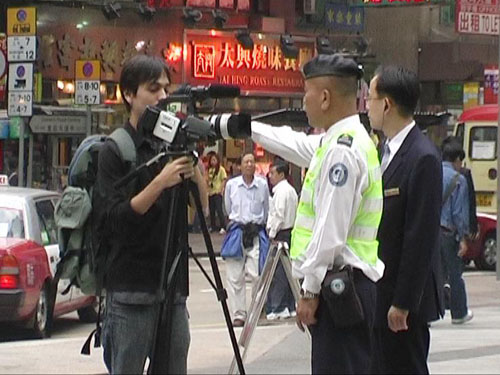

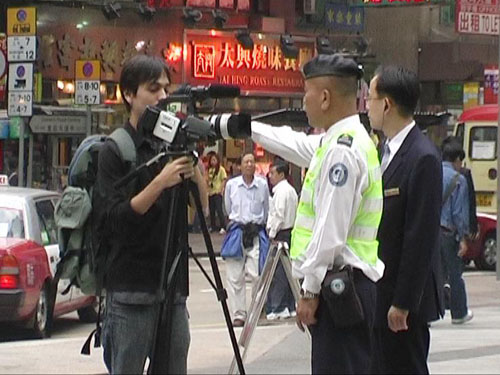

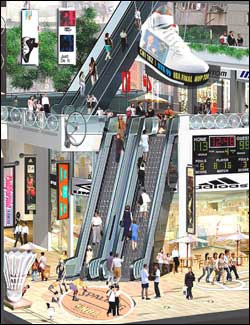

Private rules that govern public spaces - Insisting on the

right to use public space within a private development can earn you a strong

rebuke from security guards. In one case, it resulted in a call to the police.

The multimedia team of the Sunday Morning Post conducted a test last week to

gauge the accessibility of these public spaces. The test involved using a video

camera to film city sights popular with tourists. In two cases - at the

fourth-floor public podium at IFC mall and at Swire Properties' Park Court

outside Pacific Place - security guards allowed filming without condition. In

the third case, staff working for Hong Kong Land in Exchange Square permitted

filming of the sculptures on public display, but said tripods were not allowed.

At the fourth location, guards reacted differently as we filmed from a public

sidewalk in Quarry Bay. Two guards said we were not permitted to take images of

the exterior of Taikoo Place, claiming those images were the property of Swire.

Nevertheless, they took no further action as we continued to shoot, as we

insisted filming could take place from a public sidewalk. The greatest trouble

encountered was at the public courtyard at The Center, in Central, which is

managed by Citybase Property Management. Staff said that while the area was

public, it was "under the control" of Citybase and we were required to apply to

management for shooting permission. Security services manager Terence Mok said

someone might trip over our tripod, while our Canon XL1 camera - because of its

size - would draw too much attention. "The tripod and the shooting will affect

our guests. They will ask, `What's going on? What's going on? What happened

here?'" he said. After we turned off our cameras, Mr Mok asked us to erase

footage of him, saying we had violated his privacy. We declined to do so,

explaining we had identified ourselves as reporters and that the shooting took

place in a public area. Mr Mok then called the police, in the apparent belief

the police could order the footage to be deleted. However, the commanding

officer who arrived at the scene told Citybase it was not within his authority

to order the destruction of the private property of another individual. The

Sunday Morning Post (SEHK: 0583, announcements, news) informed Citybase that Mr

Mok's image would not be used as part of the video report accompanying this

story. The test was to measure the openness of these public spaces, not to

highlight the actions of any particular individual. The police officer proposed

to Citybase that it post its rules clearly on how the public may use the

courtyard. The Development Bureau on Friday recommended that property owners

across Hong Kong do the same. Spokeswoman Eunice Chan said Citybase had no rules

for the courtyard, "and so there is no issue, as suggested, to post rules in an

area where the public can view them". She said the security guards had

disallowed the use of tripods "to maintain free flow of passage for the

convenience of the public", but did not say why filming was banned. Asked

whether calling the police was an appropriate use of police resources, Ms Chan

said this "should be appreciated as an act to avoid further escalation of

arguments". However, during 15 minutes of friendly chat as we waited for the

police, Mr Mok said we were not being detained, though he wished for us to

remain until police arrived to resolve the issue.

Private rules that govern public spaces - Insisting on the

right to use public space within a private development can earn you a strong

rebuke from security guards. In one case, it resulted in a call to the police.

The multimedia team of the Sunday Morning Post conducted a test last week to

gauge the accessibility of these public spaces. The test involved using a video

camera to film city sights popular with tourists. In two cases - at the

fourth-floor public podium at IFC mall and at Swire Properties' Park Court

outside Pacific Place - security guards allowed filming without condition. In

the third case, staff working for Hong Kong Land in Exchange Square permitted

filming of the sculptures on public display, but said tripods were not allowed.

At the fourth location, guards reacted differently as we filmed from a public

sidewalk in Quarry Bay. Two guards said we were not permitted to take images of

the exterior of Taikoo Place, claiming those images were the property of Swire.

Nevertheless, they took no further action as we continued to shoot, as we

insisted filming could take place from a public sidewalk. The greatest trouble

encountered was at the public courtyard at The Center, in Central, which is

managed by Citybase Property Management. Staff said that while the area was

public, it was "under the control" of Citybase and we were required to apply to

management for shooting permission. Security services manager Terence Mok said

someone might trip over our tripod, while our Canon XL1 camera - because of its

size - would draw too much attention. "The tripod and the shooting will affect

our guests. They will ask, `What's going on? What's going on? What happened

here?'" he said. After we turned off our cameras, Mr Mok asked us to erase

footage of him, saying we had violated his privacy. We declined to do so,

explaining we had identified ourselves as reporters and that the shooting took

place in a public area. Mr Mok then called the police, in the apparent belief

the police could order the footage to be deleted. However, the commanding

officer who arrived at the scene told Citybase it was not within his authority

to order the destruction of the private property of another individual. The

Sunday Morning Post (SEHK: 0583, announcements, news) informed Citybase that Mr

Mok's image would not be used as part of the video report accompanying this

story. The test was to measure the openness of these public spaces, not to

highlight the actions of any particular individual. The police officer proposed

to Citybase that it post its rules clearly on how the public may use the

courtyard. The Development Bureau on Friday recommended that property owners

across Hong Kong do the same. Spokeswoman Eunice Chan said Citybase had no rules

for the courtyard, "and so there is no issue, as suggested, to post rules in an

area where the public can view them". She said the security guards had

disallowed the use of tripods "to maintain free flow of passage for the

convenience of the public", but did not say why filming was banned. Asked

whether calling the police was an appropriate use of police resources, Ms Chan

said this "should be appreciated as an act to avoid further escalation of

arguments". However, during 15 minutes of friendly chat as we waited for the

police, Mr Mok said we were not being detained, though he wished for us to

remain until police arrived to resolve the issue.

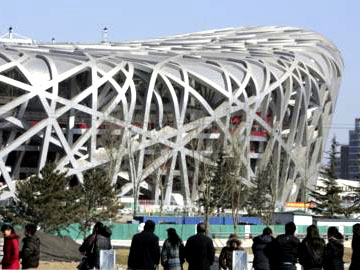

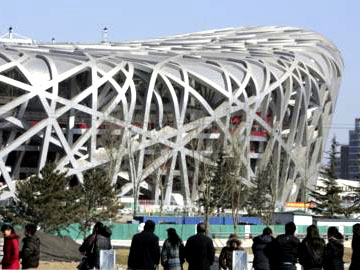

The police will do a good job at ensuring law and order if

protests break out during the Olympic equestrian events, Hong Kong's police

chief said yesterday. Commissioner of Police Tang King-shing said the force had

received information that protests by foreign groups would be staged in the city

during the Games. He said the force would contact the protest groups to sort out

the logistics as soon as possible. "We will contact foreign protest groups

because they don't know the city and because we want to make sure that all

protests go smoothly and are peaceful," Mr Tang said. Mr Tang said the force had

not received any intelligence that terrorist groups had targeted the city during

the Games but a medium security alert had been raised. The force has also been

working with the Beijing Organising Committee for the Games to ensure the event

goes smoothly. Mr Tang said officers trained to handle any eventuality would be

deployed to ensure security at the equestrian events and throughout the city.

Information on securing Hong Kong would also be sought from other countries.

Booming industry 'threatens safety' - A boom in

shipbuilding across East Asia is fuelling an acute shortage of experienced

mariners, which poses a serious risk to safety standards, industry experts warn.

New shipyards are coming on stream across China following industry expansion in

the Pearl River Delta, Shanghai, Ningbo, Dalian and Tsingtao, with Vietnam and

South Korea also seeing rapid growth. "We are set to see an even greater

expansion over the next five years and the whole industry - because of the rapid

expansion - is suffering from a shortage of experienced staff," one industry

insider said. "It takes 10 to 12 years to build a captain in terms of giving him

the experience and security to head a vessel, but it only takes two years to

build a ship." Classification society DNV Maritime warned last week that global

accident rates for large ships had doubled in the past five years, citing the

boom in shipping, a shortage of officers, lower retention rates and faster

promotion as key factors. Arthur Bowring, chairman of the Hong Kong Shipowners

Association, said: "We do have a crisis in seafarer supply. Everybody is short

of people. So far we haven't laid up any ships for lack of crew but in the next

two to three years we should see a situation where ships are not able to sail

because they don't have the right crew."

China:

EU foreign ministers rejected Saturday the call for a boycott of the upcoming

Beijing Olympic Games over the Tibet issue. EU acknowledged Tibet is part of

China and Chinese territorial integrity should be respected.

China:

EU foreign ministers rejected Saturday the call for a boycott of the upcoming

Beijing Olympic Games over the Tibet issue. EU acknowledged Tibet is part of

China and Chinese territorial integrity should be respected.

3G cell phone services on trial run in 8 cities - China Mobile will next week

launch the pre-commercial service of third generation (3G) mobile phone

telephony based on a home-grown standard.

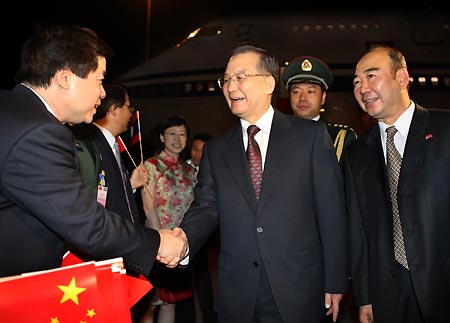

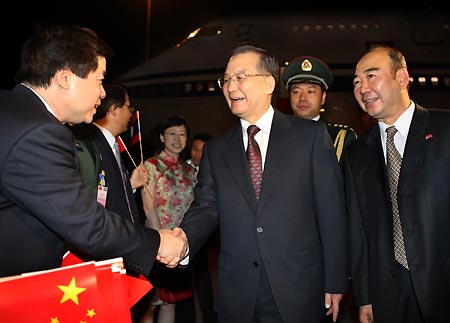

Chinese Premier Wen

Jiabao (C) arrives in Vientiane, capital of Laos, March 29, 2008. Wen started

his working visit to Laos on Saturday evening by the invitation of Lao Prime

Minister Bouasone Bouphavanh, and he is also scheduled to attend the 3rd Summit

of the Great Mekong Subregion countries in Vientiane. Chinese Premier Wen Jiabao

arrived here on Saturday evening, starting his working visit to Laos. Wen is

also scheduled to attend the 3rd Summit of the Great Mekong Subregion countries

-- China, Laos, Vietnam, Cambodia, Thailand and Myanmar -- to be convened in

this Laos capital city on Monday. According to the Chinese Foreign Ministry,

Wen, invited by Lao Prime Minister Bouasone Bouphavanh, will meet with Lao

President Choummaly Saygnasone and hold talks with his Lao counterpart Bouasone

on future bilateral cooperation. Wen and Bouasone are scheduled to attend the

signing ceremony of cooperation agreement in the sectors of economy, technology,

coal and e-governance. After his working visit to Laos, Wen will join with

leaders from the other five GMS members as well as representatives from the

Asian Development Bank at the summit and attend the opening ceremony of a

1,800-km international road from China's Kunming city to Thailand's Bangkok. The

GMS, established in 1992, promotes economic and social development, irrigation

and cooperation within the six Mekong countries. About 320 million people live

within the GMS region, and their common link, the Mekong River, winds its way

for 4,200 km. The great majority of these people live in rural areas where they

lead subsistence or semi-subsistence agricultural lifestyles. The area boasts

abundant natural resources and huge development potential. With a long history

of cultural and economic exchanges among the nations, the area has formed

peculiar cultural and economic characteristics based on different folk customs

and natural landscapes of the six nations sharing the river. The first GMS

Summit was held in Cambodia's Phnom Penh in 2002,and the second in southwest

China's Kunming in 2005. Chinese Premier Wen

Jiabao (C) arrives in Vientiane, capital of Laos, March 29, 2008. Wen started

his working visit to Laos on Saturday evening by the invitation of Lao Prime

Minister Bouasone Bouphavanh, and he is also scheduled to attend the 3rd Summit

of the Great Mekong Subregion countries in Vientiane. Chinese Premier Wen Jiabao

arrived here on Saturday evening, starting his working visit to Laos. Wen is

also scheduled to attend the 3rd Summit of the Great Mekong Subregion countries

-- China, Laos, Vietnam, Cambodia, Thailand and Myanmar -- to be convened in

this Laos capital city on Monday. According to the Chinese Foreign Ministry,

Wen, invited by Lao Prime Minister Bouasone Bouphavanh, will meet with Lao

President Choummaly Saygnasone and hold talks with his Lao counterpart Bouasone

on future bilateral cooperation. Wen and Bouasone are scheduled to attend the

signing ceremony of cooperation agreement in the sectors of economy, technology,

coal and e-governance. After his working visit to Laos, Wen will join with

leaders from the other five GMS members as well as representatives from the

Asian Development Bank at the summit and attend the opening ceremony of a

1,800-km international road from China's Kunming city to Thailand's Bangkok. The

GMS, established in 1992, promotes economic and social development, irrigation

and cooperation within the six Mekong countries. About 320 million people live

within the GMS region, and their common link, the Mekong River, winds its way

for 4,200 km. The great majority of these people live in rural areas where they

lead subsistence or semi-subsistence agricultural lifestyles. The area boasts

abundant natural resources and huge development potential. With a long history

of cultural and economic exchanges among the nations, the area has formed

peculiar cultural and economic characteristics based on different folk customs

and natural landscapes of the six nations sharing the river. The first GMS

Summit was held in Cambodia's Phnom Penh in 2002,and the second in southwest

China's Kunming in 2005.

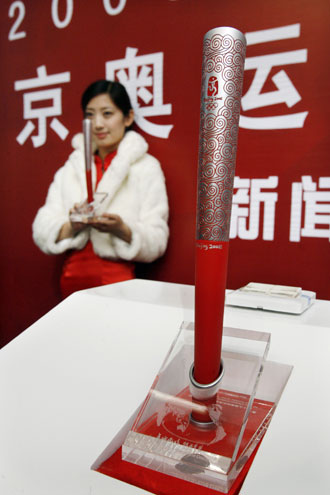

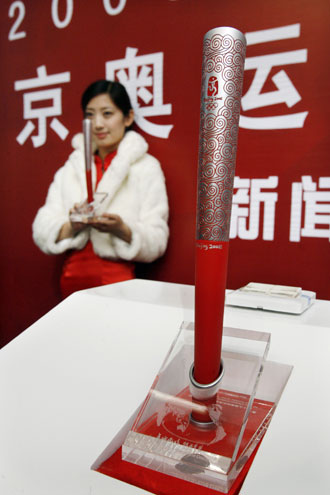

Crew members of the Olympic Torch

plane take oath in front of the plane at Beijing Capital International Airport

March 27, 2008. The plane, chartered to carry the torch back to Beijing, will

take off for Athens on Saturday. The Olympic Torch plane takes off from Beijing

Capital International Airport on Saturday morning, heading for Athens where it

will collect the famous flame, Tan Zhihong, senior vice-president of Air China,

which provided the plane, said on Friday. The Airbus A330 passenger airliner,

which has 200-plus seats, including 30 for VIPs, has been chartered to carry the

torch on its global tour. "The aircraft has a specially designed stand to hold

the flame while it is in transit," Tan said. "We guarantee it will continue to

burn throughout the 11-and-a-half-hour flight from Athens. "It will arrive in

Beijing on Monday, after its six-day relay through Greece," he said. A grand

ceremony will be held to welcome the flame and officially launch the torch relay

of the 2008 Olympic Games. Crew members of the Olympic Torch

plane take oath in front of the plane at Beijing Capital International Airport

March 27, 2008. The plane, chartered to carry the torch back to Beijing, will

take off for Athens on Saturday. The Olympic Torch plane takes off from Beijing

Capital International Airport on Saturday morning, heading for Athens where it

will collect the famous flame, Tan Zhihong, senior vice-president of Air China,

which provided the plane, said on Friday. The Airbus A330 passenger airliner,

which has 200-plus seats, including 30 for VIPs, has been chartered to carry the

torch on its global tour. "The aircraft has a specially designed stand to hold

the flame while it is in transit," Tan said. "We guarantee it will continue to

burn throughout the 11-and-a-half-hour flight from Athens. "It will arrive in

Beijing on Monday, after its six-day relay through Greece," he said. A grand

ceremony will be held to welcome the flame and officially launch the torch relay

of the 2008 Olympic Games.

Chinese actress Zhang Ziyi got close to

two orangutans at a conservation area in Sabah, Malaysia last December while

shooting a program to promote wildlife protection. Chinese actress Zhang Ziyi is

in the spotlight once again, but not as an actress. This time, Zhang Ziyi is

hosting an English TV program titled "The Story of Wildlife," which aims to draw

attention to wild animals facing extinction. Zhang shot the program last

December at a conservation area in Sabah, a region in Malaysia, Xiaoxiang

Morning Post reported. The trailer of the program shows Zhang visiting a

tropical rainforest and introducing some species of the nearly-extinct wildlife.

Although the insects in the rainforest are potentially harmful, Zhang insisted

going into the rainforest herself to give the audience a closer look at the

animals. After spending three days with a pair of orphaned orangutans, Zhang

experienced their deteriorating living environment firsthand. This primate,

which acts much like humans, is often captured and regarded as a pet. Some

wildlife experts predict that they will die out in ten years if no effective

measures are taken. Chinese actress Zhang Ziyi got close to

two orangutans at a conservation area in Sabah, Malaysia last December while

shooting a program to promote wildlife protection. Chinese actress Zhang Ziyi is

in the spotlight once again, but not as an actress. This time, Zhang Ziyi is

hosting an English TV program titled "The Story of Wildlife," which aims to draw

attention to wild animals facing extinction. Zhang shot the program last

December at a conservation area in Sabah, a region in Malaysia, Xiaoxiang

Morning Post reported. The trailer of the program shows Zhang visiting a

tropical rainforest and introducing some species of the nearly-extinct wildlife.

Although the insects in the rainforest are potentially harmful, Zhang insisted

going into the rainforest herself to give the audience a closer look at the

animals. After spending three days with a pair of orphaned orangutans, Zhang

experienced their deteriorating living environment firsthand. This primate,

which acts much like humans, is often captured and regarded as a pet. Some

wildlife experts predict that they will die out in ten years if no effective

measures are taken.

A girl stands

beside a Bright Dairy booth at a supermarket of Yichang, Central China's Hubei

Province, on March 28. Approved by the regulator, Bright Dairy raised the prices

of some of its milk products on Friday. A girl stands

beside a Bright Dairy booth at a supermarket of Yichang, Central China's Hubei

Province, on March 28. Approved by the regulator, Bright Dairy raised the prices

of some of its milk products on Friday.

The unmanned lunar

orbiter Chang'e I that blasted off from Xichang Satellite Launch Center in

Sichuan province atop a Long March 3A rocket last October, heralding the first

stage of the mainland's lunar exploration program, is among several other space

technologies on display at an exhibition in West Kowloon. China Space Expo -

Space Odyssey, which winds up at the end of this week at the PopTV Arena in West

Kowloon, offers a rare look at the Chang'e I, the Long March rocket and Shenzhou

spacecraft. A space documentary is also a part of the show. Exhibits are on show

in two separate areas - the China Space Expo hall, and the Space Odyssey hall.

The Space Expo hall has more than 10 pieces of key equipment on display, such as

the Long March-2 rocket launcher, Shenzhou re-entry capsule and the Shenzhou

spacecraft. Huang Chunping, the commander of Shenzhou No 5 and 6 missions who is

also vice-chairman of China Academy of Launch Vehicle Technology, hopes the show

will inspire the young and stir their ties to the mainland. Secretary for Home

Affairs Tsang Tak-sing says that the expo reflects the giant leap made by China

in space technology. The expo is open from 2-10pm from today to Friday and from

noon to 10pm this weekend. Tickets for adults are priced from HK$80 to HK$100,

while students, children, the handicapped and seniors pay HK$40 on weekdays and

HK$50 on weekends. The exhibition is presented by Beijing Science Association in

conjunction with Beijing 1831 Mobility Technology Centre and the China

Exhibition Organizing Committee. It is also supported by the China Space Museum,

PopTV Arena HK, Cosmedia Group, and Live Nation. The unmanned lunar

orbiter Chang'e I that blasted off from Xichang Satellite Launch Center in

Sichuan province atop a Long March 3A rocket last October, heralding the first

stage of the mainland's lunar exploration program, is among several other space

technologies on display at an exhibition in West Kowloon. China Space Expo -

Space Odyssey, which winds up at the end of this week at the PopTV Arena in West

Kowloon, offers a rare look at the Chang'e I, the Long March rocket and Shenzhou

spacecraft. A space documentary is also a part of the show. Exhibits are on show

in two separate areas - the China Space Expo hall, and the Space Odyssey hall.

The Space Expo hall has more than 10 pieces of key equipment on display, such as

the Long March-2 rocket launcher, Shenzhou re-entry capsule and the Shenzhou

spacecraft. Huang Chunping, the commander of Shenzhou No 5 and 6 missions who is

also vice-chairman of China Academy of Launch Vehicle Technology, hopes the show

will inspire the young and stir their ties to the mainland. Secretary for Home

Affairs Tsang Tak-sing says that the expo reflects the giant leap made by China

in space technology. The expo is open from 2-10pm from today to Friday and from

noon to 10pm this weekend. Tickets for adults are priced from HK$80 to HK$100,

while students, children, the handicapped and seniors pay HK$40 on weekdays and

HK$50 on weekends. The exhibition is presented by Beijing Science Association in

conjunction with Beijing 1831 Mobility Technology Centre and the China

Exhibition Organizing Committee. It is also supported by the China Space Museum,

PopTV Arena HK, Cosmedia Group, and Live Nation.

The "Made in China" label, once scorned in Laos, is now

coveted. "About eight years ago, the quality of Chinese products sold in Laos

was so bad that they had an infamous reputation," said Peng Zhenghua, a Chinese

businessman who has lived in the capital, Vientiane, since 1993. "Many people

found that Chinese food they bought had already expired. Others complained their

new washing machines and video players broke down after a few months' use. "Laos

people used to boycott Chinese products. Even me. I refused to buy them at that

time. As a result, many shops selling Chinese products were forced to fold and

Chinese businessmen faced a hard time during the period." Mr Peng was speaking

on the eve of the arrival of Premier Wen Jiabao in Laos for the third summit of

the Greater Mekong Subregion. The change finally came when the central

government weighed in, the Shanghai native and general secretary of the

Vientiane Chinese Association said. "In 2002 or 2003, the Chinese embassy in

Vientiane gathered Chinese businessmen in the capital," he said. "In a bid to

avoid further deterioration of the reputation of Chinese products, officials

warned them to stop selling substandard goods immediately. "As well, Chinese

officers at border checkpoints tightened up on fake and bad-quality goods

exported to Laos." The moves quickly achieved the desired effect. "From then on,

motorbikes made in China gradually took over the Japanese market share because

of their overwhelmingly low price," Mr Peng said. "For instance, a Japanese

motorbike sells for US$1,200, while you can buy one imported from China for only

US$500. "Although the quality of Japanese products still gives them advantages,

more importantly, people must consider whether they are affordable before buying

them. "People know how to choose. Nowadays, almost all Chinese products are

welcomed by people in Laos. "Kangjia and Changhong are well-known brand names

for TV sets, Haier is famous for its refrigerators, while Meide may be the

best-seller of cookers here." Mr Peng's point of view is shared by China'

ambassador to Laos, Pan Guangxue. "Bilateral trade between China and Laos is

experiencing its fastest growth period and Sino-Laotian ties are at their

highest point in history," Mr Pan said. In 1998, the volume of trade between the

two countries was about US$28 million. "Last year, bilateral trade volumes hit

historical highs and reached US$249 million, more than twice as much as four

years ago," Mr Pan said. The governments of both countries were aiming for US$1

billion in the next few years. "I definitely believe economic and trade

co-operation will deepen, and political relations will strengthen between the

two countries after Premier Wen's visit," the ambassador said.

March 30, 2008

Hong Kong:

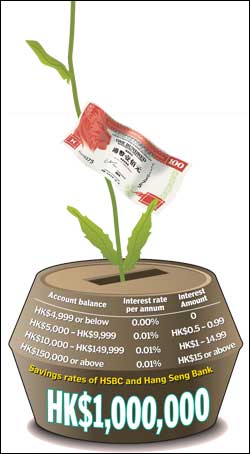

Millionaires fall along with stocks - More than 60,000 people have lost their

"millionaire" status since November because of the stocks slump. According to a

Citibank-commissioned survey by City University, 414,000 people had liquid

assets of more than HK$1 million in October and November, up from 276,000 in

2006. But, with the recent stocks slump, a resampling, carried out in February,

found the number is down 15 percent to 350,000. "Most people may have had

between HK$600,000 and HK$900,000 in liquid assets in 2006 and the bullish

market turned them into millionaires, but they lost this status when the market

slumped," Citibank global consumer group chief executive Weber Lo Wai-pak said

yesterday. More young people between 30 and 39 have acquired millionaire status,

22 percent of the total, up from 15 percent in 2006. Ditto for those aged from

21 to 29, but up a mere 1 percent to 4 percent. There was a decline among those

40 and above. About 15 percent of the millionaires originated from the mainland.

Of these, 84 percent made their money here. Overall, most millionaires came from

the financial, insurance and property sectors as well as civil servants. Each

person had on average HK$4.6 million in liquid assets and HK$9.9 million in

total assets. About 31 percent had average liabilities of HK$3.8 million. About

81 percent had invested in stocks and 60 percent in forex trading and time

deposits. About 38 percent are optimistic about the future of the stock market,

while 47 percent are optimistic about property. One in seven people on Hong Kong

Island are millionaires, against one in 15 in Kowloon and one in 17 in the New

Territories. Eastern topped the districts with 69,000 millionaires. But it is

easier to bump into a millionaire in Wan Chai where they form 18.2 percent of

the district's population. Hong Kong:

Millionaires fall along with stocks - More than 60,000 people have lost their

"millionaire" status since November because of the stocks slump. According to a

Citibank-commissioned survey by City University, 414,000 people had liquid

assets of more than HK$1 million in October and November, up from 276,000 in

2006. But, with the recent stocks slump, a resampling, carried out in February,

found the number is down 15 percent to 350,000. "Most people may have had

between HK$600,000 and HK$900,000 in liquid assets in 2006 and the bullish

market turned them into millionaires, but they lost this status when the market

slumped," Citibank global consumer group chief executive Weber Lo Wai-pak said

yesterday. More young people between 30 and 39 have acquired millionaire status,

22 percent of the total, up from 15 percent in 2006. Ditto for those aged from

21 to 29, but up a mere 1 percent to 4 percent. There was a decline among those

40 and above. About 15 percent of the millionaires originated from the mainland.

Of these, 84 percent made their money here. Overall, most millionaires came from

the financial, insurance and property sectors as well as civil servants. Each

person had on average HK$4.6 million in liquid assets and HK$9.9 million in

total assets. About 31 percent had average liabilities of HK$3.8 million. About

81 percent had invested in stocks and 60 percent in forex trading and time

deposits. About 38 percent are optimistic about the future of the stock market,

while 47 percent are optimistic about property. One in seven people on Hong Kong

Island are millionaires, against one in 15 in Kowloon and one in 17 in the New

Territories. Eastern topped the districts with 69,000 millionaires. But it is

easier to bump into a millionaire in Wan Chai where they form 18.2 percent of

the district's population.

Hong Kong film

star Maggie Cheung has settled down in Beijing and turned a new page in her life

with German architect boyfriend. "I'm quite happy nowadays even when I've got no

work to do." Maggie said on Wednesday in a fashion event as the spokesperson of

a luxurious brand, Beijing Times reports. "I can stay home for a whole week, do

nothing but cook. And, believe it or not, I can make both Chinese and western

style food, such as fried eggplant, steamed ribs, beefsteak and salad." Maggie

Cheung said. Although she owns properties in Beijing, Hong Kong and Paris,

Maggie chose to live in Beijing, where she met her latest beau in June last

year. They were introduced to each other at a party and the two hit it off at

first sight. At the time Maggie, 43, just broke up with former boyfriend of four

years, French businessman Guillaume Brochard. Ole Scheeren, 36, a partner in

Dutch firm Office for Metropolitan Architecture (OMA), is leading the design of

the new headquarters building of China Central Television in Beijing. He was

also behind the Prada Epicenter store projects in New York and Los Angeles. He

is said to be a film buff. "Besides being tall and handsome, Ole is sweet and

considerate," said a friend of the pair, "They both love films and photography,

and seem to have endless topics." Maggie, who has starred in 75 films, expressed

her will to be an ordinary house wife, saying that "family and love matter the

most." When asked about her next film, she said "I don't know when." Hong Kong film

star Maggie Cheung has settled down in Beijing and turned a new page in her life

with German architect boyfriend. "I'm quite happy nowadays even when I've got no

work to do." Maggie said on Wednesday in a fashion event as the spokesperson of

a luxurious brand, Beijing Times reports. "I can stay home for a whole week, do

nothing but cook. And, believe it or not, I can make both Chinese and western

style food, such as fried eggplant, steamed ribs, beefsteak and salad." Maggie

Cheung said. Although she owns properties in Beijing, Hong Kong and Paris,

Maggie chose to live in Beijing, where she met her latest beau in June last

year. They were introduced to each other at a party and the two hit it off at

first sight. At the time Maggie, 43, just broke up with former boyfriend of four

years, French businessman Guillaume Brochard. Ole Scheeren, 36, a partner in

Dutch firm Office for Metropolitan Architecture (OMA), is leading the design of

the new headquarters building of China Central Television in Beijing. He was

also behind the Prada Epicenter store projects in New York and Los Angeles. He

is said to be a film buff. "Besides being tall and handsome, Ole is sweet and

considerate," said a friend of the pair, "They both love films and photography,

and seem to have endless topics." Maggie, who has starred in 75 films, expressed

her will to be an ordinary house wife, saying that "family and love matter the

most." When asked about her next film, she said "I don't know when."

Conglomerate Hutchison Whampoa (0013) said yesterday 2007

net profit rose 53 percent to HK$30.6 billion, generally in line with

expectations, after losses shrank in its 3 Group mobile business and it booked a

one-off gain on the sale of its Indian mobile business.

Cheung Kong

(Holdings) (0001) said last year's underlying profit grew 73 percent to HK$10.4

billion, as strong investment gains covered stagnant property sales results.

Attributable profit, which includes revaluation gains and contribution from 49.9

percent associate Hutchison Whampoa (0013), rose 53 percent to HK$27.7 billion,

or HK$11.95 per share. Cheung Kong will pay HK$1.95 per share as final dividend,

compared to HK$1.74 a year ago. From investment and finance, largely equity

disposal, the company reaped HK$4.94 billion, versus HK$1.08 billion in 2006.

While property development profits were stagnant at HK$5.63 billion, earnings

from leasing, hotel and property management together grew 35 percent to HK$1.87

billion. The latter parts are better than expected, Macquarie analyst Eva Lee

said. In 2008, Cheung Kong plans to complete 21 projects in Greater China with

17.2 million sq ft of floor area, including The Capitol in Tseung Kwan O, a

project which was virtually pre-sold within a day and a half last month, with

prices just on par with the secondary market. Asked if the relatively low

selling prices achieved with The Capitol reflect Cheung Kong's bleak outlook for

the property market, deputy chairman Victor Li Tzar-kuoi said yesterday: "If we

didn't have a bright outlook, we wouldn't go on land hunting. Our logic is to

sell as quickly as possible." Cheung Kong

(Holdings) (0001) said last year's underlying profit grew 73 percent to HK$10.4

billion, as strong investment gains covered stagnant property sales results.

Attributable profit, which includes revaluation gains and contribution from 49.9

percent associate Hutchison Whampoa (0013), rose 53 percent to HK$27.7 billion,

or HK$11.95 per share. Cheung Kong will pay HK$1.95 per share as final dividend,

compared to HK$1.74 a year ago. From investment and finance, largely equity

disposal, the company reaped HK$4.94 billion, versus HK$1.08 billion in 2006.

While property development profits were stagnant at HK$5.63 billion, earnings

from leasing, hotel and property management together grew 35 percent to HK$1.87

billion. The latter parts are better than expected, Macquarie analyst Eva Lee

said. In 2008, Cheung Kong plans to complete 21 projects in Greater China with

17.2 million sq ft of floor area, including The Capitol in Tseung Kwan O, a

project which was virtually pre-sold within a day and a half last month, with

prices just on par with the secondary market. Asked if the relatively low

selling prices achieved with The Capitol reflect Cheung Kong's bleak outlook for

the property market, deputy chairman Victor Li Tzar-kuoi said yesterday: "If we

didn't have a bright outlook, we wouldn't go on land hunting. Our logic is to

sell as quickly as possible."

CITIC International Financial Holdings (0183), which owns

CITIC Ka Wah Bank, yesterday reported a net operating loss of HK$24.86 million

for 2007 after writing down HK$1.31 billion to cover its structured investment

vehicle holdings which have lost value.

New diver drama may

end tragic tug search - Fire services rescuers are considering ending search

operations for 16 seamen trapped in a sunken Ukrainian tugboat off Lantau Island

after another diver got his air tube entangled in debris underwater. The

development came on the heels of news that Asia's largest floating derrick,

which could salvage the 2,700-tonne shipwreck, was not expected to arrive this

weekend as planned. Director of Fire Services Lo Chun- hung admitted for the

first time since the accident happened last Saturday that the chances of

survival of the missing Ukrainian seamen were slim while the danger for the

divers continued to escalate. "If the rescue operations underwater become too

dangerous, putting our divers under excessive threat, then we would make the

decision [to cease the operation]," he said. "The 32 rooms in the tugboat vary

in size and after searching them, we may have to search them over again.

Everyone should understand that the environment in which we are operating is

completely different from that when you go scuba-diving to see the coral." Lo

said the divers, who had now completed more than 40 dives to the wreck, had

searched six rooms of the sunken tugboat, one more than Wednesday's total. He

added the safety time limit for divers to stay underwater had already been

extended by 10 minutes to half an hour. The endangered diver, the third in two

days, had his air tube tangled in debris and had to be assisted to safety by a

standby diver. His stay underwater exceeded the safety limit by five minutes.

Meanwhile, salvage operations were dealt a blow yesterday when a spokesman for

the Guangzhou Salvage Bureau said the 4,000-tonne floating derrick Hua Tian Long

would not arrive over the weekend as planned. The spokesman said preparatory

salvage work underwater had not been completed and thus it would be futile even

if the derrick entered Hong Kong waters. An engineer of an Ukrainian delegation

led by vice minister of transport and communication Shevchenko Vasyl Vasylyovych

arrived at the scene yesterday to observe operations. He did not take questions

from reporters. A source said a marine police squad will head out to sea along

with the divers to immediately perform check ups if bodies are recovered. The

80-meter-long Ukrainian tugboat sank upside down at a depth of 37 meters after a

collision with mainland cargo ship Yao Hai last Saturday. The tugboat's captain

and six of his crew were rescued after the collision. Two bodies were recovered

early Wednesday. New diver drama may

end tragic tug search - Fire services rescuers are considering ending search

operations for 16 seamen trapped in a sunken Ukrainian tugboat off Lantau Island

after another diver got his air tube entangled in debris underwater. The

development came on the heels of news that Asia's largest floating derrick,

which could salvage the 2,700-tonne shipwreck, was not expected to arrive this

weekend as planned. Director of Fire Services Lo Chun- hung admitted for the

first time since the accident happened last Saturday that the chances of

survival of the missing Ukrainian seamen were slim while the danger for the

divers continued to escalate. "If the rescue operations underwater become too

dangerous, putting our divers under excessive threat, then we would make the

decision [to cease the operation]," he said. "The 32 rooms in the tugboat vary

in size and after searching them, we may have to search them over again.

Everyone should understand that the environment in which we are operating is

completely different from that when you go scuba-diving to see the coral." Lo

said the divers, who had now completed more than 40 dives to the wreck, had

searched six rooms of the sunken tugboat, one more than Wednesday's total. He

added the safety time limit for divers to stay underwater had already been

extended by 10 minutes to half an hour. The endangered diver, the third in two

days, had his air tube tangled in debris and had to be assisted to safety by a

standby diver. His stay underwater exceeded the safety limit by five minutes.

Meanwhile, salvage operations were dealt a blow yesterday when a spokesman for

the Guangzhou Salvage Bureau said the 4,000-tonne floating derrick Hua Tian Long

would not arrive over the weekend as planned. The spokesman said preparatory

salvage work underwater had not been completed and thus it would be futile even

if the derrick entered Hong Kong waters. An engineer of an Ukrainian delegation

led by vice minister of transport and communication Shevchenko Vasyl Vasylyovych

arrived at the scene yesterday to observe operations. He did not take questions

from reporters. A source said a marine police squad will head out to sea along

with the divers to immediately perform check ups if bodies are recovered. The

80-meter-long Ukrainian tugboat sank upside down at a depth of 37 meters after a

collision with mainland cargo ship Yao Hai last Saturday. The tugboat's captain

and six of his crew were rescued after the collision. Two bodies were recovered

early Wednesday.

Democratic Party

founding member Martin Lee Chu-ming confirmed on Friday that he would step down

from the Legislative Council when his term ends in July. The decision by veteran

democrat Martin Lee Chu-ming not to seek re-election is likely to remove

uncertainty over whether former chief secretary Anson Chan Fang On-sang stands.

With Mr Lee out of the picture, Mrs Chan's participation would be crucial to the

pan-democratic camp's ambition of gaining four of the six Hong Kong Island seats

in the September Legco polls, Democratic Party sources said. Mrs Chan, who won

the by-election for the seat of late Democratic Alliance for the Betterment of

Hong Kong leader Ma Lik, has yet to say if she will run in September. She is not

a member of the Democratic Party but can be counted as a democrat. Meanwhile,

the sources said Mr Lee, former chairman of the Democratic Party, had made up

his mind only in the past few days. They said some political heavyweights, who

were not party members, had urged him to stay on, while other politicians had

urged him to step down to make room for new blood. "His family always wanted him

to step down. I would say that was an important concern for Mr Lee in coming to

his decision," a source close to the former chairman said. Party popularity

polls showing Mr Lee ranked around halfway down the list of potential Hong Kong

Island candidates was another factor, a veteran party member said. This emerged

in at least two polls conducted by the party to help in its planning, one last

year and one early this month. The sources said Mr Lee's decision had greatly

increased the possibility of Mrs Chan standing, which they said would give the

camp its only chance of securing four seats. The likely candidates from the

pan-democratic camp include Central and Western district councillor Kam Nai-wai,

former Democratic Party chairman Yeung Sum and Audrey Eu Yuet-mee and Tanya Chan

Suk-chong of the Civic Party. It is not clear whether Mrs Chan and Mr Kam would

be on a joint ticket, which is seen as the best way to secure Mr Kam a seat in

the legislature. A party source said it became urgent for Mr Lee to make up his

mind before Sunday, when the party will endorse the lists for the forthcoming

election. If Mr Lee had made his declaration then it would have overshadowed the

meeting, the source said. Democratic Party

founding member Martin Lee Chu-ming confirmed on Friday that he would step down

from the Legislative Council when his term ends in July. The decision by veteran

democrat Martin Lee Chu-ming not to seek re-election is likely to remove

uncertainty over whether former chief secretary Anson Chan Fang On-sang stands.

With Mr Lee out of the picture, Mrs Chan's participation would be crucial to the

pan-democratic camp's ambition of gaining four of the six Hong Kong Island seats

in the September Legco polls, Democratic Party sources said. Mrs Chan, who won

the by-election for the seat of late Democratic Alliance for the Betterment of

Hong Kong leader Ma Lik, has yet to say if she will run in September. She is not

a member of the Democratic Party but can be counted as a democrat. Meanwhile,

the sources said Mr Lee, former chairman of the Democratic Party, had made up

his mind only in the past few days. They said some political heavyweights, who

were not party members, had urged him to stay on, while other politicians had

urged him to step down to make room for new blood. "His family always wanted him

to step down. I would say that was an important concern for Mr Lee in coming to

his decision," a source close to the former chairman said. Party popularity

polls showing Mr Lee ranked around halfway down the list of potential Hong Kong

Island candidates was another factor, a veteran party member said. This emerged

in at least two polls conducted by the party to help in its planning, one last

year and one early this month. The sources said Mr Lee's decision had greatly

increased the possibility of Mrs Chan standing, which they said would give the

camp its only chance of securing four seats. The likely candidates from the

pan-democratic camp include Central and Western district councillor Kam Nai-wai,

former Democratic Party chairman Yeung Sum and Audrey Eu Yuet-mee and Tanya Chan

Suk-chong of the Civic Party. It is not clear whether Mrs Chan and Mr Kam would

be on a joint ticket, which is seen as the best way to secure Mr Kam a seat in

the legislature. A party source said it became urgent for Mr Lee to make up his

mind before Sunday, when the party will endorse the lists for the forthcoming

election. If Mr Lee had made his declaration then it would have overshadowed the

meeting, the source said.

Shares in Hong

Kong-based trading firm Li & Fung (SEHK: 0494), which sources goods for

Wal-Mart, fell nearly 10 per cent on Friday after its full-year results missed

expectations due to a slowdown in orders from its dominant United States market.

Shares ended 9.89 per cent lower at HK$28.70 while the Hang Seng Index rose 2.74

per cent. On Thursday, Li & Fung reported a 39 per cent rise in full-year net

profit to HK$3.06 billion but that fell short of an average forecast of HK$3.34

billion, according to analysts polled by Reuters Estimates. Merrill Lynch

downgraded the stock to neutral from buy, and Cazenove cut the stock to in-line

from outperform. “Given the market’s high expectations and the stock’s 42 per

cent rebound from its January low, we think the market is unlikely to look

through this miss,” Merrill said in a research note. Shares in Hong

Kong-based trading firm Li & Fung (SEHK: 0494), which sources goods for

Wal-Mart, fell nearly 10 per cent on Friday after its full-year results missed

expectations due to a slowdown in orders from its dominant United States market.

Shares ended 9.89 per cent lower at HK$28.70 while the Hang Seng Index rose 2.74

per cent. On Thursday, Li & Fung reported a 39 per cent rise in full-year net

profit to HK$3.06 billion but that fell short of an average forecast of HK$3.34

billion, according to analysts polled by Reuters Estimates. Merrill Lynch

downgraded the stock to neutral from buy, and Cazenove cut the stock to in-line

from outperform. “Given the market’s high expectations and the stock’s 42 per

cent rebound from its January low, we think the market is unlikely to look

through this miss,” Merrill said in a research note.

Social networking site Facebook had closed a second US$60

million investment round with Hong Kong billionaire Li Ka-shing through his

foundation, a source familiar with the deal confirmed late on Thursday. The

source said the deal, which boosted Mr Li’s holdings in Facebook to US$120

million, including an earlier US$60 million round late last year, was valued on

the same US$15 billion terms as a US$240 million stake Microsoft took in

October. Mr Li’s investment was made by the Li Ka Shing Foundation. His

companies such as Hutchison Whampoa (SEHK: 0013) and TOM Group (SEHK: 2383) were

not involved, the source said. The stake boosted Mr Li’s holdings to a 0.8 per

cent share of Facebook while Microsoft’s holds a further 1.6 per cent. A

Facebook spokesman declined to comment on Mr Li’s stake. MarketWatch broke

details of the story earlier out of Hong Kong, quoting Mr Li as saying “I may

raise my investment in Facebook - anything is possible” during an earnings

conference call for his company Hutchison Whampoa. But the report did not detail

the scope of his investment. Founded in 1980, the Li Ka Shing Foundation has

focused on funding a variety of health, education and environmental projects in

recent years. In prior rounds dating back to 2004, Facebook has taken about

US$40.7 million from venture capital investors including PayPal co-founder and

former chief executive Peter Thiel along with Accel Partners, Greylock Partners

and Meritech Capital Partners.

Li Ka-shing dismisses need for 10th terminal - Tycoon Li

Ka-shing, whose business empire spans a string of Chinese imports, including

Hong Kong's, has poured cold water on government plans to develop a 10th

container terminal. The Hutchison Whampoa (SEHK: 0013) chairman said those who

assumed that expanding the port and building a cross-border bridge would boost

the city's cargo business were guilty of "wishful thinking". Reiterating

comments made in past years, Hong Kong's richest man predicted Shenzhen would

overtake Hong Kong within four years as the world's third-busiest cargo port.

"Other ports are growing fast, and their terminals are continuously being

developed," Mr Li said at a meeting announcing Hutchinson's annual results. By

cargo tonnage, or the total weight of goods loaded at a port, Shanghai ranked

first, with 560 million tonnes in 2007, followed by Singapore with 483.4 million

tons. Measured by 20ft equivalent units (TEUs) of container throughput,

Singapore is the world's largest, with about 28 million, and Shanghai second,

with more than 26 million. Hong Kong handled 245.4 million tonnes of cargo and

24 million TEUs last year. The government is eyeing southwestern Tsing Yi as a

possible site to build Container Terminal 10. It cites forecasts container

throughput will continue to increase. A spokesman for the Transport and Housing

Bureau said a new berth would be needed by as early as 2015. But Mr Li said: "At

Zhuhai's container terminals in Gaolan, the fees for handling cargo are cheaper

than in Hong Kong. Even if the cargo leaves via Hong Kong, it would still be

cheaper than if the cargo was handled here. We cannot compete." Mr Li's

companies hold lucrative stakes in mainland ports. If built, Container Terminal

10 would boost Hong Kong's port capacity and employ the latest labor-saving

technology, which could improve the city's cost competitiveness. New port

facilities and a cross-border bridge could thus affect Mr Li's mainland port

business. Hutchison Whampoa generated 15 per cent of its revenue last year from

port-related business, which earned it HK$37.89 billion, up from HK$33.04

billion in 2006.

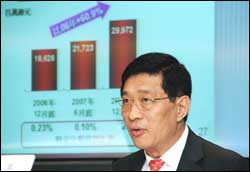

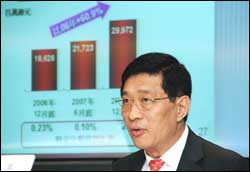

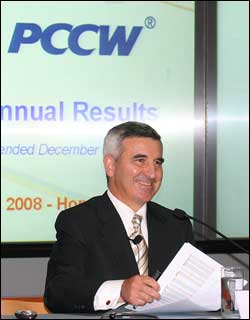

China Unicom

says no operational overhaul yet - It is still too early for China Unicom (SEHK:

0762, announcements, news) to overhaul its operations in anticipation of a

restructuring of the mainland telecommunications sector, chairman Chang Xiaobing

said in Hong Kong yesterday. The nation's smallest mobile operator is tipped to

be one of the parties most affected by the restructuring. Rumours have indicated

that Unicom's GSM mobile network could be merged with China Netcom Group (SEHK:

0906) Corp, while its smaller CDMA mobile business could be sold to China

Telecom Corp (SEHK: 0728). "I don't have anything new on the restructuring to

tell you," Mr Chang said. "It's too early to talk about our plans and our 3G

mobile-phone strategy post-restructuring. I think China is ready for 3G services

and I hope the government will issue a licence as soon as possible." Unicom

president Shang Bing yesterday denied rumours that the company had stopped

marketing activities for its CDMA business before a possible sale of assets to

China Telecom. "We haven't stopped our CDMA business," Mr Shang said. "We will

develop CDMA as usual and aim to increase high-tier users this year." Unicom

plans 30.95 billion yuan (HK$34.32 billion) in capital spending this year, up 20

per cent from 25.72 billion yuan last year. Of this, 73 per cent would be spent

on expanding its GSM network, he said. Net profit for the year to December

reached 9.29 billion yuan, up from 3.8 billion yuan in 2006. Revenue increased

4.4 per cent to 99.54 billion yuan, up from 95.34 billion yuan a year earlier.

The surge in net profit was due to a government tax refund on reinvestment in a

subsidiary of 2.78 billion yuan. Adjusted net profit, which excludes the impact

per share of convertible bonds issued to SK Telecom and the tax refund, rose

14.4 per cent to 7.09 billion yuan. The market had expected Unicom's adjusted

net profit to be between 7.16 billion yuan and 8 billion yuan. "Initial guidance

for this year appears weak," said Macquarie Research analyst Tim Smart in a

research note. "The company may face pressure to keep the profit margin due to

competitive pressure on the GSM business." Earnings per share were 71.3 fen, up

from 30.2 fen in the previous year. The company will pay a final dividend of 20

fen per share. Unicom's debts fell 84.9 per cent to 3.86 billion yuan last year

and the company generated free cash flow of 6.61 billion yuan. Unicom shares

fell 1.02 per cent to close at HK$17.54 yesterday. China Unicom

says no operational overhaul yet - It is still too early for China Unicom (SEHK:

0762, announcements, news) to overhaul its operations in anticipation of a

restructuring of the mainland telecommunications sector, chairman Chang Xiaobing

said in Hong Kong yesterday. The nation's smallest mobile operator is tipped to

be one of the parties most affected by the restructuring. Rumours have indicated

that Unicom's GSM mobile network could be merged with China Netcom Group (SEHK:

0906) Corp, while its smaller CDMA mobile business could be sold to China

Telecom Corp (SEHK: 0728). "I don't have anything new on the restructuring to

tell you," Mr Chang said. "It's too early to talk about our plans and our 3G

mobile-phone strategy post-restructuring. I think China is ready for 3G services

and I hope the government will issue a licence as soon as possible." Unicom

president Shang Bing yesterday denied rumours that the company had stopped

marketing activities for its CDMA business before a possible sale of assets to

China Telecom. "We haven't stopped our CDMA business," Mr Shang said. "We will

develop CDMA as usual and aim to increase high-tier users this year." Unicom

plans 30.95 billion yuan (HK$34.32 billion) in capital spending this year, up 20

per cent from 25.72 billion yuan last year. Of this, 73 per cent would be spent

on expanding its GSM network, he said. Net profit for the year to December

reached 9.29 billion yuan, up from 3.8 billion yuan in 2006. Revenue increased

4.4 per cent to 99.54 billion yuan, up from 95.34 billion yuan a year earlier.

The surge in net profit was due to a government tax refund on reinvestment in a

subsidiary of 2.78 billion yuan. Adjusted net profit, which excludes the impact

per share of convertible bonds issued to SK Telecom and the tax refund, rose

14.4 per cent to 7.09 billion yuan. The market had expected Unicom's adjusted

net profit to be between 7.16 billion yuan and 8 billion yuan. "Initial guidance

for this year appears weak," said Macquarie Research analyst Tim Smart in a

research note. "The company may face pressure to keep the profit margin due to

competitive pressure on the GSM business." Earnings per share were 71.3 fen, up

from 30.2 fen in the previous year. The company will pay a final dividend of 20

fen per share. Unicom's debts fell 84.9 per cent to 3.86 billion yuan last year

and the company generated free cash flow of 6.61 billion yuan. Unicom shares

fell 1.02 per cent to close at HK$17.54 yesterday.

China:

Thirty-three Museums in Beijing, 20 museums in the northwestern Gansu Province

and nine museums in the southern Guangdong Province started to open to visitors

for free on Friday. Earlier, some museums had already stopped charging

admissions. According to the government's plan, the number of free entry museums

across the country will reach 600 by April 1 this year. They will be joined by

800 museums next year. "I believe the free admission policy will attract more

people to enter the museums, which will help improve the public's cultural

awareness," said Xiao Yonggao, a visitor from northeastern Liaoning Province, at

Beijing's Capital Museum on Friday. The Capital Museum, which opened at the end

of 2005, received far fewer visitors than its capacity of 3,000 people per day

before Friday when it charged 30 yuan (4.3 U.S. dollars) for entry. More than

5,000 people made reservations online or by phone to visit the museum on Friday,

said Kong Fansi, head of the Beijing Municipal Administration of Cultural

Heritage. The museum will impose an upper limit for visitors every day by

distributing a certain number of tickets. Kong predicted more than3,000 people

will visit the museum the whole day. Historical architecture and sites like the

Forbidden City are not on the list of free admission venues. Beijing has 143

museums, of which 69 are run by the municipal government. The government will

earmark 120 million yuan (17 million U.S. dollars) to the museums a year for the

free admission. Gansu Province will open another 20 museums and memorial halls

this year and its remaining 82 museums will be open for free next year. Vice

Minister of Finance Zhang Shaochun said in February that the operating expenses

of all national museums and memorial halls would be covered from the central

budget, while institutions at the provincial level would be jointly supported by

central and local budgets. The central government will invest 1.2 billion yuan

(171 million U.S. dollars) to free museums, memorial halls and patriotic

educational bases, according to the central government's budget report in March.

"The free entry of museums and memorial halls must be guaranteed and should in

no way be hampered by fund shortages," he said. China issued a circular on Jan.

23 saying that all museums, memorial halls and national patriotism education

bases would offer free admission by 2009, excluding some cultural relics and

historical sites. China has more than 2,300 museums, which received 150 million

people last year, according to Zhang Bai, deputy director of the State

Administration of Cultural Heritage.

China:

Thirty-three Museums in Beijing, 20 museums in the northwestern Gansu Province

and nine museums in the southern Guangdong Province started to open to visitors

for free on Friday. Earlier, some museums had already stopped charging

admissions. According to the government's plan, the number of free entry museums

across the country will reach 600 by April 1 this year. They will be joined by

800 museums next year. "I believe the free admission policy will attract more

people to enter the museums, which will help improve the public's cultural

awareness," said Xiao Yonggao, a visitor from northeastern Liaoning Province, at

Beijing's Capital Museum on Friday. The Capital Museum, which opened at the end

of 2005, received far fewer visitors than its capacity of 3,000 people per day

before Friday when it charged 30 yuan (4.3 U.S. dollars) for entry. More than

5,000 people made reservations online or by phone to visit the museum on Friday,

said Kong Fansi, head of the Beijing Municipal Administration of Cultural

Heritage. The museum will impose an upper limit for visitors every day by

distributing a certain number of tickets. Kong predicted more than3,000 people

will visit the museum the whole day. Historical architecture and sites like the

Forbidden City are not on the list of free admission venues. Beijing has 143

museums, of which 69 are run by the municipal government. The government will

earmark 120 million yuan (17 million U.S. dollars) to the museums a year for the

free admission. Gansu Province will open another 20 museums and memorial halls

this year and its remaining 82 museums will be open for free next year. Vice

Minister of Finance Zhang Shaochun said in February that the operating expenses

of all national museums and memorial halls would be covered from the central

budget, while institutions at the provincial level would be jointly supported by

central and local budgets. The central government will invest 1.2 billion yuan

(171 million U.S. dollars) to free museums, memorial halls and patriotic

educational bases, according to the central government's budget report in March.

"The free entry of museums and memorial halls must be guaranteed and should in

no way be hampered by fund shortages," he said. China issued a circular on Jan.

23 saying that all museums, memorial halls and national patriotism education

bases would offer free admission by 2009, excluding some cultural relics and

historical sites. China has more than 2,300 museums, which received 150 million

people last year, according to Zhang Bai, deputy director of the State

Administration of Cultural Heritage.

Tang Qingyan,

a worker in Yishion clothing store where five sales assistants were burned to

death in an arson attack by the rioters, tells the details of the atrocity

as journalists listen during an interview in Lhasa, capital of southwest China's

Tibet Autonomous Region, March 27, 2008. Reporters, from 19 media organizations

including the US-based Associated Press, Britain's Financial Times and the South

China Morning Post in Hong Kong, were touring the Tibetan capital on a three-day

trip following the recent riots. Tang Qingyan,

a worker in Yishion clothing store where five sales assistants were burned to

death in an arson attack by the rioters, tells the details of the atrocity

as journalists listen during an interview in Lhasa, capital of southwest China's

Tibet Autonomous Region, March 27, 2008. Reporters, from 19 media organizations

including the US-based Associated Press, Britain's Financial Times and the South

China Morning Post in Hong Kong, were touring the Tibetan capital on a three-day

trip following the recent riots.

A model is showing ABB's

energy-saving products to visitors at the China International Industry Fair 2007

in Shanghai on November 8, 2007. The company opened a global transformer design

center in Chongqing yesterday. A model is showing ABB's

energy-saving products to visitors at the China International Industry Fair 2007

in Shanghai on November 8, 2007. The company opened a global transformer design

center in Chongqing yesterday.

Foreign diplomats set to visit Lhasa - A group of

Beijing-based foreign diplomats were scheduled to leave for Tibet’s riot-hit

capital Lhasa on Friday for a two-day trip organized by the Chinese government,

embassy officials here said. Diplomats from a number of countries including the

United States, Britain, France, Australia and Italy were to participate in the

trip, which came on the heels of another government-arranged tour for foreign

journalists. “I suppose the objective of the Chinese foreign ministry is to

basically answer the international calls including from the Australian

government to have diplomatic access to Tibet,” said Janaline Oh, an Australian

embassy official. She said embassies in Beijing were only informed about the

planned trip on Thursday, while an Italian embassy spokeswoman said the

representatives were expected back on Saturday night. One diplomat said that the

embassies had been allowed to send one official each, although there was no

official comment on the trip from Beijing and it was not clear how many

countries were going or had been invited. In Washington, State Department

spokesman Sean McCormack welcomed the move, but said it was not enough. “We see

this as a step in the right direction, but it’s not a substitute for the ability

of our diplomats, as well as others, to travel not only to Lhasa, but into the

surrounding area specifically,” he told reporters. China took a foreign media

delegation to Lhasa on Wednesday for a three-day trip following international

pressure to allow independent reporting from the Tibetan capital after it was

sealed off due to the unrest. AFP and some other major news organizations were

not invited. Two weeks of deadly demonstrations against China’s rule of Tibet

have put China under international pressure as it prepares to host the Olympics

in August. China has insisted its response to the protests, the biggest

challenge to its rule of Tibet in decades, has been restrained and that it has

brought the situation under control.

Tibetan doctor protected Han boy from mob, Ambulance

attacked as rioters demanded child - Lobsang Tsering, a 36-year-old Tibetan

emergency doctor, still believes he did the right thing when he risked his life

to save a Han Chinese father and his son. March 14 was a busy day for the

emergency medical staff, and Dr Lobsang was in an ambulance with a Tibetan nurse

responding to a request for help. The ambulance stopped when the crew saw a

desperate Han Chinese man holding an unconscious boy whose face was blackened by

smoke. The boy's life was at risk from smoke inhalation. When they helped the

pair into the ambulance, they suddenly found themselves surrounded by an angry

mob demanding the boy. The Tibetan nurse begged the mob to spare the ambulance,

telling them they were only saving lives, but the rioters smashed the window and

jumped onto the vehicle. According to the boy's father, Wu Guangming, Dr Lobsang

gave him his helmet and asked him to get down on the floor, fearing the rioters

would kill him if they found out he was a Han Chinese. Dr Lobsang held the boy

in his arms as he was battered on his head, jaw and back with stones and clubs.

Speaking in a frail voice from his bed yesterday, the Tibetan doctor, who has

worked at local hospitals and the emergency centre for 12 years, said he was