|

Newsletter

Seminar Material

Biz:

China

Hong

Kong Hawaii

What people

said about us

China

Earthquake Relief

Tax &

Government

Hawaii Voter Registration

Biz-Video

Biz-Video

Hawaii's

China Connection Hawaii's

China Connection

CDP#1780962

CDP#1780962

Doing Business in

Hong Kong & China

Doing Business in

Hong Kong & China

| |

Hong Kong, China & Hawaii Biz*

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our event page to find out more!

After

attended a China/Hong Kong Business/Trade Seminar in Hawaii...still unsure what

to do next, contact us, our Officers, Directors and Founding Members are

actively engaged in China/Hong Kong/Asia trade - we can help!

Are you ready to export your product or

service? You will find out in 3 minutes with resources to help you -

enter

to give it a try

China Central TV - live

Webcast

China Central TV - live

Webcast

Skype - FREE

Voice Over IP Skype - FREE

Voice Over IP

View Hawaii's China Connection

Video Trailer

View Hawaii's China Connection

Video Trailer

Direct link

PDF file

Direct link

PDF file

Year of the Pig - February 18, 2007

Year of the Pig - February 18, 2007

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

Holidays Greeting from President Obama &

Johnson Choi

Holidays Greeting from President Obama &

Johnson Choi

http://www.youtube.com/watch?v=pNk4Z4lUV-k

http://www.youtube.com/watch?v=pNk4Z4lUV-k

http://www.facebook.com/video/video.php?v=219896871983&ref=mf

http://www.facebook.com/video/video.php?v=219896871983&ref=mf

Wine-Biz - Hong Kong

Wine-Biz - Hong Kong

Brand Hong Kong

Video

Brand Hong Kong

Video

June 30, 2008

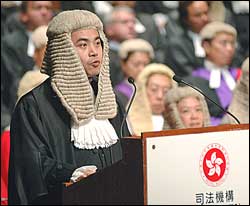

Hong Kong:

Chief's plea falls on deaf ears - An unprecedented attempt by chief executive

Donald Tsang Yam-kuen to silence his critics over the political appointees row

looked to have backfired last night as debate raged in the Legislative Council

more than seven hours after he spoke. Hong Kong:

Chief's plea falls on deaf ears - An unprecedented attempt by chief executive

Donald Tsang Yam-kuen to silence his critics over the political appointees row

looked to have backfired last night as debate raged in the Legislative Council

more than seven hours after he spoke.

There are now 95,000 individuals in

Hong Kong with net assets of at least US$1 million (HK$7.8 million), excluding

their primary residence and cars. The number indicates a 10.2 percent increase

in the number of high net worth individuals in the territory since 2006,

according to the latest annual world wealth report by Merrill Lynch and

Capgemini. Driving growth last year were the increase in property prices, the 39

percent rise in the Hang Seng Index, real gross domestic product of 6.4 percent

driven by robust export growth, and the 55 percent increase in market

capitalization on the Hong Kong stock exchange, the report said. "Hong Kong

continues to attract a lot of listings from China," said Mark Matthew, senior

director and chief Asia strategist of Merrill Lynch. "When I combine the very

low levels of valuations in Hong Kong, particularly in the property sector ...

the fact that we will not be having rising rates here, and with the better

outlook in China for the second half, makes us positively disposed to Hong

Kong." Matthew said "the worst is over" for the mainland's economy - now that

the government has introduced a lot of tightening measures on the economy, and

because inflation is on a downward trend. Even though last year's HNWI

population growth rate fell below the 12.2 percent of the 2006 report, Victor

Tan, market director of of Greater China at Merrill Lynch, said the number of

HNWI in Hong Kong was unlikely to shrink, as most of them had diversified

portfolios, thereby spreading out the risks. "Possibly, when the economy was

volatile, investments had been hedged and moved into lower-risk investments,"

Tan said. He noted in the report a quarter of all financial assets in

Asia-Pacific are in cash and deposits, while 21 percent are in fixed income. The

report also showed that the mainland has the second-fastest growing HNWI

population in the world. There are now 95,000 individuals in

Hong Kong with net assets of at least US$1 million (HK$7.8 million), excluding

their primary residence and cars. The number indicates a 10.2 percent increase

in the number of high net worth individuals in the territory since 2006,

according to the latest annual world wealth report by Merrill Lynch and

Capgemini. Driving growth last year were the increase in property prices, the 39

percent rise in the Hang Seng Index, real gross domestic product of 6.4 percent

driven by robust export growth, and the 55 percent increase in market

capitalization on the Hong Kong stock exchange, the report said. "Hong Kong

continues to attract a lot of listings from China," said Mark Matthew, senior

director and chief Asia strategist of Merrill Lynch. "When I combine the very

low levels of valuations in Hong Kong, particularly in the property sector ...

the fact that we will not be having rising rates here, and with the better

outlook in China for the second half, makes us positively disposed to Hong

Kong." Matthew said "the worst is over" for the mainland's economy - now that

the government has introduced a lot of tightening measures on the economy, and

because inflation is on a downward trend. Even though last year's HNWI

population growth rate fell below the 12.2 percent of the 2006 report, Victor

Tan, market director of of Greater China at Merrill Lynch, said the number of

HNWI in Hong Kong was unlikely to shrink, as most of them had diversified

portfolios, thereby spreading out the risks. "Possibly, when the economy was

volatile, investments had been hedged and moved into lower-risk investments,"

Tan said. He noted in the report a quarter of all financial assets in

Asia-Pacific are in cash and deposits, while 21 percent are in fixed income. The

report also showed that the mainland has the second-fastest growing HNWI

population in the world.

Exchange Fund quarterly loss

possible, warns Yam - Hong Kong's HK$1.468 trillion Exchange Fund may post a

loss on its investments in the second quarter of this year, Hong Kong Monetary

Authority chief executive Joseph Yam Chi-kwong warned yesterday.

Pressure is mounting for more Hong

Kong lenders to hike mortgage rates, senior bankers said yesterday, as funding

costs remain at a high level and prime rates will remain unchanged following the

Fed meeting.

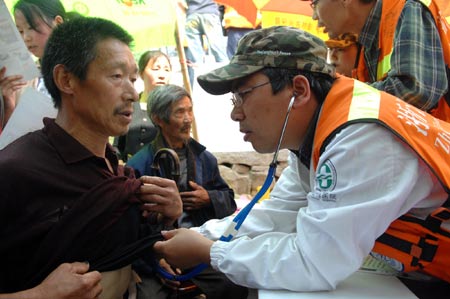

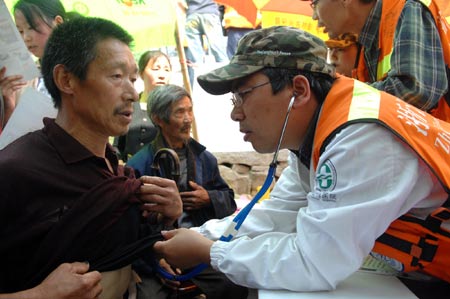

Hong Kong’s top officials – from

Friday evening to Sunday – will head a special delegation which will visit areas

of Sichuan damaged by last month’s earthquake. The delegation will be lead by

Chief Executive Donald Tsang Yam-kuen and Chief Secretary Henry Tang Ying-yen, a

government spokesman said on Friday. Sichuan was struck by a devastating

earthquake on May 12. The quake caused extensive damage in the western mainland

province – killing thousands of people and making many others homeless.

According to official figures some 68,636 people died and 374,171 injured, with

18,467 listed as missing. The quake left about 4.8 million people homeless –

though the number could be as high as 11 million. The government delegation will

oversee Hong Kong’s contribution to reconstruction work in quake-affected areas

and liaise with mainland authorities. In the aftermath of the earthquake,

individuals, companies and organisations in Hong Kong have donated more than

HK$1 billion to earthquake relief efforts. The government has given HK$300

million, as well as relief materials such as tents, and has also sent medical

and rescue teams. Mr Tsang and Mr Tang will meet the officials in Sichuan to

discuss how Hong Kong can further assist in reconstruction work. The spokesman

said other top officials would also go to Sichuan with delegation. They will

include Secretary for Constitutional and Mainland Affairs Stephen Lam Sui-lung,

Secretary for Development Carrie Lam Cheng Yuet-ngor, the director of the chief

executive’s office, Norman Chan Tak-lam, and senior civil servants. Financial

Secretary John Tsang Chun-wah will be acting chief executive while Mr Tsang is

away. Secretary for Education Michael Suen Ming-yueng will be acting chief

secretary.

Former bank executive wins tax

battle over HK$15.1m payout - A German bank executive has won a legal victory in

his battle with the city's tax man. The Court of First Instance ruled yesterday

that Walter Fuchs does not have to pay tax on a chunk of the HK$15.1 million he

pocketed after being fired from the Hong Kong office of German bank Bayerische

Hypo-und Vereinsbank. The case centred on whether the money was taxable income,

or termination pay, which is typically tax-free in Hong Kong. In his written

decision yesterday, Mr Justice Michael Burrell said that HK$8.9 million of the

payout was the same as regular income and should be taxed. But the remaining

HK$6.2 million was beyond the reach of the Inland Revenue Department because it

was a one-off termination payment. The judge also awarded the bank's former head

of Asian operations half his legal costs. Mr Fuchs was fired after a company

takeover two years ago. Separately, he also received HK$3.1 million salary for

the last year of his contract, which the Inland Revenue did not tax. But the

Inland Revenue ruled last year that the remaining payout - about HK$15 million -

was taxable. Mr Fuchs appealed against the decision. "If [tax authorities] don't

appeal this, they could run into problems in future cases," said Jennifer Wong,

a tax partner at consulting firm KPMG. "I would say that this [the ruling] could

be quite controversial." The Inland Revenue reasoned that the payment was income

because it was spelled out in the banker's employment contract. But Mr Fuchs

countered that the money was simply non-taxable damages related to his sacking.

Under the terms of the executive's three-year contract, his sacking would

require the bank to make a one-time payout equal to double his annual salary -

about HK$6 million - plus the average of his annual bonuses, or HK$9 million.

"They are two separate payments which are arguably different in nature and

attract different legal consequences," Mr Justice Burrell wrote in his judgment.

The doubled salary would not have been paid out if Mr Fuchs continued working,

suggesting the HK$6 million was "designed to soften the blow of premature

unemployment", Mr Justice Burrell added. KPMG's Ms Wong said employees could

avoid similar battles if they did not have the details of termination pay

spelled out in their employment contracts. "The chances of winning a case

against Inland Revenue would improve," she added. "But that could lead to

disputes with the employer when an employee [is fired]."

Li Ka-shing reveals his key to success -

Hong Kong's richest man has unveiled his secret to success - an index warning

against arrogance. Li Ka-shing said his formula was borrowed from the Greeks: to

strike a balance between "arete" - meaning goodness, excellence and virtue - and

"hubris", referring to pride bordering on arrogance. "The hubris index governs

not only our attitude, but our behaviour. Are we excessively proud and boastful?

Do we fail to listen to foils [critics] that say you're wrong? Do we refuse to

get feedback about the outcome of our acts and decisions? And are we lax in

planning in advance for possible problems, consequences and corrective

measures?" he asked. Mr Li was speaking at a graduation ceremony at Shantou

University in Guangdong. He is honorary chairman of the university council. The

index had been a navigational tool that had guided him through life, Mr Li told

students. Saying a humble heart was the beginning of all knowledge, he reminded

young people to avoid walking on dangerous ground to "systematically inflate the

view of one's own abilities, to become caught up in exaggerated pride or

self-confidence". The tycoon, who had said he treated his philanthropic

foundation as a third son, also cited ancient Chinese philosopher Zhuangzi to

encourage young people to give, not only to take. "A position of sovereign does

not necessarily connect with being thought noble, nor the condition of being

poor with being thought mean," he said. The ceremony was also attended by Yang

Liwei , the nation's first man in space, and Guangdong vice-governor Song Hai.

Mr Li was rewarded for unveiling the secret of his success - with the singing of

a song to mark his 80th birthday, entitled Great Wisdom. Li Ka-shing reveals his key to success -

Hong Kong's richest man has unveiled his secret to success - an index warning

against arrogance. Li Ka-shing said his formula was borrowed from the Greeks: to

strike a balance between "arete" - meaning goodness, excellence and virtue - and

"hubris", referring to pride bordering on arrogance. "The hubris index governs

not only our attitude, but our behaviour. Are we excessively proud and boastful?

Do we fail to listen to foils [critics] that say you're wrong? Do we refuse to

get feedback about the outcome of our acts and decisions? And are we lax in

planning in advance for possible problems, consequences and corrective

measures?" he asked. Mr Li was speaking at a graduation ceremony at Shantou

University in Guangdong. He is honorary chairman of the university council. The

index had been a navigational tool that had guided him through life, Mr Li told

students. Saying a humble heart was the beginning of all knowledge, he reminded

young people to avoid walking on dangerous ground to "systematically inflate the

view of one's own abilities, to become caught up in exaggerated pride or

self-confidence". The tycoon, who had said he treated his philanthropic

foundation as a third son, also cited ancient Chinese philosopher Zhuangzi to

encourage young people to give, not only to take. "A position of sovereign does

not necessarily connect with being thought noble, nor the condition of being

poor with being thought mean," he said. The ceremony was also attended by Yang

Liwei , the nation's first man in space, and Guangdong vice-governor Song Hai.

Mr Li was rewarded for unveiling the secret of his success - with the singing of

a song to mark his 80th birthday, entitled Great Wisdom.

China:

Chinese shares plummeted on Friday as investor sentiment was hurt by weak

overseas markets and concerns about new share offerings. The benchmark Shanghai

Composite Index trimmed 153.42 points, or 5.29 percent, to close at 2,748.43

points. The Shenzhen Component Index dropped 563.45 points or 5.63 percent to

9,436.21. Combined turnover on the two bourses shrank to 97.2 billion yuan

(around 14.17 billion U.S dollars) from 108.6 billion yuan on the previous

trading day. Oil caps were deeply hurt by the rising international crude oil

price, said Wan Bing, a Guangdong-based GF Securities analyst. PetroChina, the

country's largest oil producer, and Sinopec, Asia's top oil refiner, plunged

3.47 percent to 15 yuan and 9.12 percent to 10.27 yuan respectively. Securities

shares fell on the news of Everbright Securities' coming initial public offering

(IPO). The China Securities Regulatory Commission (CSRC), the market watchdog,

said late Thursday it would review IPO applications from the Everbright

Securities and China South Locomotive and Rolling Stock Corp. on June 30.

According to the draft prospectus, the two companies are scheduled to raise

about 20 billion yuan, which would further drain liquidity from the sluggish

market, dealers said. CITIC Securities, the country's largest listed brokerage

firm, lost 8.33 percent to 24.55 yuan per share and Shanghai-based Haitong

Securities was down 6.11 percent to 24.12 yuan. The market is also concerned

about a possible interest rate rise during the weekend, which may have

unfavorable effects on the A-share market, said Zhang Dongyun, a Haitong

Securities analyst. A report by Guotai Jun'an Securities said that one should

not be over-pessimistic about the market, believing that the country would

loosen its tight monetary policy in the third quarter of this year, which would

create more investment opportunities. The Shanghai Composite Index may fluctuate

between 2,500 and 3,700 points in the second half of this year, said the report.

Losing shares outnumbered gainers by 791 to 35 in Shanghai and by 675 to 17 in

Shenzhen on Friday. The benchmark Shanghai Composite Index has shrunk more than

55 percent from its peak in mid-October last year.

China:

Chinese shares plummeted on Friday as investor sentiment was hurt by weak

overseas markets and concerns about new share offerings. The benchmark Shanghai

Composite Index trimmed 153.42 points, or 5.29 percent, to close at 2,748.43

points. The Shenzhen Component Index dropped 563.45 points or 5.63 percent to

9,436.21. Combined turnover on the two bourses shrank to 97.2 billion yuan

(around 14.17 billion U.S dollars) from 108.6 billion yuan on the previous

trading day. Oil caps were deeply hurt by the rising international crude oil

price, said Wan Bing, a Guangdong-based GF Securities analyst. PetroChina, the

country's largest oil producer, and Sinopec, Asia's top oil refiner, plunged

3.47 percent to 15 yuan and 9.12 percent to 10.27 yuan respectively. Securities

shares fell on the news of Everbright Securities' coming initial public offering

(IPO). The China Securities Regulatory Commission (CSRC), the market watchdog,

said late Thursday it would review IPO applications from the Everbright

Securities and China South Locomotive and Rolling Stock Corp. on June 30.

According to the draft prospectus, the two companies are scheduled to raise

about 20 billion yuan, which would further drain liquidity from the sluggish

market, dealers said. CITIC Securities, the country's largest listed brokerage

firm, lost 8.33 percent to 24.55 yuan per share and Shanghai-based Haitong

Securities was down 6.11 percent to 24.12 yuan. The market is also concerned

about a possible interest rate rise during the weekend, which may have

unfavorable effects on the A-share market, said Zhang Dongyun, a Haitong

Securities analyst. A report by Guotai Jun'an Securities said that one should

not be over-pessimistic about the market, believing that the country would

loosen its tight monetary policy in the third quarter of this year, which would

create more investment opportunities. The Shanghai Composite Index may fluctuate

between 2,500 and 3,700 points in the second half of this year, said the report.

Losing shares outnumbered gainers by 791 to 35 in Shanghai and by 675 to 17 in

Shenzhen on Friday. The benchmark Shanghai Composite Index has shrunk more than

55 percent from its peak in mid-October last year.

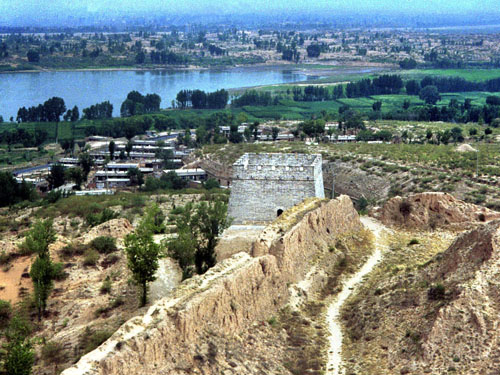

A bird's eye view of the Shanghai Yangtze Bridge under

construction over the mouth of the Yangtze River in Shanghai, East China, June

27, 2008. Shanghai is working on a mass transport project, including a bridge

and tunnel to connect suburban islands to the city center.

A bird's eye view of the Shanghai Yangtze Bridge under

construction over the mouth of the Yangtze River in Shanghai, East China, June

27, 2008. Shanghai is working on a mass transport project, including a bridge

and tunnel to connect suburban islands to the city center.

An agreement to let Taipei

participate in the 2010 World Expo in Shanghai was signed yesterday, confirming

the first official Taiwanese involvement in a world fair since the island was

ousted from the United Nations in 1971. Taipei Mayor Hau Lung-bin also invited

Shanghai Mayor Han Zheng to be his guest at the 2010 International Gardening and

Horticulture Exposition in Taipei. Mr Han, who seemed to be caught off guard by

the invitation, did not make any firm commitment. Any visits by mainland

officials to Taiwan could be controversial since there are no official relations

between the governments on the two sides of the Taiwan Strait. Chen Yunlin ,

chairman of the Association for Relations Across the Taiwan Straits, a

semi-official body set up by Beijing to handle affairs with Taiwan, has not yet

visited the island. Martin Ting, general producer of the expo in Taipei, said:

"We hope Shanghai can join the event. Even if they can't participate on an

official level, they can send their non-government organisations to Taipei."

Also attending the two mayors' meeting was Terry Guo Tai-ming, chairman and

founder of Hon Hai Group and one of the richest men in Taiwan. Mr Guo sat next

to Mr Hau at the meeting, though he was not a formal member of the Taipei

mayor's delegation. The tycoon pledged to donate NT$300 million (HK$77.1

million) to the Taipei government to set up its pavilion at the Expo. Taipei,

with 800 square metres to showcase its wireless broadband internet

infrastructure and garbage recycling system, will occupy one of the most

prominent locations on the Expo grounds. Zhou Hanmin, deputy director of the

Expo co-ordinating bureau, said it would stand right next to the Expo's

landmark, a 165-metre chimney called the Harmony Tower that he said reflected

Beijing's goal of building a harmonious society. Mr Hau returns to Taipei today

after leading a delegation of 25 people which arrived in Shanghai on Monday. It

was his second visit to Shanghai; the first was in 2005 as head of Taiwan's Red

Cross. Yesterday, he toured the Expo construction site, including the Taipei

pavilion's location. He also revealed he would return to Shanghai for the event,

which takes place between May 1 and October 31, 2010. The organising committee

is expecting it to attract more than 70 million visitors. The horticulture

exposition in Taipei will run from November 2010 to April 2011.

June 27 - 29, 2008

Hong Kong:

Frederick Ma, secretary for Commerce and Economic Development of the Hong Kong

Special Administrative Region (HKSAR) government announced here Tuesday night

that he had tendered resignation on health reasons. "I have recently discovered

that I have 'cavernous hemangioma' and 'venous angioma'. After discussing with

my family, I have decided to step down from my current position," said Ma in his

statement, adding that he will meet the media Wednesday to give a full account

of his decision. Meanwhile, HKSAR Chief Executive Donald Tsang also issued a

statement, saying that he fully sympathizes with Ma's situation and will forward

Ma's resignation to the Central People's Government for consideration. Tsang

said Ma told him on June 12 that he had to resign because of his health

conditions. "I have since discussed with him in depth twice and fully sympathize

with his situation. I shall forward his resignation to the Central People's

Government for consideration forthwith. My heart is with Mr. Ma and his family

and I wish him a speedy recovery," said the chief executive. Aged 56, Ma first

joined the HKSAR government as the Secretary for Financial Services and the

Treasury in July 2002. He was appointed to the current post in June 2007. Before

joining the HKSAR government, Ma has served in key posts in Pacific Century

Cyberworks Limited, J.P. Morgan Private Bank, Chase Manhattan Bank, Kumagai Gumi

(HK) Limited and RBC Dominion Securities Limited. He also held a number of

public service positions, including serving on the Hong Kong Exchanges and

Clearing Limited and the Hong Kong Securities and Futures Commission. Hong Kong:

Frederick Ma, secretary for Commerce and Economic Development of the Hong Kong

Special Administrative Region (HKSAR) government announced here Tuesday night

that he had tendered resignation on health reasons. "I have recently discovered

that I have 'cavernous hemangioma' and 'venous angioma'. After discussing with

my family, I have decided to step down from my current position," said Ma in his

statement, adding that he will meet the media Wednesday to give a full account

of his decision. Meanwhile, HKSAR Chief Executive Donald Tsang also issued a

statement, saying that he fully sympathizes with Ma's situation and will forward

Ma's resignation to the Central People's Government for consideration. Tsang

said Ma told him on June 12 that he had to resign because of his health

conditions. "I have since discussed with him in depth twice and fully sympathize

with his situation. I shall forward his resignation to the Central People's

Government for consideration forthwith. My heart is with Mr. Ma and his family

and I wish him a speedy recovery," said the chief executive. Aged 56, Ma first

joined the HKSAR government as the Secretary for Financial Services and the

Treasury in July 2002. He was appointed to the current post in June 2007. Before

joining the HKSAR government, Ma has served in key posts in Pacific Century

Cyberworks Limited, J.P. Morgan Private Bank, Chase Manhattan Bank, Kumagai Gumi

(HK) Limited and RBC Dominion Securities Limited. He also held a number of

public service positions, including serving on the Hong Kong Exchanges and

Clearing Limited and the Hong Kong Securities and Futures Commission.

People holding umbrellas walk pass a

fallen tree in south China's Hong Kong on June 25, 2008. Hong Kong was affected

by heavy rain as the Typhoon Fengshen headed towards the southern Chinese city.

The Hong Kong Observatory issued the No. 8 Northeast Gale or Storm Signal on

Tuesday and red warning on Wednesday. People holding umbrellas walk pass a

fallen tree in south China's Hong Kong on June 25, 2008. Hong Kong was affected

by heavy rain as the Typhoon Fengshen headed towards the southern Chinese city.

The Hong Kong Observatory issued the No. 8 Northeast Gale or Storm Signal on

Tuesday and red warning on Wednesday.

As Macao's tourism industry

continues its rapid development, the island city saw its market share of

international markets in visitor arrivals rose to 10.5 percent in the first five

months of this year, the city's tourism chief said on Wednesday. During the

period, visitor arrivals almost reached 12.6 million, registering an increase of

17.4 percent year-on-year, and the Chinese Mainland, Hong Kong and Taiwan

continued to be the three largest visitor generating markets, said Joao Manuel

Costa Antunes, Director of Macao Government Tourist Office (MGTO). Antunes

presented the tourism development of Macao and outlined MGTO's future marketing

strategies at the opening ceremony of the MGTO Annual Marketing Meeting held

here on Wednesday. He stressed that MGTO is moving toward the goal of source

markets and tourism product diversification. According to a press release from

MGTO, it is putting forward a number of tactics to attract more tourists, which

include reinforcing cooperation with airlines on new routes, developing and

promoting new tourism products, such as wedding/honeymoon package and

strengthening regional cooperation and multi- destination travel. In addition,

the Macao Special Administrative Region Government has provided steadfast

support towards the development of business travel and the MICE industry,

Antunes added.

Government ultimatum to chicken farmers: Take our $1b or leave it! - The poultry

industry has been given an official ultimatum accept a HK$1 billion government

compensation package to shut down their businesses or face an uncertain future.

The city's 469 chicken retailers have been told they must decide what to do by

July 24 while farmers, wholesalers and transport workers have been given until

September 24. Secretary for Food and Health York Chow Yat-ngok said this was the

government's final offer after a meeting of the Executive Council yesterday. As

well as retailers, Hong Kong has 71 wholesalers, 50 chicken farms and 266

transport workers who depend on the trade for their livelihood. However, if the

retailers' accept the buyout deal it will effectively end the businesses of the

rest of the sector as well as Hong Kong's culture of cooking live chickens. The

need for central slaughtering by 2011 may also be made redundant. Chow expressed

confidence that most of the retailers will accept the deal which is more than

three times the 2005 Voluntary Surrender Scheme. A lot of the traders said they

can't operate under the overnight ban and they are also considering the risk of

facing another bird flu outbreak within the next few years, he said. But, the

government will only approve the offer when 90 percent of the trade accepts it.

Another offer will not be tabled in the future before central slaughtering, Chow

added. A source said the government has improved the deal for retailers with an

increase of almost HK$100 million or over 20 percent to a total of HK$513

million. A source said the increase was justified. "If we terminate the trade's

tools for living out of public health concerns, we must be more reasonable in

our offer," the source said, adding that no further increase is expected after

any future negotiations. Retailers who choose to resume operation on July 2 must

operate under an overnight ban on keeping live chickens in the stalls between

8pm and 5am. Violators are subject to a penalty of HK$50,000 and six months'

imprisonment. The amendments of the law will be gazetted this week and will be

tabled at the Legislative Council for negative vetting. Chow believes the

overnight ban will be agreed by lawmakers out of public health concerns. "H5N1

is not political, we must be scientific in dealing with it," he said. Chow said

the 400,000 chickens which have been held in farms due to the ban and can no

longer be sold because they are too old will be compensated for at a rate of

HK$30 per bird. A source said the government fears the recent discovery of the

H5N1 virus in the chickens of four wet markets is not a problem of smuggling,

but a drop in chickens' immunity against the virus.

Government ultimatum to chicken farmers: Take our $1b or leave it! - The poultry

industry has been given an official ultimatum accept a HK$1 billion government

compensation package to shut down their businesses or face an uncertain future.

The city's 469 chicken retailers have been told they must decide what to do by

July 24 while farmers, wholesalers and transport workers have been given until

September 24. Secretary for Food and Health York Chow Yat-ngok said this was the

government's final offer after a meeting of the Executive Council yesterday. As

well as retailers, Hong Kong has 71 wholesalers, 50 chicken farms and 266

transport workers who depend on the trade for their livelihood. However, if the

retailers' accept the buyout deal it will effectively end the businesses of the

rest of the sector as well as Hong Kong's culture of cooking live chickens. The

need for central slaughtering by 2011 may also be made redundant. Chow expressed

confidence that most of the retailers will accept the deal which is more than

three times the 2005 Voluntary Surrender Scheme. A lot of the traders said they

can't operate under the overnight ban and they are also considering the risk of

facing another bird flu outbreak within the next few years, he said. But, the

government will only approve the offer when 90 percent of the trade accepts it.

Another offer will not be tabled in the future before central slaughtering, Chow

added. A source said the government has improved the deal for retailers with an

increase of almost HK$100 million or over 20 percent to a total of HK$513

million. A source said the increase was justified. "If we terminate the trade's

tools for living out of public health concerns, we must be more reasonable in

our offer," the source said, adding that no further increase is expected after

any future negotiations. Retailers who choose to resume operation on July 2 must

operate under an overnight ban on keeping live chickens in the stalls between

8pm and 5am. Violators are subject to a penalty of HK$50,000 and six months'

imprisonment. The amendments of the law will be gazetted this week and will be

tabled at the Legislative Council for negative vetting. Chow believes the

overnight ban will be agreed by lawmakers out of public health concerns. "H5N1

is not political, we must be scientific in dealing with it," he said. Chow said

the 400,000 chickens which have been held in farms due to the ban and can no

longer be sold because they are too old will be compensated for at a rate of

HK$30 per bird. A source said the government fears the recent discovery of the

H5N1 virus in the chickens of four wet markets is not a problem of smuggling,

but a drop in chickens' immunity against the virus.

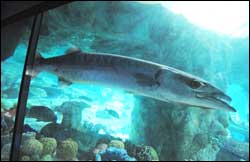

No one at fault in sturgeon death says Ocean Park - Ocean

Park plans to release the four surviving Chinese sturgeons back into the main

tank of its aquarium in early July despite the death of a fifth fish bitten by a

barracuda. The park's executives, veterinarians and oceanologists insisted

yesterday the attack was an accident. The necropsy on the sturgeon indicated the

bite was not aggressive but a reflex action induced by contact between the fish.

"No one is at fault, and no one is getting fired," executive director of

zoological operations and education Suzanne Gendron said. She said it is the

first time in the world for both species to be kept in the same saltwater

environment and that the two species do co-exist in the South China Sea.

Director of the National Aquatic Wildlife Conservation Association Li Yanliang

said sturgeons should be able to get along with other fish, but barracudas may

have attacked the sturgeons because they were newcomers. Sturgeons are

separately kept in the Beijing Aquarium, but experts from the Ministry of

Agriculture said barracudas are not particularly fierce species and interpreted

the attack as an accident. Chinese sturgeons are an endangered species native to

China. Five were presented to the park last month and went on display at Ocean

Park's Atoll Reef main tank last Thursday. Gendron said the eight barracudas

have been with the park for almost 10 years and never showed any signs of

aggression.

No one at fault in sturgeon death says Ocean Park - Ocean

Park plans to release the four surviving Chinese sturgeons back into the main

tank of its aquarium in early July despite the death of a fifth fish bitten by a

barracuda. The park's executives, veterinarians and oceanologists insisted

yesterday the attack was an accident. The necropsy on the sturgeon indicated the

bite was not aggressive but a reflex action induced by contact between the fish.

"No one is at fault, and no one is getting fired," executive director of

zoological operations and education Suzanne Gendron said. She said it is the

first time in the world for both species to be kept in the same saltwater

environment and that the two species do co-exist in the South China Sea.

Director of the National Aquatic Wildlife Conservation Association Li Yanliang

said sturgeons should be able to get along with other fish, but barracudas may

have attacked the sturgeons because they were newcomers. Sturgeons are

separately kept in the Beijing Aquarium, but experts from the Ministry of

Agriculture said barracudas are not particularly fierce species and interpreted

the attack as an accident. Chinese sturgeons are an endangered species native to

China. Five were presented to the park last month and went on display at Ocean

Park's Atoll Reef main tank last Thursday. Gendron said the eight barracudas

have been with the park for almost 10 years and never showed any signs of

aggression.

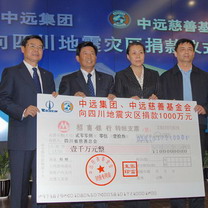

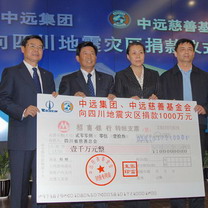

Tycoon and politician Tsang Hin-chi and son Ricky Tsang

Chi-ming have donated HK$10 million for the training of volunteers helping

rebuild earthquake- devastated Sichuan.

Hang Seng Bank (0011) said yesterday it has raised its mortgage rate for new

customers by 25 basis points even as the US Federal Reserve's two-day meeting

got under way in Washington.

Walter Kwok Ping-sheung,

the eldest brother at the heart of controversy surrounding property giant Sun

Hung Kai Properties (0016), has finally broken his silence over the issues

dogging the company. In his first personal appearance since being ousted as SHKP

chairman and chief executive on May 28, Kwok made an effort to mend his

relationship with his family by putting recent events down to misunderstandings.

"The company has grown bigger and numbers of investments are on the rise. It's

normal to have more conflicts among the management," he was reported as saying

yesterday. His ties with matriarch Kwong Siu-hing and with his two brothers

remain strong, and more communication could have solved the problem, he said. "I

maintain a good relationship with my mother and we are having lunch regularly

once or twice a week. "Most of the time she stands by my decisions, on the IFC

[International Finance Center] and ICC [International Commerce Center]

developments for example," the eldest Kwok said. He dismissed rumors that

disagreements with his younger brothers, Thomas Kwok Ping-kwong and Raymond Kwok

Ping- luen, stemmed from the influence of his confidante Ida Tong. "I have been

the chairman for 18 years, any influence would not happen just now. She [Tong]

is a good friend of mine for more than 20 years. We, among a few other friends,

always meet together to discuss economic and political issues," he said. Kwok

also said he has no hard feelings over his new role as an SHKP independent

non-executive director. "I will adjust to it and keep on monitoring the

operations of the company as a non-executive director," he said. Kwok added that

he has no intention of dividing the family wealth: "I will not sell my stake [in

the company] or start up my own business, it's totally a misunderstanding." SHKP

was founded by his late father under the SHKP Foundation, and Kwok said he has

never thought of changing the setup. Walter Kwok Ping-sheung,

the eldest brother at the heart of controversy surrounding property giant Sun

Hung Kai Properties (0016), has finally broken his silence over the issues

dogging the company. In his first personal appearance since being ousted as SHKP

chairman and chief executive on May 28, Kwok made an effort to mend his

relationship with his family by putting recent events down to misunderstandings.

"The company has grown bigger and numbers of investments are on the rise. It's

normal to have more conflicts among the management," he was reported as saying

yesterday. His ties with matriarch Kwong Siu-hing and with his two brothers

remain strong, and more communication could have solved the problem, he said. "I

maintain a good relationship with my mother and we are having lunch regularly

once or twice a week. "Most of the time she stands by my decisions, on the IFC

[International Finance Center] and ICC [International Commerce Center]

developments for example," the eldest Kwok said. He dismissed rumors that

disagreements with his younger brothers, Thomas Kwok Ping-kwong and Raymond Kwok

Ping- luen, stemmed from the influence of his confidante Ida Tong. "I have been

the chairman for 18 years, any influence would not happen just now. She [Tong]

is a good friend of mine for more than 20 years. We, among a few other friends,

always meet together to discuss economic and political issues," he said. Kwok

also said he has no hard feelings over his new role as an SHKP independent

non-executive director. "I will adjust to it and keep on monitoring the

operations of the company as a non-executive director," he said. Kwok added that

he has no intention of dividing the family wealth: "I will not sell my stake [in

the company] or start up my own business, it's totally a misunderstanding." SHKP

was founded by his late father under the SHKP Foundation, and Kwok said he has

never thought of changing the setup.

China:

Whistle-blowers given protection - Huang Rui (not his real name), a resident of

Chongqing municipality, had valuable information for authorities about how a

government official had abused his power in approving a local land deal. In the

past, Huang may have hesitated before stepping forward, for fear of retribution

from the government office. However, the local procuratorate has recently taken

steps to encourage informants like Huang to share what they know. Huang was

taken to the new "whistleblower's center" of the first branch of the Chongqing

municipal people's procuratorate. He sat in a small private room with no

windows. After he was assured that there was no video camera or recording

equipment in the room, Huang revealed his information to two procurators. His

report helped them successfully crack the case of abuse of power by a

high-ranking local official. Yang Yi, chief of the procuratorate's accusation

and appeal section, said the new room was part of broader effort to encourage

whistle-blowers. "The first branch has launched the system of protecting

whistle-blowers, if they are under threat because of their report," Yang said.

In addition to the new whistle-blower's room, which opened earlier this year,

other steps are being taken. "We will send policemen to protect whistle-blowers

around the clock," Yang said. The new system appears to be having an impact.

Huang is one of nearly 100 informants who have submitted reports to the branch

since the protection system was adopted in February, according to the branch's

records. Yu Jie, chief of the first branch, said the number of clues provided by

whistle-blowers has risen by 55 per cent over the same period last year.

Chongqing residents have said these efforts deal with an important concern.

"Being a whistle-blower can be dangerous," Zhang Jian, a Chongqing resident,

said. "We are gratified because the first branch protects whistle-blowers."

Whistle-blowers also play a role in cracking cases elsewhere. Mu Ping, chief of

the Beijing municipal people's procuratorate, said about 11,000 clues pertaining

to job-related crimes by officials in the municipality have been provided by

whistle-blowers in the past five years. Also the Guangzhou people's

procuratorate said earlier nearly 80 percent of cases pertaining to job-related

crimes by officials were set in motion by information from whistle-blowers.

China:

Whistle-blowers given protection - Huang Rui (not his real name), a resident of

Chongqing municipality, had valuable information for authorities about how a

government official had abused his power in approving a local land deal. In the

past, Huang may have hesitated before stepping forward, for fear of retribution

from the government office. However, the local procuratorate has recently taken

steps to encourage informants like Huang to share what they know. Huang was

taken to the new "whistleblower's center" of the first branch of the Chongqing

municipal people's procuratorate. He sat in a small private room with no

windows. After he was assured that there was no video camera or recording

equipment in the room, Huang revealed his information to two procurators. His

report helped them successfully crack the case of abuse of power by a

high-ranking local official. Yang Yi, chief of the procuratorate's accusation

and appeal section, said the new room was part of broader effort to encourage

whistle-blowers. "The first branch has launched the system of protecting

whistle-blowers, if they are under threat because of their report," Yang said.

In addition to the new whistle-blower's room, which opened earlier this year,

other steps are being taken. "We will send policemen to protect whistle-blowers

around the clock," Yang said. The new system appears to be having an impact.

Huang is one of nearly 100 informants who have submitted reports to the branch

since the protection system was adopted in February, according to the branch's

records. Yu Jie, chief of the first branch, said the number of clues provided by

whistle-blowers has risen by 55 per cent over the same period last year.

Chongqing residents have said these efforts deal with an important concern.

"Being a whistle-blower can be dangerous," Zhang Jian, a Chongqing resident,

said. "We are gratified because the first branch protects whistle-blowers."

Whistle-blowers also play a role in cracking cases elsewhere. Mu Ping, chief of

the Beijing municipal people's procuratorate, said about 11,000 clues pertaining

to job-related crimes by officials in the municipality have been provided by

whistle-blowers in the past five years. Also the Guangzhou people's

procuratorate said earlier nearly 80 percent of cases pertaining to job-related

crimes by officials were set in motion by information from whistle-blowers.

Taipei mayor calls for direct

flights - The mayor of Taipei hopes to soon see a direct flight open between

Shanghai and Taipei. A direct link between Shanghai's Hongqiao International

Airport and Taipei's Songshan Airport will benefit both cities, Hau Lung-bin

said yesterday. He was speaking during an official visit to the Shanghai

airport. "I could imagine that Hongqiao (district) will become an important

business and transport hub for Shanghai and the Yangtze River Delta by 2010,"

Hau said. "And with the large mass of population and business clusters, Songshan

(district in Taipei) will also play a key role in Taiwan's future economic

development," he said. "A direct flight will reduce travel time between the two

hubs to about 80 minutes, which will closely link Taipei and Shanghai, as well

as the entire Yangtze River Delta region economically," he said. "What we need

to plan is how to combine our efforts in mutual development." Currently, there

is no direct air route between the two cites. Travelers must transfer in Hong

Kong or Macao. Chartered flights which are available on occasions like the

Spring Festival take about three hours, and planes have to stop off or fly

through Hong Kong or Macao. Regular weekend charter flights starts from July 4.

After visiting the airport, Hau and his delegation visited the Shanghai

municipal urban planning museum. Hau wrote in the museum's signing book: "May

dreams of Shanghai and Taipei come true." Today, Hau will visit the Shanghai

Wild Animals Park. Jason Yeh, director of Taipei Zoo, told China Daily yesterday

that they would not discuss importing pandas from the mainland on this visit, as

they had originally planned. The reason is that representatives from the China

Wildlife Conservation Association are not available to meet as expected. "But we

are very confident in getting the pandas eventually," Yeh said. Several zoos on

the island are vying for the right to host the pair of pandas. Yeh said that as

early as 1995, Taipei Zoo started sending staff to the mainland and zoos around

the world, which have pandas, for trainings on raising pandas. "We have spent

more than NT$310 million ($10.3 million) on building facilities for pandas," Yeh

said. "The weather from November to March will be cooler in Taiwan and we hope

they will come during that time period." Officials from both cities are expected

to discuss zoo exchange programs for other rare animals, he said. Lin Hwa-Ching,

CEO of the Wildlife Conservation & Research Center at Taipei Zoo, said the

exchanges may include Yangtze River alligators and black snub-nosed monkeys from

Shanghai and orangutans, white-handed gibbons and sun bears from Taiwan.

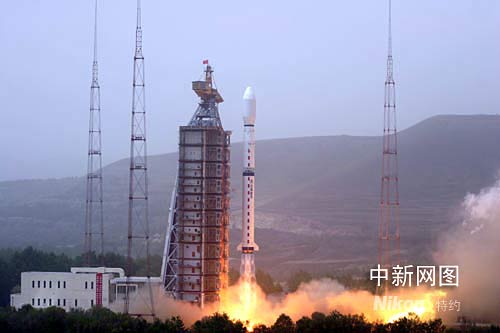

China has developed a new-generation

supersonic trainer aircraft with state-of-the-art turbines and a full authority

digital engine control.

China National Offshore Oil Company Limited (CNOOC Ltd.) announced Tuesday that

a new oil field in the South China Sea had started production with a current

daily output reaching 31,000 barrels.

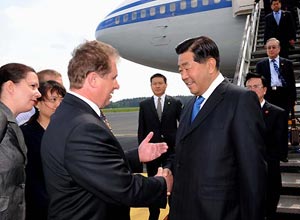

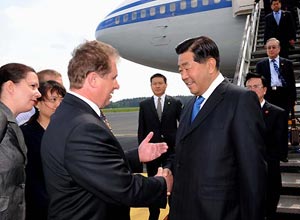

Lieutenant General Su

Shiliang (L), commander of China's South Sea Fleet, gestures while welcoming

Major-Gen. Shinichi Tokumaru (R) of the Japanese Maritime Self-Defense Force

after the Japanese Maritime Self-Defense Force destroyer arrived in Zhangjiang,

south China's Guangdong Province on Tuesday, June 24, 2008. Lieutenant General Su

Shiliang (L), commander of China's South Sea Fleet, gestures while welcoming

Major-Gen. Shinichi Tokumaru (R) of the Japanese Maritime Self-Defense Force

after the Japanese Maritime Self-Defense Force destroyer arrived in Zhangjiang,

south China's Guangdong Province on Tuesday, June 24, 2008.

Shanghai film fest a far cry from

Cannes - The Shanghai festival, which recently celebrated its 11th anniversary

on June 22, fails to claim its own name to fame - its image is at best, vague.

June 24 - 26, 2008

Hong Kong:

Hong Kong has become the most popular destination for mainland outbound

travelers, according to the latest survey released by the Ac Nielsen. The

company surveyed 4,103 travelers in 26 major cities during the first two months

of this year. Interviewees from north and northeast China listed France as their

second favorite destination, while those from southern and western parts of the

country ticked Macao and Australia, according to the survey result. Meanwhile,

according to the company's Destination Satisfaction Index, a measurement of

tourists' satisfaction with their destinations, Japan and Australia ranked the

top two. Hong Kong:

Hong Kong has become the most popular destination for mainland outbound

travelers, according to the latest survey released by the Ac Nielsen. The

company surveyed 4,103 travelers in 26 major cities during the first two months

of this year. Interviewees from north and northeast China listed France as their

second favorite destination, while those from southern and western parts of the

country ticked Macao and Australia, according to the survey result. Meanwhile,

according to the company's Destination Satisfaction Index, a measurement of

tourists' satisfaction with their destinations, Japan and Australia ranked the

top two.

Lawyers warned

over dirty money - Lawyers in Hong Kong have been told to step up the checks

they make on potential clients amid growing concern over the twin threats of

money laundering and terrorist financing. Lawyers warned

over dirty money - Lawyers in Hong Kong have been told to step up the checks

they make on potential clients amid growing concern over the twin threats of

money laundering and terrorist financing.

Chicken ban to

be lifted - Live chicken will be for sale again on July 2 if vendors agree not

to keep the poultry alive overnight. Chicken ban to

be lifted - Live chicken will be for sale again on July 2 if vendors agree not

to keep the poultry alive overnight.

No more hurdles to Ho flagship listing - Casino mogul

Stanley Ho Hung-sun's gaming flagship SJM Holdings finally overcame all hurdles

yesterday to kick off its roadshow, with its retail book expected to be open

from Thursday until July 2.

Euro V duty waiver `just drop in bucket' - The government

has decided to waive the duty on Euro V diesel but has shot down calls to lower

the tax on unleaded petrol and ultra-low sulfur diesel as well as fuel

subsidies.

Chief Executive Donald Tsang Yam-kuen will lead a Hong

Kong government delegation to quake-hit parts of Sichuan this weekend to find

out how the city can help in their reconstruction. A government source said the

delegation, which will spend three days in the southwestern province, would be

briefed by the provincial government about the latest situation in the counties

affected by the magnitude- 8 earthquake on May 12, which killed more than 70,000

people. "We hope to set up a mechanism by which Hong Kong and Sichuan government

officials can discuss co-operation in the reconstruction," said the source.

Among those travelling to Sichuan will be Secretary for Constitutional and

Mainland Affairs Stephen Lam Sui-lung, Secretary for Development Carrie Lam

Cheng Yuet-ngor, the director of the Chief Executive's Office, Norman Chan Tak-lam,

and senior civil servants. Macau Chief Executive Edmund Ho Hau-wah will also

lead a delegation to Sichuan from Friday to Sunday. In witnessing the

destruction first-hand, the delegations will be following in the footsteps of

Premier Wen Jiabao and singer-actor Andy Lau Tak-wah. Individuals, companies and

organisations in Hong Kong have donated more than HK$1 billion to earthquake

relief efforts. More than 1,000 Hongkongers have registered as quake relief

volunteers. The government has given HK$300 million as well as sending medical

and rescue teams. Conservancy Association chairman Albert Lai Kwong-tak, a civil

engineer, has teamed up with fellow Hong Kong engineers and professionals to

plan redevelopment in the destruction zone. He said the group they had formed,

Engineers Without Borders, had sent a team to Sichuan this month to make a site

assessment and that another trip was being arranged for early next month.

Chinese University political analyst Ivan Choy Chi-keung said Mr Tsang was

worried about his falling popularity and the perception that he ducks

controversy. He pointed to the publicity and photo opportunities the trip to

Sichuan would generate, and said: "This will send the message that Mr Tsang is

still in charge." Mr Tsang's popularity fell amid the recent controversy over

the administration's handling of new appointments to his governing team. A

University of Hong Kong opinion survey early this month found his approval

rating had dropped to 60.8 out of 100, against 66 when the appointments were

announced in May.

Tailor, hotel staff named in bribery cases - Eleven people

- all suspected of helping to divert hotel guests illegally to a well-known

Kowloon tailor - have been charged with bribery in four separate cases, the ICAC

said yesterday. In the first case, the Independent Commission Against Corruption

alleged that between December 2001 and January last year, the proprietor and

three employees of Baron Kay's Tailor conspired and offered advantages to

concierge staff of six hotels - The Marco Polo Prince, The Peninsula, The Marco

Polo Gateway, Renaissance Kowloon Hotel Hong Kong, Marco Polo Hong Kong Hotel

and Marriott Hong Kong - in return for them referring hotel guests. The ICAC

named the defendants as George Kay Wai-ming, 48, proprietor of Baron Kay's

Tailor; salesman Ngai Yan-lung, 61; and accounts clerks Wong Lai-ching, 52, and

Lee Fung-ho, 47. Kay, Ngai and Wong each faced one count of conspiracy to offer

advantages to agents, while Kay, Ngai and Lee faced a similar conspiracy offence

with Wong, the ICAC said. Lee also faced one charge of perverting the course of

justice. Baron Kay's Tailor, in Mody Road in Tsim Sha Tsui, has been listed in

travel guides and on the Hong Kong Tourism Board's recommended shopping list. In

the second case, three concierge staff at The Marco Polo Gateway hotel and two

of its bell captains each face one count of conspiring to accept advantages

between mid- 2005 and January this year. The ICAC said those defendants were

Wong Hing-cheung, 60, Pan Wai-man, 43, and Yeung Wing-wai, 33, Cheng Chi-chiu,

59, and Leung Siu-ho, 46. In the third case, Chan Wing-yin, 46, chief concierge

at the Harbour Plaza Metropolis, has been charged with one count of conspiring

to accept advantages between January 2004 and November 2006. In the last case,

Felix Wong Tim-ki, 27, a concierge clerk at The Peninsula, faces one count of

being an agent accepting an advantage - allegedly a suit jacket, a pair of

trousers and a shirt - in early 2004. The defendants, all on ICAC bail, will

appear in Kowloon City Court this week.

China:

The Communist Party of China (CPC) Central Committee on Sunday revealed its

five-year plan for the Party's prevention and punishment of corruption. The

committee has ordered Party organs at all levels to seriously carry out the plan

which aims at establishing a system to punish and prevent corruption from 2008

to 2012. A focus of the plan, a guideline for the Party's anti-corruption work

in the next five years, is to correct sybaritic and wasteful spending of the

government's money by bosses of state-owned corporations. It orders leaders in

state-owned companies to create legal, clean and democratic management by paying

more attention to the appeals and demands of the public. As an important shift

for the Party's anti-corruption endeavor, the plan pledges to improve its

internal supervision over the power. It vows to establish a supervision system

in which the Political Bureau of the CPC Central Committee regularly reports its

work to the plenary meeting of the committee which supervises the Political

Bureau. It also plans to intensify the supervision over officials in various

Party organs and governments, making close examination of their illegal incomes,

bribery, interference of market or trade and other corruptions by making use of

their positions. Meanwhile, it supports pushing forward the government's

information transparency through holding more public hearings and professional

consultation meetings. The plan also invites the mass media to implement press

supervision over the government and Party. The media will be encouraged to

provide legal and constructive criticizing reports with professional ethics and

Party officials shall deal with those reports in a proper way. The plan was

ratified by the Political Bureau of the CPC Central Committee on April 28.

China:

The Communist Party of China (CPC) Central Committee on Sunday revealed its

five-year plan for the Party's prevention and punishment of corruption. The

committee has ordered Party organs at all levels to seriously carry out the plan

which aims at establishing a system to punish and prevent corruption from 2008

to 2012. A focus of the plan, a guideline for the Party's anti-corruption work

in the next five years, is to correct sybaritic and wasteful spending of the

government's money by bosses of state-owned corporations. It orders leaders in

state-owned companies to create legal, clean and democratic management by paying

more attention to the appeals and demands of the public. As an important shift

for the Party's anti-corruption endeavor, the plan pledges to improve its

internal supervision over the power. It vows to establish a supervision system

in which the Political Bureau of the CPC Central Committee regularly reports its

work to the plenary meeting of the committee which supervises the Political

Bureau. It also plans to intensify the supervision over officials in various

Party organs and governments, making close examination of their illegal incomes,

bribery, interference of market or trade and other corruptions by making use of

their positions. Meanwhile, it supports pushing forward the government's

information transparency through holding more public hearings and professional

consultation meetings. The plan also invites the mass media to implement press

supervision over the government and Party. The media will be encouraged to

provide legal and constructive criticizing reports with professional ethics and

Party officials shall deal with those reports in a proper way. The plan was

ratified by the Political Bureau of the CPC Central Committee on April 28.

Regulator says to balance stocks supply

and demand for stability - Shang Fulin, chairman of the China Securities

Regulatory Commission (CSRC), on Sunday vowed to deepen reform and boost

regulation to promote a stable and healthy development of the capital market. Regulator says to balance stocks supply

and demand for stability - Shang Fulin, chairman of the China Securities

Regulatory Commission (CSRC), on Sunday vowed to deepen reform and boost

regulation to promote a stable and healthy development of the capital market.

Baosteel Group, China's top steel

producer, plans to pay 28.68 billion yuan (HK$32.57 billion) for a controlling

stake in a new steel mill, which will merge two existing mills, as Beijing calls

for the formation of national giants to rival the likes of ArcelorMittal.

Foreign banks struggle to keep

talent - While foreign banks in China foresee robust growth in the mainland this

year, those overseas lenders are struggling to retain senior executives,

according to a survey conducted by PricewaterhouseCoopers. The survey found the

three most difficult positions to fill are senior executives, compliance

officers and wealth management officers.

China Southern Airlines (1055), the

nation's largest carrier by fleet size, has applied for an increase in fuel

surcharge to offset expected losses resulting from last Friday's nationwide fuel

price hike.

Baosteel Group, China's largest

steelmaker, agreed to pay up to 96.5 per cent more for its iron ore this year in

a term contract with Australian miner Rio Tinto.

Taipei Mayor Hau Lung-bin has

arrived in Shanghai to close a deal that will allow a participant from Taiwan to

join in the 2010 World Expo - the island's first official return to a world fair

since it was ousted from the UN in 1971. Mr Hau, who led a 25-member delegation

to Shanghai yesterday for a five-day visit, is scheduled to sign Taipei up for

the "best cities for urban practices" exhibition from May to October 2010.

Taipei will showcase its wireless broadband internet infrastructure and rubbish

recycling system. "The most important mission of this trip is to witness the

signing of the agreement for Taipei to take part in Shanghai Expo 2010, showing

how Taipei has become a wireless city and how it has recycled its rubbish into

useful things," Mr Hau, the first Taipei mayor to visit the mainland, said

before his departure. The city's rubbish is separated into reusable and

non-reusable categories. Taipei competed with 130 cities worldwide to enter the

exhibition. The entry as a city rather than a country has allowed the island to

return to Expo. Taiwan last participated in an Expo in Osaka, Japan, in 1970 -

the year before the UN awarded its China seat to Beijing. In 2005, by signing an

agreement with a Japanese restaurant and paying a royalty of NT$15 million

(HK$3.85 million), Taiwan was able to host a food stall - in the restaurant's

name - showcasing the island's best food at Expo 2005 in Aichi, Japan. Mr Hau

said that to avoid being criticised by the opposition Democratic Progressive

Party for wasting taxpayers' money by taking part in the exhibition, the city

government obtained some funding from the Hon Hai Group, one of Taiwan's leading

electronics makers. Terry Guo Tai-min, head of Hon Hai and the third-richest man

in Taiwan, signed a NT$300 million contract with Mr Hau on Sunday to build and

operate an exhibition hall for Taipei. While on the mainland, Mr Hau will also

be competing against other Taiwanese cities for the two pandas the mainland

offered to send the island as a gift after then Kuomintang chairman Lien Chan

met mainland President Hu Jintao in 2005, the Taipei mayor said. "We will also

visit the Shanghai Wild Animal Park, and hope to learn how it takes care of

pandas," he said. Taipei is vying with Taichung, Taoyuan and Kaohsiung, but it

is the only city to have built a NT$250 million panda house and bamboo grove for

the two pandas. City officials said Mr Hau would also discuss with mainland

authorities the possibility of hosting two other rare species - the snub-nosed

monkey and golden monkey - that Beijing has promised to send to Taiwan as a gift

after People First Party chairman James Soong Chu-yu's mainland visit in the

same year. Mr Hau will also survey Shanghai's transport facilities and other

public works, including the project of developing Hongqiao airport into a

multiple transport hub in order to draw on Shanghai's experience in airport

development for the remodeling of Taipei's 60-year-old airport. Mr Hau met

Shanghai's deputy mayor, Tang Dengjie , last night. He is scheduled to meet his

Shanghai counterpart, Han Zheng , on Thursday.

June 20 - 23, 2008

Hong Kong:

The credit derivative and securitization markets in Hong Kong grew

significantly, with credit derivative activity jumping 61 percent and

securitization transactions up 103 percent, revealed a survey here Wednesday.

The transactions were mainly entered into for trading purposes. Medium-term (one

to five year) credit default swaps with investment grade reference entities

continued to be the most common product, according to a survey published

Wednesday by the Monetary Authority, the city's de facto central bank. On the

securitization market the survey found synthetic securitization surged 313

percent and accounted for 61 percent of the total outstanding securitization

exposures last year. The overall market activity heavily concentrated on a small

number of institutions' activities. The market share of local banks, most of

which participated in such transactions as investing banks, increased year on

year from 69 percent to 83 percent. Claims on central governments and central

banks as well as residential mortgage loans continued to be the most popular

types of underlying assets in securitization transactions. The authority said

the sub-prime fallout in the United States has prompted regulators and the

market to be more cautious of certain securitization transactions. Regulators

particularly are re-examining the capital and disclosure treatment of these

transactions, which may shape future market activities. To ensure the prudent

development of the credit risk transfer activities of authorized institutions in

Hong Kong, the Monetary Authority will keep a close watch on the development of

international standards and work closely with the industry in promoting sound

risk-management practices. It will also consider further improvements to its

data collection requirements to better capture institutions' exposure to

complex-structured products given the rapid market developments and the

potential risks these can entail as exemplified by the sub-prime crisis. Hong Kong:

The credit derivative and securitization markets in Hong Kong grew

significantly, with credit derivative activity jumping 61 percent and

securitization transactions up 103 percent, revealed a survey here Wednesday.

The transactions were mainly entered into for trading purposes. Medium-term (one

to five year) credit default swaps with investment grade reference entities

continued to be the most common product, according to a survey published

Wednesday by the Monetary Authority, the city's de facto central bank. On the

securitization market the survey found synthetic securitization surged 313

percent and accounted for 61 percent of the total outstanding securitization

exposures last year. The overall market activity heavily concentrated on a small

number of institutions' activities. The market share of local banks, most of

which participated in such transactions as investing banks, increased year on

year from 69 percent to 83 percent. Claims on central governments and central

banks as well as residential mortgage loans continued to be the most popular

types of underlying assets in securitization transactions. The authority said

the sub-prime fallout in the United States has prompted regulators and the

market to be more cautious of certain securitization transactions. Regulators

particularly are re-examining the capital and disclosure treatment of these

transactions, which may shape future market activities. To ensure the prudent

development of the credit risk transfer activities of authorized institutions in

Hong Kong, the Monetary Authority will keep a close watch on the development of

international standards and work closely with the industry in promoting sound

risk-management practices. It will also consider further improvements to its

data collection requirements to better capture institutions' exposure to

complex-structured products given the rapid market developments and the

potential risks these can entail as exemplified by the sub-prime crisis.

Three orders implementing double

taxation relief arrangements for flights between Hong Kong, Mexico and Finland

will be gazetted Friday, the Transport and Housing Bureau said here Wednesday.

The three jurisdictions' airlines will be tax exempt for income and profits

derived from international flights in a bid to cut operation costs, and improve

income and efficiency, the bureau said. The Specification of Arrangements

(Government of the Republic of Finland) (Avoidance of Double Taxation on Income

from Aircraft Operation) Order will no longer be required, according to the

bureau. The orders will be submitted at the Legislative Council on June 25.

People in the transport sector are

angry at the government for what they see as delaying tactics in the form of a

pledge to review duty on fuel. "The government is acting irresponsibly," said

Stanley Chaing Chi- wai, who organized a two-day protest last week. "It is still

considering when it should make a decision." Earlier yesterday a government

spokesman said the decision to conduct a review had been made after "listening

to the trade's views." The offer to conduct a review came one day before

legislators are to debate a motion calling for lower duties, although senior

government officials are reportedly against any reductions. Drivers staged a

truck blockade in Central last Tuesday, causing traffic jams, while hundreds of

protesters took part in a two-day sit-in outside Government House. The

protesters last Wednesday gave the government a week to act on the fuel tax

before it shaped for more rallies. Chaing said yesterday he was angry about the

government's response. The removal of the duty would only cost the government

about HK$400 million and would not affect revenue much, Chaing said. The

transport sector has been hit by soaring fuel prices this year, with some

businesses forced to close. A fuel tax cut would help offset the higher prices,

people in the sector argue. A government spokeswoman has, meanwhile, defended

the tariff, saying Hong Kong's diesel duty represented less than 5 percent of

the retail price and was among the world's lowest. She also noted that a

concessionary duty of HK$0.56 per liter for Euro V diesel applied from last

December. That fell from an original rate of HK$2.89 per liter. And the

concessionary duty rate of ultra-low sulfur diesel was only HK$1.11 per liter.

Mainland property tycoon Yeung Kwok-keung

will soon have the bank financing to take over Shaw Brothers (0080), but the

interest rate may have been hiked even higher. The long-term debt funding of

HK$7 billion will be made available five to 10 days after Citi, which is

arranging the syndicated-loan deal, finalizes the list of banks, Bloomberg

quoted sources as saying. The already-high interest rate being levied on Yeung

may have been increased. The loan pays "more than 3 percentage points" above the

benchmark lending rate, the sources were quoted as saying. It was previously

reported the interest rate would be set at 3 percentage points above the

benchmark, equivalent to about 7 percent. Yeung, who is chairman of Country

Garden (2007), has already obtained another HK$3 billion in financing from

Henderson Land Development (0012) chairman Lee Shau-kee. Shares in Shaw Brothers

jumped 4.3 percent yesterday to end trading at HK$21.75. At current levels,

Shaw's stake in the holding company is worth at least HK$6.49 billion.

Secretary for Transport and Housing Eva Cheng Yu-wah on Wednesday said the

government had not reached a decision on scrapping the duty on diesel fuel. Ms

Cheng was speaking after meeting representatives from transport sectors and some

lawmakers from the Democratic Alliance for the Betterment and Progress of Hong

Kong (DAB) party. DAB vice-chairman Lau Kong-wah quoted her as saying the

government might be prepared to phase out Hong Kong’s diesel tax. He made the

comments after a meeting her on Wednesday morning. But Ms Cheng later issued a

statement which clarified the government’s position. It said the government was

still considering the feasibility of cutting the diesel duty. This was because

the government needed to hear more opinions from different sectors, she

explained. Ms Cheng said they would review duties on Euro-V diesel as soon as

possible. But she said duties would be maintained on less environmentally

friendly and low-sulphur diesel. This is more widely used by lorry drivers. The

transport chief said reducing or eliminating the diesel tax was seen as an

important way to help commercial drivers cope with rising fuel costs. After a

meeting with Ms Cheng and other lawmakers on Wednesday morning, Mr Lau had told

local media: “From our conversation, I believe Ms Cheng said the government

could exempt all diesel taxes.” Mr Lau said it was unlikely the government would

scrap Hong Kong’s petrol tax. He said eliminating the diesel tax made sense. “We

hope the measure could help reduce operating costs of mini bus drivers and other

commercial drivers, as well as to reducing their pressure to raise fares,” he

said. Meanwhile, over 100 representatives from the transport sector, including

minibus, taxi and other drivers protested outside the Legislative Council on

Wednesday morning. On Wednesday, Legco also planned to debate the scrapping of

taxes of Euro-V diesel and unleaded petrol by 50 per cent. This is to help

reduce inflationary pressure in the wake of soaring oil prices. Representatives

from the transport sector have said halving the taxes was not enough. They are

demanding the government ends all diesel taxes and introduces an exemption on

diesel station land premiums. Chiang Chi-wai, a spokesman for the Fuel Price

Concern Transportation Joint Conference, said all diesel taxes should be

exempted. “We hope the government can exempt all diesel tax, so as to reduce the