|

Newsletter

Seminar Material

Biz:

China

Hong

Kong Hawaii

What people

said about us

China

Earthquake Relief

Tax &

Government

Hawaii Voter Registration

Biz-Video

Biz-Video

Hawaii's

China Connection Hawaii's

China Connection

CDP#1780962

CDP#1780962

Doing Business in

Hong Kong & China

Doing Business in

Hong Kong & China

| |

Hong Kong, China & Hawaii Biz*

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our event page to find out more!

After

attended a China/Hong Kong Business/Trade Seminar in Hawaii...still unsure what

to do next, contact us, our Officers, Directors and Founding Members are

actively engaged in China/Hong Kong/Asia trade - we can help!

Are you ready to export your product or

service? You will find out in 3 minutes with resources to help you -

enter

to give it a try

China Central TV - live

Webcast

China Central TV - live

Webcast

Skype - FREE

Voice Over IP Skype - FREE

Voice Over IP

View Hawaii's China Connection

Video Trailer

View Hawaii's China Connection

Video Trailer

Direct link

PDF file

Direct link

PDF file

Year of the Pig - February 18, 2007

Year of the Pig - February 18, 2007

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

July 30 - 31, 2008

Hong Kong:

Nestle workers agree to end strike -

Nestle transport workers and deliverymen agreed to end their two-day strike and

resume work immediately after reaching a satisfactory resolution with the

company. Hong Kong:

Nestle workers agree to end strike -

Nestle transport workers and deliverymen agreed to end their two-day strike and

resume work immediately after reaching a satisfactory resolution with the

company.

Sohu.com, the mainland's second-largest online portal, says it will list its

games business in the United States after reporting a sevenfold increase in

second-quarter profit. ith sales of online games and advertising soaring,

Beijing-based Sohu is taking advantage of growing investor appetite for the

mainland internet industry. Boasting 253 million internet users, the mainland

has passed the US as the largest Web market in the world, according to China

Internet Network Information Centre. Sohu reported net income of US$40.2 million

in the second quarter, compared with US$5.7 million a year earlier. Diluted

earnings per share reached US$1.02, well ahead of market estimates of 67 US

cents. Revenue increased 161.6 per cent to US$101.98 million, beating market

estimates of US$96.5 million. "Both online games and online advertising are

doing extremely well," said Dick Wei, a mainland internet analyst at JP Morgan.

The new company in the US will be named Changyou.com and focus on online games

and related strategic opportunities. Sohu will remain Changyou's majority

shareholder. Other details of the share sale plan were not disclosed. "It is

great that Sohu is spinning off its online game business," said Bryan Yuan, an

analyst at IDC China. "After all, operating games are quite different from

running a portal. Games target individual consumers while portals target

companies." With future earnings less certain, online game companies on average

are valued at 15 times earnings, while online portals can fetch valuations of 30

times, Mr Wei said. Online games account for 47 per cent of Sohu's total

revenue. Most of that comes from TLBB, a multi-player online role-playing game

based on a Chinese martial art novel, Tian Long Ba Bu. The game was developed

in-house and launched last year. Total online games revenues reached US$47.9

million in the second quarter, up 11.5 times from the same period last year, and

TLBB accounted for US$45.5 million. Advertising revenues increased 53 per cent

from a year earlier to US$43.4 million, reflecting the overall expansion of the

internet market and the increased shift in advertising budgets from offline to

online. "The robust pace of advertising spending leading up to the Beijing

Olympic Games as well as our significant traffic increase further enhances the

overall effectiveness of advertisers' marketing campaigns on Sohu," said Belinda

Wang, the co-president and chief marketing officer at Sohu.com. Sohu expects

third-quarter revenue of US$112 million to US$116 million. However, a

China-based analyst warned the Olympics might have a negative impact on sales of

online games in the third quarter, given planned restrictions on the sector.

"The government has just announced policies that online game companies cannot

upgrade their games during the Olympic months. Most online game companies depend

on upgrades to boost users. However, the government doesn't want people to get

distracted from the Olympics," the analyst said.

Sohu.com, the mainland's second-largest online portal, says it will list its

games business in the United States after reporting a sevenfold increase in

second-quarter profit. ith sales of online games and advertising soaring,

Beijing-based Sohu is taking advantage of growing investor appetite for the

mainland internet industry. Boasting 253 million internet users, the mainland

has passed the US as the largest Web market in the world, according to China

Internet Network Information Centre. Sohu reported net income of US$40.2 million

in the second quarter, compared with US$5.7 million a year earlier. Diluted

earnings per share reached US$1.02, well ahead of market estimates of 67 US

cents. Revenue increased 161.6 per cent to US$101.98 million, beating market

estimates of US$96.5 million. "Both online games and online advertising are

doing extremely well," said Dick Wei, a mainland internet analyst at JP Morgan.

The new company in the US will be named Changyou.com and focus on online games

and related strategic opportunities. Sohu will remain Changyou's majority

shareholder. Other details of the share sale plan were not disclosed. "It is

great that Sohu is spinning off its online game business," said Bryan Yuan, an

analyst at IDC China. "After all, operating games are quite different from

running a portal. Games target individual consumers while portals target

companies." With future earnings less certain, online game companies on average

are valued at 15 times earnings, while online portals can fetch valuations of 30

times, Mr Wei said. Online games account for 47 per cent of Sohu's total

revenue. Most of that comes from TLBB, a multi-player online role-playing game

based on a Chinese martial art novel, Tian Long Ba Bu. The game was developed

in-house and launched last year. Total online games revenues reached US$47.9

million in the second quarter, up 11.5 times from the same period last year, and

TLBB accounted for US$45.5 million. Advertising revenues increased 53 per cent

from a year earlier to US$43.4 million, reflecting the overall expansion of the

internet market and the increased shift in advertising budgets from offline to

online. "The robust pace of advertising spending leading up to the Beijing

Olympic Games as well as our significant traffic increase further enhances the

overall effectiveness of advertisers' marketing campaigns on Sohu," said Belinda

Wang, the co-president and chief marketing officer at Sohu.com. Sohu expects

third-quarter revenue of US$112 million to US$116 million. However, a

China-based analyst warned the Olympics might have a negative impact on sales of

online games in the third quarter, given planned restrictions on the sector.

"The government has just announced policies that online game companies cannot

upgrade their games during the Olympic months. Most online game companies depend

on upgrades to boost users. However, the government doesn't want people to get

distracted from the Olympics," the analyst said.

The central government has

agreed to further liberalization of its markets under the Closer Economic

Partnership Arrangement (Cepa) between Hong Kong and the mainland, Chief

Executive Donald Tsang Yam-kuen said on Tuesday. Mr Tsang said Cepa had already

attracted HK$5.1 billion of investment into Hong Kong and had created 36,000 new

jobs during the first three years of implementation since 2003. He said the new

package of Cepa measures would open up more opportunities for Hong Kong firms

seeking to enter the China market. “The current Cepa package and the Guangdong

pilot measures will offer new business opportunities on the mainland for Hong

Kong businesses and service suppliers, making Hong Kong even more attractive to

overseas investors,” he said. Under Supplement V to Cepa, the liberalisation

measures will cover 40 services sectors. This includes existing sectors such as

conventions and exhibitions, banking, construction and related engineering

services, social services, tourism, accounting, and medical and dental services.

It will also cover two new services areas – incidental to mining and related

scientific and technical consulting services. All liberalisation measures will

come into force on January 1, 2009. They will cover: Banking sectors: under the

new measures, any mainland-incorporated banking institution established by a

Hong Kong bank (SEHK: 0005, announcements, news) will be allowed to locate its

data centre in Hong Kong, subject to certain requirements. Medical and dental

sectors: Hong Kong’s qualified Hong Kong permanent residents with Chinese

citizenship and with specialist qualifications will be allowed to set up

outpatient clinics in Guangdong. Tourism: the coverage of “simplified entry

arrangement for a period of 144 hours” for non-Hong Kong residents will be

extended to the whole of Guangdong. Under the new measures, Hong Kong travel

enterprises will be allowed to organize one day group tours to Hong Kong

Disneyland for non-Guangdong residents who have resided and worked in Shenzhen

for over one year. The central government has

agreed to further liberalization of its markets under the Closer Economic

Partnership Arrangement (Cepa) between Hong Kong and the mainland, Chief

Executive Donald Tsang Yam-kuen said on Tuesday. Mr Tsang said Cepa had already

attracted HK$5.1 billion of investment into Hong Kong and had created 36,000 new

jobs during the first three years of implementation since 2003. He said the new

package of Cepa measures would open up more opportunities for Hong Kong firms

seeking to enter the China market. “The current Cepa package and the Guangdong

pilot measures will offer new business opportunities on the mainland for Hong

Kong businesses and service suppliers, making Hong Kong even more attractive to

overseas investors,” he said. Under Supplement V to Cepa, the liberalisation

measures will cover 40 services sectors. This includes existing sectors such as

conventions and exhibitions, banking, construction and related engineering

services, social services, tourism, accounting, and medical and dental services.

It will also cover two new services areas – incidental to mining and related

scientific and technical consulting services. All liberalisation measures will

come into force on January 1, 2009. They will cover: Banking sectors: under the

new measures, any mainland-incorporated banking institution established by a

Hong Kong bank (SEHK: 0005, announcements, news) will be allowed to locate its

data centre in Hong Kong, subject to certain requirements. Medical and dental

sectors: Hong Kong’s qualified Hong Kong permanent residents with Chinese

citizenship and with specialist qualifications will be allowed to set up

outpatient clinics in Guangdong. Tourism: the coverage of “simplified entry

arrangement for a period of 144 hours” for non-Hong Kong residents will be

extended to the whole of Guangdong. Under the new measures, Hong Kong travel

enterprises will be allowed to organize one day group tours to Hong Kong

Disneyland for non-Guangdong residents who have resided and worked in Shenzhen

for over one year.

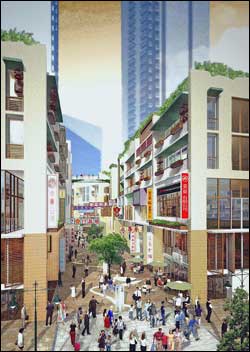

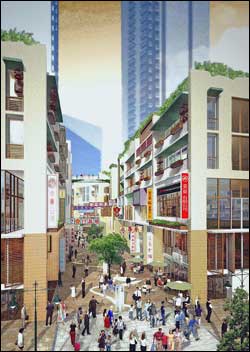

The Urban Renewal Authority wants to spend an extra HK$200 million to stop the

historic 160-year-old Graham Street open market being wiped out by

redevelopment, despite uncertainty about whether the market's hawkers will

continue operating stalls there. As well as the additional cost, the move would

delay completion of the project by two years, to 2014. Under new proposals put

up for consultation by the authority yesterday, the redevelopment would be

divided into three phases, enabling the existing 54 hawkers to stay in business

by moving from place to place during building work. Once work is complete, the

dry-goods stalls would reopen where they are now, while wet-goods stalls would

move into a new two-storey market building. Authority chairman Barry Cheung

Chun-yuen said it would supply hawkers with water and electricity during

construction, and traders would be able to rent space in a 300 square metre

storage area in which to store their goods. He said the operators of the 14

wet-goods stalls would be given priority when shops in the new market, on Gage

Street, were let. "The design of the two-storey centre actually takes advantage

of the sloping site, so all shops for selling wet goods would be at ground level

and easily accessible by visitors," he said. The centre would offer better

hygiene and management for stall owners, he added. The frontages of buildings on

Graham Street and Peel Street would be 3 meters further back from the roadway

than they are now. This would make the market safer, improve its environment and

keep passing vehicles from disturbing shoppers and stallholders. The authority

has also scrapped a proposal to build a 100-space underground car park. Mr

Cheung said the additional measures would add more than HK$200 million to the

project's cost, which last year was estimated at HK$3.8 billion. Carrying it out

in phases would increase construction costs, and the longer period for

completion of the work would mean higher bank interest charges would be

incurred. A forum will be held early next month to gauge the public's views

about the proposed measures. Despite the authority's efforts to save the city's

oldest street market, operating since 1841, hawkers operating there are still

not sure whether they can all stay, because the government may not renew their

licenses or allow their transfer. The government's policy is to encourage

hawkers to surrender their licences for one-off compensation, and only immediate

family members can take over a license. Fish-stall manager Wong Chi-wah, who has

been thinking of surrendering his license, said he would now consider moving

into the new market centre. He welcomed the new measures, but lamented that his

business had dropped about 30 per cent as residents gradually move out of

buildings to be demolished. Central and Western District Council vice-chairman

Stephen Chan Chit-kwai, a member of the authority's heritage advisory panel,

warned that high rents in the future market centre could discourage wet- stall

operators from staying. He suggested letting shops the hawkers do not want by

open tender.

The Urban Renewal Authority wants to spend an extra HK$200 million to stop the

historic 160-year-old Graham Street open market being wiped out by

redevelopment, despite uncertainty about whether the market's hawkers will

continue operating stalls there. As well as the additional cost, the move would

delay completion of the project by two years, to 2014. Under new proposals put

up for consultation by the authority yesterday, the redevelopment would be

divided into three phases, enabling the existing 54 hawkers to stay in business

by moving from place to place during building work. Once work is complete, the

dry-goods stalls would reopen where they are now, while wet-goods stalls would

move into a new two-storey market building. Authority chairman Barry Cheung

Chun-yuen said it would supply hawkers with water and electricity during

construction, and traders would be able to rent space in a 300 square metre

storage area in which to store their goods. He said the operators of the 14

wet-goods stalls would be given priority when shops in the new market, on Gage

Street, were let. "The design of the two-storey centre actually takes advantage

of the sloping site, so all shops for selling wet goods would be at ground level

and easily accessible by visitors," he said. The centre would offer better

hygiene and management for stall owners, he added. The frontages of buildings on

Graham Street and Peel Street would be 3 meters further back from the roadway

than they are now. This would make the market safer, improve its environment and

keep passing vehicles from disturbing shoppers and stallholders. The authority

has also scrapped a proposal to build a 100-space underground car park. Mr

Cheung said the additional measures would add more than HK$200 million to the

project's cost, which last year was estimated at HK$3.8 billion. Carrying it out

in phases would increase construction costs, and the longer period for

completion of the work would mean higher bank interest charges would be

incurred. A forum will be held early next month to gauge the public's views

about the proposed measures. Despite the authority's efforts to save the city's

oldest street market, operating since 1841, hawkers operating there are still

not sure whether they can all stay, because the government may not renew their

licenses or allow their transfer. The government's policy is to encourage

hawkers to surrender their licences for one-off compensation, and only immediate

family members can take over a license. Fish-stall manager Wong Chi-wah, who has

been thinking of surrendering his license, said he would now consider moving

into the new market centre. He welcomed the new measures, but lamented that his

business had dropped about 30 per cent as residents gradually move out of

buildings to be demolished. Central and Western District Council vice-chairman

Stephen Chan Chit-kwai, a member of the authority's heritage advisory panel,

warned that high rents in the future market centre could discourage wet- stall

operators from staying. He suggested letting shops the hawkers do not want by

open tender.

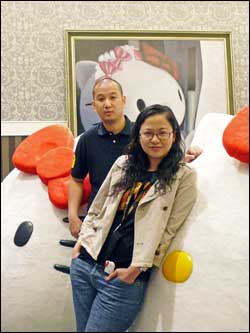

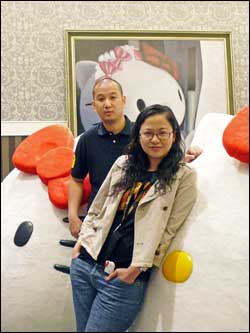

The Madagascar government is seeking the help of the Hong Kong police in

stopping the exhibition of what is claimed to be the world's largest emerald,

claiming it was exported from the island illegally. The emerald, weighing 536

kilograms and measuring 125 centimeters in length, 78cm in depth and 55cm in

height, has been on display at the BaoQu Tang Modern Art Gallery in Tsim Sha

Tsui since June 20. It has been named Gift from Heaven by Chinese painter Chan

Sicpo, a longtime Madagascar resident whose works are also on display in the

gallery. Officials from the Madagascar judiciary, police and procurator's

officer have arrived in Hong Kong, claiming the gem was declared as "green jade"

when it was illegally exported. It was allegedly shipped out of Madagascar

through the French colony of Reunion Island. A spokesman of the gallery said the

emerald belonged to a French company, Orgaco, which won a legal battle with the

Madagascar government over the ownership of the emerald while it was in Reunion.

The Madagascar government is seeking the help of the Hong Kong police in

stopping the exhibition of what is claimed to be the world's largest emerald,

claiming it was exported from the island illegally. The emerald, weighing 536

kilograms and measuring 125 centimeters in length, 78cm in depth and 55cm in

height, has been on display at the BaoQu Tang Modern Art Gallery in Tsim Sha

Tsui since June 20. It has been named Gift from Heaven by Chinese painter Chan

Sicpo, a longtime Madagascar resident whose works are also on display in the

gallery. Officials from the Madagascar judiciary, police and procurator's

officer have arrived in Hong Kong, claiming the gem was declared as "green jade"

when it was illegally exported. It was allegedly shipped out of Madagascar

through the French colony of Reunion Island. A spokesman of the gallery said the

emerald belonged to a French company, Orgaco, which won a legal battle with the

Madagascar government over the ownership of the emerald while it was in Reunion.

China:

Crucial talks for a new global trade pact entered the ninth day Tuesday with the

atmosphere was growing more and more tense amid a blame game triggered by the

U.S. verbal attack on emerging economies. The closed-door negotiations resumed

in the morning after a marathon bargaining session among the seven key members

in the World Trade Organization (WTO), namely the United States, the European

Union (EU), Japan, Australia, Indian, Brazil and China, dragged on into early

hours of today. Emerging from late-night battling, Indian Commerce Minister

Kamal Nath told reporters that the good news was the talks would continue,

failing to note any progress. Nath said he had been hoping for progress on

issues such as a further reduction of farm subsidies by developed countries and

the special safeguard mechanism, a measure for developing countries to protect

their domestic farming from import surges. "I am still hoping we will see some

movement. I am still optimistic," Nath said. EU Trade Commissioner Peter

Mandelson told reporters that the ministers had held "very intensive

discussions." "We work and will continue on what is a very, very complex and

sensitive," he said. Ahead of the meeting Monday evening, WTO spokesman Keith

Rockwell painted a pessimistic picture of the ongoing negotiations, which had

passed the planned schedule of one week. "The situation is very tense. Things

are finely balanced and the outcome is by no means certain," he said. Tensions

peaked Monday after the U.S. pointed fingers at India and China, blaming the

current deadlock on the two emerging economies. "We are very much concerned

about the direction that a couple of countries are taking," U.S. Trade

Representative Susan Schwab said. She said one party was against an agreement

worked out Friday night by a majority of the seven trading powers, while another

was now "backtracking" on an earlier commitment. Although she did not name the

two countries, the U.S. deputy head at the Geneva mission to the WTO, David

Shark, pointed the finger at India and China. "I am very concerned it will

jeopardize the outcome of this round," Schwab said. The accusation was

immediately rejected by India and China. "Developed countries are asking for

flexibilities for commercial interests. Developing countries are looking to

protect the poor and for provisions that will help them out of poverty, while

developed countries are looking for provisions which will lead to greater

prosperity," Nath said. Chinese ambassador to the WTO Sun Zhenyu described the

U.S. finger pointing as "surprising," urging the world's largest economy to show

flexibility instead of threatening developing countries. "We have tried very

hard to contribute to the success of the round," Sun told delegates. "It is a

little bit surprising that at this time the U.S. started this finger-pointing."

"They have to remember that this is a Development Round. If they cover all their

sensitivities for themselves, and keep on putting threats on developing

countries, I think we are going nowhere," the ambassador said. India is

demanding for more flexibility under the special safeguard mechanism, while

China wants to protect certain sensitive agriculture products like cotton, sugar

and rice from deep tariff cuts, which was allowed by the mandate of the Doha

Round. Both were supported by a large portion of poorer developing countries,

while others said the demands are justified in light of food security and the

still enormous numbers of small farmers that the two countries have to care for.

China:

Crucial talks for a new global trade pact entered the ninth day Tuesday with the

atmosphere was growing more and more tense amid a blame game triggered by the

U.S. verbal attack on emerging economies. The closed-door negotiations resumed

in the morning after a marathon bargaining session among the seven key members

in the World Trade Organization (WTO), namely the United States, the European

Union (EU), Japan, Australia, Indian, Brazil and China, dragged on into early

hours of today. Emerging from late-night battling, Indian Commerce Minister

Kamal Nath told reporters that the good news was the talks would continue,

failing to note any progress. Nath said he had been hoping for progress on

issues such as a further reduction of farm subsidies by developed countries and

the special safeguard mechanism, a measure for developing countries to protect

their domestic farming from import surges. "I am still hoping we will see some

movement. I am still optimistic," Nath said. EU Trade Commissioner Peter

Mandelson told reporters that the ministers had held "very intensive

discussions." "We work and will continue on what is a very, very complex and

sensitive," he said. Ahead of the meeting Monday evening, WTO spokesman Keith

Rockwell painted a pessimistic picture of the ongoing negotiations, which had

passed the planned schedule of one week. "The situation is very tense. Things

are finely balanced and the outcome is by no means certain," he said. Tensions

peaked Monday after the U.S. pointed fingers at India and China, blaming the

current deadlock on the two emerging economies. "We are very much concerned

about the direction that a couple of countries are taking," U.S. Trade

Representative Susan Schwab said. She said one party was against an agreement

worked out Friday night by a majority of the seven trading powers, while another

was now "backtracking" on an earlier commitment. Although she did not name the

two countries, the U.S. deputy head at the Geneva mission to the WTO, David

Shark, pointed the finger at India and China. "I am very concerned it will

jeopardize the outcome of this round," Schwab said. The accusation was

immediately rejected by India and China. "Developed countries are asking for

flexibilities for commercial interests. Developing countries are looking to

protect the poor and for provisions that will help them out of poverty, while

developed countries are looking for provisions which will lead to greater

prosperity," Nath said. Chinese ambassador to the WTO Sun Zhenyu described the

U.S. finger pointing as "surprising," urging the world's largest economy to show

flexibility instead of threatening developing countries. "We have tried very

hard to contribute to the success of the round," Sun told delegates. "It is a

little bit surprising that at this time the U.S. started this finger-pointing."

"They have to remember that this is a Development Round. If they cover all their

sensitivities for themselves, and keep on putting threats on developing

countries, I think we are going nowhere," the ambassador said. India is

demanding for more flexibility under the special safeguard mechanism, while

China wants to protect certain sensitive agriculture products like cotton, sugar

and rice from deep tariff cuts, which was allowed by the mandate of the Doha

Round. Both were supported by a large portion of poorer developing countries,

while others said the demands are justified in light of food security and the

still enormous numbers of small farmers that the two countries have to care for.

Visiting Chinese Foreign Minister Yang Jiechi (L) shakes hands with his U.S.

counterpart Condoleezza Rice during their meeting in Washington, July 28, 2008.

The successful meeting between Chinese President Hu Jintao and U.S. President

George W. Bush held on the sidelines of the Hokkaido G8 summit in Japan earlier

this month provides an important guidance for the future development of

bilateral relationship, he said. As the United States will hold presidential

elections later this year and the two countries will celebrate the 30th

anniversary of the establishment of their diplomatic ties between the end of

this year and the beginning next year, the Chinese minister said, bilateral

relationship will enter a crucial transitional period. The Chinese side would

work with the U.S. side to earnestly implement the common consensus reached

between heads of state of the two countries to move forward bilateral

constructive and cooperative relationship in a sound and steady manner, Yang

said. For this end, he said, both sides should always treat bilateral

relationship from a strategic and long-term perspective, maintain high-level

contacts, strengthen dialogues and communications, enhance mutual understanding

and trust, extend interchanges and cooperation, and properly handle differences

and sensitive issues.

Visiting Chinese Foreign Minister Yang Jiechi (L) shakes hands with his U.S.

counterpart Condoleezza Rice during their meeting in Washington, July 28, 2008.

The successful meeting between Chinese President Hu Jintao and U.S. President

George W. Bush held on the sidelines of the Hokkaido G8 summit in Japan earlier

this month provides an important guidance for the future development of

bilateral relationship, he said. As the United States will hold presidential

elections later this year and the two countries will celebrate the 30th

anniversary of the establishment of their diplomatic ties between the end of

this year and the beginning next year, the Chinese minister said, bilateral

relationship will enter a crucial transitional period. The Chinese side would

work with the U.S. side to earnestly implement the common consensus reached

between heads of state of the two countries to move forward bilateral

constructive and cooperative relationship in a sound and steady manner, Yang

said. For this end, he said, both sides should always treat bilateral

relationship from a strategic and long-term perspective, maintain high-level

contacts, strengthen dialogues and communications, enhance mutual understanding

and trust, extend interchanges and cooperation, and properly handle differences

and sensitive issues.

Visitors walk past a

poster during the Traditional Chinese Medicine Week at the Royal Society of

Medicine in London, Britain, July 28, 2008. The one-week event, starting from

July 27, is aimed at promoting greater understanding and cooperation in medicine

between China and the UK. It will also boost cooperation and exchanges between

China and Britain in the field of TCM, she added. According to Wang Guoqiang,

director general of China's State Administration of Traditional Chinese

Medicine, the event will showcase the special effects of TCM, which may benefit

people from around the world. During Wang's meeting with officials from

Britain's Health Department, both sides agreed to boost Chinese medicine-related

legislation in Britain and to achieve multi-dimensional cooperation in TCM. Wang

also encouraged increased interaction between Chinese and western medicine, in

keeping with future development trends in medicine. The TCM exhibition, key part

of the event, involves over 500 precious items related to Chinese medicine,

two-thirds of which have never been exhibited abroad before. Visitors walk past a

poster during the Traditional Chinese Medicine Week at the Royal Society of

Medicine in London, Britain, July 28, 2008. The one-week event, starting from

July 27, is aimed at promoting greater understanding and cooperation in medicine

between China and the UK. It will also boost cooperation and exchanges between

China and Britain in the field of TCM, she added. According to Wang Guoqiang,

director general of China's State Administration of Traditional Chinese

Medicine, the event will showcase the special effects of TCM, which may benefit

people from around the world. During Wang's meeting with officials from

Britain's Health Department, both sides agreed to boost Chinese medicine-related

legislation in Britain and to achieve multi-dimensional cooperation in TCM. Wang

also encouraged increased interaction between Chinese and western medicine, in

keeping with future development trends in medicine. The TCM exhibition, key part

of the event, involves over 500 precious items related to Chinese medicine,

two-thirds of which have never been exhibited abroad before.

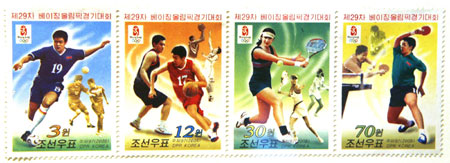

Games effort on right track say

greens - China got a pat on the back from Greenpeace for launching impressive

green policies in the run-up to next month's Beijing Olympic Games but also

received a soft rap on the knuckles for missing out on crucial environmental

initiatives across the capital. Games effort on right track say

greens - China got a pat on the back from Greenpeace for launching impressive

green policies in the run-up to next month's Beijing Olympic Games but also

received a soft rap on the knuckles for missing out on crucial environmental

initiatives across the capital.

Procter & Gamble has decided to raise prices for its products by as much as 10%

in China, Zhang Qunxiang, spokesman for P&G China, said.

Procter & Gamble has decided to raise prices for its products by as much as 10%

in China, Zhang Qunxiang, spokesman for P&G China, said.

July 28 - 29, 2008

Hong Kong:

The Hong Kong Monetary Authority

announced Friday that it has upgraded Shinhan Bank's (SHB) restricted banking

license to a banking license under the Banking Ordinance. The upgrade took

effect on July 24, 2008, the authority said. SHB is incorporated in South Korea

and has operated a branch in Hong Kong under a restricted banking license since

November 2006. According to the July 2007 issue of The Banker, SHB is the 3rd

largest bank in South Korea and the 76th largest bank in the world in terms of

tier one capital. After the upgrade of SHB, the number of licensed banks in Hong

Kong has increased to 146 while the number of restricted license banks in Hong

Kong has decreased to 28. Hong Kong:

The Hong Kong Monetary Authority

announced Friday that it has upgraded Shinhan Bank's (SHB) restricted banking

license to a banking license under the Banking Ordinance. The upgrade took

effect on July 24, 2008, the authority said. SHB is incorporated in South Korea

and has operated a branch in Hong Kong under a restricted banking license since

November 2006. According to the July 2007 issue of The Banker, SHB is the 3rd

largest bank in South Korea and the 76th largest bank in the world in terms of

tier one capital. After the upgrade of SHB, the number of licensed banks in Hong

Kong has increased to 146 while the number of restricted license banks in Hong

Kong has decreased to 28.

Implementing

regulatory policies such as the competition law or minimum wage could undermine

Hong Kong's economic growth, the chairman of the Hong Kong General Chamber of

Commerce has warned.

Talks fail to resolve Nestle pay

impasse - Around 200 Nestle employees staged a strike outside the factory in

Yuen Long yesterday, demanding increases in both their basic wages and

commissions. Talks fail to resolve Nestle pay

impasse - Around 200 Nestle employees staged a strike outside the factory in

Yuen Long yesterday, demanding increases in both their basic wages and

commissions.

Former head of the civil service

Joseph Wong Wing-ping has criticized the haste with which the maid levy waiver

is being brought in and the fact it doesn't cover employers of domestic helpers

with existing contracts.

The mainland's austerity measures in

the second half will involve a twin- pronged initiative - steady economic growth

and curbing inflation. Our first task is to ensure steady and rapid economic

growth," said President Hu Jintao at the Politburo's latest meeting. "We also

need to effectively control prices from rising too fast." As Standard Chartered

economist Frances Cheung sees it: "The central government has changed its focus

from fighting inflation to slowing growth." China's gross domestic product

growth rate slowed to 10.4 percent in the first half from 11.9 percent last

year. The People's Bank of China, in its second-quarter meeting yesterday, said

it will use various monetary tools to create a sound environment for the

country's stable and relatively fast economic growth. But Standard Chartered

does not expect any interest rate hike this year. "China will continue to

tighten liquidity but with quantitative tools such as reserve requirement ratio

hike and the issue of government bonds," said Cheung. TDTZ Debenham Tie Leung's

head of residential properties for China, Alan Chiang Sheung-lai, said mainland

developers may cut prices on unsold units amid a tight lending market. "Some

developers in Shenzhen and Shanghai have already lowered prices of small and

medium units by 15 percent," said Chiang. As Cheung sees it, "Initiatives

mentioned by Hu are rather general. But the message that the government may not

hike rates will improve market sentiment a bit." But Cheung does not expect the

new round of austerity measures to have a great impact on the economies of Hong

Kong and the mainland. Yuan appreciation will remain unchanged at a 6.65 percent

growth this year, according to Standard Chartered. "But yuan growth will be

slashed to 2 to 3 percent next year as we expect the US dollar to strengthen in

the first two quarters of 2009," said Cheung.

Shares of Hong Kong-listed Macau

plays have taken a beating recently, and it is becoming clear that American

plays in the SAR casino market have the long- term advantage.

HSBC Holdings (0005) is expected to

report next week that first-half profit before tax fell 27 percent year-on-year

to US$10.3 billion (HK$80.34 billion), according to the average forecast of four

analysts surveyed by The Standard, because of expenses for bad-loan provisions

in the United States and Britain.

The chief executive yesterday cast

himself in the role of paternal saviour for impoverished children, telling Tin

Shui Wai primary school pupils that his favourite book when he was young was

Oliver Twist. In a half-hour session with 18 children aged eight to 12 at the

Book Fair, Donald Tsang Yam-kuen told the children he had taken an interest in

every one of Charles Dickens' stories. He said that before the session he had

recalled how there were no public libraries when he was a child and that

English-language books were not readily available. "Times have changed. There

are libraries everywhere now," Mr Tsang said. After confirming with the children

that they were all from Tin Shui Wai, he told them: "That's my favourite

district to visit." But the fact that Dickens' portrayals of life amid poverty

and institutionalised injustice brought about significant change in 19th-century

Britain seemed lost on the youngsters. Mr Tsang met with similarly blank looks

when he asked children from Lok Sin Tong Leung Kau Kui Primary School in one of

Hong Kong's most impoverished districts whether they enjoyed reading travel

books. However, mention of Harry Potter brought some acknowledgement, although

it was unclear whether the children had read the books or just seen the films.

The chief executive encouraged them to learn English and read more books, saying

Hong Kong was an international city and reading encouraged independent thinking.

After his brief chat, Mr Tsang took the children to view two book stalls, and

later presented them with a book written by Hong Kong athletes. Chan Lai-ying,

12, said she had never heard of Dickens, but might look out for his books,

because she wanted to obey Mr Tsang. "Mr Tsang said he began reading keenly when

he was in middle school, and I am moving up to middle school now," she said.

"Seeing him on television, he looks pretentious, but he's much more caring in

real life." Eight-year-old Hui Kai-man, who held Mr Tsang's hand as they visited

the stalls, said the city's leader felt like a real father. Although she was

given a Chinese-language Geronimo Stilton book that chronicles the rat's

adventures as editor-in-chief of the Rodent's Gazette, she said she wanted to be

a swimmer when she grew up. Kai-man's mother said she hoped Mr Tsang would

provide more libraries and other facilities for Tin Shui Wai residents. "With

transport fees so high, it's hard for us to find things elsewhere," she said.

The chief executive yesterday cast

himself in the role of paternal saviour for impoverished children, telling Tin

Shui Wai primary school pupils that his favourite book when he was young was

Oliver Twist. In a half-hour session with 18 children aged eight to 12 at the

Book Fair, Donald Tsang Yam-kuen told the children he had taken an interest in

every one of Charles Dickens' stories. He said that before the session he had

recalled how there were no public libraries when he was a child and that

English-language books were not readily available. "Times have changed. There

are libraries everywhere now," Mr Tsang said. After confirming with the children

that they were all from Tin Shui Wai, he told them: "That's my favourite

district to visit." But the fact that Dickens' portrayals of life amid poverty

and institutionalised injustice brought about significant change in 19th-century

Britain seemed lost on the youngsters. Mr Tsang met with similarly blank looks

when he asked children from Lok Sin Tong Leung Kau Kui Primary School in one of

Hong Kong's most impoverished districts whether they enjoyed reading travel

books. However, mention of Harry Potter brought some acknowledgement, although

it was unclear whether the children had read the books or just seen the films.

The chief executive encouraged them to learn English and read more books, saying

Hong Kong was an international city and reading encouraged independent thinking.

After his brief chat, Mr Tsang took the children to view two book stalls, and

later presented them with a book written by Hong Kong athletes. Chan Lai-ying,

12, said she had never heard of Dickens, but might look out for his books,

because she wanted to obey Mr Tsang. "Mr Tsang said he began reading keenly when

he was in middle school, and I am moving up to middle school now," she said.

"Seeing him on television, he looks pretentious, but he's much more caring in

real life." Eight-year-old Hui Kai-man, who held Mr Tsang's hand as they visited

the stalls, said the city's leader felt like a real father. Although she was

given a Chinese-language Geronimo Stilton book that chronicles the rat's

adventures as editor-in-chief of the Rodent's Gazette, she said she wanted to be

a swimmer when she grew up. Kai-man's mother said she hoped Mr Tsang would

provide more libraries and other facilities for Tin Shui Wai residents. "With

transport fees so high, it's hard for us to find things elsewhere," she said.

China:

China reports half of world's new

liver cancer cases - China has 350,000 new liver cancer patients every year,

accounting for nearly half of the world's total, according to Leng Xisheng,

president of the Chinese College of Surgeons.

China:

China reports half of world's new

liver cancer cases - China has 350,000 new liver cancer patients every year,

accounting for nearly half of the world's total, according to Leng Xisheng,

president of the Chinese College of Surgeons.

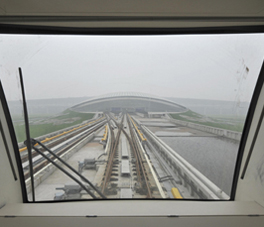

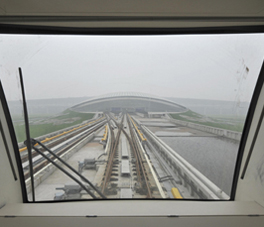

Volunteers from the United States

take the Olympic Line of Beijing Subway, July 28, 2008. Beijing kicked off on

Monday the operation of its metro transport artery leading to the central

Olympic areas.

Volunteers from the United States

take the Olympic Line of Beijing Subway, July 28, 2008. Beijing kicked off on

Monday the operation of its metro transport artery leading to the central

Olympic areas.

China to float more than 24b yuan in three-year T-bonds - China's Ministry of

Finance said on Friday it would float 24.59 billion yuan ($3.62 billion) worth

of three-year, book-entry treasury bonds next week.

China to float more than 24b yuan in three-year T-bonds - China's Ministry of

Finance said on Friday it would float 24.59 billion yuan ($3.62 billion) worth

of three-year, book-entry treasury bonds next week.

China's trade deficit down with

ASEAN - China's trade with ASEAN members amounted to $95.55 billion in the first

five months of this year, a growth of 26.9 percent over the same period of last

year.

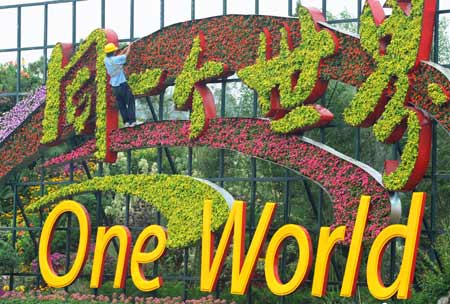

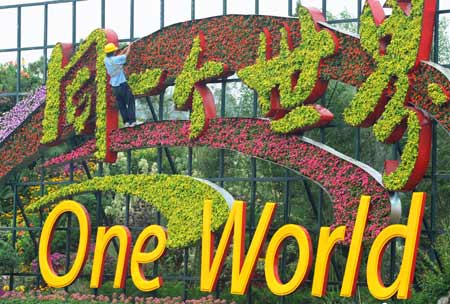

Some workers are busy with

decorating the Tian'anmen Square with flowers in central Beijing, China, July

28, 2008. More than one million basins of flowers will be placed here to

decorate Tian'anmen Square at the center of Beijing and welcome the upcoming

Beijing 2008 Olympics, Paralympics and China's National Day.

Some workers are busy with

decorating the Tian'anmen Square with flowers in central Beijing, China, July

28, 2008. More than one million basins of flowers will be placed here to

decorate Tian'anmen Square at the center of Beijing and welcome the upcoming

Beijing 2008 Olympics, Paralympics and China's National Day.

Chinese economy expected to maintain

stable, fast growth - The Chinese economy was likely to maintain stable and fast

growth this year, despite being beset with problems and uncertainties, as

fundamentals of the economy remained unchanged, Yao Jingyuan, National Bureau of

Statistics chief economist, said on Sunday.

Thousands evacuated in E China as

typhoon Fung Wong nears - Authorities in Zhejiang Province evacuated 230,764

people and recalled 26,242 fishing boats on Monday as typhoon Fung Wong

approached.

Thousands evacuated in E China as

typhoon Fung Wong nears - Authorities in Zhejiang Province evacuated 230,764

people and recalled 26,242 fishing boats on Monday as typhoon Fung Wong

approached.

About 67,000 taxicabs in the Olympic

host city of Beijing will soon be able to take payment with pre-paid public

transport cards, making traveling in the city more convenient. From Aug. 1, taxi

passengers can pay either in cash or with the IC card, which has been widely

used for the city's buses, subway and even some convenience stores. Taxi fares

will be deducted from the credit on the card, which can save both the driver and

the passenger from hassles such as giving small change. The Beijing Traffic

Management Bureau has asked all taxi drivers to have their meters updated to

allow the card payment. This is seen as the latest step to encourage commuters

in the city of 17million to use public transport rather than private cars,

particularly before the Olympic Games begin on Aug. 8. The capital implemented

an odd-even alternate-day ban on 3 million privately owned motor vehicles on

July 20 in order to guarantee smoother traffic flows and cleaner air during the

Olympics. This has prompted more Beijingers to use public transport, which

already offers discounts for public transport card holders. The IC card has

gained increasing popularity since it was launched in April 2006 to replace

traditional paper tickets. About20 million cards had been issued so far, the

Beijing Morning Post reported. Many taxi drivers had resisted the cards,

claiming they were too time-consuming as all charged fares would first go to the

taxi company before they are returned to the drivers. But the authorities had

promised drivers payment within three days, the newspaper said.

July 25 - 27, 2008

Hong Kong:

First-half Hong Kong investment in

the mainland nearly doubled in value from a year earlier, the Ministry of

Commerce reported on Thursday, although it's unclear how much of this investment

was actually speculative funds or so-called "hot money." From January to June,

the mainland approved the establishment of 6,900 Hong Kong-invested projects,

down 8.2 percent year-on-year, but investment actually used soared 94.5 percent

to 23.39 billion U.S. dollars. Given the close trade and economic ties between

the Hong Kong Special Administrative Region (SAR) and the mainland, analysts

said, at least some of the investment might be speculative funds. That's because

the amount invested surged while the number of projects fell, at the same time

that numerous foreign-funded processing enterprises were closing in the Pearl

River Delta, adjacent to Hong Kong, according to professor Ding Zhijie with the

Beijing-based University of International Business and Economics. Ding said

given the close Hong Kong-mainland relationship, it was much easier for hot

money seeking to profit from interest and exchange rate differentials to enter

the mainland through Hong Kong. Also, he said, "in comparison with other

channels, it is much easier for speculative funds that entered the mainland in

the form of direct investment from Hong Kong to leave. This is more hazardous."

China has recently tightened control over foreign direct investment (FDI) and

intensified scrutiny of investors' credentials. The aim is to curb the influx of

short-term speculative funds, which has added to the inflationary pressure on

the mainland. According to the Ministry of Commerce, as of the end of June, the

mainland had approved the establishment of 292,663 Hong Kong-funded projects,

involving 331.93 billion U.S. dollars of capital actually used, or 40.7 percent

of total FDI used in the mainland. The figures are cumulative since 1978, the

start of the reform and opening-up polices on the mainland. First-half

mainland-Hong Kong trade was 97 billion U.S. dollars, up 8 percent year-on-year.

The total included 90.65 billion U.S. dollars in exports to Hong Kong, up 7.8

percent, and 6.35 billion U.S. dollars in imports from the SAR, up 9.8 percent. Hong Kong:

First-half Hong Kong investment in

the mainland nearly doubled in value from a year earlier, the Ministry of

Commerce reported on Thursday, although it's unclear how much of this investment

was actually speculative funds or so-called "hot money." From January to June,

the mainland approved the establishment of 6,900 Hong Kong-invested projects,

down 8.2 percent year-on-year, but investment actually used soared 94.5 percent

to 23.39 billion U.S. dollars. Given the close trade and economic ties between

the Hong Kong Special Administrative Region (SAR) and the mainland, analysts

said, at least some of the investment might be speculative funds. That's because

the amount invested surged while the number of projects fell, at the same time

that numerous foreign-funded processing enterprises were closing in the Pearl

River Delta, adjacent to Hong Kong, according to professor Ding Zhijie with the

Beijing-based University of International Business and Economics. Ding said

given the close Hong Kong-mainland relationship, it was much easier for hot

money seeking to profit from interest and exchange rate differentials to enter

the mainland through Hong Kong. Also, he said, "in comparison with other

channels, it is much easier for speculative funds that entered the mainland in

the form of direct investment from Hong Kong to leave. This is more hazardous."

China has recently tightened control over foreign direct investment (FDI) and

intensified scrutiny of investors' credentials. The aim is to curb the influx of

short-term speculative funds, which has added to the inflationary pressure on

the mainland. According to the Ministry of Commerce, as of the end of June, the

mainland had approved the establishment of 292,663 Hong Kong-funded projects,

involving 331.93 billion U.S. dollars of capital actually used, or 40.7 percent

of total FDI used in the mainland. The figures are cumulative since 1978, the

start of the reform and opening-up polices on the mainland. First-half

mainland-Hong Kong trade was 97 billion U.S. dollars, up 8 percent year-on-year.

The total included 90.65 billion U.S. dollars in exports to Hong Kong, up 7.8

percent, and 6.35 billion U.S. dollars in imports from the SAR, up 9.8 percent.

Bonanza at book fair -

Actress and singer Theresa Fu Wing stole the spotlight at yesterday's opening of

the Hong Kong Book Fair, with some of her fans waiting up to 44 hours to get

their hands on her new photo collection and CD.

Bonanza at book fair -

Actress and singer Theresa Fu Wing stole the spotlight at yesterday's opening of

the Hong Kong Book Fair, with some of her fans waiting up to 44 hours to get

their hands on her new photo collection and CD.

Leung in vow to end levy chaos - The

waiving of the domestic helper levy was not meant to cause chaos, Executive

Council convener Leung Chun-ying said yesterday, while assuring that all parties

can fairly soon enjoy the concession.

D-Day for live chicken trade - Hong Kong Poultry Wholesalers and Retailers

Association chairman Steven Wong Wai-chuen has made a last- minute call for

poultry vendors to surrender their licences.

All eyes on March for MPF windfall - About 1.7 million low-income earners are

due for a one-off payment of HK$6,000 into their Mandatory Provident Fund

accounts before the end of March next year.

Henderson Land Development

(0012), controlled by tycoon Lee Shau-kee, plans to sell 10 billion yuan

(HK$11.42 billion) of flats each year in the mainland from 2011. Many of our

projects in China have completed their design and are now entering the

construction phase," Reuters quoted executive director John Yip Ying-chee as

saying. "We plan to have 20 million square feet of residential space completed

each year from 2011 and that will be enough for six years' development."

Henderson Land turnover was HK$8.356 billion in the year ended June 2007, mostly

from Hong Kong property income. The developer, whose mainland strategy focuses

on second-tier cities such as Shenyang, Chengdu and Chongqing, aims to replenish

its landbank in those cities by a quarter to offer a gross floor area of 150

million sq ft by the end of this year. A property analyst said Henderson Land's

plans are positive for its business, even though flat sales are falling under

tightening measures imposed by the mainland government. "For the long term,

developers can seek more investment opportunities in the mainland as it's more

difficult to do so in Hong Kong," the analyst said. He added that it is

difficult to predict the impact of tightening measures on the market in 2011.

Henderson Land hopes its eight commercial projects in mainland cities, which are

planned to be developed by mid-2014, "will contribute an additional 1 billion

yuan of rental income a year to the company by then," Yip was quoted as saying.

Reuters reported that many analysts have criticized Henderson Land for holding

too many "passive" investments in the stock market and not expanding its

business fast enough. "Henderson Land is not an opportunist and will take a

prudent strategy in China," said Yip. "When the market is hot we will buy less

but sell more."

Henderson Land Development

(0012), controlled by tycoon Lee Shau-kee, plans to sell 10 billion yuan

(HK$11.42 billion) of flats each year in the mainland from 2011. Many of our

projects in China have completed their design and are now entering the

construction phase," Reuters quoted executive director John Yip Ying-chee as

saying. "We plan to have 20 million square feet of residential space completed

each year from 2011 and that will be enough for six years' development."

Henderson Land turnover was HK$8.356 billion in the year ended June 2007, mostly

from Hong Kong property income. The developer, whose mainland strategy focuses

on second-tier cities such as Shenyang, Chengdu and Chongqing, aims to replenish

its landbank in those cities by a quarter to offer a gross floor area of 150

million sq ft by the end of this year. A property analyst said Henderson Land's

plans are positive for its business, even though flat sales are falling under

tightening measures imposed by the mainland government. "For the long term,

developers can seek more investment opportunities in the mainland as it's more

difficult to do so in Hong Kong," the analyst said. He added that it is

difficult to predict the impact of tightening measures on the market in 2011.

Henderson Land hopes its eight commercial projects in mainland cities, which are

planned to be developed by mid-2014, "will contribute an additional 1 billion

yuan of rental income a year to the company by then," Yip was quoted as saying.

Reuters reported that many analysts have criticized Henderson Land for holding

too many "passive" investments in the stock market and not expanding its

business fast enough. "Henderson Land is not an opportunist and will take a

prudent strategy in China," said Yip. "When the market is hot we will buy less

but sell more."

$1.5b Pacific Place revamp - Swire

Pacific (0019) plans to spend about HK$1.5 billion on refurbishing Pacific Place

in Admiralty. The mall will remain open for business throughout the project

period.

HPH makes highest bid for Greek port rights - A consortium led by Hutchison Port

Holdings, a unit of Hutchison Whampoa (0013), offered the highest of three

bidders in the tender for 30-year rights to the Greek port of Thessaloniki, the

port authority announced.

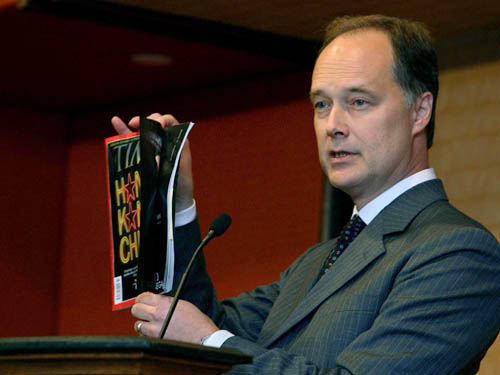

Hong Kong Exchanges and Clearing (SEHK: 0388, announcements, news) has warned

that the unfolding global credit crunch is hurting the finances of listing

candidates and advised investment banks to bolster their disclosure to

investors. Richard Williams, head of the HKEx's listing division, in a letter to

investment banks said that poor market sentiment had created difficulties for

listing candidates as they tried to obtain loans to finance operations. Mr

Williams reminded the banks to keep an eye on their listing-bound clients,

citing the recent deterioration in financial markets and tightened monetary

policy on the mainland. The US subprime lending crisis hit the global market for

initial public offerings at the beginning of the year, with eight share sales

pulled in Hong Kong so far this year. "Recent experience suggests that it is

appropriate to issue a reminder about the applicable disclosure standards and

further guidance on its expectations," Mr Williams said.

Hong Kong Exchanges and Clearing (SEHK: 0388, announcements, news) has warned

that the unfolding global credit crunch is hurting the finances of listing

candidates and advised investment banks to bolster their disclosure to

investors. Richard Williams, head of the HKEx's listing division, in a letter to

investment banks said that poor market sentiment had created difficulties for

listing candidates as they tried to obtain loans to finance operations. Mr

Williams reminded the banks to keep an eye on their listing-bound clients,

citing the recent deterioration in financial markets and tightened monetary

policy on the mainland. The US subprime lending crisis hit the global market for

initial public offerings at the beginning of the year, with eight share sales

pulled in Hong Kong so far this year. "Recent experience suggests that it is

appropriate to issue a reminder about the applicable disclosure standards and

further guidance on its expectations," Mr Williams said.

China:

An official with the 2010 Shanghai

World Expo said 211 countries and international organizations had confirmed

their participation for the event at a press conference here on Wednesday. "An

estimated 70 million visitors are expected to attend," said Chen Xianjin, deputy

director of the expo coordination bureau, at an international conference held

under the theme of "Modern service and metropolis development." "Only when it

has an advanced service industry, will a city be able to host the World Expo.

Hosting the World Expo will also help develop the modern service industry in

Shanghai." Vicente Gonzales Loscertales, Secretary General of Bureau of

International Expositions (BIE), said China's government and the whole nation

had actively participated in the preparation work of the Shanghai World Expo,

just like they did for next month's Olympic Games. "Shanghai World Expo is the

most well-prepared expo I have ever seen." He believed the expo would be a

showcase for the societies, economies, cultures and scientific achievements of

different countries. The expo, running from May 1 to Oct. 31, 2010, will feature

five theme pavilions -- "Urbanian," "City as a Form of Life," "Urban Planet,"

"Urban Future" and "Urban Culture."

China:

An official with the 2010 Shanghai

World Expo said 211 countries and international organizations had confirmed

their participation for the event at a press conference here on Wednesday. "An

estimated 70 million visitors are expected to attend," said Chen Xianjin, deputy

director of the expo coordination bureau, at an international conference held

under the theme of "Modern service and metropolis development." "Only when it

has an advanced service industry, will a city be able to host the World Expo.

Hosting the World Expo will also help develop the modern service industry in

Shanghai." Vicente Gonzales Loscertales, Secretary General of Bureau of

International Expositions (BIE), said China's government and the whole nation

had actively participated in the preparation work of the Shanghai World Expo,

just like they did for next month's Olympic Games. "Shanghai World Expo is the

most well-prepared expo I have ever seen." He believed the expo would be a

showcase for the societies, economies, cultures and scientific achievements of

different countries. The expo, running from May 1 to Oct. 31, 2010, will feature

five theme pavilions -- "Urbanian," "City as a Form of Life," "Urban Planet,"

"Urban Future" and "Urban Culture."

Local residents wait in line to buy

Olympic tickets in Beijing, July 24, 2008 - More than nine in 10 polled said

they think the summer Games will be successful and nearly 70 percent predicted

the event will speed up Beijing's development, help its image, or increase

national coherence, the survey by Beijing Social Facts and Public Opinion Survey

Center showed.

Local residents wait in line to buy

Olympic tickets in Beijing, July 24, 2008 - More than nine in 10 polled said

they think the summer Games will be successful and nearly 70 percent predicted

the event will speed up Beijing's development, help its image, or increase

national coherence, the survey by Beijing Social Facts and Public Opinion Survey

Center showed.

Tourists visit the Olympic theme parterres at Tian'anmen Square in central

Beijing, capital of China, July 24, 2008. Olympic theme parterres are

installed in the square before the opening of the 2008 Beijing Olympic Games on

Aug 8.

Tourists visit the Olympic theme parterres at Tian'anmen Square in central

Beijing, capital of China, July 24, 2008. Olympic theme parterres are

installed in the square before the opening of the 2008 Beijing Olympic Games on

Aug 8.

The country is set to enter the high-speed railway club, with its first

350kmh-passenger train traveling between Beijing and Tianjin scheduled for

launch on Aug 1. The new service is expected to cut travel time between the

120-km route by half, to less than 30 minutes. "From now on, China will possess

one of the world's fastest high-speed rail services," Zhang Shuguang, deputy

chief engineer of the Ministry of Railways, said on Tuesday. In comparison,

high-speed trains in Spain and Japan run at 320kmh, while those in France,

Germany and Italy travel at 300kmh, Zhang said. And for the passengers who were

invited to experience the service during a trial, riding the trains were "just

as comfortable" as being on slower ones. Such expertise has made it possible for

the 350-kmh trains to leave the railway station every five minutes during peak

hours, and every 10 minutes during non-peak hours, Zhang said. The second core

technology is in synthesizing up to seven rail coordination systems, each with

up to 70,000 parts, and making them work as one to maintain track performance,

he said. It is something China has also acquired on its own after years of

research and experience, he said. The third core technology of high-speed

railways involves the design and manufacture of high-speed trains themselves.

"When a train runs at 350kmh, it will produce an environment of 'negative air

pressure'. Designing the high-speed train's air-conditioning system becomes a

difficult task, since the train can draw objects into the carriage through any

opening, like a big vacuum," he said. The authorities chose to cooperate with

foreign companies that had the necessary expertise, like Germany-based Siemens,

to meet such challenges. Under a joint project between the Tangshan Railway

Transportation Equipment Company and Siemens, Chinese engineers completed the

requisite designs and submitted it to Siemens, who were involved in the

industrial certification of the project, Zhang said.

The country is set to enter the high-speed railway club, with its first

350kmh-passenger train traveling between Beijing and Tianjin scheduled for

launch on Aug 1. The new service is expected to cut travel time between the

120-km route by half, to less than 30 minutes. "From now on, China will possess

one of the world's fastest high-speed rail services," Zhang Shuguang, deputy

chief engineer of the Ministry of Railways, said on Tuesday. In comparison,

high-speed trains in Spain and Japan run at 320kmh, while those in France,

Germany and Italy travel at 300kmh, Zhang said. And for the passengers who were

invited to experience the service during a trial, riding the trains were "just

as comfortable" as being on slower ones. Such expertise has made it possible for

the 350-kmh trains to leave the railway station every five minutes during peak

hours, and every 10 minutes during non-peak hours, Zhang said. The second core

technology is in synthesizing up to seven rail coordination systems, each with

up to 70,000 parts, and making them work as one to maintain track performance,

he said. It is something China has also acquired on its own after years of

research and experience, he said. The third core technology of high-speed

railways involves the design and manufacture of high-speed trains themselves.

"When a train runs at 350kmh, it will produce an environment of 'negative air

pressure'. Designing the high-speed train's air-conditioning system becomes a

difficult task, since the train can draw objects into the carriage through any

opening, like a big vacuum," he said. The authorities chose to cooperate with

foreign companies that had the necessary expertise, like Germany-based Siemens,

to meet such challenges. Under a joint project between the Tangshan Railway

Transportation Equipment Company and Siemens, Chinese engineers completed the

requisite designs and submitted it to Siemens, who were involved in the

industrial certification of the project, Zhang said.

There were 169 merger and

acquisition (M&A) deals in China in the second quarter, up 225 percent from the

first quarter, according to a report released on Monday by investment research

firm ChinaVenture. Of these 169 deals, 129 disclosed the value, which totaled

15.5billion U.S. dollars, up 137 percent. ChinaVenture figures show M&A deals

were most common in manufacturing, comprising 22.4 percent of the total cases,

while property had the biggest share by value, or about 46 percent of the total.

Cross-border mergers expanded appreciably, with 15 cross-border M&A deals by

Chinese companies in the second quarter, up 24.7 percent. The report listed

reasons for the M&A wave. One was a surge in corporate profits in 2007, which,

combined with the proceeds from initial public offerings, provided companies

with capital. Another reason was the rising price of raw materials, which

motivated Chinese strategic investors to seek deals in energy and mining.

Under what is hoped will be a clear August 8 night sky free of rain and smog,

Beijing's pyrotechnics gurus hope to set the first record of the 2008 Olympics.

Officials announced yesterday that the opening ceremony, which had been wrapped

in secrecy, would feature a magical, iconic fireworks first. "For the first

time, the shape of the Olympic Rings will be formed in the sky," revealed Wang

Ning, deputy director of the opening and closing ceremonies department of Bocog,

the Games' organiser. But that will not be the only colourful, fiery,

jaw-dropping spectacle to grace the firmament on opening night. More

sophisticated, stylised flash-bangs and whizzes will be seen over the Olympic

Forest Park and the Juyongguan section of the Great Wall, said Mr Wang -

including a simultaneous exploding of a 3km long battery of fireworks. "Olympic

symbols and elements will be a part of [the] fireworks' designs, [all] with an

aim to promote Olympic ideals," he added. Those with their fingers on the

computerised firing buttons will spark hundreds of compressive.

Under what is hoped will be a clear August 8 night sky free of rain and smog,

Beijing's pyrotechnics gurus hope to set the first record of the 2008 Olympics.

Officials announced yesterday that the opening ceremony, which had been wrapped

in secrecy, would feature a magical, iconic fireworks first. "For the first

time, the shape of the Olympic Rings will be formed in the sky," revealed Wang

Ning, deputy director of the opening and closing ceremonies department of Bocog,

the Games' organiser. But that will not be the only colourful, fiery,

jaw-dropping spectacle to grace the firmament on opening night. More

sophisticated, stylised flash-bangs and whizzes will be seen over the Olympic

Forest Park and the Juyongguan section of the Great Wall, said Mr Wang -

including a simultaneous exploding of a 3km long battery of fireworks. "Olympic

symbols and elements will be a part of [the] fireworks' designs, [all] with an

aim to promote Olympic ideals," he added. Those with their fingers on the

computerised firing buttons will spark hundreds of compressive.

July 23 - 24, 2008

Hong Kong:

HK rebuked over dirty money deals -

An authoritative international report into how well equipped Hong Kong is to

tackle the twin scourges of money laundering and terrorist financing has accused

the city's nonfinancial businesses of failing in their duty to report suspicious

transactions. Hong Kong:

HK rebuked over dirty money deals -

An authoritative international report into how well equipped Hong Kong is to

tackle the twin scourges of money laundering and terrorist financing has accused

the city's nonfinancial businesses of failing in their duty to report suspicious

transactions.

Jackie Chan performs at an

Olympic-themed concert in Hong Kong on July 18, 2008. Jackie Chan performs at an

Olympic-themed concert in Hong Kong on July 18, 2008.

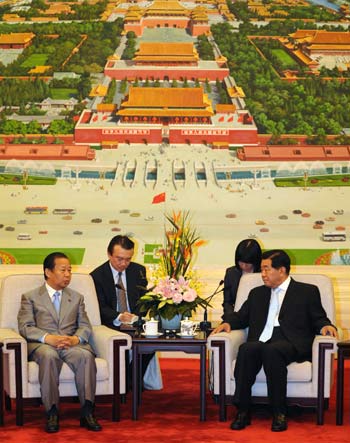

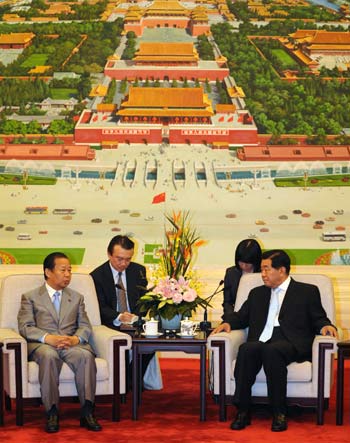

Xu Jianyi (R), general manager

of the FAW Group Corporation, gives a present to Chief Executive of Hong Kong

Special Administrative Region (HKSAR) Donald Tsang (L) after their visit to the

workshop of FAW-Volkswagen in Changchun, northeast China's Jilin Province, July

22, 2008. A Hong Kong delegation headed by Donald Tsang visited on Tuesday FAW-Volkswagen

Automotive Company Ltd. in Changchun. Xu Jianyi (R), general manager

of the FAW Group Corporation, gives a present to Chief Executive of Hong Kong

Special Administrative Region (HKSAR) Donald Tsang (L) after their visit to the

workshop of FAW-Volkswagen in Changchun, northeast China's Jilin Province, July

22, 2008. A Hong Kong delegation headed by Donald Tsang visited on Tuesday FAW-Volkswagen

Automotive Company Ltd. in Changchun.

Secretary for Labor and Welfare

Matthew Cheung Kin-chung and immigration officials have agreed to start the

waiver on the domestic helpers levy a month early, beginning August 1.

A mechanism designed to simplify the

registration of property could instead give rise to an avalanche of litigation

between buyers and sellers on the validity of property transactions, the Law

Society has warned. he new mechanism will enable lawyers to save time when

verifying property ownership and claims and this, in turn, will lead to reduced

conveyancing fees, Law Society president Lester Huang said yesterday. But, he

said, there are glitches in the government's amendments which if not ironed out

could result in booby traps. The issue in question comes under the Land Titles

Ordinance, with amendments set to be discussed in the new legislative term. The

ordinance was passed in 2004, but the long-awaited registration system has been

on hold pending amendments. In theory, the new mechanism guarantees indefeasible

titles to those included in the register. In layman's terms, it means lawyers

and buyers only need to rely on the last record of registration to proceed with

transactions. The conventional system depends on proof of an unbroken chain of

titles leading back to a good root of title. But the law has yet to address the

risk of legal disputes if a third party suddenly challenges the titles and the

validity of the registration. Huang said land titles in the New Territories,

with its long history of heritage and culture, can become vulnerable to legal

challenges. "Lawyers will have to fully rely on the government registration to

determine if the properties are in good title to prepare the transactions for

buyers or sellers," he said. However, clients will point an accusing finger at

lawyers if a third party suddenly emerges to claim ownership. "This has happened

from time to time," Huang said, adding on such occasions the government has

failed to back lawyers. "There will be risks and uncertainties, which are not

good for the whole community and the property market if people have to spend

more on legal costs when such disputes erupt." Huang said the current practice

of verifying the titles and deeds is cumbersome but reliable. The government

admitted the flaws in its paper to the Legislative Council in May last year.