|

Newsletter

Seminar Material

Biz:

China

Hong

Kong Hawaii

What people

said about us

China

Earthquake Relief

Tax &

Government

Hawaii Voter Registration

Biz-Video

Biz-Video

Hawaii's

China Connection Hawaii's

China Connection

CDP#1780962

CDP#1780962

Doing Business in

Hong Kong & China

Doing Business in

Hong Kong & China

| |

Hong Kong, China & Hawaii Biz*

Skype - FREE

Voice Over IP Skype - FREE

Voice Over IP  View Hawaii's China Connection

Video Trailer

View Hawaii's China Connection

Video Trailer

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our event page to find out more!

After

attended a China/Hong Kong Business/Trade Seminar in Hawaii...still unsure what

to do next, contact us, our Officers, Directors and Founding Members are

actively engaged in China/Hong Kong/Asia trade - we can help!

Are you ready to export your product or

service? You will find out in 3 minutes with resources to help you -

enter

to give it a try

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

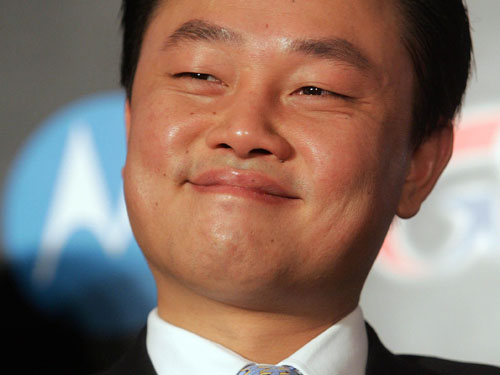

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

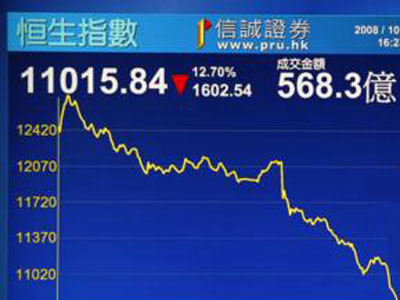

October 31 2008

Hong Kong:

Financial Secretary John Tsang Chun-wah said on Thursday Hong Kong faced the

likelihood of an economic recession next year. Hong Kong:

Financial Secretary John Tsang Chun-wah said on Thursday Hong Kong faced the

likelihood of an economic recession next year.

The Hong Kong Monetary Authority

(HKMA) on Thursday lowered its base interest rate to 1.5 per cent – down 50

basis points.

Premier Wen Jiabao has assured Hong Kong that Beijing will make "all-out

efforts" to help the city ride out the global financial storm. But as he issued

five pledges designed to bolster the city's economy, the state leader urged its

government to "seriously learn the lessons arising from this financial crisis".

"We should analyse the problems with the structure of Hong Kong's economy and

regulation of its financial system so that we can enhance our management and

improve [Hong Kong's] economic structure," he said in Moscow yesterday. "We

should make a thorough assessment of the possible difficulties and make full

preparations to face them," he said. Mr Wen said confidence was key to coping

with the financial crisis. "People's confidence hinges on the resolute measures

introduced by the leadership [in Hong Kong]. I note that the Hong Kong

government has introduced a series of measures which have achieved some positive

results," he said. "But there is a need to monitor how the crisis unfolds and

adjust policies promptly." A Hong Kong government spokesman said: "We agree with

Premier Wen ... We welcome the measures suggested, which are beneficial to Hong

Kong. We will work closely with the central government to ensure that the

measures will be implemented smoothly." The premier said he had instructed

mainland financial regulators to work with their counterparts in Hong Kong to

map out contingency plans to cope with risks arising from the crisis. Beijing

would facilitate such co-operation and communication. He promised help for Hong

Kong-owned businesses on the mainland, a speeding up of infrastructure projects

and a stable supply of food to Hong Kong to keep inflation in check. Mr Wen also

said the scheme allowing individual travel to Hong Kong from parts of the

mainland would now cover 44 cities. More than 29 million people have used the

scheme to visit in five years. Joseph Yam Chi-kwong, chief executive of the Hong

Kong Monetary Authority, supported further co-operation between financial

regulators in Hong Kong and on the mainland. The Chinese Manufacturers'

Association of Hong Kong said the central government should suspend the Labour

Contract Law, which has been criticised for increasing production costs for Hong

Kong-owned firms on the mainland. It is not the first time Mr Wen has said Hong

Kong has lessons to learn. In December 2005, he told Chief Executive Donald

Tsang Yam-kuen "deep-rooted problems and conflicts" in Hong Kong needed

resolving. During Mr Tsang's duty visit to Beijing in November, Mr Wen suggested

four ways to enhance Hong Kong's competitiveness - boosting technological

innovation, improving knowledge, nurturing talent and ensuring environmental

conditions were good. The Democratic Party called Mr Wen's remarks "a red flag"

for the administration, but the head of the main Beijing-loyalist party

disagreed with the suggestion the premier was not satisfied with the performance

of the Hong Kong government. Five ways to help - Wen Jiabao said the mainland

would: Work with Hong Kong financial regulators on contingency plans to handle

risks from financial crisis; Fast-track infrastructure projects, particularly

the bridge linking Hong Kong with Zhuhai and Macau; Ease inflationary pressure

by guaranteeing stable supplies of food; Extend to more cities the scheme

permitting individual travellers to visit Hong Kong; Provide support for Hong

Kong-owned small and medium-sized enterprises on the mainland.

Premier Wen Jiabao has assured Hong Kong that Beijing will make "all-out

efforts" to help the city ride out the global financial storm. But as he issued

five pledges designed to bolster the city's economy, the state leader urged its

government to "seriously learn the lessons arising from this financial crisis".

"We should analyse the problems with the structure of Hong Kong's economy and

regulation of its financial system so that we can enhance our management and

improve [Hong Kong's] economic structure," he said in Moscow yesterday. "We

should make a thorough assessment of the possible difficulties and make full

preparations to face them," he said. Mr Wen said confidence was key to coping

with the financial crisis. "People's confidence hinges on the resolute measures

introduced by the leadership [in Hong Kong]. I note that the Hong Kong

government has introduced a series of measures which have achieved some positive

results," he said. "But there is a need to monitor how the crisis unfolds and

adjust policies promptly." A Hong Kong government spokesman said: "We agree with

Premier Wen ... We welcome the measures suggested, which are beneficial to Hong

Kong. We will work closely with the central government to ensure that the

measures will be implemented smoothly." The premier said he had instructed

mainland financial regulators to work with their counterparts in Hong Kong to

map out contingency plans to cope with risks arising from the crisis. Beijing

would facilitate such co-operation and communication. He promised help for Hong

Kong-owned businesses on the mainland, a speeding up of infrastructure projects

and a stable supply of food to Hong Kong to keep inflation in check. Mr Wen also

said the scheme allowing individual travel to Hong Kong from parts of the

mainland would now cover 44 cities. More than 29 million people have used the

scheme to visit in five years. Joseph Yam Chi-kwong, chief executive of the Hong

Kong Monetary Authority, supported further co-operation between financial

regulators in Hong Kong and on the mainland. The Chinese Manufacturers'

Association of Hong Kong said the central government should suspend the Labour

Contract Law, which has been criticised for increasing production costs for Hong

Kong-owned firms on the mainland. It is not the first time Mr Wen has said Hong

Kong has lessons to learn. In December 2005, he told Chief Executive Donald

Tsang Yam-kuen "deep-rooted problems and conflicts" in Hong Kong needed

resolving. During Mr Tsang's duty visit to Beijing in November, Mr Wen suggested

four ways to enhance Hong Kong's competitiveness - boosting technological

innovation, improving knowledge, nurturing talent and ensuring environmental

conditions were good. The Democratic Party called Mr Wen's remarks "a red flag"

for the administration, but the head of the main Beijing-loyalist party

disagreed with the suggestion the premier was not satisfied with the performance

of the Hong Kong government. Five ways to help - Wen Jiabao said the mainland

would: Work with Hong Kong financial regulators on contingency plans to handle

risks from financial crisis; Fast-track infrastructure projects, particularly

the bridge linking Hong Kong with Zhuhai and Macau; Ease inflationary pressure

by guaranteeing stable supplies of food; Extend to more cities the scheme

permitting individual travellers to visit Hong Kong; Provide support for Hong

Kong-owned small and medium-sized enterprises on the mainland.

A customer buys eggs on display for sale

in a Beijing supermarket on Wednesday. Eggs in Hong Kong and the mainland have

been found with traces of melamine. The government would propose to mainland

food safety authorities that they use melamine-free certification of eggs before

exporting them to Hong Kong, Secretary for Food and Health York Chow Yat-ngok

said on Thursday. This comes after three out of 62 egg samples tested by the

Centre for Food Safety (CFS) during the past five days were found to have

excessive levels of melamine. Dr Chow said the department would work closely

with mainland authorities to trace the source of eggs found in Hong Kong. “We

will continue to liaise closely with mainland authorities. We have asked them to

trace the source of melamine and whether there are common factors that affect

the various suppliers. “At the moment, we are also discussing with them whether

it is possible to have a melamine-free certification for eggs exported to Hong

Kong,” he said. Although two samples were from Hubei and Shanxi, Dr Chow said it

was impossible to ban eggs from Hubei. This was because eggs imported from the

province accounted for nearly 40 per cent of the total number in Hong Kong. He

has urged consumers and traders to closely follow the latest announcements by

the CFS. The CFS would post latest daily test results on its website. A customer buys eggs on display for sale

in a Beijing supermarket on Wednesday. Eggs in Hong Kong and the mainland have

been found with traces of melamine. The government would propose to mainland

food safety authorities that they use melamine-free certification of eggs before

exporting them to Hong Kong, Secretary for Food and Health York Chow Yat-ngok

said on Thursday. This comes after three out of 62 egg samples tested by the

Centre for Food Safety (CFS) during the past five days were found to have

excessive levels of melamine. Dr Chow said the department would work closely

with mainland authorities to trace the source of eggs found in Hong Kong. “We

will continue to liaise closely with mainland authorities. We have asked them to

trace the source of melamine and whether there are common factors that affect

the various suppliers. “At the moment, we are also discussing with them whether

it is possible to have a melamine-free certification for eggs exported to Hong

Kong,” he said. Although two samples were from Hubei and Shanxi, Dr Chow said it

was impossible to ban eggs from Hubei. This was because eggs imported from the

province accounted for nearly 40 per cent of the total number in Hong Kong. He

has urged consumers and traders to closely follow the latest announcements by

the CFS. The CFS would post latest daily test results on its website.

Local lenders should adopt a more

supportive attitude towards small and medium-sized enterprises (SMEs) during the

current financial crisis, the Monetary Authority has said. It would be against

their interests to tighten credit indiscriminately out of "generic fear over

what the future may hold", Choi Yiu-kwan, deputy chief executive of the

authority, said yesterday in a circular to all authorized institutions. The call

comes as SMEs express worries about getting loans to tide them over through the

tough times. The authority urged all authorized institutions involved in lending

money to SMEs to be "as accommodative and flexible as possible" to the

companies' funding needs, Mr Choi said. "It is for [the authorized institutions]

to manage credit risks and to price credit flexibly in the light of changing

conditions and changing risks," he said. "However, in these difficult times and

following the unprecedented steps taken to support the banking system, the HKMA

believes that it will be in the best long-term interests of the economy and the

banking industry if [authorised institutions] adopt a supportive attitude

towards their SME customers." He suggested lenders assess individual cases based

on their merits and avoid across-the-board tightening, which "could have a

significant adverse impact on the business and economic prospects of otherwise

healthy SMEs". Mr Choi said that if a lender had to tighten credit provision, it

should explain the rationale to its customer. He asked lenders to adopt a

"sympathetic" attitude towards requests for temporary relief arrangements, such

as extensions of repayment deadlines. Danny Lau Tat-pong, chairman of the Small

and Medium Enterprises Association, said many SMEs were desperate for cash. He

called on the government to raise the maximum amount of its guarantee from 50

per cent to 80 per cent of the loan offered to SMEs. One lender said banks were

willing to help their customers, but had to be careful because of the slump. He

expected banks might be more willing to lend money if the government implemented

the revised SME Loan Guarantee Scheme, including extending the maximum guarantee

period for working capital loans from two years to five. "It's difficult for us

to lend if the customer's business is going down," he said. Local lenders should adopt a more

supportive attitude towards small and medium-sized enterprises (SMEs) during the

current financial crisis, the Monetary Authority has said. It would be against

their interests to tighten credit indiscriminately out of "generic fear over

what the future may hold", Choi Yiu-kwan, deputy chief executive of the

authority, said yesterday in a circular to all authorized institutions. The call

comes as SMEs express worries about getting loans to tide them over through the

tough times. The authority urged all authorized institutions involved in lending

money to SMEs to be "as accommodative and flexible as possible" to the

companies' funding needs, Mr Choi said. "It is for [the authorized institutions]

to manage credit risks and to price credit flexibly in the light of changing

conditions and changing risks," he said. "However, in these difficult times and

following the unprecedented steps taken to support the banking system, the HKMA

believes that it will be in the best long-term interests of the economy and the

banking industry if [authorised institutions] adopt a supportive attitude

towards their SME customers." He suggested lenders assess individual cases based

on their merits and avoid across-the-board tightening, which "could have a

significant adverse impact on the business and economic prospects of otherwise

healthy SMEs". Mr Choi said that if a lender had to tighten credit provision, it

should explain the rationale to its customer. He asked lenders to adopt a

"sympathetic" attitude towards requests for temporary relief arrangements, such

as extensions of repayment deadlines. Danny Lau Tat-pong, chairman of the Small

and Medium Enterprises Association, said many SMEs were desperate for cash. He

called on the government to raise the maximum amount of its guarantee from 50

per cent to 80 per cent of the loan offered to SMEs. One lender said banks were

willing to help their customers, but had to be careful because of the slump. He

expected banks might be more willing to lend money if the government implemented

the revised SME Loan Guarantee Scheme, including extending the maximum guarantee

period for working capital loans from two years to five. "It's difficult for us

to lend if the customer's business is going down," he said.

The Transport Advisory Committee

does not intend to change its decision over the controversial proposal to raise

taxi fares, committee chairwoman Teresa Cheng Yeuk-wah said on Thursday.

Travel agents may resort to

rejecting credit cards should banks continue to take months to settle customers'

card transactions, the Travel Industry Council has said. "This will be a

lose-lose situation," executive director Joseph Tung Yao-chung said. "Not only

will this affect banks and travel agents' business, but it will also cause much

inconvenience to inbound visitors who are used to paying for travel services by

credit cards." Mr Tung and council chairman Ronnie Ho Pak-ting relayed their

concerns and requests to Commissioner for Tourism Au King-chi yesterday. Mr Tung

said it used to take two days or so for a bank to transfer card payments to a

travel agent, but now it took as much as six months. "Many travel agents would

not have the cash to pay for air tickets and other expenditure." He also hoped

the government could waive the HK$5,820 annual licence fee, saying "more than 90

per cent of the travel agents in Hong Kong are small-scale operations". Mr Ho

said he found the meeting helpful and was satisfied with the positive stance

taken by the government.

Former beauty queen Cally Kwong credits

the principles of her Buddhist faith for guidance in business and investment, as

well as charity. Former beauty queen Cally Kwong credits

the principles of her Buddhist faith for guidance in business and investment, as

well as charity.

China:

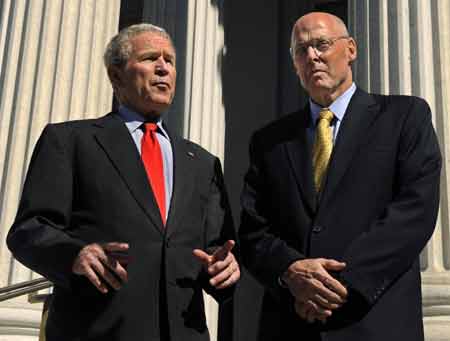

Beijing hit out on Thursday at claims made by US presidential candidate Barack

Obama that its huge trade surplus with the United States was related to its

manipulation of its currency. “The yuan exchange rate is not the cause of the US

trade deficit,” foreign ministry spokeswoman Jiang Yu said in response to a

question on how China viewed Obama’s remarks. “I hope that the US can expand its

exports to China and reduce barriers for trade and investment. We believe this

will help the US reduce its trade deficit.” In a letter to the US National

Council of Textile Organisations published on Wednesday, Obama called for China

to change its foreign exchange policies to rely less on exports and more on

domestic demand for growth. “The massive current account surpluses accumulated

by China are directly related to its manipulation of its currency’s value,”

Obama said in the letter, published on the council’s website. “The result is a

large imbalance that is not good for the United States, not good for the global

economy and likely to create problems in China itself. “China must change its

policies, including its foreign exchange policies, so that it relies less on

exports and more on domestic demand for its growth.” Jiang however refused to

comment specifically on Obama, giving no indication as to whom the Chinese

government favoured out of the Democratic candidate or Republican nominee John

McCain. “The US presidential elections are the internal affairs of the United

States,” she said. “We believe that whoever wins this election will attach

importance to US relations with China.” Both Obama and McCain have focused

mainly on the global financial crisis and said little about their policies

towards China.

China:

Beijing hit out on Thursday at claims made by US presidential candidate Barack

Obama that its huge trade surplus with the United States was related to its

manipulation of its currency. “The yuan exchange rate is not the cause of the US

trade deficit,” foreign ministry spokeswoman Jiang Yu said in response to a

question on how China viewed Obama’s remarks. “I hope that the US can expand its

exports to China and reduce barriers for trade and investment. We believe this

will help the US reduce its trade deficit.” In a letter to the US National

Council of Textile Organisations published on Wednesday, Obama called for China

to change its foreign exchange policies to rely less on exports and more on

domestic demand for growth. “The massive current account surpluses accumulated

by China are directly related to its manipulation of its currency’s value,”

Obama said in the letter, published on the council’s website. “The result is a

large imbalance that is not good for the United States, not good for the global

economy and likely to create problems in China itself. “China must change its

policies, including its foreign exchange policies, so that it relies less on

exports and more on domestic demand for its growth.” Jiang however refused to

comment specifically on Obama, giving no indication as to whom the Chinese

government favoured out of the Democratic candidate or Republican nominee John

McCain. “The US presidential elections are the internal affairs of the United

States,” she said. “We believe that whoever wins this election will attach

importance to US relations with China.” Both Obama and McCain have focused

mainly on the global financial crisis and said little about their policies

towards China.

A top climate official has admitted the mainland's greenhouse gas emissions are

at least on a par with those of the United States, but said the unfolding

financial crisis was presenting new economic and technological opportunities to

restructure the international campaign against global warming. Xie Zhenhua ,

deputy director of the National Development and Reform Commission, also said

yesterday rich countries must take the lead in cutting greenhouse gas emissions,

and contributing money and technology to developing countries. It was the first

time the central government had publicly acknowledged that China may have passed

the US to become the world's biggest greenhouse gas emitter. "Based on

information we have at hand, our total emissions are roughly the same as the

US," Mr Xie said at the launch of the country's first white paper on tackling

climate change. International research institutes and experts have said for two

years that China's output of carbon dioxide, the key greenhouse gas, had

surpassed that of the US, given that the latest data on China's greenhouse gas

emissions was from 1994. But Mr Xie said: "Whether or not we have surpassed the

US is not in itself important." He repeated China's stance that it was only fair

to consider historical and accumulated emissions in determining whether

developed or developing countries should play a bigger role in the global fight

against climate change. The white paper says: "Developed countries should be

responsible for their accumulative emissions and current high per capita

emissions, and take the lead in reducing emissions, in addition to providing

financial support and transferring technologies to developing countries." Mr Xie

said China's per-capita emissions for its 1.3 billion people remain much lower

than those of rich countries, and was about a fifth of the US average. "As China

is in the process of industrialisation and urbanisation, it is fairly natural

that the country's greenhouse gas emissions grow very fast," he said. He also

said it was not fair for China to take responsibility for emissions generated on

behalf of countries that consumed Chinese exports, which accounted for 24 per

cent of the country's total emissions. Both the white paper and Mr Xie played

down the growing criticism over China's refusal to accept a mandatory target in

cutting emissions. "There is no doubt that under the Kyoto Protocol, developed

countries must take the lead in reducing their greenhouse gas emissions," Mr Xie

said. Under the UN-sponsored treaty, developing countries are not obliged to

accept mandatory caps, but the US has refused to ratify it, citing the

framework's failure to hold China and India more responsible. "But regardless of

the results of international negotiations and how much developed countries

honour their commitments, China from its own perspective must realise

sustainable development," Mr Xie said. "We must save energy, raise energy

efficiency, develop renewable energies and adopt measures aimed at reducing

greenhouse gases." He said the financial turmoil should be viewed as an

opportunity for China as well as the whole world to carry out economic

restructuring, promoting environmentally friendly technology and cutting

pollution. "Tackling climate change and the financial crisis is not

contradictory," he said. "We will seize the opportunity to increase domestic

demand and funding on energy efficiency. We will have to solve climate change

and environmental problems through development." Mr Xie said developed countries

should contribute at least 0.7 per cent of their gross domestic products to help

developing countries fight global warming. Analysts said the release of the

policy paper as well as recent remarks by mainland officials were part of

Beijing's strategy amid intense negotiations on a successor to the Kyoto

Protocol, which expires in 2012. An international climate change seminar on

technology transfer organised by the UN and China will be held in Beijing next

week, and delegates from more than 190 countries will participate in another key

UN conference on climate change in Poznan, Poland, in December. Yang Ailun ,

from Greenpeace China, said the white paper was basically a review of the

government's achievements in tackling climate change in the past few years.

"While it may not have much new information, it is clearly aimed at highlighting

China's progress in cutting emissions ahead of international negotiations," she

said.

A top climate official has admitted the mainland's greenhouse gas emissions are

at least on a par with those of the United States, but said the unfolding

financial crisis was presenting new economic and technological opportunities to

restructure the international campaign against global warming. Xie Zhenhua ,

deputy director of the National Development and Reform Commission, also said

yesterday rich countries must take the lead in cutting greenhouse gas emissions,

and contributing money and technology to developing countries. It was the first

time the central government had publicly acknowledged that China may have passed

the US to become the world's biggest greenhouse gas emitter. "Based on

information we have at hand, our total emissions are roughly the same as the

US," Mr Xie said at the launch of the country's first white paper on tackling

climate change. International research institutes and experts have said for two

years that China's output of carbon dioxide, the key greenhouse gas, had

surpassed that of the US, given that the latest data on China's greenhouse gas

emissions was from 1994. But Mr Xie said: "Whether or not we have surpassed the

US is not in itself important." He repeated China's stance that it was only fair

to consider historical and accumulated emissions in determining whether

developed or developing countries should play a bigger role in the global fight

against climate change. The white paper says: "Developed countries should be

responsible for their accumulative emissions and current high per capita

emissions, and take the lead in reducing emissions, in addition to providing

financial support and transferring technologies to developing countries." Mr Xie

said China's per-capita emissions for its 1.3 billion people remain much lower

than those of rich countries, and was about a fifth of the US average. "As China

is in the process of industrialisation and urbanisation, it is fairly natural

that the country's greenhouse gas emissions grow very fast," he said. He also

said it was not fair for China to take responsibility for emissions generated on

behalf of countries that consumed Chinese exports, which accounted for 24 per

cent of the country's total emissions. Both the white paper and Mr Xie played

down the growing criticism over China's refusal to accept a mandatory target in

cutting emissions. "There is no doubt that under the Kyoto Protocol, developed

countries must take the lead in reducing their greenhouse gas emissions," Mr Xie

said. Under the UN-sponsored treaty, developing countries are not obliged to

accept mandatory caps, but the US has refused to ratify it, citing the

framework's failure to hold China and India more responsible. "But regardless of

the results of international negotiations and how much developed countries

honour their commitments, China from its own perspective must realise

sustainable development," Mr Xie said. "We must save energy, raise energy

efficiency, develop renewable energies and adopt measures aimed at reducing

greenhouse gases." He said the financial turmoil should be viewed as an

opportunity for China as well as the whole world to carry out economic

restructuring, promoting environmentally friendly technology and cutting

pollution. "Tackling climate change and the financial crisis is not

contradictory," he said. "We will seize the opportunity to increase domestic

demand and funding on energy efficiency. We will have to solve climate change

and environmental problems through development." Mr Xie said developed countries

should contribute at least 0.7 per cent of their gross domestic products to help

developing countries fight global warming. Analysts said the release of the

policy paper as well as recent remarks by mainland officials were part of

Beijing's strategy amid intense negotiations on a successor to the Kyoto

Protocol, which expires in 2012. An international climate change seminar on

technology transfer organised by the UN and China will be held in Beijing next

week, and delegates from more than 190 countries will participate in another key

UN conference on climate change in Poznan, Poland, in December. Yang Ailun ,

from Greenpeace China, said the white paper was basically a review of the

government's achievements in tackling climate change in the past few years.

"While it may not have much new information, it is clearly aimed at highlighting

China's progress in cutting emissions ahead of international negotiations," she

said.

Canadian expert: China has made

tremendous achievements in 30 years of reform, opening-up: China has made

tremendous achievements in all social aspects and improved its status on the

international arena as a result of its reform and opening-up policy adopted 30

years ago, Peter Harder, a Canadian expert on international affairs, told Xinhua

in a recent interview. Harder has visited China at least 14 times since 1980 and

thus enjoys first-hand knowledge of what the country has undergone in the past

three decades. "China was colorless, (and) it was grey, everybody wore grey," he

said while recalling his first Chinese tour. However, things have changed

tremendously since then, said Harder, who served as deputy chief for 16 years in

several Canadian federal government departments including the Treasury Board,

Ministry of Justice, Ministry of Citizenship and Immigration, Foreign Ministry

and Ministry of International Trade. In just 30 years' time, China has emerged

as a colorful, prosperous and self-confident society with a significant

influence on world political and economic affairs, he said. While economic

growth has substantially facilitated the improvement of the material life of

ordinary people, the whole of Chinese society has seen progress in all aspects,

from people's awareness of their social responsibilities, their openness to the

outside world, the mode and level of governance, to the awareness of sustainable

development, Harder pointed out. "You cannot come on visits to China over a

period of time as frequently as I have without noticing the tremendous increase

of human freedom, of rule of law, of focusing on accountability, particularly at

the municipal and local levels where the issues of being responsive to native

citizens are very much discussed," he said. China's progress is a good thing for

the whole world, he said. "I view the opening-up to the outside world as having

been hugely beneficial to both China and the world." "By that I mean China has

been able to provide economic opportunities to its public, which has vastly

improved the quality of life of its population and has done so over a period of

years, which indicates sustainable economic strategy." On the other hand, "the

world has benefited from China's participation in the global market place and

global political space," he noted. Harder credited China with being a

responsible member of the United Nations Security Council and a partner in

global solutions for several international and regional issues. Though China

faces the challenge of economic disparity between its coastal and interior areas

as well as between rural and urban regions, its leadership is fully aware of the

situation and is putting in place a development strategy to address that

challenge. As for environmental challenges, the Chinese government has advocated

the notion of harmonious growth in its latest five-year plan to better balance

the relationship between economic growth and environmental protection, Harder

said. He expressed confidence that China would have an even brighter future as

the Chinese leadership is responsible and has displayed the ability to maintain

national economic growth and to participate in global affairs effectively and

responsibly. Harder currently holds the post of president of the Canada-China

Business Council (CCBC), Canada's leading organization to facilitate bilateral

trade and investment. He will lead a large delegation consisting of Canadian

entrepreneurs and five provincial government heads scheduled to visit China from

Nov. 2-7. The tour will be part of celebrations marking the 30th anniversary of

the establishment of the CCBC and of China's opening-up policy.

October 30 2008

Hong Kong:

The U.S. Federal Reserve decided Wednesday to cut a key interest rate by half a

percentage point to 1.0 percent to prevent the economy from slipping into deep

recession. Hong Kong:

The U.S. Federal Reserve decided Wednesday to cut a key interest rate by half a

percentage point to 1.0 percent to prevent the economy from slipping into deep

recession.

Leading Hong Kong supermarkets and

wholesale associations said on Wednesday mainland eggs contaminated with

excessive melamine were no longer on sale.

Most Lehman minibonds 'still have value' - Most Lehman Brothers minibonds were

still worth something, Financial Secretary John Tsang Chun-wah said on

Wednesday.

True to his promise, Chief Executive

Donald Tsang Yam-kuen has swiftly set up a special taskforce to tackle the

challenges posed by the global financial meltdown. But while the experience and

expertise of most of its members are not in question, we should not expect it to

offer a panacea. The government needs to be seen to be taking a proactive

stance. The public, however, may reasonably be sceptical of what can be achieved

by a committee of well-connected people. Governments the world over tend to set

up expert taskforces in the face of serious crises as a substitute for real

policy; Hong Kong is particularly adept at playing this game. Certainly the

taskforce has high-quality members. Lawrence Lau Juen-yee, Chinese University's

vice-chancellor, is a distinguished economist. Tycoon Victor Fung Kwok-king is a

seasoned businessman and accomplished finance scholar. And Stephen Roach of

Morgan Stanley has been prescient in his many published analyses of the credit

crisis and proposed solutions. The appointment of Mathias Woo Yan-wai, who is

director of the avant-garde art group Zuni Icosahedron, is more surprising.

Perhaps the idea is to channel his creativity and outside-the-box thinking into

the taskforce. The credit crunch has evolved and will not be resolved quickly.

Thousands of Hong Kong and Pearl River Delta businesses are being exposed

because of the drying up of credit lines. The crisis has been inflicting damage

on the world economy in a way which is unprecedented since the Great Depression.

Though major central banks and finance officials have successfully thrown a

cordon around their banks to protect the system from collapse, the process of

deleveraging continues. This has resulted in terrifying plunges in asset values

and has shocked policymakers in Hong Kong and elsewhere. The new taskforce's

mandate is to help better understand the crisis, consider ways to respond to it,

identify opportunities and enhance the city's competitiveness. But, to be

effective, taskforce members need to react quickly to new problems as they arise

and offer counter-measures. They need to think outside the box. To this end, the

taskforce should be flexible in securing outside expert help and meet regularly.

Above all, it must avoid "white elephant" projects such as Cyberport as well as

the sort of ill-conceived economic policies seen during the Tung Chee-hwa era.

What we need are innovative fiscal measures and policies which will spur growth.

But the road ahead is perhaps not as grim as it looks. Premier Wen Jiabao said

yesterday Hong Kong could rely on the mainland for support. The nation's growth

rate will slow, but is still forecast to be in the high-end of single-digit

growth, which will provide a cushion for Hong Kong. With planning, foresight and

confidence, our community may yet come through this great economic contraction

in relatively good shape. True to his promise, Chief Executive

Donald Tsang Yam-kuen has swiftly set up a special taskforce to tackle the

challenges posed by the global financial meltdown. But while the experience and

expertise of most of its members are not in question, we should not expect it to

offer a panacea. The government needs to be seen to be taking a proactive

stance. The public, however, may reasonably be sceptical of what can be achieved

by a committee of well-connected people. Governments the world over tend to set

up expert taskforces in the face of serious crises as a substitute for real

policy; Hong Kong is particularly adept at playing this game. Certainly the

taskforce has high-quality members. Lawrence Lau Juen-yee, Chinese University's

vice-chancellor, is a distinguished economist. Tycoon Victor Fung Kwok-king is a

seasoned businessman and accomplished finance scholar. And Stephen Roach of

Morgan Stanley has been prescient in his many published analyses of the credit

crisis and proposed solutions. The appointment of Mathias Woo Yan-wai, who is

director of the avant-garde art group Zuni Icosahedron, is more surprising.

Perhaps the idea is to channel his creativity and outside-the-box thinking into

the taskforce. The credit crunch has evolved and will not be resolved quickly.

Thousands of Hong Kong and Pearl River Delta businesses are being exposed

because of the drying up of credit lines. The crisis has been inflicting damage

on the world economy in a way which is unprecedented since the Great Depression.

Though major central banks and finance officials have successfully thrown a

cordon around their banks to protect the system from collapse, the process of

deleveraging continues. This has resulted in terrifying plunges in asset values

and has shocked policymakers in Hong Kong and elsewhere. The new taskforce's

mandate is to help better understand the crisis, consider ways to respond to it,

identify opportunities and enhance the city's competitiveness. But, to be

effective, taskforce members need to react quickly to new problems as they arise

and offer counter-measures. They need to think outside the box. To this end, the

taskforce should be flexible in securing outside expert help and meet regularly.

Above all, it must avoid "white elephant" projects such as Cyberport as well as

the sort of ill-conceived economic policies seen during the Tung Chee-hwa era.

What we need are innovative fiscal measures and policies which will spur growth.

But the road ahead is perhaps not as grim as it looks. Premier Wen Jiabao said

yesterday Hong Kong could rely on the mainland for support. The nation's growth

rate will slow, but is still forecast to be in the high-end of single-digit

growth, which will provide a cushion for Hong Kong. With planning, foresight and

confidence, our community may yet come through this great economic contraction

in relatively good shape.

HK, Guangdong 'should set up

investment firm' - A think-tank close to Chief Executive Donald Tsang Yam-kuen

has proposed that the governments of Guangdong and Hong Kong set up an

investment company to finance cross-border infrastructure projects.

The government put a damper

yesterday on a move in the Legislative Council to scrap the levy on employers of

foreign domestic helpers. Secretary for Labor and Welfare Matthew Cheung Kin-chung

insisted that doing so would have an impact on government spending. Therefore,

he said, the administration would urge Legco president Tsang Yok-sing to rule

out of order any resolution to scrap the levy. Independent lawmaker Regina Ip

Lau Suk-yee had said she was confident the amendment could proceed.

More tainted eggs as hairy crabs cleared -

Eggs sold in a government-run market were found to contain high levels of

melamine, the Centre for Food Safety said, but crustacean lovers will be pleased

to know that hairy crabs are safe - so far. More tainted eggs as hairy crabs cleared -

Eggs sold in a government-run market were found to contain high levels of

melamine, the Centre for Food Safety said, but crustacean lovers will be pleased

to know that hairy crabs are safe - so far.

Travel agencies have appealed to the

Hong Kong Monetary Authority to pressure banks into resuming the policy of

settling credit card payments in two days instead of 60 days or more. Travel agencies have appealed to the

Hong Kong Monetary Authority to pressure banks into resuming the policy of

settling credit card payments in two days instead of 60 days or more.

China:

China's central bank announced on Wednesday it would cut benchmark interest

rates by 0.27 percent to spur economic growth. The move would become effective

on Oct. 30.

China:

China's central bank announced on Wednesday it would cut benchmark interest

rates by 0.27 percent to spur economic growth. The move would become effective

on Oct. 30.

China's southern Guangdong province

and Hong Kong jointly staged a business and technology cooperation conference on

Tuesday in the Spanish capital to boost their business ties with Europe. The

opening ceremony drew some 1,800 businessmen and officials, including Spanish

Minister of Industry, Tourism and Commerce Miguel Sebastian Gascon, Guangdong

Governor Huang Huahua, Chinese Ambassador to Spain Qiu Xiaoqi, Secretary for

Commerce and Economic Development of the Hong Kong Special Administrative Region

Rita Lau. On the first day of the gathering, agreements on 27 projects with a

total value of 2 billion U.S. dollars were signed. Trade between Guangdong and

Spain topped more than 4.9 billion dollars in 2007, accounting for 23.6 percent

of the total trade volume between China and Spain, Huang said in a speech. Spain

is a key EU member and has played a significant role in promoting China-EU

economic and trade cooperation, the governor said. "The Guangdong provincial

government will encourage more import from Spain and support Spanish businesses'

entry into the Chinese market," he said. Guangdong will support the expansion of

cooperation between medium and small Spanish businesses and their Guangdong

counterparts to achieve win-win results, he said. Lau said at the gathering that

Hong Kong has close business links with Spain, with two-way trade totaling 2.2

billion euros (2.8 billion dollars) last year. Nearly 100 Spanish companies have

businesses in Hong Kong, mostly in the financial, logistics, commercial and

fashion industries, Lau said.

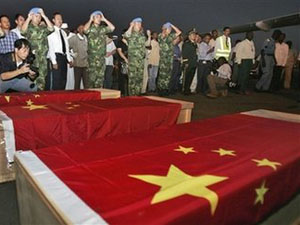

Condemnation can be the only

response to the abduction and killing in cold blood of Chinese oil workers in

Sudan. Their presence was contributing to that country's economic development.

They presumably were not involved in any of the ethnic, separatist or

anti-government movements challenging Sudanese President Omar al-Beshir's rule.

The killings are loathsome; especially so when foreigners are unwittingly

dragged into matters in which they have no part. Who carried out the heinous

crime and why is unclear. Sudan's government has blamed rebels in the troubled

Darfur region, but none of the groups involved has taken responsibility. It

could be that dissidents angry at China's support for General Beshir's

dictatorship were the culprits. There are suggestions that detractors pushing

for the leader to be extradited to The Hague to stand trial on charges of

genocide were involved. No matter how worthy their cause or fervent their

desire, taking the lives of innocents is despicable. Sudan has been wracked by

anti-government unrest for much of its 52 years of independence from Britain and

Egypt. China well knew this when it began exploring and drilling for oil there.

The same is the case in the other unstable parts of the world that Chinese

companies and workers are increasingly moving into. It is because of such risks

that Beijing in 2004 created a Department of External Security Affairs, which is

in part charged with protecting Chinese assets and citizens working abroad.

China's search for energy sources, overseas investment by its companies and

desire to get involved in global diplomacy has correspondingly put its

officials, volunteers, workers and tourists at greater exposure to risk. Chinese

workers have been killed by extremists in Afghanistan, Pakistan, Ethiopia and

now Sudan; a mainland peacekeeper was shot dead during the conflict in south

Lebanon in 2006; countries where Chinese nationals have been abducted for ransom

include Iraq and Nigeria; and anti-Chinese protests have led to the looting of

Chinese-owned factories and shops the world over. When China was isolationist,

such incidents were rare; as its influence grows, they are becoming frequent.

Beijing strictly follows the principle of non-interference in the affairs of

other states. This does not protect its citizens and companies beyond Chinese

shores from political violence. As its foreign investment strategy gets more

aggressive, so, too, will the human price it has to pay. Beijing needs to be

more worldly-wise. It has to do its utmost to protect Chinese citizens and firms

overseas and to ensure that the risks they face are as low as possible.

Sudan seeks missing hostages - Sudan said it was searching for three missing

Chinese oil workers on Tuesday after what Beijing described as a failed attempt

to rescue nine mainland men kidnapped.

Sudan seeks missing hostages - Sudan said it was searching for three missing

Chinese oil workers on Tuesday after what Beijing described as a failed attempt

to rescue nine mainland men kidnapped.

The deputy director of the Supreme

People's Court, Huang Songyou , was among four government officials sacked

yesterday as the fifth session of the 11th National People's Congress Standing

Committee ended. The committee also approved two proposed laws on state-owned

assets and fire prevention. Mr Huang, 51, also lost his title of member of the

judicial committee and judge. The South China Morning Post (SEHK: 0583,

announcements, news) reported two weeks ago that investigators from the

Communist Party's Central Commission for Discipline Inspection had questioned

him on October 15 and searched his office and home. Mr Huang was widely believed

to be involved with financial corruption in Guangdong province, but the court

remained vague on his case yesterday. Standing Committee press bureau chief Kan

Ke also announced at yesterday's press conference that the committee had

"accepted the resignation of Zhu Zhigang , director of the NPC Standing

Committee's budgetary affairs committee". "Zhu Zhigang was suspected of a

serious breach of the law and party rules, and is under investigation," Mr Kan

said, without disclosing the results of the investigation. Mr Zhu was subject to

party disciplinary action for alleged corruption, Xinhua reported yesterday. The

investigation into Mr Zhu had started before the week-long National Day holiday,

but he was not officially put under shuanggui - a form of party investigation -

until last Wednesday, according to Caijing magazine. Two deputies of the 11th

NPC were also expelled yesterday for "involvement in serious corruption". The

two lawmakers are Zhu Siyi , general manager of Yida Fuel Development Limited Co

in Guangdong, and Xie Bing , chairman of Miaodayi Meichu Food Co in Sichuan

province. Zhu Siyi was suspected of offering bribes and Mr Xie was suspected of

fraud, but no other details were given by the NPC. Besides passing amended

versions of laws on fire prevention and state-owned assets, legislators also

reviewed drafts of other laws, including the food safety law. Laws on state

compensation, the postal service and precautions against earthquakes and

disaster reduction were also read and discussed during the session, and

legislators have discussed a State Council plan on improving macroeconomic

controls over financial markets.

Bank of China (3988) said yesterday

its net profit for the third quarter rose 11.5 percent to 17.76 billion yuan

(HK$20.11 billion), broadly in line with expectations, on growing fee income

business.

A vice governor from the central bank will head a group of top mainland bankers

to Taiwan next week as they look for new opportunities in anticipation of an

investment agreement.

Workers check the generating unit 15

on the right bank of the Three Gorges Project in central China's Hubei Province

Oct. 29, 2008. The last turbo-generator completed a 72-hour test run at 9 a.m.

Wednesday, and would be connected to the power grid. Main works of the Three

Gorges Project are a 185-meter-high dam, a five-tier ship lock, and 26

hydropower turbo-generators. The dam has 14 turbo-generators on the left bank

and 12 on the right. Workers check the generating unit 15

on the right bank of the Three Gorges Project in central China's Hubei Province

Oct. 29, 2008. The last turbo-generator completed a 72-hour test run at 9 a.m.

Wednesday, and would be connected to the power grid. Main works of the Three

Gorges Project are a 185-meter-high dam, a five-tier ship lock, and 26

hydropower turbo-generators. The dam has 14 turbo-generators on the left bank

and 12 on the right.

This photo taken on Oct. 28, 2008 shows

the dam of the Three Gorges Project in central China's Hubei Province Oct. 29,

2008. With a budget equivalent to 22.5 billion U.S. dollars, the project is also

a water control system for the upper and middle reaches of the Yangtze, China's

longest waterway. Its functions cover power generation, flood control and

navigation. Main works of the project are a 185-meter-high dam, a five-tier ship

lock, and 26 hydropower turbo-generators. The dam has 14 turbo-generators on the

left bank and 12 on the right. Combined, they will produce 84.7 billion kw of

electricity annually, which would require 40 million to 50 million tons of coal

consumption for a coal-fired station to produce. Plans were expanded further to

include six more turbines by 2012. A ship lift will be finished by 2015. This photo taken on Oct. 28, 2008 shows

the dam of the Three Gorges Project in central China's Hubei Province Oct. 29,

2008. With a budget equivalent to 22.5 billion U.S. dollars, the project is also

a water control system for the upper and middle reaches of the Yangtze, China's

longest waterway. Its functions cover power generation, flood control and

navigation. Main works of the project are a 185-meter-high dam, a five-tier ship

lock, and 26 hydropower turbo-generators. The dam has 14 turbo-generators on the

left bank and 12 on the right. Combined, they will produce 84.7 billion kw of

electricity annually, which would require 40 million to 50 million tons of coal

consumption for a coal-fired station to produce. Plans were expanded further to

include six more turbines by 2012. A ship lift will be finished by 2015.

October 29 2008

Hong Kong:

The central government would support Hong Kong during the global financial

crisis, Premier Wen Jiabao said on Tuesday. Hong Kong:

The central government would support Hong Kong during the global financial

crisis, Premier Wen Jiabao said on Tuesday.

Hong Kong Monetary Authority chief

executive Joseph Yam Chi-kwong said on Tuesday he believed central banks

internationally would continue to lower interest rates.

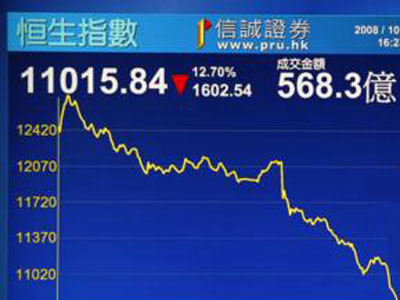

HK shares bounce back, post a 14.4pc

gain on Tuesday, clawing back Monday’s losses and notching up their biggest

one-day gain in 11 years as investors snapped up bargains.

Legco debates taxi fare rises as lawmakers debated increases to taxi fares in

the Legislative Council on Tuesday afternoon, cabbies re-iterated that their

incomes would be seriously affected by the move.

Hong Kong has appointed Morgan Stanley Asia chairman Stephen Roach and Standard

Chartered chairman Mervyn Davies to an economic task force to deal with the

worsening global financial crisis.

The Bauhinia Foundation Research

Centre on Tuesday called for more co-operation between Guangdong and Hong Kong

to create a Pearl River Delta metropolis over the next 20 years. The centre is

an economic and social policy think-tank established in March 2006. In a new

study, the centre said both cities should take advantage of new economic and

social developments in the region. The study was conducted between February and

October with participation by the China Business Centre of Hong Kong Polytechnic

University and China Development Institute of Research in Shenzhen. It

interviewed 100 government officials, specialists, academics and industry

representatives, 30 Hong Kong enterprises, 100 Guangdong enterprises and 2,000

citizens in both cities. The centre noted that the Pearl River Delta Metropolis

covered nine areas – including Hong Kong and Macau. Centre chairman Anthony Wu

Ting-yuk said considerable benefits had resulted from economic developments in

Guangdong and Hong Kong. “The industrialisation in Guangdong and post-industrialisation

in Hong Kong have been accelerated – resulting in a concentration of highly

competitive industries and fostering a cluster of townships in the Pearl River

Delta Region,” he noted. The study predicted the development of a Pearl River

Delta metropolis. This would boost the region’s gross domestic product, trade

and level of investment. However, Mr Wu said there were problems in developing a

metropolis. These included Hong Kong and Guangdong’s differences in legal and

economic systems, and in public administration and social services. Competition

and conflict of interest also existed among cities in the region, he added.

The Jockey Club's racing

operations might go into the red for the first time because of a lower turnover

amid the economic downturn and a "heavy" tax regime, its chief executive said.

Winfried Engelbrecht-Bresges has called for a tax waiver, a review of the tax

structure and an easing of restrictions on betting to plug a likely deficit of

between HK$50 million and HK$100 million. Although the club's charitable

commitments would not be affected in the short term, Mr Engelbrecht-Bresges said

that if the situation continued, the club might have to cut jobs and reduce

donations. The club would also be unable to invest in the future by renovating

its facilities to maintain the appeal of racing in the light of increased

competition from overseas betting operators, he said. "You can't restrain our

business and tax us to death. If there is no change in three to five years'

time, we have to cut jobs. We may not be able to do another Olympics, handle

another Sichuan [earthquake], or help in Tin Shui Wai," he said. As one of Hong

Kong's leading charity providers, the club has funded many projects such as the

Olympic equestrian events, relief efforts in Sichuan and community services for

the poor including those in Tin Shui Wai. Its total charity payout in 2007-08

was HK$1.052 billion, up from HK$1.049 billion in the previous year. Under an

agreement struck with the government in 2006, the club has to pay at least

HK$12.50 out of every HK$100 it receives in bets placed by racing punters,

keeping only HK$5. The remainder is paid out. But Mr Engelbrecht-Bresges said

the agreement to pay at least HK$8 billion each year as betting duty to the

government would be unsustainable because of the drop in turnover as a result of

the financial crisis. Racing turnover has already dropped by 6 per cent compared

with the same period of last season. The club expects that the annual drop in

turnover could reach 10 per cent by the end of the season. If that happened,

then losses could amount to HK$100 million. Although the club's soccer-betting

business is making money, its profit margin has dropped from 17 per cent to 14

per cent. The Mark Six lottery operation could just break even, according to the

club. Under the current agreement, the government takes 50 per cent of profits

from the soccer-betting business. In Mark Six, the club pays a 25 per cent

betting duty after taking a commission, with the remainder going to the

Lotteries Fund. In the light of the gloomy estimates, Mr Engelbrecht-Bresges has

written to Financial Secretary John Tsang Chun-wah requesting greater

flexibility in running events and a change in the way horse racing is heavily

taxed, as the mechanism is due for review next year. Among demands made by the

club were the addition of five race days each year, operating simulcast race

days for overseas racing events, and waiving the betting duty guarantee to allow

for operations during an economic downturn. "We are not going to close down, but

we have to invest for the future," Mr Engelbrecht-Bresges said. A spokeswoman

for the Home Affairs Bureau said that although the government had been in talks

with the Jockey Club over its concerns, the present formula of betting duty was

decided by the legislature and could not be revised without its approval. She

said discussions would continue with the club ahead of the scheduled review of

the tax mechanism but no change was planned for the present season. In the last

racing season, the Jockey Club paid HK$8.17 billion in betting duty for horse

racing. The tax payments for soccer betting and Mark Six were HK$3.1 billion and

HK$1.59 billion respectively. The overall turnover for horse racing was up from

HK$63.8 billion in 2006-07 to HK$66.7 billion last season. Turnover for soccer

betting also rose from HK$30.2 billion in 2005-7 to HK$34.4 billion. The Jockey Club's racing

operations might go into the red for the first time because of a lower turnover

amid the economic downturn and a "heavy" tax regime, its chief executive said.

Winfried Engelbrecht-Bresges has called for a tax waiver, a review of the tax

structure and an easing of restrictions on betting to plug a likely deficit of

between HK$50 million and HK$100 million. Although the club's charitable

commitments would not be affected in the short term, Mr Engelbrecht-Bresges said

that if the situation continued, the club might have to cut jobs and reduce

donations. The club would also be unable to invest in the future by renovating

its facilities to maintain the appeal of racing in the light of increased

competition from overseas betting operators, he said. "You can't restrain our

business and tax us to death. If there is no change in three to five years'

time, we have to cut jobs. We may not be able to do another Olympics, handle

another Sichuan [earthquake], or help in Tin Shui Wai," he said. As one of Hong

Kong's leading charity providers, the club has funded many projects such as the

Olympic equestrian events, relief efforts in Sichuan and community services for

the poor including those in Tin Shui Wai. Its total charity payout in 2007-08

was HK$1.052 billion, up from HK$1.049 billion in the previous year. Under an

agreement struck with the government in 2006, the club has to pay at least

HK$12.50 out of every HK$100 it receives in bets placed by racing punters,

keeping only HK$5. The remainder is paid out. But Mr Engelbrecht-Bresges said

the agreement to pay at least HK$8 billion each year as betting duty to the

government would be unsustainable because of the drop in turnover as a result of

the financial crisis. Racing turnover has already dropped by 6 per cent compared

with the same period of last season. The club expects that the annual drop in

turnover could reach 10 per cent by the end of the season. If that happened,

then losses could amount to HK$100 million. Although the club's soccer-betting

business is making money, its profit margin has dropped from 17 per cent to 14

per cent. The Mark Six lottery operation could just break even, according to the

club. Under the current agreement, the government takes 50 per cent of profits

from the soccer-betting business. In Mark Six, the club pays a 25 per cent

betting duty after taking a commission, with the remainder going to the

Lotteries Fund. In the light of the gloomy estimates, Mr Engelbrecht-Bresges has

written to Financial Secretary John Tsang Chun-wah requesting greater

flexibility in running events and a change in the way horse racing is heavily

taxed, as the mechanism is due for review next year. Among demands made by the

club were the addition of five race days each year, operating simulcast race

days for overseas racing events, and waiving the betting duty guarantee to allow

for operations during an economic downturn. "We are not going to close down, but

we have to invest for the future," Mr Engelbrecht-Bresges said. A spokeswoman

for the Home Affairs Bureau said that although the government had been in talks

with the Jockey Club over its concerns, the present formula of betting duty was

decided by the legislature and could not be revised without its approval. She

said discussions would continue with the club ahead of the scheduled review of

the tax mechanism but no change was planned for the present season. In the last

racing season, the Jockey Club paid HK$8.17 billion in betting duty for horse

racing. The tax payments for soccer betting and Mark Six were HK$3.1 billion and

HK$1.59 billion respectively. The overall turnover for horse racing was up from

HK$63.8 billion in 2006-07 to HK$66.7 billion last season. Turnover for soccer

betting also rose from HK$30.2 billion in 2005-7 to HK$34.4 billion.

Most of the customers who bought

Lehman Brothers’ constellation structured retail notes would lose their entire

principal, DBS Bank (Hong Kong) said on Tuesday .

Billionaire property tycoon Cheng Yu-tung

urged Hongkongers yesterday not to worry too much about the financial crisis,

saying the tumbling stock market would eventually bottom out. Mr Cheng, chairman

of New World Development, said the mainland economy's continued growth would

help Hong Kong ride out the crisis. "I think [we] don't need to worry too much,"

he said. "Hong Kong is lucky to have China because China's economy, according to

Premier Wen [Jiabao ], will grow by a few per cent. The financial [crisis]

doesn't have too much impact on it and if Hong Kong has any [problem], China

will support us." But he said he believed the local economy would be affected by

the economic turmoil for a year or two, and said Hongkongers should unify in

combating it. Saying that small and medium-sized enterprises (SMEs) were

suffering the most, he urged the government to come up with ways to help them.

He said it should also stimulate consumption, boost tourism and speed up the

building of infrastructure to boost the local economy. "It's not that Hong Kong

people don't have money. Hong Kong people are rich, but they don't want to spend

money. Therefore, we need to stimulate the public to spend more," he said. With

land supply limited, Mr Cheng said property prices would not plummet too much,

although he predicted a fall of 10 per cent to 20 per cent next year. He also

said the mainland property market would rebound gradually, When asked how much

his wealth had shrunk because of the stock market slump, Mr Cheng - reportedly

worth US$9.4 billion in January - said he had no problems with his investments.

"Just leave the shares there when they have shrunk," he said. "[The slump] is

like a tsunami so no one can handle it or [could have] guessed that it would

come so quickly. But we will see [the bottom] eventually." The noted

philanthropist, recently awarded the city's top honour - the Grand Bauhinia

Medal - said he would not cut his donations amid the financial crisis. He said

he wanted to continue doing charity work and hoped to "help more people in the

academic and medical fields". Billionaire property tycoon Cheng Yu-tung

urged Hongkongers yesterday not to worry too much about the financial crisis,

saying the tumbling stock market would eventually bottom out. Mr Cheng, chairman

of New World Development, said the mainland economy's continued growth would

help Hong Kong ride out the crisis. "I think [we] don't need to worry too much,"

he said. "Hong Kong is lucky to have China because China's economy, according to

Premier Wen [Jiabao ], will grow by a few per cent. The financial [crisis]

doesn't have too much impact on it and if Hong Kong has any [problem], China

will support us." But he said he believed the local economy would be affected by

the economic turmoil for a year or two, and said Hongkongers should unify in

combating it. Saying that small and medium-sized enterprises (SMEs) were

suffering the most, he urged the government to come up with ways to help them.

He said it should also stimulate consumption, boost tourism and speed up the

building of infrastructure to boost the local economy. "It's not that Hong Kong

people don't have money. Hong Kong people are rich, but they don't want to spend

money. Therefore, we need to stimulate the public to spend more," he said. With

land supply limited, Mr Cheng said property prices would not plummet too much,

although he predicted a fall of 10 per cent to 20 per cent next year. He also

said the mainland property market would rebound gradually, When asked how much

his wealth had shrunk because of the stock market slump, Mr Cheng - reportedly

worth US$9.4 billion in January - said he had no problems with his investments.

"Just leave the shares there when they have shrunk," he said. "[The slump] is

like a tsunami so no one can handle it or [could have] guessed that it would

come so quickly. But we will see [the bottom] eventually." The noted

philanthropist, recently awarded the city's top honour - the Grand Bauhinia

Medal - said he would not cut his donations amid the financial crisis. He said

he wanted to continue doing charity work and hoped to "help more people in the

academic and medical fields".

Bank of East Asia (0023), Hong Kong's third- largest lender by assets, expects a

HK$2.2 billion loss in the second half after disposing of its collateral debt

obligations.

Bank of East Asia (0023), Hong Kong's third- largest lender by assets, expects a

HK$2.2 billion loss in the second half after disposing of its collateral debt

obligations.

HK

dollar offers a port in storm - The Hong Kong dollar became an attractive safe

haven for institutional investors and major companies yesterday as

emerging-market currencies continued to tumble. HK

dollar offers a port in storm - The Hong Kong dollar became an attractive safe

haven for institutional investors and major companies yesterday as

emerging-market currencies continued to tumble.

China:

China’s top offshore oil and gas producer, CNOOC (SEHK: 0883), produced 15.2 per

cent more oil and gas in the third quarter while total revenue rose 69 per cent

to 30.9 billion yuan (HK$35 billion) on higher crude prices.

China:

China’s top offshore oil and gas producer, CNOOC (SEHK: 0883), produced 15.2 per

cent more oil and gas in the third quarter while total revenue rose 69 per cent

to 30.9 billion yuan (HK$35 billion) on higher crude prices.

Global crude oil prices fell from US$140 per barrel in July to US$100 in

September, but they were still higher than the US$70-80 level a year earlier.

State-owned CNOOC is hunting for overseas assets to meet demand from mainland,

the world’s largest oil consumer after the United States. CNOOC and domestic

rival Sinopec, parent of Sinopec Corp (SEHK: 0386), are closing in on buying an

Angolan oil field stake being sold by US energy firm Marathon Oil, a source with

knowledge of the bidding said this month. CNOOC said in a statement that its

overall output rose to 549,589 barrels of oil equivalent per day in the July to

September period. Its average oil selling price was 58.7 per cent higher at

US$106.94 per barrel in the quarter. CNOOC has set a target of producing about

15 per cent more oil and gas to 195-199 million barrels of oil and gas

equivalent this year.

The mainland should issue 3G mobile licences based on the principle of

technology neutrality to end the year-long head start for homegrown TD-SCDMA

mobile technology, according to Frank Meng Pu, the president of Greater China

for 3G mobile technologies developer Qualcomm. Mr Meng said the technology would

mature once it hits the street and competes with rival technologies in the form

of the United States-developed CDMA 2000 EV-DO platform and WCDMA system

developed in Europe. China Mobile (SEHK: 0941, announcements, news) has been

handling the building and operation of a TD-SCDMA 3G commercial trial since

April in 10 cities, including Beijing, Guangzhou and Shanghai. The company will

establish the network in 28 more cities in the second phase of expansion.

According to government figures, about 300,000 users have signed up to the

network since it was launched in April. However, problems such as frequent

technical failures, dropped calls and a lack of coverage have beset a system

that is said to be years behind its rivals. "The government should open the

market. Operators know how to drive the technology under market competition,"

said Mr Meng, adding that if the government really wanted to help TD-SCDMA

become stronger, other systems should not be blocked. "The technology will

improve when it competes with others. Just like the competition between CDMA and

GSM is driving the improvement of these two technologies," Mr Meng said. China

Telecom (SEHK: 0728) and China Unicom (SEHK: 0762, announcements, news) , which

are most likely to adopt CDMA 2000 and WCDMA, still do not have government

approval to build their networks or provide trial services, despite conducting

trial runs. The mainland has given TD-SCDMA a one-year lead over others and

"that's enough of a head start", Mr Meng said. In May, the mainland authorities

said 3G mobile licences would be issued after the completion of the

telecommunications industry restructuring. The reshuffle has resulted in the

formation of three full-service carriers, namely China Telecom, which acquired

China Unicom's CDMA services; China Mobile, which took over China Tietong; and

China Unicom, which merged with China Netcom. Qualcomm has the patents for all

three 3G mobile technologies and has licensing agreements with more than 80

foreign companies. Qualcomm is also a consultant to fixed-line giant China

Telecom for its launch of CDMA services. Mr Meng said China Telecom might take a

year to enhance its network coverage to meet the quality of China Mobile's GSM

network. "China Telecom needs to add new base stations and undertake some

network optimisation projects to improve network quality. This will take a

year." China Telecom has about 100,000 CDMA base stations, compared with China

Mobile's 300,000-plus. Mr Meng said that an independent survey conducted a few

years ago found that the CDMA network had outperformed China Mobile's GSM

network. However, network quality dropped because of a lack of investment by

China Unicom brought on by uncertainties arising from the industry

restructuring. Mr Meng said the latest round of network enhancement would give

China Telecom the capacity to upgrade its existing CDMA network to a 3G or EV-DO

mobile network. "The CDMA technology can enable China Telecom to deploy the CDMA

EV-DO service by only changing some equipment in existing base stations, and

then the company can immediately start providing 3G services," said Mr Meng.

China Telecom, which already provides CDMA services on the 800 megahertz

frequency, should be able to provide 3G services without seeking new bandwidth.

CDMA handset supply would also be key to the success of China Telecom's mobile

business. In excess of 70 CDMA handset models from more than 30 vendors

reportedly featured in China Telecom's recent handset bidding. Mr Meng said he

believed China Telecom could focus on high-spending commercial customers and

low-end users to meet the target of 100 million CDMA users in three years, from

42 million last month. "China Telecom can provide high-speed mobile internet

service based on EV-DO to compete in the high-end segment for higher profits,

while launching low-cost CDMA phones to boost user numbers," he said.

The mainland should issue 3G mobile licences based on the principle of

technology neutrality to end the year-long head start for homegrown TD-SCDMA

mobile technology, according to Frank Meng Pu, the president of Greater China

for 3G mobile technologies developer Qualcomm. Mr Meng said the technology would

mature once it hits the street and competes with rival technologies in the form

of the United States-developed CDMA 2000 EV-DO platform and WCDMA system

developed in Europe. China Mobile (SEHK: 0941, announcements, news) has been