|

Newsletter

Seminar Material

Biz:

China

Hong

Kong Hawaii

What people

said about us

China

Earthquake Relief

Tax &

Government

Hawaii Voter Registration

Biz-Video

Biz-Video

Hawaii's

China Connection Hawaii's

China Connection

CDP#1780962

CDP#1780962

Doing Business in

Hong Kong & China

Doing Business in

Hong Kong & China

| |

Hong Kong, China & Hawaii Biz*

Skype - FREE

Voice Over IP Skype - FREE

Voice Over IP  View Hawaii's China Connection

Video Trailer

View Hawaii's China Connection

Video Trailer

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our event page to find out more!

After

attended a China/Hong Kong Business/Trade Seminar in Hawaii...still unsure what

to do next, contact us, our Officers, Directors and Founding Members are

actively engaged in China/Hong Kong/Asia trade - we can help!

Are you ready to export your product or

service? You will find out in 3 minutes with resources to help you -

enter

to give it a try

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

Nov 27 - 30 2008

Happy Thanksgiving

Hong Kong:

Thousands of passengers were stranded in Hong Kong yesterday as a result of the

closure of Bangkok's Suvarnabhumi international airport. Hong Kong:

Thousands of passengers were stranded in Hong Kong yesterday as a result of the

closure of Bangkok's Suvarnabhumi international airport.

Sun Hung Kai Properties (SEHK: 0016) plans to offer its luxury low-density

residential project in Sha Tin at 35 per cent less than a nearby project,

reflecting growing fears of a slump that will see volumes this month plunge to a

20-year low. As the first new project to go on sale since the collapse of Lehman

Brothers Holdings in September, the sales response would offer clues to the

strength of the primary market, analysts said. SHKP said it would release 20

units at Peak One tomorrow at about HK$7,366 per square foot and would offer

buyers up to 500 days to complete the transaction. Prices for the first batch

are between HK$12.67 million and HK$20.79 million each, or HK$6,801 to HK$8,011

per square foot. The prices are 35 per cent lower than an adjacent project,

Great Hill, built by KWah International Holdings. To compete for buyers, KWah

last Friday reduced prices for two penthouses at Great Hill to HK$10,000 per

square foot, 3.8 per cent lower than the launch.

Sun Hung Kai Properties (SEHK: 0016) plans to offer its luxury low-density

residential project in Sha Tin at 35 per cent less than a nearby project,

reflecting growing fears of a slump that will see volumes this month plunge to a

20-year low. As the first new project to go on sale since the collapse of Lehman

Brothers Holdings in September, the sales response would offer clues to the

strength of the primary market, analysts said. SHKP said it would release 20

units at Peak One tomorrow at about HK$7,366 per square foot and would offer

buyers up to 500 days to complete the transaction. Prices for the first batch

are between HK$12.67 million and HK$20.79 million each, or HK$6,801 to HK$8,011

per square foot. The prices are 35 per cent lower than an adjacent project,

Great Hill, built by KWah International Holdings. To compete for buyers, KWah

last Friday reduced prices for two penthouses at Great Hill to HK$10,000 per

square foot, 3.8 per cent lower than the launch.

A bitter legal battle at late tycoon Henry Fok Ying-tung's company took another

turn yesterday after Ho Ming-sze sued a fellow board member for allegedly

accusing him of destroying the firm's finances - and then hiding the mess by

sacking a senior manager. Mr Ho, the late tycoon's adviser, claimed that Manson

Fok, one of the tycoon's sons, had penned a letter which compared him to some of

the most reviled figures in Chinese history, including the notorious Gang of

Four and Dowager Empress Cixi. That letter was allegedly circulated among

shareholders and other board members at the Fok Ying Tung Ming Yuan Development

Company. The firm was set up to realise the late billionaire's dream of creating

a miniature Hong Kong in the Pearl River Delta, known as Little Nansha. Dr Fok's

alleged accusations included claims that Mr Ho stopped visiting Henry Fok before

his death in 2006 when he realised the billionaire was not mentally fit to sign

documents "for the purpose of transferring property to the plaintiff". The

letter claimed that Mr Ho had been plotting to take over the company's Nansha

development, the lawsuit said. Mr Ho denied the alleged accusations, including

claims that general manager Edward Lam Sik-lau was fired to stop him exposing a

financial catastrophe created by Mr Ho and others involved in the project. Mr

Lam is an uncle of the HK$3.5 billion company's chairman, Michael Fok Hin-keung,

one of the tycoon's sons. "[Mr Ho] has been seriously injured in his character,

credit and reputation, and has suffered considerable hurt and embarrassment,"

said the November 25 claim filed in the High Court. Efforts to reach Manson Fok,

chief of surgery at Macau's Kiang Wu Hospital, for comment on the lawsuit were

unsuccessful. The legal action came about one week after Mr Ho - who resigned as

company chairman on November 6 - filed a separate legal action in a bid to

reverse the decision of the firm's general meeting on the same day to remove

Otto Lin Chui-chau and Ng Sau-shan from the board. Mr Lin is chief executive of

Nansha Information Technology Park and Mr Ng is and aide to Mr Ho. Meanwhile,

the letter, written in Chinese, suggested that Mr Ho and several directors

behaved like the Gang of Four by consolidating their power and then unleashing

disastrous policies that sparked disarray at the company, the lawsuit claimed.

The Gang of Four gained prominence in the Cultural Revolution in the 1960s and

were blamed for a decade of chaos that enveloped China. Mr Ho claimed he was

also compared to the Dowager Empress Cixi, who ordered the execution of rival

politicians during the Qing dynasty (1644-1911). Mr Ho's lawsuit claimed Dr Fok

had an "ulterior motive for revenge" because he was close friends with the fired

manager and had a vested interest in the Nansha development. "[Dr Fok] published

the words maliciously knowing the same to be untrue and/or being reckless as to

their truth or falsity," the claim said, adding that Dr Fok "calculated that the

pecuniary and/or other advantages to himself would outweigh any compensation

[for defamation] that may be awarded to the plaintiff". Unspecified damages are

sought.

A bitter legal battle at late tycoon Henry Fok Ying-tung's company took another

turn yesterday after Ho Ming-sze sued a fellow board member for allegedly

accusing him of destroying the firm's finances - and then hiding the mess by

sacking a senior manager. Mr Ho, the late tycoon's adviser, claimed that Manson

Fok, one of the tycoon's sons, had penned a letter which compared him to some of

the most reviled figures in Chinese history, including the notorious Gang of

Four and Dowager Empress Cixi. That letter was allegedly circulated among

shareholders and other board members at the Fok Ying Tung Ming Yuan Development

Company. The firm was set up to realise the late billionaire's dream of creating

a miniature Hong Kong in the Pearl River Delta, known as Little Nansha. Dr Fok's

alleged accusations included claims that Mr Ho stopped visiting Henry Fok before

his death in 2006 when he realised the billionaire was not mentally fit to sign

documents "for the purpose of transferring property to the plaintiff". The

letter claimed that Mr Ho had been plotting to take over the company's Nansha

development, the lawsuit said. Mr Ho denied the alleged accusations, including

claims that general manager Edward Lam Sik-lau was fired to stop him exposing a

financial catastrophe created by Mr Ho and others involved in the project. Mr

Lam is an uncle of the HK$3.5 billion company's chairman, Michael Fok Hin-keung,

one of the tycoon's sons. "[Mr Ho] has been seriously injured in his character,

credit and reputation, and has suffered considerable hurt and embarrassment,"

said the November 25 claim filed in the High Court. Efforts to reach Manson Fok,

chief of surgery at Macau's Kiang Wu Hospital, for comment on the lawsuit were

unsuccessful. The legal action came about one week after Mr Ho - who resigned as

company chairman on November 6 - filed a separate legal action in a bid to

reverse the decision of the firm's general meeting on the same day to remove

Otto Lin Chui-chau and Ng Sau-shan from the board. Mr Lin is chief executive of

Nansha Information Technology Park and Mr Ng is and aide to Mr Ho. Meanwhile,

the letter, written in Chinese, suggested that Mr Ho and several directors

behaved like the Gang of Four by consolidating their power and then unleashing

disastrous policies that sparked disarray at the company, the lawsuit claimed.

The Gang of Four gained prominence in the Cultural Revolution in the 1960s and

were blamed for a decade of chaos that enveloped China. Mr Ho claimed he was

also compared to the Dowager Empress Cixi, who ordered the execution of rival

politicians during the Qing dynasty (1644-1911). Mr Ho's lawsuit claimed Dr Fok

had an "ulterior motive for revenge" because he was close friends with the fired

manager and had a vested interest in the Nansha development. "[Dr Fok] published

the words maliciously knowing the same to be untrue and/or being reckless as to

their truth or falsity," the claim said, adding that Dr Fok "calculated that the

pecuniary and/or other advantages to himself would outweigh any compensation

[for defamation] that may be awarded to the plaintiff". Unspecified damages are

sought.

Nearly half of the 14,900 stalls managed by the Food and Environmental Hygiene

Department pay 60 per cent or less of the open-market rental, with one in Ngau

Tau Kok Market paying as little as HK$112 a month - only 1 per cent of the

market price. The Director of Audit's report on the management of public markets

found the department recorded a deficit of HK$160 million for its management of

104 public markets across the city, with 24 per cent of stalls vacant. The loss

was not only due to the high vacancy rate but also cheap rentals, with deficits

recorded in some vibrant markets with high patronage. "According to a recent

survey by the Rating and Valuation Department, about 15 per cent of stalls'

tenants were paying full open-market rental," the report said, adding that 48

per cent of the stalls were paying 60 per cent or less of the open-market

rental. It found the low rentals were caused by concessionary rentals offered to

former licensed itinerant hawkers, who on average paid only 6 per cent to 7 per

cent of the open-market rentals for small stalls and 50 per cent for large

stalls. In Ngau Tau Kok Market, a stall owner selling wet goods paid only HK$112

a month, while the market price was HK$11,900. In the same market, a stall owner

selling dry goods paid HK$128 a month but another owner selling similar goods

with the same sized stall paid HK$3,900 a month, the report said. It added that

the cheap rentals were also caused by the 30 per cent across-the board rental

reduction in 1998, during the Asian financial crisis, a subsequent rental freeze

and reduced rentals for stalls that had been vacant for a long time. Thirty-four

markets had a stall vacancy rate of more than 30 per cent, with 11 having 50 per

cent of their stalls vacant. Five years ago the Director of Audit demanded the

department review whether to close down or privatise some public markets. The

report also noted the department had failed to recover the annual HK$11 million

air-conditioning cost from 31 markets and demanded it work out an arrangement to

recover the cost.

Nearly half of the 14,900 stalls managed by the Food and Environmental Hygiene

Department pay 60 per cent or less of the open-market rental, with one in Ngau

Tau Kok Market paying as little as HK$112 a month - only 1 per cent of the

market price. The Director of Audit's report on the management of public markets

found the department recorded a deficit of HK$160 million for its management of

104 public markets across the city, with 24 per cent of stalls vacant. The loss

was not only due to the high vacancy rate but also cheap rentals, with deficits

recorded in some vibrant markets with high patronage. "According to a recent

survey by the Rating and Valuation Department, about 15 per cent of stalls'

tenants were paying full open-market rental," the report said, adding that 48

per cent of the stalls were paying 60 per cent or less of the open-market

rental. It found the low rentals were caused by concessionary rentals offered to

former licensed itinerant hawkers, who on average paid only 6 per cent to 7 per

cent of the open-market rentals for small stalls and 50 per cent for large

stalls. In Ngau Tau Kok Market, a stall owner selling wet goods paid only HK$112

a month, while the market price was HK$11,900. In the same market, a stall owner

selling dry goods paid HK$128 a month but another owner selling similar goods

with the same sized stall paid HK$3,900 a month, the report said. It added that

the cheap rentals were also caused by the 30 per cent across-the board rental

reduction in 1998, during the Asian financial crisis, a subsequent rental freeze

and reduced rentals for stalls that had been vacant for a long time. Thirty-four

markets had a stall vacancy rate of more than 30 per cent, with 11 having 50 per

cent of their stalls vacant. Five years ago the Director of Audit demanded the

department review whether to close down or privatise some public markets. The

report also noted the department had failed to recover the annual HK$11 million

air-conditioning cost from 31 markets and demanded it work out an arrangement to

recover the cost.

The global financial crisis would not stop Hong Kong pushing ahead with major

infrastructure projects, Secretary for Commerce and Economic Development Rita

Lau Ng Wai-lan said on Wednesday. Ms Lau was speaking at a luncheon seminar

organised by the Vancouver Board of Trade. She is in the British Colombian city

as part of an official visit to Canada. “Despite the gloomy global economic

outlook, and an expected budget deficit next year, we will maintain our public

expenditure on infrastructure as well as social services for the disadvantaged,”

Ms Lau said. She said Hong Kong was currently working on important

infrastructure projects. “Within the next two years, we will start the

construction of a new cruise ship terminal at the old Kai Tak Airport site, the

Hong Kong-Zhuhai-Macao Bridge that will span 29.6km across the three cities,” Ms

Lau said. She said the Guangzhou-Shenzhen-Hong Kong Express Rail Link which

would shorten the commute time between Hong Kong and Shenzhen to 14 minutes.

Another project, the West Kowloon Cultural District, would become the arts and

cultural centre of Hong Kong. “We will also continue to reinforce Hong Kong’s

position as a global financial centre, and continue to stick to the principle of

“Big market, Small government” by providing business with the best possible

environment to grow and prosper. The government believed infrastructure projects

will help boost the economy and reduce unemployment during the global financial

crisis. Ms Lau said recent announcement by Premier Wen Jiabao on the US$586

billion (HK$4.5 trillion) investment package further strengthens our confidence

in overcoming the current financial and economic turmoil. “The economic stimulus

in the package ranges from building affordable housing to infrastructural

projects, from advancing development of medical care, culture and education to

ecological and environmental projects,” Ms Lau said. She said Beijing was

determined about promoting and managing growth carefully. “And Hong Kong will

certainly benefit from this,” she added.

Cisco Systems, the world's largest

supplier of networking equipment, has completed its most extensive collaboration

with a local academic institution as it helps launch a new laboratory today for

the Hong Kong Polytechnic University. Researchers at the advanced enterprise

infrastructure laboratory, part of the university's department of computing,

will use a range of networking technologies from Cisco to develop e-commerce,

unified communications and wireless applications that businesses in Hong Kong

could adopt. The project involved more than HK$7 million worth of equipment,

software and services sponsored by United States-based Cisco and partner

Macroview Telecom, a leading networking systems integrator in Hong Kong. Barbara

Chiu Cheuk-mun, the general manager of Cisco's operations in Hong Kong and

Macau, described the facility as "one of Cisco's most significant collaborative

efforts with the education sector in Asia". The laboratory, which has platforms

for fixed-line local area network (LAN), wireless LAN infrastructure, network

security and digital signage systems research, has already started participating

in several major initiatives. One of these projects is called the "Intelligent

Airport", which aims to develop advanced wired and wireless networks for future

airport terminal operations. The effort is being led by scientist Ian White,

head of the school of technology at the University of Cambridge in Britain.

Another project with DHL Global Forwarding aims to design innovative systems for

the logistics industry. "The university believes the emphasis on applied

research will enhance learning, equipping student researchers not only with

professional competency but also practical experience in developing solutions

for use in the real business world," said Henry Chan Chun-bun, an associate

professor in the university's department of computing. Macroview founder and

chief technology officer Tang Pak-hung says the laboratory and "the technical

depth in application programming it provides" will help attract more students to

take up information technology studies. "We hope it will help nurture the future

IT leaders of Hong Kong," said Mr Tang. Cisco Systems, the world's largest

supplier of networking equipment, has completed its most extensive collaboration

with a local academic institution as it helps launch a new laboratory today for

the Hong Kong Polytechnic University. Researchers at the advanced enterprise

infrastructure laboratory, part of the university's department of computing,

will use a range of networking technologies from Cisco to develop e-commerce,

unified communications and wireless applications that businesses in Hong Kong

could adopt. The project involved more than HK$7 million worth of equipment,

software and services sponsored by United States-based Cisco and partner

Macroview Telecom, a leading networking systems integrator in Hong Kong. Barbara

Chiu Cheuk-mun, the general manager of Cisco's operations in Hong Kong and

Macau, described the facility as "one of Cisco's most significant collaborative

efforts with the education sector in Asia". The laboratory, which has platforms

for fixed-line local area network (LAN), wireless LAN infrastructure, network

security and digital signage systems research, has already started participating

in several major initiatives. One of these projects is called the "Intelligent

Airport", which aims to develop advanced wired and wireless networks for future

airport terminal operations. The effort is being led by scientist Ian White,

head of the school of technology at the University of Cambridge in Britain.

Another project with DHL Global Forwarding aims to design innovative systems for

the logistics industry. "The university believes the emphasis on applied

research will enhance learning, equipping student researchers not only with

professional competency but also practical experience in developing solutions

for use in the real business world," said Henry Chan Chun-bun, an associate

professor in the university's department of computing. Macroview founder and

chief technology officer Tang Pak-hung says the laboratory and "the technical

depth in application programming it provides" will help attract more students to

take up information technology studies. "We hope it will help nurture the future

IT leaders of Hong Kong," said Mr Tang.

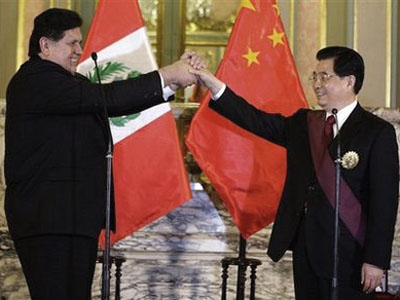

Hong Kong and Peru signed a

Cooperation Arrangement on Trade and Investment Facilitation on Thursday in

Peru, a press release from the Information Services Department of Hong Kong

Special Administrative Region (HKSAR) government said on Friday. According to

the press release, Hong Kong Secretary for Commerce and Economic Development

Rita Lau signed the cooperation arrangement with Peruvian Foreign Trade and

Tourism Minister Mercedes Araoz Fernandez. The signing ceremony took place at

the margins of the Asia Pacific Economic Cooperation's Ministerial Meeting in

Lima, Peru. Lau said both sides had concluded the cooperation arrangement

following the signing of the Joint Statement on Strengthening Trade and Economic

Relations between the two economies on May 30. "The successful signing of the

cooperation arrangement will be instrumental in fostering closer trade and

economic ties between the two sides," she said, adding that the cooperation

arrangement laid the foundation for future discussion of a bilateral free trade

agreement (FTA) between Hong Kong and Peru. The Cooperation Arrangement on Trade

and Investment Facilitation mainly aims to facilitate and promote bilateral

trade in areas including exhibition and trade fairs, financial services,

investment, tourism, rail, maritime and logistics transportation, and sanitary

and phytosanitary measures. It also covers cooperation between the two economies

in areas of intellectual property rights, customs and competition-related

matters, as well as technical assistance and capacity-building in areas of

mutual interests.

Hong Kong's overall staff turnover

rate for the third quarter of this year fell to 4.23 percent, a first quarterly

drop since 2003, according to a manpower statistics survey which was made public

on Tuesday. Conducted by the Hong Kong Institute of Human Resource Management,

the quarterly survey aimed to track manpower movements in the city's labor

market. The survey told that the overall turnover rate for July to September was

0.13 percentage points lower than in the second quarter. This is the first time

that such figure in the third quarter dive since 2003, showing that job seekers

were taking a more cautious approach about job changing.

China:

China has postponed a summit with the European Union next week over a visit to

Europe by the Dalai Lama, the EU said in a statement yesterday.

China:

China has postponed a summit with the European Union next week over a visit to

Europe by the Dalai Lama, the EU said in a statement yesterday.

China dairy giants Mengniu and Yili

say they have recovered to 70 percent of the sales volumes they enjoyed before

the country's tainted-milk scandal broke earlier this year. Mengniu deputy

president Yao Haitao said they were confident sales would be back to normal by

the end of next month or early January. He also revealed they were planning to

build 27 "mega-dairy farms" with 10,000 cows in each in a bid to avoid a repeat

of the scandal. Yao spoke at an exclusive briefing for the Hong Kong and Macau

media in the Chinese dairy capital, Huhhot. He denied reports the scandal had

cost the company three billion yuan (HK$3.39 billion) but said the actual figure

had yet to be finalized. Yao said the company had sufficient funds although

senior management had taken salary cuts of 30 to 50 percent. He admitted Mengniu

applied for help from the central government's 4 trillion yuan financial crisis

bailout package. He said the melamine scandal happened because the chemical that

causes kidney stones was added to raw milk by those selling the milk to the

company. China dairy giants Mengniu and Yili

say they have recovered to 70 percent of the sales volumes they enjoyed before

the country's tainted-milk scandal broke earlier this year. Mengniu deputy

president Yao Haitao said they were confident sales would be back to normal by

the end of next month or early January. He also revealed they were planning to

build 27 "mega-dairy farms" with 10,000 cows in each in a bid to avoid a repeat

of the scandal. Yao spoke at an exclusive briefing for the Hong Kong and Macau

media in the Chinese dairy capital, Huhhot. He denied reports the scandal had

cost the company three billion yuan (HK$3.39 billion) but said the actual figure

had yet to be finalized. Yao said the company had sufficient funds although

senior management had taken salary cuts of 30 to 50 percent. He admitted Mengniu

applied for help from the central government's 4 trillion yuan financial crisis

bailout package. He said the melamine scandal happened because the chemical that

causes kidney stones was added to raw milk by those selling the milk to the

company.

China Southern Airlines (1055) said

yesterday its parent company will get a 3 billion yuan (HK$3.4 billion) capital

injection from the central government, with the money considered to be injected

into the listed entity. The Guangzhou-based carrier said it will suspend trading

of its shares until it receives confirmation from the government. During the

suspension, the company will release weekly progress reports. Meanwhile,

Shanghai-based China Eastern Airlines (0670) disclosed 1.83 billion yuan worth

of jet fuel hedging contract losses after speculative exaggeration of the loss

figure affected its share price. "We believe the jet fuel hedging losses of CSA

and CEA will be much less than Air China, as Air China has more international

flights and bigger exposure to international jet fuel hedging," said Kelvin Lau

at Daiwa Institute of Research. Beijing-based Air China (0753) last week said

its jet fuel hedging contract losses widened to 3.1 billion yuan from 1 billion

yuan in the third quarter. "We believe the government's capital injection plan

is already in the processing stage, which has little to do with the hedging

strategy. The capital injections are to help the carriers pay their debts and

interests," Lau said. In a stock exchange filing, CEA said its mark-to- market

fuel hedging losses amounted to 1.83 billion yuan by October 31, dispelling the

earlier wildly inaccurate speculation of US$690 million (4.7 billion yuan). CSA

did not disclose its jet fuel hedging loss. CEA H-shares yesterday advanced 15.4

percent to close at 75 HK cents, while CSA gained 12 percent to 93 HK cents

before its share suspension. Air China climbed 5.6 percent to end at HK$1.70.

A joint official statement promised on Monday to ensure close supervision of

China's 100 billion yuan (14.7 billion U.S. dollars) stimulus package to prevent

waste and fraud. Two dozen inspection teams will soon be sent to locations

around China to follow projects funded by the package. The inspectors will

"check whether the money is used to build office buildings or guesthouses of

party and government departments," said the central government notice. Projects

built for "image or achievement" that "waste both money and manpower must be

strictly prevented," said the notice, jointly issued by the Communist Party of

China Central Commission for Discipline Inspection, the National Development and

Reform Commission (NDRC), the Ministry of Supervision, the Ministry of Finance

and the National Audit Office. It also asked inspectors to pay close attention

to project quality and stop any "jerry-built projects." Investment in smokestack

industries or those with excess capacity should also be prevented, according to

the notice. The notice put central and local government departments under

scrutiny and asked inspectors to determine if funds were being held up,

misappropriated, intercepted, embezzled or falsely claimed. Emphasizing that the

funds must be used "safely, transparently and efficiently," the notice said

inspectors will check all aspects of fund use, including project planning,

assessment and approval, procurement and construction. "Officials who are found

to be negligent, cheating, taking bribes in fund management or intercepting,

misappropriating and embezzling project funds will receive party or

administrative punishment or even face criminal charges," the notice said. The

notice also asked central government departments to act promptly to implement

the stimulus package. The NDRC must "lose no time" in formulating investment

plans and the Ministry of Finance must allocate money to relevant projects

within one month after the plans were made, according to the notice. Announced

by the State Council (cabinet) on Nov. 9 as an additional central government

investment this year, the 100 billion yuan package is expected to be used in

social welfare projects, infrastructure construction, environmental protection

and industrial restructuring.

China’s central bank announced on Wednesday a steep cut in its interest rates –

by four times the usual margin – in a signal that it would pull out all the

stops to boost weakening economic growth. The benchmark one-year lending and

deposit rates will both be reduced by 108 basis points, compared with the usual

27 basis points in mainland rate cuts, the People’s Bank of China said. “It

means the government is moving on more fronts to stimulate growth,” said Stephen

Green, a Shanghai-based economist with Standard Chartered Bank. It was Beijing’s

fourth interest rate cut since mid-September. Earlier this month, mainland

announced an unprecedented 4 trillion yuan (HK$4.5 trillion) spending package to

lift the economy, which grew at its slowest pace in five years last quarter. The

central bank move came a day after the World Bank said it expected mainland’s

economy to grow by 7.5 per cent next year, a 19-year low. After the rate cut

which comes into effect from Thursday, one-year lending rates in mainland will

be 5.58 per cent, while one-year deposit rates will drop as low as 2.52 per

cent. With inflation at 4 per cent in October, it means that borrowing money

from the bank is currently very cheap. At the same time, putting money in the

bank will be a guaranteed way to lose cash, providing the mainlanders with a

strong incentive to spend and thus boost domestic consumption. “They are

continuing what is the best policy prescription in these times, which is

increased fiscal spending and easier monetary policy. This is a good move,” said

Patrick Bennett, Asia foreign exchange and rates strategist with Societe

Generale in Hong Kong. “China is out to save itself here. The rest of Asia is

strong, but all policy makers in the region and on the planet need to take their

own steps. China is showing good leadership by what it has done.” Like other

countries, mainland has watched its economy slow dramatically since the

bankruptcy of Lehman Brothers in mid-September opened a new, dark chapter in the

financial crisis, shaking confidence and prompting banks to cut credit lines.

The PBOC said the easing, which follows interest rate cuts on October 29,

October 8 and September 15, was meant to ensure sufficient liquidity in the

banking system to ensure growth. To that end, it also carried out big cuts in

banks’ reserve requirements. The ratio for big banks will decrease by 1

percentage point, while that for smaller banks will be cut by 2 percentage

points, effective December 5. The five biggest banks will have to hold 16.0 per

cent of their deposits in reserve at the PBOC, down from 17.0 per cent. The

requirement for other lenders drops to 14.0 per cent from 16.0 per cent. “All my

colleagues were shocked by such a big easing. It signals the government may

believe the economic situation is really serious for it to call for such a

drastic move,” said Liu Dongliang, a currency analyst at China Merchants Bank (SEHK:

3968) in Shenzhen. “No doubt it will be negative for the yuan’s exchange rate in

the medium and long run, though the central bank may work to keep the currency

stable in coming days.”

China’s central bank announced on Wednesday a steep cut in its interest rates –

by four times the usual margin – in a signal that it would pull out all the

stops to boost weakening economic growth. The benchmark one-year lending and

deposit rates will both be reduced by 108 basis points, compared with the usual

27 basis points in mainland rate cuts, the People’s Bank of China said. “It

means the government is moving on more fronts to stimulate growth,” said Stephen

Green, a Shanghai-based economist with Standard Chartered Bank. It was Beijing’s

fourth interest rate cut since mid-September. Earlier this month, mainland

announced an unprecedented 4 trillion yuan (HK$4.5 trillion) spending package to

lift the economy, which grew at its slowest pace in five years last quarter. The

central bank move came a day after the World Bank said it expected mainland’s

economy to grow by 7.5 per cent next year, a 19-year low. After the rate cut

which comes into effect from Thursday, one-year lending rates in mainland will

be 5.58 per cent, while one-year deposit rates will drop as low as 2.52 per

cent. With inflation at 4 per cent in October, it means that borrowing money

from the bank is currently very cheap. At the same time, putting money in the

bank will be a guaranteed way to lose cash, providing the mainlanders with a

strong incentive to spend and thus boost domestic consumption. “They are

continuing what is the best policy prescription in these times, which is

increased fiscal spending and easier monetary policy. This is a good move,” said

Patrick Bennett, Asia foreign exchange and rates strategist with Societe

Generale in Hong Kong. “China is out to save itself here. The rest of Asia is

strong, but all policy makers in the region and on the planet need to take their

own steps. China is showing good leadership by what it has done.” Like other

countries, mainland has watched its economy slow dramatically since the

bankruptcy of Lehman Brothers in mid-September opened a new, dark chapter in the

financial crisis, shaking confidence and prompting banks to cut credit lines.

The PBOC said the easing, which follows interest rate cuts on October 29,

October 8 and September 15, was meant to ensure sufficient liquidity in the

banking system to ensure growth. To that end, it also carried out big cuts in

banks’ reserve requirements. The ratio for big banks will decrease by 1

percentage point, while that for smaller banks will be cut by 2 percentage

points, effective December 5. The five biggest banks will have to hold 16.0 per

cent of their deposits in reserve at the PBOC, down from 17.0 per cent. The

requirement for other lenders drops to 14.0 per cent from 16.0 per cent. “All my

colleagues were shocked by such a big easing. It signals the government may

believe the economic situation is really serious for it to call for such a

drastic move,” said Liu Dongliang, a currency analyst at China Merchants Bank (SEHK:

3968) in Shenzhen. “No doubt it will be negative for the yuan’s exchange rate in

the medium and long run, though the central bank may work to keep the currency

stable in coming days.”

Visitors look at a Cadillac

Escalade SUV at the Auto China 2008 auto show in Beijing earlier this year. With

the global economy slowing down, makers of luxury goods are hoping the mainland

shoppers will rescue them with their spending. Visitors look at a Cadillac

Escalade SUV at the Auto China 2008 auto show in Beijing earlier this year. With

the global economy slowing down, makers of luxury goods are hoping the mainland

shoppers will rescue them with their spending.

Fred Nauleau in his cellar in Manas -

Fred Nauleau, late of the Loire Valley, blinks up at the relentless sun above

his adopted home of Manas, beside the snowcapped Tian Shan mountains. He's

standing amid giant new warehouses and processing facilities - the boxy,

workaday headquarters of a winemaking empire that he has helped build in less

than a decade from his redoubt in the western reaches of the mainland. It's an

ambitious project in a nation where most people still call the unfamiliar drink

"red liquor". "In 2000, most of these buildings weren't here," says Nauleau, a

phlegmatic and compact 42-year-old with bright blue eyes and a shock of unruly

brown curls. "In the beginning, it was quite difficult." The fertile plains of

Xinjiang province - closer culturally and geographically to Istanbul than

Beijing - have lured speculators since the days of the Silk Road. Nauleau is

part of a new generation of adventurers who are gambling that its land can

produce top wines. They're betting on geography: Xinjiang, more than three times

the size of France, sprawls across the 45th parallel, which slices through

Bordeaux, Piedmont and Oregon. Xinjiang's temperate climate produces vast fields

of sunflowers and cotton, as well as table grapes and melons renowned for their

sweetness. Xinjiang produces enough tomatoes not only to feed China but also to

send to Italy. Nauleau is the winemaker at Vini-Suntime International, which

bills itself as the largest wine producer in Asia. It has 10,117 hectares of

vineyards on the mainland, six wineries, and a total bottling capacity of 200

tonnes of wine per day. Some of that wine is sold in the US under the label

China Silk, which was launched in 2006. It is sold in 14 states and expected to

be available nationwide by the end of next year, according to Vini-Suntime's

president, Steve Clarke. Most of the company's product is consumed on the

mainland, which has begun to look beyond its traditional favourites - beer and a

ferocious grain alcohol known as baijiu - to drink more wine, including some of

the world's best. In a sign of growing interest among Chinese collectors, Hong

Kong earlier this year scrapped its tax on wine and later held a record-breaking

wine auction. In January, a mainland company bought a Bordelais chateau called

Latour-Laguens, the first acquisition of its kind by a Chinese firm. In May,

British wine merchant Berry Bros & Rudd released a report predicting that in 50

years China will be the world's leading supplier of wine, including cabernet

sauvignon and chardonnay to rival French offerings. Some question the scale of

that prediction, although China's 1.3 billion consumers, with a proud culinary

culture, make the country an important new player. China's 400 winemakers

already make the mainland the world's sixth-largest producer, ahead of Chile and

South Africa. Outside China, however, there is little knowledge of the country's

brands, which include Dragon's Hollow, Grace Vineyard, Great Wall, Chateau

Junding, Catai and China Silk. The greatest challenge for Chinese winemakers,

however, is not quantity. "The joke about Chinese wine was always, `Have you

tried Chinese wine - leaded or unleaded?'" says Jim Boyce, a Canadian who lives

in Beijing and runs Grapewallof china.com, a blog covering the country's growing

market and production. Many of China's wines are unsatisfying to western

palates. "Very, very thin, not quite clean, red Bordeaux," wrote critic Jancis

Robinson about wine she tasted on visits in 2002 and 2003. Since then, Chinese

wines have been slow to improve because high-end buyers look abroad, and

ordinary mainlanders have so little experience of wine that they're content to

buy the cruder offerings. "The incentive for improving the wine is quite light,"

Boyce says. "But I think improvement is coming. Chinese people pick up trends

very quickly and they get sophisticated about new things very quickly. You are

already seeing that in the number of wine bars opening up." China has a longer

connection with wine than is commonly believed to be the case. In 2004,

scientist Patrick McGovern of the University of Pennsylvania uncovered what he

called the world's earliest evidence of deliberate winemaking, from a Neolithic

village named Jiahu, in Henan province. That find, which dated from between

6,000BC and 7,000BC, replaced what McGovern had previously considered the oldest

evidence of winemaking, from about 5,400BC in what is now northwestern Iran.

Wine fell out of favour in 20th-century China, but Xinjiang continued to produce

a variety of table grapes and raisins. Modern winemaking began only in the late

1970s after Deng Xiaoping launched China down the path of reform. The new

industry attracted some surprising entrants. Vini-Suntime was founded in 1998

with the backing of a conglomerate that owns everything from coal fields to

hotels to petrol plants. From the beginning, it had a global outlook: it

imported technology from France, Italy, the US, Germany and Switzerland, and

exported bulk wine to the US, France, Cuba and other countries. Desks in the

sales department are piled with books with titles such as Speaking Russian and

Speaking Japanese. Lured by the prospect of travel, Nauleau arrived in 2000

after a career in vineyards and wine labs in France. He was no stranger to

developing countries, having previously helped get wineries off the ground in

Bulgaria. But he was taken aback by what he found on the mainland. "The workers

were very young. They had experience in the baijiu industry or fermentation, but

not in wine," he says. "I had to show them how to connect a pump. I installed my

desk in the cellar and had a big whiteboard and said, `OK, you have to connect

the A8 to B10 and so on'. "I stayed here because I was so surprised with the

quality of the grapes," he says. He learned Putonghua, met and married a woman

from the area and, except for three years back in France, he has remained ever

since in Manas, a low-rise town about an hour's drive from Urumqi, the

provincial capital. It's not quite Bordeaux. Xinjiang sits farther from the sea

than almost any place on the planet. That makes the climate drier and prone to

more dramatic swings than other winegrowing regions. Many of China's wine

producers are based in Shandong, on the eastern coast. But even there they are

beset by vine diseases in the damp and humid climate. Nauleau and other Xinjiang

winemakers have come to see their location as an ideal place to develop Chinese

wine. "We have less than 200mm of rain a year. That means we rely on irrigation,

and the water comes mostly from the Tian Shan mountains. So we can control the

amount of water," he says. "The grapes are sweeter because of the difference in

temperature between the day and night. And there are more than 1,600 hours of

sunlight per year. Because the climate is dry, there are very few pests, so no

need for pesticides."bWinery worker Ding Fanhua, 24, knew little of wine before

he landed his job, and now helps oversee a crop made up of varieties found in

Bordeaux: cabernet sauvignon, merlot, syrah and cabernet franc. "There was a lot

of snow last year, so the grape output this year will be down," Ding says,

crouching to examine some small plump fruit. "This year the weather is hot and

there is little rain, so the grape colour and sugar level will be good." A

glimpse of the future of Chinese wine can be seen in Nauleau's cellar, where he

has cabernet sauvignon and merlot ageing for at least one year in barrels made

of French and American oak. Some of that wine ends up in France, mostly in

Chinese restaurants. When he returns to France for visits, he is proud to offer

fellow winemakers his creations. "I buy them a bottle and they are quite

surprised," he says. "They don't know - nobody knows - about Chinese wine, that

it can be good." Fred Nauleau in his cellar in Manas -

Fred Nauleau, late of the Loire Valley, blinks up at the relentless sun above

his adopted home of Manas, beside the snowcapped Tian Shan mountains. He's

standing amid giant new warehouses and processing facilities - the boxy,

workaday headquarters of a winemaking empire that he has helped build in less

than a decade from his redoubt in the western reaches of the mainland. It's an

ambitious project in a nation where most people still call the unfamiliar drink

"red liquor". "In 2000, most of these buildings weren't here," says Nauleau, a

phlegmatic and compact 42-year-old with bright blue eyes and a shock of unruly

brown curls. "In the beginning, it was quite difficult." The fertile plains of

Xinjiang province - closer culturally and geographically to Istanbul than

Beijing - have lured speculators since the days of the Silk Road. Nauleau is

part of a new generation of adventurers who are gambling that its land can

produce top wines. They're betting on geography: Xinjiang, more than three times

the size of France, sprawls across the 45th parallel, which slices through

Bordeaux, Piedmont and Oregon. Xinjiang's temperate climate produces vast fields

of sunflowers and cotton, as well as table grapes and melons renowned for their

sweetness. Xinjiang produces enough tomatoes not only to feed China but also to

send to Italy. Nauleau is the winemaker at Vini-Suntime International, which

bills itself as the largest wine producer in Asia. It has 10,117 hectares of

vineyards on the mainland, six wineries, and a total bottling capacity of 200

tonnes of wine per day. Some of that wine is sold in the US under the label

China Silk, which was launched in 2006. It is sold in 14 states and expected to

be available nationwide by the end of next year, according to Vini-Suntime's

president, Steve Clarke. Most of the company's product is consumed on the

mainland, which has begun to look beyond its traditional favourites - beer and a

ferocious grain alcohol known as baijiu - to drink more wine, including some of

the world's best. In a sign of growing interest among Chinese collectors, Hong

Kong earlier this year scrapped its tax on wine and later held a record-breaking

wine auction. In January, a mainland company bought a Bordelais chateau called

Latour-Laguens, the first acquisition of its kind by a Chinese firm. In May,

British wine merchant Berry Bros & Rudd released a report predicting that in 50

years China will be the world's leading supplier of wine, including cabernet

sauvignon and chardonnay to rival French offerings. Some question the scale of

that prediction, although China's 1.3 billion consumers, with a proud culinary

culture, make the country an important new player. China's 400 winemakers

already make the mainland the world's sixth-largest producer, ahead of Chile and

South Africa. Outside China, however, there is little knowledge of the country's

brands, which include Dragon's Hollow, Grace Vineyard, Great Wall, Chateau

Junding, Catai and China Silk. The greatest challenge for Chinese winemakers,

however, is not quantity. "The joke about Chinese wine was always, `Have you

tried Chinese wine - leaded or unleaded?'" says Jim Boyce, a Canadian who lives

in Beijing and runs Grapewallof china.com, a blog covering the country's growing

market and production. Many of China's wines are unsatisfying to western

palates. "Very, very thin, not quite clean, red Bordeaux," wrote critic Jancis

Robinson about wine she tasted on visits in 2002 and 2003. Since then, Chinese

wines have been slow to improve because high-end buyers look abroad, and

ordinary mainlanders have so little experience of wine that they're content to

buy the cruder offerings. "The incentive for improving the wine is quite light,"

Boyce says. "But I think improvement is coming. Chinese people pick up trends

very quickly and they get sophisticated about new things very quickly. You are

already seeing that in the number of wine bars opening up." China has a longer

connection with wine than is commonly believed to be the case. In 2004,

scientist Patrick McGovern of the University of Pennsylvania uncovered what he

called the world's earliest evidence of deliberate winemaking, from a Neolithic

village named Jiahu, in Henan province. That find, which dated from between

6,000BC and 7,000BC, replaced what McGovern had previously considered the oldest

evidence of winemaking, from about 5,400BC in what is now northwestern Iran.

Wine fell out of favour in 20th-century China, but Xinjiang continued to produce

a variety of table grapes and raisins. Modern winemaking began only in the late

1970s after Deng Xiaoping launched China down the path of reform. The new

industry attracted some surprising entrants. Vini-Suntime was founded in 1998

with the backing of a conglomerate that owns everything from coal fields to

hotels to petrol plants. From the beginning, it had a global outlook: it

imported technology from France, Italy, the US, Germany and Switzerland, and

exported bulk wine to the US, France, Cuba and other countries. Desks in the

sales department are piled with books with titles such as Speaking Russian and

Speaking Japanese. Lured by the prospect of travel, Nauleau arrived in 2000

after a career in vineyards and wine labs in France. He was no stranger to

developing countries, having previously helped get wineries off the ground in

Bulgaria. But he was taken aback by what he found on the mainland. "The workers

were very young. They had experience in the baijiu industry or fermentation, but

not in wine," he says. "I had to show them how to connect a pump. I installed my

desk in the cellar and had a big whiteboard and said, `OK, you have to connect

the A8 to B10 and so on'. "I stayed here because I was so surprised with the

quality of the grapes," he says. He learned Putonghua, met and married a woman

from the area and, except for three years back in France, he has remained ever

since in Manas, a low-rise town about an hour's drive from Urumqi, the

provincial capital. It's not quite Bordeaux. Xinjiang sits farther from the sea

than almost any place on the planet. That makes the climate drier and prone to

more dramatic swings than other winegrowing regions. Many of China's wine

producers are based in Shandong, on the eastern coast. But even there they are

beset by vine diseases in the damp and humid climate. Nauleau and other Xinjiang

winemakers have come to see their location as an ideal place to develop Chinese

wine. "We have less than 200mm of rain a year. That means we rely on irrigation,

and the water comes mostly from the Tian Shan mountains. So we can control the

amount of water," he says. "The grapes are sweeter because of the difference in

temperature between the day and night. And there are more than 1,600 hours of

sunlight per year. Because the climate is dry, there are very few pests, so no

need for pesticides."bWinery worker Ding Fanhua, 24, knew little of wine before

he landed his job, and now helps oversee a crop made up of varieties found in

Bordeaux: cabernet sauvignon, merlot, syrah and cabernet franc. "There was a lot

of snow last year, so the grape output this year will be down," Ding says,

crouching to examine some small plump fruit. "This year the weather is hot and

there is little rain, so the grape colour and sugar level will be good." A

glimpse of the future of Chinese wine can be seen in Nauleau's cellar, where he

has cabernet sauvignon and merlot ageing for at least one year in barrels made

of French and American oak. Some of that wine ends up in France, mostly in

Chinese restaurants. When he returns to France for visits, he is proud to offer

fellow winemakers his creations. "I buy them a bottle and they are quite

surprised," he says. "They don't know - nobody knows - about Chinese wine, that

it can be good."

Energy: Nuclear and wind power to get

subsidy - A wind power plant in Inner Mongolia in this photo taken on September

30, 2008. The Chinese government will subsidize China's top nuclear and wind

power providers with $11.76 million by the end of 2008. The central government

has decided to allocate 800 million yuan ($11.76 million) by the end of this

year to subsidize China's top nuclear and wind power providers, China Radio

International reported. The improvement is part of the government's 100 billion

yuan additional fiscal package, which should be spent by the end of this

quarter, to prevent an excessive economic slowdown. "The subsidy is mainly

targeted at key technology for national nuclear power and wind turbine

producers", said Huang Li, a deputy-director in energy saving at the National

Energy Administration. Huang expected the move could promote localization of the

technology for nuclear and wind power generation. Energy: Nuclear and wind power to get

subsidy - A wind power plant in Inner Mongolia in this photo taken on September

30, 2008. The Chinese government will subsidize China's top nuclear and wind

power providers with $11.76 million by the end of 2008. The central government

has decided to allocate 800 million yuan ($11.76 million) by the end of this

year to subsidize China's top nuclear and wind power providers, China Radio

International reported. The improvement is part of the government's 100 billion

yuan additional fiscal package, which should be spent by the end of this

quarter, to prevent an excessive economic slowdown. "The subsidy is mainly

targeted at key technology for national nuclear power and wind turbine

producers", said Huang Li, a deputy-director in energy saving at the National

Energy Administration. Huang expected the move could promote localization of the

technology for nuclear and wind power generation.

Nov 26 2008

Hong Kong:

The central government should allow a wider range of companies to sell yuan debt

in Hong Kong to promote wider use of its currency in global markets, said Joseph

Yam Chi-kwong, the chief executive of the Hong Kong Monetary Authority. "It's a

good time to further internationalise [the yuan] business," he said yesterday in

Beijing after meetings with mainland government officials. "For example, we can

expand the [yuan] bond issuances in Hong Kong, extending them to more buyers and

issuing institutions and allowing the volume of the bonds to be more

market-oriented." Yuan bond sales in Hong Kong have so far been limited to

financial institutions. Mainland non-financial companies, including property

developer China Vanke and power producer China Datang Corp, have sold 159.6

billion yuan (HK$181.2 billion) of local currency bonds in the country this

year, up 49 per cent from a year earlier, data shows. Central government and

Hong Kong authorities had been discussing the possibility of using yuan for

trade settlement between Hong Kong and the mainland, Mr Yam said. He said the

mainland and Hong Kong should strengthen co-operation in capital markets as the

global financial crisis deepened. Mr Yam last week announced that the mainland

branches of Hong Kong banks could pledge collateral to seek cash from the

People's Bank of China if needed. The so-called "through train" plan for

mainland individuals to buy Hong Kong stocks was not talked about, Mr Yam added.

Meanwhile, he said the HKMA and the Federation of Hong Kong Industries planned

to visit Guangdong, and meet local banking regulators, a move aimed at helping

small and medium-sized enterprises to obtain financing on the mainland.

"Cross-border co-operation is important in view of increasing cross-border

activities," he said. Separately, a Hong Kong Association of Banks delegation

concluded a two-day visit to Beijing on Monday. Association chairman He Guangbei

said the mainland central bank and financial regulators had shown their support

to Hong Kong and looked at whether there were any measures to help the city's

capital market. Hong Kong:

The central government should allow a wider range of companies to sell yuan debt

in Hong Kong to promote wider use of its currency in global markets, said Joseph

Yam Chi-kwong, the chief executive of the Hong Kong Monetary Authority. "It's a

good time to further internationalise [the yuan] business," he said yesterday in

Beijing after meetings with mainland government officials. "For example, we can

expand the [yuan] bond issuances in Hong Kong, extending them to more buyers and

issuing institutions and allowing the volume of the bonds to be more

market-oriented." Yuan bond sales in Hong Kong have so far been limited to

financial institutions. Mainland non-financial companies, including property

developer China Vanke and power producer China Datang Corp, have sold 159.6

billion yuan (HK$181.2 billion) of local currency bonds in the country this

year, up 49 per cent from a year earlier, data shows. Central government and

Hong Kong authorities had been discussing the possibility of using yuan for

trade settlement between Hong Kong and the mainland, Mr Yam said. He said the

mainland and Hong Kong should strengthen co-operation in capital markets as the

global financial crisis deepened. Mr Yam last week announced that the mainland

branches of Hong Kong banks could pledge collateral to seek cash from the

People's Bank of China if needed. The so-called "through train" plan for

mainland individuals to buy Hong Kong stocks was not talked about, Mr Yam added.

Meanwhile, he said the HKMA and the Federation of Hong Kong Industries planned

to visit Guangdong, and meet local banking regulators, a move aimed at helping

small and medium-sized enterprises to obtain financing on the mainland.

"Cross-border co-operation is important in view of increasing cross-border

activities," he said. Separately, a Hong Kong Association of Banks delegation

concluded a two-day visit to Beijing on Monday. Association chairman He Guangbei

said the mainland central bank and financial regulators had shown their support

to Hong Kong and looked at whether there were any measures to help the city's

capital market.

Taxi drivers are ready to surrender their

hard-fought fuel price fare rise after the average price for LPG fell below HK$3

a litre yesterday for the first time in almost two years. Taxi drivers are ready to surrender their

hard-fought fuel price fare rise after the average price for LPG fell below HK$3

a litre yesterday for the first time in almost two years.

The Hang Lung Group (SEHK: 0010) has no

plans to fire staff but may cut pay, starting with management, the property

group's chairman said yesterday. Ronnie Chan Chi-chung, speaking after the China

Economic and Business Forum 2008 at Hong Kong Polytechnic University, said Hang

Lung was still hiring trainees, but may cut salaries as property sales had been

lagging. "The first thing I can tell you is - this year the salaries of our four

executive directors are going to be colder than water. Of course, ours are going

to be cut first. It was like this last time. When performance was poor, we cut

[salaries]. When times are bad, cutting salaries - I think that's very

reasonable," he said. The group will decide later whether to give out bonuses.

With no debts and up to HK$6 billion in reserves, the company was in good stead,

Mr Chan said, and planned to start projects on the mainland next year. Last

week, Cathay Pacific (SEHK: 0293) slashed bonuses, usually a month's salary, by

half or to HK$8,000, whichever was greater, while raising salaries by an average

2 per cent for its 13,160 employees. Dragonair adjusted salaries according to

staff pay scales. Sauce maker Lee Kum Kee has cut 30 jobs, Li & Fung has fired

150 staff, ATV 47, and the Las Vegas Sands Resort 4,000. The Hang Lung Group (SEHK: 0010) has no

plans to fire staff but may cut pay, starting with management, the property

group's chairman said yesterday. Ronnie Chan Chi-chung, speaking after the China

Economic and Business Forum 2008 at Hong Kong Polytechnic University, said Hang

Lung was still hiring trainees, but may cut salaries as property sales had been

lagging. "The first thing I can tell you is - this year the salaries of our four

executive directors are going to be colder than water. Of course, ours are going

to be cut first. It was like this last time. When performance was poor, we cut

[salaries]. When times are bad, cutting salaries - I think that's very

reasonable," he said. The group will decide later whether to give out bonuses.

With no debts and up to HK$6 billion in reserves, the company was in good stead,

Mr Chan said, and planned to start projects on the mainland next year. Last

week, Cathay Pacific (SEHK: 0293) slashed bonuses, usually a month's salary, by

half or to HK$8,000, whichever was greater, while raising salaries by an average

2 per cent for its 13,160 employees. Dragonair adjusted salaries according to

staff pay scales. Sauce maker Lee Kum Kee has cut 30 jobs, Li & Fung has fired

150 staff, ATV 47, and the Las Vegas Sands Resort 4,000.

Hong Kong's economy could shrink

during the whole of next year for the first time since the Asian financial

crisis in 1998, according to a forecast by the Bank of China (Hong Kong). Its

estimate of a 1 per cent contraction is far more pessimistic than most

forecasts, which predict average growth of about 1 per cent next year. However,

Fitch Ratings earlier slashed its forecast from growth of 4.5 per cent to a 1.2

per cent contraction. The government also said the risk of recession persisting

through next year had increased as the global economic downturn showed no sign

of ending. Government data showed the economy shrank 1.4 per cent in the third

quarter, after a fall of 0.5 per cent in the previous quarter. A recession is

usually defined as two consecutive quarters of economic contraction. In its

monthly economic review, the bank predicted that the most difficult times would

come in the first half of the year, adding that the recession would probably

extend into the second half if the global woes turned out to be more severe than

estimated. "In this case, the Hong Kong economy could slip into negative

territory on the full-year basis for the first time since 1998, registering a

minus 1 per cent contraction," it said. It predicted that by the end of next

year, the unemployment rate would probably rise to 5.5 per cent or more, up from

the bank's estimate of 4 per cent at the end of this year. The bank revised its

prediction for growth this year down to 2.9 per cent. The government has cut its

full-year growth forecast to between 3 and 3.5 per cent from 4 to 5 per cent. In

its third-quarter economic report released yesterday, the government said:

"Economic conditions are likely to be difficult in early 2009, and the prospect

of a turnaround in the latter part of 2009 remains highly uncertain." The

administration expected domestic demand to slow, while the performance of

exports was likely to remain lacklustre. Meanwhile, speaking at a public

function last night, Financial Secretary John Tsang Chun-wah laid down three

principles for his budget next year: creating jobs, enhancing the city's

competitiveness, and introducing policies to maintain sustainable economic

development. He began meeting lawmakers yesterday to hear their views on ways to

tackle the financial crisis. The Liberal Party and the Hong Kong Federation of

Trade Unions proposed distributing shopping vouchers to stimulate domestic

consumption. The FTU suggested everyone be given HK$2,000 in vouchers quarterly

or every six months. Lawmaker Paul Chan Mo-po, who represents the accountancy

sector, said the scheme should target a specific group instead of everyone.

About 6,000 shops will pay only half

their normal rent in January and February, courtesy of their landlord the

Housing Authority. The authority's Commercial Properties Committee decided on

the temporary measure yesterday to help tenants in its shopping malls cope with

the economic downturn. The Link Management, meanwhile, which in recent weeks had

resisted pressure to cut rents, reiterated that its top priority was to attract

more shoppers to its malls and to persuade them to spend more.

More than half the Hong Kong people

nearing retirement are postponing making the big leap due to insufficient

savings, a survey conducted by insurer Aviva has found. "It may seem tempting to

delay or suspend saving up for retirement during these difficult economic

conditions, but we urge people to take a longer term view," Aviva Hong Kong

managing director Simon Phipps said. In a sample of 1,000 people in Hong Kong,

55 percent of them expected they could not retire from work at age 65 - the

normal retirement age - due to inadequate savings. The same percentage expressed

regret at not having taken action sooner to prepare for retirement.

Chinese People's Liberation Army troops stand in their formation during troop

rotation at a barrack in Hong Kong, south China, Nov. 25, 2008. The Chinese

People's Liberation Army garrison troops in HKSAR conducted on Tuesday its 11th

troop rotation since it assumed Hong Kong's defense responsibility on July 1,

1997.

Chinese People's Liberation Army troops stand in their formation during troop

rotation at a barrack in Hong Kong, south China, Nov. 25, 2008. The Chinese

People's Liberation Army garrison troops in HKSAR conducted on Tuesday its 11th

troop rotation since it assumed Hong Kong's defense responsibility on July 1,

1997.

China will spend 120 billion yuan

(17.6 billion U.S. dollars) to build a second railway linking the northwestern

Xinjiang Uygur Autonomous Region with inland cities, according to information

from a meeting of the Xinjiang committee of the Communist Party of China on

Tuesday. Construction is expected to begin next year, with investment from the

central and local governments and other sources. The new line will be parallel

to the existing Lanxin Railway linking Gansu, Qinghai and Xinjiang. Only

passenger trains will run on it. When the new line is completed, the old Lanxin

railway, running1,892 kilometers, will be used by cargo trains only.

China:

The World Bank expects China will experience the most sluggish growth in 19

years next year despite unprecedented measures by Beijing to boost spending and

investment. With the global financial crisis continuing to spread, funding

shortages and battered confidence are souring demand in countries that consume

half of China's exports, according to the World Bank's quarterly report

yesterday. This will weigh on the mainland's export-based economy, prompting an

urgent need to rebalance its growth model to encourage more domestic

consumption. The World Bank cut its forecast for next year to 7.5 per cent from

9.2 per cent previously, the most bearish among major financial institutions.

"The emphasis will be on accelerating and increasing infrastructure and other

investment," said David Dollar, the World Bank country director for China. "As

China builds infrastructure as part of the stimulus package, we are hoping it's

focusing on infrastructure that addresses future needs such as energy

efficiency, urban public transport and high-speed rail." Beijing's unprecedented

4 trillion yuan (HK$4.54 trillion) spending spree designed to spur domestic

demand over the next two years will not be the last, the World Bank believes.

"Additional measures are necessary to make headway with rebalancing the pattern

of growth," it said. "This includes resource and utility pricing, government

spending on health, education and social security as well as financial reform."

The government-induced spending would produce half of next year's economic

growth, it added. The central government will undertake about 1.2 trillion yuan

out of the 4 trillion yuan spending, with the rest coming from local governments

and state enterprises. The spending, to be funnelled into infrastructure, real

estate, environment, health and education, aims at drumming up domestic demand,

imports and employment. The World Bank forecasts China's export growth will slow

markedly to 3.5 per cent next year from an estimated 11 per cent this year. It

was even more pessimistic than the International Monetary Fund, which

anticipates the mainland's economic stimulus measures to account for 8.5 per

cent of growth next year. The mainland's economic growth stood at 11.9 per cent

last year. Its estimate is also below the 8 to 9 per cent growth forecast by the

National Development and Reform Commission. However, China's prospects were not

totally bleak, Mr Dollar said, pointing to receding inflation. "The outlook for

raw material prices means that looking ahead, inflation is no longer a concern

in the near future," he said. Inflation drifted lower to 4 per cent last month,

the lowest in 17 months. Economists widely believe the country will fare better

than many other emerging markets, helped by the massive spending and fiscal

policies. They believe the spending spree will help shore up next year's

economic growth. However, China International Capital Corp chief economist Ha

Jiming said the worst would not come until 2010. "Next year won't be the

bottom." Recessions in the European Union and the United States would mean

poorer fortunes for China's exports next year, with weaker exports to linger

until 2010, Mr Ha said. He estimated the mainland's economy would climb 8 per

cent next year and 7.8 per cent in 2010. Merrill Lynch has estimated the

mainland's economic growth at 8.6 per cent next year while Credit Suisse and

Nomura Research Institute have said it will reach 8 per cent.

China:

The World Bank expects China will experience the most sluggish growth in 19

years next year despite unprecedented measures by Beijing to boost spending and

investment. With the global financial crisis continuing to spread, funding

shortages and battered confidence are souring demand in countries that consume

half of China's exports, according to the World Bank's quarterly report

yesterday. This will weigh on the mainland's export-based economy, prompting an

urgent need to rebalance its growth model to encourage more domestic

consumption. The World Bank cut its forecast for next year to 7.5 per cent from

9.2 per cent previously, the most bearish among major financial institutions.

"The emphasis will be on accelerating and increasing infrastructure and other

investment," said David Dollar, the World Bank country director for China. "As

China builds infrastructure as part of the stimulus package, we are hoping it's

focusing on infrastructure that addresses future needs such as energy

efficiency, urban public transport and high-speed rail." Beijing's unprecedented

4 trillion yuan (HK$4.54 trillion) spending spree designed to spur domestic

demand over the next two years will not be the last, the World Bank believes.

"Additional measures are necessary to make headway with rebalancing the pattern

of growth," it said. "This includes resource and utility pricing, government

spending on health, education and social security as well as financial reform."

The government-induced spending would produce half of next year's economic

growth, it added. The central government will undertake about 1.2 trillion yuan

out of the 4 trillion yuan spending, with the rest coming from local governments

and state enterprises. The spending, to be funnelled into infrastructure, real

estate, environment, health and education, aims at drumming up domestic demand,

imports and employment. The World Bank forecasts China's export growth will slow

markedly to 3.5 per cent next year from an estimated 11 per cent this year. It

was even more pessimistic than the International Monetary Fund, which

anticipates the mainland's economic stimulus measures to account for 8.5 per

cent of growth next year. The mainland's economic growth stood at 11.9 per cent

last year. Its estimate is also below the 8 to 9 per cent growth forecast by the

National Development and Reform Commission. However, China's prospects were not

totally bleak, Mr Dollar said, pointing to receding inflation. "The outlook for

raw material prices means that looking ahead, inflation is no longer a concern

in the near future," he said. Inflation drifted lower to 4 per cent last month,

the lowest in 17 months. Economists widely believe the country will fare better

than many other emerging markets, helped by the massive spending and fiscal

policies. They believe the spending spree will help shore up next year's

economic growth. However, China International Capital Corp chief economist Ha

Jiming said the worst would not come until 2010. "Next year won't be the

bottom." Recessions in the European Union and the United States would mean

poorer fortunes for China's exports next year, with weaker exports to linger

until 2010, Mr Ha said. He estimated the mainland's economy would climb 8 per

cent next year and 7.8 per cent in 2010. Merrill Lynch has estimated the

mainland's economic growth at 8.6 per cent next year while Credit Suisse and

Nomura Research Institute have said it will reach 8 per cent.

Although Gome Electrical Appliances

(0493) has still released no information about the current situation of company

chairman Wong Kwong-yu, mainland newspapers reported yesterday that the police

and securities watchdog have joined hands to investigate any possible illegal

acts. "Wong is still detained and under investigation by the police and also the

China Securities Regulatory Commission," an unnamed source involved in the

investigation was quoted by the China Business News as saying. The 21st Century

Business Herald said Wong's detention was not only related to alleged market

manipulation but also the alleged bribing of a former Commerce Ministry official

to gain approval for Gome's Hong Kong listing. "Wong, as well as financial

controller Zhou Yafei, has since October been restricted from going abroad," the

Shenzhen-based financial paper said. They were detained last Friday, it said.

Shares of the firm remained suspended yesterday. Hong Kong stock exchange data