|

Newsletter

Seminar Material

Biz:

China

Hong

Kong Hawaii

What people

said about us

China

Earthquake Relief

Tax &

Government

Hawaii Voter Registration

Biz-Video

Biz-Video

Hawaii's

China Connection Hawaii's

China Connection

CDP#1780962

CDP#1780962

Doing Business in

Hong Kong & China

Doing Business in

Hong Kong & China

| |

Hong Kong, China & Hawaii Biz*

Skype - FREE

Voice Over IP Skype - FREE

Voice Over IP  View Hawaii's China Connection

Video Trailer

View Hawaii's China Connection

Video Trailer

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our event page to find out more!

After

attended a China/Hong Kong Business/Trade Seminar in Hawaii...still unsure what

to do next, contact us, our Officers, Directors and Founding Members are

actively engaged in China/Hong Kong/Asia trade - we can help!

Are you ready to export your product or

service? You will find out in 3 minutes with resources to help you -

enter

to give it a try

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

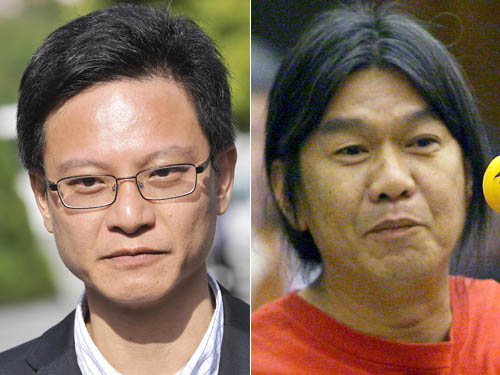

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

December 25 - 31, 2008

Hong Kong:

Thousands of construction industry

employees from Hong Kong, including workers and supervisors, have been tipped to

lose their jobs in Macau and Dubai and return home in the coming months. The

Construction Industry Council says it will provide retraining courses in an

effort to help them find other jobs in the recession-battered local economy. The

chairman of the council's training board, Billy Wong Wing-hoo, said the industry

estimated that 8,000 workers would be sacked at stalled casino developments in

Macau. This includes 4,000 job losses already announced at the massive Las Vegas

Sands project. "Apart from Macau workers, Hong Kong supervisors working in

Middle East places like Dubai might return to the city as well," Mr Wong said.

"The Dubai economy is not as good as expected." Hong Kong has 230,000 registered

construction workers. From next month, the council will use new comprehensive

models designed by two universities to predict movement of construction labor.

"It will help the government and industry to get objective information on the

demand and supply of workers," Mr Wong said. The council estimates that peak

demand for construction workers on 10 infrastructure projects to be undertaken

by the government will be from 2013 to 2015. It is working on making the demand

for workers more evenly distributed. "We would like to avoid a repeat of what

happened in 1997, when loads of workers lost jobs," Mr Wong said. The council

will provide training programs according to the estimated demand for workers. Mr

Wong said predicting demand for construction workers had become more difficult

amid the gloomy global economy and uncertainty over government policies. New

courses combining several skills, including carpentry, painting, plumbing and

plastering, will be provided from next month. Secretary for Labor and Welfare

Mathew Cheung Kin-chung said more than 55,000 construction jobs would be created

next financial year. A new training centre will be opened in Tin Shui Wai in

March, and the council is looking into opening another centre in Yuen Long,

where many South Asians live. It has also introduced a course on shot firing -

using the explosives needed to break up soil and rock on projects such as

tunnels and demolitions. There are only eight registered shot-firers in the city

and the council aims to train as many as 210. Hong Kong:

Thousands of construction industry

employees from Hong Kong, including workers and supervisors, have been tipped to

lose their jobs in Macau and Dubai and return home in the coming months. The

Construction Industry Council says it will provide retraining courses in an

effort to help them find other jobs in the recession-battered local economy. The

chairman of the council's training board, Billy Wong Wing-hoo, said the industry

estimated that 8,000 workers would be sacked at stalled casino developments in

Macau. This includes 4,000 job losses already announced at the massive Las Vegas

Sands project. "Apart from Macau workers, Hong Kong supervisors working in

Middle East places like Dubai might return to the city as well," Mr Wong said.

"The Dubai economy is not as good as expected." Hong Kong has 230,000 registered

construction workers. From next month, the council will use new comprehensive

models designed by two universities to predict movement of construction labor.

"It will help the government and industry to get objective information on the

demand and supply of workers," Mr Wong said. The council estimates that peak

demand for construction workers on 10 infrastructure projects to be undertaken

by the government will be from 2013 to 2015. It is working on making the demand

for workers more evenly distributed. "We would like to avoid a repeat of what

happened in 1997, when loads of workers lost jobs," Mr Wong said. The council

will provide training programs according to the estimated demand for workers. Mr

Wong said predicting demand for construction workers had become more difficult

amid the gloomy global economy and uncertainty over government policies. New

courses combining several skills, including carpentry, painting, plumbing and

plastering, will be provided from next month. Secretary for Labor and Welfare

Mathew Cheung Kin-chung said more than 55,000 construction jobs would be created

next financial year. A new training centre will be opened in Tin Shui Wai in

March, and the council is looking into opening another centre in Yuen Long,

where many South Asians live. It has also introduced a course on shot firing -

using the explosives needed to break up soil and rock on projects such as

tunnels and demolitions. There are only eight registered shot-firers in the city

and the council aims to train as many as 210.

Companies in Hong Kong and Macau will be allowed to use yuan to settle trade in

goods with partners in Guangdong and the Yangtze River Delta under a pilot

program announced in Beijing yesterday. Under the scheme, reported by Xinhua

after a State Council meeting, the currency will also be used to settle the

tangible trade of companies in Guangxi and Yunnan with counterparts in the 10

Southeast Asian countries which comprise the Asean bloc. The

larger-than-expected scale of the pilot scheme underscores Beijing's intention

to avert risks brought on by an unstable US dollar - the currency in which most

trades are settled - and to strengthen the position of the yuan in the

international currency system, analysts said. "It is not mainly targeted at

bolstering Hong Kong's economy," said Zhao Xijun , a professor at Renmin

University in Beijing. "Though the city will undoubtedly benefit from the

scheme, the point of the policy is to cope with the fallout from the financial

meltdown." Details of the scheme, including when it will begin, have yet to be

announced. Earlier this month, the central government issued a 30-point

directive in which it vowed to "support the development of yuan business in Hong

Kong" and expand the use of the currency to settle trade with neighbouring

countries. On December 16, central bank governor Zhou Xiaochuan said it was

ready to implement measures to expand renminbi business in Hong Kong, and noted

that the use of the US dollar in trade could incur higher risks as its value

fluctuated. "The US dollar is unlikely to be stable next year and later," Mr

Zhao said. "And the likelihood of the United States issuing more money in the

near future adds to the depreciation risk in US-dollar-denominated assets and

trade settlements." "It's like packaging similar things together," he added.

"Guangxi and Vietnam have been settling in yuan for a long time." Together, the

members of Asean - the Association of Southeast Asian Nations - make up the

mainland's fourth-largest trade partner. Imports and exports totalled US$202.5

billion last year, accounting for 9.3 per cent of the mainland's foreign trade.

Hong Kong, the mainland's fifth-largest trading partner, settled trade of

US$197.2 billion last year, accounting for 9.1 per cent of the total. Stanley

Wong Yuen-fai, an executive director of Hong Kong-listed bank ICBC (Asia) (SEHK:

0349), said even though the city was not granted "an exclusive right" under the

scheme, it still had the advantage in developing as a centre for offshore

renminbi business. "Hong Kong is part of China, and it also accounted for the

biggest share of investment on the mainland, so the demand for yuan service will

be bigger," he said. Mr Wong said the scope of the yuan trade-settlement scheme

was bigger than expected. This partly reflected Beijing's desire to repatriate

yuan in an orderly manner, he said. Trading volumes between the mainland and

countries such as Vietnam and Thailand had increased significantly in recent

years, and some yuan was in circulation in those countries. Billy Mak Sui-choi,

associate professor of finance at Hong Kong Baptist University, agreed Hong Kong

would still have the advantage. "A [yuan offshore] centre is driven by market

demand," he said. Li Youhuan, an economist with the Guangdong Academy of Social

Sciences, said China was also seeking a more influential position for its

currency. "Behind the move, there are big powers tussling - the US, EU, Japan

and China," said Professor Li. "China is also actively paving the way for yuan

settlements in northeast Asia, Russia and other regions. It is eyeing a bigger

role in the international monetary system." However, there are hurdles for the

initiative. The yuan is not fully convertible. Trade companies can buy and sell

yuan on condition they present legitimate trade documents to banks. But

investors cannot exchange the currency freely and the new scheme does not

include the nation's capital accounts.

Companies in Hong Kong and Macau will be allowed to use yuan to settle trade in

goods with partners in Guangdong and the Yangtze River Delta under a pilot

program announced in Beijing yesterday. Under the scheme, reported by Xinhua

after a State Council meeting, the currency will also be used to settle the

tangible trade of companies in Guangxi and Yunnan with counterparts in the 10

Southeast Asian countries which comprise the Asean bloc. The

larger-than-expected scale of the pilot scheme underscores Beijing's intention

to avert risks brought on by an unstable US dollar - the currency in which most

trades are settled - and to strengthen the position of the yuan in the

international currency system, analysts said. "It is not mainly targeted at

bolstering Hong Kong's economy," said Zhao Xijun , a professor at Renmin

University in Beijing. "Though the city will undoubtedly benefit from the

scheme, the point of the policy is to cope with the fallout from the financial

meltdown." Details of the scheme, including when it will begin, have yet to be

announced. Earlier this month, the central government issued a 30-point

directive in which it vowed to "support the development of yuan business in Hong

Kong" and expand the use of the currency to settle trade with neighbouring

countries. On December 16, central bank governor Zhou Xiaochuan said it was

ready to implement measures to expand renminbi business in Hong Kong, and noted

that the use of the US dollar in trade could incur higher risks as its value

fluctuated. "The US dollar is unlikely to be stable next year and later," Mr

Zhao said. "And the likelihood of the United States issuing more money in the

near future adds to the depreciation risk in US-dollar-denominated assets and

trade settlements." "It's like packaging similar things together," he added.

"Guangxi and Vietnam have been settling in yuan for a long time." Together, the

members of Asean - the Association of Southeast Asian Nations - make up the

mainland's fourth-largest trade partner. Imports and exports totalled US$202.5

billion last year, accounting for 9.3 per cent of the mainland's foreign trade.

Hong Kong, the mainland's fifth-largest trading partner, settled trade of

US$197.2 billion last year, accounting for 9.1 per cent of the total. Stanley

Wong Yuen-fai, an executive director of Hong Kong-listed bank ICBC (Asia) (SEHK:

0349), said even though the city was not granted "an exclusive right" under the

scheme, it still had the advantage in developing as a centre for offshore

renminbi business. "Hong Kong is part of China, and it also accounted for the

biggest share of investment on the mainland, so the demand for yuan service will

be bigger," he said. Mr Wong said the scope of the yuan trade-settlement scheme

was bigger than expected. This partly reflected Beijing's desire to repatriate

yuan in an orderly manner, he said. Trading volumes between the mainland and

countries such as Vietnam and Thailand had increased significantly in recent

years, and some yuan was in circulation in those countries. Billy Mak Sui-choi,

associate professor of finance at Hong Kong Baptist University, agreed Hong Kong

would still have the advantage. "A [yuan offshore] centre is driven by market

demand," he said. Li Youhuan, an economist with the Guangdong Academy of Social

Sciences, said China was also seeking a more influential position for its

currency. "Behind the move, there are big powers tussling - the US, EU, Japan

and China," said Professor Li. "China is also actively paving the way for yuan

settlements in northeast Asia, Russia and other regions. It is eyeing a bigger

role in the international monetary system." However, there are hurdles for the

initiative. The yuan is not fully convertible. Trade companies can buy and sell

yuan on condition they present legitimate trade documents to banks. But

investors cannot exchange the currency freely and the new scheme does not

include the nation's capital accounts.

Thousands flocked to Canton Road in Tsim

Sha Tsui last night for the Christmas countdown street party. Organizers were

expecting 300,000 participants, while police expected 400,000 people to turn out

on both sides of Victoria Harbor. Special traffic control measures were in force

in Tsim Sha Tsui, Central and Causeway Bay. Thousands flocked to Canton Road in Tsim

Sha Tsui last night for the Christmas countdown street party. Organizers were

expecting 300,000 participants, while police expected 400,000 people to turn out

on both sides of Victoria Harbor. Special traffic control measures were in force

in Tsim Sha Tsui, Central and Causeway Bay.

A pair of giant pandas take food

in the Taipei zoo in Taipei, southeast China's Taiwan Province, Dec. 23, 2008.

The 4-year-old giant pandas, Tuan Tuan and Yuan Yuan offered by the Chinese

mainland arrived in Taiwan by air on Dec. 23, 2008. A pair of giant pandas take food

in the Taipei zoo in Taipei, southeast China's Taiwan Province, Dec. 23, 2008.

The 4-year-old giant pandas, Tuan Tuan and Yuan Yuan offered by the Chinese

mainland arrived in Taiwan by air on Dec. 23, 2008.

Lai Fung Holdings (1125) - the

mainland property arm of Lai Sun Group - expects to reap about HK$2.2 billion

from two mainland residential projects next year. The company plans to start

marketing the remaining 300 flats at Shanghai Regents Park phase II during the

Lunar New Year or later and expects to earn between HK$1.6 billion and HK$1.7

billion. About 150 homes were sold earlier this year. "The property market is

slower this year compared with the previous year, but prices are stable,"

executive director Kraven Tam Kin-man said yesterday. "We are still optimistic

about the market after the central government cut interest rates actively." Lai

Fung has also sold up to 70 percent of the units at Guangzhou West Point. The

project consists of 243 flats and serviced apartments as well as commercial

space. Tam expects the remaining homes will all be sold next year for HK$500

million. He predicts rental income from its Shanghai Hong Kong Plaza will surge

after a yearlong HK$200 million renovation. Rental income for the year ended

July 31 was HK$181.4 million for the plaza. "Rental income in Guangzhou and

Shanghai amounted to HK$250 million [last year]," he said. Sister company Lai

Sun Development (0488) said it expects rent from its properties in Hong Kong to

drop by up to 5 percent because of the weak market after recording some growth

this year.

China:

Shanghai conglomerate Fosun International has paid US$150.11 million for a 13.33

per cent stake in advertising firm Focus Media Holding, expanding its

diversified investment portfolio into a new industry. The company bought 17.27

million American depositary shares of Focus Media between November 17 and

December 22 on the Nasdaq Stock Market, Fosun said in a statement filed with the

Hong Kong stock exchange yesterday. Fosun on average paid US$8.69 for each

share, a 9.38 per cent discount to the advertising firm's closing price of

US$9.59 on Tuesday. Focus Media shares have slumped 83.12 per cent this year.

"We'll hold the shares as a strategic investment," said Sun Jun, the assistant

president of Fosun. Fosun's businesses range from retail to pharmaceutical,

financial services and strategic investments, property development, mining and

steel. The purchase, which will make Fosun the biggest shareholder in Focus

Media, could boost its investment in consumer-related sectors that would benefit

from Beijing's economic stimulus to boost domestic consumption, Mr Sun said. He

said media and advertisements would not be Fosun's core business, although the

sector's prospects were bright. He declined to comment on whether the firm would

increase its stake in Focus Media. Fosun, which has more than 10 billion yuan

(HK$11.33 billion) in cash and 14.7 billion yuan of credit facilities, last week

said it would continue to seek acquisitions over the next two years as falling

asset values created new opportunities. It said priority would be given to

overseas-listed mainland firms in sectors including consumer goods,

pharmaceuticals, retail and financial services, all of which have been heavily

sold off by investors. Focus Media said on Monday it would sell its out-of-home

operations to Sina Corp, operator of the mainland's most popular website, for

about US$1.3 billion in stock. As Focus Media plans to distribute 47 million

Sina shares to shareholders after the deal is closed, Fosun will also hold a

stake in Sina. Fosun's Shanghai-listed unit, Shanghai Fosun Pharmaceutical,

earlier bought an 8.56 per cent stake in New York-listed Tongjitang Chinese

Medicines for US$10 million. In October, Fosun spent HK$632 million to increase

its stake in Shanghai Forte Land.

China:

Shanghai conglomerate Fosun International has paid US$150.11 million for a 13.33

per cent stake in advertising firm Focus Media Holding, expanding its

diversified investment portfolio into a new industry. The company bought 17.27

million American depositary shares of Focus Media between November 17 and

December 22 on the Nasdaq Stock Market, Fosun said in a statement filed with the

Hong Kong stock exchange yesterday. Fosun on average paid US$8.69 for each

share, a 9.38 per cent discount to the advertising firm's closing price of

US$9.59 on Tuesday. Focus Media shares have slumped 83.12 per cent this year.

"We'll hold the shares as a strategic investment," said Sun Jun, the assistant

president of Fosun. Fosun's businesses range from retail to pharmaceutical,

financial services and strategic investments, property development, mining and

steel. The purchase, which will make Fosun the biggest shareholder in Focus

Media, could boost its investment in consumer-related sectors that would benefit

from Beijing's economic stimulus to boost domestic consumption, Mr Sun said. He

said media and advertisements would not be Fosun's core business, although the

sector's prospects were bright. He declined to comment on whether the firm would

increase its stake in Focus Media. Fosun, which has more than 10 billion yuan

(HK$11.33 billion) in cash and 14.7 billion yuan of credit facilities, last week

said it would continue to seek acquisitions over the next two years as falling

asset values created new opportunities. It said priority would be given to

overseas-listed mainland firms in sectors including consumer goods,

pharmaceuticals, retail and financial services, all of which have been heavily

sold off by investors. Focus Media said on Monday it would sell its out-of-home

operations to Sina Corp, operator of the mainland's most popular website, for

about US$1.3 billion in stock. As Focus Media plans to distribute 47 million

Sina shares to shareholders after the deal is closed, Fosun will also hold a

stake in Sina. Fosun's Shanghai-listed unit, Shanghai Fosun Pharmaceutical,

earlier bought an 8.56 per cent stake in New York-listed Tongjitang Chinese

Medicines for US$10 million. In October, Fosun spent HK$632 million to increase

its stake in Shanghai Forte Land.

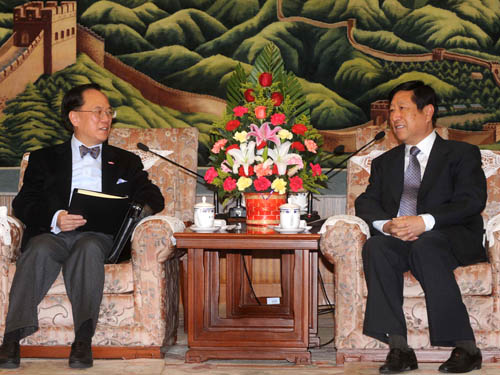

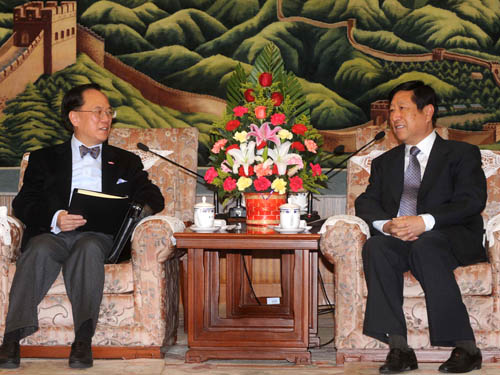

Visiting Chinese Vice-Premier Li Keqiang is greeted by a welcome delegation on

his arrival at an airport in Cairo, capital of Egypt, Dec. 24, 2008. At the

invitation of Egyptian Prime Minister Ahmed Mahmoud Mohamed Nazef, Chinese Vice

Premier Li Keqiang arrived here on Wednesday afternoon for an official visit to

Egypt. "I believe my visit will promote the China-Egypt strategic partnership of

cooperation to a higher level," Li said in a written speech upon arrival at the

airport. He noted that China attaches great importance to developing relations

with Egypt and is ready to make joint efforts with the Egyptian side to

consolidate the traditional friendship, deepen the strategic partnership of

cooperation and enhance coordination in international and regional issues with

Egypt.

Visiting Chinese Vice-Premier Li Keqiang is greeted by a welcome delegation on

his arrival at an airport in Cairo, capital of Egypt, Dec. 24, 2008. At the

invitation of Egyptian Prime Minister Ahmed Mahmoud Mohamed Nazef, Chinese Vice

Premier Li Keqiang arrived here on Wednesday afternoon for an official visit to

Egypt. "I believe my visit will promote the China-Egypt strategic partnership of

cooperation to a higher level," Li said in a written speech upon arrival at the

airport. He noted that China attaches great importance to developing relations

with Egypt and is ready to make joint efforts with the Egyptian side to

consolidate the traditional friendship, deepen the strategic partnership of

cooperation and enhance coordination in international and regional issues with

Egypt.

The China Association of Automobile

Manufacturers recently announced the top 10 sedan models in regards to sales

volume from January to November this year. They are, in order, Jetta, Santana,

Excelle, Corolla, Accord, Camry, F3, QQ, Xiali and Elantra.

A key feature of the mainland's

export-friendly measures, the new VAT rebate on certain electronics and

machinery items marks the fourth round of increases since August. The State

Council has unleashed a fresh package of measures to increase exports and

domestic consumption to help the mainland ride out the global economic crisis.

At a meeting yesterday, Premier Wen Jiabao revealed several additions to the

stimulus plan: value-added tax rebates will be increased on high-value,

high-technology electronics and machinery exports; export credit and insurance

will be strengthened; and a yuan settlement scheme on trade will be implemented

in Guangdong, Yunnan and Guangxi. Domestically, distribution networks will be

expanded to boost the flow of agricultural products to urban areas and white

goods into rural areas as a key strategy to spur demand. The expanded measures,

which follow the 4 trillion yuan (HK$4.53 trillion) stimulus package announced

last month, are intended to ensure the mainland economy grows at about 8 per

cent next year as the global economic crisis eats further into the nation's

foreign trade. Some economists said the State Council's latest moves showed top

policymakers were worried about the growing adverse impact of the crisis on the

nation's economy, which is heavily reliant on exports. As a key feature of the

export-friendly measures, the new VAT rebate on certain electronics and

machinery exports marked the fourth round of increases since August. This will

be a hearty Christmas gift to about 55,200 Hong Kong processing trade exporters,

many of whom are struggling to ride out the recession in their top three markets

- the United States, Europe and Japan. However, Mr Wen has yet to specify the

details of the latest VAT change, such as the new rebate rates on the exports in

question and the effective date. While Toys Manufacturers' Association of Hong

Kong executive vice-president Yeung Chi-kong welcomed the move, he called on

policymakers to offer more tax incentives and revise the controversial new labor

contract legislation. "The VAT rebate on toys can be raised further as the

rebate on garments is now at 17 per cent, which means VAT-free," Mr Yeung said. A key feature of the mainland's

export-friendly measures, the new VAT rebate on certain electronics and

machinery items marks the fourth round of increases since August. The State

Council has unleashed a fresh package of measures to increase exports and

domestic consumption to help the mainland ride out the global economic crisis.

At a meeting yesterday, Premier Wen Jiabao revealed several additions to the

stimulus plan: value-added tax rebates will be increased on high-value,

high-technology electronics and machinery exports; export credit and insurance

will be strengthened; and a yuan settlement scheme on trade will be implemented

in Guangdong, Yunnan and Guangxi. Domestically, distribution networks will be

expanded to boost the flow of agricultural products to urban areas and white

goods into rural areas as a key strategy to spur demand. The expanded measures,

which follow the 4 trillion yuan (HK$4.53 trillion) stimulus package announced

last month, are intended to ensure the mainland economy grows at about 8 per

cent next year as the global economic crisis eats further into the nation's

foreign trade. Some economists said the State Council's latest moves showed top

policymakers were worried about the growing adverse impact of the crisis on the

nation's economy, which is heavily reliant on exports. As a key feature of the

export-friendly measures, the new VAT rebate on certain electronics and

machinery exports marked the fourth round of increases since August. This will

be a hearty Christmas gift to about 55,200 Hong Kong processing trade exporters,

many of whom are struggling to ride out the recession in their top three markets

- the United States, Europe and Japan. However, Mr Wen has yet to specify the

details of the latest VAT change, such as the new rebate rates on the exports in

question and the effective date. While Toys Manufacturers' Association of Hong

Kong executive vice-president Yeung Chi-kong welcomed the move, he called on

policymakers to offer more tax incentives and revise the controversial new labor

contract legislation. "The VAT rebate on toys can be raised further as the

rebate on garments is now at 17 per cent, which means VAT-free," Mr Yeung said.

The mainland is at "grave risk" of

missing its goals for social and economic development if it fails to deal

properly with problems thrown up by the global financial crisis, the minister

for economic planning warned yesterday. "As a result of the global financial

crisis, we are facing severe challenges in the implementation of the 11th

five-year plan," Xinhua quoted Zhang Ping , minister in charge of the National

Development and Reform Commission, as saying. The 11th five-year plan runs from

2006 to 2010. He said the global financial turmoil was expected to last for some

time, and a global economic downturn was inevitable. "If we are unable to

properly deal with the difficulties, we might be faced with grave risks of

failing to realize our strategic goals in economic and social development." To

counter this, a cabinet meeting chaired by Premier Wen Jiabao decided yesterday

to take steps to boost domestic consumption and exports, the two main drivers of

the world's fourth-largest economy. To boost growth in the short term, the

government would invest an additional 100 billion yuan (HK$113 billion) in new

projects in the fourth quarter - which ends next week - and allocate 20 billion

yuan to a special earthquake relief fund, he said. Mr Zhang warned the quality

of bank assets would worsen as corporate losses mounted. Under the 4 trillion

yuan stimulus package the central government announced early last month, banks

are being encouraged to lend more for infrastructure projects and to small and

medium-sized firms badly hit by the crisis. Mr Zhang also proposed measures to

help boost exports, help low-income families and fund education, health care,

pensions and environmental protection. He did not elaborate. He warned that

weakening demand for property had affected economic growth. The minister said

the volume of real estate sales, in square meters, in the first 11 months of the

year was 18.3 per cent lower than in the same period last year. Mr Zhang's

deputy, Zhang Mao , said the government would regulate land sales and seek to

stop land prices rising too rapidly. "Volatility in the property market may

induce some negative impact," Zhang Mao said. "A moderate decline in high

property prices can help the property market return to a path of rational and

healthy development, but we ought to prevent a sharp fall in property prices."

The government has stepped up its efforts to stabilise the property market since

mid-September - slashing lending rates and reducing duty on home sales. Economic

growth slowed to 9 per cent in the third quarter, and to 9.9 per cent in the

first nine months, compared with 11.9 per cent for the whole of last year.

Economists expect a further weakening of growth in the fourth quarter. But Li

Yang, a prominent economist, said the economy would probably recover in the

second half of next year, making it one of the first to see a turnaround. To

make that a reality, Beijing is taking steps to boost development in nine major

industries - steelmaking, carmaking, shipping, petrochemicals, textiles, light

manufacturing, nonferrous metals production, equipment manufacturing and

information technology - Zhang Ping said in a briefing to lawmakers.

Guangzhou will spend nearly 50

billion yuan (HK$56.66 billion) on cleaning up the Pearl River and its

tributaries by mid-2010, in time for the Asian Games that November. Zhang Hu ,

director of the Guangzhou municipal bureau of water affairs, said the city

government would clean up 121 rivers with a total length of 388km in 18 months.

It would order factories, restaurants, clinics, construction sites and farms to

upgrade their sewage treatment facilities, he said. Guangzhou will also build 30

new sewage treatment plants, increasing treatment capacity by 2.25 million tons

a day. The announcement was made as a water quality program was launched on

Tuesday with construction of a treatment plant for the Shijinghe, a tributary of

the Pearl River. Locals often call the Shijinghe "Black Dragon River" because of

its severe pollution and foul odour. Mr Zhang said that from January 1,

Guangzhou residents would no longer be allowed to discharge untreated sewage

directly into rivers. The bureau would also demolish buildings on the banks of

rivers designated as sources for drinking water, he said. Water shortages, water

pollution and flooding have constrained growth and affected public health in

many parts of the mainland. The World Bank says the per capita availability of

natural fresh water on the mainland is a quarter of the world average. A report

from the bank in 2006 said a combination of water scarcity and poor water

quality was greatly jeopardizing the sustainability of water resources. The

environment minister said the nation had stepped up efforts to curb pollution at

major water sources to improve water quality. The mainland had invested nearly

24 billion yuan over the past two years on distributing clean drinking water to

its rural population, Environmental Protection Minister Zhou Shengxian said on

Tuesday. In a report to a plenary session of the National People's Congress

Standing Committee, Mr Zhou said the programme had so far benefited 109 million

people. Water quality last year was almost the same as in 2006, while the urban

sewage treatment rate reached 63 per cent last year, an 11 percentage point rise

from 2005, he said.

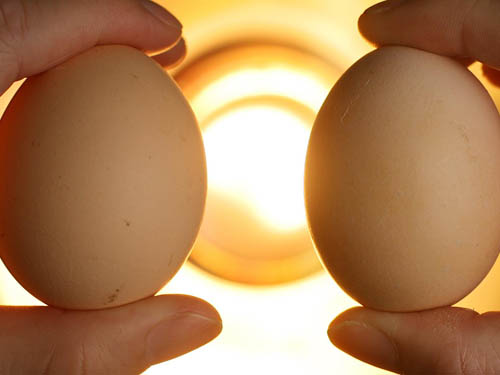

China's quality supervisor said on

Tuesday that it would step up checks of soybeans from the United States after

tons of soybeans were found tainted by pesticides. The General Administration of

Quality Supervision, Inspection and Quarantine (AQSIQ) said the local quality

watchdog in eastern Zhejiang province found some 57,000 tons of US soybeans were

mixed with soybean seeds coated with three types of pesticides: metalaxyl,

fludioxonil and thiamethoxam. Such seeds are for planting and usually bear

warning colors such as red, blue or green, said the AQSIQ. In response, the

AQSIQ said it had issued a notice to all local quality bureaus, ordering them to

implement an early-warning system within 90 days and step up inspections of US

soybeans. The AQSIQ also informed the United States about the issue and required

the US side to intensify quality checks on soybeans destined for China. The

AQSIQ said it had found soybean seeds mixed in many batches of soybeans imported

from the United States, which it said indicated there were major problems in the

US soybean export system.

December 24, 2008

Hong Kong:

Sceptics cast doubt yesterday on the future of mobile television in Hong Kong,

citing concerns about the small market and the absence of a viable business

model. An industry source said it was not the right time to launch new

broadcasting services, noting that digital television, launched last year by

free-to-air broadcasters TVB (SEHK: 0511) and ATV, was still in its infancy.

Digital television now covers 75 per cent of the population, but there has been

only a 25 per cent take-up. "Hong Kong is a very unique place where you can

access any kind of information within reach. Why will someone watch television

on a tiny screen if he can watch elsewhere on a big screen, like in a fast-food

restaurant?" the source asked. Wong Kam-fai, director of the centre for

innovation and technology at Chinese University, agreed that the city might be

too small to run mobile TV services alone. But opportunities existed if Hong

Kong's mobile TV network could co-operate closely with the mainland network, and

extended the services to populations in the Pearl River Delta. "Technology is

ready but when we talk about the market, it is another matter. People may watch

mobile TV on a long-haul trip, but definitely not on a ride on the MTR," he

said. Following the "market-led" approach, the government had not stipulated any

business model in its framework and that made it unclear how the new services

would be rolled out. Another industry source said existing broadcasters had a

better chance, driven by the large base of potential mobile TV viewers.

"Broadcasters as the content providers would love to see their programmes being

seen by a wider audience," said the source, adding that it was possible that the

mobile services could be free, as they would be supported by advertisers. But it

was also possible that telecoms operators would join the auction and provide

mobile TV service as a value-added component for their customers. They would

have to source content from broadcasters, and the subscribers were likely to be

charged. Hong Kong Digital Content Alliance convenor Ringo Lam Wing-kwan said

the decision to lift the ownership or cross-holding restrictions had paved the

way for broadcasters to "join the game". The exemption from the Broadcasting

Ordinance also meant that there would be no regulations on the duration of

advertising, he said. "I would not be surprised to see newspapers bid for their

own news channel," he said. Hong Kong:

Sceptics cast doubt yesterday on the future of mobile television in Hong Kong,

citing concerns about the small market and the absence of a viable business

model. An industry source said it was not the right time to launch new

broadcasting services, noting that digital television, launched last year by

free-to-air broadcasters TVB (SEHK: 0511) and ATV, was still in its infancy.

Digital television now covers 75 per cent of the population, but there has been

only a 25 per cent take-up. "Hong Kong is a very unique place where you can

access any kind of information within reach. Why will someone watch television

on a tiny screen if he can watch elsewhere on a big screen, like in a fast-food

restaurant?" the source asked. Wong Kam-fai, director of the centre for

innovation and technology at Chinese University, agreed that the city might be

too small to run mobile TV services alone. But opportunities existed if Hong

Kong's mobile TV network could co-operate closely with the mainland network, and

extended the services to populations in the Pearl River Delta. "Technology is

ready but when we talk about the market, it is another matter. People may watch

mobile TV on a long-haul trip, but definitely not on a ride on the MTR," he

said. Following the "market-led" approach, the government had not stipulated any

business model in its framework and that made it unclear how the new services

would be rolled out. Another industry source said existing broadcasters had a

better chance, driven by the large base of potential mobile TV viewers.

"Broadcasters as the content providers would love to see their programmes being

seen by a wider audience," said the source, adding that it was possible that the

mobile services could be free, as they would be supported by advertisers. But it

was also possible that telecoms operators would join the auction and provide

mobile TV service as a value-added component for their customers. They would

have to source content from broadcasters, and the subscribers were likely to be

charged. Hong Kong Digital Content Alliance convenor Ringo Lam Wing-kwan said

the decision to lift the ownership or cross-holding restrictions had paved the

way for broadcasters to "join the game". The exemption from the Broadcasting

Ordinance also meant that there would be no regulations on the duration of

advertising, he said. "I would not be surprised to see newspapers bid for their

own news channel," he said.

Sir Run Run Shaw, executive chairman of

Shaw Holdings pictured at the Shaw Brothers Annual General Meeting at Kowloon

Shangri-la, Tsim Sha Tsui earlier this year. On Tuesday, shares in Shaw Brothers

surged after Sir Shaw floated a bid to buyout the firm. Movie mogul Sir Run Run

Shaw’s plan to buy out his listed unit, Shaw Brothers (Hong Kong), for HK$1.33

billion after he failed to sell his stake in the firm, propelled the stock as

much as 58 per cent higher on Tuesday. The move could facilitate a possible sale

of the firm’s crown jewel, Television Broadcasts (SEHK: 0511) (TVB) by Sir Shaw,

analysts said, referring to the centenarian tycoon who helped fund the 1982

science fiction film Blade Runner. “The privatization plan could remove a

potential executive hurdle should Shaw Brothers decide to sell its TVB stake in

the future, as minority shareholders’ approval would no longer be necessary,”

UBS said in a research note on Tuesday. But a bid for TVB was unlikely in the

near term, as any potential buyers would probably be constrained by tight credit

due to the global financial crisis, it added. Shaw Holdings, controlled by Sir

Shaw, would pay HK$13.35 per share for all the Shaw Brothers shares it does not

already own, the company said on Monday. The stock closed on Tuesday’s morning

session up 55 per cent at HK$12.64, after earlier surging to as much as

HK$12.86. TVB shares rose 2.7 per cent to HK$24.45. Entertainment conglomerate

Shaw Brothers’ studio produced up to a thousand titles and its influence is also

evident in the films of Bruce Lee, Jackie Chan and John Woo. But in 1980, Sir

Shaw focused on television, becoming the chairman of TVB, which became the

city’s dominant terrestrial TV broadcaster. The company now derives 100 per cent

of its earnings from TVB, in which it has a 26 per cent stake. It also has a

large piece of land in Hong Kong’s Clearwater Bay. The offer price represents a

64 per cent premium to the stock’s last close of HK$8.13 on December 12, prior

to a trading suspension. The stock resumed trading on Tuesday. “That’s a good

price and close to its asset value of about HK$15 per share,” said Francis Lun,

general manager at Fulbright Securities. He expects the offer will be approved

by minority investors. Arnhold and S. Bleichroeder Advisers, which represents

about 10.2 per cent of Shaw Brothers’ issued shares, had agreed to vote in favor

of the offer, the company said. Shaw Brothers’ market value fell more than 67

per cent from its peak in June to HK$3.2 billion on December 12 after hopes to

sell Sir Shaw’s controlling stake in the company were dashed amid the global

financial crisis. Sir Shaw owns about 75 per cent of Shaw Brothers and has a 6.5

per cent interest in TVB. Shaw Brothers hit a record high of HK$24.30 on June

25, boosted by reports that Yeung Kwok-keung, chairman of property developer

Country Garden Holdings, would buy Sir Shaw’s interest in Shaw Brothers to get

control of TVB. But Shaw Brothers said in October that talks by Shaw Holdings to

sell its stake in the firm had ended due to the tumultuous situation in

financial markets. In May last year, talk that Sir Shaw may sell his slice of

the entertainment giant ahead of his 100th birthday in October that year lifted

its shares as much as 32 per cent in two days. Sir Run Run Shaw, executive chairman of

Shaw Holdings pictured at the Shaw Brothers Annual General Meeting at Kowloon

Shangri-la, Tsim Sha Tsui earlier this year. On Tuesday, shares in Shaw Brothers

surged after Sir Shaw floated a bid to buyout the firm. Movie mogul Sir Run Run

Shaw’s plan to buy out his listed unit, Shaw Brothers (Hong Kong), for HK$1.33

billion after he failed to sell his stake in the firm, propelled the stock as

much as 58 per cent higher on Tuesday. The move could facilitate a possible sale

of the firm’s crown jewel, Television Broadcasts (SEHK: 0511) (TVB) by Sir Shaw,

analysts said, referring to the centenarian tycoon who helped fund the 1982

science fiction film Blade Runner. “The privatization plan could remove a

potential executive hurdle should Shaw Brothers decide to sell its TVB stake in

the future, as minority shareholders’ approval would no longer be necessary,”

UBS said in a research note on Tuesday. But a bid for TVB was unlikely in the

near term, as any potential buyers would probably be constrained by tight credit

due to the global financial crisis, it added. Shaw Holdings, controlled by Sir

Shaw, would pay HK$13.35 per share for all the Shaw Brothers shares it does not

already own, the company said on Monday. The stock closed on Tuesday’s morning

session up 55 per cent at HK$12.64, after earlier surging to as much as

HK$12.86. TVB shares rose 2.7 per cent to HK$24.45. Entertainment conglomerate

Shaw Brothers’ studio produced up to a thousand titles and its influence is also

evident in the films of Bruce Lee, Jackie Chan and John Woo. But in 1980, Sir

Shaw focused on television, becoming the chairman of TVB, which became the

city’s dominant terrestrial TV broadcaster. The company now derives 100 per cent

of its earnings from TVB, in which it has a 26 per cent stake. It also has a

large piece of land in Hong Kong’s Clearwater Bay. The offer price represents a

64 per cent premium to the stock’s last close of HK$8.13 on December 12, prior

to a trading suspension. The stock resumed trading on Tuesday. “That’s a good

price and close to its asset value of about HK$15 per share,” said Francis Lun,

general manager at Fulbright Securities. He expects the offer will be approved

by minority investors. Arnhold and S. Bleichroeder Advisers, which represents

about 10.2 per cent of Shaw Brothers’ issued shares, had agreed to vote in favor

of the offer, the company said. Shaw Brothers’ market value fell more than 67

per cent from its peak in June to HK$3.2 billion on December 12 after hopes to

sell Sir Shaw’s controlling stake in the company were dashed amid the global

financial crisis. Sir Shaw owns about 75 per cent of Shaw Brothers and has a 6.5

per cent interest in TVB. Shaw Brothers hit a record high of HK$24.30 on June

25, boosted by reports that Yeung Kwok-keung, chairman of property developer

Country Garden Holdings, would buy Sir Shaw’s interest in Shaw Brothers to get

control of TVB. But Shaw Brothers said in October that talks by Shaw Holdings to

sell its stake in the firm had ended due to the tumultuous situation in

financial markets. In May last year, talk that Sir Shaw may sell his slice of

the entertainment giant ahead of his 100th birthday in October that year lifted

its shares as much as 32 per cent in two days.

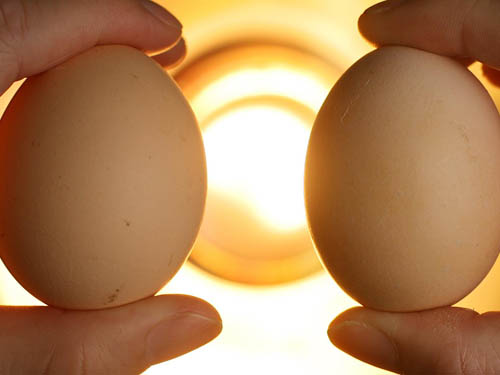

Professor Ron Hui Shu-yuen at City University's Department of Electronic

Engineering shows how his battery-charging plate works. An international

consortium founded in Hong Kong wants to cut the last cord that limits the

mobility of wireless consumer electronic devices. Member-companies of the

Wireless Power Consortium aim to develop a universal standard for people to

charge over-the-air all of their portable electronic gadgets - including mobiles

phones, media players and laptops - almost as simply as they access the internet

through Wi-fi networks. A conservative estimate from consortium co-founder

ConvenientPower, based in the Hong Kong Science Park, projects the market for

universal wireless power-charging solutions and accessories could be worth US$15

billion a year. "Seamless, safe charging that is available everywhere for mobile

electronic devices can only be achieved through a universal wireless

power-charging standard. Wireless power cuts the `last wire' after wireless

communications and data," said Camille Tang, president of local wireless

charging systems developer ConvenientPower. Ms Tang said a number of wire-free

technologies for transferring electric power existed, such as those used in

electric toothbrushes. Ron Hui Shu-yuen, a professor at the Department of

Electronic Engineering at City University, had earlier developed his version of

an "unplugged" power charger - a wireless battery-charging plate. The charger

uses so-called near-field electromagnetic coupling, allowing various devices to

be charged simultaneously when placed on a charging plate plugged into a normal

power outlet. Ms Tang said ConvenientPower had licensed Professor Hui's

technology from the university. ConvenientPower chief executive Mike

Mastroyiannis said the key would be contributing elements of that and other

technologies to a universal wireless charging standard accepted by the industry.

Otherwise, proprietary wire-free charging technologies will still prevent

different power chargers from being used on a single device or different gadgets

from being charged at a common power source. Having a universal wireless

power-charging standard would ensure the compatibility of consumer electronic

products and charging stations, Mr Mastroyiannis said. ABI Research has

estimated sales of mobile phones will reach 1.3 billion units this year.

Worldwide sales of all portable, rechargeable electronic devices in the

telecommunications and consumer electronics sector are estimated to be more than

2 billion units. Demand for universal wireless power-charging systems could

hence be significant when the standards are set and manufacturers start churning

out their solutions. The consortium will first establish a standard for

low-power electronic devices using 5 watts and below, such as mobile phones,

portable media players, laptops and video game accessories. A standard for

higher power portable electronics and electrical equipment is also planned.

"This is a crucial moment in the development of wireless power," said Menno

Treffers, a senior director for standardisation at Philips Electronics and the

consortium chairman. Mr Mastroyiannis said the consortium would draw up the

standard "as soon as possible". Stephen Chau Kam-kun, the chief technology

officer at cellular-phone network operator SmarTone-Vodafone, said: "This is a

good first step forward to help boost people's mobility with their devices." The

global initiative for a universal standard was launched by the consortium last

week at the Hong Kong Science Park. Other consortium members include Royal

Philips Electronics, Texas Instruments, Sanyo Electric, Logitech, National

Semiconductor, Fulton Innovation and Shenzhen Sang Fei Consumer Communications.

The consortium will initially focus on a wireless charging technology that

transmits power to a product near a charging station. The power transfer is

based on the principle of magnetic induction. Magnetic induction, or transformer

technology, is used in all kinds of electronic equipment because it is simple,

efficient and safe. It makes rapid battery charging possible and will not

interfere with data or devices nearby. In addition, it is reliable in demanding

environments where there may be water, sand and dirt. "To establish a robust

standard, we embrace diverse expertise and collaboration. The Wireless Power

Consortium seeks as many electronics groups and companies as possible to join as

members," said Wolf Oelschlegel, a general manager at Shenzhen Sang Fei.

Professor Ron Hui Shu-yuen at City University's Department of Electronic

Engineering shows how his battery-charging plate works. An international

consortium founded in Hong Kong wants to cut the last cord that limits the

mobility of wireless consumer electronic devices. Member-companies of the

Wireless Power Consortium aim to develop a universal standard for people to

charge over-the-air all of their portable electronic gadgets - including mobiles

phones, media players and laptops - almost as simply as they access the internet

through Wi-fi networks. A conservative estimate from consortium co-founder

ConvenientPower, based in the Hong Kong Science Park, projects the market for

universal wireless power-charging solutions and accessories could be worth US$15

billion a year. "Seamless, safe charging that is available everywhere for mobile

electronic devices can only be achieved through a universal wireless

power-charging standard. Wireless power cuts the `last wire' after wireless

communications and data," said Camille Tang, president of local wireless

charging systems developer ConvenientPower. Ms Tang said a number of wire-free

technologies for transferring electric power existed, such as those used in

electric toothbrushes. Ron Hui Shu-yuen, a professor at the Department of

Electronic Engineering at City University, had earlier developed his version of

an "unplugged" power charger - a wireless battery-charging plate. The charger

uses so-called near-field electromagnetic coupling, allowing various devices to

be charged simultaneously when placed on a charging plate plugged into a normal

power outlet. Ms Tang said ConvenientPower had licensed Professor Hui's

technology from the university. ConvenientPower chief executive Mike

Mastroyiannis said the key would be contributing elements of that and other

technologies to a universal wireless charging standard accepted by the industry.

Otherwise, proprietary wire-free charging technologies will still prevent

different power chargers from being used on a single device or different gadgets

from being charged at a common power source. Having a universal wireless

power-charging standard would ensure the compatibility of consumer electronic

products and charging stations, Mr Mastroyiannis said. ABI Research has

estimated sales of mobile phones will reach 1.3 billion units this year.

Worldwide sales of all portable, rechargeable electronic devices in the

telecommunications and consumer electronics sector are estimated to be more than

2 billion units. Demand for universal wireless power-charging systems could

hence be significant when the standards are set and manufacturers start churning

out their solutions. The consortium will first establish a standard for

low-power electronic devices using 5 watts and below, such as mobile phones,

portable media players, laptops and video game accessories. A standard for

higher power portable electronics and electrical equipment is also planned.

"This is a crucial moment in the development of wireless power," said Menno

Treffers, a senior director for standardisation at Philips Electronics and the

consortium chairman. Mr Mastroyiannis said the consortium would draw up the

standard "as soon as possible". Stephen Chau Kam-kun, the chief technology

officer at cellular-phone network operator SmarTone-Vodafone, said: "This is a

good first step forward to help boost people's mobility with their devices." The

global initiative for a universal standard was launched by the consortium last

week at the Hong Kong Science Park. Other consortium members include Royal

Philips Electronics, Texas Instruments, Sanyo Electric, Logitech, National

Semiconductor, Fulton Innovation and Shenzhen Sang Fei Consumer Communications.

The consortium will initially focus on a wireless charging technology that

transmits power to a product near a charging station. The power transfer is

based on the principle of magnetic induction. Magnetic induction, or transformer

technology, is used in all kinds of electronic equipment because it is simple,

efficient and safe. It makes rapid battery charging possible and will not

interfere with data or devices nearby. In addition, it is reliable in demanding

environments where there may be water, sand and dirt. "To establish a robust

standard, we embrace diverse expertise and collaboration. The Wireless Power

Consortium seeks as many electronics groups and companies as possible to join as

members," said Wolf Oelschlegel, a general manager at Shenzhen Sang Fei.

Global luxury retailer DFS Hong Kong,

which operates duty-free shops, plans to expand its outlet in Tsim Sha Tsui by

40 per cent to cater for strong demand from mainland tourists. In strong

contrast to the declining sales suffered by many retailers in the neighborhood,

DFS sales remain on an upward trend, according to Maureen Fung Sau-yim, the

general manager for leasing at Sun Hung Kai Real Estate Agency. DFS Galleria,

which sells prestigious international brands including Louis Vuitton, Gucci and

Chanel, will rent an additional 35,000 square feet at Sun Hung Kai Properties (SEHK:

0016)' Sun Arcade in Tsim Sha Tsui. "The group is proceeding with the expansion

despite the deepening financial turmoil. We just signed the leasing agreement

last week," Ms Fung said. DFS Galleria's retail space at Sun Arcade, which

generates shopper traffic of up to 120,000 visitors during weekends, will expand

to 120,000 sq ft from 85,000 sq ft now. Ms Fung said retailers that remained in

a strong financial position were able to take advantage of the economic downturn

to expand in light of the declining competition for prime space and landlords

becoming more flexible in discussing leasing terms. "DFS Galleria will expand

its cosmetics and jewellery and watch zone in a bid to capitalise on

mainlanders' strong appetite for luxury goods," she said, adding that cosmetics

sales this month jumped significantly compared with December last year. As

mainland tourists account for up to 50 per cent of DFS Galleria's sales, she

said, the financial turmoil had a limited impact on its sales, and the retailer

would add 17,500 sq ft of space this month and the remainder by the end of next

year. After the completion of the expansion, DFS Galleria will account for 57

per cent of the 210,000 sq ft Sun Arcade, the biggest store in the shopping

centre. Ms Fung declined to disclose the leasing terms but said the rents for

the additional space to be committed to by DFS Galleria were higher than in

previous leases. Currently, rents at Sun Arcade were HK$150 to HK$300 per square

foot, she said. Aside from DFS, several global retailers are expanding their

outlets. Spanish fashion retailer Zara will soon enlarge its store at IFC Mall

in Central by 25 per cent to 16,000 sq ft. Sources have said Zara would close

its IFC store on January 31 and the new store would open on April 1 next year.

Rival luxury retailer Prada intends to expand from 2,800 sq ft to 8,000 sq ft,

while Ferragamo plans to enlarge its space from 1,500 sq ft to more than 3,000

sq ft. Industry watchers said international brands tended to open fewer big

shops instead of many small shops. Global luxury retailer DFS Hong Kong,

which operates duty-free shops, plans to expand its outlet in Tsim Sha Tsui by

40 per cent to cater for strong demand from mainland tourists. In strong

contrast to the declining sales suffered by many retailers in the neighborhood,

DFS sales remain on an upward trend, according to Maureen Fung Sau-yim, the

general manager for leasing at Sun Hung Kai Real Estate Agency. DFS Galleria,

which sells prestigious international brands including Louis Vuitton, Gucci and

Chanel, will rent an additional 35,000 square feet at Sun Hung Kai Properties (SEHK:

0016)' Sun Arcade in Tsim Sha Tsui. "The group is proceeding with the expansion

despite the deepening financial turmoil. We just signed the leasing agreement

last week," Ms Fung said. DFS Galleria's retail space at Sun Arcade, which

generates shopper traffic of up to 120,000 visitors during weekends, will expand

to 120,000 sq ft from 85,000 sq ft now. Ms Fung said retailers that remained in

a strong financial position were able to take advantage of the economic downturn

to expand in light of the declining competition for prime space and landlords

becoming more flexible in discussing leasing terms. "DFS Galleria will expand

its cosmetics and jewellery and watch zone in a bid to capitalise on

mainlanders' strong appetite for luxury goods," she said, adding that cosmetics

sales this month jumped significantly compared with December last year. As

mainland tourists account for up to 50 per cent of DFS Galleria's sales, she

said, the financial turmoil had a limited impact on its sales, and the retailer

would add 17,500 sq ft of space this month and the remainder by the end of next

year. After the completion of the expansion, DFS Galleria will account for 57

per cent of the 210,000 sq ft Sun Arcade, the biggest store in the shopping

centre. Ms Fung declined to disclose the leasing terms but said the rents for

the additional space to be committed to by DFS Galleria were higher than in

previous leases. Currently, rents at Sun Arcade were HK$150 to HK$300 per square

foot, she said. Aside from DFS, several global retailers are expanding their

outlets. Spanish fashion retailer Zara will soon enlarge its store at IFC Mall

in Central by 25 per cent to 16,000 sq ft. Sources have said Zara would close

its IFC store on January 31 and the new store would open on April 1 next year.

Rival luxury retailer Prada intends to expand from 2,800 sq ft to 8,000 sq ft,

while Ferragamo plans to enlarge its space from 1,500 sq ft to more than 3,000

sq ft. Industry watchers said international brands tended to open fewer big

shops instead of many small shops.

Improved relations between the

mainland and Taiwan do not necessarily pose a threat to Hong Kong, according a

pro-government think-tank. Bauhinia Foundation Research Centre chairman Anthony

Wu Ting-yuk said yesterday that members of the think-tank visited Taiwan

recently and took note of aspects of life and activities that carry lessons and

potential benefits for Hong Kong. "Hong Kong government officials should visit

Taiwan more often since cross-strait relations have improved," Wu said. More

Taiwanese firms should be encouraged to list in Hong Kong, while local

professionals should consider opportunities in Taiwan. Hong Kong should also

consider importing agricultural products from the island. Wu said Taiwan has a

successful creative outlook and an educational system that fosters cultural

development. For instance, Taiwanese embrace gastronomy in their culture, Wu

continued. "They have countrywide beef noodle competitions every year, so why

can't we have a wonton noodle competition?" Wu hopes too that the day will come

when Hong Kong think-tanks can be as influential as those in Taiwan and the

mainland. The Chung-Hua Institution for Economic Research, the Taiwan Institute

of Economic Research and the mainland's Chinese Academy of Social Sciences were

welcomed as official think-tanks, he remarked. "I don't rule out the possibility

that Bauhinia can eventually develop into a think-tank like those." Bauhinia has

developed ties with several political appointees, but Wu side- stepped questions

about the think-tank moving to foster more political talent. Bauhinia wanted to

do no more than stimulate interest in public affairs, Wu said.

Hong Kong recorded a 51.3 billion HK

dollars surplus in its balance of payment account, at 11.9 percent of GDP, in

the third quarter, announced the Census and Statistics Department of Hong Kong

SAR on Tuesday. According to the Census and Statistics Department, of the major

balance of payments components there was a current account surplus of 76.5

billion HK dollars, compared with 34.8 billion HK dollars in the previous

quarter. A net outflow of financial non-reserve assets amounting to 49.2 billion

HK dollars was recorded. Beating the 60.1 billion HK dollars for the same

quarter last year, the current account surplus in the third quarter of 2008 was

characterized by an increase in visible trade deficit, a rise in invisible trade

surplus, an increase in net inflow of external factor income, and a continued

net outflow of current transfers.

China:

China Railway Construction (SEHK: 1186) Corp said on Tuesday that subsidiaries

had won contracts worth 24.97 billion yuan (HK$28.30 billion) for rail

construction in the southern part of the country, as the country steps up

spending to bolster its economy and infrastructure. The value of the contracts

is equivalent to 14.07 per cent of the company’s last year sales under domestic

accounting standards, it said in a stock exchange filing. In a separate

statement, China Railway Group (SEHK: 0390), the country’s largest railway and

highway builder, said subsidiaries had won 7.91 billion yuan in rail

construction contracts, equivalent to 4.38 per cent of last year sales. Another

construction contractor, China Railway Erju Co, announced that it had won

contracts worth 5.36 billion yuan. Mainland will spend 5 trillion yuan until

2020 to add another 41,000km to its already extensive rail network, a recent

publication issued by the official Xinhua news agency quoted Deputy Railway

Ministry Lu Dongfu as saying. The country has been stepping up spending on its

rail network under a long-term plan to bolster its transport infrastructure. It

also recently announced a massive 4 trillion yuan stimulus package to support

economic growth and stave off the impact of the global financial crisis.

China:

China Railway Construction (SEHK: 1186) Corp said on Tuesday that subsidiaries

had won contracts worth 24.97 billion yuan (HK$28.30 billion) for rail

construction in the southern part of the country, as the country steps up

spending to bolster its economy and infrastructure. The value of the contracts

is equivalent to 14.07 per cent of the company’s last year sales under domestic

accounting standards, it said in a stock exchange filing. In a separate

statement, China Railway Group (SEHK: 0390), the country’s largest railway and

highway builder, said subsidiaries had won 7.91 billion yuan in rail

construction contracts, equivalent to 4.38 per cent of last year sales. Another

construction contractor, China Railway Erju Co, announced that it had won

contracts worth 5.36 billion yuan. Mainland will spend 5 trillion yuan until

2020 to add another 41,000km to its already extensive rail network, a recent

publication issued by the official Xinhua news agency quoted Deputy Railway

Ministry Lu Dongfu as saying. The country has been stepping up spending on its

rail network under a long-term plan to bolster its transport infrastructure. It

also recently announced a massive 4 trillion yuan stimulus package to support

economic growth and stave off the impact of the global financial crisis.

Workers wave as pandas Tuan Tuan and Yuan Yuan are escorted from Yaan panda

sanctuary in Sichuan on Tuesday. A pair of giant pandas arrived in Taiwan on

Tuesday as a gift from the mainland, the latest move in rapidly warming ties

between the longtime rivals. A green-liveried Eva Airways jet carrying “Tuan

Tuan” and “Yuan Yuan” set down at Taipei airport after the three-hour flight

from Chengdu in Sichuan province. Taken together the pandas’ names mean reunion

– underscoring Beijing’s hopes that the animals’ arrival in Taiwan will spur

unity between the sides, 59 years after they split amid civil war. Tuesday’s

panda arrival follows by a week the initiation of expanded transportation links

across the 160-kilometre wide Taiwan Strait and other signs of friendship

between Beijing and Taipei. Since his inauguration seven months ago, Taiwanese

President Ma Ying-jeou has moved aggressively to link Taiwan closer to the

mainland, opening the door to a substantially increased flow of mainland

tourists and sanctioning a more liberalised regime for bilateral investments.

His steps contrast sharply with predecessor Chen Shui-bian’s efforts to

emphasize Taiwan’s political and cultural separateness, which enraged Beijing,

and prompted it to reaffirm long-standing threats to use military force against

the democratic island it claims as its own. After their arrival at Taipei

airport, the pandas were prepared for the short trip to the city’s zoo, where

they are expected to remain in quarantine for 30 days. Assuming they are

disease-free, Yuan Yuan and Tuan Tuan – and their new, two-story zoo habitat –

will be unveiled to the public during the Lunar New Year holiday in late

January. They are expected to double the zoo’s number of annual visitors to 5 or

6 million. For more than five decades, Beijing has used panda diplomacy to make

friends and influence people in countries ranging from the United States to the

former Soviet Union. The giant panda is unique to China and serves as an

unofficial national mascot. Beijing regularly sends the animals abroad as a sign

of warm diplomatic relations or to mark breakthroughs in ties. The offer to send

Yuan Yuan and Tuan Tuan to Taiwan was first made in 2005 when the

pro-independence Chen was still in charge. Citing various bureaucratic

obstacles, his government rejected it, but after Mr Ma’s inauguration in May,

the way was cleared to reverse that decision.

Workers wave as pandas Tuan Tuan and Yuan Yuan are escorted from Yaan panda

sanctuary in Sichuan on Tuesday. A pair of giant pandas arrived in Taiwan on

Tuesday as a gift from the mainland, the latest move in rapidly warming ties

between the longtime rivals. A green-liveried Eva Airways jet carrying “Tuan

Tuan” and “Yuan Yuan” set down at Taipei airport after the three-hour flight

from Chengdu in Sichuan province. Taken together the pandas’ names mean reunion

– underscoring Beijing’s hopes that the animals’ arrival in Taiwan will spur

unity between the sides, 59 years after they split amid civil war. Tuesday’s

panda arrival follows by a week the initiation of expanded transportation links

across the 160-kilometre wide Taiwan Strait and other signs of friendship

between Beijing and Taipei. Since his inauguration seven months ago, Taiwanese

President Ma Ying-jeou has moved aggressively to link Taiwan closer to the

mainland, opening the door to a substantially increased flow of mainland

tourists and sanctioning a more liberalised regime for bilateral investments.

His steps contrast sharply with predecessor Chen Shui-bian’s efforts to

emphasize Taiwan’s political and cultural separateness, which enraged Beijing,

and prompted it to reaffirm long-standing threats to use military force against

the democratic island it claims as its own. After their arrival at Taipei

airport, the pandas were prepared for the short trip to the city’s zoo, where

they are expected to remain in quarantine for 30 days. Assuming they are

disease-free, Yuan Yuan and Tuan Tuan – and their new, two-story zoo habitat –

will be unveiled to the public during the Lunar New Year holiday in late

January. They are expected to double the zoo’s number of annual visitors to 5 or

6 million. For more than five decades, Beijing has used panda diplomacy to make

friends and influence people in countries ranging from the United States to the

former Soviet Union. The giant panda is unique to China and serves as an

unofficial national mascot. Beijing regularly sends the animals abroad as a sign

of warm diplomatic relations or to mark breakthroughs in ties. The offer to send

Yuan Yuan and Tuan Tuan to Taiwan was first made in 2005 when the

pro-independence Chen was still in charge. Citing various bureaucratic

obstacles, his government rejected it, but after Mr Ma’s inauguration in May,

the way was cleared to reverse that decision.

China military authorities are

considering building an aircraft carrier to protect its interests, a development

likely to worry its neighbors. Beijing’s rising military spending has prompted

concern in the United States and elsewhere, especially in Japan and self-ruled

Taiwan. “Aircraft carriers are a symbol of a country’s overall national strength

as well as the competitiveness of the country’s naval force,” Chinese Ministry

of National Defense spokesman Senior Colonel Huang Xueping told reporters.

“China has a large sea territory. It is the sacred responsibility of our armed

forces to protect our sea territory and to maintain our maritime sovereignty and

rights and interests. China, taking into account all relevant factors, will

earnestly research and consider [building aircraft carriers].” Taiwan was

cautious in its reaction. “We need to do some research before we can judge

whether (the carrier) is directed at Taiwan,” said Ministry of National Defence

spokeswoman Chih Yu-lan. Mainland military officials have been lobbying the

central government for years to build an aircraft carrier, which would allow

naval forces to project air power offshore, but rarely make public statements

about their intentions. Hong Kong media have said the mainland could build its

first carrier by 2010. The comments come amid strained military ties between

Washington and Beijing, and as China prepares to send two navy destroyers and a

supply ship on Friday to the Gulf of Aden, to join international efforts to

fight rampant piracy off the Somalian coast. US defense officials last week

welcomed China’s Somalia mission and said they hoped it would act as a

“springboard” for resuming contacts with Beijing, which China suspended in

October in protest over a US$6.5 billion arms sale to Taiwan. Huang, however,

said the US military had more work to do to improve ties. “At present the

military relationship between China and the United States has some difficulties,

but the responsibility is not with the Chinese side,” he said. “We hope the US

side will take seriously the major concerns and interests of the Chinese side...

and take concrete actions to create conditions for military relations to

recover.” The United States switched diplomatic recognition from Taiwan to China

in 1979, recognizing “one China”, but remains the island’s biggest ally and arms

supplier and is obliged by the Taiwan Relations Act to help the it defend

itself.

Chinese tourists seek ultimate US

souvenir - Caravans of cash-rich Chinese have been weaving through US

neighborhoods, looking for foreclosures and other bargain properties to buy. US

home-buying trips are becoming one of the more popular tour group packages in

China. New US visa rules and a loosening of foreign investment policies by China

have made it easier for people like Zhao Hongjun of Beijing to go house hunting

across the Pacific. The 48-year-old owner of a media firm went on a two-week

road trip last fall, checking out properties from Los Angeles to New York. He's

been following the swoon in prices since, and next month he may join another

prospecting group heading for San Francisco, Los Angeles and Las Vegas - three

of the worst-hit US housing markets. His budget: US$1 million (HK$7.8 million).

"LA is not bad; a lot of Chinese live there," said Zhao, whose interest is in

apartments and detached houses. Overseas Chinese have been buying southern

California properties for years. What's different now is they are starting to do

it in large groups and quite openly. Chow Ling, president of the Chinese

American Real Estate Professionals Association in Southern California's San

Gabriel Valley, says brokers and agents welcome the tours - anything to shake

the doldrums of the market crash. But Chow, who serves mainlanders mostly, is

skeptical. Unless they're willing to spend more than US$400,000, they'll likely

be disappointed in the available homes. Liu Jian, chief operating officer at