|

Newsletter

Seminar Material

Biz:

China

Hong

Kong Hawaii

What people

said about us

China

Earthquake Relief

Tax &

Government

Hawaii Voter Registration

Biz-Video

Biz-Video

Hawaii's

China Connection Hawaii's

China Connection

CDP#1780962

CDP#1780962

Doing Business in

Hong Kong & China

Doing Business in

Hong Kong & China

| |

Hong Kong, China & Hawaii Biz*

Skype - FREE

Voice Over IP Skype - FREE

Voice Over IP  View Hawaii's China Connection

Video Trailer

View Hawaii's China Connection

Video Trailer

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our event page to find out more!

After

attended a China/Hong Kong Business/Trade Seminar in Hawaii...still unsure what

to do next, contact us, our Officers, Directors and Founding Members are

actively engaged in China/Hong Kong/Asia trade - we can help!

Are you ready to export your product or

service? You will find out in 3 minutes with resources to help you -

enter

to give it a try

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

Mar 28 - 30, 2009

Hong Kong:

Hong Kong shares fell 0.5 per cent by midday on Friday, as Esprit slumped after

the surprise departure of a key executive, but losses were capped as investors

bought into some of the laggards in this week’s rally. Shares in the world’s No

6 fashion retailer by market value following Gap, slid 9.3 per cent to HK$43.40

after the resignation of Thomas Grote, a director of the company and president

of the Esprit brand, raised doubts over Esprit’s succession plan. Mr Grote’s is

the second high profile exit from Esprit in less than a year. In July last year

Esprit announced the resignation of its chief financial officer John Poon,

sending shares in the company sliding. “In less than a year, we saw two

departures in the management, both who were familiar with the group’s operation.

The market would have concerns over these personnel changes, and their impact on

the company,” said Fiona Wong, analyst with Sun Hung Kai Financial. The

benchmark Hang Seng Index ended the morning session 63.96 points lower at

14,045.02 after opening 1.1 per cent firmer. Mainboard turnover edged up to

HK$34.9 billion from HK$33.1 billion by midday Thursday. The improved liquidity

in the market this week has brokers betting on further upside in the near term.

Stocks that got left behind in this week’s more than 1,200 point rally, led

mostly by banking stocks, on the main index raced ahead of the broad market on

Friday. Hong Kong:

Hong Kong shares fell 0.5 per cent by midday on Friday, as Esprit slumped after

the surprise departure of a key executive, but losses were capped as investors

bought into some of the laggards in this week’s rally. Shares in the world’s No

6 fashion retailer by market value following Gap, slid 9.3 per cent to HK$43.40

after the resignation of Thomas Grote, a director of the company and president

of the Esprit brand, raised doubts over Esprit’s succession plan. Mr Grote’s is

the second high profile exit from Esprit in less than a year. In July last year

Esprit announced the resignation of its chief financial officer John Poon,

sending shares in the company sliding. “In less than a year, we saw two

departures in the management, both who were familiar with the group’s operation.

The market would have concerns over these personnel changes, and their impact on

the company,” said Fiona Wong, analyst with Sun Hung Kai Financial. The

benchmark Hang Seng Index ended the morning session 63.96 points lower at

14,045.02 after opening 1.1 per cent firmer. Mainboard turnover edged up to

HK$34.9 billion from HK$33.1 billion by midday Thursday. The improved liquidity

in the market this week has brokers betting on further upside in the near term.

Stocks that got left behind in this week’s more than 1,200 point rally, led

mostly by banking stocks, on the main index raced ahead of the broad market on

Friday.

Tycoon Li Ka-shing, Hong Kong's richest

man, has vouched for the local economy and expressed confidence in the stock and

property markets despite the uncertain global outlook. Mr Li, who is known for

his perennially bullish comments, said there had been recent signs of

improvement in the economy. "Recently, the property market has improved a bit,

there have been more orders for durable goods, and stock markets have gone up in

the past two weeks," Mr Li said. "If the US economy remains stable, there will

be a positive reaction around the world." The need to replenish low inventories

in the US and EU would boost exports from the mainland next month and in May, he

said. Mr Li said he expected a recovery "will not be too far away" given efforts

to kick-start the stalled US economy and help banks clear up toxic assets. Hong

Kong would also benefit from the mainland, which would be the first to emerge

from the global downturn, he said. "Hong Kong needs to be strong," he said.

"Don't waste energy on unconstructive things for Hong Kong. For Hong Kong, the

most important thing is that we have the support of our mother country. The

individual visit scheme from the mainland has contributed greatly to Hong Kong.

Whatever our country can do for us, they have done so. "China will be the

fastest to recover among all countries. I expect a recovery will not be too far

away ... we should hope for the best and prepare for the worst. But the

situation should not be too bad." Repeating comments he made last year, the

billionaire cautioned against spending beyond one's means but remained buoyant

on his companies as investments. During the stock market boom last year, Mr Li

urged people not to borrow funds for investments. "I am the chairman and largest

shareholder of Cheung Kong (SEHK: 0001) and Hutchison (SEHK: 0013). I put a lot

of time and effort into these companies and yet only draw an annual salary of

HK$5,000. I think this signifies whether I have confidence in these two

companies. I don't need to do any selling job," he said. "I won't comment on

short-term speculation. But if you have extra money, buying Cheung Kong and

Hutchison shares should be good." Asked about layoff plans, Mr Li offered no

guarantees. He said it was difficult to say whether the jobless rate would

worsen to 8 per cent. "We operate in 54 countries with over 23,800 staff in many

different businesses. There is no guarantee that there will be no redundancies

in all these different businesses," he said. "I can only say right now, at this

very minute, that we have no immediate layoff plans. However, circumstances may

change." Mr Li maintained that he was very happy and did not feel fatigued

despite getting up at about 4am, playing golf, going to work and attending an

evening cocktail gathering. Tycoon Li Ka-shing, Hong Kong's richest

man, has vouched for the local economy and expressed confidence in the stock and

property markets despite the uncertain global outlook. Mr Li, who is known for

his perennially bullish comments, said there had been recent signs of

improvement in the economy. "Recently, the property market has improved a bit,

there have been more orders for durable goods, and stock markets have gone up in

the past two weeks," Mr Li said. "If the US economy remains stable, there will

be a positive reaction around the world." The need to replenish low inventories

in the US and EU would boost exports from the mainland next month and in May, he

said. Mr Li said he expected a recovery "will not be too far away" given efforts

to kick-start the stalled US economy and help banks clear up toxic assets. Hong

Kong would also benefit from the mainland, which would be the first to emerge

from the global downturn, he said. "Hong Kong needs to be strong," he said.

"Don't waste energy on unconstructive things for Hong Kong. For Hong Kong, the

most important thing is that we have the support of our mother country. The

individual visit scheme from the mainland has contributed greatly to Hong Kong.

Whatever our country can do for us, they have done so. "China will be the

fastest to recover among all countries. I expect a recovery will not be too far

away ... we should hope for the best and prepare for the worst. But the

situation should not be too bad." Repeating comments he made last year, the

billionaire cautioned against spending beyond one's means but remained buoyant

on his companies as investments. During the stock market boom last year, Mr Li

urged people not to borrow funds for investments. "I am the chairman and largest

shareholder of Cheung Kong (SEHK: 0001) and Hutchison (SEHK: 0013). I put a lot

of time and effort into these companies and yet only draw an annual salary of

HK$5,000. I think this signifies whether I have confidence in these two

companies. I don't need to do any selling job," he said. "I won't comment on

short-term speculation. But if you have extra money, buying Cheung Kong and

Hutchison shares should be good." Asked about layoff plans, Mr Li offered no

guarantees. He said it was difficult to say whether the jobless rate would

worsen to 8 per cent. "We operate in 54 countries with over 23,800 staff in many

different businesses. There is no guarantee that there will be no redundancies

in all these different businesses," he said. "I can only say right now, at this

very minute, that we have no immediate layoff plans. However, circumstances may

change." Mr Li maintained that he was very happy and did not feel fatigued

despite getting up at about 4am, playing golf, going to work and attending an

evening cocktail gathering.

Auction director John Kapon of Acker Merrall & Condit shows some of the fine

wines to go on the block tomorrow at the Island Shangri-La. This year's local

wine-auction season kicks off tomorrow with an ambitious 1,000-lot sale of fine

wines and vintage champagnes that is expected to be a litmus test of people's

appetite for investment and consumption amid the economic downturn. Valued at an

estimated HK$30 million to HK$35 million, the lots in New York-based Acker

Merrall & Condit's auction already reflect a year-on-year drop of between 20 and

40 per cent in prices, the firm's president and auction director John Kapon

said. With the rapid decline in prices, many sellers have been less enthusiastic

than before about offloading their collections, preferring to wait out the

crisis. But some people have had to cash in because of financial difficulties,

Mr Kapon said. "There are not as many people rushing to sell as there had been

in 2008, when prices were so high," he said. "But I don't see more people forced

to sell in the financial crisis. I don't see desperation on the part of

collectors." One possible consequence of the credit crunch was in evidence at

the firm's previous Hong Kong sale, in November, when a mainland bidder failed

to pay for his purchases. "There was one significant purchaser that openly

disappeared on us, and we've kind of been advised that it might not necessarily

be worth it to go into the mainland legal system to try to pursue this person to

the very end. So we are more cautious. It's the only time it's happened in

years," Mr Kapon said. The bidder, who signed up at the last minute,

successfully bid for between 20 and 30 assorted lots, including some cases of

1982 Chateau Lafite Rothschild. He said he would make a down payment in January

and pay the balance in February, but subsequently disappeared. The purchases

totalled "over six figures, US", Mr Kapon said. Tomorrow's auction, at the

Island Shangri-La, will offer online bidding.

Auction director John Kapon of Acker Merrall & Condit shows some of the fine

wines to go on the block tomorrow at the Island Shangri-La. This year's local

wine-auction season kicks off tomorrow with an ambitious 1,000-lot sale of fine

wines and vintage champagnes that is expected to be a litmus test of people's

appetite for investment and consumption amid the economic downturn. Valued at an

estimated HK$30 million to HK$35 million, the lots in New York-based Acker

Merrall & Condit's auction already reflect a year-on-year drop of between 20 and

40 per cent in prices, the firm's president and auction director John Kapon

said. With the rapid decline in prices, many sellers have been less enthusiastic

than before about offloading their collections, preferring to wait out the

crisis. But some people have had to cash in because of financial difficulties,

Mr Kapon said. "There are not as many people rushing to sell as there had been

in 2008, when prices were so high," he said. "But I don't see more people forced

to sell in the financial crisis. I don't see desperation on the part of

collectors." One possible consequence of the credit crunch was in evidence at

the firm's previous Hong Kong sale, in November, when a mainland bidder failed

to pay for his purchases. "There was one significant purchaser that openly

disappeared on us, and we've kind of been advised that it might not necessarily

be worth it to go into the mainland legal system to try to pursue this person to

the very end. So we are more cautious. It's the only time it's happened in

years," Mr Kapon said. The bidder, who signed up at the last minute,

successfully bid for between 20 and 30 assorted lots, including some cases of

1982 Chateau Lafite Rothschild. He said he would make a down payment in January

and pay the balance in February, but subsequently disappeared. The purchases

totalled "over six figures, US", Mr Kapon said. Tomorrow's auction, at the

Island Shangri-La, will offer online bidding.

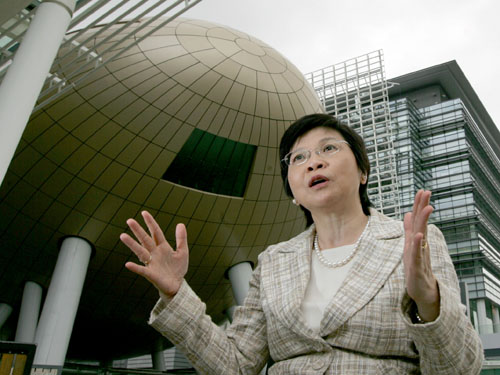

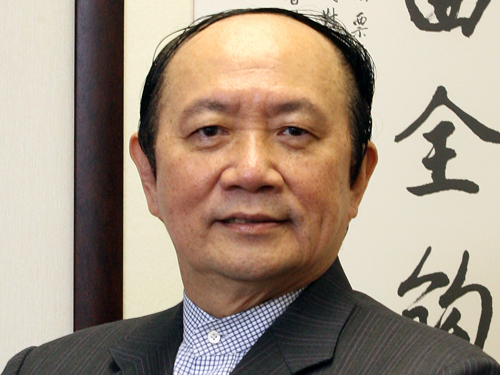

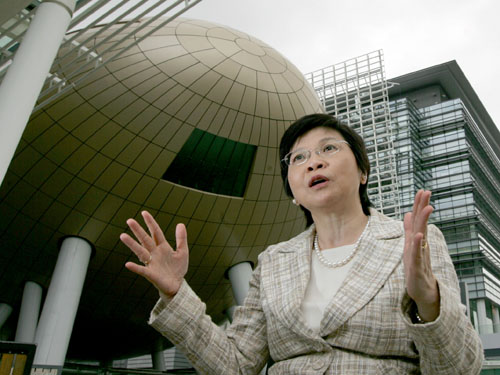

Shanghai's ambitions of becoming a

global financial hub were given a boost by the central government. Imagine, 11

years from now, a Hong Kong factory owner produces electronics gadgets in

Shanghai's state-level Jinqiao export processing zone for clients in Europe and

then settles the trade in yuan directly through banks in the city. This scenario

could come to fruition following the central government's anointment of Shanghai

as a global hub for finance and shipping in 2020, with possible full

convertibility of the yuan in a vision for the fast-growing city and the

industrialising Yangtze River Delta region. As the mainland's second

international financial centre, in tandem with Hong Kong, Shanghai would

facilitate the country's growing prominence on the global economic and political

stage, but it would also catapult the two cities to a fresh level of

competition. The competition debate would escalate from a Mickey Mouse issue - a

proposed Disneyland theme park in Shanghai - to the probable prospect of that

city threatening Hong Kong as the gateway for foreign capital and the entrepot

for the mainland. The 2020 vision would also raise questions about the future of

the Hong Kong dollar. "Shanghai has got the gift it has longed for, for ages,"

said Priscilla Lau Pui-king, an associate professor and associate head of the

department of business studies at Hong Kong Polytechnic University and a Hong

Kong representative at the National People's Congress, referring to a freely

convertible yuan. "The two cities will brace for more competition. Shanghai has

lots of potential in banking and finance, whereas Hong Kong could expand

horizontally." China's tight grip on foreign exchange has cemented Hong Kong's

role as the artery for foreign capital inflows. The city was the mainland's

single largest source of overseas capital last year, accounting for 44.4 per

cent of US$92.4 billion in foreign direct investment, according to statistics

from the Ministry of Commerce. However, a freely convertible yuan will change

all that and provide the ultimate key to help Shanghai realise its grand

ambition of becoming an international financial, economic, trade and shipping

hub by 2020. It would mean bigger convenience in trade and financial

transactions for Shanghai, despite the fact that Hong Kong was picked for the

first batch of trial centres for yuan settlement of trade, along with Guangxi,

Yunnan, Guangdong and the Yangtze River Delta. At present, Shanghai is arguably

the country's financial powerhouse, home to the mainland's main stock markets,

the foreign-currency market, one of three commodities futures exchanges, and the

only financial futures exchange and gold exchange. The People's Bank of China

also has a second headquarters in the city, after Beijing. Nonetheless, a

comprehensive set of financial infrastructure does not necessarily give the city

the upper hand, some critics argue. "Hong Kong is a real global financial

centre," said Chen Shuang, chief executive of Hong Kong-listed financial group

China Everbright (SEHK: 0165). "Shanghai has a long road ahead. It at least

requires the support of a sound regulatory system." As the head of a red-chip

company, Mr Chen has no intention of repatriating resources from Hong Kong to

Shanghai, where Everbright's core securities brokerage operations are located.

Ms Lau said that on the back of its developed capital and equity markets, Hong

Kong could develop and offer yuan-related derivatives, financial instruments

that are not expected to be available in the Shanghai market, at least in the

coming decade. "It is not impossible to see Shanghai surface as the world's

financial market in 11 years, as China moves ahead `a thousand miles a day', as

the Chinese saying goes," she said. "The question is how it strengthens its

rules and regulations, judicial system and talent supply." She said Shanghai

would enjoy greater convenience in trade should the yuan be fully exchangeable.

The tale of the two cities has unfolded differently primarily owing to Hong

Kong's governance under the "one country, two systems" principle. "The political

arrangement did resolve a confidence crisis, but it ties Hong Kong's hands in

its future development," said a senior official at one of Hong Kong's oldest

banks. Opportunities, therefore, thrive in the banking and financial sector in

Shanghai, where advantages would sway in favour of mainland banks and financial

institutions such as the Bank of China, Industrial and Commercial Bank of China

(SEHK: 1398) and Bank of Communications (SEHK: 3328), he said. "If Hong Kong

doesn't rethink seriously its way forward in terms of positioning and strategy,

it stands to lose its existing position," the bank official said. He also warned

of the waning importance of the Hong Kong dollar when the yuan becomes fully

convertible. With its geographical advantage as the window to the west, Hong

Kong has sought to align its economic development with the Pearl River Delta.

With China's aggressive transformation to a service-led economy and its ongoing

upgrade to a hi-tech based industrial structure, the city has little choice but

to merge further into the country's economy. Hong Kong's development roadmap

could have been rewritten if the city chose to be included in the 11th national

five-year plan, which spans from 2007 to 2012. A State Council researcher said

Hong Kong missed the chance of fitting into the country's planning as it did not

contact the National Development and Reform Commission until the top planning

agency finished the plan. What difference will full convertibility of the yuan

bring to Shanghai? It may be hard to quantify at present, but few will dispute

the positive impacts on city's top-notch international hotels, glitzy

fine-dining restaurants and shopping malls, the modern and expansive Pudong

international airport and the world's second-busiest port. Shanghai's ambitions of becoming a

global financial hub were given a boost by the central government. Imagine, 11

years from now, a Hong Kong factory owner produces electronics gadgets in

Shanghai's state-level Jinqiao export processing zone for clients in Europe and

then settles the trade in yuan directly through banks in the city. This scenario

could come to fruition following the central government's anointment of Shanghai

as a global hub for finance and shipping in 2020, with possible full

convertibility of the yuan in a vision for the fast-growing city and the

industrialising Yangtze River Delta region. As the mainland's second

international financial centre, in tandem with Hong Kong, Shanghai would

facilitate the country's growing prominence on the global economic and political

stage, but it would also catapult the two cities to a fresh level of

competition. The competition debate would escalate from a Mickey Mouse issue - a

proposed Disneyland theme park in Shanghai - to the probable prospect of that

city threatening Hong Kong as the gateway for foreign capital and the entrepot

for the mainland. The 2020 vision would also raise questions about the future of

the Hong Kong dollar. "Shanghai has got the gift it has longed for, for ages,"

said Priscilla Lau Pui-king, an associate professor and associate head of the

department of business studies at Hong Kong Polytechnic University and a Hong

Kong representative at the National People's Congress, referring to a freely

convertible yuan. "The two cities will brace for more competition. Shanghai has

lots of potential in banking and finance, whereas Hong Kong could expand

horizontally." China's tight grip on foreign exchange has cemented Hong Kong's

role as the artery for foreign capital inflows. The city was the mainland's

single largest source of overseas capital last year, accounting for 44.4 per

cent of US$92.4 billion in foreign direct investment, according to statistics

from the Ministry of Commerce. However, a freely convertible yuan will change

all that and provide the ultimate key to help Shanghai realise its grand

ambition of becoming an international financial, economic, trade and shipping

hub by 2020. It would mean bigger convenience in trade and financial

transactions for Shanghai, despite the fact that Hong Kong was picked for the

first batch of trial centres for yuan settlement of trade, along with Guangxi,

Yunnan, Guangdong and the Yangtze River Delta. At present, Shanghai is arguably

the country's financial powerhouse, home to the mainland's main stock markets,

the foreign-currency market, one of three commodities futures exchanges, and the

only financial futures exchange and gold exchange. The People's Bank of China

also has a second headquarters in the city, after Beijing. Nonetheless, a

comprehensive set of financial infrastructure does not necessarily give the city

the upper hand, some critics argue. "Hong Kong is a real global financial

centre," said Chen Shuang, chief executive of Hong Kong-listed financial group

China Everbright (SEHK: 0165). "Shanghai has a long road ahead. It at least

requires the support of a sound regulatory system." As the head of a red-chip

company, Mr Chen has no intention of repatriating resources from Hong Kong to

Shanghai, where Everbright's core securities brokerage operations are located.

Ms Lau said that on the back of its developed capital and equity markets, Hong

Kong could develop and offer yuan-related derivatives, financial instruments

that are not expected to be available in the Shanghai market, at least in the

coming decade. "It is not impossible to see Shanghai surface as the world's

financial market in 11 years, as China moves ahead `a thousand miles a day', as

the Chinese saying goes," she said. "The question is how it strengthens its

rules and regulations, judicial system and talent supply." She said Shanghai

would enjoy greater convenience in trade should the yuan be fully exchangeable.

The tale of the two cities has unfolded differently primarily owing to Hong

Kong's governance under the "one country, two systems" principle. "The political

arrangement did resolve a confidence crisis, but it ties Hong Kong's hands in

its future development," said a senior official at one of Hong Kong's oldest

banks. Opportunities, therefore, thrive in the banking and financial sector in

Shanghai, where advantages would sway in favour of mainland banks and financial

institutions such as the Bank of China, Industrial and Commercial Bank of China

(SEHK: 1398) and Bank of Communications (SEHK: 3328), he said. "If Hong Kong

doesn't rethink seriously its way forward in terms of positioning and strategy,

it stands to lose its existing position," the bank official said. He also warned

of the waning importance of the Hong Kong dollar when the yuan becomes fully

convertible. With its geographical advantage as the window to the west, Hong

Kong has sought to align its economic development with the Pearl River Delta.

With China's aggressive transformation to a service-led economy and its ongoing

upgrade to a hi-tech based industrial structure, the city has little choice but

to merge further into the country's economy. Hong Kong's development roadmap

could have been rewritten if the city chose to be included in the 11th national

five-year plan, which spans from 2007 to 2012. A State Council researcher said

Hong Kong missed the chance of fitting into the country's planning as it did not

contact the National Development and Reform Commission until the top planning

agency finished the plan. What difference will full convertibility of the yuan

bring to Shanghai? It may be hard to quantify at present, but few will dispute

the positive impacts on city's top-notch international hotels, glitzy

fine-dining restaurants and shopping malls, the modern and expansive Pudong

international airport and the world's second-busiest port.

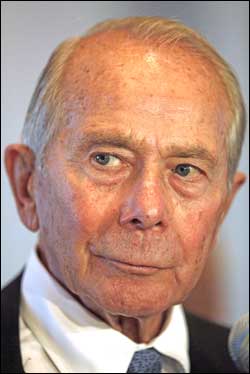

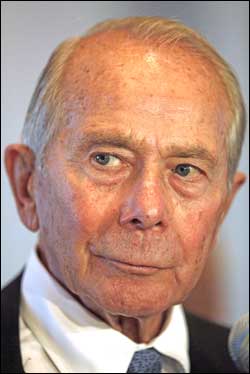

Former AIG chief executive Maurice

"Hank" Greenberg lashed out at his former employer yesterday, telling a Hong

Kong audience it made no sense to pay US$165 million (HK$1.27 billion) in

bonuses to executives in AIG's failed financial products unit. "There's no

reason to pay them bonuses," Greenberg said in a talk arranged by the American

Chamber of Commerce in Hong Kong. "Compensation did get out of hand." Greenberg

was the sole architect of the unit, AIG Financial Products, which lost more than

US$100 billion on credit- default swaps. "When they lost all this money in

2005/6/7, why would you pay them a bonus to make up for the losses that they had

in their capital account?" Greenberg said. "It doesn't make any sense."

Greenberg, 83, said AIG's decision to pay the bonuses was part of a wider

failure at the firm since it ran into trouble. He singled out new chief

executive Edward Liddy for particular criticism. "[This is an] example of people

running a company with no experience of dealing with a company of AIG's

background," he said. The former US Army captain, who led the insurance company

for almost 40 years, was forced out by AIG's board in March 2005 amid state and

federal probes into whether he used off-balance sheet transactions to improperly

boost profits. He had refused to cooperate with the company's own probe.

Greenberg yesterday disputed the claim that he was responsible for losses in AIG

Financial Products. The unit "went on a spree" writing credit-default swaps in

huge volumes after AIG lost its triple-A credit ratings in the wake of his

departure in 2005, Greenberg said. Instead, it should have stopped writing

credit-default swaps and hedged its holdings. AIG has said Greenberg was

"directly responsible" for the creation of the financial products unit. "It

strains common sense to accept Greenberg's allegations that he ... did not

appreciate the risks from the multisector CDS book written by AIG," the company

said in response to a lawsuit from Greenberg earlier this month. "AIG FP, from

the way it operated to its compensation, were all set up under Greenberg." On

Greenberg's watch, AIG Financial Products became a sought- after employer as it

offered to share a third of all its profits with staff. But several key

executives have quit the financial products unit after weeks of ridicule and

scorn. They include executive vice president Jake DeSantis who, in a parting

letter to CEO Liddy, wrote: "Most of those responsible have left the company and

have conspicuously escaped the public outrage." Greenberg also hit out at the US

government, describing its various AIG rescue plans as "going from one failed

strategy to another." He added: "There's only one way to pay back

taxpayers...that is to rebuild AIG. Destroying it doesn't accomplish anything -

nobody wins." That's especially true for Greenberg, who was AIG's largest

shareholder before the government takeover. He has seen most of his net worth,

pegged at US$3.2 billion the year after he left AIG, evaporate in the turmoil. Former AIG chief executive Maurice

"Hank" Greenberg lashed out at his former employer yesterday, telling a Hong

Kong audience it made no sense to pay US$165 million (HK$1.27 billion) in

bonuses to executives in AIG's failed financial products unit. "There's no

reason to pay them bonuses," Greenberg said in a talk arranged by the American

Chamber of Commerce in Hong Kong. "Compensation did get out of hand." Greenberg

was the sole architect of the unit, AIG Financial Products, which lost more than

US$100 billion on credit- default swaps. "When they lost all this money in

2005/6/7, why would you pay them a bonus to make up for the losses that they had

in their capital account?" Greenberg said. "It doesn't make any sense."

Greenberg, 83, said AIG's decision to pay the bonuses was part of a wider

failure at the firm since it ran into trouble. He singled out new chief

executive Edward Liddy for particular criticism. "[This is an] example of people

running a company with no experience of dealing with a company of AIG's

background," he said. The former US Army captain, who led the insurance company

for almost 40 years, was forced out by AIG's board in March 2005 amid state and

federal probes into whether he used off-balance sheet transactions to improperly

boost profits. He had refused to cooperate with the company's own probe.

Greenberg yesterday disputed the claim that he was responsible for losses in AIG

Financial Products. The unit "went on a spree" writing credit-default swaps in

huge volumes after AIG lost its triple-A credit ratings in the wake of his

departure in 2005, Greenberg said. Instead, it should have stopped writing

credit-default swaps and hedged its holdings. AIG has said Greenberg was

"directly responsible" for the creation of the financial products unit. "It

strains common sense to accept Greenberg's allegations that he ... did not

appreciate the risks from the multisector CDS book written by AIG," the company

said in response to a lawsuit from Greenberg earlier this month. "AIG FP, from

the way it operated to its compensation, were all set up under Greenberg." On

Greenberg's watch, AIG Financial Products became a sought- after employer as it

offered to share a third of all its profits with staff. But several key

executives have quit the financial products unit after weeks of ridicule and

scorn. They include executive vice president Jake DeSantis who, in a parting

letter to CEO Liddy, wrote: "Most of those responsible have left the company and

have conspicuously escaped the public outrage." Greenberg also hit out at the US

government, describing its various AIG rescue plans as "going from one failed

strategy to another." He added: "There's only one way to pay back

taxpayers...that is to rebuild AIG. Destroying it doesn't accomplish anything -

nobody wins." That's especially true for Greenberg, who was AIG's largest

shareholder before the government takeover. He has seen most of his net worth,

pegged at US$3.2 billion the year after he left AIG, evaporate in the turmoil.

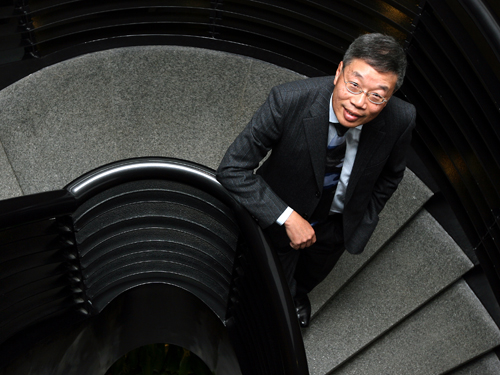

InvestHK associate director Simon Galpin

will replace Mike Rowse, who retired in January, as head of the investment

promotion body, a source said yesterday. Rowse, who became director general when

InvestHK was set up in July 2000, was seen as a trusted subordinate of Chief

Executive Donald Tsang Yam-kuen. Prior to taking up the post he was an

administrative officer, which Galpin is not. Another source said an

administrative officer would have been a more suited candidate as he would be

more familiar with the workings of the government and especially in seeking

resources. However, an open recruitment exercise last year for the directorate

grade six position, which offers a monthly salary of HK$181,450, apparently

failed to turn up new faces. A government source said Galpin is the most

experienced in the department. Rowse had intentionally kept a low profile in

recent months so as not to affect Galpin who became acting director general on

his retirement, the source said. Galpin, as one of the three associate directors

of InvestHK, was responsible for the retail, information technology,

telecommunications, tourism and entertainment sectors. Galpin is in Nanjing,

Jiangsu province, with Undersecretary for Commerce and Economic Development Greg

So Kam-leung for an investment promotion. Galpin received his appointment letter

last Friday, it is understood. An InvestHK spokesman declined to comment. InvestHK associate director Simon Galpin

will replace Mike Rowse, who retired in January, as head of the investment

promotion body, a source said yesterday. Rowse, who became director general when

InvestHK was set up in July 2000, was seen as a trusted subordinate of Chief

Executive Donald Tsang Yam-kuen. Prior to taking up the post he was an

administrative officer, which Galpin is not. Another source said an

administrative officer would have been a more suited candidate as he would be

more familiar with the workings of the government and especially in seeking

resources. However, an open recruitment exercise last year for the directorate

grade six position, which offers a monthly salary of HK$181,450, apparently

failed to turn up new faces. A government source said Galpin is the most

experienced in the department. Rowse had intentionally kept a low profile in

recent months so as not to affect Galpin who became acting director general on

his retirement, the source said. Galpin, as one of the three associate directors

of InvestHK, was responsible for the retail, information technology,

telecommunications, tourism and entertainment sectors. Galpin is in Nanjing,

Jiangsu province, with Undersecretary for Commerce and Economic Development Greg

So Kam-leung for an investment promotion. Galpin received his appointment letter

last Friday, it is understood. An InvestHK spokesman declined to comment.

China:

Australia rejected China’s state-owned firm Minmetals’ US$1.7 billion bid for

Australian miner OZ Minerals on Friday, saying it would only approve the deal if

it excluded the local firm’s prime mining asset. Treasurer Wayne Swan, in

announcing the surprise decision, noted OZ Minerals’ Prominent Hill copper-gold

mine was situated close to a sensitive defence facility, the Woomera

weapons-testing range in the deserts of outback south Australia.

China:

Australia rejected China’s state-owned firm Minmetals’ US$1.7 billion bid for

Australian miner OZ Minerals on Friday, saying it would only approve the deal if

it excluded the local firm’s prime mining asset. Treasurer Wayne Swan, in

announcing the surprise decision, noted OZ Minerals’ Prominent Hill copper-gold

mine was situated close to a sensitive defence facility, the Woomera

weapons-testing range in the deserts of outback south Australia.

China box office is still recording

strong growth despite the global economic downturn, posting increases of 29 per

cent in January, the chairman of the country’s leading state-run movie company

says. China Film Group chairman Han Sanping also predicted growth of at least 20

per cent for this year and total box office revenue of five billion Chinese yuan

(US$732 million) for the year, according to an interview published on the

website of People’s Daily on Friday. That figure is small compared to US

domestic box office revenue for Hollywood films, which took in US$9.63 billion

in 2007, the latest figures available according to the Motion Picture

Association of America. Mr Han was quoted as saying China still has many

untapped markets in smaller cities, noting that John Woo’s recent Chinese

historical epics Red Cliff and Red Cliff II made 600 million yuan (US$88

million) from about a dozen major cities alone without being shown in some 300

smaller cities in the mainland. “If these 300 cities each build two or three

multiplexes, and if each multiplex builds four or five screens, then we can

cover another 300, 400 million people,” Mr Han said.

Mainland will provide 20 yuan (HK$22.72)

per watt peak (Wp) of subsidy for solar power projects attached to buildings

that have capacity of more than 50 kilowatt peak (KWp), the Ministry of Finance

said, as the government makes a push for clean energy development. Analysts said

the support was unprecedented and would help expand the use of solar power much

faster than before, when installation was hampered by high costs and limited

subsidies. Mainland, the world’s third-largest major economy, is heavily reliant

on burning coal to fuel its economic growth. Solar power programmes based on

monocrystalline silicon panels should transform more than 16 per cent of solar

heat that panels receive into power, while those using polysilicon panels, more

than 14 per cent of solar heat, said the document posted on the ministry’s

website. Solar power panels made by non-silicon materials are required to

transform more than 6 per cent of solar heat. The government said it will give

preferential support to projects that can integrate parts of solar power

equipment into buildings and those having connection to grid networks. It will

also give priority to schools, hospitals and government buildings aiming to

develop solar power systems. “The threshold is pretty low,” said Wang Jing,

chief power analyst with Hongyuan Securities. “Monocrystalline silicon panel

projects over 313 square metres would qualify for the subsidy of some 1 million

yuan, so will polysilicon panel projects over 833 square metres.” “Installers

almost get free modules and will only be paying installation costs and other

small fees,” she said. Solar panel installers are looking at least breaking even

with the help of the subsidy, as power generation costs from solar panels could

be lowered to as low as US$0.04-0.06 per kilowatt hour, largely in line with

current power prices, a research note by Merrill Lynch and Banc of America

Securities said. Hongyuan’s Ms Wang said she expects mainland’s new solar power

generating capacity could soar to 500 megawatts (MW) and even more by the end of

this year from less than 100 MW currently. Mainland will provide 20 yuan (HK$22.72)

per watt peak (Wp) of subsidy for solar power projects attached to buildings

that have capacity of more than 50 kilowatt peak (KWp), the Ministry of Finance

said, as the government makes a push for clean energy development. Analysts said

the support was unprecedented and would help expand the use of solar power much

faster than before, when installation was hampered by high costs and limited

subsidies. Mainland, the world’s third-largest major economy, is heavily reliant

on burning coal to fuel its economic growth. Solar power programmes based on

monocrystalline silicon panels should transform more than 16 per cent of solar

heat that panels receive into power, while those using polysilicon panels, more

than 14 per cent of solar heat, said the document posted on the ministry’s

website. Solar power panels made by non-silicon materials are required to

transform more than 6 per cent of solar heat. The government said it will give

preferential support to projects that can integrate parts of solar power

equipment into buildings and those having connection to grid networks. It will

also give priority to schools, hospitals and government buildings aiming to

develop solar power systems. “The threshold is pretty low,” said Wang Jing,

chief power analyst with Hongyuan Securities. “Monocrystalline silicon panel

projects over 313 square metres would qualify for the subsidy of some 1 million

yuan, so will polysilicon panel projects over 833 square metres.” “Installers

almost get free modules and will only be paying installation costs and other

small fees,” she said. Solar panel installers are looking at least breaking even

with the help of the subsidy, as power generation costs from solar panels could

be lowered to as low as US$0.04-0.06 per kilowatt hour, largely in line with

current power prices, a research note by Merrill Lynch and Banc of America

Securities said. Hongyuan’s Ms Wang said she expects mainland’s new solar power

generating capacity could soar to 500 megawatts (MW) and even more by the end of

this year from less than 100 MW currently.

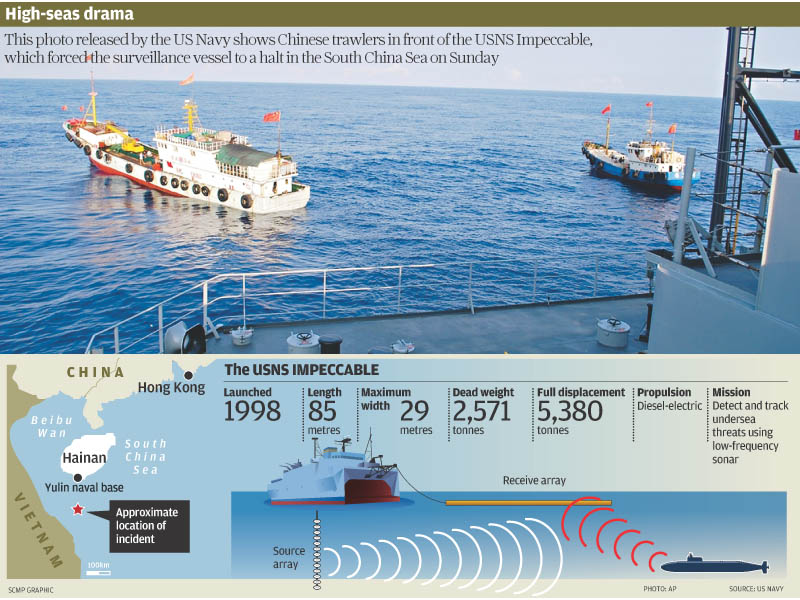

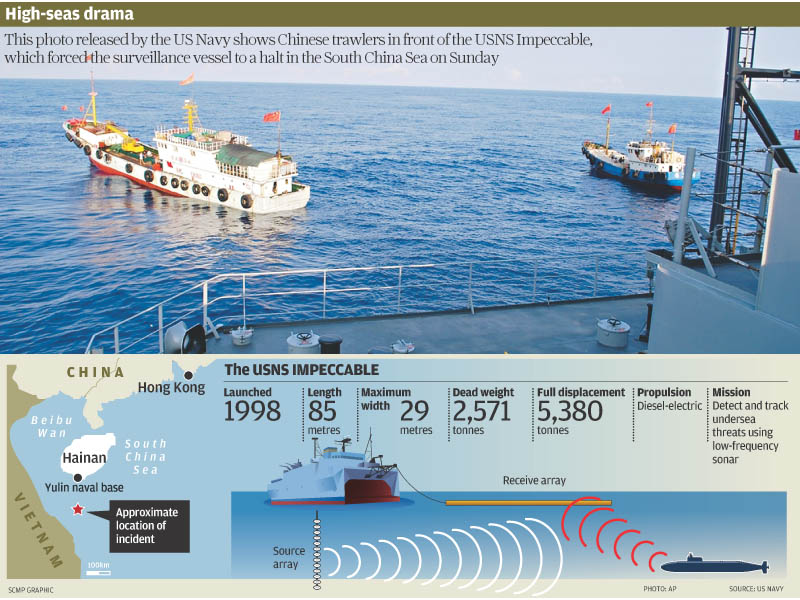

Beijing has called a Pentagon report

about the PLA's pursuit of sophisticated weaponry and its conclusion that China

was trying to alter Asia's military balance "a gross distortion of the facts".

The annual report, "Military Power of the People's Republic of China, 2009",

said Beijing had sold nearly US$7 billion worth of conventional arms in the

global market, with Pakistan as the main customer. Andrei Chang, chief editor of

the Canadian-based Kanwa Asian Defence Monthly, said the Pentagon was aware of

Beijing's arms sale to countries hostile to the US, such as Iran, in exchange

for cash and energy resources. "Beijing has expanded its weaponry global market

over the past decade by upgrading both arms quality and quantity, especially

with its deliberate arms sales to US-hostile countries such as Iran, Sudan and

Venezuela," Chang said. "I believe Beijing undertook a new arms-sale strategy to

counter the US' sale of weapons to Taiwan because mainland officials realised

that all their vocal opposition to the US' arms support of Taiwan has never

worked." He said the report also hinted the US had been concerned Beijing was

using its sophisticated weaponry in deals to obtain oil and natural gas from

resource-rich countries in the Middle East. "The US is worried that Beijing's

arms-for-energy policy might harm its long-standing national interests in the

sensitive Middle East region." In Beijing yesterday, Foreign Ministry spokesman

Qin Gang raised China's "strong objection and solemn representations to the US"

over the report. "This is a gross distortion of the facts, and China resolutely

opposes it," he said at a scheduled press briefing. "This report issued by the

US side continues to play up the fallacy of China's military threat." Although

Beijing announced the PLA had spent 417.8 billion yuan (HK$473.8 billion) on

defence last year, the Pentagon annual report said the actual amount was between

US$100 billion and US$150 billion, at least 71 per cent more. The report also

mentioned for the first time the PLA Navy was building a new base in Hainan, its

island province in the South China Sea, saying it could serve the growing fleet

of submarines, including those equipped with ballistic missiles. "The port,

which has underground facilities, would provide the PLA Navy with direct access

to vital international sea lanes, and offers the potential for stealthy

deployment of submarines into the deep waters of the South China Sea." Earlier

this month, the US surveillance ship USNS Impeccable had a standoff with several

Chinese vessels, and Beijing accused the US Navy of ordering the ship to

investigate the submarine base. The Pentagon report was written before the

standoff, but a US senior defence official said Chinese actions appeared to be

"consistent" with their military's mission of safeguarding against possible

threats to the country's sovereignty. "China is very, very sensitive about what

it perceives to be its territorial claims," the official said.

Executives sentenced in a milk

scandal in which at least six children died and tens of thousands were

hospitalized after drinking milk adulterated with melamine had their appeals

rejected by a court yesterday. The Hebei high court upheld the life sentence for

Tian Wenhua, chairwoman of dairy firm Sanlu, who was convicted last year of

manufacturing and selling fake or substandard products. Tian, who said during

her trial that she had reported the tainted milk to the government in early

August, appealed on grounds of lack of evidence. China did not announce the milk

contamination to the public until September, after the Olympic Games in Beijing

were over. The court also upheld sentences for other defendants from Sanlu and

melamine distributors, sentenced to death or life imprisonment.

Mar 26 - 27, 2009

Hong Kong:

A Silicon Valley hedge fund manager wanted in the US on charges he duped

investors out of at least US$5 million (HK$38.7 million) challenged his

extradition from Hong Kong on Wednesday. Hong Kong:

A Silicon Valley hedge fund manager wanted in the US on charges he duped

investors out of at least US$5 million (HK$38.7 million) challenged his

extradition from Hong Kong on Wednesday.

Bank of China (Hong Kong) (2388) has

recorded its first ever half-year loss. The bank lost HK$3.75 billion in the

second half of 2008 on impairment losses from investments and huge expenses

relating to Lehman minibonds. The city's third-largest lender posted

worse-than-expected earnings for 2008 of HK$3.34 billion, down from HK$15.446

billion a year ago, due to a more than sixfold rise in impairment allowances to

HK$12.5 billion. The provisions include a HK$2.73 billion hit on its 5 percent

stake in Bank of East Asia (0023) and a HK$8.253 billion charge on US non-agency

grade RMBS holdings. BOCHK vice chairman and chief executive He Guangbei also

blamed an extra HK$770 million in expenses as a result of the Lehman minibonds

for the worse than expected results. BOCHK will not pay a final dividend.

Salaries have been frozen and senior management will not get discretionary

bonuses. He Guangbei said the bank's first half results this year will depend on

the effectiveness of US government plans to bail out banks crippled by toxic

assets. "If the measures are effective, US assets prices could [rise] and help

the books," executive director and chief financial officer Lee Wing-hung said.

He Guangbei stressed the bank's core business was sound, citing its decline by

6.3 percent over the year and a slide in its non-performing loan ratio by two

basis points. BOCHK's parent Bank of China (3988) posted a net profit of 64.4

billion yuan (HK$73.07 billion) last year, up from 56.25 billion yuan in 2007,

even as it saw earnings decline by 58 percent during the fourth quarter. Its net

interest margin was 2.63 percent compared to 2.76 percent the year before on an

increase in lending since November 2008, vice chairman and president Li Lihui

said. BOC declared a final dividend of 13 fen per share. Like other lenders, it

is facing downward pressure on net interest margin. In posting net income of 4.5

billion yuan for the fourth quarter, compared to 10.78 billion yuan for the same

period the previous year, BOC fell nearly 3.5 billion yuan short of analysts'

forecasts, according to Reuters. As at 31 December 2008 its holdings in US

mortgage-related securities had taken a US$4.46 billion (HK$34.78 billion) hit.

He Guangbei said BOCHK did not need to raise funds, adding there were no plans

for massive staff layoffs or salary cuts at BOCHK. Li said BOC is positioning

itself as a clearing bank for yuan-denominated trade settlement in Hong Kong. Bank of China (Hong Kong) (2388) has

recorded its first ever half-year loss. The bank lost HK$3.75 billion in the

second half of 2008 on impairment losses from investments and huge expenses

relating to Lehman minibonds. The city's third-largest lender posted

worse-than-expected earnings for 2008 of HK$3.34 billion, down from HK$15.446

billion a year ago, due to a more than sixfold rise in impairment allowances to

HK$12.5 billion. The provisions include a HK$2.73 billion hit on its 5 percent

stake in Bank of East Asia (0023) and a HK$8.253 billion charge on US non-agency

grade RMBS holdings. BOCHK vice chairman and chief executive He Guangbei also

blamed an extra HK$770 million in expenses as a result of the Lehman minibonds

for the worse than expected results. BOCHK will not pay a final dividend.

Salaries have been frozen and senior management will not get discretionary

bonuses. He Guangbei said the bank's first half results this year will depend on

the effectiveness of US government plans to bail out banks crippled by toxic

assets. "If the measures are effective, US assets prices could [rise] and help

the books," executive director and chief financial officer Lee Wing-hung said.

He Guangbei stressed the bank's core business was sound, citing its decline by

6.3 percent over the year and a slide in its non-performing loan ratio by two

basis points. BOCHK's parent Bank of China (3988) posted a net profit of 64.4

billion yuan (HK$73.07 billion) last year, up from 56.25 billion yuan in 2007,

even as it saw earnings decline by 58 percent during the fourth quarter. Its net

interest margin was 2.63 percent compared to 2.76 percent the year before on an

increase in lending since November 2008, vice chairman and president Li Lihui

said. BOC declared a final dividend of 13 fen per share. Like other lenders, it

is facing downward pressure on net interest margin. In posting net income of 4.5

billion yuan for the fourth quarter, compared to 10.78 billion yuan for the same

period the previous year, BOC fell nearly 3.5 billion yuan short of analysts'

forecasts, according to Reuters. As at 31 December 2008 its holdings in US

mortgage-related securities had taken a US$4.46 billion (HK$34.78 billion) hit.

He Guangbei said BOCHK did not need to raise funds, adding there were no plans

for massive staff layoffs or salary cuts at BOCHK. Li said BOC is positioning

itself as a clearing bank for yuan-denominated trade settlement in Hong Kong.

Hong Kong shares ended 2.1 per cent lower on Wednesday pulling back from a

two-day, 8.4 per cent rally, but refiner Sinopec surged after Beijing announced

a hike in fuel prices.

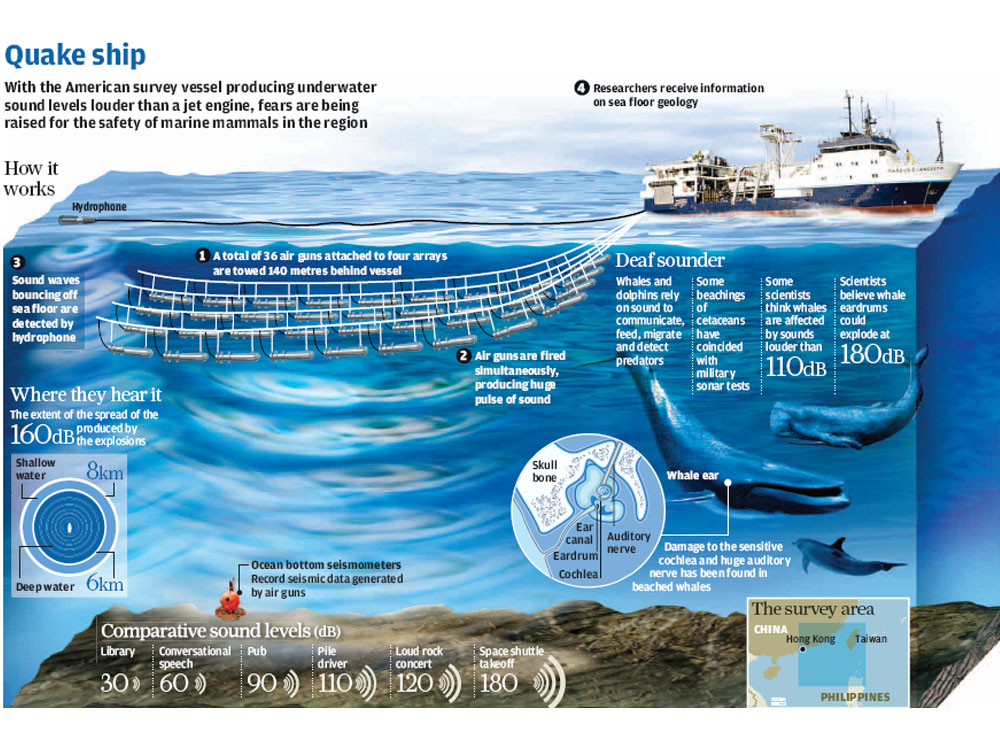

The 10-metre humpback whale that spent

a week in Hong Kong waters has not been sighted for two days might have left the

area, whale expert Samuel Hung Ka-yiu said on Wednesday. Mr Hung, director of

the Hong Kong Cetacean Research Project, said he had searched unsuccessfully for

the whale off Beaufort Island, Po Toi Island, Cape D’Aguilar and Stanley. He

told reporters that he believed it might have headed to Arctic feeding grounds.

Mr Hung said a whale has an innate sense of direction and would often swim to

the Arctic Ocean, alone. But he said local experts would continue searching for

the humpback until Sunday. The whale, first sighted in the East Lamma Channel

last Monday, aroused considerable interest in Hong Kong. Scientists say adult

humpbacks range from 12-16 metres in length and weigh approximately 36,000

kilograms. They typically migrate up to 25,000 kilometres each year. The whales

feed in polar waters only in summer. They usually migrate to tropical or

sub-tropical waters to breed and give birth in the winter. Their food consists

mostly of krill and small fish. The 10-metre humpback whale that spent

a week in Hong Kong waters has not been sighted for two days might have left the

area, whale expert Samuel Hung Ka-yiu said on Wednesday. Mr Hung, director of

the Hong Kong Cetacean Research Project, said he had searched unsuccessfully for

the whale off Beaufort Island, Po Toi Island, Cape D’Aguilar and Stanley. He

told reporters that he believed it might have headed to Arctic feeding grounds.

Mr Hung said a whale has an innate sense of direction and would often swim to

the Arctic Ocean, alone. But he said local experts would continue searching for

the humpback until Sunday. The whale, first sighted in the East Lamma Channel

last Monday, aroused considerable interest in Hong Kong. Scientists say adult

humpbacks range from 12-16 metres in length and weigh approximately 36,000

kilograms. They typically migrate up to 25,000 kilometres each year. The whales

feed in polar waters only in summer. They usually migrate to tropical or

sub-tropical waters to breed and give birth in the winter. Their food consists

mostly of krill and small fish.

Secretary for Food and Health York

Chow Yat-ngok said on Wednesday the government has earmarked HK$1.5 million for

the Health Department to hire overseas experts to study drug regulations in Hong

Kong. He made the comments at a special meeting of the Finance Committee of the

Legislative Council. However, some legislators voiced concern about whether the

department had enough resources and manpower to regulate importers, wholesalers

and drug manufacturing companies. Dr Chow replied that the Health Department

planned to enhance both inspections and regulations of drugs. These plans come

in the wake of a series of recent drug mishaps in the territory. He said the

government had also set up a 20-member review committee comprising doctors and

pharmacists to examine the regulatory system for pharmaceutical products. The

first meeting of the committee will be held in early April. It is expected the

review will be completed in six to nine months. The Health Department would also

hire 10 more non-civil service contract pharmacists in the next fiscal year to

inspect drug manufacturing companies. Dr Chow told the Legco recurrent

government expenditure on health for the 2009-2010 year was HK$35.7 billion.

This was 15.7 per cent of total recurrent expenditure and an increase of HK$1.8

billion over last year’s figure. The health secretary said the government would

continue working on its healthcare reforms. “We are preparing to launch the

second stage of a public consultation to encourage the public to discuss these

reforms”, he explained. Dr Chow said the government also planned to implement a

10-year programme for developing of an electronic health record (eHR) sharing

system.

Actors from Asia Television's talent pool help the station announce changes in

its channel lineup yesterday, including a new Taiwanese channel, CTI-Asia. Asia

Television's commitment to running a 24-hour high-definition TV channel next

month will be met at the expense of three existing digital channels, despite the

station insisting the revamp is not a cost-saving measure. It would be the first

reform taken by the station to combat its low viewership since Taiwanese

billionaire Tsai Eng-meng stepped into the cash-strapped company in January. The

plan announced yesterday included a full-fledged 24-hour HD TV channel starting

from April - in contrast to a mere two hours a day of such broadcasts since the

beginning of digital TV at the end of 2007. A new Taiwanese channel - CTI-Asia,

owned by Mr Tsai - would also be shown by the station in standard-definition

quality and follow CCTV-4 to become the second outside channel freely available

to Hong Kong viewers. But three existing digital channels run by the broadcaster

will cease. Station vice-president Ip Ka-po, in charge of production

administration and co-ordination, insisted the plan did not aim to cut costs and

said more programs would be produced under the new regime. "We are not `chopping

off' our existing channels," he said, noting that spectrum limitations had left

ATV no alternative if it wanted to step into HD production. "We see it as the

best time to commit to HD TV production as many viewers have now switched to

digital television a year after it came into service," Mr Ip said. The station

will introduce 24 hours of HD programs a week next month, rising to 38 1/2 in

July. The new arrangement would leave ATV with one HD TV channel and four SD TV

channels - ATV Home, ATV World, CTI-Asia and CCTV-4. According to the government

figures, about 32 per cent of local households, or 726,000 families, were

watching digital channels by the end of last year. Mr Ip said the broadcaster

was expecting a slight increase in production following the revamp and that

could require recruitment of 10 to 20 staff. According to the station's plan

approved by the Broadcasting Authority on Monday, ATV's proposed investment

would be revised from HK$200 million to HK$177.5 million due to savings in

programming costs. Leung Tin-wai, head of the department of journalism and

communication of Shue Yan University, said he would not be surprised by any

cost-saving measures amid the financial turmoil.

Actors from Asia Television's talent pool help the station announce changes in

its channel lineup yesterday, including a new Taiwanese channel, CTI-Asia. Asia

Television's commitment to running a 24-hour high-definition TV channel next

month will be met at the expense of three existing digital channels, despite the

station insisting the revamp is not a cost-saving measure. It would be the first

reform taken by the station to combat its low viewership since Taiwanese

billionaire Tsai Eng-meng stepped into the cash-strapped company in January. The

plan announced yesterday included a full-fledged 24-hour HD TV channel starting

from April - in contrast to a mere two hours a day of such broadcasts since the

beginning of digital TV at the end of 2007. A new Taiwanese channel - CTI-Asia,

owned by Mr Tsai - would also be shown by the station in standard-definition

quality and follow CCTV-4 to become the second outside channel freely available

to Hong Kong viewers. But three existing digital channels run by the broadcaster

will cease. Station vice-president Ip Ka-po, in charge of production

administration and co-ordination, insisted the plan did not aim to cut costs and

said more programs would be produced under the new regime. "We are not `chopping

off' our existing channels," he said, noting that spectrum limitations had left

ATV no alternative if it wanted to step into HD production. "We see it as the

best time to commit to HD TV production as many viewers have now switched to

digital television a year after it came into service," Mr Ip said. The station

will introduce 24 hours of HD programs a week next month, rising to 38 1/2 in

July. The new arrangement would leave ATV with one HD TV channel and four SD TV

channels - ATV Home, ATV World, CTI-Asia and CCTV-4. According to the government

figures, about 32 per cent of local households, or 726,000 families, were

watching digital channels by the end of last year. Mr Ip said the broadcaster

was expecting a slight increase in production following the revamp and that

could require recruitment of 10 to 20 staff. According to the station's plan

approved by the Broadcasting Authority on Monday, ATV's proposed investment

would be revised from HK$200 million to HK$177.5 million due to savings in

programming costs. Leung Tin-wai, head of the department of journalism and

communication of Shue Yan University, said he would not be surprised by any

cost-saving measures amid the financial turmoil.

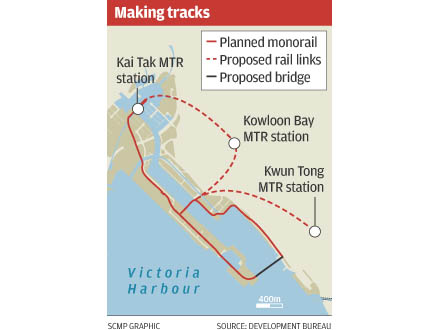

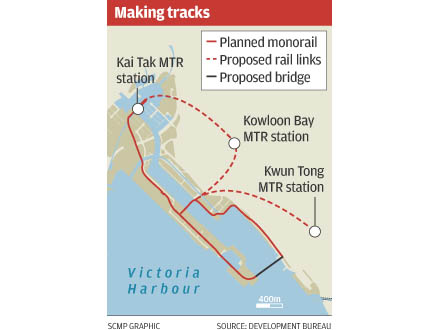

Residents of Kowloon Bay and Kwun Tong

may be able to commute to the future Kai Tak City by monorail under the latest

plan for bridging the gap between east Kowloon and the former airport site. A

monorail is already proposed to run the length of the new city, from the tip of

the former runway in the south to Kai Tak MTR station in the north. Now the

Civil Engineering and Development Department is looking into whether it could be

extended to east Kowloon. A new bridge had been planned from the tip of the old

runway to Kwun Tong but a recent study by the department found this might not be

feasible in the short term because the construction could infringe the

Protection of the Harbour Ordinance. "To allow vessels to pass under the bridge,

it would have to be very high, which is not very user-friendly," a spokesman for

the Development Bureau said. As an alternative, the department is studying the

feasibility of extending the monorail to neighbouring areas, including Kowloon

Bay and Kwun Tong, across an existing bridge. The preferred route would be from

the MTR stations in Kwun Tong and Kowloon Bay to Kai Tak station on the Sha

Tin-Central Link. The rail system is expected to be completed in 2021, subject

to the detailed design. "The extended rail link looks more user-friendly and it

serves the same purpose, strengthening the connection of old and new districts,"

the bureau's spokesman said. But the spokesman said the study was still at a

preliminary stage and a lot of problems had to be solved to implement the plan.

He said the government had to ensure streets in old areas were wide enough for

the monorail. Construction work on the monorail could also be complicated by the

busy road traffic and the public utilities carried underground. The Development

Bureau will seek funding of HK$1.18 billion from the Legislative Council for the

infrastructure and detailed design of Kai Tak, including a study of the

monorail. The infrastructure is expected to be completed in three phases: public

housing, cruise terminal and waterfront promenade in 2013; residential

development, underground street to Kowloon City and San Po Kong, heliport and

Kai Tak station in 2016; and monorail, stadium complex, remaining residential

and commercial developments, and the last stage of the district cooling system

in 2021. The first phase is expected to commence in July this year. Residents of Kowloon Bay and Kwun Tong

may be able to commute to the future Kai Tak City by monorail under the latest

plan for bridging the gap between east Kowloon and the former airport site. A

monorail is already proposed to run the length of the new city, from the tip of

the former runway in the south to Kai Tak MTR station in the north. Now the

Civil Engineering and Development Department is looking into whether it could be

extended to east Kowloon. A new bridge had been planned from the tip of the old

runway to Kwun Tong but a recent study by the department found this might not be

feasible in the short term because the construction could infringe the

Protection of the Harbour Ordinance. "To allow vessels to pass under the bridge,

it would have to be very high, which is not very user-friendly," a spokesman for

the Development Bureau said. As an alternative, the department is studying the

feasibility of extending the monorail to neighbouring areas, including Kowloon

Bay and Kwun Tong, across an existing bridge. The preferred route would be from

the MTR stations in Kwun Tong and Kowloon Bay to Kai Tak station on the Sha

Tin-Central Link. The rail system is expected to be completed in 2021, subject

to the detailed design. "The extended rail link looks more user-friendly and it

serves the same purpose, strengthening the connection of old and new districts,"

the bureau's spokesman said. But the spokesman said the study was still at a

preliminary stage and a lot of problems had to be solved to implement the plan.

He said the government had to ensure streets in old areas were wide enough for

the monorail. Construction work on the monorail could also be complicated by the

busy road traffic and the public utilities carried underground. The Development

Bureau will seek funding of HK$1.18 billion from the Legislative Council for the

infrastructure and detailed design of Kai Tak, including a study of the

monorail. The infrastructure is expected to be completed in three phases: public

housing, cruise terminal and waterfront promenade in 2013; residential

development, underground street to Kowloon City and San Po Kong, heliport and

Kai Tak station in 2016; and monorail, stadium complex, remaining residential

and commercial developments, and the last stage of the district cooling system

in 2021. The first phase is expected to commence in July this year.

Green areas in seven urban districts

will increase by 20 per cent to 50 per cent after the government's green master

plans are implemented, the Development Bureau says. Instead of tendering all

greening works to one contractor, the bureau said yesterday the greening project

covering seven districts would be divided into seven contracts, so as to create

job opportunities for small and medium-sized contractors during the economic

downturn. A total of 360 jobs would be created during the two-year greening

works. Districts selected for such work include Sham Shui Po, Kowloon City,

Western District, Southern District, Eastern District, Wong Tai Sin and Kwun

Tong. A total of 11,500 trees and 2.69 million shrubs would be planted. For

example, scholar trees (Sophora japonica) have been chosen to decorate Sai Ying

Pun, an area rich with historic monuments, educational institutions and the Dr

Sun Yat-sen historic trail. Happy trees (Camptotheca acuminata) have been chosen

for Kennedy Town, which is experiencing revitalisation. The bureau said it would

increase the green area of those districts by 20 per cent to 50 per cent.

A leading TV actress had to be rescued by

police yesterday in her luxury Kowloon City flat when her helper bit her arm and

refused to let go. The maid, 24, began weeping in the Sky Garden flat in Prince

Edward Road West after receiving a text message from a man in her home country

of Indonesia at about 9.30am. The cries woke Sonija Kwok Sin-nei, 34, who was

crowned Miss Hong Kong in 1999. She left her bedroom and found the helper

sobbing in the living room. According to details given by Kwok later during a

TVB (SEHK: 0511) program, in which she appeared with her left forearm bandaged,

her helper asked for help but kept saying: "I don't know what happened to me."

Kwok said the helper showed her the text message on her phone and became

emotional. "Then she suddenly ran into the kitchen and grabbed a chopper and

raised it against her neck." She agreed to hand over the chopper and Kwok gave

it to her mother, who hid it under a bed, while she called police. "When I was

giving details of where we were and the situation, the maid came and grabbed me.

She pulled my hair, bit my arm and refused to let go. My mum came to pull her

and the three of us went into a rough and tumble," she said. "The period

appeared to be a long time, but it was actually about five to 10 minutes." The

scuffle was only ended when police officers armed with shields arrived and

subdued the maid. Kwok and the helper were taken to Kwong Wah Hospital, where

Kwok was discharged after treatment. Despite her injuries and loss of hair, she

went to work at the TVB studios in Tseung Kwan O in the afternoon. The helper,

who has worked for the actress for about 10 months, was transferred to Kwai

Chung Hospital. A leading TV actress had to be rescued by

police yesterday in her luxury Kowloon City flat when her helper bit her arm and

refused to let go. The maid, 24, began weeping in the Sky Garden flat in Prince

Edward Road West after receiving a text message from a man in her home country

of Indonesia at about 9.30am. The cries woke Sonija Kwok Sin-nei, 34, who was

crowned Miss Hong Kong in 1999. She left her bedroom and found the helper

sobbing in the living room. According to details given by Kwok later during a

TVB (SEHK: 0511) program, in which she appeared with her left forearm bandaged,

her helper asked for help but kept saying: "I don't know what happened to me."

Kwok said the helper showed her the text message on her phone and became

emotional. "Then she suddenly ran into the kitchen and grabbed a chopper and

raised it against her neck." She agreed to hand over the chopper and Kwok gave

it to her mother, who hid it under a bed, while she called police. "When I was

giving details of where we were and the situation, the maid came and grabbed me.

She pulled my hair, bit my arm and refused to let go. My mum came to pull her

and the three of us went into a rough and tumble," she said. "The period

appeared to be a long time, but it was actually about five to 10 minutes." The

scuffle was only ended when police officers armed with shields arrived and

subdued the maid. Kwok and the helper were taken to Kwong Wah Hospital, where

Kwok was discharged after treatment. Despite her injuries and loss of hair, she

went to work at the TVB studios in Tseung Kwan O in the afternoon. The helper,

who has worked for the actress for about 10 months, was transferred to Kwai

Chung Hospital.

Secretary for Home Affairs Tsang Tak-sing

will lead a delegation to a Buddhist conference in Taipei next week - the first

visit to Taiwan by a Hong Kong principal official since the handover. He will

attend the second World Buddhist Forum along with the director of the mainland's

State Administration of Religious Affairs, Ye Xiaowen. "Hopefully Hong Kong will

play an active role in cross-strait relations. I also think this will definitely

help promote Hong Kong in the cultural and religious field," the minister said

of the tour. Mr Tsang has been invited by the Hong Kong Buddhist Association to

head a 100-strong delegation from Hong Kong and Macau. The event will start

tomorrow in Wuxi, Jiangsu, with a closing ceremony to be held in Taipei next

Wednesday. Mr Tsang played down any political implications and said he was

taking the tour as an ordinary visitor. "I am attending the activity in the

capacity as the head delegate invited by the Hong Kong Buddhist Association. Of

course I have accepted the invitation as the secretary for home affairs. The

relationship should be made clear." He did not rule out meeting Taiwanese

government officials during the conference. Secretary for Constitutional and

Mainland Affairs Stephen Lam Sui-lung said more principal officials would visit

the island if there were appropriate occasions. Chung Hwa Travel Service

managing director Jeff Yang Jia-jiunn - Taiwan's top representative in Hong Kong

- said Mr Tsang's trip was solely a civil exchange and the Hong Kong government

had not asked Taiwan to make any special arrangements. Qi Xiaofei, deputy

director of the State Administration of Religious Affairs, told the South China

Morning Post (SEHK: 0583, announcements, news) that senior state officials,

including himself and Mr Ye, would be part of the delegation to Taiwan. "This

forum is jointly organised by Buddhist groups across the Taiwan Strait. As an

organiser of the event, leaders of the China Religious Culture Communication

Association will participate in the trip," he said. Au Kit-ming, executive

director of the Hong Kong Buddhist Association, a co-organiser of the forum,

said that with Mr Ye and Mr Tsang attending, relations between Beijing and

Taipei would be further improved. "Being Buddhists and Chinese, it is our duty

to do our part in improving cross-strait relations. Both Mr Ye and Mr Tsang will

be participating in their non-official capacities." he said. Mr Au said more

than 1,000 Buddhists from 200 regions - including the politically sensitive

regions of Tibet, India and Nepal - would attend the event. "Buddhism promotes

harmony and there will not be any political problems." Separately, the Hong Kong

government announced that the Hong Kong-Taiwan Inter-City Forum had been

scheduled for April 15. Taichung Mayor Jason Hu Chih-chiang will lead a

delegation of his city officials to Hong Kong and discuss issues relating to

tourism and trade. Secretary for Home Affairs Tsang Tak-sing

will lead a delegation to a Buddhist conference in Taipei next week - the first

visit to Taiwan by a Hong Kong principal official since the handover. He will

attend the second World Buddhist Forum along with the director of the mainland's

State Administration of Religious Affairs, Ye Xiaowen. "Hopefully Hong Kong will

play an active role in cross-strait relations. I also think this will definitely

help promote Hong Kong in the cultural and religious field," the minister said

of the tour. Mr Tsang has been invited by the Hong Kong Buddhist Association to

head a 100-strong delegation from Hong Kong and Macau. The event will start

tomorrow in Wuxi, Jiangsu, with a closing ceremony to be held in Taipei next

Wednesday. Mr Tsang played down any political implications and said he was

taking the tour as an ordinary visitor. "I am attending the activity in the

capacity as the head delegate invited by the Hong Kong Buddhist Association. Of

course I have accepted the invitation as the secretary for home affairs. The

relationship should be made clear." He did not rule out meeting Taiwanese

government officials during the conference. Secretary for Constitutional and

Mainland Affairs Stephen Lam Sui-lung said more principal officials would visit

the island if there were appropriate occasions. Chung Hwa Travel Service

managing director Jeff Yang Jia-jiunn - Taiwan's top representative in Hong Kong

- said Mr Tsang's trip was solely a civil exchange and the Hong Kong government

had not asked Taiwan to make any special arrangements. Qi Xiaofei, deputy

director of the State Administration of Religious Affairs, told the South China

Morning Post (SEHK: 0583, announcements, news) that senior state officials,

including himself and Mr Ye, would be part of the delegation to Taiwan. "This

forum is jointly organised by Buddhist groups across the Taiwan Strait. As an

organiser of the event, leaders of the China Religious Culture Communication

Association will participate in the trip," he said. Au Kit-ming, executive

director of the Hong Kong Buddhist Association, a co-organiser of the forum,

said that with Mr Ye and Mr Tsang attending, relations between Beijing and

Taipei would be further improved. "Being Buddhists and Chinese, it is our duty

to do our part in improving cross-strait relations. Both Mr Ye and Mr Tsang will

be participating in their non-official capacities." he said. Mr Au said more

than 1,000 Buddhists from 200 regions - including the politically sensitive

regions of Tibet, India and Nepal - would attend the event. "Buddhism promotes