|

Newsletter

Seminar Material

Biz:

China

Hong

Kong Hawaii

What people

said about us

China

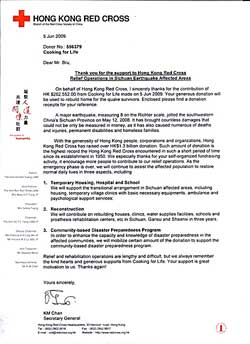

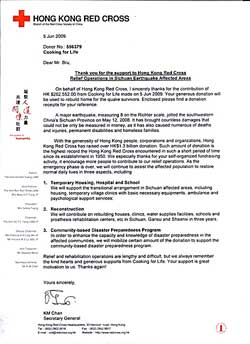

Earthquake Relief

Tax &

Government

Hawaii Voter Registration

Biz-Video

Biz-Video

Hawaii's

China Connection Hawaii's

China Connection

CDP#1780962

CDP#1780962

Doing Business in

Hong Kong & China

Doing Business in

Hong Kong & China

| |

Hong Kong, China & Hawaii Biz*

Skype - FREE

Voice Over IP Skype - FREE

Voice Over IP  View Hawaii's China Connection

Video Trailer

View Hawaii's China Connection

Video Trailer

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our event page to find out more!

After

attended a China/Hong Kong Business/Trade Seminar in Hawaii...still unsure what

to do next, contact us, our Officers, Directors and Founding Members are

actively engaged in China/Hong Kong/Asia trade - we can help!

Are you ready to export your product or

service? You will find out in 3 minutes with resources to help you -

enter

to give it a try

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

(approximate $ exchange rates: US$1 = HK$7.8, US$1 = RMB$6.8)

June 22 - 30, 2009

Hong Kong:

Pointing to "a wave of extreme anger" within their ranks, up to 1,000 police

officers are expected to rally later this month against a possible pay cut. The

protest would be the first by police since 1977, when officers took to the

streets in anger at graft investigations being carried out by the newly formed

Independent Commission Against Corruption. Police union representatives say

officers are unhappy with the government's announcement last month that civil

servants might have to follow the private sector and cut top salaries by 5.38

per cent and freeze the pay of others. They want their own salary-adjustment

mechanism. In a letter sent to the civil service minister, the force said "a

wave of extreme anger and disappointment swept across the Hong Kong Police

Force" upon learning of possible pay cuts. "Morale ... is at its lowest in a

decade" over the way the survey was conducted and "the integrity of the

results", the letter said. Officers have had three salary cuts and two pay

freezes since 1997. The chairman of the Police Inspectors' Association, Chief

Inspector Tony Liu Kit-ming, said individual officers were organising a protest

on June 28, a Sunday. Unionists expected a thousand off-duty officers to

participate. The protest will start at police headquarters in Admiralty, and

continue to the Central Government Offices. "The protest will be conducted in a

peaceful and lawful manner," Chief Inspector Liu said. Most of the committee

members in the inspectors' association including Chief Inspector Liu are likely

to join the protest. No slogans or banners will be used during the protest.

Staff representatives of the Police Force Council, which represents the four

associations of the police, yesterday wrote to the chief executive asking for a

committee to be established to review the survey results. Senior Superintendent

Peter Cornthwaite, who is also a staff representative of the council, said the

Tsang administration's final decision on pay adjustment next Tuesday would have

a big effect on what happened with the protest. "If the Executive Council agrees

to our request to set up a committee of inquiry, this may prevent them from

going for the march. All depends on the response of the government," he said.

Exco member Cheng Yiu-tong had called a meeting with staff representatives of

the Police Force Council on Monday, Mr Cornthwaite said, but the agenda of the

meeting was not known. According to the Police Ordinance, officers cannot

participate in political activities or take part in strikes. Off-duty protests

by officers did not breach any law or police regulations, Chief Inspector Liu

said. A police spokesman said that as of yesterday the force had not received

any notification of a protest organised by officers, and that management would

continue to communicate with the unions. A spokesman for the Civil Service

Bureau said it too would continue to communicate with the force unions, adding

that it was examining the police petition. Lawmakers have called for the

government to take the initiative in commencing talks with the unions.

Independent lawmaker Regina Ip Lau Suk-yee, a former security secretary, said it

was unfortunate to see the police staging a protest. She urged the police

management and the Civil Service Bureau to allay concerns among the police

staff. "I appeal to the police staff to stay calm," she said. Exco member Lau

Kong-wah and unionist lawmaker Lee Cheuk-yan urged the administration to

strengthen its communication with staff over their concerns about the pay trend

survey results. "The government should solve disputes with its labour through

active negotiation. Otherwise, the dispute may undermine public's confidence in

the government," Mr Lee said. Meanwhile, the Government Disciplined Services

General Union, which represents the staff of five disciplined services, has

called for a rally tomorrow to express dissatisfaction with the way of

government has handled the results of a Grade Structure Review, which

recommended a pay rise for long service at the lower levels but deferred the

implementation. Hong Kong:

Pointing to "a wave of extreme anger" within their ranks, up to 1,000 police

officers are expected to rally later this month against a possible pay cut. The

protest would be the first by police since 1977, when officers took to the

streets in anger at graft investigations being carried out by the newly formed

Independent Commission Against Corruption. Police union representatives say

officers are unhappy with the government's announcement last month that civil

servants might have to follow the private sector and cut top salaries by 5.38

per cent and freeze the pay of others. They want their own salary-adjustment

mechanism. In a letter sent to the civil service minister, the force said "a

wave of extreme anger and disappointment swept across the Hong Kong Police

Force" upon learning of possible pay cuts. "Morale ... is at its lowest in a

decade" over the way the survey was conducted and "the integrity of the

results", the letter said. Officers have had three salary cuts and two pay

freezes since 1997. The chairman of the Police Inspectors' Association, Chief

Inspector Tony Liu Kit-ming, said individual officers were organising a protest

on June 28, a Sunday. Unionists expected a thousand off-duty officers to

participate. The protest will start at police headquarters in Admiralty, and

continue to the Central Government Offices. "The protest will be conducted in a

peaceful and lawful manner," Chief Inspector Liu said. Most of the committee

members in the inspectors' association including Chief Inspector Liu are likely

to join the protest. No slogans or banners will be used during the protest.

Staff representatives of the Police Force Council, which represents the four

associations of the police, yesterday wrote to the chief executive asking for a

committee to be established to review the survey results. Senior Superintendent

Peter Cornthwaite, who is also a staff representative of the council, said the

Tsang administration's final decision on pay adjustment next Tuesday would have

a big effect on what happened with the protest. "If the Executive Council agrees

to our request to set up a committee of inquiry, this may prevent them from

going for the march. All depends on the response of the government," he said.

Exco member Cheng Yiu-tong had called a meeting with staff representatives of

the Police Force Council on Monday, Mr Cornthwaite said, but the agenda of the

meeting was not known. According to the Police Ordinance, officers cannot

participate in political activities or take part in strikes. Off-duty protests

by officers did not breach any law or police regulations, Chief Inspector Liu

said. A police spokesman said that as of yesterday the force had not received

any notification of a protest organised by officers, and that management would

continue to communicate with the unions. A spokesman for the Civil Service

Bureau said it too would continue to communicate with the force unions, adding

that it was examining the police petition. Lawmakers have called for the

government to take the initiative in commencing talks with the unions.

Independent lawmaker Regina Ip Lau Suk-yee, a former security secretary, said it

was unfortunate to see the police staging a protest. She urged the police

management and the Civil Service Bureau to allay concerns among the police

staff. "I appeal to the police staff to stay calm," she said. Exco member Lau

Kong-wah and unionist lawmaker Lee Cheuk-yan urged the administration to

strengthen its communication with staff over their concerns about the pay trend

survey results. "The government should solve disputes with its labour through

active negotiation. Otherwise, the dispute may undermine public's confidence in

the government," Mr Lee said. Meanwhile, the Government Disciplined Services

General Union, which represents the staff of five disciplined services, has

called for a rally tomorrow to express dissatisfaction with the way of

government has handled the results of a Grade Structure Review, which

recommended a pay rise for long service at the lower levels but deferred the

implementation.

HK's 'sound legal system' wins

praise - Senior mainland judges and officiating guests attend the closing

ceremony of the Advanced Program for Chinese Senior Judges at City University.

Hong Kong's sound legal and judicial system is an important reason for the

city's economic success and social stability, Huo Min, vice-president of the

Guangdong Higher People's Court, said after attending a four-week legal program

at a local university. Speaking at the closing ceremony for the Advanced Program

for Chinese Senior Judges, Mr Huo said that he was impressed with the way the

city's judicial personnel adhered to the rule of law. The advanced program was

organized by City University's School of Law in collaboration with the National

Judges College of the Supreme People's Court of the People's Republic of China.

The course, which started on May 26 and ended yesterday, introduced 28 senior

judges from various mainland cities and provinces to the common law system and

key international legal concepts. Participants visited legal enforcement and

judicial organizations and attended video-link lessons from Columbia

University's School of Law. "This [program] is not simply an academic exchange,"

said Justice Wang Xiuhong, a member of the judicial committee of the Supreme

People's Court. "Most importantly, it allows judges in Hong Kong and China to

better understand and respect each other's political and economic culture." Kuo

Way of City University said that the program had also benefited Hong Kong's

legal development because local practitioners had been able to learn directly

from mainland judges how mediation occurred on the mainland. "We are just

beginning to develop such a system in Hong Kong," he said, explaining that

mediation was different from the adversarial approach used in litigation

locally, in that it allowed disputes to be resolved quicker and more

harmoniously. Professor Kuo said that a similar course would be held later this

year, and the plan was to organize two programs each year for senior Chinese

judges. Elaine Lo, a senior partner with Mayer Brown JSM, the law firm that

sponsored the program, said it would be helpful to Hong Kong firms involved in

litigation or arbitration in the mainland if mainland judges had a better

understanding of the city's legal and judicial system. The advanced program had

served that purpose well, she said. HK's 'sound legal system' wins

praise - Senior mainland judges and officiating guests attend the closing

ceremony of the Advanced Program for Chinese Senior Judges at City University.

Hong Kong's sound legal and judicial system is an important reason for the

city's economic success and social stability, Huo Min, vice-president of the

Guangdong Higher People's Court, said after attending a four-week legal program

at a local university. Speaking at the closing ceremony for the Advanced Program

for Chinese Senior Judges, Mr Huo said that he was impressed with the way the

city's judicial personnel adhered to the rule of law. The advanced program was

organized by City University's School of Law in collaboration with the National

Judges College of the Supreme People's Court of the People's Republic of China.

The course, which started on May 26 and ended yesterday, introduced 28 senior

judges from various mainland cities and provinces to the common law system and

key international legal concepts. Participants visited legal enforcement and

judicial organizations and attended video-link lessons from Columbia

University's School of Law. "This [program] is not simply an academic exchange,"

said Justice Wang Xiuhong, a member of the judicial committee of the Supreme

People's Court. "Most importantly, it allows judges in Hong Kong and China to

better understand and respect each other's political and economic culture." Kuo

Way of City University said that the program had also benefited Hong Kong's

legal development because local practitioners had been able to learn directly

from mainland judges how mediation occurred on the mainland. "We are just

beginning to develop such a system in Hong Kong," he said, explaining that

mediation was different from the adversarial approach used in litigation

locally, in that it allowed disputes to be resolved quicker and more

harmoniously. Professor Kuo said that a similar course would be held later this

year, and the plan was to organize two programs each year for senior Chinese

judges. Elaine Lo, a senior partner with Mayer Brown JSM, the law firm that

sponsored the program, said it would be helpful to Hong Kong firms involved in

litigation or arbitration in the mainland if mainland judges had a better

understanding of the city's legal and judicial system. The advanced program had

served that purpose well, she said.

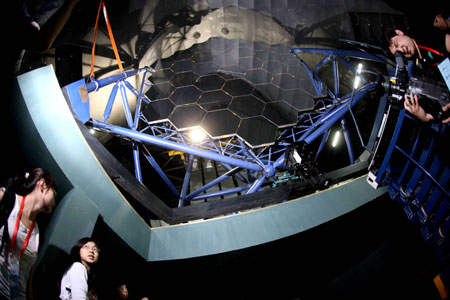

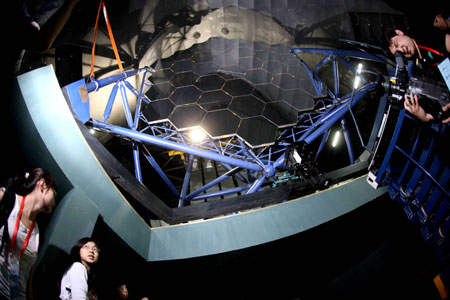

Television Broadcasts (SEHK: 0511)

general manger Stephen Chan Chi-wan insisted last night the station's management

would not intervene in the editorial policy of its news department. He was

responding at a Broadcasting Authority public hearing to criticism that the

station had downplayed the candle-light vigil on June 4, the 20th anniversary of

the Tiananmen Square crackdown. Mr Chan said that although TVB had not led its

6pm news with the item, it had devoted almost a third of the bulletin to the

vigil and had made it the lead in its 11pm newscast. "The news department is

independent in deciding how to handle news. The management has never

intervened," Mr Chan told the hearing in the lecture hall of the Hong Kong Space

Museum. It was one of three public hearings the authority plans to hold in

relation to the licences of TVB and its rival free-to-air channel, Asia

Television. Their licences were renewed for 12 years in 2003 and the authority

is conducting a mid-term review. Before the hearing, a group of Chinese

University students protested outside the venue, criticising TVB news for

exercising self-censorship. ATV plans to invest about HK$2.3 billion in

equipment and production of programmes over the next six years, while TVB has

said its investment in the same period will amount to HK$5.7 billion. Two more

hearings are planned next month, one on Hong Kong Island and one in the New

Territories. Television Broadcasts (SEHK: 0511)

general manger Stephen Chan Chi-wan insisted last night the station's management

would not intervene in the editorial policy of its news department. He was

responding at a Broadcasting Authority public hearing to criticism that the

station had downplayed the candle-light vigil on June 4, the 20th anniversary of

the Tiananmen Square crackdown. Mr Chan said that although TVB had not led its

6pm news with the item, it had devoted almost a third of the bulletin to the

vigil and had made it the lead in its 11pm newscast. "The news department is

independent in deciding how to handle news. The management has never

intervened," Mr Chan told the hearing in the lecture hall of the Hong Kong Space

Museum. It was one of three public hearings the authority plans to hold in

relation to the licences of TVB and its rival free-to-air channel, Asia

Television. Their licences were renewed for 12 years in 2003 and the authority

is conducting a mid-term review. Before the hearing, a group of Chinese

University students protested outside the venue, criticising TVB news for

exercising self-censorship. ATV plans to invest about HK$2.3 billion in

equipment and production of programmes over the next six years, while TVB has

said its investment in the same period will amount to HK$5.7 billion. Two more

hearings are planned next month, one on Hong Kong Island and one in the New

Territories.

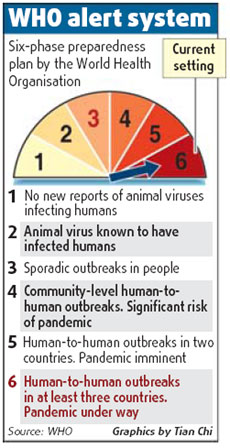

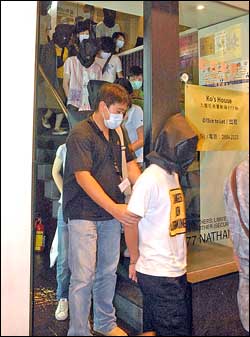

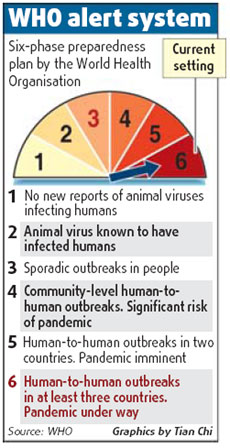

Starting as early as next week,

swine flu patients in Hong Kong will not automatically be sent to hospital for

isolation, amid growing complaints from frontline doctors that unnecessary

admissions are wasting public resources. Health officials expect that the number

of swine flu cases will double every three days, and are working with medical

experts to project the virus' behaviour. Hong Kong reported 26 new cases

yesterday, bringing the total to 247. As of yesterday, more than 170 confirmed

swine flu patients and another 130 people who had been in close contact with

them were in isolation wards in public hospitals. None had developed severe

complications. These patients are under the government's quarantine orders and

cannot be discharged until they are found to be no longer infectious. Secretary

for Food and Health York Chow Yat-ngok admitted yesterday that sending mild

cases to isolation wards had stressed public hospitals. Since Thursday, the

Hospital Authority has been admitting only confirmed swine flu patients but not

suspected cases or their close contacts. A government source revealed yesterday

that as Hong Kong proceeds past containment to the mitigation phase of the

outbreak, mild cases would be put under home care, similar to what United States

and Australia are doing. "We are revising the policy and will make a decision as

early as next week. Under home care, patients would be given Tamiflu, and

public-hospital beds would be reserved for severe cases only," the source said.

If the outbreak spreads further, mild cases will not even be given Tamiflu. The

antiviral will only be used on severely ill patients. Ho Pak-leung, of the

Public Doctors' Association and a microbiologist at the University of Hong Kong,

said the government should switch from hospital care to home care as soon as

possible. "There are complaints from frontline doctors that as the virus appears

so mild, there is no clinical basis to isolate the patients. The mitigation

effect of isolation is diminishing, as the virus is already rooted in the

community," Professor Ho said. One frontline doctor said: "These patients have

very mild or even no symptoms; it is a waste of resources to put them in single

isolated wards, and this compromises some regular services." Meanwhile, the Food

and Health Bureau is working with medical experts at the University of Hong Kong

to find an outbreak model for swine flu. Patient information and laboratory

results are being analysed to project the virus' infectivity and how long the

peak will last. Initial findings are expected in two weeks. The government is

also closely monitoring whether the new H1N1 virus will overtake the seasonal

H3N2 flu virus in Hong Kong. In the United States, about 90 per cent of flu

viruses isolated are swine flu. The government source said this "strain

replacement" situation would be one of the key factors in planning strategies.

The source said the summer flu peak would be the first wave of the swine flu

outbreak, to be followed by a second wave in the winter flu peak. "It is a long

battle. Hong Kong has to prepare for two waves that will last until next March

or April. We have to prepare for the worst."

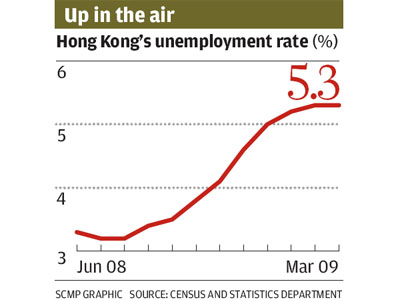

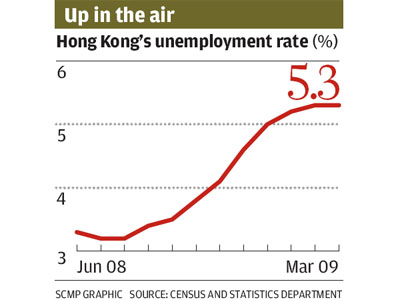

Bankruptcy petitions in Hong Kong in May jumped 54 per cent from a year earlier,

totaling 1,417, as the territory continued to struggle with economic recession,

but they fell on a monthly basis for a second straight month, government data

showed on Friday. Bankruptcies in April totalled 1,490, up 56 per cent from a

year earlier. The number of bankruptcies in May was the lowest since January and

marked only the third time since August that bankruptcy petitions, which give an

indication of future bankruptcies, had fallen from the previous month. Hong

Kong’s economy tipped into recession in the third quarter of last year and the

government has forecast it will contract by between 5.5 and 6.5 per cent this

year. Economists say it may now be bottoming out, but is likely to remain weak

this year.

An exhibition to mark the 60th

founding anniversary of the People's Republic of China has been held in Hong

Kong City Hall, which will last for two weeks. Hundreds of pictures and relics

were exhibited to show the close ties between Hong Kong and the mainland during

the past 60 years since 1949. Donald Tsang, chief executive of Hong Kong special

administrative region, Peng Qinghua, director of the Liaison Office of the

Chinese central government in the Hong Kong, Lv Xinhua, special representative

of the Ministry of Foreign Affair to Hong Kong, and Zhang Shibo, Commander of

the PLA Garrison in Hong Kong attended the opening ceremony. Through

exhibitions, the organizers hoped to carry forward the patriotism, review the

extraordinary path Hong Kong had gone through and deepen the knowledge of the

latest development of the mainland, according to Stephen Lam, secretary for

constitutional and mainland affairs of the Hong Kong government. The exhibition

was jointly organized by Hong Kong Culture Promotion Association and Chinese

General Chamber of Commerce.

The

number of Hong Kong-listed Chinese mainland firms has grown to 470 from 0 over

the past 16 years, a senior financial official of the Hong Kong Special

Administrative Region (HKSAR) said on June 18,2009. Financial Secretary John

Tsang said Hong Kong is playing a vital role as a capital formation center for

mainland enterprises. "In the past decade or so, we have seen a much broader

range of companies listing on our stock market," Tsang said, citing the first

Hong Kong listing of a mainland enterprise in 1993. More than half of the Hang

Seng Index constituents were from the mainland now. The HKSAR government is

engaged in ongoing discussions with the relevant parties in Beijing and across

the mainland to further strengthen financial co-operation, he added. The

number of Hong Kong-listed Chinese mainland firms has grown to 470 from 0 over

the past 16 years, a senior financial official of the Hong Kong Special

Administrative Region (HKSAR) said on June 18,2009. Financial Secretary John

Tsang said Hong Kong is playing a vital role as a capital formation center for

mainland enterprises. "In the past decade or so, we have seen a much broader

range of companies listing on our stock market," Tsang said, citing the first

Hong Kong listing of a mainland enterprise in 1993. More than half of the Hang

Seng Index constituents were from the mainland now. The HKSAR government is

engaged in ongoing discussions with the relevant parties in Beijing and across

the mainland to further strengthen financial co-operation, he added.

China: China's

stocks rose for the third straight day Friday, driving the benchmark index to a

10-month high as financial shares gained after the securities regulator approved

the nation's first initial public offering (IPO) since September.

China: China's

stocks rose for the third straight day Friday, driving the benchmark index to a

10-month high as financial shares gained after the securities regulator approved

the nation's first initial public offering (IPO) since September.

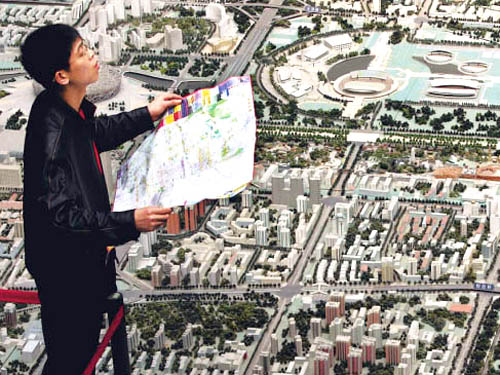

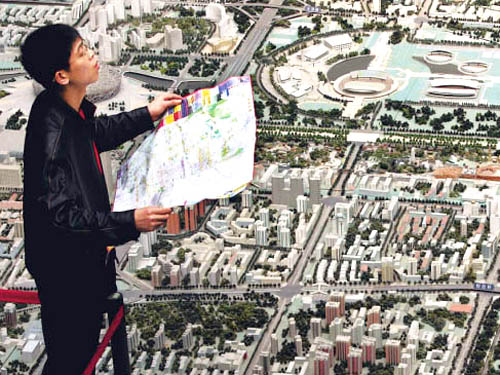

The organizers of Shanghai World Expo

2010 have ditched a "final" deadline for work on national pavilions to begin by

the end of the month, the deputy chairwoman of the fair's executive committee

said yesterday. Zhong Yanqun said the organizers needed to be flexible to

accommodate countries that were not yet ready to break ground on their Expo

stands - and hinted that construction work could extend to the eve of the

opening on May 1 next year. "Whether you can have a very strict deadline for

building pavilions or participation, in reality, as far as the World Expo is

concerned, it does need to be flexible," she said. "We hope that all of the

self-built pavilions will be able to begin work in July." When pressed on the

situation of the cash-strapped US pavilion project, she said organisers' main

concern was whether they would be ready in time for the opening. "Our time limit

is May 1 next year, when all national pavilions will need to be able to open,"

she said. Ms Zhong's position represented a U-turn on tough statements she made

last month, when she said countries would not be allowed to build their own

pavilions if they failed to begin work by June 30. "If work on a pavilion starts

after June 30 this year, it can't be completed before May 1 next year. This will

affect the operation of the whole World Expo Park," she said at the time.

Nations that failed to meet the deadline would be asked to rent facilities

constructed by the Expo organisers - considerably simpler prefabricated hangars.

The question mark hanging over US participation has been the source of

long-running embarrassment for Expo organizers, who planned on it being one of

the main draws. The largest plot for a foreign country has been set aside for

the US, but it remains the only nation that is yet to sign a participation

agreement. Unlike other countries, the US State Department has ruled out the use

of public funds to pay for its pavilion, which is to be paid for entirely with

private donations. The fund-raising committee announced on Thursday that it had

secured backing from agriculture, industry and finance giant Cargill. A

spokeswoman refused to reveal how much of the estimated US$61 million budget had

been raised. The Shanghai Daily quoted a spokeswoman for the US pavilion saying

it could take another three to six months to raise the cash. With construction

expected to take five months, that could bring work perilously close to the

opening date. However, the US is not the only country facing difficulties.

Shanghai government sources told the South China Morning Post (SEHK: 0583,

announcements, news) that there were concerns about 20 countries. Ms Zhong said

ground had been broken on some 24 of the 40-odd self-built pavilions. The

Shanghai World Expo 2010 is planned to be the biggest and most expensive in the

event's 158-year history. Organisers estimate the Expo will draw more than 70

million visitors during its 184-day run. Just 5 per cent of those are expected

to come from outside the mainland. The organizers of Shanghai World Expo

2010 have ditched a "final" deadline for work on national pavilions to begin by

the end of the month, the deputy chairwoman of the fair's executive committee

said yesterday. Zhong Yanqun said the organizers needed to be flexible to

accommodate countries that were not yet ready to break ground on their Expo

stands - and hinted that construction work could extend to the eve of the

opening on May 1 next year. "Whether you can have a very strict deadline for

building pavilions or participation, in reality, as far as the World Expo is

concerned, it does need to be flexible," she said. "We hope that all of the

self-built pavilions will be able to begin work in July." When pressed on the

situation of the cash-strapped US pavilion project, she said organisers' main

concern was whether they would be ready in time for the opening. "Our time limit

is May 1 next year, when all national pavilions will need to be able to open,"

she said. Ms Zhong's position represented a U-turn on tough statements she made

last month, when she said countries would not be allowed to build their own

pavilions if they failed to begin work by June 30. "If work on a pavilion starts

after June 30 this year, it can't be completed before May 1 next year. This will

affect the operation of the whole World Expo Park," she said at the time.

Nations that failed to meet the deadline would be asked to rent facilities

constructed by the Expo organisers - considerably simpler prefabricated hangars.

The question mark hanging over US participation has been the source of

long-running embarrassment for Expo organizers, who planned on it being one of

the main draws. The largest plot for a foreign country has been set aside for

the US, but it remains the only nation that is yet to sign a participation

agreement. Unlike other countries, the US State Department has ruled out the use

of public funds to pay for its pavilion, which is to be paid for entirely with

private donations. The fund-raising committee announced on Thursday that it had

secured backing from agriculture, industry and finance giant Cargill. A

spokeswoman refused to reveal how much of the estimated US$61 million budget had

been raised. The Shanghai Daily quoted a spokeswoman for the US pavilion saying

it could take another three to six months to raise the cash. With construction

expected to take five months, that could bring work perilously close to the

opening date. However, the US is not the only country facing difficulties.

Shanghai government sources told the South China Morning Post (SEHK: 0583,

announcements, news) that there were concerns about 20 countries. Ms Zhong said

ground had been broken on some 24 of the 40-odd self-built pavilions. The

Shanghai World Expo 2010 is planned to be the biggest and most expensive in the

event's 158-year history. Organisers estimate the Expo will draw more than 70

million visitors during its 184-day run. Just 5 per cent of those are expected

to come from outside the mainland.

The mainland says it made an operating profit of 1 billion yuan (HK$1.13

billion) hosting the Beijing Olympics - but the figure excludes the construction

cost for the venues, a long-awaited National Audit Office report said yesterday.

The Beijing Games wowed the world with extravaganza and organization. However,

the unprecedented national mobilization and single-minded pursuit of grandeur

led many to worry about budget blowouts at the expense of taxpayers. The audit

office has been under mounting pressure to publicize the report, which many hope

will shed light on the scale of spending since Beijing won the bid in 2001. The

report said the organizing committee for the Beijing Olympics (Bocog) had made

20.5 billion yuan in revenue by March 15 this year, 800 million yuan more than

expected from a profit split with the International Olympics Committee,

sponsorship, merchandising and ticket sales. It also reported a total outlay of

19.43 billion yuan for venue upgrades, television broadcasting, accommodation

and personnel. Auditors acknowledged a cost of 19.49 billion yuan to finance 102

new venues and training camps, but failed to reveal spending in other areas such

as environment and security. Economists earlier estimated that Bocog would need

400 billion yuan including costs to clean the environment and basic

infrastructure to stage a decent Olympic Games. Beijing Institute of Technology

professor Hu Xingdou said that was a fair estimation, but there was no point in

discussing if the Beijing Olympics made a profit or how much was lost "because

money was never a top priority for the country to host the Games". "The Olympics

were regarded as the country's coming out onto the world stage and to achieve

that goal the government was willing to spend as much as it needed," he said.

"Look at the number of roads that were built and how many police officers were

ferried to Beijing." The secrecy over some Olympics spending raised concerns

over official corruption after the downfall of Beijing's former vice-mayor Liu

Zhihua in 2006. Liu 60, who was in charge of the municipality's Olympic

construction office, was given a death sentence suspended for two years in April

this year for graft. Auditors admitted that irregularities were uncovered, but

most of the problems were solved. However, the National Stadium, or "Bird's

Nest", was over budget by 456 million yuan due to the complexity of the

engineering work and price increases for raw materials.

The mainland says it made an operating profit of 1 billion yuan (HK$1.13

billion) hosting the Beijing Olympics - but the figure excludes the construction

cost for the venues, a long-awaited National Audit Office report said yesterday.

The Beijing Games wowed the world with extravaganza and organization. However,

the unprecedented national mobilization and single-minded pursuit of grandeur

led many to worry about budget blowouts at the expense of taxpayers. The audit

office has been under mounting pressure to publicize the report, which many hope

will shed light on the scale of spending since Beijing won the bid in 2001. The

report said the organizing committee for the Beijing Olympics (Bocog) had made

20.5 billion yuan in revenue by March 15 this year, 800 million yuan more than

expected from a profit split with the International Olympics Committee,

sponsorship, merchandising and ticket sales. It also reported a total outlay of

19.43 billion yuan for venue upgrades, television broadcasting, accommodation

and personnel. Auditors acknowledged a cost of 19.49 billion yuan to finance 102

new venues and training camps, but failed to reveal spending in other areas such

as environment and security. Economists earlier estimated that Bocog would need

400 billion yuan including costs to clean the environment and basic

infrastructure to stage a decent Olympic Games. Beijing Institute of Technology

professor Hu Xingdou said that was a fair estimation, but there was no point in

discussing if the Beijing Olympics made a profit or how much was lost "because

money was never a top priority for the country to host the Games". "The Olympics

were regarded as the country's coming out onto the world stage and to achieve

that goal the government was willing to spend as much as it needed," he said.

"Look at the number of roads that were built and how many police officers were

ferried to Beijing." The secrecy over some Olympics spending raised concerns

over official corruption after the downfall of Beijing's former vice-mayor Liu

Zhihua in 2006. Liu 60, who was in charge of the municipality's Olympic

construction office, was given a death sentence suspended for two years in April

this year for graft. Auditors admitted that irregularities were uncovered, but

most of the problems were solved. However, the National Stadium, or "Bird's

Nest", was over budget by 456 million yuan due to the complexity of the

engineering work and price increases for raw materials.

Barclays

Capital raised its forecast for mainland’s gross domestic product growth for

this year to 7.8 per cent on Friday, from 7.2 per cent, citing unexpectedly

strong May data and a potential uptick in private spending. Barclays joins a

number of institutions that have upgraded their forecasts for mainland’s growth

in recent weeks, as a government-led investment boom has helped offset the

impact of falling exports on the world’s third-largest economy. The World Bank

on Thursday raised its GDP growth forecast for this year to 7.2 per cent from

6.5 per cent. “Our view of China on a recovery path is gaining support from

economic developments, with the May data pointing to further acceleration of

fixed asset investment and a pick-up in retail sales growth, despite continued

weakness in exports,” Barclays economists Wensheng Peng and Jian Chang said in a

report. “Overall, the latest data support our view that the Chinese economy

should be on an accelerating recovery path in H2, although indicators may not

move uniformly in one direction.” Annual growth in fixed-asset investment

accelerated to 32.9 per cent in the first five months of the year, up from 31

per cent in January through April, led by the government’s 4 trillion yuan

(HK$4.5 trillion) stimulus package. Retail sales growth also picked up in May,

to 15.2 per cent, helping offset the impact of a 26.4 per cent fall in exports

in the year to May. With the stimulus kicking in, many economists now expect

that Beijing will be able to come close to its target of 8 per cent growth for

the year as a whole. Barclays now expects GDP growth of 9.6 per cent next year,

up from its previous forecast of 9.0 per cent, in part because it sees private

investment becoming more of a growth driver. “Rising asset prices should help

lift investor confidence and stimulate private investment going forward,” Peng

and Chang wrote.

Wang Yi (L front), chief of the Taiwan Affairs Office of the Chinese State

Council, greets the overseas Chinese in San Francisco, the United States, June

18, 2009. Wang Yi said here on Thursday that the mainland will focus on

economic, cultural and educational cooperation as well as people-to-people

exchange with Taiwan in a bid to further promote cross-Strait ties.

Wang Yi (L front), chief of the Taiwan Affairs Office of the Chinese State

Council, greets the overseas Chinese in San Francisco, the United States, June

18, 2009. Wang Yi said here on Thursday that the mainland will focus on

economic, cultural and educational cooperation as well as people-to-people

exchange with Taiwan in a bid to further promote cross-Strait ties.

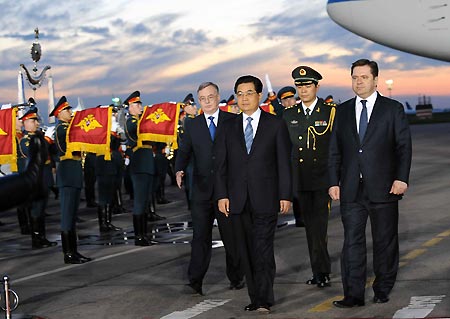

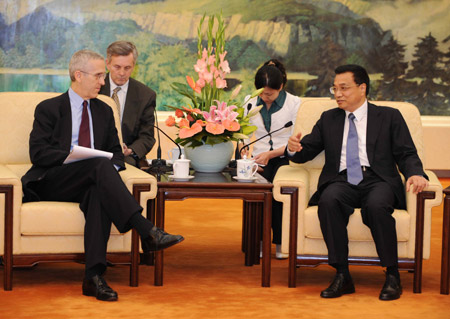

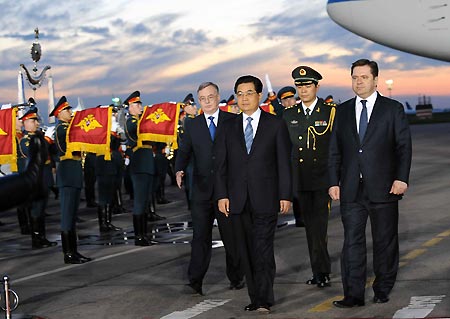

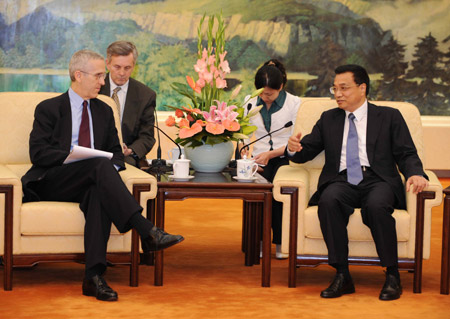

Visiting Chinese President Hu

Jintao (L) meets with Slovakian President Ivan Gasparovic for talks in

Bratislava, capital of Slovakia June 18, 2009. Chinese President Hu Jintao and

his Slovakian counterpart Ivan Gasparovic held talks in Bratislava on Thursday

and they agreed to take the 60th anniversary of diplomatic ties as an

opportunity to consolidate their traditional friendship and enrich the contents

of cooperation. Speaking highly of the longstanding friendship between the two

countries, Hu noted in particular the substantial development of bilateral

relations since the Central European country gained independence 16 years ago. Visiting Chinese President Hu

Jintao (L) meets with Slovakian President Ivan Gasparovic for talks in

Bratislava, capital of Slovakia June 18, 2009. Chinese President Hu Jintao and

his Slovakian counterpart Ivan Gasparovic held talks in Bratislava on Thursday

and they agreed to take the 60th anniversary of diplomatic ties as an

opportunity to consolidate their traditional friendship and enrich the contents

of cooperation. Speaking highly of the longstanding friendship between the two

countries, Hu noted in particular the substantial development of bilateral

relations since the Central European country gained independence 16 years ago.

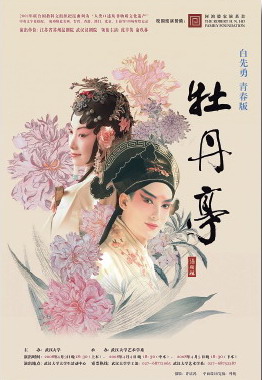

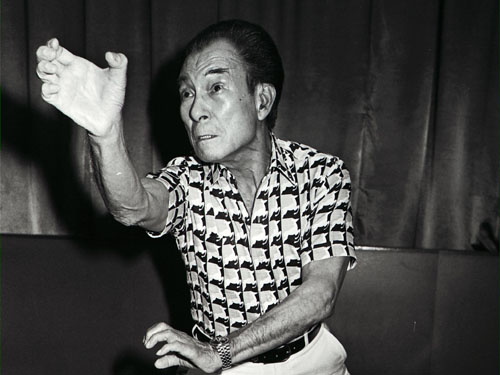

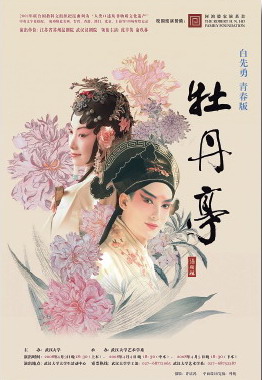

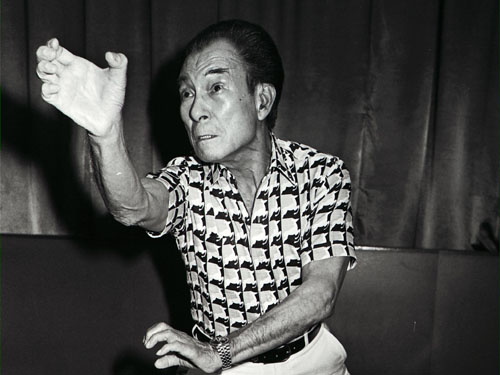

Peking Opera is perhaps China's best

known traditional opera — but traditionalists are now seeking to promote Kunqu

Opera, one of the oldest operatic forms and is considered the bedrock of the

operatic form. Now undergoing a makeover, Kunqu is attracting new audiences

around the world. One example of the opera's resurgence is the Suzhou Kunqu

Opera Theater's adaptation of The Peony Pavilion. Written by Tang Xianzu in the

Ming Dynasty(1368-1644) and first performed in 1598, the opera is about the

romance between Du Liniang and Liu Mengmei. The play is regarded as one of the

most romantic stories in Chinese literature and is often compared to

Shakespeare's Romeo and Juliet. According to producer Bai Xianyong, the story's

theme of love and beauty still resonate. While preserving the story's integrity,

Bai has used modern theater techniques to appeal to a more contemporary

audiences. He cut the original 55-act performance down to 27 for his stage

version and selected young actors to inject vitality into the centuries-old

story. The theater staged the updated version of the famous opera at more than

20 universities around China. Peking Opera is perhaps China's best

known traditional opera — but traditionalists are now seeking to promote Kunqu

Opera, one of the oldest operatic forms and is considered the bedrock of the

operatic form. Now undergoing a makeover, Kunqu is attracting new audiences

around the world. One example of the opera's resurgence is the Suzhou Kunqu

Opera Theater's adaptation of The Peony Pavilion. Written by Tang Xianzu in the

Ming Dynasty(1368-1644) and first performed in 1598, the opera is about the

romance between Du Liniang and Liu Mengmei. The play is regarded as one of the

most romantic stories in Chinese literature and is often compared to

Shakespeare's Romeo and Juliet. According to producer Bai Xianyong, the story's

theme of love and beauty still resonate. While preserving the story's integrity,

Bai has used modern theater techniques to appeal to a more contemporary

audiences. He cut the original 55-act performance down to 27 for his stage

version and selected young actors to inject vitality into the centuries-old

story. The theater staged the updated version of the famous opera at more than

20 universities around China.

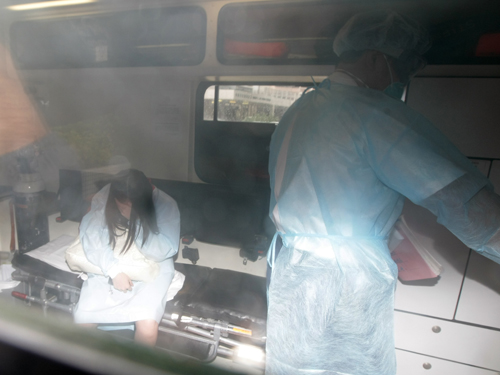

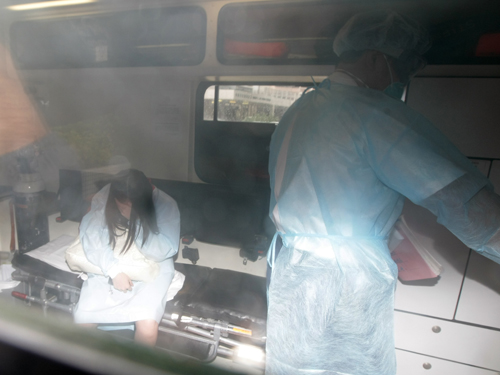

A technician puts a sample of the

A(H1N1) virus into a transfer cabinet during preparations to produce vaccines in

Wuhan, Hubei. The swine flu virus continues to spread across the mainland, with

33 more cases reported yesterday, bringing the number of infections to 297. The

Ministry of Health said that among the new cases, nine were reported in

Shanghai, seven in Guangdong and five in Fujian province . A total of 162

patients remain under treatment, and the others have been discharged from

hospital. The mainland has reported no deaths. In Guangdong, where 63 cases lead

the mainland, the Health Department denied the existence of any community

outbreaks. The province reported seven cases yesterday and nine cases on

Wednesday, but health authorities said they were scattered across the community,

the Guangdong daily newspaper New Express reported. The ministry released a work

plan on Wednesday that would be implemented in case of an outbreak or epidemic

at the community level. Authorities will focus on limiting social contacts and

isolating infection sources rather than trying to spot virus carriers at border

checkpoints as they do now. Meanwhile, dozens of American high school students

quarantined in Hubei after some of their classmates were diagnosed with swine

flu had been cleared for release, an employee of the city's swine flu command

centre said yesterday. Seven in the group, from the private Pacific Ridge School

in Carlsbad, California, tested positive for swine flu and were in hospital in

stable condition. A technician puts a sample of the

A(H1N1) virus into a transfer cabinet during preparations to produce vaccines in

Wuhan, Hubei. The swine flu virus continues to spread across the mainland, with

33 more cases reported yesterday, bringing the number of infections to 297. The

Ministry of Health said that among the new cases, nine were reported in

Shanghai, seven in Guangdong and five in Fujian province . A total of 162

patients remain under treatment, and the others have been discharged from

hospital. The mainland has reported no deaths. In Guangdong, where 63 cases lead

the mainland, the Health Department denied the existence of any community

outbreaks. The province reported seven cases yesterday and nine cases on

Wednesday, but health authorities said they were scattered across the community,

the Guangdong daily newspaper New Express reported. The ministry released a work

plan on Wednesday that would be implemented in case of an outbreak or epidemic

at the community level. Authorities will focus on limiting social contacts and

isolating infection sources rather than trying to spot virus carriers at border

checkpoints as they do now. Meanwhile, dozens of American high school students

quarantined in Hubei after some of their classmates were diagnosed with swine

flu had been cleared for release, an employee of the city's swine flu command

centre said yesterday. Seven in the group, from the private Pacific Ridge School

in Carlsbad, California, tested positive for swine flu and were in hospital in

stable condition.

Wang Yi (L front), chief of the Taiwan Affairs Office of the Chinese State

Council, greets the overseas Chinese in San Francisco, the United States, June

18, 2009. Wang Yi said here on Thursday that the mainland will focus on

economic, cultural and educational cooperation as well as people-to-people

exchange with Taiwan in a bid to further promote cross-Strait ties.

Wang Yi (L front), chief of the Taiwan Affairs Office of the Chinese State

Council, greets the overseas Chinese in San Francisco, the United States, June

18, 2009. Wang Yi said here on Thursday that the mainland will focus on

economic, cultural and educational cooperation as well as people-to-people

exchange with Taiwan in a bid to further promote cross-Strait ties.

Visiting Chinese President Hu

Jintao (L) meets with Slovakian President Ivan Gasparovic for talks in

Bratislava, capital of Slovakia June 18, 2009. Chinese President Hu Jintao and

his Slovakian counterpart Ivan Gasparovic held talks in Bratislava on Thursday

and they agreed to take the 60th anniversary of diplomatic ties as an

opportunity to consolidate their traditional friendship and enrich the contents

of cooperation. Speaking highly of the longstanding friendship between the two

countries, Hu noted in particular the substantial development of bilateral

relations since the Central European country gained independence 16 years ago. Visiting Chinese President Hu

Jintao (L) meets with Slovakian President Ivan Gasparovic for talks in

Bratislava, capital of Slovakia June 18, 2009. Chinese President Hu Jintao and

his Slovakian counterpart Ivan Gasparovic held talks in Bratislava on Thursday

and they agreed to take the 60th anniversary of diplomatic ties as an

opportunity to consolidate their traditional friendship and enrich the contents

of cooperation. Speaking highly of the longstanding friendship between the two

countries, Hu noted in particular the substantial development of bilateral

relations since the Central European country gained independence 16 years ago.

Peking Opera is perhaps China's best

known traditional opera — but traditionalists are now seeking to promote Kunqu

Opera, one of the oldest operatic forms and is considered the bedrock of the

operatic form. Now undergoing a makeover, Kunqu is attracting new audiences

around the world. One example of the opera's resurgence is the Suzhou Kunqu

Opera Theater's adaptation of The Peony Pavilion. Written by Tang Xianzu in the

Ming Dynasty(1368-1644) and first performed in 1598, the opera is about the

romance between Du Liniang and Liu Mengmei. The play is regarded as one of the

most romantic stories in Chinese literature and is often compared to

Shakespeare's Romeo and Juliet. According to producer Bai Xianyong, the story's

theme of love and beauty still resonate. While preserving the story's integrity,

Bai has used modern theater techniques to appeal to a more contemporary

audiences. He cut the original 55-act performance down to 27 for his stage

version and selected young actors to inject vitality into the centuries-old

story. The theater staged the updated version of the famous opera at more than

20 universities around China. Peking Opera is perhaps China's best

known traditional opera — but traditionalists are now seeking to promote Kunqu

Opera, one of the oldest operatic forms and is considered the bedrock of the

operatic form. Now undergoing a makeover, Kunqu is attracting new audiences

around the world. One example of the opera's resurgence is the Suzhou Kunqu

Opera Theater's adaptation of The Peony Pavilion. Written by Tang Xianzu in the

Ming Dynasty(1368-1644) and first performed in 1598, the opera is about the

romance between Du Liniang and Liu Mengmei. The play is regarded as one of the

most romantic stories in Chinese literature and is often compared to

Shakespeare's Romeo and Juliet. According to producer Bai Xianyong, the story's

theme of love and beauty still resonate. While preserving the story's integrity,

Bai has used modern theater techniques to appeal to a more contemporary

audiences. He cut the original 55-act performance down to 27 for his stage

version and selected young actors to inject vitality into the centuries-old

story. The theater staged the updated version of the famous opera at more than

20 universities around China.

A technician puts a sample of the

A(H1N1) virus into a transfer cabinet during preparations to produce vaccines in

Wuhan, Hubei. The swine flu virus continues to spread across the mainland, with

33 more cases reported yesterday, bringing the number of infections to 297. The

Ministry of Health said that among the new cases, nine were reported in

Shanghai, seven in Guangdong and five in Fujian province . A total of 162

patients remain under treatment, and the others have been discharged from

hospital. The mainland has reported no deaths. In Guangdong, where 63 cases lead

the mainland, the Health Department denied the existence of any community

outbreaks. The province reported seven cases yesterday and nine cases on

Wednesday, but health authorities said they were scattered across the community,

the Guangdong daily newspaper New Express reported. The ministry released a work

plan on Wednesday that would be implemented in case of an outbreak or epidemic

at the community level. Authorities will focus on limiting social contacts and

isolating infection sources rather than trying to spot virus carriers at border

checkpoints as they do now. Meanwhile, dozens of American high school students

quarantined in Hubei after some of their classmates were diagnosed with swine

flu had been cleared for release, an employee of the city's swine flu command

centre said yesterday. Seven in the group, from the private Pacific Ridge School

in Carlsbad, California, tested positive for swine flu and were in hospital in

stable condition. A technician puts a sample of the

A(H1N1) virus into a transfer cabinet during preparations to produce vaccines in

Wuhan, Hubei. The swine flu virus continues to spread across the mainland, with

33 more cases reported yesterday, bringing the number of infections to 297. The

Ministry of Health said that among the new cases, nine were reported in

Shanghai, seven in Guangdong and five in Fujian province . A total of 162

patients remain under treatment, and the others have been discharged from

hospital. The mainland has reported no deaths. In Guangdong, where 63 cases lead

the mainland, the Health Department denied the existence of any community

outbreaks. The province reported seven cases yesterday and nine cases on

Wednesday, but health authorities said they were scattered across the community,

the Guangdong daily newspaper New Express reported. The ministry released a work

plan on Wednesday that would be implemented in case of an outbreak or epidemic

at the community level. Authorities will focus on limiting social contacts and

isolating infection sources rather than trying to spot virus carriers at border

checkpoints as they do now. Meanwhile, dozens of American high school students

quarantined in Hubei after some of their classmates were diagnosed with swine

flu had been cleared for release, an employee of the city's swine flu command

centre said yesterday. Seven in the group, from the private Pacific Ridge School

in Carlsbad, California, tested positive for swine flu and were in hospital in

stable condition.

Several dams along the Yellow River

are close to collapse just a few years after they were built amid concerns that

over 40 per cent of the nation's reservoirs are unsafe, state media said on

Friday. Shoddy construction, unqualified workers and embezzlement of funds are

threatening dams' safety in the northwestern province of Gansu, the China Daily

said - situation that could also put people in danger. "Several dams on branches

of the Yellow River in Gansu province are near collapse only one or two years

after their construction," the paper said. Citing an investigation by the

state-run China Youth Daily newspaper, the report pointed to one dam built in

2006 in Huan county on the Yellow River that has developed a dangerous breach in

the middle. Locals were quoted as saying that at least five newly built dams in

the area were in very poor condition. An official at the county's water

protection bureau, who refused to be named, told reporters the matter was being

investigated by the government, but refused to provide any more details. But the

dire situation is not only limited to Gansu. More than 40 per cent of reservoirs

in China - or 37,000 - are in potential danger of being breached, according to

the report. Of these, about 3,640 dams are currently being reinforced, and

another 7,600 are in need of immediate attention. In the 10 years to last year,

a total of 59 dams were breached in the mainland due to torrential rain and

quality defects, the report said. It did not give a casualty figure for these

incidents. Environmentalists and rights groups have long warned of the negative

impact of dams, citing ecological damage and the forced relocation of residents.

Vehicles move on a flooded street in Xi'an, capital of northwest China's Shaanxi

Province, June 19, 2009. Heavy rain has been striking some cities and counties

in Shaanxi Province since June 18.

Vehicles move on a flooded street in Xi'an, capital of northwest China's Shaanxi

Province, June 19, 2009. Heavy rain has been striking some cities and counties

in Shaanxi Province since June 18.

The 2008 Beijing Olympics reaped

aprofit of more than 1 billion yuan (146.4 million U.S. dollars), China's

National Audit Office (NAO) said Friday. The Beijing Organizing Committee for

the Games of the XXIX Olympiad (BOCOG) reported income of 20.5 billion yuan and

expenses of 19.34 billion yuan for the 2008 Beijing Olympics, according to an

NAO tracking audit of Games' finances and construction costs of venues. The

Beijing Paralympics broke even with income and costs each totaling 863 million

yuan, said the eighth NAO report of the year. The tracking audit started from

2005, including an audit on the draft final accounts of the BOCOG, according to

NAO. The Games' income mainly came from sales of broadcasting rights, souvenirs

and tickets, assets sales, and sponsorship, while the main expenditure items

involved temporary facilities, sports and communication equipment, accommodation

and medical services. BOCOG spent 831 million yuan on the opening and closing

ceremonies, 332 million yuan on the Olympic torch relay, and 171 million yuan on

the volunteer program. Ticket sales brought in 1.28 billion yuan and assets

sales 240 million yuan. A total of 6.46 million tickets were sold, accounting

for 95 percent of the tickets available. Total investment in the Beijing Olympic

venues stood at 19.49 billion yuan, covering 102 projects in Beijing and five

co-host cities, said the report. Of that investment, 3.5 billion yuan came from

the central government, 8.26 billion yuan was allocated by local governments,

and 1.08 billion yuan from donations from overseas Chinese, according to the

report. No major problems were found during the audit, and no accidents or

quality problems were identified in the construction of the Olympic venues, it

said. BOCOG had maintained "strict control" over spending and income, and kept

"transparent, economical and efficient" accounts, said a statement on the NAO

website. However, minor problems did exist, said the report, including

irregularities in project subcontracting and bidding, as well as a deficit in

the construction of the National Stadium, or the Bird's Nest. The construction

of the stadium went 456 million yuan over budget due to its complicated

structure, technical difficulties, and adjustments in construction standards and

its functions. The estimated budget of the Bird's Nest stood at 3.14 billion

yuan, it said. "The 2008 Olympics and Paralympics were not the most expensive

games ever held," the statement said, citing the expenditure of the previous

Games and the budget of the 2012 event in London. Athens had spent more than 10

billion Euros (11.9 billion U.S. dollars in 2004) staging the 2004 Olympic

Games, and its operating costs stood at 2.4 billion U.S. dollars. The budget of

the 2012 London Olympics and Paralympics reached 9.3 billion pounds (15.2

billion U.S. dollars), according to the British government annual report on

preparations for the Olympics and Paralympics. The profit would be distributed

to the International Olympic Committee, the Chinese Olympic Committee and BOCOG,

which would set up funds for sports development, including improvements to

public sports facilities and promoting mass sports activities, said the

statement. The 2008 Beijing Olympics reaped

aprofit of more than 1 billion yuan (146.4 million U.S. dollars), China's

National Audit Office (NAO) said Friday. The Beijing Organizing Committee for

the Games of the XXIX Olympiad (BOCOG) reported income of 20.5 billion yuan and

expenses of 19.34 billion yuan for the 2008 Beijing Olympics, according to an

NAO tracking audit of Games' finances and construction costs of venues. The

Beijing Paralympics broke even with income and costs each totaling 863 million

yuan, said the eighth NAO report of the year. The tracking audit started from

2005, including an audit on the draft final accounts of the BOCOG, according to

NAO. The Games' income mainly came from sales of broadcasting rights, souvenirs

and tickets, assets sales, and sponsorship, while the main expenditure items

involved temporary facilities, sports and communication equipment, accommodation

and medical services. BOCOG spent 831 million yuan on the opening and closing

ceremonies, 332 million yuan on the Olympic torch relay, and 171 million yuan on

the volunteer program. Ticket sales brought in 1.28 billion yuan and assets

sales 240 million yuan. A total of 6.46 million tickets were sold, accounting

for 95 percent of the tickets available. Total investment in the Beijing Olympic

venues stood at 19.49 billion yuan, covering 102 projects in Beijing and five

co-host cities, said the report. Of that investment, 3.5 billion yuan came from

the central government, 8.26 billion yuan was allocated by local governments,

and 1.08 billion yuan from donations from overseas Chinese, according to the

report. No major problems were found during the audit, and no accidents or

quality problems were identified in the construction of the Olympic venues, it

said. BOCOG had maintained "strict control" over spending and income, and kept

"transparent, economical and efficient" accounts, said a statement on the NAO

website. However, minor problems did exist, said the report, including

irregularities in project subcontracting and bidding, as well as a deficit in

the construction of the National Stadium, or the Bird's Nest. The construction

of the stadium went 456 million yuan over budget due to its complicated

structure, technical difficulties, and adjustments in construction standards and

its functions. The estimated budget of the Bird's Nest stood at 3.14 billion

yuan, it said. "The 2008 Olympics and Paralympics were not the most expensive

games ever held," the statement said, citing the expenditure of the previous

Games and the budget of the 2012 event in London. Athens had spent more than 10

billion Euros (11.9 billion U.S. dollars in 2004) staging the 2004 Olympic

Games, and its operating costs stood at 2.4 billion U.S. dollars. The budget of

the 2012 London Olympics and Paralympics reached 9.3 billion pounds (15.2

billion U.S. dollars), according to the British government annual report on

preparations for the Olympics and Paralympics. The profit would be distributed

to the International Olympic Committee, the Chinese Olympic Committee and BOCOG,

which would set up funds for sports development, including improvements to

public sports facilities and promoting mass sports activities, said the

statement.

China's outsourcing industry has

maintained a strong business growth in the first five months of this year

although the financial crisis has reduced demand from foreign companies such as

big banks and insurance companies. Wang Chao, assistant minister of commerce,

said in an industry forum yesterday that the contract value of China's

outsourcing industry reached $2.59 billion from January to March, an increase of

25.9 percent compared with the same period last year. "Although overseas demand

for outsourcing services shrank in the first half of this year, China's software

exports and outsourcing industry still maintained a rapid growth," Wang said at

the China International Software & Information Service Fair in Dalian. But he

said Chinese outsourcing companies still have to face great challenges, as the

global economy cannot recover in the short term. He warned that some small and

medium sized outsourcing companies might have to wind up due as banks have

become cautious in their lending due to the economic crisis. Impacted by the

financial crisis, many of the big companies, especially the financial

institutions, have reduced their outsourcing orders due to shrinking business.

But Chinese outsourcing companies, whose major customers are Japanese companies

rather than US and European firms, still maintained a strong growth due to the

country's relatively lower labor cost, the government's strong support and the

abundant pool of college graduates. "Our software outsourcing business increased

94 percent year on year in the first five months of this year," said Zheng Shiyu,

CEO of Dalian Yidatec Co Ltd, one of China's largest outsourcing firms. The

company acquired two Japanese counterparts during the past ten months and plans

to attract more high-end customers. In order to help it transform from a

manufacturing base to a service hub, China aims to double in five years the

export value of the outsourcing industry by 2010. By achieving that, the

government announced earlier that it plans to woo some 100 multinationals to

transfer part of their service outsourcing industry to China by building 10

cities with international standards. It also plans to help 1,000 Chinese

outsourcing companies grow into medium to large size enterprises within the

five-year period ending 2010. But experts said Chinese outsourcing companies

still have a smaller scale and lack the experience and capacity to deliver

complicated outsourcing services, when compared with their Indian counterparts

like Infosys and TCS. Liu Jiren, chairman of Neusoft, China's largest

outsourcing company, said Chinese outsourcing companies need to grow bigger to

have the advantage of scale. He said Neusoft, which failed in its effort in

March to acquire Dalian Hi-Think Computer Technology Corp, China's second

largest outsourcing company, is still in acquisition talks with many domestic

and foreign companies. He said as more US and European companies are starting to

outsource their business to Chinese firms, China is expected outpace India in

outsourcing in the next five to ten years. China's outsourcing industry has

maintained a strong business growth in the first five months of this year

although the financial crisis has reduced demand from foreign companies such as

big banks and insurance companies. Wang Chao, assistant minister of commerce,

said in an industry forum yesterday that the contract value of China's

outsourcing industry reached $2.59 billion from January to March, an increase of

25.9 percent compared with the same period last year. "Although overseas demand

for outsourcing services shrank in the first half of this year, China's software

exports and outsourcing industry still maintained a rapid growth," Wang said at

the China International Software & Information Service Fair in Dalian. But he

said Chinese outsourcing companies still have to face great challenges, as the

global economy cannot recover in the short term. He warned that some small and

medium sized outsourcing companies might have to wind up due as banks have

become cautious in their lending due to the economic crisis. Impacted by the

financial crisis, many of the big companies, especially the financial

institutions, have reduced their outsourcing orders due to shrinking business.

But Chinese outsourcing companies, whose major customers are Japanese companies

rather than US and European firms, still maintained a strong growth due to the

country's relatively lower labor cost, the government's strong support and the

abundant pool of college graduates. "Our software outsourcing business increased

94 percent year on year in the first five months of this year," said Zheng Shiyu,

CEO of Dalian Yidatec Co Ltd, one of China's largest outsourcing firms. The

company acquired two Japanese counterparts during the past ten months and plans

to attract more high-end customers. In order to help it transform from a

manufacturing base to a service hub, China aims to double in five years the

export value of the outsourcing industry by 2010. By achieving that, the

government announced earlier that it plans to woo some 100 multinationals to

transfer part of their service outsourcing industry to China by building 10

cities with international standards. It also plans to help 1,000 Chinese

outsourcing companies grow into medium to large size enterprises within the

five-year period ending 2010. But experts said Chinese outsourcing companies

still have a smaller scale and lack the experience and capacity to deliver

complicated outsourcing services, when compared with their Indian counterparts

like Infosys and TCS. Liu Jiren, chairman of Neusoft, China's largest

outsourcing company, said Chinese outsourcing companies need to grow bigger to

have the advantage of scale. He said Neusoft, which failed in its effort in

March to acquire Dalian Hi-Think Computer Technology Corp, China's second

largest outsourcing company, is still in acquisition talks with many domestic

and foreign companies. He said as more US and European companies are starting to

outsource their business to Chinese firms, China is expected outpace India in

outsourcing in the next five to ten years.

The offspring of female panda Lin Hui lies

on a mattress at Chiang Mai Zoo, north of Bangkok, June 18, 2009. Lin Hui, a

female panda on loan from China, gave birth to the baby panda in Thailand on May

27 after being artificially inseminated with her partner's sperm for a second

time. The offspring of female panda Lin Hui lies

on a mattress at Chiang Mai Zoo, north of Bangkok, June 18, 2009. Lin Hui, a

female panda on loan from China, gave birth to the baby panda in Thailand on May

27 after being artificially inseminated with her partner's sperm for a second

time.

June 20- 21, 2009

Hong Kong:

Hong Kong Exchanges and Clearing (SEHK: 0388, announcements, news) may launch a

new derivative contract called "flexible options" in the first quarter of next

year, aiming to draw 10 per cent of turnover on the over-the-counter market to

the bourse. Chairman Ronald Arculli hoped the product would be able to attract

options trading to the exchange and help improve regulations. "This will enhance

market transparency and bring better regulations than on the over-the-counter

market," Mr Arculli said at a reception to celebrate the ninth anniversary of

HKEx's establishment. "US President Barack Obama has suggested a range of

regulatory reforms to tighten regulations, while the G20 meeting in London

earlier also recommended more regulations on over-the-counter trading." HKEx

chief executive Paul Chow Man-yiu said at the same event that a consultation

would be conducted in September and that the product could be launched in the

first quarter of next year. Flexible options will be structured like existing

stock options but with more settlement months, contract sizes and features,

which are to be discussed in the consultation period. "The benefit of trading

flexible options in our system is that it will be more transparent than on the

over-the-counter market," Mr Chow said. "Also, the exchange's clearing house

will settle the options, which means the investors will not face the

counterparty risks. "We hope we can attract about 10 per cent of such products'

trading turnover on the over-the-counter market to the exchange." Stock options

trading on the exchange at present are derivatives that track the prices of

their underlying stocks. The contracts carry certain sizes and maturities.

Options are popular instruments in Hong Kong and are usually used for hedging

purposes. Last year, the number of stock options traded on the exchange stood at

54.69 million, accounting for 52 per cent of all futures and option trades.

However, trading outside the exchange by investment banks and their clients,

commonly called over-the-counter trade, is also active. Hong Kong Stockbrokers

Association chairman Kenny Lee Yiu-sun said there was no data on

over-the-counter trades, but the volume could be slightly bigger than on the

bourse. "If the exchange-traded flexible options have more varied contract

sizes, terms and structures, they should be able to attract 10 to 20 per cent of

the over-the-counter market turnover on option products," Mr Lee said. "Trading

on the exchange has greater transparency." Mr Chow said the HKEx would announce

next Friday a consultation paper on the launch of carbon emission credits

futures contracts. Mr Chow, who will retire in January next year, also said he

believed the transition to the new chief, Charles Li Xiaojia, would be smooth.

Mr Li will join the exchange and work with Mr Chow in October. "We will work

together to handle many ongoing projects, such as the upgrade of the trading

system as well as the market consultations," said Mr Chow. Hong Kong:

Hong Kong Exchanges and Clearing (SEHK: 0388, announcements, news) may launch a

new derivative contract called "flexible options" in the first quarter of next

year, aiming to draw 10 per cent of turnover on the over-the-counter market to

the bourse. Chairman Ronald Arculli hoped the product would be able to attract

options trading to the exchange and help improve regulations. "This will enhance

market transparency and bring better regulations than on the over-the-counter

market," Mr Arculli said at a reception to celebrate the ninth anniversary of

HKEx's establishment. "US President Barack Obama has suggested a range of

regulatory reforms to tighten regulations, while the G20 meeting in London

earlier also recommended more regulations on over-the-counter trading." HKEx

chief executive Paul Chow Man-yiu said at the same event that a consultation

would be conducted in September and that the product could be launched in the

first quarter of next year. Flexible options will be structured like existing

stock options but with more settlement months, contract sizes and features,

which are to be discussed in the consultation period. "The benefit of trading

flexible options in our system is that it will be more transparent than on the

over-the-counter market," Mr Chow said. "Also, the exchange's clearing house

will settle the options, which means the investors will not face the

counterparty risks. "We hope we can attract about 10 per cent of such products'

trading turnover on the over-the-counter market to the exchange." Stock options

trading on the exchange at present are derivatives that track the prices of

their underlying stocks. The contracts carry certain sizes and maturities.

Options are popular instruments in Hong Kong and are usually used for hedging

purposes. Last year, the number of stock options traded on the exchange stood at

54.69 million, accounting for 52 per cent of all futures and option trades.

However, trading outside the exchange by investment banks and their clients,

commonly called over-the-counter trade, is also active. Hong Kong Stockbrokers

Association chairman Kenny Lee Yiu-sun said there was no data on

over-the-counter trades, but the volume could be slightly bigger than on the

bourse. "If the exchange-traded flexible options have more varied contract

sizes, terms and structures, they should be able to attract 10 to 20 per cent of

the over-the-counter market turnover on option products," Mr Lee said. "Trading

on the exchange has greater transparency." Mr Chow said the HKEx would announce

next Friday a consultation paper on the launch of carbon emission credits

futures contracts. Mr Chow, who will retire in January next year, also said he

believed the transition to the new chief, Charles Li Xiaojia, would be smooth.

Mr Li will join the exchange and work with Mr Chow in October. "We will work

together to handle many ongoing projects, such as the upgrade of the trading

system as well as the market consultations," said Mr Chow.

Shanghai's most senior Communist Party

official yesterday played down the city's rivalry with Hong Kong and suggested

the two could play complementary roles in the future. It was the first time a

top Shanghai official had addressed the relationship with Hong Kong since the

mainland's economic powerhouse declared its ambition of becoming a global