|

Newsletter

Seminar Material

Biz:

China

Hong

Kong Hawaii

What people

said about us

China

Earthquake Relief

Tax &

Government

Hawaii Voter Registration

Biz-Video

Biz-Video

Hawaii's

China Connection Hawaii's

China Connection

CDP#1780962

CDP#1780962

Doing Business in

Hong Kong & China

Doing Business in

Hong Kong & China

| |

Hong Kong, China & Hawaii Biz*

Skype - FREE

Voice Over IP Skype - FREE

Voice Over IP  View Hawaii's China Connection

Video Trailer

View Hawaii's China Connection

Video Trailer

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our event page to find out more!

After

attended a China/Hong Kong Business/Trade Seminar in Hawaii...still unsure what

to do next, contact us, our Officers, Directors and Founding Members are

actively engaged in China/Hong Kong/Asia trade - we can help!

Are you ready to export your product or

service? You will find out in 3 minutes with resources to help you -

enter

to give it a try

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

Holidays Greeting from President Obama &

Johnson Choi

Holidays Greeting from President Obama &

Johnson Choi

http://www.youtube.com/watch?v=pNk4Z4lUV-k

http://www.youtube.com/watch?v=pNk4Z4lUV-k

http://www.facebook.com/video/video.php?v=219896871983&ref=mf

http://www.facebook.com/video/video.php?v=219896871983&ref=mf

Wine-Biz - Hong Kong

Wine-Biz - Hong Kong

Brand Hong Kong

Video

Brand Hong Kong

Video

(approximate $ exchange rates: US$1 = HK$7.8, US$1 = RMB$6.8)

July 31, 2009

Hong Kong:

Hong Kong’s Exchange Fund, which is used to back the territory’s currency peg

with the US dollar, rebounded in the second quarter to post a HK$25 billion

investment gain for the first half, the central bank said on Thursday. The

second-quarter gain, of HK$58.5 billion according to Reuters calculations,

reflected a rebound in Hong Kong equities, which have rallied more than 50 per

cent since March, and follows a HK$33.5 billion investment loss for the first

quarter. In last year, the fund recorded a HK$74.9 billion loss, its first

full-year loss since at least 1994, as financial markets plunged in the wake of

the global financial crisis. However, while financial markets have been buoyed

recently by hopes the global economy could soon start to pick up, Joseph Yam

Chi-kwong, chief executive of the Hong Kong Monetary Authority (HKMA), warned

that there was no guarantee the fund could produce a gain in the second half.

“On several occasions … in the past couple of months I have drawn attention to

the possible disconnection between financial-market performance and economic

performance, and pointed to the risk that, as economic reality [in the form of

continued economic weakness and a slow recovery] sinks in, we may see

disappointments in the financial markets in the months ahead,” Mr Yam wrote in a

weekly column on the HKMA website

www.info.gov.hk/hkma/eng. The Hong Kong government also draws a portion of

its annual revenue from the Exchange Fund, based on the fund’s rolling six-year

average return. For the first half it would receive HK$17.6 billion, the HKMA

said. Unaudited results from the HKMA showed the Exchange Fund made a HK$26.1

billion gain on Hong Kong equities in the first six months of this year and a

HK$9.2 billion gain on other equities. It made a HK$12.3 billion loss on bond

investments. Exchange Fund assets totaled HK$1,833.2 billion at the end of June

this year and its accumulated surplus increased by HK$8.5 billion in the first

half. Hong Kong:

Hong Kong’s Exchange Fund, which is used to back the territory’s currency peg

with the US dollar, rebounded in the second quarter to post a HK$25 billion

investment gain for the first half, the central bank said on Thursday. The

second-quarter gain, of HK$58.5 billion according to Reuters calculations,

reflected a rebound in Hong Kong equities, which have rallied more than 50 per

cent since March, and follows a HK$33.5 billion investment loss for the first

quarter. In last year, the fund recorded a HK$74.9 billion loss, its first

full-year loss since at least 1994, as financial markets plunged in the wake of

the global financial crisis. However, while financial markets have been buoyed

recently by hopes the global economy could soon start to pick up, Joseph Yam

Chi-kwong, chief executive of the Hong Kong Monetary Authority (HKMA), warned

that there was no guarantee the fund could produce a gain in the second half.

“On several occasions … in the past couple of months I have drawn attention to

the possible disconnection between financial-market performance and economic

performance, and pointed to the risk that, as economic reality [in the form of

continued economic weakness and a slow recovery] sinks in, we may see

disappointments in the financial markets in the months ahead,” Mr Yam wrote in a

weekly column on the HKMA website

www.info.gov.hk/hkma/eng. The Hong Kong government also draws a portion of

its annual revenue from the Exchange Fund, based on the fund’s rolling six-year

average return. For the first half it would receive HK$17.6 billion, the HKMA

said. Unaudited results from the HKMA showed the Exchange Fund made a HK$26.1

billion gain on Hong Kong equities in the first six months of this year and a

HK$9.2 billion gain on other equities. It made a HK$12.3 billion loss on bond

investments. Exchange Fund assets totaled HK$1,833.2 billion at the end of June

this year and its accumulated surplus increased by HK$8.5 billion in the first

half.

The Internship Program for

University Graduates (GIP) would be launched on August 1, programme director

Raymond Ho Kam-biu said on Thursday.

Members of The Link Watch and other

groups angered by rent increases for shops protest outside The Link Management's

annual general meeting in Wan Chai yesterday. The Link Management defended its

policy on rent rises yesterday as more than 100 tenants in its shopping centers

protested at charges they said were driving them out of business. During the

protest, organized by various retail groups and political parties, tenants

chanted slogans and waved banners outside the Renaissance Harbor View Hotel in

Wan Chai where The Link was holding its annual general meeting. After the

meeting, Nicholas Sallnow-Smith, chairman of The Link Management, defended the

company's strategy. "On average, our rents are not going up tremendously fast,"

he said. "The Link team is dedicated to running the greatest business in Hong

Kong that is constructively engaged in the local community in Hong Kong. Yet

what I read in the press makes me feel you don't believe that. However, this is

absolutely the case." Chief executive Ian Robins said rents had increased by 25

per cent over the past three years - an annual rate of 8.3 per cent - which he

described as "a responsible level". The Link, a publicly listed real estate

investment trust, took control of 180 shopping centres, fresh-food markets and

car parks when the Housing Authority privatised the commercial spaces on

public-housing estates and sold them to the company in 2005. The Link has since

implemented a series of major renovation projects in a strategy to attract more

shoppers and boost profits. Rents have also gone up. Mr Sallnow-Smith said: "If

we want to be a successful business in Hong Kong, we have to be financially

successful first ... then we can invest in assets, improve shopping centres and

gradually improve the economy of the community." The Link pledges to be a

responsible employer, but many small retailers say they are under mounting

pressure in dealing with rent rises amid a grim economy. Lau Ma-hong, 52, who

sells hardware on Lung Hang Estate in Sha Tin, said he struggled after The Link

raised his monthly rent from HK$29,500 to HK$36,000 in 2007. "Residents in our

estate are getting old. Many families are receiving government financial

assistance and the economy is not good, yet no matter what the market is like,

The Link is set to charge us more," he said. Pressure group The Link Watch,

which joined the protest yesterday, said it surveyed 14 of The Link's shopping

centres last month and found that 20 per cent of small traders had closed over

the past year, and had largely been replaced by chain stores. Fred Li Wah-ming,

a Democratic Party lawmaker, said the management of The Link was ignorant of the

needs of the community and only knew how to make "fast money". He said the only

way to give tenants a say was for the government to buy back control from The

Link. Last month, The Link announced a 13.75 per cent rise in earnings. It said

distributable income for the year to March was HK$1.82 billion. Mr Sallnow-Smith

said The Link had earmarked HK$1.17 billion for 11 asset-enhancement projects in

the next two years and HK$1.39 billion for another 11 from 2011 onwards. Members of The Link Watch and other

groups angered by rent increases for shops protest outside The Link Management's

annual general meeting in Wan Chai yesterday. The Link Management defended its

policy on rent rises yesterday as more than 100 tenants in its shopping centers

protested at charges they said were driving them out of business. During the

protest, organized by various retail groups and political parties, tenants

chanted slogans and waved banners outside the Renaissance Harbor View Hotel in

Wan Chai where The Link was holding its annual general meeting. After the

meeting, Nicholas Sallnow-Smith, chairman of The Link Management, defended the

company's strategy. "On average, our rents are not going up tremendously fast,"

he said. "The Link team is dedicated to running the greatest business in Hong

Kong that is constructively engaged in the local community in Hong Kong. Yet

what I read in the press makes me feel you don't believe that. However, this is

absolutely the case." Chief executive Ian Robins said rents had increased by 25

per cent over the past three years - an annual rate of 8.3 per cent - which he

described as "a responsible level". The Link, a publicly listed real estate

investment trust, took control of 180 shopping centres, fresh-food markets and

car parks when the Housing Authority privatised the commercial spaces on

public-housing estates and sold them to the company in 2005. The Link has since

implemented a series of major renovation projects in a strategy to attract more

shoppers and boost profits. Rents have also gone up. Mr Sallnow-Smith said: "If

we want to be a successful business in Hong Kong, we have to be financially

successful first ... then we can invest in assets, improve shopping centres and

gradually improve the economy of the community." The Link pledges to be a

responsible employer, but many small retailers say they are under mounting

pressure in dealing with rent rises amid a grim economy. Lau Ma-hong, 52, who

sells hardware on Lung Hang Estate in Sha Tin, said he struggled after The Link

raised his monthly rent from HK$29,500 to HK$36,000 in 2007. "Residents in our

estate are getting old. Many families are receiving government financial

assistance and the economy is not good, yet no matter what the market is like,

The Link is set to charge us more," he said. Pressure group The Link Watch,

which joined the protest yesterday, said it surveyed 14 of The Link's shopping

centres last month and found that 20 per cent of small traders had closed over

the past year, and had largely been replaced by chain stores. Fred Li Wah-ming,

a Democratic Party lawmaker, said the management of The Link was ignorant of the

needs of the community and only knew how to make "fast money". He said the only

way to give tenants a say was for the government to buy back control from The

Link. Last month, The Link announced a 13.75 per cent rise in earnings. It said

distributable income for the year to March was HK$1.82 billion. Mr Sallnow-Smith

said The Link had earmarked HK$1.17 billion for 11 asset-enhancement projects in

the next two years and HK$1.39 billion for another 11 from 2011 onwards.

The Trade Development Council is

hoping the launch of fairs featuring tea and lifestyle products next month will

attract more buyers and tourists despite the challenging economic environment.

The three-day Hong Kong International Tea Fair and the four-day Lifestyle

Showcase will run alongside the Food Expo and the International Conference and

Exhibition of the Modernization of Chinese Medicine and Health Products. The

fairs will be held at the Convention and Exhibition Centre in Wan Chai. "We hope

these fairs can become a tourist activity to attract mainland visitors," Raymond

Yip Chak-yan, the council's assistant executive director, said. The council

might arrange for buses in Guangzhou to bring visitors to the tea fair or work

with travel agencies to help bring them in, he said. It has also sponsored about

200 overseas buyers to attend the show. The move is part of an HK$80 million

effort to subsidize about 10,000 overseas buyers to come to the council's shows

this year. It is trying to court first-time buyers from emerging markets such as

India, Russia and the Middle East to help offset the fewer buyers coming from

the US and the European Union. The council helped arrange for 25 overseas buying

missions from 21 markets around the world to attend the tea fair. Mr Yip said he

hoped the subsidies could last until March, as cheaper airfares and hotel

discounts meant the council had spent just over half of the funds so far.

Despite the subsidies, buyer numbers have fallen. In January, the Toys and Games

Fair, the largest in the region, reported a 3.5 per cent drop, while the number

of buyers at Fashion Week fell by almost 10 per cent. The International

Jewellery Show in March had about 5 per cent fewer buyers. Despite signs of

stabilization in the economy, the downturn continues to depress demand,

especially for luxury goods. Hong Kong relies on established markets such as the

US and the EU for about 60 per cent of its exports.

Commerce minister Rita Lau Ng Wai-lan

says she would welcome a free-television licence application from Cable TV after

it expressed interest in becoming the city's third free-to-air station. Commerce minister Rita Lau Ng Wai-lan

says she would welcome a free-television licence application from Cable TV after

it expressed interest in becoming the city's third free-to-air station.

Secretary for the Civil Service

Denise Yue Chung-yee said on Thursday the government intended to deal with the

disciplined services’ concerns about salary reviews.

Primus Financial Holdings, founded

by former top Citi Asia banker Robert Morse, plans to team up with a Hong Kong

battery maker to bid for AIG’s Taiwan unit Nan Shan Life, sources with direct

knowledge of the matter said on Thursday. American International Group, bailed

out by the US government in the financial crisis, is selling its Asia assets to

shore up its capital base and the sale of Nan Shan could fetch over US$2

billion, sources have said. Little-known China Strategic Holdings, whose major

businesses include battery production and securities investments, issued a

statement on Wednesday saying it had entered into a non-legally binding

agreement with Primus to jointly bid for a controlling stake in an insurance

firm. China Strategic also said it plans to raise about HK$7.8 billion to fund

the possible joint acquisition, though the Hong Kong-listed firm did not name

the deal target. Primus declined to comment, while a representative for China

Strategic could not be immediately reached for comment. The sources declined to

be identified as the bidding process is confidential.

A graduate of Christian Zheng Sheng

College, a drug rehabilitation school, has won a place at Lingnan University -

but still fears his past might catch up with him. Wong Wing-san, 25, who will

take up accountancy, is one of the lucky applicants in the Joint University

Programs Admissions System. Wong achieved a B in Economics and a D in Accounting

and Chinese in his A-Level exams. However, his dream could be shattered because

of his criminal record. "Even if I can't be an accountant, the knowledge I

acquire will still be very useful for my future career," said Wong. He thanked

his family and teachers and those who helped him. College principal Alman Chan

Siu-cheuk said Wong's success is a clear message to fellow students, adding he

hopes society will accept reformed young criminals. Wong is the second Zheng

Sheng student to have won a university place in eight years. Lingnan University

president Chan Yuk-shee praised Wong's persistence and ambition. Hong Kong

Institute of Certified Public Accountants president Paul Winkelmann said those

with criminal convictions may not be rejected as accountants, adding that the

institute will consider all the facts and circumstances. The institute is the

only body authorized to register and grant practicing certificates to certified

public accountants. Meanwhile, 17,613 out of 35,318 JUPAS applicants received

offers, with 12,038 for degree courses and 5,575 associate degrees and higher

diplomas. Last year, there were 17,068 with offers. Hong Kong University

admitted 1,844 applicants this year, with more than 50 percent achieving three

to six As in their exams. Chinese University admitted 2,325 candidates, with

more than 40 percent achieving four As and three with five As. A graduate of Christian Zheng Sheng

College, a drug rehabilitation school, has won a place at Lingnan University -

but still fears his past might catch up with him. Wong Wing-san, 25, who will

take up accountancy, is one of the lucky applicants in the Joint University

Programs Admissions System. Wong achieved a B in Economics and a D in Accounting

and Chinese in his A-Level exams. However, his dream could be shattered because

of his criminal record. "Even if I can't be an accountant, the knowledge I

acquire will still be very useful for my future career," said Wong. He thanked

his family and teachers and those who helped him. College principal Alman Chan

Siu-cheuk said Wong's success is a clear message to fellow students, adding he

hopes society will accept reformed young criminals. Wong is the second Zheng

Sheng student to have won a university place in eight years. Lingnan University

president Chan Yuk-shee praised Wong's persistence and ambition. Hong Kong

Institute of Certified Public Accountants president Paul Winkelmann said those

with criminal convictions may not be rejected as accountants, adding that the

institute will consider all the facts and circumstances. The institute is the

only body authorized to register and grant practicing certificates to certified

public accountants. Meanwhile, 17,613 out of 35,318 JUPAS applicants received

offers, with 12,038 for degree courses and 5,575 associate degrees and higher

diplomas. Last year, there were 17,068 with offers. Hong Kong University

admitted 1,844 applicants this year, with more than 50 percent achieving three

to six As in their exams. Chinese University admitted 2,325 candidates, with

more than 40 percent achieving four As and three with five As.

Bubble fears mar stocks - IPO fever

in Hong Kong and the mainland saw BBMG Corporation (2009) and China State

Construction Engineering soaring by nearly 60 percent on their debuts yesterday.

Cool reception for Cable TV - Sustained profitability will be a hard target for

Cable TV to achieve if it enters the free-television market, because it would

need to invest a huge amount to grab only a small slice of the advertising pie

from Television Broadcasts (0511), analysts said.

China: China

central bank pledged to maintain loose monetary policy and use market tools, not

quota-style controls, to ensure sustainable credit growth that will support

economic recovery. In a statement that analysts said was intended to calm

skittish markets, the People’s Bank of China vice-governor Su Ning said the

central bank “will unswervingly continue to apply appropriately loose monetary

policy and consolidate the economic recovery momentum”. The statement was posted

on the bank’s website after Wednesday’s 5 per cent fall in the mainland stock

market, its biggest daily drop in eight months, which was sparked in part by

worries that Beijing will push banks to restrict their lending. “They are

responding to an incorrect interpretation by the market,” Ting Lu, economist

with Merrill Lynch in Hong Kong, said. Mr Su’s comments helped push the

benchmark Shanghai stock index up in early trade, but worries that a roughly

eight month-long rally has run out of steam pushed it down 1.15 per cent at the

close of the morning session. “There will not be credit quotas this year, though

there could be window guidance,” Lu said, referring to more informal directions

that Beijing gives banks to influence their decisions. Media reports on

Wednesday said that the country’s two biggest banks had decided themselves to

put a lid on their 2009 lending targets in a move that would significantly slow

overall mainland’s credit growth in the second half. Industrial and Commercial

Bank of China (SEHK: 1398) (ICBC) and China Construction Bank (SEHK: 0939) (CCB)

both planned to grant loans in the second half that would be just about

one-quarter of the total that they issued in the first half, Caijing magazine

said. Beijing has in the past used a quota system to control lending, telling

banks not to exceed specific ceilings. This credit management was a key prong of

mainland’s monetary tightening last year and it was subsequently blamed for

contributing to the economy’s marked slowdown in the fourth quarter. Mr Su’s

comments appeared to rule out an imminent return to a strict, central

bank-directed quota system. “We will focus on market tools, not

quantitative-style control methods, flexibly using many kinds of monetary policy

instruments,” he said. “We will guide appropriate monetary and credit growth,

strengthen the sustainability and do what is necessary to drive the economic

recovery and to ensure stable and quite fast economic growth,” he said. But Dong

Xian’an, chief macro-economist with Industrial Securities in Shanghai, said firm

lending quotas were still very much on the table, because they are a direct way

to manage the underdeveloped and occasionally unruly financial system. “Credit

quotas are still an effective, if not the ideal, way to control credit growth,”

he said, adding that moving to a more market-oriented system would take time. Lu

at Merrill Lynch said that while Beijing was unlikely to impose hard-and-fast

loan caps on banks, the central bank could well use a blend of moral suasion and

punitive bill issuance to coax them into lending less. It has already started

down that path. Earlier this month, the People’s Bank of China told a group of

banks that have been particularly aggressive in lending that they would be

required to buy 100 billion yuan (HK$113.60 billion) in one-year special bills.

The special bills will carry a punitive yield of 1.5 per cent and the banks were

ordered to buy them in September – a clear move to stem lending bursts that tend

to come at quarter-end. Overall, mainland banks made a whopping 7.37 trillion

yuan in new loans in the first six months, easily topping the full-year figure

of 4.91 trillion yuan last year and igniting concern that excess liquidity was

leading to stock and property market bubbles. Mainland regulators have left

banks largely unhindered in their rampant lending in the belief that the economy

needs ample money to recover, but in recent weeks they have warned of mounting

credit risks to the banks themselves and demanded that loans be put to use for

productive purposes. The country’s top leadership and the central bank last week

both reaffirmed the country’s “active fiscal policy and appropriately loose

monetary policy” after meetings to discuss their priorities for the second half.

China: China

central bank pledged to maintain loose monetary policy and use market tools, not

quota-style controls, to ensure sustainable credit growth that will support

economic recovery. In a statement that analysts said was intended to calm

skittish markets, the People’s Bank of China vice-governor Su Ning said the

central bank “will unswervingly continue to apply appropriately loose monetary

policy and consolidate the economic recovery momentum”. The statement was posted

on the bank’s website after Wednesday’s 5 per cent fall in the mainland stock

market, its biggest daily drop in eight months, which was sparked in part by

worries that Beijing will push banks to restrict their lending. “They are

responding to an incorrect interpretation by the market,” Ting Lu, economist

with Merrill Lynch in Hong Kong, said. Mr Su’s comments helped push the

benchmark Shanghai stock index up in early trade, but worries that a roughly

eight month-long rally has run out of steam pushed it down 1.15 per cent at the

close of the morning session. “There will not be credit quotas this year, though

there could be window guidance,” Lu said, referring to more informal directions

that Beijing gives banks to influence their decisions. Media reports on

Wednesday said that the country’s two biggest banks had decided themselves to

put a lid on their 2009 lending targets in a move that would significantly slow

overall mainland’s credit growth in the second half. Industrial and Commercial

Bank of China (SEHK: 1398) (ICBC) and China Construction Bank (SEHK: 0939) (CCB)

both planned to grant loans in the second half that would be just about

one-quarter of the total that they issued in the first half, Caijing magazine

said. Beijing has in the past used a quota system to control lending, telling

banks not to exceed specific ceilings. This credit management was a key prong of

mainland’s monetary tightening last year and it was subsequently blamed for

contributing to the economy’s marked slowdown in the fourth quarter. Mr Su’s

comments appeared to rule out an imminent return to a strict, central

bank-directed quota system. “We will focus on market tools, not

quantitative-style control methods, flexibly using many kinds of monetary policy

instruments,” he said. “We will guide appropriate monetary and credit growth,

strengthen the sustainability and do what is necessary to drive the economic

recovery and to ensure stable and quite fast economic growth,” he said. But Dong

Xian’an, chief macro-economist with Industrial Securities in Shanghai, said firm

lending quotas were still very much on the table, because they are a direct way

to manage the underdeveloped and occasionally unruly financial system. “Credit

quotas are still an effective, if not the ideal, way to control credit growth,”

he said, adding that moving to a more market-oriented system would take time. Lu

at Merrill Lynch said that while Beijing was unlikely to impose hard-and-fast

loan caps on banks, the central bank could well use a blend of moral suasion and

punitive bill issuance to coax them into lending less. It has already started

down that path. Earlier this month, the People’s Bank of China told a group of

banks that have been particularly aggressive in lending that they would be

required to buy 100 billion yuan (HK$113.60 billion) in one-year special bills.

The special bills will carry a punitive yield of 1.5 per cent and the banks were

ordered to buy them in September – a clear move to stem lending bursts that tend

to come at quarter-end. Overall, mainland banks made a whopping 7.37 trillion

yuan in new loans in the first six months, easily topping the full-year figure

of 4.91 trillion yuan last year and igniting concern that excess liquidity was

leading to stock and property market bubbles. Mainland regulators have left

banks largely unhindered in their rampant lending in the belief that the economy

needs ample money to recover, but in recent weeks they have warned of mounting

credit risks to the banks themselves and demanded that loans be put to use for

productive purposes. The country’s top leadership and the central bank last week

both reaffirmed the country’s “active fiscal policy and appropriately loose

monetary policy” after meetings to discuss their priorities for the second half.

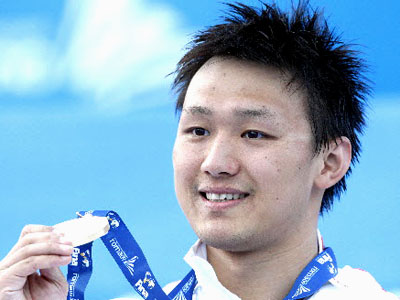

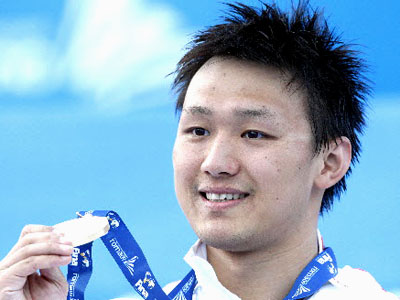

China's

Zhang Lin holds the gold medal of the men's 800m freestyle at the Fina

Swimming World Championships in Rome on Wednesday. Zhang Lin oblitreated the

world record to steam to victory in the men's 800 metres freestyle and become

China’s first male swimming world champion on Wednesday. Zhang finishing in a

breathtaking time of seven minutes 32.12 seconds, taking more than six seconds

off the mark of 7:38.65 set by retired former world champion Grant Hackett of

Australia in 2005. “This is a breakthrough for Chinese men’s swimming,” Zhang

told reporters. Zhang was the first Chinese man to win an Olympic swimming medal

with his silver in the 400 freestyle last year. Tunisia’s Olympic 1,500 champion

Oussama Mellouli, the pre-race favourite, was well beaten into second place even

though he too went below Hackett’s old best. Canada’s Ryan Cochrane was third.

Mellouli set the swift early pace but he had no answer when Zhang upped the

tempo. It was the Tunisian’s second silver medal of the week after he was also

the runner-up in the 400 freestyle on Sunday. China's

Zhang Lin holds the gold medal of the men's 800m freestyle at the Fina

Swimming World Championships in Rome on Wednesday. Zhang Lin oblitreated the

world record to steam to victory in the men's 800 metres freestyle and become

China’s first male swimming world champion on Wednesday. Zhang finishing in a

breathtaking time of seven minutes 32.12 seconds, taking more than six seconds

off the mark of 7:38.65 set by retired former world champion Grant Hackett of

Australia in 2005. “This is a breakthrough for Chinese men’s swimming,” Zhang

told reporters. Zhang was the first Chinese man to win an Olympic swimming medal

with his silver in the 400 freestyle last year. Tunisia’s Olympic 1,500 champion

Oussama Mellouli, the pre-race favourite, was well beaten into second place even

though he too went below Hackett’s old best. Canada’s Ryan Cochrane was third.

Mellouli set the swift early pace but he had no answer when Zhang upped the

tempo. It was the Tunisian’s second silver medal of the week after he was also

the runner-up in the 400 freestyle on Sunday.

A controversial oil refinery project

in southern part of the mainland will be relocated after it was criticized by

environmental groups, a senior mainland official confirmed on Thursday.

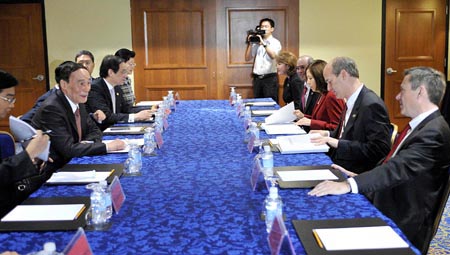

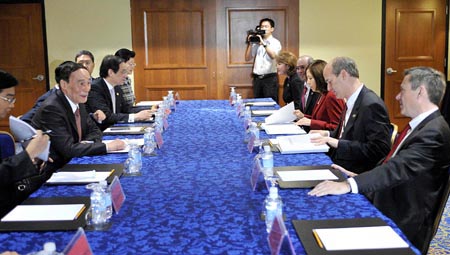

Chinese State Councilor Dai

Bingguo (2nd L) has breakfast with U.S. senators John Kerry (1st R) and Richard

Lugar (1st L) in Washington on July 29, 2009. Chinese State Councilor Dai

Bingguo said on Wednesday that the world's peace and prosperity would benefit

from a positive, cooperative and comprehensive China-U.S. relationship for the

21st century. During his meeting with Senator John Kerry and Senator Richard

Lugar in the Capitol Hill, Washington, Dai said China and the United States

share important responsibilities and have common interests for human's peace and

development. Chinese State Councilor Dai

Bingguo (2nd L) has breakfast with U.S. senators John Kerry (1st R) and Richard

Lugar (1st L) in Washington on July 29, 2009. Chinese State Councilor Dai

Bingguo said on Wednesday that the world's peace and prosperity would benefit

from a positive, cooperative and comprehensive China-U.S. relationship for the

21st century. During his meeting with Senator John Kerry and Senator Richard

Lugar in the Capitol Hill, Washington, Dai said China and the United States

share important responsibilities and have common interests for human's peace and

development.

People get on the bus at a flooded

section of the Xietu Road in Shanghai, China, July 30, 2009. People get on the bus at a flooded

section of the Xietu Road in Shanghai, China, July 30, 2009.

People watch the index screen

at a stock market in Shanghai, China, July 1, 2009. The CSRC said it is planning

to take steps to safeguard individual investors' interests. The securities

watchdog is mulling further measures to plug the loopholes that showed up in the

latest round of initial public offerings (IPO), according to Shang Fulin,

chairman, China Securities Regulatory Commission (CSRC). The CSRC is generally

satisfied with the results of the recent reforms, but also identified a number

of areas that need to be improved. One of these areas is the lack of a provision

to block institutional investors from taking advantage of the new allotment

system by masquerading as personal investors in their IPO applications. "Some

institutional investors were known to have circumvented the subscription limits

on their accounts by making applications through personal investor accounts

opened with borrowed ID cards," said Lu Junlong, analyst, China Finance Online.

"Stockbrokers keen on earning commission fees usually turn a blind eye to such

irregularities," he said. This has defeated, to some extent, the primary

objective of the reform, of increasing the allotment of new shares to personal

investors. In the past, the deluge of applications from well-financed

institutional investors had largely crowded out applications from individual

investors. Because of the loophole, the ratios of allocation of newly issued

shares to personal investors in the past several IPOs were still deemed too low.

for example, the ratio of allocation in the IPOs of Guilin Sanjin

Pharmaceutical, one of the first companies to obtain a stock exchange listing

after the lifting of the IPO suspension, was only 0.17 percent. The ratio of

allocation in the Sichuan Expressway IPO was 0.26 percent, while it was 2.83

percent for China State Construction Engineering Corp's public float. "The ratio

of allocation to subscription is at a low level, similar to the lottery system

in the past," said Zhu Hongbin, an investor with over 10-year experience in the

market. Considering the wide price gap between the primary and secondary

markets, many institutional investors borrowed heavily from banks to subscribe

for new shares. Easy credit and cheap money have given institutional investors a

much greater edge over small investors in the fight for IPO allotments. "As long

as the interbank seven-day repurchase rate stays below 3 to 4 percent, we can

make profits by subscribing to new shares," a Shanghai-based fund manger said,

who refused to be named. The investors' feverish penchant for newly listed

stocks saw Sichuan Expressway Co soar 202 percent on debut. The bourse suspended

trading in the scrip for two times to allow for a cooling off period on the

first day. The company's issue price was 3.6 yuan, nearly 20 times the PE

(price-to-earnings) ratio. After collective bidding, the opening price soared to

7.6 yuan and the shares finally closed at 10.9 yuan after touching a high of

over 15 yuan. The high price was beyond the expectation of many analysts.

According the reports from 23 securities firms, most analysts thought the

reasonable price could be around 5 yuan. Guotai Junan Securities Co was the most

optimistic, which estimated the shares could be worth around 7 yuan. The shares

subsequently began to slump and closed at 9.81 yuan, with many individual

investors burning their figures. According to the Shanghai Stock Exchange,

individual investors were the main buyers for the new shares of Sichuan

Expressway on its first trading day. Among the 74,000 accounts that bought

shares on that date, about 99.9 percent was personal accounts. Institutional

investors, including fund mangers, securities firms and insurance companies, did

not join the speculation. According to CSRC Chairman Shang Fulin, the regulators

are working on a plan to educate individual investors and also exploring

effective mechanisms to protect investors' rights. People watch the index screen

at a stock market in Shanghai, China, July 1, 2009. The CSRC said it is planning

to take steps to safeguard individual investors' interests. The securities

watchdog is mulling further measures to plug the loopholes that showed up in the

latest round of initial public offerings (IPO), according to Shang Fulin,

chairman, China Securities Regulatory Commission (CSRC). The CSRC is generally

satisfied with the results of the recent reforms, but also identified a number

of areas that need to be improved. One of these areas is the lack of a provision

to block institutional investors from taking advantage of the new allotment

system by masquerading as personal investors in their IPO applications. "Some

institutional investors were known to have circumvented the subscription limits

on their accounts by making applications through personal investor accounts

opened with borrowed ID cards," said Lu Junlong, analyst, China Finance Online.

"Stockbrokers keen on earning commission fees usually turn a blind eye to such

irregularities," he said. This has defeated, to some extent, the primary

objective of the reform, of increasing the allotment of new shares to personal

investors. In the past, the deluge of applications from well-financed

institutional investors had largely crowded out applications from individual

investors. Because of the loophole, the ratios of allocation of newly issued

shares to personal investors in the past several IPOs were still deemed too low.

for example, the ratio of allocation in the IPOs of Guilin Sanjin

Pharmaceutical, one of the first companies to obtain a stock exchange listing

after the lifting of the IPO suspension, was only 0.17 percent. The ratio of

allocation in the Sichuan Expressway IPO was 0.26 percent, while it was 2.83

percent for China State Construction Engineering Corp's public float. "The ratio

of allocation to subscription is at a low level, similar to the lottery system

in the past," said Zhu Hongbin, an investor with over 10-year experience in the

market. Considering the wide price gap between the primary and secondary

markets, many institutional investors borrowed heavily from banks to subscribe

for new shares. Easy credit and cheap money have given institutional investors a

much greater edge over small investors in the fight for IPO allotments. "As long

as the interbank seven-day repurchase rate stays below 3 to 4 percent, we can

make profits by subscribing to new shares," a Shanghai-based fund manger said,

who refused to be named. The investors' feverish penchant for newly listed

stocks saw Sichuan Expressway Co soar 202 percent on debut. The bourse suspended

trading in the scrip for two times to allow for a cooling off period on the

first day. The company's issue price was 3.6 yuan, nearly 20 times the PE

(price-to-earnings) ratio. After collective bidding, the opening price soared to

7.6 yuan and the shares finally closed at 10.9 yuan after touching a high of

over 15 yuan. The high price was beyond the expectation of many analysts.

According the reports from 23 securities firms, most analysts thought the

reasonable price could be around 5 yuan. Guotai Junan Securities Co was the most

optimistic, which estimated the shares could be worth around 7 yuan. The shares

subsequently began to slump and closed at 9.81 yuan, with many individual

investors burning their figures. According to the Shanghai Stock Exchange,

individual investors were the main buyers for the new shares of Sichuan

Expressway on its first trading day. Among the 74,000 accounts that bought

shares on that date, about 99.9 percent was personal accounts. Institutional

investors, including fund mangers, securities firms and insurance companies, did

not join the speculation. According to CSRC Chairman Shang Fulin, the regulators

are working on a plan to educate individual investors and also exploring

effective mechanisms to protect investors' rights.

July 30, 2009

Hong Kong:

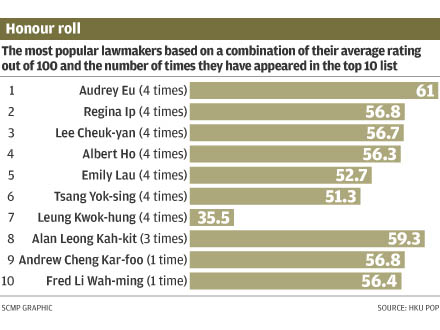

The performance of the Legislative Council in the 2008-2009 year did not satisfy

90 per cent of Hong Kong people, according to a survey released on Wednesday. Hong Kong:

The performance of the Legislative Council in the 2008-2009 year did not satisfy

90 per cent of Hong Kong people, according to a survey released on Wednesday.

More than 100 public housing estate

residents, retailers and members of the Link Concern Group staged a protest in

Wan Chai against recent rent rises by the Link Reit.

The government would support a plan by Cable TV to offer a free-to-air

television service, Secretary for Commerce and Economic Development Rita Lau Ng

Wai-lan said on Wednesday.

This year's Book Fair attracted a

record 900,000 visitors, but they did not bring big business, major local

publishers say. Although the number of visitors to the week-long fair, which

closed yesterday, increased from last year's 830,000, some publishers were

disappointed at the unexpectedly minimal growth in sales. They said the

overexposure of pseudo-models and their racy photo albums at the fair scared

away real bookworms. Commercial Press' retail director Anita Wan said the

publishing house expected 10 per cent growth in business, but did not achieve

this. "The growth in the number of visitors was not in proportion to the

increase in the size of the fair," Ms Wan said. With the completion of the

Convention and Exhibition Centre's atrium expansion, this year's fair increased

in area by one-third. Despite the increase in number of visitors, "there were

fewer people attending the night fair over the weekend", Ms Wan said. "The venue

became very quiet at 9pm on Saturday." Ming Pao Publications' general manager

William So said he was surprised by the low turnout over the weekend, a period

that has usually been extremely crowded in the past. He said there were more

youngsters than families and working adults coming to the fair this year. "There

was too much coverage on models at the fair in its first couple of days," Mr So

said. "Families and working adults were under the impression that the fair was

dominated by their photo albums, so they'd rather not come this year." He said

Ming Pao's book sales had increased by 10 per cent, but the increase in booth

size and manpower increased operating costs by 40 per cent. Kimmy Fong, Crown

Publishing's marketing manager, said sales were similar to last year, which was

unexpected. But she said sales of books on self-improvement and spirituality

improved. Meanwhile, the Trade Development Council said the fair was a success.

"We have had a record attendance and we have had more than 40,000 people

attending more than 200 cultural events," council assistant executive director

Raymond Yip said. A council survey of 887 visitors found each spent an average

HK$469 at the fair, and nearly 60 per cent said they spent the same or more than

last year. The number of tourists visiting the fair increased from last year's

7,000 to 10,000, with more than half of them coming to the city especially for

the fair. In response to Taiwanese exhibitors' threat not to return because of

their decline in business, Mr Yip said the situation had improved over the last

days of the fair and the council would evaluate the situation. However, Dymocks'

retail operations manager Matthew Steele said sales for English-language titles

were very good, and credited a new "English Avenue" section. Page One said

business had increased by 10 per cent, with 80 per cent of the stock brought to

the fair being sold. Economic Digest Publishing, which produced the pseudo-model

photo book Kissy Chrissie, said its stock of 20,000 had sold out on Sunday and

redemption vouchers were being sold. Many mainland exhibitors had cut their

prices further on the last day. One was offering discounts of up to 35 per cent

for spending more than HK$300. Another offered selected books at HK$1. This year's Book Fair attracted a

record 900,000 visitors, but they did not bring big business, major local

publishers say. Although the number of visitors to the week-long fair, which

closed yesterday, increased from last year's 830,000, some publishers were

disappointed at the unexpectedly minimal growth in sales. They said the

overexposure of pseudo-models and their racy photo albums at the fair scared

away real bookworms. Commercial Press' retail director Anita Wan said the

publishing house expected 10 per cent growth in business, but did not achieve

this. "The growth in the number of visitors was not in proportion to the

increase in the size of the fair," Ms Wan said. With the completion of the

Convention and Exhibition Centre's atrium expansion, this year's fair increased

in area by one-third. Despite the increase in number of visitors, "there were

fewer people attending the night fair over the weekend", Ms Wan said. "The venue

became very quiet at 9pm on Saturday." Ming Pao Publications' general manager

William So said he was surprised by the low turnout over the weekend, a period

that has usually been extremely crowded in the past. He said there were more

youngsters than families and working adults coming to the fair this year. "There

was too much coverage on models at the fair in its first couple of days," Mr So

said. "Families and working adults were under the impression that the fair was

dominated by their photo albums, so they'd rather not come this year." He said

Ming Pao's book sales had increased by 10 per cent, but the increase in booth

size and manpower increased operating costs by 40 per cent. Kimmy Fong, Crown

Publishing's marketing manager, said sales were similar to last year, which was

unexpected. But she said sales of books on self-improvement and spirituality

improved. Meanwhile, the Trade Development Council said the fair was a success.

"We have had a record attendance and we have had more than 40,000 people

attending more than 200 cultural events," council assistant executive director

Raymond Yip said. A council survey of 887 visitors found each spent an average

HK$469 at the fair, and nearly 60 per cent said they spent the same or more than

last year. The number of tourists visiting the fair increased from last year's

7,000 to 10,000, with more than half of them coming to the city especially for

the fair. In response to Taiwanese exhibitors' threat not to return because of

their decline in business, Mr Yip said the situation had improved over the last

days of the fair and the council would evaluate the situation. However, Dymocks'

retail operations manager Matthew Steele said sales for English-language titles

were very good, and credited a new "English Avenue" section. Page One said

business had increased by 10 per cent, with 80 per cent of the stock brought to

the fair being sold. Economic Digest Publishing, which produced the pseudo-model

photo book Kissy Chrissie, said its stock of 20,000 had sold out on Sunday and

redemption vouchers were being sold. Many mainland exhibitors had cut their

prices further on the last day. One was offering discounts of up to 35 per cent

for spending more than HK$300. Another offered selected books at HK$1.

The number of mainland women giving

birth in Hong Kong's public hospitals has dropped by about a tenth in the first

five months of this year compared with 2006.

Cliff Sun Kai-lit, chairman of the

Federation of Hong Kong Industries. The new chairman of the Federation of Hong

Kong Industries has launched a rare attack on the government for not paying

enough attention to the industrial sector and has urged it to set up a

development council to lend better support. "We hope the government can

establish a council similar to the Trade Development Council for the sector ...

which can offer a platform for officials and industrialists to formulate and

discuss related policies," Cliff Sun Kai-lit told the South China Morning Post (SEHK:

0583, announcements, news) . He was elected chairman of the federation, one of

the city's biggest trade organizations, earlier this month. "We have a feeling

that the government has not attached enough importance to the industrial

sector," said Mr Sun, who is also a committee member of the government's

business facilitation advisory committee and the Hong Kong Productivity Council.

The sector had complained about the administration abolishing the Commerce,

Industry and Technology Bureau two years ago and replacing it with the Commerce

and Economic Development Bureau, with the word "industry" omitted from the

title, the veteran industrialist said. Mr Sun said setting up a council for the

sector could enhance closer government ties, especially when the bureau oversaw

"too many areas". He was supported by Paul Yin Tek-sing, president of another

large trade group, the Chinese Manufacturers' Association of Hong Kong. Mr Yin

criticized the government for having no industrial policy and said it should at

least set up an industrial development committee, if not a council. Mr Sun said

that despite many factories relocating to the mainland, the sector was still

vital to Hong Kong. A spokeswoman for the bureau said it maintained close and

frequent contact with the sector and always welcomed any views. It provided

support measures through eight relevant departments and agencies, such as the

Trade and Industry Department, which had the expertise and resources to offer

appropriate help. Mr Sun also said government officials should have more vision,

in an apparent criticism of Chief Executive Donald Tsang Yam-kuen for his brief

presence at a forum in which Guangdong Vice-Governor Wan Qingliang and leaders

of the nine Pearl River Delta municipalities also took part in Hong Kong last

week. "Mr Tsang ... left right after giving the opening speech. He should have

at least sat for another three minutes and listened to the vice-governor's

speech before leaving. Then I'd feel he showed some respect," he said. "He chose

to come but did not give the vice-governor face. Others will treat us Hong Kong

businessmen the way they are treated." Chief Secretary Henry Tang Ying-yen and

other officials stayed until the end of the program. The Chief Executive's

Office said the event schedule and Mr Tsang's participation had been agreed by

the Hong Kong and Guangdong governments. Chinese General Chamber of Commerce

chairman Jonathan Choi Koon-shum, who also attended the event, said Mr Tsang's

appearance showed that he respected it. Mr Choi noted that Guangdong Governor

Huang Huahua , who held the same rank as Mr Tsang, had been absent. Cliff Sun Kai-lit, chairman of the

Federation of Hong Kong Industries. The new chairman of the Federation of Hong

Kong Industries has launched a rare attack on the government for not paying

enough attention to the industrial sector and has urged it to set up a

development council to lend better support. "We hope the government can

establish a council similar to the Trade Development Council for the sector ...

which can offer a platform for officials and industrialists to formulate and

discuss related policies," Cliff Sun Kai-lit told the South China Morning Post (SEHK:

0583, announcements, news) . He was elected chairman of the federation, one of

the city's biggest trade organizations, earlier this month. "We have a feeling

that the government has not attached enough importance to the industrial

sector," said Mr Sun, who is also a committee member of the government's

business facilitation advisory committee and the Hong Kong Productivity Council.

The sector had complained about the administration abolishing the Commerce,

Industry and Technology Bureau two years ago and replacing it with the Commerce

and Economic Development Bureau, with the word "industry" omitted from the

title, the veteran industrialist said. Mr Sun said setting up a council for the

sector could enhance closer government ties, especially when the bureau oversaw

"too many areas". He was supported by Paul Yin Tek-sing, president of another

large trade group, the Chinese Manufacturers' Association of Hong Kong. Mr Yin

criticized the government for having no industrial policy and said it should at

least set up an industrial development committee, if not a council. Mr Sun said

that despite many factories relocating to the mainland, the sector was still

vital to Hong Kong. A spokeswoman for the bureau said it maintained close and

frequent contact with the sector and always welcomed any views. It provided

support measures through eight relevant departments and agencies, such as the

Trade and Industry Department, which had the expertise and resources to offer

appropriate help. Mr Sun also said government officials should have more vision,

in an apparent criticism of Chief Executive Donald Tsang Yam-kuen for his brief

presence at a forum in which Guangdong Vice-Governor Wan Qingliang and leaders

of the nine Pearl River Delta municipalities also took part in Hong Kong last

week. "Mr Tsang ... left right after giving the opening speech. He should have

at least sat for another three minutes and listened to the vice-governor's

speech before leaving. Then I'd feel he showed some respect," he said. "He chose

to come but did not give the vice-governor face. Others will treat us Hong Kong

businessmen the way they are treated." Chief Secretary Henry Tang Ying-yen and

other officials stayed until the end of the program. The Chief Executive's

Office said the event schedule and Mr Tsang's participation had been agreed by

the Hong Kong and Guangdong governments. Chinese General Chamber of Commerce

chairman Jonathan Choi Koon-shum, who also attended the event, said Mr Tsang's

appearance showed that he respected it. Mr Choi noted that Guangdong Governor

Huang Huahua , who held the same rank as Mr Tsang, had been absent.

The popular Ani-Com and Games Hong Kong

fair will be used as a platform for the city's war on drugs. Microsoft, in

cooperation with Polytechnic University and Hong Kong University of Science and

Technology, will set up an Xbox 360 free play corner designed to educate

youngsters on the dangers of drug abuse. Attendance at the comics fair - at

which there will be no restrictions on sexy models promoting products like at

the just-closed book fair - is expected to top last year's 600,000 attendance.

Microsoft senior marketing manger Anna Chow Sui-nar said: "Seeing the

seriousness of the drug abuse problem, we hope to convey a positive message. We

think it is effective as video games speak their language." Microsoft will also

provide a free Human Swine Flu game designed by Hong Kong University students to

raise hygiene awareness. The 11th ACGHK 2009 chief executive Leung Chung-poon

said there would be no specific restrictions for young models. "Our fair has a

more relaxing and fun function. As long as it is legal, there will not be any

restrictions." U1 Digital Entertainment Group president Oscar Chu Chung-ho said

first arrivals will be given a gold robot, but did not reveal its value. The

first 300 visitors to the fair, to be held from Friday until August 4, will be

given early bird cards to help them negotiate the first-round of shopping.

Admission tickets are priced at HK$25 and the fair will open from 10am to 9pm.

Although the event will start on Friday, 10 teenagers have already camped

outside the Hong Kong Convention and Exhibition Centre in Wan Chai. In first

position is a 16-year-old Secondary Five student surnamed Chan who has been

there since Sunday. He stands to win a golden robot but is prepared to spend

HK$2,000 on limited edition products. Nine candidates will be taking part in an

ACGHK Image Girl Pageant, including popular model Lavina Chung Wai-chi. Gamania

sales and marketing manager Lau Man-wai said the company has recruited 17

promotion models, most of them pseudo-models. The popular Ani-Com and Games Hong Kong

fair will be used as a platform for the city's war on drugs. Microsoft, in

cooperation with Polytechnic University and Hong Kong University of Science and

Technology, will set up an Xbox 360 free play corner designed to educate

youngsters on the dangers of drug abuse. Attendance at the comics fair - at

which there will be no restrictions on sexy models promoting products like at

the just-closed book fair - is expected to top last year's 600,000 attendance.

Microsoft senior marketing manger Anna Chow Sui-nar said: "Seeing the

seriousness of the drug abuse problem, we hope to convey a positive message. We

think it is effective as video games speak their language." Microsoft will also

provide a free Human Swine Flu game designed by Hong Kong University students to

raise hygiene awareness. The 11th ACGHK 2009 chief executive Leung Chung-poon

said there would be no specific restrictions for young models. "Our fair has a

more relaxing and fun function. As long as it is legal, there will not be any

restrictions." U1 Digital Entertainment Group president Oscar Chu Chung-ho said

first arrivals will be given a gold robot, but did not reveal its value. The

first 300 visitors to the fair, to be held from Friday until August 4, will be

given early bird cards to help them negotiate the first-round of shopping.

Admission tickets are priced at HK$25 and the fair will open from 10am to 9pm.

Although the event will start on Friday, 10 teenagers have already camped

outside the Hong Kong Convention and Exhibition Centre in Wan Chai. In first

position is a 16-year-old Secondary Five student surnamed Chan who has been

there since Sunday. He stands to win a golden robot but is prepared to spend

HK$2,000 on limited edition products. Nine candidates will be taking part in an

ACGHK Image Girl Pageant, including popular model Lavina Chung Wai-chi. Gamania

sales and marketing manager Lau Man-wai said the company has recruited 17

promotion models, most of them pseudo-models.

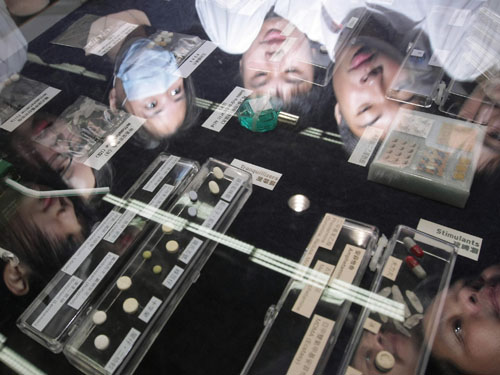

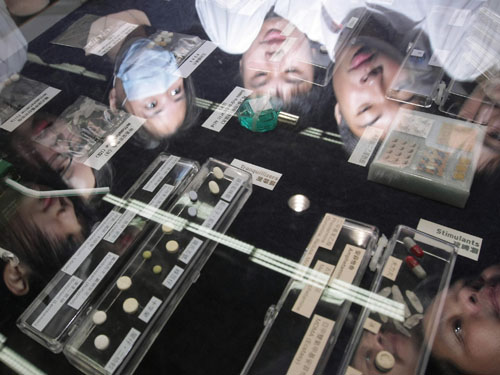

SKH Chan Yong Secondary School

students in Sheung Shui check out various drugs. Debate rages about whether or

not the planned testing regime will send drug users underground or destroy ties

between youth and social workers. Hong Kong has never been a drug-free society.

But after a number of cases of students abusing ketamine were widely reported,

Chief Executive Donald Tsang Yam-kuen intervened personally this month to speed

up the introduction of anti-drug initiatives. Mr Tsang told the Legislative

Council that the situation among young people in Hong Kong was "much worse than

expected" and announced a pilot scheme of voluntary testing at secondary schools

in Tai Po, starting in September, which would then be implemented in other

areas. But now there are worries that drug-taking youngsters will be driven away

from schools under the new scheme. And those who try to help young drug abusers

fear the new tests will merely make it harder to do so. The Security Bureau's

narcotics division said schools had pledged not to expel students or prosecute

them if they tested positive for drugs. Officials said the Tai Po trial was

designed to prevent drug abuse and identify young users early. But what if drug

users just decide to skip school? Fifteen-year-old Joey Leung, a Form Four

student in Tuen Mun, said that young drug takers would just stay away from

school if there was a danger of being tested. "I would not go to school; I'd

just say I am sick. There are many excuses to skip school," she said, adding

that she had taken ketamine. She said drug testing might not be an effective way

to single out student drug users. "Usually, we don't take drugs at school. We

take them on the backstairs of a building or at a friend's house," she said. "We

usually go to the disabled people's toilets or those that are rarely used," she

said. "Those toilets are spacious, allowing a few people to take ketamine inside

and then we separate afterwards." She said she thought student drug takers would

not tell others about their habit. But social workers disagree. They say many

talk to them about their drug habits because they trust them. "It is important

to gain the trust of these students. When they trust you, they will tell you

about their drug-taking habits," Jessica Ng Lai-man, a social worker in Tuen Mun,

said. But Ms Ng is worried that such relationships will be more difficult to

build once testing begins. "Once the drug tests start, those youngsters who have

tested positive will be forced to have treatment. Instead of having the

motivation to change, they will think you are testing them. It is difficult to

build up a trusting relationship with students under these circumstances," she

said. Many in the social services sector are worried, given the experience of

testing in schools overseas. A report by the Australian National Council on

Drugs in 2008 found that most drug tests were not reliable enough for use in

schools. Half of those interviewed said there would be no advantage from such

testing and nearly all respondents said it would lead to mistrust between

students and staff. Lynn Law, of the Hong Kong Council of Social Service, said

she had studied various jurisdictions. She had found no reports suggesting that

drug testing was effective but it did increase schools' legal liabilities and

was costly to implement. "Even Australia, which did so much research and

preparation work in advance of introducing testing, did not find tests at school

effective," she said, adding that she was worried about the situation in Hong

Kong schools because there had been so little time to prepare. "For example,

there are so many ways to affect the accuracy of a urine test," she said. In a

drug rehabilitation centre, a worker of the same sex has to be present, to

monitor the process. "Will it be insulting to those who have not taken any drugs

but were chosen to be tested?" Ms Law asked. "It would make helping young people

with a drug problem more difficult because some of them will leave school once

the tests start. In the past, we could go to rave parties or discos to get these

young people out. But it is going to be tougher, as some of them will stay at

home and become marginalised. There seems to be no research findings from the US

or the UK to support that drug tests in school are an effective tool in drug

detection and screening. Though some might cite Singapore as an example, Hong

Kong is just a different society," Ms Law, who has lived in Singapore, said. A

Hong Kong government task-force report on youth drug abuse last year noted that,

in Singapore, schools did not need government approval for testing. If a US

school decided that drugs were a significant threat, it could seek federal,

state and local funding to run tests. The British government supported random

testing in 2004, but schools still need the consent of students and parents for

testing. In Hong Kong, social-sector representatives did not question the

intention to fight drug abuse, but said they believed more preparation was

needed before the trials. "The chief executive asks us to cross the river by

groping for each stone. However, [this is just like] prescribing drugs with a

trial-and-error approach. It may cure the patient, but it may also kill him,"

said Max Szeto Ming-wong, superintendent of Hong Kong Christian Service Jockey

Club Lodge of Rising Sun, a drug treatment centre in Tuen Mun. Mr Szeto, who has

been involved in drug rehabilitation services for more than 30 years, said he

envisaged many problems without thorough preparation and other follow-up

measures. "Who is going to pay for the urine test? Parents or schools? Which

institution is going to conduct the tests and how are they going to be handled?"

he asked. The government will pay testing costs during the Tai Po trial, but the

issue will be revisited in relation to future schemes. "How long is that data

going to be stored? Mr Szeto said. "Who has the right to hold this data? Even if

a student tests positive, we would not know how long the student had been a drug

taker. There is a need for lots of follow-up, for further assessment. Consider

Tai Po. There are 22,000 secondary school students there. Statistics show that 2

to 6 per cent of students might be drug takers. If we consider 4 per cent of

these students will test positive, that's about 1,000 students. This would

outnumber the total youth drug rehabilitation places in Hong Kong." There are

about 500 rehabilitation places for young drug takers in Hong Kong. One social

worker who works with youth drug users in Tai Po, Billy Tang Kam-piu, a

supervisor at Hong Kong Lutheran Social Service, said he expected that only a

few "party drug users" would be identified. "The measure might affect 5 per cent

of `silly students'," he said. "What will happen to these students? We know that

some schools use different reasons, like smoking, to kick students out once they

are found to be a drug taker." Hong Kong International School, widely cited as a

school which already tests students for drugs, was unwilling to disclose the

details. However, one person familiar with the situation said students were

expelled if they tested positive. "According to my understanding, students who

test positive in international schools will be kicked out at once," the person

said. "Before being expelled, a student can go back to school after attending a

[rehabilitation] course that lasts six months. It cost hundreds of thousands of

dollars. Not many Hong Kong parents can afford this." Mr Szeto suggested that

clear guidelines be set up for schools to follow. "It is important to state what

the school should do once students test positive. It is impossible to depend

solely on the judgment of different principals." But Kwok Wing-keung, chairman

of the Association of Secondary School heads of Tai Po district, pointed out

that the government should have faith in schools. "Every school has experience

in handling misbehavior," she said. The Security Bureau's narcotics division

advises that those in the early stages of experimentation should continue normal

schooling, and also receive counselling. For heavy abusers, arrangements should

be made with one of the 39 residential rehab centers. After completing a

programme, the student should return to normal schooling or otherwise

reintegrate into the community. SKH Chan Yong Secondary School

students in Sheung Shui check out various drugs. Debate rages about whether or

not the planned testing regime will send drug users underground or destroy ties

between youth and social workers. Hong Kong has never been a drug-free society.

But after a number of cases of students abusing ketamine were widely reported,

Chief Executive Donald Tsang Yam-kuen intervened personally this month to speed

up the introduction of anti-drug initiatives. Mr Tsang told the Legislative

Council that the situation among young people in Hong Kong was "much worse than

expected" and announced a pilot scheme of voluntary testing at secondary schools

in Tai Po, starting in September, which would then be implemented in other

areas. But now there are worries that drug-taking youngsters will be driven away

from schools under the new scheme. And those who try to help young drug abusers

fear the new tests will merely make it harder to do so. The Security Bureau's

narcotics division said schools had pledged not to expel students or prosecute

them if they tested positive for drugs. Officials said the Tai Po trial was

designed to prevent drug abuse and identify young users early. But what if drug

users just decide to skip school? Fifteen-year-old Joey Leung, a Form Four

student in Tuen Mun, said that young drug takers would just stay away from

school if there was a danger of being tested. "I would not go to school; I'd

just say I am sick. There are many excuses to skip school," she said, adding

that she had taken ketamine. She said drug testing might not be an effective way

to single out student drug users. "Usually, we don't take drugs at school. We

take them on the backstairs of a building or at a friend's house," she said. "We

usually go to the disabled people's toilets or those that are rarely used," she

said. "Those toilets are spacious, allowing a few people to take ketamine inside

and then we separate afterwards." She said she thought student drug takers would

not tell others about their habit. But social workers disagree. They say many

talk to them about their drug habits because they trust them. "It is important

to gain the trust of these students. When they trust you, they will tell you

about their drug-taking habits," Jessica Ng Lai-man, a social worker in Tuen Mun,

said. But Ms Ng is worried that such relationships will be more difficult to

build once testing begins. "Once the drug tests start, those youngsters who have

tested positive will be forced to have treatment. Instead of having the

motivation to change, they will think you are testing them. It is difficult to

build up a trusting relationship with students under these circumstances," she

said. Many in the social services sector are worried, given the experience of

testing in schools overseas. A report by the Australian National Council on

Drugs in 2008 found that most drug tests were not reliable enough for use in

schools. Half of those interviewed said there would be no advantage from such

testing and nearly all respondents said it would lead to mistrust between

students and staff. Lynn Law, of the Hong Kong Council of Social Service, said

she had studied various jurisdictions. She had found no reports suggesting that

drug testing was effective but it did increase schools' legal liabilities and

was costly to implement. "Even Australia, which did so much research and

preparation work in advance of introducing testing, did not find tests at school

effective," she said, adding that she was worried about the situation in Hong

Kong schools because there had been so little time to prepare. "For example,

there are so many ways to affect the accuracy of a urine test," she said. In a

drug rehabilitation centre, a worker of the same sex has to be present, to

monitor the process. "Will it be insulting to those who have not taken any drugs

but were chosen to be tested?" Ms Law asked. "It would make helping young people

with a drug problem more difficult because some of them will leave school once

the tests start. In the past, we could go to rave parties or discos to get these

young people out. But it is going to be tougher, as some of them will stay at

home and become marginalised. There seems to be no research findings from the US

or the UK to support that drug tests in school are an effective tool in drug

detection and screening. Though some might cite Singapore as an example, Hong

Kong is just a different society," Ms Law, who has lived in Singapore, said. A

Hong Kong government task-force report on youth drug abuse last year noted that,

in Singapore, schools did not need government approval for testing. If a US

school decided that drugs were a significant threat, it could seek federal,

state and local funding to run tests. The British government supported random

testing in 2004, but schools still need the consent of students and parents for

testing. In Hong Kong, social-sector representatives did not question the

intention to fight drug abuse, but said they believed more preparation was

needed before the trials. "The chief executive asks us to cross the river by

groping for each stone. However, [this is just like] prescribing drugs with a

trial-and-error approach. It may cure the patient, but it may also kill him,"

said Max Szeto Ming-wong, superintendent of Hong Kong Christian Service Jockey

Club Lodge of Rising Sun, a drug treatment centre in Tuen Mun. Mr Szeto, who has

been involved in drug rehabilitation services for more than 30 years, said he

envisaged many problems without thorough preparation and other follow-up

measures. "Who is going to pay for the urine test? Parents or schools? Which

institution is going to conduct the tests and how are they going to be handled?"

he asked. The government will pay testing costs during the Tai Po trial, but the

issue will be revisited in relation to future schemes. "How long is that data

going to be stored? Mr Szeto said. "Who has the right to hold this data? Even if

a student tests positive, we would not know how long the student had been a drug

taker. There is a need for lots of follow-up, for further assessment. Consider

Tai Po. There are 22,000 secondary school students there. Statistics show that 2

to 6 per cent of students might be drug takers. If we consider 4 per cent of

these students will test positive, that's about 1,000 students. This would

outnumber the total youth drug rehabilitation places in Hong Kong." There are

about 500 rehabilitation places for young drug takers in Hong Kong. One social

worker who works with youth drug users in Tai Po, Billy Tang Kam-piu, a

supervisor at Hong Kong Lutheran Social Service, said he expected that only a

few "party drug users" would be identified. "The measure might affect 5 per cent

of `silly students'," he said. "What will happen to these students? We know that

some schools use different reasons, like smoking, to kick students out once they

are found to be a drug taker." Hong Kong International School, widely cited as a

school which already tests students for drugs, was unwilling to disclose the

details. However, one person familiar with the situation said students were

expelled if they tested positive. "According to my understanding, students who

test positive in international schools will be kicked out at once," the person

said. "Before being expelled, a student can go back to school after attending a

[rehabilitation] course that lasts six months. It cost hundreds of thousands of