|

Newsletter

Seminar Material

Biz:

China

Hong

Kong Hawaii

What people

said about us

China

Earthquake Relief

Tax &

Government

Hawaii Voter Registration

Biz-Video

Biz-Video

Hawaii's

China Connection Hawaii's

China Connection

CDP#1780962

CDP#1780962

Doing Business in

Hong Kong & China

Doing Business in

Hong Kong & China

| |

Hong Kong, China & Hawaii Biz*

Skype - FREE

Voice Over IP Skype - FREE

Voice Over IP  View Hawaii's China Connection

Video Trailer

View Hawaii's China Connection

Video Trailer

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our event page to find out more!

After

attended a China/Hong Kong Business/Trade Seminar in Hawaii...still unsure what

to do next, contact us, our Officers, Directors and Founding Members are

actively engaged in China/Hong Kong/Asia trade - we can help!

Are you ready to export your product or

service? You will find out in 3 minutes with resources to help you -

enter

to give it a try

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

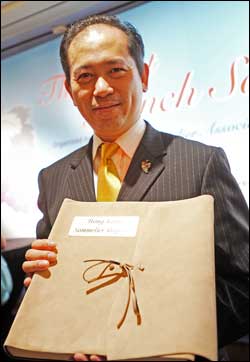

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

(approximate $ exchange rates: US$1 = HK$7.8, US$1 = RMB$6.8)

Aug 31, 2009

Hong Kong:

The assets of the Exchange Fund, which is used to back the Hong Kong dollar,

totaled HK$1,863.9 billion at the end of July, the Hong Kong Monetary Authority

(HKMA) said on Monday. The figure was HK$30.7 billion higher than the total at

the end of June, with foreign currency assets rising HK$39.1 billion while Hong

Kong dollar assets fell HK$8.4 billion, the city’s de facto central bank said in

a statement. The rise in foreign currency assets was mainly a result of

purchases of foreign currencies with Hong Kong dollars and valuation gains on

foreign currency investments. These increases were partly offset by a decrease

in securities purchased but settled in the following month. The decline in Hong

Kong dollar assets was mainly a result of a decrease in Exchange Fund Bills and

Notes issued but not yet settled and fiscal draw downs, which were partly offset

by valuation gains on Hong Kong equities held by the Exchange Fund and an

increase in bank borrowings. Hong Kong:

The assets of the Exchange Fund, which is used to back the Hong Kong dollar,

totaled HK$1,863.9 billion at the end of July, the Hong Kong Monetary Authority

(HKMA) said on Monday. The figure was HK$30.7 billion higher than the total at

the end of June, with foreign currency assets rising HK$39.1 billion while Hong

Kong dollar assets fell HK$8.4 billion, the city’s de facto central bank said in

a statement. The rise in foreign currency assets was mainly a result of

purchases of foreign currencies with Hong Kong dollars and valuation gains on

foreign currency investments. These increases were partly offset by a decrease

in securities purchased but settled in the following month. The decline in Hong

Kong dollar assets was mainly a result of a decrease in Exchange Fund Bills and

Notes issued but not yet settled and fiscal draw downs, which were partly offset

by valuation gains on Hong Kong equities held by the Exchange Fund and an

increase in bank borrowings.

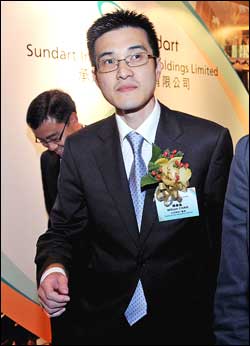

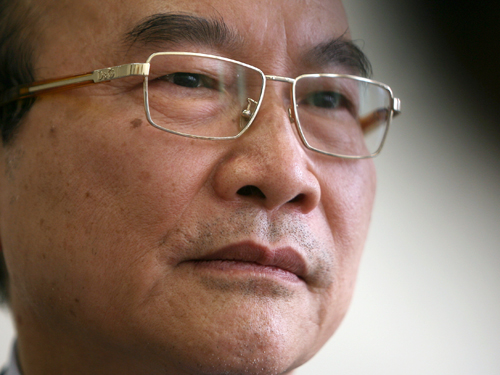

Kenneth Lau attends the Heung Yee Kuk

consultative assembly on the Guangzhou-Shenzhen-Hong Kong rail link in Yuen

Long. Rural leaders in Pat Heung have urged the government to consider moving a

village whose residents have refused to make way for the multibillion-dollar

railway project that will connect the city to the national high-speed network.

Kenneth Lau Ip-keung, a Heung Yee Kuk member who yesterday met representatives

of villages that will be affected by the Guangzhou-Shenzhen-Hong Kong express

rail link, suggested the government move the community of Tsoi Yuen Tsuen - a

strategy not used since the 1970s. Kenneth Lau attends the Heung Yee Kuk

consultative assembly on the Guangzhou-Shenzhen-Hong Kong rail link in Yuen

Long. Rural leaders in Pat Heung have urged the government to consider moving a

village whose residents have refused to make way for the multibillion-dollar

railway project that will connect the city to the national high-speed network.

Kenneth Lau Ip-keung, a Heung Yee Kuk member who yesterday met representatives

of villages that will be affected by the Guangzhou-Shenzhen-Hong Kong express

rail link, suggested the government move the community of Tsoi Yuen Tsuen - a

strategy not used since the 1970s.

Five historic buildings – including

the Old Tai Po Police Station – will be restored under a government scheme which

aims to preserve Hong Kong’s heritage architecture. The Development Bureau said

on Friday it was inviting proposals from non-profit-making organizations (NPOs)

to help with restoration work under the Revitalizing Historic Buildings Through

Partnership Scheme. The five buildings will be part of the second batch to be

restored under the scheme. Along with the police station in Tai Po, the Blue

House Cluster in Wan Chai, the former Fanling Magistracy building, the Old House

at Wong Uk Village in Sha Tin, and the Stone Houses in Kowloon City. The

government said successful NGOs applying under the scheme would receive a

one-off grant, worth a maximum of HK$5 million. This is to cover the renovation

and start-up costs for up to the first two years. Nominal rents would also be

charged for the buildings. Commissioner for Heritage Jack Chan said the

government hoped to use the buildings in a more innovative way. “By transforming

them into unique cultural landmarks, we hope to promote active public

participation in the conservation of historic buildings and, in particular,

create jobs at a district level,” Mr Chan said. The Development Bureau will

arrange open days with tours in September for applicants to visit the buildings.

The deadline for applications is December 28. The revitalization program was

first mentioned by Chief Executive Donald Tsang Yam-kuen in his October 2008

policy address. For more information, see:

www.heritage.gov.hk

The Hong Kong police force has long

been dubbed Asia's finest, our firefighters have won numerous medals at the

World Firefighters Games and our immigration officers provide speedy service

that lets us clear immigration in just eight seconds, a source of pride given

the long queues in other cities. But this summer something has gone wrong with

our disciplined services officers. Thousands of policemen threatened to stage a

protest on the streets, ambulancemen said they might not provide some

paramedical services to patients, and immigration officers publicly mocked their

customs counterparts for idling at border control points. Meanwhile, the public

was left puzzled and uneasy about all the demands for pay rises, and open

arguments about salary differences between the officers during a global downturn

that has seen many people suffer pay cuts and lay-offs. It all stemmed from

police frustration at a long-awaited report on a review of the disciplined

services grade structure, released last November, and the government's handing

of it. The row has highlighted the crucial and unique role played by the

services both in the post-handover special administrative region and the

previous colonial structure. Hong Kong does not have its own army, and PLA

troops are only in the city for defense. Law and order is maintained by the six

official disciplined services - the police force, Fire Services Department

(which includes the Ambulance Command), the Immigration Department, Customs and

Excise Department, Correctional Services Department, Government Flying Service -

and the Independent Commission Against Corruption, considered the de facto

seventh service. With 53,005 officers, the services account for 32 per cent of

all civil servants. They are recognized as guardians of the city's stability.

But their pay scales and mechanisms have not been reviewed by the government for

21 years, despite many reforms. Until the November report, the last study was

the Rennie Review, conducted in 1988 when the political and social landscape

were very different. To add to the frustration, the overdue report was seen as a

let-down. Tony Liu Kit-ming, chairman of the Police Inspectors' Association,

said: "While the management and unions in the force had very high expectations

of the review, we realised that the government had just given us false hope."

Throughout the two-year consultation on the review, he said, many views and

suggestions had been given to the government, and the lack of any objections had

led them to believe that the government agreed. "But in the end we found our

views had just vanished - like into a black hole," he said. A key complaint by

the police was that their request for a pay mechanism independent from that of

the other services was rejected. However, the report did recommend pay rises for

nearly all grades of disciplined services officers. A police station sergeant

with 30 years of service and earning HK$37,265 - already not a bad salary for a

person with only secondary-school education, which is all most veteran

junior-rank policemen have - would get a rise of nearly HK$3,000, to HK$40,900.

By comparison, a fresh university graduate in recent years has typically been

able to command only about HK$16,000. If all the recommendations in the report

were implemented, they would cost the taxpayer an additional HK$700 million a

year. When they were unveiled in November - at the height of the financial

turmoil - Civil Service minister Denise Yue Chung-yee said the increases should

be deferred "until Hong Kong's economy has returned to stability". The unions

took a wait-and-see attitude. But their patience evaporated in June when, as

news on their pay rises was still pending, the government announced a pay cut of

5.38 per cent for senior civil servants and a freeze for middle and lower ranks.

"This is an injustice," Mr Liu said. "Why does the minister, with a salary of

HK$180,000, have the same level of pay cut as a senior inspector on HK$50,000?"

Thousands of off-duty policemen prepared to take to the streets in protest,

which they called off only after a personal pledge by their commissioner, Tang

King-shing, to fight for early and backdated implementation of the

recommendations in the grade structure review. Political commentator Lo Chi-kin

said Mr Tang's intervention was "a significant turning point" in the disciplined

services pay dispute. "The commissioner took the role as union head, which

totally deviated from the established procedures for handling pay issues," Dr Lo

said. Mr Tang as commander of the force had the responsibility to present a

clear stance on the labour rights of policemen and on the legitimacy of the

police protest and its effects on society. He did neither and "dramatically

switched his role to union head", Dr Lo said. Police are not allowed to go on

strike. Demonstrations are allowed, but none has been held in the past three

decades. Also, no trade union is allowed in the force, which is why the four

bodies commonly referred to by the media as police unions - an accurate

reflection of their function - are officially just "associations". The impact of

Mr Tang's words quickly began to be felt outside the force with other services,

which are allowed unions, agitating for their leaders and bosses to back them as

well. At times, the discord descended into name-calling, with some disciplined

officers lampooning firefighters for playing volleyball or having barbecues

while on standby in fire stations, and the immigration union saying at a press

conference that they were treated as a third-class department. An Immigration

Department officer told journalists that customs officers were "always idling".

The starting salaries for immigration staff are the lowest of all the services.

They start on HK$24,050 - compared with HK$27,155 for officers of the same rank

in the customs, fire services and correctional services departments, and

HK$29,460 for a new police inspector. Chief Executive Donald Tsang Yam-kuen's

June 25 declaration of his family links to the police and "deep affection" for

the force only served to deepen the divide. "My father was a police officer, my

younger brother was a police officer, my sister-in-law was a police officer, my

uncle was a police officer," he recalled, in urging the police to reconsider

their protest. While the march was called off, a police unionist confided that

Mr Tsang's words had spurred ill-feeling in the force, with many thinking he had

made them a joke among the other disciplined services, while not helping them in

their pay fight. "This is an example of the poor political spin-doctoring skills

that the chief executive's aides provide," the unionist said. Firefighters'

union chairman Chiu Sin-chung was moved to declare at a press conference in the

middle of this month: "The chief executive is not our relative, but all

disciplined services are his limbs, his brothers. We believe the chief executive

does not wish to see the brothers in discord and criticising one another." He

went on: "As a responsible labour union, we will not threaten residents or

confront the government to get what we want. This is selfish behavior." This

summer of discontent seems set to simmer for several more weeks, with Miss Yue

due in either September or October to present for discussion a proposal for

Exco's final decision on the implementation of the review. Disciplined services

unions have realised that the review will not result in any structural change,

but are determined that any pay rises should be backdated to November and that

the government should promise a proper salary review every six years. Without

these, the dispute can only heat up again, resulting in a more vociferous union

movement in all the disciplined services. The Government Disciplined Services

General Union has scheduled a forum for Wednesday and has invited heads of the

services to attend, to listen to their grievances before the Civil Service

Bureau submits its proposal. Dr Lo believes that something else is needed - an

open clarification from Mr Tang of his role in the pay review, as his

intervention deviated from established procedures and put chiefs in other

disciplined services under pressure. The Hong Kong police force has long

been dubbed Asia's finest, our firefighters have won numerous medals at the

World Firefighters Games and our immigration officers provide speedy service

that lets us clear immigration in just eight seconds, a source of pride given

the long queues in other cities. But this summer something has gone wrong with

our disciplined services officers. Thousands of policemen threatened to stage a

protest on the streets, ambulancemen said they might not provide some

paramedical services to patients, and immigration officers publicly mocked their

customs counterparts for idling at border control points. Meanwhile, the public

was left puzzled and uneasy about all the demands for pay rises, and open

arguments about salary differences between the officers during a global downturn

that has seen many people suffer pay cuts and lay-offs. It all stemmed from

police frustration at a long-awaited report on a review of the disciplined

services grade structure, released last November, and the government's handing

of it. The row has highlighted the crucial and unique role played by the

services both in the post-handover special administrative region and the

previous colonial structure. Hong Kong does not have its own army, and PLA

troops are only in the city for defense. Law and order is maintained by the six

official disciplined services - the police force, Fire Services Department

(which includes the Ambulance Command), the Immigration Department, Customs and

Excise Department, Correctional Services Department, Government Flying Service -

and the Independent Commission Against Corruption, considered the de facto

seventh service. With 53,005 officers, the services account for 32 per cent of

all civil servants. They are recognized as guardians of the city's stability.

But their pay scales and mechanisms have not been reviewed by the government for

21 years, despite many reforms. Until the November report, the last study was

the Rennie Review, conducted in 1988 when the political and social landscape

were very different. To add to the frustration, the overdue report was seen as a

let-down. Tony Liu Kit-ming, chairman of the Police Inspectors' Association,

said: "While the management and unions in the force had very high expectations

of the review, we realised that the government had just given us false hope."

Throughout the two-year consultation on the review, he said, many views and

suggestions had been given to the government, and the lack of any objections had

led them to believe that the government agreed. "But in the end we found our

views had just vanished - like into a black hole," he said. A key complaint by

the police was that their request for a pay mechanism independent from that of

the other services was rejected. However, the report did recommend pay rises for

nearly all grades of disciplined services officers. A police station sergeant

with 30 years of service and earning HK$37,265 - already not a bad salary for a

person with only secondary-school education, which is all most veteran

junior-rank policemen have - would get a rise of nearly HK$3,000, to HK$40,900.

By comparison, a fresh university graduate in recent years has typically been

able to command only about HK$16,000. If all the recommendations in the report

were implemented, they would cost the taxpayer an additional HK$700 million a

year. When they were unveiled in November - at the height of the financial

turmoil - Civil Service minister Denise Yue Chung-yee said the increases should

be deferred "until Hong Kong's economy has returned to stability". The unions

took a wait-and-see attitude. But their patience evaporated in June when, as

news on their pay rises was still pending, the government announced a pay cut of

5.38 per cent for senior civil servants and a freeze for middle and lower ranks.

"This is an injustice," Mr Liu said. "Why does the minister, with a salary of

HK$180,000, have the same level of pay cut as a senior inspector on HK$50,000?"

Thousands of off-duty policemen prepared to take to the streets in protest,

which they called off only after a personal pledge by their commissioner, Tang

King-shing, to fight for early and backdated implementation of the

recommendations in the grade structure review. Political commentator Lo Chi-kin

said Mr Tang's intervention was "a significant turning point" in the disciplined

services pay dispute. "The commissioner took the role as union head, which

totally deviated from the established procedures for handling pay issues," Dr Lo

said. Mr Tang as commander of the force had the responsibility to present a

clear stance on the labour rights of policemen and on the legitimacy of the

police protest and its effects on society. He did neither and "dramatically

switched his role to union head", Dr Lo said. Police are not allowed to go on

strike. Demonstrations are allowed, but none has been held in the past three

decades. Also, no trade union is allowed in the force, which is why the four

bodies commonly referred to by the media as police unions - an accurate

reflection of their function - are officially just "associations". The impact of

Mr Tang's words quickly began to be felt outside the force with other services,

which are allowed unions, agitating for their leaders and bosses to back them as

well. At times, the discord descended into name-calling, with some disciplined

officers lampooning firefighters for playing volleyball or having barbecues

while on standby in fire stations, and the immigration union saying at a press

conference that they were treated as a third-class department. An Immigration

Department officer told journalists that customs officers were "always idling".

The starting salaries for immigration staff are the lowest of all the services.

They start on HK$24,050 - compared with HK$27,155 for officers of the same rank

in the customs, fire services and correctional services departments, and

HK$29,460 for a new police inspector. Chief Executive Donald Tsang Yam-kuen's

June 25 declaration of his family links to the police and "deep affection" for

the force only served to deepen the divide. "My father was a police officer, my

younger brother was a police officer, my sister-in-law was a police officer, my

uncle was a police officer," he recalled, in urging the police to reconsider

their protest. While the march was called off, a police unionist confided that

Mr Tsang's words had spurred ill-feeling in the force, with many thinking he had

made them a joke among the other disciplined services, while not helping them in

their pay fight. "This is an example of the poor political spin-doctoring skills

that the chief executive's aides provide," the unionist said. Firefighters'

union chairman Chiu Sin-chung was moved to declare at a press conference in the

middle of this month: "The chief executive is not our relative, but all

disciplined services are his limbs, his brothers. We believe the chief executive

does not wish to see the brothers in discord and criticising one another." He

went on: "As a responsible labour union, we will not threaten residents or

confront the government to get what we want. This is selfish behavior." This

summer of discontent seems set to simmer for several more weeks, with Miss Yue

due in either September or October to present for discussion a proposal for

Exco's final decision on the implementation of the review. Disciplined services

unions have realised that the review will not result in any structural change,

but are determined that any pay rises should be backdated to November and that

the government should promise a proper salary review every six years. Without

these, the dispute can only heat up again, resulting in a more vociferous union

movement in all the disciplined services. The Government Disciplined Services

General Union has scheduled a forum for Wednesday and has invited heads of the

services to attend, to listen to their grievances before the Civil Service

Bureau submits its proposal. Dr Lo believes that something else is needed - an

open clarification from Mr Tang of his role in the pay review, as his

intervention deviated from established procedures and put chiefs in other

disciplined services under pressure.

Fortis Insurance Co (Asia) is

demanding that former regional director Inneo Lam Hau-wah, who was at the center

of the recent PCCW (0008) privatization controversy, immediately pay back

HK$34.92 million he borrowed from the company to make payments on a luxury Bel-Air

apartment.

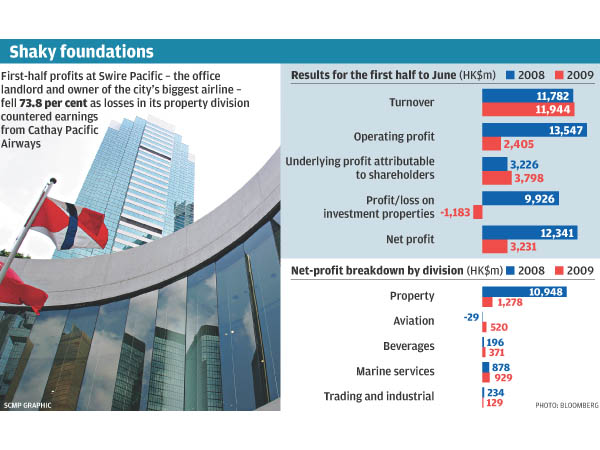

Air China (0753) is not planning to increase its stake in Cathay Pacific Airways

(0293), easing market concerns over a mandatory general offer if it did.

Shui On Land (0272) said first-half net profit fell 45 percent because of the

deferral of profit contributions from its high-end residential project Casa

Lakeville and the lack of equity interest sales to strategic partners.

Emperor Watch & Jewellery (0887) plans to open up to 10 new shops in the

mainland next year despite reporting a huge drop in first-half net profit

yesterday.

President Ma Ying-jeou

comforts a woman made homeless by landslides after Typhoon Morakot struck her

village of Hsinkai, Pintung county, in southern Taiwan. Taiwan's president has

not ruled out a chance meeting with the Dalai Lama when the Tibetan spiritual

leader visits next week, officials said on Friday, a move that would sour the

island's recent closer ties with the mainland. Beijing brands the India-based

Dalai Lama as a separatist and has lashed out at Taiwan’s opposition, which

invited the Dalai Lama subject to President Ma Ying-jeou’s approval. China’s

reaction is also seen as a blow to Mr Ma, elected last year pledged to improve

relations with Beijing, but only in the short-term. Neither side has discounted

the possibility of a chance encounter during the Dalai’s Sunday-Friday visit to

comfort victims of deadly Typhoon Morakot, the island’s worst storm in 50 years. President Ma Ying-jeou

comforts a woman made homeless by landslides after Typhoon Morakot struck her

village of Hsinkai, Pintung county, in southern Taiwan. Taiwan's president has

not ruled out a chance meeting with the Dalai Lama when the Tibetan spiritual

leader visits next week, officials said on Friday, a move that would sour the

island's recent closer ties with the mainland. Beijing brands the India-based

Dalai Lama as a separatist and has lashed out at Taiwan’s opposition, which

invited the Dalai Lama subject to President Ma Ying-jeou’s approval. China’s

reaction is also seen as a blow to Mr Ma, elected last year pledged to improve

relations with Beijing, but only in the short-term. Neither side has discounted

the possibility of a chance encounter during the Dalai’s Sunday-Friday visit to

comfort victims of deadly Typhoon Morakot, the island’s worst storm in 50 years.

China: Hunan,

one of China's top indium producers, has shut almost all crude indium production

this month after environmental checks, trading sources said on Friday.

China: Hunan,

one of China's top indium producers, has shut almost all crude indium production

this month after environmental checks, trading sources said on Friday.

China's legislature yesterday

adopted the first law on the country's armed police force, which reaffirms the

central government's control over it and clarifies its duties. First established

in 1982, the People's Armed Police is a special half-police, half-military force

entrusted with the umbrella mission of "protecting internal security". However,

its chain of command and administrative status have not always been clear. The

high-profile use of the PAP in major events, from the Sichuan earthquake to

riots in Tibet last year and Xinjiang this year brought its duties and rights

under public scrutiny. "The passing of the PAP Law will not only provide a

clearer legal basis and legal protection for the PAP when they carry out their

safety missions, but will also provide legal guidance for the PAP to rein in

their behaviour when carrying out their missions," National People's Congress

Standing Committee law-drafting-office director Wang Shangxin said yesterday.

Commander of PAP Wu Shuangzhan was quoted by Xinhua as saying yesterday that the

PAP had been deployed more frequently in recent years on missions to restore

social stability. As it had to handle more and more difficult situations, the

law was urgently needed. The new legislation of the PAP, originally administered

under the country's Defence Law, will divide its roles into eight main

categories, from the protection of key personnel and strategic facilities to the

handling of riots, violent crimes, terrorist attacks and other threats to

society. The new law spells out limits on an armed police officer's power,

including that they must not illegally detain or search a citizen, and must

carry identification when on duty. But, ultimately, it reaffirms the joint and

paramount jurisdiction of the State Council and the Communist Party's Central

Military Commission over the PAP. A telling difference between the final draft

of the law, which was passed yesterday, and the first draft in April, is a

clause stating that all deployment of the PAP must follow a protocol set by

these two top decision-making bodies. Although the protocol is not new, it now

underlines the central government's determination to keep deployment of the PAP

closely in its hands, mainland analysts have said. The passing of legislation in

China normally requires three readings at the National People's Congress, but

the PAP Law was passed yesterday after the second reading. Mr Wang said this was

because discussions had been carried out for years on the law, which is built on

existing regulations, with no real changes. Descended from internal guards and

border patrols in earlier years of the People's Republic, the 680,000-strong PAP

is considered a unit of the military, but subject to "unified leadership and

management, with command divided by levels". The State Council is mainly in

charge of daily deployments and the budget of the PAP, while the military is in

charge of personnel affairs, political education and training.

China said on Friday it has revised

its tariffs on imported auto parts after losing an appeal against a WTO ruling

that it was breaking international trade rules. Effective from Tuesday, all

imported auto parts will be taxed at the same rate regardless of the percentage

of foreign-made parts used to make a vehicle, according to a notice posted on

the website of the National Development and Reform Commission. The notice gave

no details or reason for the change. However, Beijing was required to amend its

regulations after the World Trade Organisation ruled against its policy of

requiring foreign automakers to buy more than 40 per cent of the components used

in any locally made vehicle from local suppliers or pay more than double the

usual tariff on imported parts. The WTO ruling last year that such policies

violate international trade rules was a rare coup for mainland’s trading

partners. Beijing lost an appeal against the ruling in December. Mainland argued

that the higher tariffs were needed to prevent automakers from evading steep

vehicle import duties by importing cars in large chunks. The US, the 27-nation

EU and Canada contended that the tariffs encouraged car parts companies to shift

production to mainland, costing Americans, Canadians and Europeans their jobs.

Failure to change the policy could have resulted in the imposition of sanctions.

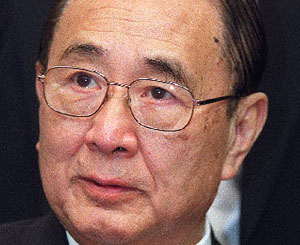

China Mobile chairman Wang Jianzhou

says smartphones using the company's operating system will be introduced soon.

HTC Corp, the No 1 maker of mobile telephones using Google's Android and

Microsoft Corp's Windows operating systems, will supply one handset model to

China Mobile (SEHK: 0941) this year and six next year, said Wang Jianzhou,

chairman of the mainland's leading mobile network operator. Taiwan-based HTC

would manufacture a smartphone for China Mobile, the world's biggest telephone

firm by market value, based on the country's TD-SCDMA technology, Mr Wang said

yesterday. China Mobile plans to expand into the smartphone market as growth in

subscriber numbers slows. Shipments of smartphones, mobile telephones that

enable users to make voice calls, check e-mail and browse the internet, were

forecast to exceed voice handsets by 2014, RBC Capital Markets Corp said in a

report. China Mobile has climbed 3.3 per cent this year, lagging behind the

benchmark Hang Seng Index's 43 per cent; HTC's 8.7 per cent advance this year

trails the Taiwan Weighted Index's 48 per cent increase. Last week, China Mobile

posted its first decline in profit since 1999. It said it would co-operate with

vendors including Dell and HTC to develop handsets that used its own operating

system. Smartphones based on China Mobile's operating system, which uses Android

technology, would be introduced "soon", Mr Wang said last week. China Mobile

added 15.96 million users in the three months to June, compared with 22.5

million a year earlier. It had 493 million subscribers at the end of last month,

more than the combined populations of the United States and Japan. The stock

fell 1.19 per cent to HK$79.05 in Hong Kong yesterday, while HTC closed up 1.81

per cent in Taipei. China Mobile chairman Wang Jianzhou

says smartphones using the company's operating system will be introduced soon.

HTC Corp, the No 1 maker of mobile telephones using Google's Android and

Microsoft Corp's Windows operating systems, will supply one handset model to

China Mobile (SEHK: 0941) this year and six next year, said Wang Jianzhou,

chairman of the mainland's leading mobile network operator. Taiwan-based HTC

would manufacture a smartphone for China Mobile, the world's biggest telephone

firm by market value, based on the country's TD-SCDMA technology, Mr Wang said

yesterday. China Mobile plans to expand into the smartphone market as growth in

subscriber numbers slows. Shipments of smartphones, mobile telephones that

enable users to make voice calls, check e-mail and browse the internet, were

forecast to exceed voice handsets by 2014, RBC Capital Markets Corp said in a

report. China Mobile has climbed 3.3 per cent this year, lagging behind the

benchmark Hang Seng Index's 43 per cent; HTC's 8.7 per cent advance this year

trails the Taiwan Weighted Index's 48 per cent increase. Last week, China Mobile

posted its first decline in profit since 1999. It said it would co-operate with

vendors including Dell and HTC to develop handsets that used its own operating

system. Smartphones based on China Mobile's operating system, which uses Android

technology, would be introduced "soon", Mr Wang said last week. China Mobile

added 15.96 million users in the three months to June, compared with 22.5

million a year earlier. It had 493 million subscribers at the end of last month,

more than the combined populations of the United States and Japan. The stock

fell 1.19 per cent to HK$79.05 in Hong Kong yesterday, while HTC closed up 1.81

per cent in Taipei.

Riled residents on Shanghai track

attack - The construction of a high-speed rail link between Shanghai and the

nearby city of Hangzhou is raising protests among residents who say the trains

will run too close to their apartments - the latest hiccup in the long-debated

project.

Cash for patriotism the reel deal for movie fans - Beijing officials will offer

nearly 1 million discount coupons in a bid to get residents to flood theaters to

watch patriotic films opening next month to celebrate the 60th anniversary of

Communist China.

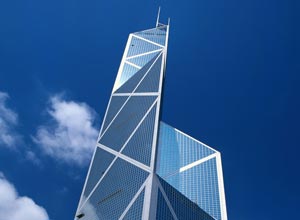

Bank of China (Hong Kong) said Thursday

its half-year profit fell by 5.6 percent from a year earlier, dragged lower by

falling interest income amid the deepening economic downturn. The bank's net

profit for the six months ending June 30 amounted to 6.69 billion Hong Kong

dollars, down from 7.09 billion Hong Kong dollars in the same period last year. Bank of China (Hong Kong) said Thursday

its half-year profit fell by 5.6 percent from a year earlier, dragged lower by

falling interest income amid the deepening economic downturn. The bank's net

profit for the six months ending June 30 amounted to 6.69 billion Hong Kong

dollars, down from 7.09 billion Hong Kong dollars in the same period last year.

China's State Council, the Cabinet, warned Wednesday of overcapacity in emerging

sectors such as wind power, saying the country would move to "guide" development

troubled by overcapacity and redundant projects. Overcapacity has persisted in

the steel and cement sectors, while redundant projects have surfaced in the

emerging sectors of wind power and polysilicon, said a statement issued after an

executive meeting of the State Council, presided over by Premier Wen Jiabao.

"Overcapacity and redundant projects remain prominent because of slow progress

in industrial restructuring in some of these sectors," the statement said.

"Guidance" would be particularly enhanced on the development of steel, cement,

plate glass, coal chemical, poly silicon, and wind power sectors, it said. The

guidance would include strict controls on market access, reinforced

environmental supervision, and tougher controls over land use. Banks were

ordered to lend money for these sectors in strict accordance with present

industrial policies. Relevant government agencies would also strengthen

monitoring over industrial capacity in these sectors, and jointly release

information on topics such as the current scale of operations, public demand,

and government industrial policies, said the statement.

China's State Council, the Cabinet, warned Wednesday of overcapacity in emerging

sectors such as wind power, saying the country would move to "guide" development

troubled by overcapacity and redundant projects. Overcapacity has persisted in

the steel and cement sectors, while redundant projects have surfaced in the

emerging sectors of wind power and polysilicon, said a statement issued after an

executive meeting of the State Council, presided over by Premier Wen Jiabao.

"Overcapacity and redundant projects remain prominent because of slow progress

in industrial restructuring in some of these sectors," the statement said.

"Guidance" would be particularly enhanced on the development of steel, cement,

plate glass, coal chemical, poly silicon, and wind power sectors, it said. The

guidance would include strict controls on market access, reinforced

environmental supervision, and tougher controls over land use. Banks were

ordered to lend money for these sectors in strict accordance with present

industrial policies. Relevant government agencies would also strengthen

monitoring over industrial capacity in these sectors, and jointly release

information on topics such as the current scale of operations, public demand,

and government industrial policies, said the statement.

Aug 28 - 30, 2009

Hong Kong:

The Practicing Pharmacists Association on Thursday warned parents not to overuse

the anti-flu drug Tamiflu – because it might result in serious side effects for

patients. Hong Kong:

The Practicing Pharmacists Association on Thursday warned parents not to overuse

the anti-flu drug Tamiflu – because it might result in serious side effects for

patients.

Paul Chu waves farewell to the media yesterday at HKUST's campus in Clear Water

Bay. Hong Kong should seek the chance to position itself as something more than

a financial hub following the financial meltdown, says the soon-to-retire head

of Hong Kong University of Science and Technology. It would be in the city's

best interest to co-operate with the mainland on the development of top

technologies similar to those from Silicon Valley, Paul Chu Ching-wu suggested

yesterday. The United States and Japan were devoting more attention to

technological development after the crisis savaged their financial sectors and

Hong Kong should follow their lead, he said at a media luncheon. "[The

economies] of China and Hong Kong will recover faster than those in other areas.

But we should seek the chance to position ourselves best," he said. Focusing on

a single field could make society unstable, he warned. "The economic base of

Hong Kong is very narrow. When it does well it does very well. When it's not

doing so well, the situation turns really bad." An HK$18 billion Research

Endowment Fund, approved this year, was a good initiative that boosted

researchers' spirits. But the government should make sure resources went to

outstanding projects, he said. "Hong Kong is a wealthy society. But it is

impossible for all its eight universities to become top universities by

international standards." There should be "mission differentiation" among

universities, with each receiving resources to develop its key strength, the

president said. The renowned scientist saw great potential in technologies that

helped conserve energy. Semi-conductors - his research area - could help reduce

energy loss during its transmission and save tens of billions in US dollars.

Physical constraints meant it might not be possible to place solar panels in the

city, but Professor Chu said local researchers could help mainland partners

develop materials to transform sunshine into energy. Hongkongers had to seize

the opportunity to co-operate with the mainland - the world's fastest growing

economy. "The window of opportunity is already narrowing," he said, referring to

great advances by mainland cities. In September, Professor Chu will hand over to

Tony Chan Fan-cheong after eight years as president. His biggest regret was that

the "University of Science and Technology hasn't turned into Massachusetts

Institute of Technology yet". Eight years ago, his friends in the US bet he

would not come to Hong Kong; now they bet against him returning to the US, he

joked. The generosity of Hongkongers, such as their contributions to

typhoon-stricken Taiwan and quake-hit Sichuan , had touched him. Professor Chu

said the next stage of his life was conducting superconductivity research in the

US in the hope of discovering a semi-conductor that worked at room temperature.

"There are some goals that a person goes after in life. I still want to pursue

my dream in the scientific field," he said. "I hope young people will find their

aspirations and create something new for mankind."

Paul Chu waves farewell to the media yesterday at HKUST's campus in Clear Water

Bay. Hong Kong should seek the chance to position itself as something more than

a financial hub following the financial meltdown, says the soon-to-retire head

of Hong Kong University of Science and Technology. It would be in the city's

best interest to co-operate with the mainland on the development of top

technologies similar to those from Silicon Valley, Paul Chu Ching-wu suggested

yesterday. The United States and Japan were devoting more attention to

technological development after the crisis savaged their financial sectors and

Hong Kong should follow their lead, he said at a media luncheon. "[The

economies] of China and Hong Kong will recover faster than those in other areas.

But we should seek the chance to position ourselves best," he said. Focusing on

a single field could make society unstable, he warned. "The economic base of

Hong Kong is very narrow. When it does well it does very well. When it's not

doing so well, the situation turns really bad." An HK$18 billion Research

Endowment Fund, approved this year, was a good initiative that boosted

researchers' spirits. But the government should make sure resources went to

outstanding projects, he said. "Hong Kong is a wealthy society. But it is

impossible for all its eight universities to become top universities by

international standards." There should be "mission differentiation" among

universities, with each receiving resources to develop its key strength, the

president said. The renowned scientist saw great potential in technologies that

helped conserve energy. Semi-conductors - his research area - could help reduce

energy loss during its transmission and save tens of billions in US dollars.

Physical constraints meant it might not be possible to place solar panels in the

city, but Professor Chu said local researchers could help mainland partners

develop materials to transform sunshine into energy. Hongkongers had to seize

the opportunity to co-operate with the mainland - the world's fastest growing

economy. "The window of opportunity is already narrowing," he said, referring to

great advances by mainland cities. In September, Professor Chu will hand over to

Tony Chan Fan-cheong after eight years as president. His biggest regret was that

the "University of Science and Technology hasn't turned into Massachusetts

Institute of Technology yet". Eight years ago, his friends in the US bet he

would not come to Hong Kong; now they bet against him returning to the US, he

joked. The generosity of Hongkongers, such as their contributions to

typhoon-stricken Taiwan and quake-hit Sichuan , had touched him. Professor Chu

said the next stage of his life was conducting superconductivity research in the

US in the hope of discovering a semi-conductor that worked at room temperature.

"There are some goals that a person goes after in life. I still want to pursue

my dream in the scientific field," he said. "I hope young people will find their

aspirations and create something new for mankind."

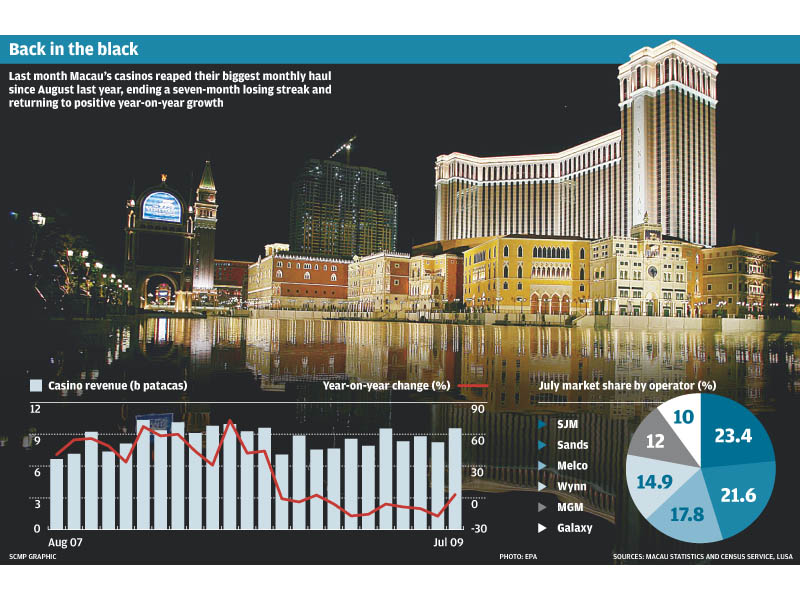

A Japanese-American gambler who lost

more than US$110 million in Las Vegas casinos is waging a Nevada court battle,

the outcome of which could affect Hong Kong legal judgments against such

high-rollers. Terrance "Terry" Watanabe, who lost the money in casinos owned by

Harrah's Entertainment, is asking a Las Vegas court to throw out charges that he

defaulted on gambling debts. He alleges the casinos plied him with alcohol and

prescription drugs to keep him intoxicated while playing. He also claims that

under the casinos' system for granting credit to high-rollers, his "markers"

were, in essence, loans and that he should be given greater leeway in paying

them. The Clark county district court has scheduled a hearing today to consider

motions filed by the Nebraska philanthropist, who once ran a direct marketing

business importing toys and novelty items from the mainland and Hong Kong. He is

asking the court to dismiss a grand jury indictment against him for writing 38

bad cheques to pay gambling debts of US$14.7 million. If successful, Mr

Watanabe's move could prompt a rethink of the way that Las Vegas casinos have,

for decades, enforced gambling debts via the courts. It is a system that has

been recognized repeatedly over the years in Hong Kong legal judgments against

local, Macau and mainland high-rollers. By all accounts, Mr Watanabe, 52, was a

"whale", or a gambler of epic proportions. His lawyers estimate his play at

Harrah's Caesars Palace and Rio casinos in Las Vegas accounted for around 20 per

cent of revenue at both properties in 2006 and 2007. Harrah's - the world's

largest gaming company by revenue - created a unique "chairman" level in its

customer loyalty programme, issuing Mr Watanabe a membership card signed by

Harrah's chairman and chief executive Gary Loveman. Mr Watanabe's gaming history

statement for 2007, issued by Harrah's and filed with the court, shows he lost

US$112.01 million gambling at seven of the company's casinos that year. About

half of that amount was from playing slot machines. "Terry Watanabe was among

the most noteworthy gamblers in the history of Las Vegas," court documents filed

by his lawyers said. Spokesmen for Harrah's did not reply to an e-mail and a

phone call seeking comment. In the 1980s and 1990s, while running his family's

Oriental Trading Company, which he sold to a private equity group in 2000, Mr

Watanabe made about 20 trips a year to Hong Kong and the mainland. He would

occasionally bet on horse races at the Hong Kong Jockey Club or visit casinos in

Macau, but nothing on the scale of his recent Las Vegas activity, a source close

to him said. Mr Watanabe was indicted by a Clark county grand jury in April on

felony charges of theft. The judge in the case is scheduled to hold a hearing

today on motions filed by Mr Watanabe's lawyers seeking to throw out the

charges. Mr Watanabe's lawyers claim Harrah's Caesars Palace and Rio casinos

plied him with alcohol and prescription painkillers over the course of several

months in late 2007. While visiting the casinos during this period Mr Watanabe

was "significantly and visibly intoxicated", to the point that his speech was

slurred, according to filings by his legal team. He walked into doors and took

naps at the tables while gambling, the filings said. Gaming watchdogs can take

disciplinary action against casinos who allow visibly intoxicated people to

gamble or supply them alcohol. But perhaps the bigger legal challenge being

mounted by Mr Watanabe's lawyers is to the Nevada casino industry's system of

issuing credit and collecting debt. High-rollers visiting Las Vegas usually sign

credit agreements with casinos specifying a maximum amount of credit that can be

issued. Each time a player draws down funds against the credit line he signs a

specific "marker" for the amount, which is paid in chips. If the player loses

and doesn't pay, casinos can then deposit the markers with the bad cheque unit

of the local district attorney's office, which, under Nevada law, is empowered

to take legal action to reclaim the debt on behalf of the casinos. Since at

least the early 1990s, Nevada casinos have used Hong Kong courts to enforce

gambling debts incurred in Las Vegas by punters from the city, Macau and the

mainland. While casinos are illegal in Hong Kong, there are multiple precedents

for local courts accepting the Nevada laws governing casino credit agreements.

They allow Las Vegas creditors to enforce a debt against a punter's Hong Kong

assets. High-profile cases have included that of Macau legislator, junket

operator and developer David Chow Kam-fai. In 2000, he was sued in Hong Kong for

nearly US$5 million in gambling debts related to a 1995 credit agreement he

signed at the Sheraton Desert Inn in Las Vegas, which was subsequently acquired

by casino developer Steve Wynn. Mr Chow and Mr Wynn settled out of court in

2004. This month, a High Court judge ruled that high-roller Henry Mong Hengli

must pay US$3 million in casino debts to Mr Wynn's Wynn Las Vegas, which he ran

up last year. Mr Watanabe's lawyers are seeking to dismiss the charges partly on

the grounds that the credit markers he signed should not have been treated by

Nevada authorities as "bad cheques" that were repayable on demand. His lawyers

contends that he had a standing agreement with Harrah's that allowed him at

least 60 days to repay markers - terms which made them more akin to loans.

Should the judge agree with that argument, it could have a far-reaching impact

on how courts in Nevada, and, in turn, Hong Kong handle casino debt cases. While

Mr Watanabe may be one of the biggest whales in the pond, other high-rollers

will no doubt be watching.

A union representing

rank-and-file civil servants yesterday called on the government to extend

retirement age from 60 to 65, saying the extra years in the service would help

them make ends meet in old age. Although it is estimated that public coffers

could initially save more than HK$500 million a year if the plan is carried out,

senior officers and an academic believed it would block the career path of

middle-age officials. At a meeting with Chief Secretary Henry Tang Ying-yen,

Federation of Civil Service Unions chairman Leung Chau-ting said that many

retired rank-and-file civil servants received small pensions and keeping them in

the civil service could keep them off welfare. The government estimates that

HK$17.5 billion will be paid to 109,750 pensioners in the current financial

year. The total pension liability exceeds HK$427.6 billion. The Civil Service

Bureau estimated that about 3,400 civil servants would retire each year up to

2012-13. If these officers work for another five years, it is estimated that an

annual spending of about HK$540 million would be deferred, while the

government's pension liability would also be reduced as the payout period would

be shortened. However, Mr Leung's proposal was given short shrift by other civil

service unions. Senior Government Officers Association senior vice-chairman

Philip Kwok Chi-tak said that "having the old hands at the helm for all eternity

would affect the grooming of the next generation". James Sung Lap-kung, a public

administration academic at City University, said Mr Leung's proposal was not

realistic, because senior civil servants could earn more in the private sector

after retirement. A spokeswoman for the Civil Service Bureau said the government

had no plans to change the retirement age of civil servants. A union representing

rank-and-file civil servants yesterday called on the government to extend

retirement age from 60 to 65, saying the extra years in the service would help

them make ends meet in old age. Although it is estimated that public coffers

could initially save more than HK$500 million a year if the plan is carried out,

senior officers and an academic believed it would block the career path of

middle-age officials. At a meeting with Chief Secretary Henry Tang Ying-yen,

Federation of Civil Service Unions chairman Leung Chau-ting said that many

retired rank-and-file civil servants received small pensions and keeping them in

the civil service could keep them off welfare. The government estimates that

HK$17.5 billion will be paid to 109,750 pensioners in the current financial

year. The total pension liability exceeds HK$427.6 billion. The Civil Service

Bureau estimated that about 3,400 civil servants would retire each year up to

2012-13. If these officers work for another five years, it is estimated that an

annual spending of about HK$540 million would be deferred, while the

government's pension liability would also be reduced as the payout period would

be shortened. However, Mr Leung's proposal was given short shrift by other civil

service unions. Senior Government Officers Association senior vice-chairman

Philip Kwok Chi-tak said that "having the old hands at the helm for all eternity

would affect the grooming of the next generation". James Sung Lap-kung, a public

administration academic at City University, said Mr Leung's proposal was not

realistic, because senior civil servants could earn more in the private sector

after retirement. A spokeswoman for the Civil Service Bureau said the government

had no plans to change the retirement age of civil servants.

Sir Harry Fang at a fund-raising gala film

premiere on March 5, 1981, at the Palace Theatre with Emily Shum (left), Anson

Chan and (far right) his wife Laura Fang Ip. Throughout his long professional

life, Sir Harry Fang Sin-yang, who died on Monday aged 86, was gripped by a

passion to help the disabled. His success in doing so was recognised at the

highest level. The professor of orthopaedic surgery at the University of Hong

Kong was the first Asian to become president of Rehabilitation International. It

was typical that when he was hit by a stroke at the age of 78, he kept a diary

about his struggle to cope. He noted every step of his long road back to a

fruitful life. The affable doctor laughed. "I'm benefiting from some of the

programs I helped create." With his good humour, ready smile and ability to

listen to anyone, Harry Fang was hugely popular. They had a name for him, one in

which he took great pride: "the father of rehabilitation". For most of his

distinguished career, he concentrated on making life better for the disabled,

including those incapacitated by crippling disease. "For those I can't cure," he

said, "at least I can improve the way they live, help them to enjoy a full and

better life." He did that for thousands of people in Hong Kong and millions more

on the mainland, helping them look forward to a quality of life that never used

to be possible. Rehabilitation is now taught in medical institutions throughout

the mainland. Kit Sinclair, past president and ambassador of the World

Federation of Occupational Therapists, who worked closely with Sir Harry for

more than 20 years on rehabilitation projects, described Sir Harry as "the

grandfather of rehabilitation in Hong Kong and [the mainland]". "He dedicated

his life totally to trying to improve the lot of people with disabilities," she

said. "Sir Harry had the vision and foresight to prepare doctors in China to

take up roles in rehabilitation through a truly innovative training program. He

was inspirational in his breadth of thinking; of ways to spread rehabilitation

techniques to every corner of China. His goal was to train 2,000 rehabilitation

workers by the year 2000. This he accomplished by 1997." Dr Sinclair said Sir

Harry's commitment to the principles of rehabilitation, his dynamic personality,

his enthusiasm about people and the betterment of their lives had been a great

inspiration to all who worked with him. Ruby Ho Shui-wan, who has been manager

of the occupational therapist department at the MacLehose Rehabilitation Centre

and chairwoman of the Hong Kong Occupational Therapy Association, agreed. "He

was a dedicated man, a visionary," said Ms Ho, who worked with him for two

decades. "He was so terribly charming and nice that people would do anything he

asked. Sir Harry saw the need for rehabilitation in China. He knew the mould [in

the mainland] should not be the same as in Hong Kong because in rural areas of

China methods and daily interaction are so very different. "He initiated and

created workshop community-based rehab in 1986. In Guangzhou, they set up a

place for people to learn how to become occupational therapists, with students

from many different provinces. Then fully trained occupational therapists would

be able to help people all over China." Barbara Duncan, communications director

of Rehabilitation International, said Sir Harry had founded many organizations

on his own. "He collaborated with Beijing to build, from ground up, the Chinese

Disabled People's Federation. Once he put his magic hands on it, people poured

through the doors." Sir Harry, who was an uncle of former chief secretary Anson

Chan Fang On-sang, traced his family roots to Anhui province. He was born on

August 2, 1923, during his father General Fang Zhenwu's posting at the

Kuomintang headquarters in Nanjing. In the 1930s, General Fang believed that the

Nationalists should be fighting alongside the Communists against the Japanese -

a view seen as undesirable at the time. He was killed by Kuomintang agents, Sir

Harry suspected, in 1942. The rest of the family, led by Sir Harry's mother,

fled Nanjing and lived for a time in Shanghai before reaching Hong Kong in 1936.

Sir Harry studied at Queen's College and went on to study medicine at HKU.

During the occupation, he fled Hong Kong and continued his studies on the

mainland. He later gained a master's degree in orthopaedic surgery at the

University of Liverpool, England. It was while working in the wards at Queen

Mary Hospital in the 1950s that Sir Harry began his intense interest in making

life better for those with untreatable conditions. It was an era of fast-rising

prosperity (SEHK: 0803) for Hong Kong, and he felt keenly that those who fell by

the wayside should be cared for adequately. A high-rise construction worker had

fallen and was hopelessly crippled. He would never walk again. Sir Harry not

only helped the man gain rightful compensation, but also helped renovate his

resettlement estate flat so the wheelchair-bound man could move from bed to

toilet to kitchen. Then he found him a job in a factory. But realizing he had

helped only one person, he was spurred into public service. "There were so many

others who needed help," he recalled 45 years later. The best way to help the

strickened lead full lives, he believed, was to teach them to look after their

own needs. To do that, society had to offer special schools, therapy programs

and trained staff. Sir Harry made full use of his 1974 appointment to the

Legislative Council. By 1977, the government had published its first paper on

rehabilitation and later laid down a 10-year plan. When he landed a five-year

term on the Executive Council in 1978, Sir Harry used his influence to expand

treatment and to emphasise top quality education for therapists. His work gained

further momentum after he became president of Rehabilitation International in

1980. The UN declared 1981 the year of the disabled and, two years later,

announced the decade of the disabled. Sir Harry was delighted; the doctor had

fought for both moves. Sheila Purves, project director of the Hong Kong Society

for Rehabilitation, which Sir Harry founded, described him as the epitome of

leadership. "He would launch an ambitious project and give you his enthusiasm.

He worked so hard we always had to run to keep up. "Dr Fang truly realized that

surgery and hospitals weren't enough. What would happen to these young people

after their surgery? Rehabilitation centers were needed in Hong Kong. Just

because they were injured didn't mean they could not have a productive life."

For many years, Sir Harry said, treatment for people with such ailments as

cerebral palsy had been non-existent in Asian societies. Such patients led lives

without hope or purpose, lying in a bed and waiting to die. Sir Harry believed

that the survival spirit in people could conquer grave injuries or disabilities,

and, with proper treatment, they could become useful, contributing members of

society. A great way to do that, he believed, was through sport; he was the

founding father of the Far East and South Pacific Games for the Disabled and was

awarded the Paralympic Order in 2001 from the International Paralympic

Committee. His idealism rubbed off on others. He organised Hong Kong's first

disabled sports day, in 1970, founded the Paralympic committee in 1972 and, by

1982, was able to watch athletes from more than 20 countries take part in the

Far East and South Pacific Games for the Disabled at Sha Tin. "Sports are

competitive," he said. "They stretch people to the limit, goad them to

excellence. A disabled person winning a gold medal for Hong Kong becomes a hero

and gains widespread recognition." It was a matter of immense satisfaction for

him to note that Hong Kong's disabled athletes had won 2,000 medals through the

years. Sir Harry himself also won awards, including a knighthood in 1996 and the

Grand Bauhinia Medal in 2001, both in recognition of his lifelong work for the

disabled. Ms Duncan, calling Sir Harry a true humanist, said: "You could be the

queen or someone like me, and he would treat you the same. He received diplomas,

honorary degrees, a knighthood and every sort of honor one can think of, but he

never changed. "The special thing about Harry was he truly understood the need

for regional representation. New York and Geneva weren't going to cut it. Harry

really got down to the everyday communication and regional representation which

is so important. He saw openings and took them." After suffering his first

stroke, Sir Harry suddenly found himself in a similar condition to many of those

whom he had helped over the years. Ever optimistic, he insisted on following the

lessons he had preached, and returned to work as soon as he could. But Sir Harry

had a second stroke in 2003, and remained in hospital until he died. St Paul's

Hospital superintendent Dr David Fang Chun-sang, a nephew, said Sir Harry was

truly the founding father of equal opportunity. "Equal opportunities for sports,

recreation and work for the disabled, among other things," he said. "He held the

helm for society for 40 years and he has set the bar for the future. The effort

must go on." Sir Harry is survived by wife Laura Fang Ip Hung-cho, a son and

four daughters. Sir Harry Fang at a fund-raising gala film

premiere on March 5, 1981, at the Palace Theatre with Emily Shum (left), Anson

Chan and (far right) his wife Laura Fang Ip. Throughout his long professional

life, Sir Harry Fang Sin-yang, who died on Monday aged 86, was gripped by a

passion to help the disabled. His success in doing so was recognised at the

highest level. The professor of orthopaedic surgery at the University of Hong

Kong was the first Asian to become president of Rehabilitation International. It

was typical that when he was hit by a stroke at the age of 78, he kept a diary

about his struggle to cope. He noted every step of his long road back to a

fruitful life. The affable doctor laughed. "I'm benefiting from some of the

programs I helped create." With his good humour, ready smile and ability to

listen to anyone, Harry Fang was hugely popular. They had a name for him, one in

which he took great pride: "the father of rehabilitation". For most of his

distinguished career, he concentrated on making life better for the disabled,

including those incapacitated by crippling disease. "For those I can't cure," he

said, "at least I can improve the way they live, help them to enjoy a full and

better life." He did that for thousands of people in Hong Kong and millions more

on the mainland, helping them look forward to a quality of life that never used

to be possible. Rehabilitation is now taught in medical institutions throughout

the mainland. Kit Sinclair, past president and ambassador of the World

Federation of Occupational Therapists, who worked closely with Sir Harry for

more than 20 years on rehabilitation projects, described Sir Harry as "the

grandfather of rehabilitation in Hong Kong and [the mainland]". "He dedicated

his life totally to trying to improve the lot of people with disabilities," she

said. "Sir Harry had the vision and foresight to prepare doctors in China to

take up roles in rehabilitation through a truly innovative training program. He

was inspirational in his breadth of thinking; of ways to spread rehabilitation

techniques to every corner of China. His goal was to train 2,000 rehabilitation

workers by the year 2000. This he accomplished by 1997." Dr Sinclair said Sir

Harry's commitment to the principles of rehabilitation, his dynamic personality,

his enthusiasm about people and the betterment of their lives had been a great

inspiration to all who worked with him. Ruby Ho Shui-wan, who has been manager

of the occupational therapist department at the MacLehose Rehabilitation Centre

and chairwoman of the Hong Kong Occupational Therapy Association, agreed. "He

was a dedicated man, a visionary," said Ms Ho, who worked with him for two

decades. "He was so terribly charming and nice that people would do anything he

asked. Sir Harry saw the need for rehabilitation in China. He knew the mould [in

the mainland] should not be the same as in Hong Kong because in rural areas of

China methods and daily interaction are so very different. "He initiated and

created workshop community-based rehab in 1986. In Guangzhou, they set up a

place for people to learn how to become occupational therapists, with students

from many different provinces. Then fully trained occupational therapists would

be able to help people all over China." Barbara Duncan, communications director

of Rehabilitation International, said Sir Harry had founded many organizations

on his own. "He collaborated with Beijing to build, from ground up, the Chinese

Disabled People's Federation. Once he put his magic hands on it, people poured

through the doors." Sir Harry, who was an uncle of former chief secretary Anson

Chan Fang On-sang, traced his family roots to Anhui province. He was born on

August 2, 1923, during his father General Fang Zhenwu's posting at the

Kuomintang headquarters in Nanjing. In the 1930s, General Fang believed that the

Nationalists should be fighting alongside the Communists against the Japanese -

a view seen as undesirable at the time. He was killed by Kuomintang agents, Sir

Harry suspected, in 1942. The rest of the family, led by Sir Harry's mother,

fled Nanjing and lived for a time in Shanghai before reaching Hong Kong in 1936.

Sir Harry studied at Queen's College and went on to study medicine at HKU.

During the occupation, he fled Hong Kong and continued his studies on the

mainland. He later gained a master's degree in orthopaedic surgery at the

University of Liverpool, England. It was while working in the wards at Queen

Mary Hospital in the 1950s that Sir Harry began his intense interest in making

life better for those with untreatable conditions. It was an era of fast-rising

prosperity (SEHK: 0803) for Hong Kong, and he felt keenly that those who fell by

the wayside should be cared for adequately. A high-rise construction worker had

fallen and was hopelessly crippled. He would never walk again. Sir Harry not

only helped the man gain rightful compensation, but also helped renovate his

resettlement estate flat so the wheelchair-bound man could move from bed to

toilet to kitchen. Then he found him a job in a factory. But realizing he had

helped only one person, he was spurred into public service. "There were so many

others who needed help," he recalled 45 years later. The best way to help the

strickened lead full lives, he believed, was to teach them to look after their

own needs. To do that, society had to offer special schools, therapy programs

and trained staff. Sir Harry made full use of his 1974 appointment to the

Legislative Council. By 1977, the government had published its first paper on

rehabilitation and later laid down a 10-year plan. When he landed a five-year

term on the Executive Council in 1978, Sir Harry used his influence to expand

treatment and to emphasise top quality education for therapists. His work gained

further momentum after he became president of Rehabilitation International in

1980. The UN declared 1981 the year of the disabled and, two years later,

announced the decade of the disabled. Sir Harry was delighted; the doctor had

fought for both moves. Sheila Purves, project director of the Hong Kong Society

for Rehabilitation, which Sir Harry founded, described him as the epitome of

leadership. "He would launch an ambitious project and give you his enthusiasm.

He worked so hard we always had to run to keep up. "Dr Fang truly realized that

surgery and hospitals weren't enough. What would happen to these young people

after their surgery? Rehabilitation centers were needed in Hong Kong. Just

because they were injured didn't mean they could not have a productive life."

For many years, Sir Harry said, treatment for people with such ailments as

cerebral palsy had been non-existent in Asian societies. Such patients led lives

without hope or purpose, lying in a bed and waiting to die. Sir Harry believed

that the survival spirit in people could conquer grave injuries or disabilities,

and, with proper treatment, they could become useful, contributing members of

society. A great way to do that, he believed, was through sport; he was the

founding father of the Far East and South Pacific Games for the Disabled and was

awarded the Paralympic Order in 2001 from the International Paralympic

Committee. His idealism rubbed off on others. He organised Hong Kong's first

disabled sports day, in 1970, founded the Paralympic committee in 1972 and, by

1982, was able to watch athletes from more than 20 countries take part in the

Far East and South Pacific Games for the Disabled at Sha Tin. "Sports are

competitive," he said. "They stretch people to the limit, goad them to

excellence. A disabled person winning a gold medal for Hong Kong becomes a hero

and gains widespread recognition." It was a matter of immense satisfaction for

him to note that Hong Kong's disabled athletes had won 2,000 medals through the

years. Sir Harry himself also won awards, including a knighthood in 1996 and the

Grand Bauhinia Medal in 2001, both in recognition of his lifelong work for the

disabled. Ms Duncan, calling Sir Harry a true humanist, said: "You could be the

queen or someone like me, and he would treat you the same. He received diplomas,

honorary degrees, a knighthood and every sort of honor one can think of, but he

never changed. "The special thing about Harry was he truly understood the need

for regional representation. New York and Geneva weren't going to cut it. Harry

really got down to the everyday communication and regional representation which

is so important. He saw openings and took them." After suffering his first

stroke, Sir Harry suddenly found himself in a similar condition to many of those

whom he had helped over the years. Ever optimistic, he insisted on following the

lessons he had preached, and returned to work as soon as he could. But Sir Harry

had a second stroke in 2003, and remained in hospital until he died. St Paul's

Hospital superintendent Dr David Fang Chun-sang, a nephew, said Sir Harry was

truly the founding father of equal opportunity. "Equal opportunities for sports,

recreation and work for the disabled, among other things," he said. "He held the

helm for society for 40 years and he has set the bar for the future. The effort

must go on." Sir Harry is survived by wife Laura Fang Ip Hung-cho, a son and

four daughters.

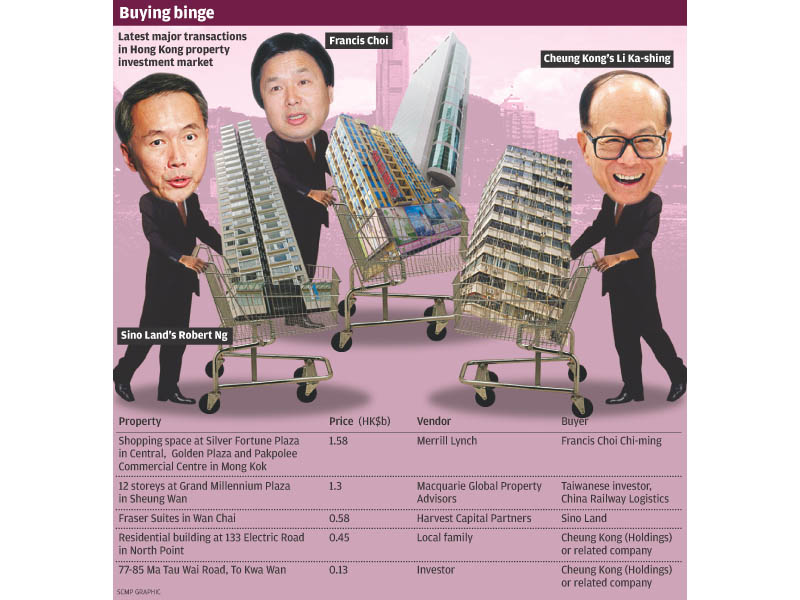

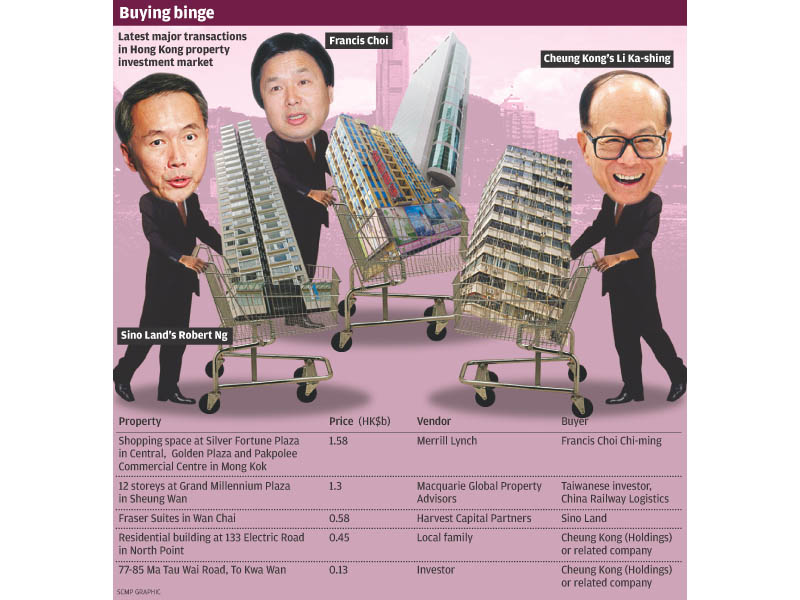

Bilateral trade between

the mainland and India is expected to receive a big boost as China Low interest

rates and risk aversion have drawn more investors to the property market despite

the low yields it offers because rent rises are failing to match the

demand-driven increase in capital values, agents say. Hong Kong Lands Registry

data show 13 deals of more than HK$100 million were closed in the commercial

property market in July, and total deal values reached HK$3.05 billion for the

month, an increase of 68.5 per cent on the HK$1.81 billion worth of transactions

in June. A total of 114 transactions of more than HK$100 million were done so

far this year, with transaction values reaching about HK$25.7 billion - down 49

per cent on deal values of HK$50.3 billion for the same period last year,

according to property consultancy DTZ. The July result was a 20-month high for

sales values in the sector, according to Centaline Property Agency's research

department. And more recent transactions show there is still no sign that

investor appetite for commercial property is set to slow, agents say, citing the

purchase announced last week by a Taiwanese investor and China Railway (SEHK:

0390) Logistics of 12 retail and office floors at Grand Millennium Plaza in

Sheung Wan for a total of about HK$1.3 billion. Sino Land bought the 87-unit

Fraser Suites serviced flats project in Wan Chai for HK$580 million last week.

Hong Kong's second-largest developer, Cheung Kong (Holdings) (SEHK: 0001), has

also been in the market with its associated companies in recent weeks, buying

two small sites in Hung Hom and North Point for a total of HK$580 million. Henry

Lam, a director of investment at Knight Frank, believes developers have returned

to the acquisition trail because of strong sales in the last few months and

limited land supply in urban areas. The outlook for the residential market was

also encouraging, he added. "Demand for high-end residential flats in Hong Kong

is unlimited due to the influx of mainland buyers and high land prices." The