|

Newsletter

Seminar Material

Biz:

China

Hong

Kong Hawaii

What people

said about us

China

Earthquake Relief

Tax &

Government

Hawaii Voter Registration

Biz-Video

Biz-Video

Hawaii's

China Connection Hawaii's

China Connection

CDP#1780962

CDP#1780962

Doing Business in

Hong Kong & China

Doing Business in

Hong Kong & China

| |

Hong Kong, China & Hawaii Biz*

Skype - FREE

Voice Over IP Skype - FREE

Voice Over IP  View Hawaii's China Connection

Video Trailer

View Hawaii's China Connection

Video Trailer

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our event page to find out more!

After

attended a China/Hong Kong Business/Trade Seminar in Hawaii...still unsure what

to do next, contact us, our Officers, Directors and Founding Members are

actively engaged in China/Hong Kong/Asia trade - we can help!

Are you ready to export your product or

service? You will find out in 3 minutes with resources to help you -

enter

to give it a try

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

(approximate $ exchange rates: US$1 = HK$7.8, US$1 = RMB$6.8)

Holidays Greeting from President Obama &

Johnson Choi

Holidays Greeting from President Obama &

Johnson Choi

http://www.youtube.com/watch?v=pNk4Z4lUV-k

http://www.youtube.com/watch?v=pNk4Z4lUV-k

http://www.facebook.com/video/video.php?v=219896871983&ref=mf

http://www.facebook.com/video/video.php?v=219896871983&ref=mf

Wine-Biz - Hong Kong

Wine-Biz - Hong Kong

Brand Hong Kong

Video

Brand Hong Kong

Video

Sept 30, 2009

Hong Kong:

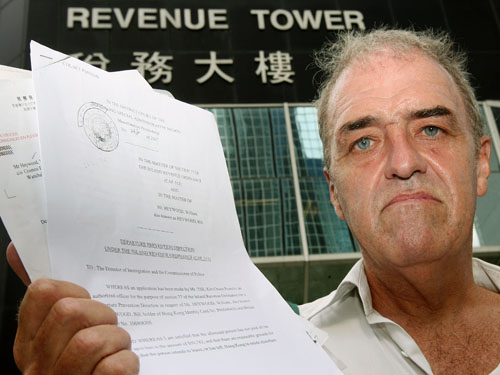

The Hong Kong police have launched a fraud investigation into Ernst & Young’s

practice in the city following allegations the big four accounting firm

falsified and doctored papers it used to defend itself in a civil trial relating

to its audit of collapsed former client Akai Holdings. An Ernst & Young Hong

Kong partner, Edmund Dang, was arrested at his home yesterday on suspicion of

forgery by officers from the commercial crime bureau (CCB (SEHK: 0939)). He was

later released on bail without being charged. The CCB also raided Ernst &

Young’s premises in Central and Quarry Bay yesterday, a senior police officer

and the accounting firm confirmed. Hong Kong:

The Hong Kong police have launched a fraud investigation into Ernst & Young’s

practice in the city following allegations the big four accounting firm

falsified and doctored papers it used to defend itself in a civil trial relating

to its audit of collapsed former client Akai Holdings. An Ernst & Young Hong

Kong partner, Edmund Dang, was arrested at his home yesterday on suspicion of

forgery by officers from the commercial crime bureau (CCB (SEHK: 0939)). He was

later released on bail without being charged. The CCB also raided Ernst &

Young’s premises in Central and Quarry Bay yesterday, a senior police officer

and the accounting firm confirmed.

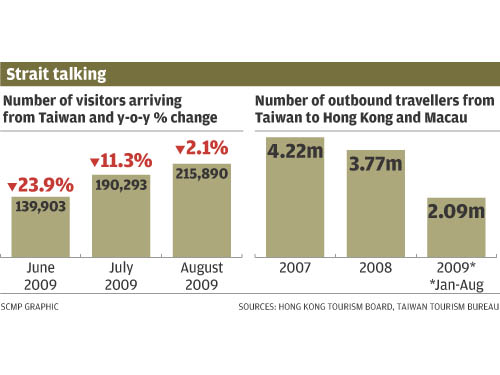

Hong Kong retail sales in August dipped by just 0.2 per cent in value from a

year earlier – bringing them virtually back to levels seen before the global

financial crisis worsened sharply last September. Economists said the latest

figures were a further indication that the economic outlook was getting better.

Retail sales have declined for seven straight months. In August, sales fell one

per cent by volume, government data showed on Tuesday. The government also said

on Tuesday that visitor arrivals in August rose 5.8 per cent from a year earlier

– after declining in the three preceding months. Tourists account for 20-30 per

cent of retail sales. The territory received about 2,834,178 in visitors in

August, Hong Kong Tourism Board (HKTB) figures showed on Tuesday.

Financial Secretary John Tsang Chun-wah

was relaxing after heart surgery, Chief Secretary Henry Tang Ying-yen said on

Tuesday. Financial Secretary John Tsang Chun-wah

was relaxing after heart surgery, Chief Secretary Henry Tang Ying-yen said on

Tuesday.

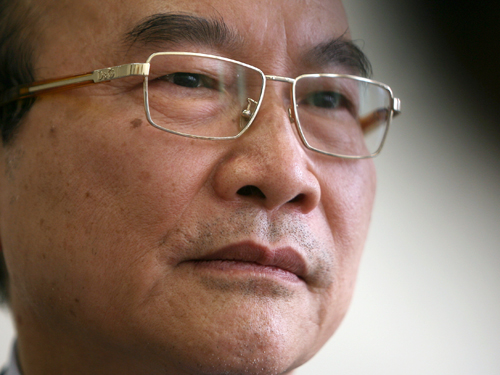

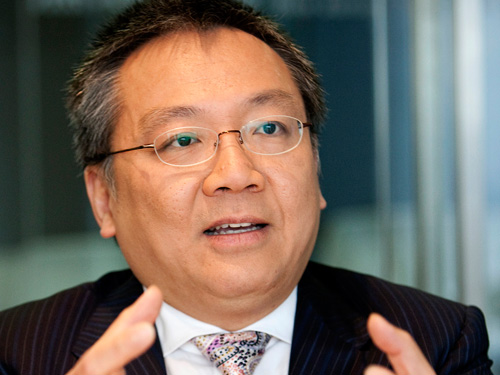

Now 82, Lu Ping looks on Hong Kong as his son and fears for its future. Stand on

your own feet and start thinking, Lu Ping tells HK - Hong Kong should stop

relying on favors from Beijing and improve its competitiveness, says Lu Ping -

the official who was in charge of the city's affairs in the central government

in the run-up to the handover. Twelve years after retiring, he still worries

about the future of the city he thinks of as his son. He says it is being

marginalized by the rapid development of the mainland and risks falling behind

Shanghai, Guangzhou and Shenzhen. "While the central government has been

offering policy favors for Hong Kong, you can't ask Shanghai and other cities

not to develop as a means to maintain Hong Kong's edge. Hong Kong people should

have a sense of crisis and strive to enhance the city's competitiveness through

their own efforts. You can't always count on the support and favors from the

central government to prop up Hong Kong's economy," he said. Lu is also critical

of local officials - saying that many are incapable of independent thought,

having been trained during the colonial era merely to implement policies

dictated by their British superiors. "To be honest, Hong Kong has already been

marginalized," Lu, a former director of the State Council's Hong Kong and Macau

Affairs Office, said in a wide-ranging interview. "Shanghai is developing itself

as a financial centre and is posing a big challenge to Hong Kong, even though

[mainland officials] are saying that China would be able to accommodate two

financial centers." The central government has endorsed Shanghai's goal of

becoming an international financial centre by 2020, and Shanghai is developing

Yangshan, a deep-water port 70 kilometers from the city in Zhoushan , Zhejiang

province. Lu said Yangshan would be a major rival to Hong Kong's port operations

when its third phase was completed next year, since its handling charges were

much lower than Hong Kong's. Guangzhou's Baiyun International Airport was also

expanding rapidly and becoming a major competitor to Hong Kong's airport, he

said. Lu, now 82, said neither the Closer Economic Partnership Arrangement

launched in 2003, nor the scheme allowing mainlanders to visit Hong Kong on

their own rather than in tour groups, which began the same year, could resolve

the city's fundamental economic problems. "There is an urgent need for Hong Kong

to speed up economic restructuring. The lesson of the global financial crisis is

that Hong Kong should not only rely on real estate and financial services," Lu

said. Reflecting on the Sino-British Joint Declaration signed 25 years ago, Lu

said the concept of "Hong Kong people ruling Hong Kong" had proved successful,

although there was room for improvement. He attributes some of the governance

problems since the handover to the inability of colonially trained officials to

think independently. The declaration was signed by the Chinese and British

governments on September 26, 1984. It promised a high degree of autonomy for

Hong Kong after China's resumption of sovereignty. Lu was a member of the

Chinese delegation during the talks on the future of Hong Kong and took part in

drafting Beijing's post-handover policy on Hong Kong. He became director of the

Hong Kong and Macau Affairs Office in 1990 and retired on July 6, 1997. Lu said

many Hong Kong officials were lukewarm about Guangdong's proposals for

cross-border co-operation in the first few years after the handover since they

did not have a long-term perspective of Hong Kong's development (something he

considers it vital the next chief executive have). For example, he said, in the

mid-1990s many senior Hong Kong officials did not believe it was worth investing

in a bridge to Zhuhai and Macau. "Hong Kong has wasted a lot of time and the

cost of building the bridge has skyrocketed since then. It is crucial to change

the mindset of Hong Kong's civil servants so that they won't only care about the

immediate future," Lu said. He hopes there will be progress in electoral

arrangements for 2012 to pave the way for direct election of the chief executive

in 2017 and of the Legislative Council in 2020, in accordance with the National

People's Congress Standing Committee's timetable. He feels it would be very

unfortunate if agreement could not be reached on such changes for the 2012

elections. Pan-democrats are threatening to veto any government proposal for

reforms in 2012 that does not also provide a road map for implementing universal

suffrage thereafter. "I hope various sectors in Hong Kong, including the

pan-democratic camp, take into account the city's overall interests," Lu said.

He said the pan-democrats' call for the chief executive to resign if Legco

vetoes the government's electoral reform plans was impractical. Lu, formerly

deputy secretary general of the Basic Law Drafting Committee, admitted the

drafters played down the importance of party politics in the 1980s. "There is no

party which enjoys a majority in Legco. It's a big problem for the Hong Kong

government to secure stable support from the legislature." Still, he does not

see any of the city's political parties as being capable of becoming a ruling

party. He thinks businesspeople should be more active in politics and devote

more resources to winning the hearts and minds of the public. Lu said that, 12

years after the handover, many Hong Kong people still had negative feelings

about the mainland, as shown by the near-60 per cent support for pan-democrats.

But he is confident their views will change. "There are still some areas in our

country where there is room for improvement. With it developing rapidly, I am

sure Hong Kong people will show more confidence in the country," he said.

Now 82, Lu Ping looks on Hong Kong as his son and fears for its future. Stand on

your own feet and start thinking, Lu Ping tells HK - Hong Kong should stop

relying on favors from Beijing and improve its competitiveness, says Lu Ping -

the official who was in charge of the city's affairs in the central government

in the run-up to the handover. Twelve years after retiring, he still worries

about the future of the city he thinks of as his son. He says it is being

marginalized by the rapid development of the mainland and risks falling behind

Shanghai, Guangzhou and Shenzhen. "While the central government has been

offering policy favors for Hong Kong, you can't ask Shanghai and other cities

not to develop as a means to maintain Hong Kong's edge. Hong Kong people should

have a sense of crisis and strive to enhance the city's competitiveness through

their own efforts. You can't always count on the support and favors from the

central government to prop up Hong Kong's economy," he said. Lu is also critical

of local officials - saying that many are incapable of independent thought,

having been trained during the colonial era merely to implement policies

dictated by their British superiors. "To be honest, Hong Kong has already been

marginalized," Lu, a former director of the State Council's Hong Kong and Macau

Affairs Office, said in a wide-ranging interview. "Shanghai is developing itself

as a financial centre and is posing a big challenge to Hong Kong, even though

[mainland officials] are saying that China would be able to accommodate two

financial centers." The central government has endorsed Shanghai's goal of

becoming an international financial centre by 2020, and Shanghai is developing

Yangshan, a deep-water port 70 kilometers from the city in Zhoushan , Zhejiang

province. Lu said Yangshan would be a major rival to Hong Kong's port operations

when its third phase was completed next year, since its handling charges were

much lower than Hong Kong's. Guangzhou's Baiyun International Airport was also

expanding rapidly and becoming a major competitor to Hong Kong's airport, he

said. Lu, now 82, said neither the Closer Economic Partnership Arrangement

launched in 2003, nor the scheme allowing mainlanders to visit Hong Kong on

their own rather than in tour groups, which began the same year, could resolve

the city's fundamental economic problems. "There is an urgent need for Hong Kong

to speed up economic restructuring. The lesson of the global financial crisis is

that Hong Kong should not only rely on real estate and financial services," Lu

said. Reflecting on the Sino-British Joint Declaration signed 25 years ago, Lu

said the concept of "Hong Kong people ruling Hong Kong" had proved successful,

although there was room for improvement. He attributes some of the governance

problems since the handover to the inability of colonially trained officials to

think independently. The declaration was signed by the Chinese and British

governments on September 26, 1984. It promised a high degree of autonomy for

Hong Kong after China's resumption of sovereignty. Lu was a member of the

Chinese delegation during the talks on the future of Hong Kong and took part in

drafting Beijing's post-handover policy on Hong Kong. He became director of the

Hong Kong and Macau Affairs Office in 1990 and retired on July 6, 1997. Lu said

many Hong Kong officials were lukewarm about Guangdong's proposals for

cross-border co-operation in the first few years after the handover since they

did not have a long-term perspective of Hong Kong's development (something he

considers it vital the next chief executive have). For example, he said, in the

mid-1990s many senior Hong Kong officials did not believe it was worth investing

in a bridge to Zhuhai and Macau. "Hong Kong has wasted a lot of time and the

cost of building the bridge has skyrocketed since then. It is crucial to change

the mindset of Hong Kong's civil servants so that they won't only care about the

immediate future," Lu said. He hopes there will be progress in electoral

arrangements for 2012 to pave the way for direct election of the chief executive

in 2017 and of the Legislative Council in 2020, in accordance with the National

People's Congress Standing Committee's timetable. He feels it would be very

unfortunate if agreement could not be reached on such changes for the 2012

elections. Pan-democrats are threatening to veto any government proposal for

reforms in 2012 that does not also provide a road map for implementing universal

suffrage thereafter. "I hope various sectors in Hong Kong, including the

pan-democratic camp, take into account the city's overall interests," Lu said.

He said the pan-democrats' call for the chief executive to resign if Legco

vetoes the government's electoral reform plans was impractical. Lu, formerly

deputy secretary general of the Basic Law Drafting Committee, admitted the

drafters played down the importance of party politics in the 1980s. "There is no

party which enjoys a majority in Legco. It's a big problem for the Hong Kong

government to secure stable support from the legislature." Still, he does not

see any of the city's political parties as being capable of becoming a ruling

party. He thinks businesspeople should be more active in politics and devote

more resources to winning the hearts and minds of the public. Lu said that, 12

years after the handover, many Hong Kong people still had negative feelings

about the mainland, as shown by the near-60 per cent support for pan-democrats.

But he is confident their views will change. "There are still some areas in our

country where there is room for improvement. With it developing rapidly, I am

sure Hong Kong people will show more confidence in the country," he said.

Canadian International School students yesterday mourned principal Alan Dick,

who came down with swine flu and died on Sunday. Doctors diagnosed Dick with

severe pneumonia. His condition deteriorated rapidly and he died in the

afternoon, a spokesman for the Centre for Health Protection said. He tested

positive for swine flu yesterday. Dick was one of two people with the disease to

die on Sunday, taking the city's death toll to 23. The other was an 86-year-old

man with swine flu and other illnesses who died in North District Hospital.

Dick, 55, principal of the Lower School of the Canadian International School of

Hong Kong in Aberdeen, had been on sick leave the week before being admitted to

the Hong Kong Sanatorium and Hospital on Sunday with fever and respiratory

symptoms, the spokesman said.

Canadian International School students yesterday mourned principal Alan Dick,

who came down with swine flu and died on Sunday. Doctors diagnosed Dick with

severe pneumonia. His condition deteriorated rapidly and he died in the

afternoon, a spokesman for the Centre for Health Protection said. He tested

positive for swine flu yesterday. Dick was one of two people with the disease to

die on Sunday, taking the city's death toll to 23. The other was an 86-year-old

man with swine flu and other illnesses who died in North District Hospital.

Dick, 55, principal of the Lower School of the Canadian International School of

Hong Kong in Aberdeen, had been on sick leave the week before being admitted to

the Hong Kong Sanatorium and Hospital on Sunday with fever and respiratory

symptoms, the spokesman said.

Acting Chief Executive Henry Tang

Ying-yen (left) and Vice-Minister of Finance Li Yong celebrate the launching of

the bonds in Hong Kong. The Ministry of Finance yesterday started selling 6

billion yuan (HK$6.81 billion) worth of sovereign bonds in Hong Kong, in a move

expected to internationalize the yuan and enhance the city's international

financial centre status. Acting Chief Executive Henry Tang Ying-yen also

described the yuan bond issue as "the best retirement gift" to Joseph Yam Chi-kwong,

the outgoing chief of the Hong Kong Monetary Authority. Tang said at the launch

ceremony that the yuan would become a major regional and global currency and

that he was confident Hong Kong could act as a testing ground for its gradual

and steady internationalisation. He expected the sovereign bonds would build a

foundation for more yuan-denominated products in the city in future. Tang also

said Yam, who will retire tomorrow, had worked hard to build up the use of the

yuan in Hong Kong. "The fruit it yields today is the best retirement gift to

him," Tang said. Hong Kong's yuan business started in 2004, and yuan deposits

stood at 55.89 billion yuan at the end of July. Mainland lenders have been

allowed to issue yuan bonds in the city since 2007, with 10 yuan bond issues

totalling about 32 billion yuan issued in Hong Kong so far. The ministry's first

sovereign bond sale outside the mainland to retail and institutional investors

has three tranches. Coupon rates for the two and three-year tranches are 2.25

per cent and 2.7 per cent, respectively, while the five-year tranche - only sold

to institutional investors - has a coupon rate of 3.3 per cent. Acting Chief Executive Henry Tang

Ying-yen (left) and Vice-Minister of Finance Li Yong celebrate the launching of

the bonds in Hong Kong. The Ministry of Finance yesterday started selling 6

billion yuan (HK$6.81 billion) worth of sovereign bonds in Hong Kong, in a move

expected to internationalize the yuan and enhance the city's international

financial centre status. Acting Chief Executive Henry Tang Ying-yen also

described the yuan bond issue as "the best retirement gift" to Joseph Yam Chi-kwong,

the outgoing chief of the Hong Kong Monetary Authority. Tang said at the launch

ceremony that the yuan would become a major regional and global currency and

that he was confident Hong Kong could act as a testing ground for its gradual

and steady internationalisation. He expected the sovereign bonds would build a

foundation for more yuan-denominated products in the city in future. Tang also

said Yam, who will retire tomorrow, had worked hard to build up the use of the

yuan in Hong Kong. "The fruit it yields today is the best retirement gift to

him," Tang said. Hong Kong's yuan business started in 2004, and yuan deposits

stood at 55.89 billion yuan at the end of July. Mainland lenders have been

allowed to issue yuan bonds in the city since 2007, with 10 yuan bond issues

totalling about 32 billion yuan issued in Hong Kong so far. The ministry's first

sovereign bond sale outside the mainland to retail and institutional investors

has three tranches. Coupon rates for the two and three-year tranches are 2.25

per cent and 2.7 per cent, respectively, while the five-year tranche - only sold

to institutional investors - has a coupon rate of 3.3 per cent.

The German chemical giant BASF said

on Tuesday that it would invest two billion euros (HK$22.67 billion) by 2013 in

the Asia Pacific region to double its sales there by 2020.

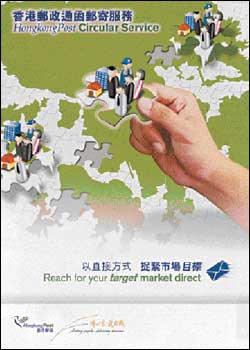

The Ombudsman has faulted Hongkong Post

for stuffing letter boxes with unsolicited mail. Its circular service was

described as an abuse of the postal service which brought unwanted nuisance and

annoyance to the public. An investigation led by Ombudsman Alan Lai Nin

concluded the service which distributes promotional mail for clients without

address labels encourages paper consumption, according to Sing Tao Daily, sister

paper of The Standard. The service was introduced in 1992, with Hongkong Post

reaping a HK$111 million profit in fiscal 2007. The Ombudsman initiated an

investigation after receiving a complaint from a civil servant in 2007 who was

unhappy about receiving unaddressed, unsolicited mail almost every day. It

always ends up in the garbage, according to the civil servant. The investigation

was wrapped up on September 10 and found the complaint to be substantiated. "A

citizen's request not to receive unsolicited mail should be respected by the

government," the report said. The Ombudsman said the practice is biased towards

providing senders a convenient and economical means to disseminate information

without giving due consideration for citizens' choice. The report considered the

Mandatory Opt Out Scheme introduced by Hongkong Post in 2007 to be unrealistic

as it places an unreasonable burden on recipients to instruct each and every

sender to stop sending circular mail to them. The Ombudsman has faulted Hongkong Post

for stuffing letter boxes with unsolicited mail. Its circular service was

described as an abuse of the postal service which brought unwanted nuisance and

annoyance to the public. An investigation led by Ombudsman Alan Lai Nin

concluded the service which distributes promotional mail for clients without

address labels encourages paper consumption, according to Sing Tao Daily, sister

paper of The Standard. The service was introduced in 1992, with Hongkong Post

reaping a HK$111 million profit in fiscal 2007. The Ombudsman initiated an

investigation after receiving a complaint from a civil servant in 2007 who was

unhappy about receiving unaddressed, unsolicited mail almost every day. It

always ends up in the garbage, according to the civil servant. The investigation

was wrapped up on September 10 and found the complaint to be substantiated. "A

citizen's request not to receive unsolicited mail should be respected by the

government," the report said. The Ombudsman said the practice is biased towards

providing senders a convenient and economical means to disseminate information

without giving due consideration for citizens' choice. The report considered the

Mandatory Opt Out Scheme introduced by Hongkong Post in 2007 to be unrealistic

as it places an unreasonable burden on recipients to instruct each and every

sender to stop sending circular mail to them.

China: Many

tourist spots, hotels, restaurants and shops in downtown Beijing closed on

Tuesday amid tightened security as the capital prepared for Thursday’s massive

parade marking the 60th anniversary of the People’s Republic of China. A keynote

address from President Hu Jintao is expected, followed by an elabourate military

parade and performances involving 200,000 people, 60 floats and fireworks.

Authorities plan to ground flights into and out of Beijing for three hours

during the parade, according to state media. The restrictions are similar to the

ones put in place for last year’s Beijing Olympics. The Forbidden City and the

Great Hall of the People were shut on Tuesday along with many businesses on

Chang An Avenue, the city’s major east-west boulevard, including the Raffles and

Beijing hotels, supermarkets, Starbucks coffee shops, noodle stalls and tourist

boutiques. Armed pairs of riot police stood guard beside armoured vehicles at

many of the avenue’s intersections, while subway riders and their bags were

scanned with metal detectors. The authorities have even banned the sale of

knives at some stores, including large retailers such as Wal-Mart and Carrefour.

Tiananmen Square itself and a few other tourist spots, including the Silk Street

Shopping Mall, were due to close Wednesday. A row of shops that usually sell

watches, silk pyjamas and other souvenirs a few blocks east of Tiananmen Square

had its doors taped over with a Beijing police seal, and notices posted nearby

said most would re-open on Friday.

China: Many

tourist spots, hotels, restaurants and shops in downtown Beijing closed on

Tuesday amid tightened security as the capital prepared for Thursday’s massive

parade marking the 60th anniversary of the People’s Republic of China. A keynote

address from President Hu Jintao is expected, followed by an elabourate military

parade and performances involving 200,000 people, 60 floats and fireworks.

Authorities plan to ground flights into and out of Beijing for three hours

during the parade, according to state media. The restrictions are similar to the

ones put in place for last year’s Beijing Olympics. The Forbidden City and the

Great Hall of the People were shut on Tuesday along with many businesses on

Chang An Avenue, the city’s major east-west boulevard, including the Raffles and

Beijing hotels, supermarkets, Starbucks coffee shops, noodle stalls and tourist

boutiques. Armed pairs of riot police stood guard beside armoured vehicles at

many of the avenue’s intersections, while subway riders and their bags were

scanned with metal detectors. The authorities have even banned the sale of

knives at some stores, including large retailers such as Wal-Mart and Carrefour.

Tiananmen Square itself and a few other tourist spots, including the Silk Street

Shopping Mall, were due to close Wednesday. A row of shops that usually sell

watches, silk pyjamas and other souvenirs a few blocks east of Tiananmen Square

had its doors taped over with a Beijing police seal, and notices posted nearby

said most would re-open on Friday.

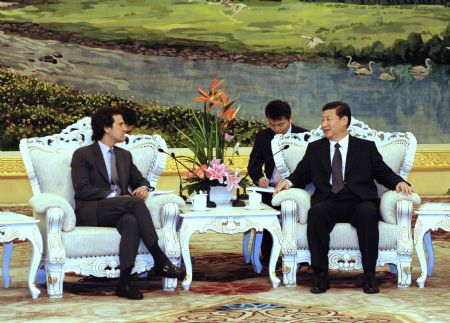

Senior Chinese officials Hu

Jintao, Wu Bangguo, Wen Jiabao, Jia Qinglin, Li Changchun, Xi Jinping, Li

Keqiang, He Guoqiang and Zhou Yongkang meet with role models who had made major

contributions to ethnic harmony prior to a ceremony in Beijing, capital of

China, Sept. 29, 2009. At the ceremony, 739 organizations and 749 individuals

received awards from the State Council (the Cabinet). Senior Chinese officials Hu

Jintao, Wu Bangguo, Wen Jiabao, Jia Qinglin, Li Changchun, Xi Jinping, Li

Keqiang, He Guoqiang and Zhou Yongkang meet with role models who had made major

contributions to ethnic harmony prior to a ceremony in Beijing, capital of

China, Sept. 29, 2009. At the ceremony, 739 organizations and 749 individuals

received awards from the State Council (the Cabinet).

Chinese space scientists have completed

a high-resolution, three-dimensional map of the entire surface of the moon, an

expert involved in the project said. The map marks an important step toward a

future lunar landing, Liu Xianlin of the Chinese Academy of Surveying and

Mapping, who headed the project review panel, added. After putting its first man

into space in 2003 - only the third nation to do so - China aims to launch an

unmanned rover on the moon's surface by 2012 and a manned mission there by

around 2020. The map was made using image data obtained by a camera on Chang'e

1, China's first lunar probe, Liu said. Chen Yongqi, a professor in the

department of land surveying and geo-informatics at Hong Kong Polytechnic

University, said the map would help China understand the structure of the moon.

"Another objective is to understand the soil of the lunar surface and mineral

distribution," Chen said. Liu called the achievement an important step along the

path toward a future lunar landing. "This map finishes the primary prospecting

of the moon and lays the foundation for further surveys such as choosing the

landing point or the path of a satellite." The map was the world's

highest-resolution lunar chart, Liu added. Japan launched a lunar probe in 2007,

but either had not completed its own map or had not yet publicized it, he said.

The United States had sent a probe in the 1990s but the accuracy of their map

was not as good, Liu claimed China plans to launch a second lunar probe in

October 2010. That is expected to generate a map of an even higher resolution,

according to Liu. The Chang'e I was launched on October 24, 2007. Chinese space scientists have completed

a high-resolution, three-dimensional map of the entire surface of the moon, an

expert involved in the project said. The map marks an important step toward a

future lunar landing, Liu Xianlin of the Chinese Academy of Surveying and

Mapping, who headed the project review panel, added. After putting its first man

into space in 2003 - only the third nation to do so - China aims to launch an

unmanned rover on the moon's surface by 2012 and a manned mission there by

around 2020. The map was made using image data obtained by a camera on Chang'e

1, China's first lunar probe, Liu said. Chen Yongqi, a professor in the

department of land surveying and geo-informatics at Hong Kong Polytechnic

University, said the map would help China understand the structure of the moon.

"Another objective is to understand the soil of the lunar surface and mineral

distribution," Chen said. Liu called the achievement an important step along the

path toward a future lunar landing. "This map finishes the primary prospecting

of the moon and lays the foundation for further surveys such as choosing the

landing point or the path of a satellite." The map was the world's

highest-resolution lunar chart, Liu added. Japan launched a lunar probe in 2007,

but either had not completed its own map or had not yet publicized it, he said.

The United States had sent a probe in the 1990s but the accuracy of their map

was not as good, Liu claimed China plans to launch a second lunar probe in

October 2010. That is expected to generate a map of an even higher resolution,

according to Liu. The Chang'e I was launched on October 24, 2007.

New York’s iconic Empire State

Building will light up red and yellow on Wednesday in honour of the 60th

anniversary of the People’s Republic of China. Peng Keyu, Beijing’s consul, and

other officials will take part in the lighting ceremony that will bathe the

skyscraper in the colours of the People’s Republic until Thursday, Empire State

Building representatives said in a statement. The upper sections of the building

are regularly illuminated to mark special occasions, ranging from all blue to

mark Frank Sinatra’s death in 1998, to green for the annual Saint Patrick’s Day.

On September 4, 1997 the 102-storey building turned red, white and blue to

commemorate Princess Diana.

China's Anhui Jianghuai Automobile

said on Tuesday it plans to set up a 2 billion yuan (HK$2.27 billion) joint

venture with the truck unit of US construction equipment giant Caterpillar.

Jianghuai Automotive will also develop new products with NC2 Global, a tie-up

between Caterpillar and US truck maker Navistar International Corp, the mainland

firm said in a statement. Jianghuai Automobile and NC2 agreed each will own half

of the joint venture, which will produce heavy-duty trucks and accessories in

mainland, the statement said.

Taiwan will allow contract

chipmakers and flat-panel companies to acquire rivals in mainland, an economic

ministry official said on Tuesday, sending semiconductor stocks higher. The

official confirmed an Economic Daily report quoting Economics Minister Shih Yen-shiang

as saying panelmakers and chip companies using advanced 0.13 micron process

technology would be able to directly invest in mainland and buy stakes in

mainland rivals. “This is the direction we’re taking, but we don’t have a

timetable yet,” Huang Hsien-lin, a section chief, said. Timing is the most

crucial thing. We need to maintain Taiwan’s leadership in the technologies.” At

about 20 minutes into trade, the semiconductor sub-index was up 2.45 per cent,

with TSMC and UMC, the world’s top two contract chipmakers, up more than 3 per

cent. AU Optronics, the world’s No 3 LCD maker after South Korea rivals, climbed

2.4 per cent. All the shares outperformed the main Taiex index’s 1.3 per cent

gain. Taiwan firms, including AU Optronics, TSMC and UMC, have urged the

government to allow them to invest in mainland or use more advanced technologies

to help cut costs and compete with global rivals.

Sept 29, 2009

Hong Kong:

Financial Secretary John Tsang Chun-wah is in stable condition and recovering

well on Monday after undergoing heart surgery on Sunday night. Hong Kong:

Financial Secretary John Tsang Chun-wah is in stable condition and recovering

well on Monday after undergoing heart surgery on Sunday night.

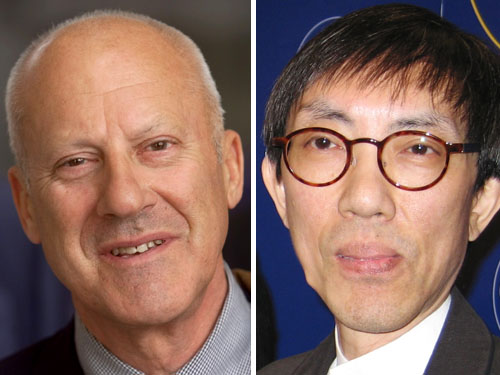

Hongkong and Shanghai Banking

Corporation chairman Vincent Cheng Hoi- chuen will be promoted to chairman of

sister lender Hang Seng Bank (0011), as part of an HSBC (0005) management

reshuffle, when he steps down from his current post, according to market

sources. Cheng - whose expertise is the China region - is set to replace Raymond

Chien Kuo-fung, in a move that is in line with HSBC's plan to tap in on the

growing importance of Asia and emerging markets. Cheng, 61, was vice chairman

and chief executive of Hang Seng Bank from 1998 before he rejoined HSBC as the

first Chinese executive director in 2005. Analysts said the appointment "makes

sense" and believe Cheng can handle business at both banks at the strategic

level. "Margaret Leung Ko May-yee, who was appointed as vice chairman this year,

will still be the hands-on person and taking most of the responsibilities at

[Hang Seng]," a Hong Kong-based banking analyst said. On Friday, HSBC said the

office of its chief executive will be relocated back to Hong Kong in February.

It also announced a high-level reshuffle that will take place in the same month.

Group chief executive Michael Geoghegan will replace Cheng as HSBC Asia Pacific

chairman, while Cheng will continue as chairman of HSBC China and HSBC Taiwan.

Peter Wong Tung-shun will be promoted to chief executive of HSBC Asia Pacific.

Wong said in a media briefing over the weekend that Greater China will be a

fast-growing region, and will be one of his priorities after he assumes his new

duties. A few months ago HSBC set up a special committee, chaired by Wong and

including chief executives of the bank's operations in the mainland, Hong Kong

and Taiwan, to monitor and study upcoming business opportunities. The UK-based

lender is also considering setting up a regional office in Guangdong, according

to Wong. "The growth momentum of the region will only pick up when Taiwan and

the mainland sign the Economic Cooperation Framework Agreement by the end of

this year," said Wong, adding Taiwan has so far invested up to US$150 billion

(HK$1.17 trillion) in the mainland. Although trade with Taiwan accounts for only

7 percent of Hong Kong's overall trade, capital-raising activities through the

city have been increasing. Wong said the flow of Taiwanese funds through the SAR

and into the mainland made up between 20 and 25 percent of Hong Kong's total

fund flow. "When the ties between Taiwan, Hong Kong and Guangdong become closer,

economic integration between Taiwan and the mainland will gradually take

shape,"Wong said. The lender plans to add up to 600 new staff in the mainland to

cater for the growth.HSBC will today announce another set of executive changes,

according to Geoghegan. This will be the second round of appointments after

Friday's when, among others, Sandy Flockhart was appointed chairman of personal

and commercial banking, based in Hong Kong. Hongkong and Shanghai Banking

Corporation chairman Vincent Cheng Hoi- chuen will be promoted to chairman of

sister lender Hang Seng Bank (0011), as part of an HSBC (0005) management

reshuffle, when he steps down from his current post, according to market

sources. Cheng - whose expertise is the China region - is set to replace Raymond

Chien Kuo-fung, in a move that is in line with HSBC's plan to tap in on the

growing importance of Asia and emerging markets. Cheng, 61, was vice chairman

and chief executive of Hang Seng Bank from 1998 before he rejoined HSBC as the

first Chinese executive director in 2005. Analysts said the appointment "makes

sense" and believe Cheng can handle business at both banks at the strategic

level. "Margaret Leung Ko May-yee, who was appointed as vice chairman this year,

will still be the hands-on person and taking most of the responsibilities at

[Hang Seng]," a Hong Kong-based banking analyst said. On Friday, HSBC said the

office of its chief executive will be relocated back to Hong Kong in February.

It also announced a high-level reshuffle that will take place in the same month.

Group chief executive Michael Geoghegan will replace Cheng as HSBC Asia Pacific

chairman, while Cheng will continue as chairman of HSBC China and HSBC Taiwan.

Peter Wong Tung-shun will be promoted to chief executive of HSBC Asia Pacific.

Wong said in a media briefing over the weekend that Greater China will be a

fast-growing region, and will be one of his priorities after he assumes his new

duties. A few months ago HSBC set up a special committee, chaired by Wong and

including chief executives of the bank's operations in the mainland, Hong Kong

and Taiwan, to monitor and study upcoming business opportunities. The UK-based

lender is also considering setting up a regional office in Guangdong, according

to Wong. "The growth momentum of the region will only pick up when Taiwan and

the mainland sign the Economic Cooperation Framework Agreement by the end of

this year," said Wong, adding Taiwan has so far invested up to US$150 billion

(HK$1.17 trillion) in the mainland. Although trade with Taiwan accounts for only

7 percent of Hong Kong's overall trade, capital-raising activities through the

city have been increasing. Wong said the flow of Taiwanese funds through the SAR

and into the mainland made up between 20 and 25 percent of Hong Kong's total

fund flow. "When the ties between Taiwan, Hong Kong and Guangdong become closer,

economic integration between Taiwan and the mainland will gradually take

shape,"Wong said. The lender plans to add up to 600 new staff in the mainland to

cater for the growth.HSBC will today announce another set of executive changes,

according to Geoghegan. This will be the second round of appointments after

Friday's when, among others, Sandy Flockhart was appointed chairman of personal

and commercial banking, based in Hong Kong.

Henry Tang, left, acting chief

executive of Hong Kong, and Li Yong, vice-minister of the central Ministry of

Finance, attend the launch ceremony of yuan sovereign bonds in Hong Kong on

Monday. Mainland on Monday launched the sale of 6 billion yuan (HK$6.82 billion)

in government bonds in Hong Kong, the finance ministry said, marking the first

such offer outside the mainland. Hong Kong’s chief secretary for administration

Henry Tang Ying-yen said the bond sale would help boost the international use of

the yuan in a “stable and orderly manner”, the finance ministry said in a

statement on its website. Individual and institutional investors can subscribe

for two-year and three-year bonds, which carry coupon rates of 2.25 percent and

2.7 percent respectively, the statement said. Only institutional investors will

be allowed to subscribe for five-year bonds, which carry a coupon rate of 3.3

per cent. Henry Tang, left, acting chief

executive of Hong Kong, and Li Yong, vice-minister of the central Ministry of

Finance, attend the launch ceremony of yuan sovereign bonds in Hong Kong on

Monday. Mainland on Monday launched the sale of 6 billion yuan (HK$6.82 billion)

in government bonds in Hong Kong, the finance ministry said, marking the first

such offer outside the mainland. Hong Kong’s chief secretary for administration

Henry Tang Ying-yen said the bond sale would help boost the international use of

the yuan in a “stable and orderly manner”, the finance ministry said in a

statement on its website. Individual and institutional investors can subscribe

for two-year and three-year bonds, which carry coupon rates of 2.25 percent and

2.7 percent respectively, the statement said. Only institutional investors will

be allowed to subscribe for five-year bonds, which carry a coupon rate of 3.3

per cent.

Hong Kong was in a festive mood yesterday as a host of parades and activities

brought tens of thousands of fun-seekers to Hong Kong Island to celebrate the

60th anniversary of the People's Republic. Festooned with national flags and

colourful banners, busy streets in Wan Chai, Causeway Bay and Western District

were closed for traffic at different times to accommodate events throughout the

day. Activities kicked off with an early morning four-kilometre charity walk.

Dubbed by some "a mini-long march", 14,000 people from 110 groups walked from

Victoria Park in Causeway Bay along the Island Eastern Corridor to Quarry Bay

Park. About HK$10 million was raised for the Community Chest. Later Golden

Bauhinia Square on the Wan Chai waterfront was transformed into a carnival

venue, drawing hundreds of visitors to watch a sea, land and sky parade. The

half-hour event included a procession of vessels - among them a fire boat, a

Chinese junk, a ferry and yachts - while four helicopters from the Government

Flying Service and Heliservices carried out a fly-past. In Western District, a

dragon made of crystals stole the show in a massive dragon and lion dance. But

the highlight was a large parade in the afternoon, which saw 2,500 participants

from 32 local and mainland groups parading from Victoria Park to Southorn

Playground in Wan Chai. Executive Councillor Cheng Yiu-tong, who officiated at

the opening of the parade, said he was moved to see so many people at the

National Day celebrations. "Sixty years is a short period of time from the

perspective of history. But in the past 60 years, we have witnessed tremendous

developments in our home country." Because of the celebrations, many streets

were closed to traffic and more than 70 bus and 15 minibus timetables were

changed and routes diverted. The traffic did not resume as normal until the

evening. A woman who took her two-year-old daughter to Victoria Park said: "I

think it is a good to see people get together and enjoy themselves." But

university student Jack Cheung went shopping instead. "I don't really feel

strongly about the celebrations. Perhaps some Hong Kong people, like me, are

starting to get fed up with marches and parades. We already have a big march on

July 1 every year," he said.

Hong Kong was in a festive mood yesterday as a host of parades and activities

brought tens of thousands of fun-seekers to Hong Kong Island to celebrate the

60th anniversary of the People's Republic. Festooned with national flags and

colourful banners, busy streets in Wan Chai, Causeway Bay and Western District

were closed for traffic at different times to accommodate events throughout the

day. Activities kicked off with an early morning four-kilometre charity walk.

Dubbed by some "a mini-long march", 14,000 people from 110 groups walked from

Victoria Park in Causeway Bay along the Island Eastern Corridor to Quarry Bay

Park. About HK$10 million was raised for the Community Chest. Later Golden

Bauhinia Square on the Wan Chai waterfront was transformed into a carnival

venue, drawing hundreds of visitors to watch a sea, land and sky parade. The

half-hour event included a procession of vessels - among them a fire boat, a

Chinese junk, a ferry and yachts - while four helicopters from the Government

Flying Service and Heliservices carried out a fly-past. In Western District, a

dragon made of crystals stole the show in a massive dragon and lion dance. But

the highlight was a large parade in the afternoon, which saw 2,500 participants

from 32 local and mainland groups parading from Victoria Park to Southorn

Playground in Wan Chai. Executive Councillor Cheng Yiu-tong, who officiated at

the opening of the parade, said he was moved to see so many people at the

National Day celebrations. "Sixty years is a short period of time from the

perspective of history. But in the past 60 years, we have witnessed tremendous

developments in our home country." Because of the celebrations, many streets

were closed to traffic and more than 70 bus and 15 minibus timetables were

changed and routes diverted. The traffic did not resume as normal until the

evening. A woman who took her two-year-old daughter to Victoria Park said: "I

think it is a good to see people get together and enjoy themselves." But

university student Jack Cheung went shopping instead. "I don't really feel

strongly about the celebrations. Perhaps some Hong Kong people, like me, are

starting to get fed up with marches and parades. We already have a big march on

July 1 every year," he said.

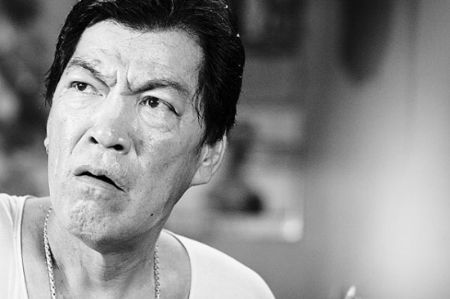

Tai Tung Bakery owner Tse Ching-yuen. Tai Tung Bakery, founded during one of the

darkest periods of Hong Kong's history, is still battling the odds. No one

expected the family-owned Yuen Long business, which was started during the

Japanese occupation of the city in 1943 - a time when money was so useless that

it was used to wrap the bakery's sweets - to survive. But the much-loved company

is thriving more than 60 years later, despite the best efforts of food

conglomerates to dominate the market. Small, family-run food factories such as

Tai Tung are becoming rarer in Hong Kong as rising rents, competition and labour

costs force many to close their doors. Most have gone across the border, but

some survive in the city. Across town at Kwun Tong, the Fong brothers - fellow

small-business survivors - produce batches of candies in a hot kitchen just as

their father did 50 years ago. Tai Tung and Smith's Confectionery have survived

because of customer loyalty and the fact they own their own factories. They also

produce the best products, judging by the long queue at Tai Tung last week to

buy mooncakes for the Mid-Autumn Festival. Tai Tung Bakery chose not to follow

most of its competitors by moving production across the border to cut costs. Its

commitment to "Made in Hong Kong" means it churns out mooncakes, Chinese wedding

cakes, preserved sausages - or lap cheong - and bread from a 4,000 sq ft kitchen

on the Tuen Mun industrial estate. Neither can it count on celebrities such as

Kelly Chen Wai-lam, who promotes mooncakes for the city's largest food and

catering firm, Maxim's Catering, or Eric Tsang Chi-wai for Kee Wah Bakery. "We

won't and can't compete with the deep-pocket chain stores, especially splurging

on advertising," said Tse Ching-yuen, the owner of the business his late father

set up in 1943. "Running a family business is tough, but we survive by trading

our profit margins for better quality and reputation." Tse was 13 when the store

opened and remembers not having enough candies for its young customers. The

Japanese Occupation Currency depreciated so rapidly that profits were eroded.

Wild inflation exacerbated the situation, with "a catty [600 grams] of sugar

costing 1 Japanese yen one day but going up to 1.5 yen in three days", he said.

Three years later, when peace was restored, the Japanese currency eventually

became candy wrappers, Tse recalled. "Paper supplies remained so tight that we

couldn't find any paper and had to use the currency notes as paper bags." Tai

Tung is among the few traditional Chinese bakery factories still surviving in

the city - the others being Hang Heung Cake Shop, founded in 1920, and Kee Wah

Bakery, in 1938. The global financial crisis has exacerbated the plight of

struggling food manufacturers. Last week, traditional Chinese confectionery

maker Luk Kam Kee King of Melon Seeds closed after half a century in business.

The shop went bust because of unpaid wages and debts. "In any boom or bust time,

brand reputation and quality are the priority," Tse said. "That's why we have no

intention to move across the border and always keep our ovens and workers in

Hong Kong." At the Tuen Mun factory, the 80-year-old chef has been with the

company for the past 50 years, leading about 10 workers and operating the

production line designed in the 1960s. When Tai Tung was founded 66 years ago,

its operating license was issued by Japanese troops and it was written in

Japanese. The bakery could only produce peanuts and ginger candies, as peanuts,

ginger and sugar were the only ingredients available, Tse recalled. In the

1960s, the store branched into Chinese almond cakes, loaves and Chinese wedding

cakes when extra supplies such as green beans, margarine and flour were

available, he said. "Traditional wedding cakes have been the best seller for

decades, particularly with indigenous villagers," he said. However, with greater

availability of raw materials came competition, pushing Tai Tung to produce

higher-value delicacies such as mooncakes. "Egg yolks used to be delicacies and

expensive," Tse said, adding that the company had imported 700,000 egg yolks

from the mainland this year. "Now, they are regarded as cheap stuff." As the

Mid-Autumn Festival looms, Tai Tung is rolling out new flavors of mooncakes,

including preserved oyster, to fend off competition from chilled mooncakes and

ice-cream mooncakes. "We use quality ingredients, say, the best lotus from Hunan

and peanut oil from South Africa," Tse said, pointing out that a barrel of

peanut oil costs HK$7,000 compared with mainland peanut oil priced at HK$1,000

per barrel. "That's why our mooncakes cost 50 per cent more than our rivals."

However, customers seem undaunted by the price. One regular walked into the shop

last week and paid HK$7,700 for 20 boxes of mooncakes. Tse, who has been with

the bakery since day one, is preparing to pass the torch on to the third

generation - his son, Peter Tse Hing-chi. Despite his training as an architect,

Peter Tse will continue the business of the old bakery and expand its

distribution outlets. Keeping a business in the family is one problem facing the

Fong family, which runs the 49-year-old Smith Confectionery in Kwun Tong. Fong

Fu-sing, the youngest of the three brothers working with the company their

father took over in 1960, said eating candies was far easier than producing

them. "Hiring is a problem, as young people do not want to get into this

industry," said Fong, wearing a stained apron and cooking rainbow-coloured,

clay-like glucose on a stove in a kitchen in a temperature of 45 degrees

Celsius. "We still haven't been able to find chef replacements after the old

ones died one after another some years ago." Working from the ninth floor of a

commercial building, Fong and another brother work in the kitchen making moulds

of glucose before throwing them into a machine that produces bright-colored

candies ready for packaging. The other Fung brother delivers the group's

specialities - Smith nougat, hard boiled candies and soft candies - to

traditional confectionery shops such as Chan Yee Jai in Sheung Wan. Some of the

candies are exported as far as away as Fiji. "The more bad news on tainted food

in China, the better our sales," he said of a recent sales rise of at least 20

per cent. "The `Made in Hong Kong' trademark gives customers confidence." That

perhaps explains why Fong has rejected several offers since the 1980s to move

the factory to the lower-cost Pearl River Delta. But he is facing other

challenges. The factories that used to produce machinery for Smith Confectionery

vanished with the city's industrial migration. "We want to make more candies and

other types of candies but can't," said Fong, who was forced to let go an order

from one of the city's two largest supermarket chains. "Completing the order

will take us nine months, but the delivery is in four months, or before the

Chinese New Year." However, Fong was confident about future prospects,

especially as the Fong brothers own the factory, meaning they can avoid

rocketing rents. The Tse family also owns its flagship shop in Yuen Long and the

Tuen Mun factory. Fong said: "The business is certainly unviable if you don't

own the properties."

Tai Tung Bakery owner Tse Ching-yuen. Tai Tung Bakery, founded during one of the

darkest periods of Hong Kong's history, is still battling the odds. No one

expected the family-owned Yuen Long business, which was started during the

Japanese occupation of the city in 1943 - a time when money was so useless that

it was used to wrap the bakery's sweets - to survive. But the much-loved company

is thriving more than 60 years later, despite the best efforts of food

conglomerates to dominate the market. Small, family-run food factories such as

Tai Tung are becoming rarer in Hong Kong as rising rents, competition and labour

costs force many to close their doors. Most have gone across the border, but

some survive in the city. Across town at Kwun Tong, the Fong brothers - fellow

small-business survivors - produce batches of candies in a hot kitchen just as

their father did 50 years ago. Tai Tung and Smith's Confectionery have survived

because of customer loyalty and the fact they own their own factories. They also

produce the best products, judging by the long queue at Tai Tung last week to

buy mooncakes for the Mid-Autumn Festival. Tai Tung Bakery chose not to follow

most of its competitors by moving production across the border to cut costs. Its

commitment to "Made in Hong Kong" means it churns out mooncakes, Chinese wedding

cakes, preserved sausages - or lap cheong - and bread from a 4,000 sq ft kitchen

on the Tuen Mun industrial estate. Neither can it count on celebrities such as

Kelly Chen Wai-lam, who promotes mooncakes for the city's largest food and

catering firm, Maxim's Catering, or Eric Tsang Chi-wai for Kee Wah Bakery. "We

won't and can't compete with the deep-pocket chain stores, especially splurging

on advertising," said Tse Ching-yuen, the owner of the business his late father

set up in 1943. "Running a family business is tough, but we survive by trading

our profit margins for better quality and reputation." Tse was 13 when the store

opened and remembers not having enough candies for its young customers. The

Japanese Occupation Currency depreciated so rapidly that profits were eroded.

Wild inflation exacerbated the situation, with "a catty [600 grams] of sugar

costing 1 Japanese yen one day but going up to 1.5 yen in three days", he said.

Three years later, when peace was restored, the Japanese currency eventually

became candy wrappers, Tse recalled. "Paper supplies remained so tight that we

couldn't find any paper and had to use the currency notes as paper bags." Tai

Tung is among the few traditional Chinese bakery factories still surviving in

the city - the others being Hang Heung Cake Shop, founded in 1920, and Kee Wah

Bakery, in 1938. The global financial crisis has exacerbated the plight of

struggling food manufacturers. Last week, traditional Chinese confectionery

maker Luk Kam Kee King of Melon Seeds closed after half a century in business.

The shop went bust because of unpaid wages and debts. "In any boom or bust time,

brand reputation and quality are the priority," Tse said. "That's why we have no

intention to move across the border and always keep our ovens and workers in

Hong Kong." At the Tuen Mun factory, the 80-year-old chef has been with the

company for the past 50 years, leading about 10 workers and operating the

production line designed in the 1960s. When Tai Tung was founded 66 years ago,

its operating license was issued by Japanese troops and it was written in

Japanese. The bakery could only produce peanuts and ginger candies, as peanuts,

ginger and sugar were the only ingredients available, Tse recalled. In the

1960s, the store branched into Chinese almond cakes, loaves and Chinese wedding

cakes when extra supplies such as green beans, margarine and flour were

available, he said. "Traditional wedding cakes have been the best seller for

decades, particularly with indigenous villagers," he said. However, with greater

availability of raw materials came competition, pushing Tai Tung to produce

higher-value delicacies such as mooncakes. "Egg yolks used to be delicacies and

expensive," Tse said, adding that the company had imported 700,000 egg yolks

from the mainland this year. "Now, they are regarded as cheap stuff." As the

Mid-Autumn Festival looms, Tai Tung is rolling out new flavors of mooncakes,

including preserved oyster, to fend off competition from chilled mooncakes and

ice-cream mooncakes. "We use quality ingredients, say, the best lotus from Hunan

and peanut oil from South Africa," Tse said, pointing out that a barrel of

peanut oil costs HK$7,000 compared with mainland peanut oil priced at HK$1,000

per barrel. "That's why our mooncakes cost 50 per cent more than our rivals."

However, customers seem undaunted by the price. One regular walked into the shop

last week and paid HK$7,700 for 20 boxes of mooncakes. Tse, who has been with

the bakery since day one, is preparing to pass the torch on to the third

generation - his son, Peter Tse Hing-chi. Despite his training as an architect,

Peter Tse will continue the business of the old bakery and expand its

distribution outlets. Keeping a business in the family is one problem facing the

Fong family, which runs the 49-year-old Smith Confectionery in Kwun Tong. Fong

Fu-sing, the youngest of the three brothers working with the company their

father took over in 1960, said eating candies was far easier than producing

them. "Hiring is a problem, as young people do not want to get into this

industry," said Fong, wearing a stained apron and cooking rainbow-coloured,

clay-like glucose on a stove in a kitchen in a temperature of 45 degrees

Celsius. "We still haven't been able to find chef replacements after the old

ones died one after another some years ago." Working from the ninth floor of a

commercial building, Fong and another brother work in the kitchen making moulds

of glucose before throwing them into a machine that produces bright-colored

candies ready for packaging. The other Fung brother delivers the group's

specialities - Smith nougat, hard boiled candies and soft candies - to

traditional confectionery shops such as Chan Yee Jai in Sheung Wan. Some of the

candies are exported as far as away as Fiji. "The more bad news on tainted food

in China, the better our sales," he said of a recent sales rise of at least 20

per cent. "The `Made in Hong Kong' trademark gives customers confidence." That

perhaps explains why Fong has rejected several offers since the 1980s to move

the factory to the lower-cost Pearl River Delta. But he is facing other

challenges. The factories that used to produce machinery for Smith Confectionery

vanished with the city's industrial migration. "We want to make more candies and

other types of candies but can't," said Fong, who was forced to let go an order

from one of the city's two largest supermarket chains. "Completing the order

will take us nine months, but the delivery is in four months, or before the

Chinese New Year." However, Fong was confident about future prospects,

especially as the Fong brothers own the factory, meaning they can avoid

rocketing rents. The Tse family also owns its flagship shop in Yuen Long and the

Tuen Mun factory. Fong said: "The business is certainly unviable if you don't

own the properties."

More mainland developers plan to

tap the Hong Kong market for more than HK$20 billion despite the poor

performance of newly listed companies. Evergrande Real Estate - a

Guangzhou-based home developer seeking to raise HK$11.7 billion - is set to go

through a listing hearing tomorrow. Mingfa Group, which is aiming for HK$8

billion, will also have its hearing tomorrow and Yuzhou Group, which is seeking

up to HK$3.9 billion, may present its case later this week. Meanwhile, the

directors of United Company Rusal - the world's largest aluminum producer - will

decide this week whether to approve an IPO plan to float a 10 percent stake in

Hong Kong, the Sunday Times reported. The Russian aluminum giant is expected to

start bookbuilding in November and list in December. According to the British

newspaper, Rusal is in talks with potential cornerstone investors including

sovereign wealth funds China Investment Corp and Singapore's Temasek. Wilmar

International, the world's largest palm oil processor, plans to raise as much as

HK$31.2 billion from listing 733 million shares of its mainland business. The

firm is chaired by Kuok Khoon-hong - nephew of Robert Kuok Hock-nien, known as

"sugar king of Asia." Greens Group, a maker of waste heat recovery products had

its listing hearing last Thursday. It plans to raise as much as HK$1 billion.

Shenguan Holdings, a mainland sausage casing maker, starts bookbuilding today

and will open its retail book on Wednesday, eyeing up to HK$1.17 billion, market

sources said. The firm plans to invest 240 million yuan (HK$272.38 million) this

year and 469 million yuan in 2010 to expand production capacity. Its first-half

net income surged 66.5 percent to 129 million yuan. Shenguan's clients include

Yurun Group, an unit of China Yurun Food (1068). Yingde Gases, Ausnutria Dairy

Corp and China Vanadium Titano-Magnetite Mining, which will close their retail

book tomorrow, had their retail tranche oversubscribed 3.5 times, twice and 5.6

times respectively, according to margin financing orders at nine brokers as of

Friday. But Wynn Macau's HK$12.6 billion offering was only 61.3 percent covered

with subscription via margin financing hitting HK$773 million. Powerlong Real

Estate also got a lukewarm. response Both will close their retail book on

Wednesday. More mainland developers plan to

tap the Hong Kong market for more than HK$20 billion despite the poor

performance of newly listed companies. Evergrande Real Estate - a

Guangzhou-based home developer seeking to raise HK$11.7 billion - is set to go

through a listing hearing tomorrow. Mingfa Group, which is aiming for HK$8

billion, will also have its hearing tomorrow and Yuzhou Group, which is seeking

up to HK$3.9 billion, may present its case later this week. Meanwhile, the

directors of United Company Rusal - the world's largest aluminum producer - will

decide this week whether to approve an IPO plan to float a 10 percent stake in

Hong Kong, the Sunday Times reported. The Russian aluminum giant is expected to

start bookbuilding in November and list in December. According to the British

newspaper, Rusal is in talks with potential cornerstone investors including

sovereign wealth funds China Investment Corp and Singapore's Temasek. Wilmar

International, the world's largest palm oil processor, plans to raise as much as

HK$31.2 billion from listing 733 million shares of its mainland business. The

firm is chaired by Kuok Khoon-hong - nephew of Robert Kuok Hock-nien, known as

"sugar king of Asia." Greens Group, a maker of waste heat recovery products had

its listing hearing last Thursday. It plans to raise as much as HK$1 billion.

Shenguan Holdings, a mainland sausage casing maker, starts bookbuilding today

and will open its retail book on Wednesday, eyeing up to HK$1.17 billion, market

sources said. The firm plans to invest 240 million yuan (HK$272.38 million) this

year and 469 million yuan in 2010 to expand production capacity. Its first-half

net income surged 66.5 percent to 129 million yuan. Shenguan's clients include

Yurun Group, an unit of China Yurun Food (1068). Yingde Gases, Ausnutria Dairy

Corp and China Vanadium Titano-Magnetite Mining, which will close their retail

book tomorrow, had their retail tranche oversubscribed 3.5 times, twice and 5.6

times respectively, according to margin financing orders at nine brokers as of

Friday. But Wynn Macau's HK$12.6 billion offering was only 61.3 percent covered

with subscription via margin financing hitting HK$773 million. Powerlong Real

Estate also got a lukewarm. response Both will close their retail book on

Wednesday.

Local wine auction sales are expected to

top US$60 million this year, about twice the value of wine sold at auction in

London, according to estimates from major auction houses. This will see the city

solidify its position as the world's biggest fine wine auction market after New

York. Local wine auction sales are expected to

top US$60 million this year, about twice the value of wine sold at auction in

London, according to estimates from major auction houses. This will see the city

solidify its position as the world's biggest fine wine auction market after New

York.

Investors keen on punting on

mainland property stocks could get another candidate for their share portfolio,

with upmarket residential developer Longfor Group said to be reviving plans to

seek a US$1 billion listing in Hong Kong. The developer, based in Chongqing,

proposed to launch a similar-sized sale last year but the plan was aborted

because of a slowdown on mainland equity markets. "This time, the exact

flotation size has not been finalized but it will be more or less US$1 billion,"

said a source familiar with the deal. Longfor, which aims to list in the fourth

quarter, is the latest among mainland developers seeking listing status in the

city this year as candidates queue up to take advantage of the improved stock

market. Investors keen on punting on

mainland property stocks could get another candidate for their share portfolio,

with upmarket residential developer Longfor Group said to be reviving plans to

seek a US$1 billion listing in Hong Kong. The developer, based in Chongqing,

proposed to launch a similar-sized sale last year but the plan was aborted

because of a slowdown on mainland equity markets. "This time, the exact

flotation size has not been finalized but it will be more or less US$1 billion,"

said a source familiar with the deal. Longfor, which aims to list in the fourth

quarter, is the latest among mainland developers seeking listing status in the

city this year as candidates queue up to take advantage of the improved stock

market.

More than 1.23 million people - one

in six of Hong Kong's population - are living in poverty and the widening wealth

gap could lead to instability, the Hong Kong Council of Social Services warned

yesterday.

China: China’s

state-owned Sinochem bid US$2.5 billion on Monday for Australian farm chemicals

group Nufarm, looking to gain a global footprint in a deal that could again test

investment ties between China and Australia. The bid sent Nufarm shares up

nearly 10 per cent to A$12.22 (HK$82.28), though still substantially below the

A$13 offer price, reflecting concerns that the deal still has many hurdles to

clear, including due diligence and both shareholder and regulatory approvals.

China: China’s

state-owned Sinochem bid US$2.5 billion on Monday for Australian farm chemicals

group Nufarm, looking to gain a global footprint in a deal that could again test

investment ties between China and Australia. The bid sent Nufarm shares up

nearly 10 per cent to A$12.22 (HK$82.28), though still substantially below the

A$13 offer price, reflecting concerns that the deal still has many hurdles to

clear, including due diligence and both shareholder and regulatory approvals.

Star hurdler Liu Xiang will join

other top sporting personalities in Beijing on October 1 at a parade marking 60

years of the People’s Republic of China, state media said on Monday. Liu – who

made a much-anticipated comeback earlier this month in Shanghai after his

dramatic withdrawal from last year’s Beijing Olympics due to injury – will ride

on top of a colourful float on Thursday, the Beijing Morning Post said. Other

sports stars, including basketball player Wang Zhizhi and former gymnastics

champion Li Ning (SEHK: 2331), will join Liu on the float, the report said.

China's domestic helpers may be a

step closer to reality. A government think tank has proposed more safeguards for

their importation, in a move seen as providing a policy framework that addresses

key questions that have stymied bringing in maids from across the border. "There

is demand in the market for mainland domestic helpers," a Central Policy Unit

official said. "They don't have the racial cultural difference with local people

because they don't have the language problem." The official said the idea was

first hatched more than two years ago after conflict between employers and their

foreign helpers stemming from racial and language differences. Restrictions to

avoid people abusing the system in seeking to settle in Hong Kong permanently

and bring in mainland wives and relatives will be covered in the research. These

include imposing an age limit on mainland maids and restricting them to work in

the city for no more than - for example - six years. Instead of allowing people

to arrange for someone they know to come and work for them, employers would be

given candidates to choose from.

Frugality is the order of the day as the preparations for the 60th anniversary

celebrations reach a climax. In a recent circular, the government said

extravagance would give way to austerity, and the money saved would be diverted

to reconstruction projects in earthquake-hit areas of Sichuan and to efforts

aimed at helping the economy rebound from the financial crisis. President Hu

Jintao has pledged to avoid extravagance and bring people practical benefits in

the celebration, in an effort to promote "social harmony", his ruling mantra.

The circular, issued by the general offices of the party's Central Committee and

the State Council, and cited by a provincial party official in charge of

publicity affairs, ordered local officials to resist any opportunities for

personal profit. It banned local agencies' using the anniversary as an excuse to

raise funds from businesses. Fund-raising in the name of National Day

celebrations by local government agencies has been widespread in the past, but

this time the central government said they should not collect fees, ask for

financial support or canvass advertisements from enterprises under the name of

donations for celebrations.

Frugality is the order of the day as the preparations for the 60th anniversary

celebrations reach a climax. In a recent circular, the government said

extravagance would give way to austerity, and the money saved would be diverted

to reconstruction projects in earthquake-hit areas of Sichuan and to efforts

aimed at helping the economy rebound from the financial crisis. President Hu

Jintao has pledged to avoid extravagance and bring people practical benefits in

the celebration, in an effort to promote "social harmony", his ruling mantra.

The circular, issued by the general offices of the party's Central Committee and

the State Council, and cited by a provincial party official in charge of

publicity affairs, ordered local officials to resist any opportunities for

personal profit. It banned local agencies' using the anniversary as an excuse to

raise funds from businesses. Fund-raising in the name of National Day

celebrations by local government agencies has been widespread in the past, but

this time the central government said they should not collect fees, ask for

financial support or canvass advertisements from enterprises under the name of

donations for celebrations.

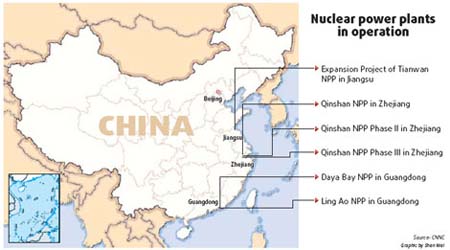

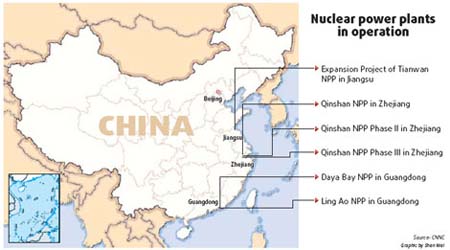

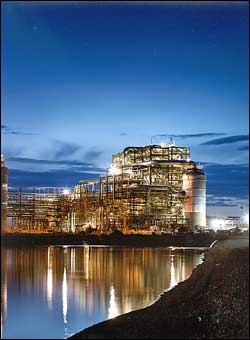

The State Council has

formally approved the construction of Shandong Haiyang Nuclear Power Station,

State Nuclear Power Technology Corp (SNPTC) said on Friday. The State Council has

formally approved the construction of Shandong Haiyang Nuclear Power Station,

State Nuclear Power Technology Corp (SNPTC) said on Friday.

China has started investigating

complaints that American chicken products are being dumped on the mainland and

are unfairly benefiting from subsidies, adding to a string of trade disputes

with Washington. The Ministry of Commerce said the probe was launched yesterday

on broiler products and chicken products, following requests by Chinese

companies to investigate the United States imports which they say are hurting

the domestic industry. The investigation comes at a time of mutual finger

pointing by Washington and Beijing, accusing the other of protectionism, which

both say will hurt efforts to end the global economic crisis. A US labour union

and three paper companies announced last week they had filed a new trade

complaint over imports of Chinese paper. The move came a week after Beijing

filed a World Trade Organisation challenge to Washington's decision to raise

tariffs on imports of Chinese-made tyres. The two governments also are involved

in disputes over access to each other's markets for steel pipes, music and

movies. On Tuesday, China appealed against a US victory in a trade dispute over

curbs on the sale of US music, films and books in the Chinese market. The same