|

Newsletter

Seminar Material

Biz:

China

Hong

Kong Hawaii

What people

said about us

China

Earthquake Relief

Tax &

Government

Hawaii Voter Registration

Biz-Video

Biz-Video

Hawaii's

China Connection Hawaii's

China Connection

CDP#1780962

CDP#1780962

Doing Business in

Hong Kong & China

Doing Business in

Hong Kong & China

| |

Hong Kong, China & Hawaii Biz*

Skype - FREE

Voice Over IP Skype - FREE

Voice Over IP  View Hawaii's China Connection

Video Trailer

View Hawaii's China Connection

Video Trailer

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our event page to find out more!

After

attended a China/Hong Kong Business/Trade Seminar in Hawaii...still unsure what

to do next, contact us, our Officers, Directors and Founding Members are

actively engaged in China/Hong Kong/Asia trade - we can help!

Are you ready to export your product or

service? You will find out in 3 minutes with resources to help you -

enter

to give it a try

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

(approximate $ exchange rates: US$1 = HK$7.8, US$1 = RMB$6.8)

View China 60th

Anniversary Video and Photo online View China 60th

Anniversary Video and Photo online

Nov 30, 2009

Hong Kong*:

Guangdong is to replace Hong Kong as the leader of a committee that will make

major decisions on the multibillion-dollar highway across the Pearl River Delta.

Officials close to the Hong Kong-Zhuhai-Macau Bridge project said the change

would not give the province control or veto rights because decisions could be

made only after consensus among all governments. But it has prompted a

suggestion that it would be fairer for representatives of the three governments

to take turns presiding over meetings. Lawmakers who will scrutinise Hong Kong's

6.75 billion yuan (HK$7.65 billion) contribution to the project said a fair

mechanism must be set up to ensure each government had an equal say regardless

of who led the group. Hong Kong's Transport and Housing Bureau was named

convenor when the committee was set up in 2003 to take care of preparatory work.

But with construction due to start next month, the committee's name and function

will be changed. It will be part of a three-tier structure that determines

important issues, including charges for using the bridge and vehicle admissions,

which will affect its use and income. The committee will be sandwiched between a

high-level body comprising Beijing representatives, including the National

Development and Reform Commission and the Ministry of Communications, and a new

bureau under it to oversee the bridge's daily operation. But as most of the 29.6

kilometre bridge falls within the mainland's jurisdiction, and as it contributed

the largest share of the budget, Guangdong was chosen to lead the new committee,

sources familiar with the project said. In fact, Guangdong only has to pay two

billion yuan up front for its share of the 37.73 billion yuan main bridge - less

than one third of Hong Kong's share. But because Beijing committed five billion

yuan to Guangdong's share last August to speed up the project, the share to be

paid by the pair increased from 35.1 per cent to 44.5 per cent. Hong Kong's

share is 42.9 per cent. Contributions from the governments made up 42 per cent

of the total cost while a private consortium led by the Bank of China will

finance the remainder, or 22 billion yuan, at an interest rate 10 per cent below

its benchmark lending rate - the lowest allowed by the state authorities. A

local government official said it did not matter who led the committee because

the consent of all governments must be obtained before a decision could be made.

In cases where differences cannot be resolved, Beijing - which will have

delegates but no members on the committee - will intervene. A mainland source

said the new convenor would work as a mediator for the three governments rather

than just a representative of its province. But Zheng Tianxiang, a delta

transport specialist at Sun Yat-sen University in Guangzhou, said consensus

would be difficult to reach on matters where interests were divided - such as

admission of vehicles - and it would be better if the three governments took

turns as convenor. "Guangdong has always wanted more mainland vehicles allowed

into Hong Kong, but Hong Kong has limited road handling capacity and also

environmental concerns," he said. Democratic Party lawmaker Lee Wing-tat said

there should be a voting system. Secretary for Transport and Housing Eva Cheng

said in August that private cars might pay less than HK$100 to use the bridge

and trucks about HK$200. But that assumes that at least 9,200 vehicles a day

used the bridge upon its opening in 2016, and its success will depend largely on

an ad hoc cross-border vehicle permit system still being negotiated. A chief

executive will be recruited globally to head the bureau that oversees daily

operations. But as the annual salary proposed in an early feasibility report was

just 600,000 yuan, the position may be more attractive to mainland candidates

than experienced Hong Kong managers. Hong Kong*:

Guangdong is to replace Hong Kong as the leader of a committee that will make

major decisions on the multibillion-dollar highway across the Pearl River Delta.

Officials close to the Hong Kong-Zhuhai-Macau Bridge project said the change

would not give the province control or veto rights because decisions could be

made only after consensus among all governments. But it has prompted a

suggestion that it would be fairer for representatives of the three governments

to take turns presiding over meetings. Lawmakers who will scrutinise Hong Kong's

6.75 billion yuan (HK$7.65 billion) contribution to the project said a fair

mechanism must be set up to ensure each government had an equal say regardless

of who led the group. Hong Kong's Transport and Housing Bureau was named

convenor when the committee was set up in 2003 to take care of preparatory work.

But with construction due to start next month, the committee's name and function

will be changed. It will be part of a three-tier structure that determines

important issues, including charges for using the bridge and vehicle admissions,

which will affect its use and income. The committee will be sandwiched between a

high-level body comprising Beijing representatives, including the National

Development and Reform Commission and the Ministry of Communications, and a new

bureau under it to oversee the bridge's daily operation. But as most of the 29.6

kilometre bridge falls within the mainland's jurisdiction, and as it contributed

the largest share of the budget, Guangdong was chosen to lead the new committee,

sources familiar with the project said. In fact, Guangdong only has to pay two

billion yuan up front for its share of the 37.73 billion yuan main bridge - less

than one third of Hong Kong's share. But because Beijing committed five billion

yuan to Guangdong's share last August to speed up the project, the share to be

paid by the pair increased from 35.1 per cent to 44.5 per cent. Hong Kong's

share is 42.9 per cent. Contributions from the governments made up 42 per cent

of the total cost while a private consortium led by the Bank of China will

finance the remainder, or 22 billion yuan, at an interest rate 10 per cent below

its benchmark lending rate - the lowest allowed by the state authorities. A

local government official said it did not matter who led the committee because

the consent of all governments must be obtained before a decision could be made.

In cases where differences cannot be resolved, Beijing - which will have

delegates but no members on the committee - will intervene. A mainland source

said the new convenor would work as a mediator for the three governments rather

than just a representative of its province. But Zheng Tianxiang, a delta

transport specialist at Sun Yat-sen University in Guangzhou, said consensus

would be difficult to reach on matters where interests were divided - such as

admission of vehicles - and it would be better if the three governments took

turns as convenor. "Guangdong has always wanted more mainland vehicles allowed

into Hong Kong, but Hong Kong has limited road handling capacity and also

environmental concerns," he said. Democratic Party lawmaker Lee Wing-tat said

there should be a voting system. Secretary for Transport and Housing Eva Cheng

said in August that private cars might pay less than HK$100 to use the bridge

and trucks about HK$200. But that assumes that at least 9,200 vehicles a day

used the bridge upon its opening in 2016, and its success will depend largely on

an ad hoc cross-border vehicle permit system still being negotiated. A chief

executive will be recruited globally to head the bureau that oversees daily

operations. But as the annual salary proposed in an early feasibility report was

just 600,000 yuan, the position may be more attractive to mainland candidates

than experienced Hong Kong managers.

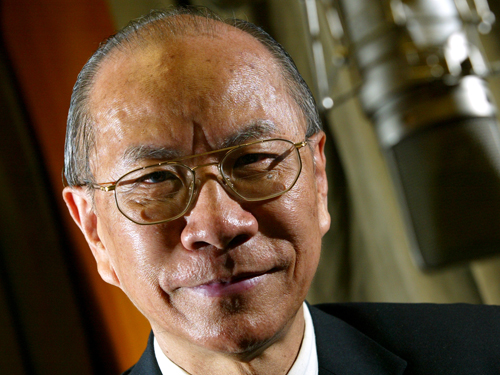

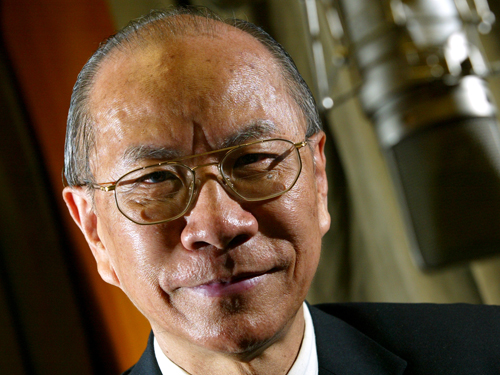

The city lost one of its favourite

voices yesterday when "King of Broadcasting" Chung Wai-ming died aged 78 after a

six-decade career in radio. Chung collapsed in Prince Edward MTR station on his

way to work at RTHK, where he was known as "Big Brother Chung". A nurse who was

at the scene tried unsuccessfully to revive Chung, whose heartbeat and breathing

had stopped. He was taken to Kwong Wah Hospital where he was declared dead at

11.36am. The cause of death remained unknown last night. Chung had been in the

broadcasting industry since 1947. He worked at Rediffusion Hong Kong and the

United States Information Service before moving to RTHK. In 1992, he became the

first Chinese broadcaster to be awarded an MBE. Family members and RTHK

colleagues were shocked at his sudden death. They described him as a fit man who

went to work nearly every day. He was a host of Radio 5 programmes Hello

Sunrise, Senior Citizens and Programme for the Elderly, all of them still

airing. Chung also appeared in numerous radio dramas and monologues based on

Chinese folk stories from the 1950s to the '70s, including Hong Xiguan and Zhuge

Liang. Chung's participation in the public announcement for Vietnamese boat

people who came to Hong Kong in the 1980s was also familiar to many. Chung is

survived by his wife, a son and a daughter. His son Danny Chung said at the

hospital that his father's death was a shock because he had shown no signs of

poor health. "He was already past retirement age but he still worked hard and

hoped the audience could still hear his voice," the younger Chung said. The city lost one of its favourite

voices yesterday when "King of Broadcasting" Chung Wai-ming died aged 78 after a

six-decade career in radio. Chung collapsed in Prince Edward MTR station on his

way to work at RTHK, where he was known as "Big Brother Chung". A nurse who was

at the scene tried unsuccessfully to revive Chung, whose heartbeat and breathing

had stopped. He was taken to Kwong Wah Hospital where he was declared dead at

11.36am. The cause of death remained unknown last night. Chung had been in the

broadcasting industry since 1947. He worked at Rediffusion Hong Kong and the

United States Information Service before moving to RTHK. In 1992, he became the

first Chinese broadcaster to be awarded an MBE. Family members and RTHK

colleagues were shocked at his sudden death. They described him as a fit man who

went to work nearly every day. He was a host of Radio 5 programmes Hello

Sunrise, Senior Citizens and Programme for the Elderly, all of them still

airing. Chung also appeared in numerous radio dramas and monologues based on

Chinese folk stories from the 1950s to the '70s, including Hong Xiguan and Zhuge

Liang. Chung's participation in the public announcement for Vietnamese boat

people who came to Hong Kong in the 1980s was also familiar to many. Chung is

survived by his wife, a son and a daughter. His son Danny Chung said at the

hospital that his father's death was a shock because he had shown no signs of

poor health. "He was already past retirement age but he still worked hard and

hoped the audience could still hear his voice," the younger Chung said.

Cosmetics retailer Sa Sa

International Holdings (SEHK: 0178) is proving the recession-beating power of

lipstick and mascara sales after reporting a 40.9 per cent leap in profit and

forecasting double-digit turnover growth. The healthy result came despite the

gloomy economy and a swine flu outbreak. Shares of the popular chain, which

sells beauty and skin care products, have soared 143 per cent so far this year.

The company had turnover of HK$1.76 billion during the six months to September,

up 8.3 per cent from HK$1.63 billion a year ago. Profit surged to HK$123.52

million from HK$87.66 million. Although turnover fell in May and June, when

fewer tourists visited the city during the swine flu outbreak, the retailer

quickly rebounded with a double-digit increase in August and September.

Cosmetics, along with fast food, are considered by many to be recession-proof to

a certain extent. Estee Lauder chairman Leonard Lauder is credited with coming

up with the "lipstick theory", which suggests that during economic uncertainty

sales of cosmetics increase as women opt to indulge themselves while having to

cut back in other areas of spending. Sa Sa chairman and chief executive Simon

Kwok Siu-ming attributed the earnings growth to a diversified retail network,

flexible marketing, tighter cost controls and quicker inventory turnover. "Since

the economy has not fully recovered, we have a strategy of offering more

low-priced options to our customers, which proved to be quite effective in

boosting turnover," he said. Customer spending was about HK$243 per transaction

at Sa Sa's Hong Kong and Macau outlets, 2.5 per cent less than a year earlier.

However, retail sales and the number of transactions rose 5 per cent and 7.8 per

cent, respectively, pushing overall turnover 3.9 per cent higher to HK$1.38

billion in the two cities. Looking forward, Kwok said double-digit turnover

growth was foreseeable over the next six months. "I am confident about the

growth, as long as the epidemic does not get worse and rent rises remain at a

reasonable level," he said. Gross profit margin rose to 43.9 per cent from 42.7

per cent. The company declared a dividend of three HK cents and a special

dividend of six HK cents per share. Its shares rose five HK cents or 1.1 per

cent to HK$4.45 yesterday. Cosmetics retailer Sa Sa

International Holdings (SEHK: 0178) is proving the recession-beating power of

lipstick and mascara sales after reporting a 40.9 per cent leap in profit and

forecasting double-digit turnover growth. The healthy result came despite the

gloomy economy and a swine flu outbreak. Shares of the popular chain, which

sells beauty and skin care products, have soared 143 per cent so far this year.

The company had turnover of HK$1.76 billion during the six months to September,

up 8.3 per cent from HK$1.63 billion a year ago. Profit surged to HK$123.52

million from HK$87.66 million. Although turnover fell in May and June, when

fewer tourists visited the city during the swine flu outbreak, the retailer

quickly rebounded with a double-digit increase in August and September.

Cosmetics, along with fast food, are considered by many to be recession-proof to

a certain extent. Estee Lauder chairman Leonard Lauder is credited with coming

up with the "lipstick theory", which suggests that during economic uncertainty

sales of cosmetics increase as women opt to indulge themselves while having to

cut back in other areas of spending. Sa Sa chairman and chief executive Simon

Kwok Siu-ming attributed the earnings growth to a diversified retail network,

flexible marketing, tighter cost controls and quicker inventory turnover. "Since

the economy has not fully recovered, we have a strategy of offering more

low-priced options to our customers, which proved to be quite effective in

boosting turnover," he said. Customer spending was about HK$243 per transaction

at Sa Sa's Hong Kong and Macau outlets, 2.5 per cent less than a year earlier.

However, retail sales and the number of transactions rose 5 per cent and 7.8 per

cent, respectively, pushing overall turnover 3.9 per cent higher to HK$1.38

billion in the two cities. Looking forward, Kwok said double-digit turnover

growth was foreseeable over the next six months. "I am confident about the

growth, as long as the epidemic does not get worse and rent rises remain at a

reasonable level," he said. Gross profit margin rose to 43.9 per cent from 42.7

per cent. The company declared a dividend of three HK cents and a special

dividend of six HK cents per share. Its shares rose five HK cents or 1.1 per

cent to HK$4.45 yesterday.

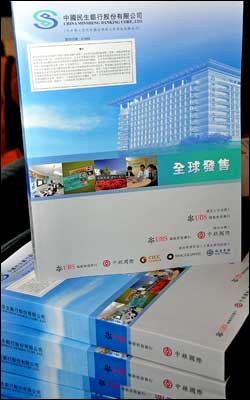

The China Pacific Insurance Co., the

country's third largest life insurer, got the green light from the Hong Kong

Stock Exchange for its 3.4-billion-U.S.-dollar share float on the bourse. The

company received approval from China Securities Regulatory Commission Wednesday

and would list up to 990 million shares in the overseas market, Saturday's China

Daily reported. "The Hong Kong listing will help the company step up its

business expansion and compete with bigger domestic rivals like China Life and

Ping An," the newspaper quoted Zhao Xinan, a Shanghai-based analyst with

Northeast Securities as saying. The company's shares on the Shanghai bourse

declined 4.3 percent to 23.84 yuan (3.49 U.S. dollars) Friday. "It is

understandable that the insurer's A shares danced with the general downtrend of

the stock market, as investors have largely priced in the IPO news," Zhao said.

The company, partly owned by American private equity firm Carlyle Group, said in

August that it expected to price its H shares at around 23.5 yuan per share and

planned to raise around 23.5 billion yuan from the Hong Kong listing, the paper

said. In the first three quarters this year, the company reported a net profit

of 4.1 billion yuan, up 4.8 percent from a year earlier. Its revenue fell 1.1

percent year on year to 81.4 billion yuan.

China*: There

have been 38 million more males born on the mainland since 1980 than females,

sparking fears among demographers that a rising number of single males could

threaten social stability. Official statistics show that male births outnumbered

female births by 107 to 100 in 1980, but that rose to 120.49 to 100 by the end

of 2006. At that rate, males born since 1980 would have outnumbered females born

in the same period by 38 million at the end of last year. Professor Yuan Xin ,

from Tianjin's Nankai University, said a gender ratio ranging from 103:100 to

107:100 was considered normal by international standards. He said the

significantly more single males would have no families to support them later in

life and they would have to depend on the social security system after

retirement. So many single males "could mean a significant problem for social

stability and the social fabric, particularly marriage, if they could not find a

partner of the opposite sex and a family of their own". The drastic rise in the

gender imbalance followed the introduction by the central government of the

controversial family planning policy that limits most families to one child.

Although the authorities have claimed that the one-child policy has helped China

avoid a population increase of 400 million people since the 1980s, it has come

under intense international scrutiny for some of the inhumane measures adopted

by family planning authorities in the past, including forced abortion and

sterilisation. Yuan said the one-child policy had contributed to the

deteriorating gender imbalance in newborns, "but the root cause of the problem

is preference for boys in a male-dominated culture, and a lack of social and

economic development". He said the abuse of sex-screening techniques had also

played a role. Yuan said adjustment of the policy would go some way towards

addressing the imbalance, but the authorities needed to take several approaches

to tackling the problem, including a clampdown on sex-screening techniques and

making efforts to build a sound social welfare system. There has been widespread

concern expressed about the welfare of single males in the future as a result of

the deteriorating gender imbalance, but Yuan said he was saddened by the fact

that the welfare of women was being ignored. He said a surplus of millions of

males "would naturally mean the loss of an equal number of females in the same

period". "How? They're either destroyed as a fetus or killed after birth. It's a

story soaked with blood as the surplus came as a sacrifice of the same number of

women," Yuan said.

China*: There

have been 38 million more males born on the mainland since 1980 than females,

sparking fears among demographers that a rising number of single males could

threaten social stability. Official statistics show that male births outnumbered

female births by 107 to 100 in 1980, but that rose to 120.49 to 100 by the end

of 2006. At that rate, males born since 1980 would have outnumbered females born

in the same period by 38 million at the end of last year. Professor Yuan Xin ,

from Tianjin's Nankai University, said a gender ratio ranging from 103:100 to

107:100 was considered normal by international standards. He said the

significantly more single males would have no families to support them later in

life and they would have to depend on the social security system after

retirement. So many single males "could mean a significant problem for social

stability and the social fabric, particularly marriage, if they could not find a

partner of the opposite sex and a family of their own". The drastic rise in the

gender imbalance followed the introduction by the central government of the

controversial family planning policy that limits most families to one child.

Although the authorities have claimed that the one-child policy has helped China

avoid a population increase of 400 million people since the 1980s, it has come

under intense international scrutiny for some of the inhumane measures adopted

by family planning authorities in the past, including forced abortion and

sterilisation. Yuan said the one-child policy had contributed to the

deteriorating gender imbalance in newborns, "but the root cause of the problem

is preference for boys in a male-dominated culture, and a lack of social and

economic development". He said the abuse of sex-screening techniques had also

played a role. Yuan said adjustment of the policy would go some way towards

addressing the imbalance, but the authorities needed to take several approaches

to tackling the problem, including a clampdown on sex-screening techniques and

making efforts to build a sound social welfare system. There has been widespread

concern expressed about the welfare of single males in the future as a result of

the deteriorating gender imbalance, but Yuan said he was saddened by the fact

that the welfare of women was being ignored. He said a surplus of millions of

males "would naturally mean the loss of an equal number of females in the same

period". "How? They're either destroyed as a fetus or killed after birth. It's a

story soaked with blood as the surplus came as a sacrifice of the same number of

women," Yuan said.

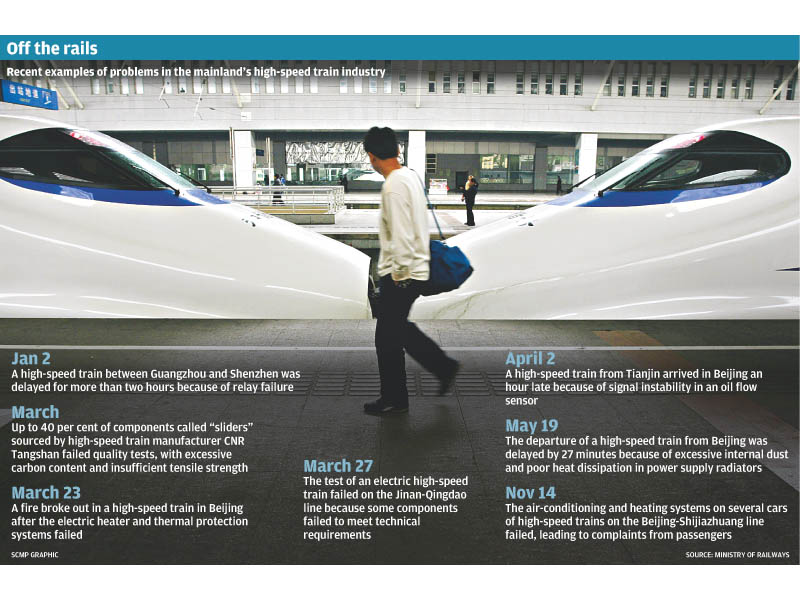

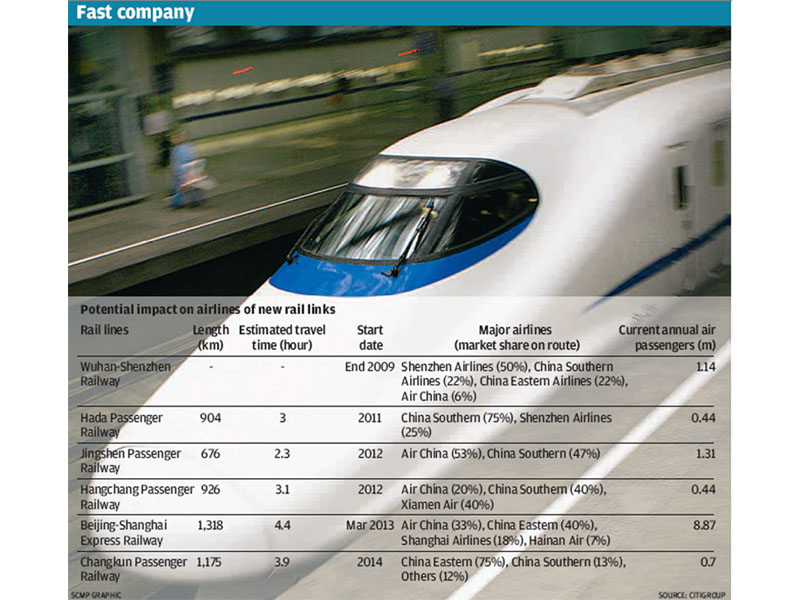

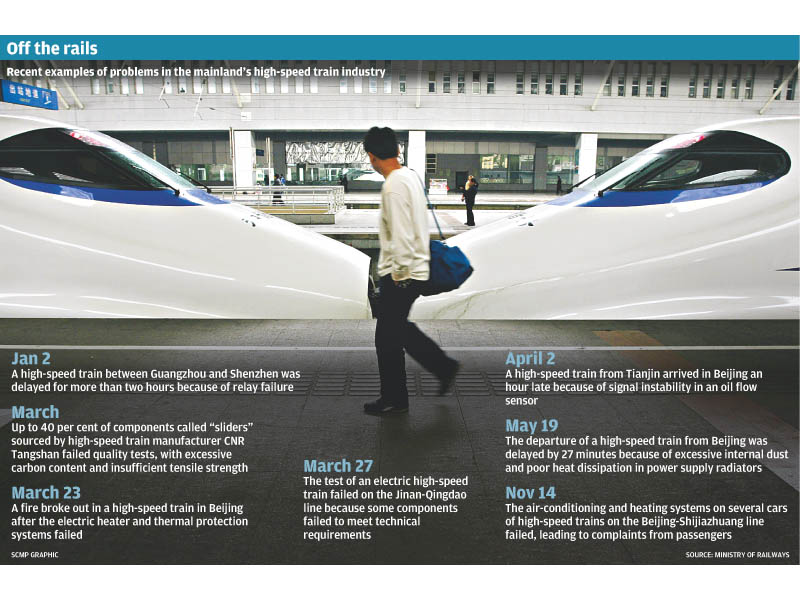

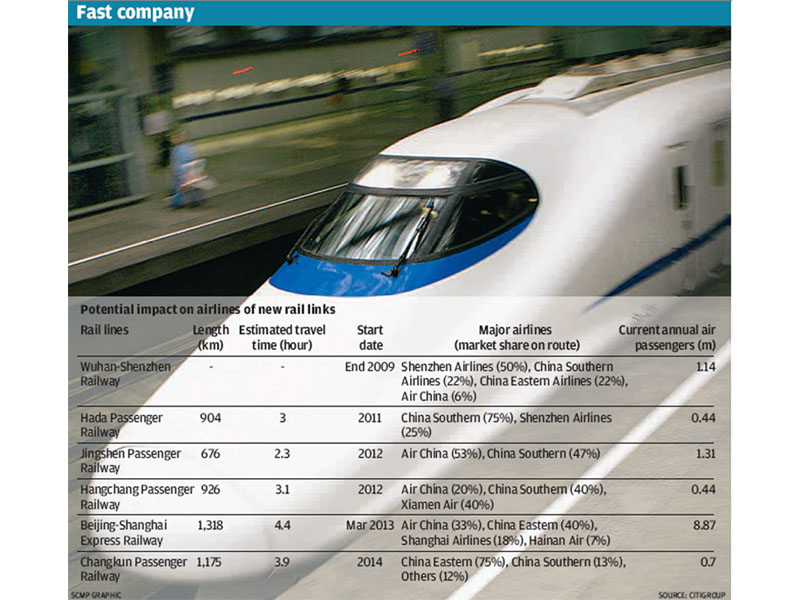

State train makers under fire for

poor standards - Official exposes problems undermining high-speed network - A

senior rail official has criticized the quality and safety standards of the

mainland's growing fleet of high-speed trains, a serious blow for the country as

it fast tracks construction of what will be the world's largest high-speed train

network. Zhang Shuguang, a vice-chief engineer and chief of the transport bureau

at the Ministry of Railways, told an industry meeting that the train

manufacturing process had "exposed a lot of quality issues". Zhang singled out

"safety, management and quality" of trains being manufactured at CNR Changchun,

CSR Sifang and CNR Tangshan. CNR Changchun and CNR Tangshan are subsidiaries of

China CNR Corp, one of the mainland's two dominant state-owned train

manufacturers. CSR Sifang is a subsidiary of China South Locomotive & Rolling

Stock Corp, the other leading state-owned rolling stock maker. "There are many

problems with product quality. We invite you to immediately correct this bad

tendency," Zhang told the meeting. High-speed trains are usually capable of

speeds of 200 km/h or more. This year, China South and China CNR have won 152.4

billion yuan (HK$172.96 billion) of orders from the Ministry of Railways and the

country is expected to overtake Europe with the largest high-speed rail system

in the world by 2012. China South is also tipped as the favourite to win the

contract to supply high-speed trains to the fledgling fast rail system in the

United States. It is also in advanced talks to sell high-speed trains to

Britain. China South and China CNR have joint ventures with foreign rolling

stock manufacturers such as Siemens of Germany, Alstom of France and Bombardier

of Canada, from whom they were to acquire know-how to build the trains. However,

the technology transfer has had its failings. Railways Minister Liu Zhijun

"severely criticised" CNR Tangshan during his inspection of the company in June,

Zhang said. "It shows that CNR Tangshan didn't cherish the hard-won orders and

did not really absorb Siemens technology properly," he said. For example, in

March, CNR bought train parts called "sliders" from Changzhou Baiyidar Railway

Vehicles, but 40 per cent failed quality tests, he said. "This is shoddy

behavior of suppliers, which exposed serious loopholes in the quality control of

OEM (original equipment manufacturers) suppliers." On March 23, a fire broke out

on a high-speed train in Beijing, because the electric heater and thermal

protection systems failed. Insulation systems did not meet technical

requirements and substandard components were used, "which brought about a

serious safety risk", Zhang said. In another example, a substitute fire safety

material that did not comply with requirements was found to have been secretly

used in some trains. "The emergence of these problems makes us very worried,"

Zhang said. "Some OEMs have slipped into pride, complacency and self-importance,

focusing on fighting for orders, but have not entered the factory for a long

time. Teams are very weak in the factories, but management is out of control."

Quality control groups have also found a number of other problems, such as water

leakage in trains. This year, high-speed rail equipment failures had caused

network delays and problems, Zhang said. On January 2, a relay failure caused a

two-hour, 11-minute delay on the high-speed service between Guangzhou and

Shenzhen. On November 14, during a cold spell in northern China, the

air-conditioning and heating systems of several high-speed trains on the

Beijing-Shijiazhuang line failed. Zhang urged high-speed rail manufacturers to

maintain high safety awareness and quality standards - as if they were "close to

the abyss, skating on thin ice or sitting on pins and needles". State train makers under fire for

poor standards - Official exposes problems undermining high-speed network - A

senior rail official has criticized the quality and safety standards of the

mainland's growing fleet of high-speed trains, a serious blow for the country as

it fast tracks construction of what will be the world's largest high-speed train

network. Zhang Shuguang, a vice-chief engineer and chief of the transport bureau

at the Ministry of Railways, told an industry meeting that the train

manufacturing process had "exposed a lot of quality issues". Zhang singled out

"safety, management and quality" of trains being manufactured at CNR Changchun,

CSR Sifang and CNR Tangshan. CNR Changchun and CNR Tangshan are subsidiaries of

China CNR Corp, one of the mainland's two dominant state-owned train

manufacturers. CSR Sifang is a subsidiary of China South Locomotive & Rolling

Stock Corp, the other leading state-owned rolling stock maker. "There are many

problems with product quality. We invite you to immediately correct this bad

tendency," Zhang told the meeting. High-speed trains are usually capable of

speeds of 200 km/h or more. This year, China South and China CNR have won 152.4

billion yuan (HK$172.96 billion) of orders from the Ministry of Railways and the

country is expected to overtake Europe with the largest high-speed rail system

in the world by 2012. China South is also tipped as the favourite to win the

contract to supply high-speed trains to the fledgling fast rail system in the

United States. It is also in advanced talks to sell high-speed trains to

Britain. China South and China CNR have joint ventures with foreign rolling

stock manufacturers such as Siemens of Germany, Alstom of France and Bombardier

of Canada, from whom they were to acquire know-how to build the trains. However,

the technology transfer has had its failings. Railways Minister Liu Zhijun

"severely criticised" CNR Tangshan during his inspection of the company in June,

Zhang said. "It shows that CNR Tangshan didn't cherish the hard-won orders and

did not really absorb Siemens technology properly," he said. For example, in

March, CNR bought train parts called "sliders" from Changzhou Baiyidar Railway

Vehicles, but 40 per cent failed quality tests, he said. "This is shoddy

behavior of suppliers, which exposed serious loopholes in the quality control of

OEM (original equipment manufacturers) suppliers." On March 23, a fire broke out

on a high-speed train in Beijing, because the electric heater and thermal

protection systems failed. Insulation systems did not meet technical

requirements and substandard components were used, "which brought about a

serious safety risk", Zhang said. In another example, a substitute fire safety

material that did not comply with requirements was found to have been secretly

used in some trains. "The emergence of these problems makes us very worried,"

Zhang said. "Some OEMs have slipped into pride, complacency and self-importance,

focusing on fighting for orders, but have not entered the factory for a long

time. Teams are very weak in the factories, but management is out of control."

Quality control groups have also found a number of other problems, such as water

leakage in trains. This year, high-speed rail equipment failures had caused

network delays and problems, Zhang said. On January 2, a relay failure caused a

two-hour, 11-minute delay on the high-speed service between Guangzhou and

Shenzhen. On November 14, during a cold spell in northern China, the

air-conditioning and heating systems of several high-speed trains on the

Beijing-Shijiazhuang line failed. Zhang urged high-speed rail manufacturers to

maintain high safety awareness and quality standards - as if they were "close to

the abyss, skating on thin ice or sitting on pins and needles".

Wan Baobao, granddaughter of Wan Li, "came out" at the ball in 2003. Once the

realm of Europe's elite, Paris' extravagant debutante ball has become a must-do

social event for the Middle Kingdom's "red princesses". This year, it's the turn

of Jasmin Li, the granddaughter of Jia Qinglin - No4 in the Communist Party. She

will be among 24 teenage girls to present themselves to society tonight at one

of the most opulent and aristocratic events on the European calendar. Li, Jia's

17-year-old granddaughter, will join the likes of Ariel Ho-Kjaer, the

granddaughter of Stanley Ho Hung-sun, Clint Eastwood's daughter Francesca, the

late Princess Diana's niece, Lady Kitty Spencer, and other girls blessed by

being born into privilege and wealth. The ball, held at the Hotel de Crillon in

Paris, is an aristocratic tradition that has been resurrected in recent years to

mark the "coming out" of the daughters of the rich and famous. Once unknown to

most mainlanders, the debutantes' ball is attracting growing interest. It has

become a new stage for "red princesses" to announce their arrival and coming of

age. Jia is chairman of the Chinese People's Political Consultative Committee, a

close ally of former president Jiang Zemin and a political survivor whose

reputation has been tainted by a smuggling scandal. Li is not the first

offspring of mainland leaders to be invited to the aristocratic event. Several

"red princesses" have gone before her to hobnob with the international elite. In

2006, Chen Xiaodan - the granddaughter of Chen Yun - was chosen to open the ball

- dancing to Johann Strauss' Emperor Waltz. Chen Yun, Deng Xiaoping's

arch-rival, was a founding father of the People's Republic who wielded vast

political influence. Xiaodan's father, Chen Yuan , was the deputy governor of

the People's Bank of China. Xiaodan was joined by the likes of Princess Costanza

della Torre e Tasso from Italy and Belgian Princess Alexandra de Croy-Roeulx on

that day. In 2003, it was the turn of Wan Baobao - granddaughter of Wan Li - who

became the talk of the ball. Wan Li was a former chairman of the National

People's Congress. Baobao's father is Wan Jifei , chairman of the China Council

for the Promotion of International Trade. The Paris ball is not the only event

at which the children of Beijing's elite step into the international social

limelight. Increasingly, they have become part of the western glitterati. Ye

Mingzi , granddaughter of Marshal Ye Jianying - a founding father of the

People's Republic - is now a celebrated designer of western-style evening gowns

and wedding dresses. She studied at Saint Martins College of Art and Design in

London and regularly appears at extravagant social events and balls. This year's

De Crillon ball will host young women from Australia and Venezuela for the first

time. Turkey will be represented by national ski team member Gulsah Alkoclar,

and India by the last descendant of the maharaja of Jammu and Kashmir. The event

was intended as an opportunity for young women to be presented at court where

they might find a future husband from a suitable bloodline. But with the

execution of much of France's aristocracy in the wake of the 1789 revolution,

the tradition also died out, until it was resurrected as a public relations

event by public relations woman Ophelie Renouard. The proceeds will be donated

to charity, making the event "less trivial", according to host Stephane Bern.

"The tradition has lost nothing of its appeal but it perpetuates itself by

abandoning the vestiges of aristocratic glory: there are more and more

debutantes from families that have made a name for themselves other than simply

by being born," said Bern, a society journalist. "The debutantes' ball is thus

less trivial ... which doesn't stop them dreaming of an evening on the Place de

la Concorde in an haute couture dress."

Wan Baobao, granddaughter of Wan Li, "came out" at the ball in 2003. Once the

realm of Europe's elite, Paris' extravagant debutante ball has become a must-do

social event for the Middle Kingdom's "red princesses". This year, it's the turn

of Jasmin Li, the granddaughter of Jia Qinglin - No4 in the Communist Party. She

will be among 24 teenage girls to present themselves to society tonight at one

of the most opulent and aristocratic events on the European calendar. Li, Jia's

17-year-old granddaughter, will join the likes of Ariel Ho-Kjaer, the

granddaughter of Stanley Ho Hung-sun, Clint Eastwood's daughter Francesca, the

late Princess Diana's niece, Lady Kitty Spencer, and other girls blessed by

being born into privilege and wealth. The ball, held at the Hotel de Crillon in

Paris, is an aristocratic tradition that has been resurrected in recent years to

mark the "coming out" of the daughters of the rich and famous. Once unknown to

most mainlanders, the debutantes' ball is attracting growing interest. It has

become a new stage for "red princesses" to announce their arrival and coming of

age. Jia is chairman of the Chinese People's Political Consultative Committee, a

close ally of former president Jiang Zemin and a political survivor whose

reputation has been tainted by a smuggling scandal. Li is not the first

offspring of mainland leaders to be invited to the aristocratic event. Several

"red princesses" have gone before her to hobnob with the international elite. In

2006, Chen Xiaodan - the granddaughter of Chen Yun - was chosen to open the ball

- dancing to Johann Strauss' Emperor Waltz. Chen Yun, Deng Xiaoping's

arch-rival, was a founding father of the People's Republic who wielded vast

political influence. Xiaodan's father, Chen Yuan , was the deputy governor of

the People's Bank of China. Xiaodan was joined by the likes of Princess Costanza

della Torre e Tasso from Italy and Belgian Princess Alexandra de Croy-Roeulx on

that day. In 2003, it was the turn of Wan Baobao - granddaughter of Wan Li - who

became the talk of the ball. Wan Li was a former chairman of the National

People's Congress. Baobao's father is Wan Jifei , chairman of the China Council

for the Promotion of International Trade. The Paris ball is not the only event

at which the children of Beijing's elite step into the international social

limelight. Increasingly, they have become part of the western glitterati. Ye

Mingzi , granddaughter of Marshal Ye Jianying - a founding father of the

People's Republic - is now a celebrated designer of western-style evening gowns

and wedding dresses. She studied at Saint Martins College of Art and Design in

London and regularly appears at extravagant social events and balls. This year's

De Crillon ball will host young women from Australia and Venezuela for the first

time. Turkey will be represented by national ski team member Gulsah Alkoclar,

and India by the last descendant of the maharaja of Jammu and Kashmir. The event

was intended as an opportunity for young women to be presented at court where

they might find a future husband from a suitable bloodline. But with the

execution of much of France's aristocracy in the wake of the 1789 revolution,

the tradition also died out, until it was resurrected as a public relations

event by public relations woman Ophelie Renouard. The proceeds will be donated

to charity, making the event "less trivial", according to host Stephane Bern.

"The tradition has lost nothing of its appeal but it perpetuates itself by

abandoning the vestiges of aristocratic glory: there are more and more

debutantes from families that have made a name for themselves other than simply

by being born," said Bern, a society journalist. "The debutantes' ball is thus

less trivial ... which doesn't stop them dreaming of an evening on the Place de

la Concorde in an haute couture dress."

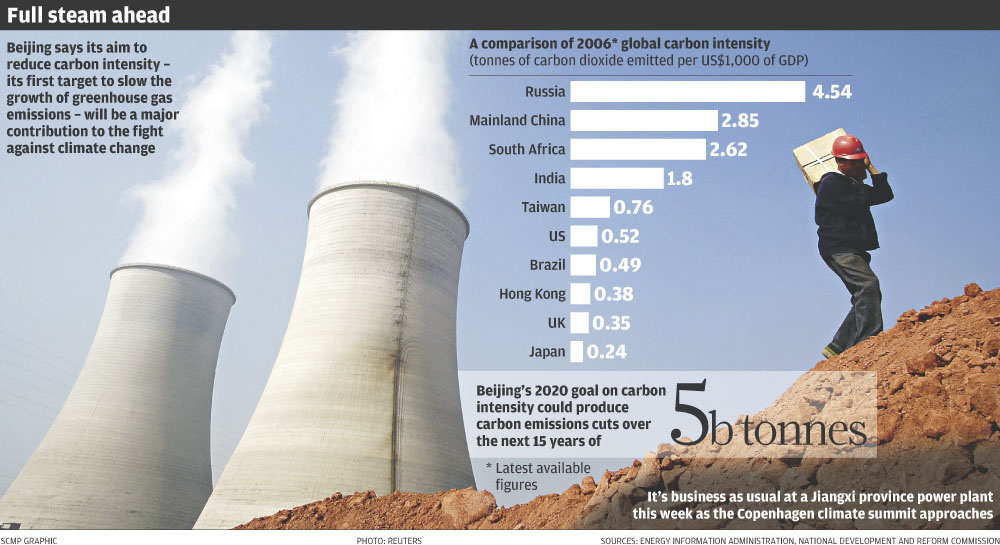

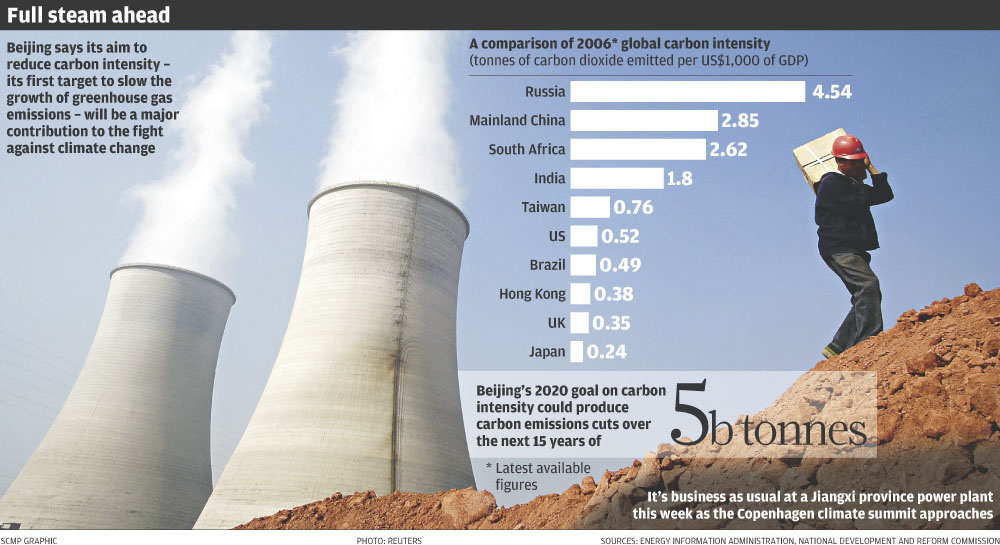

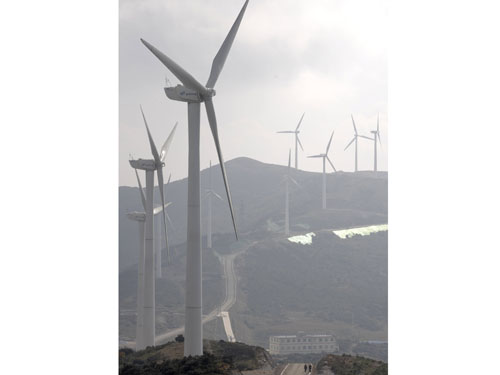

A top Chinese climate envoy said

yesterday that the only emissions curbs open to outside scrutiny under its new

carbon intensity target would be those with international financial support. Yu

Qingtai , China's climate change ambassador, said most of the country's

emissions-curbing plans were unlikely to be "measurable, reportable and

verifiable". The phrase, agreed in international talks three years ago, implies

third-party checks on reported reductions. "Actions would be measurable,

reportable and verifiable if [international] support is measurable, reportable

and verifiable," Yu said. "If you look at the magnitude of the measures that

were announced yesterday, I would assume only a very small proportion would come

under this particular provision. "You cannot apply the same kind of standards

for actions that we take on our own, with our own resources, [as you do] for

actions that we take with international support." China announced on Thursday

that it would cut 2005 carbon intensity levels - the amount of carbon dioxide

produced per unit of gross domestic product growth - by 40 per cent to 45 per

cent by 2020. The move boosted hopes for a deal on a new pact to fight climate

change at UN-led talks in Copenhagen next month. Foreign governments generally

welcomed China's new greenhouse-gas-curb target but some hinted that more needed

to be done. Beijing's commitment, together with an earlier one by the US for a

17 per cent cut in emissions by 2020 from 2005, has been scrutinised by the

international community. Many believe the US and China - the two biggest

emitters of global warming gases - hold the key to the success of a new round of

talks on climate change in Denmark next month. French President Nicolas Sarkozy,

in Brazil for a one-day meeting on climate change and Amazon forest

conservation, hailed the new US and Chinese proposals. "The latest statements by

Barack Obama and China's leaders are extremely encouraging in making Copenhagen

a success," Sarkozy said. India's environment minister, Jairam Ramesh, said that

China's decision to unveil a carbon emissions target had put pressure on India.

"China has given a wake-up call to India," he said. "We've to think hard about

our climate strategy now and look for flexibility ... to avoid being isolated at

Copenhagen. India has consistently said it will not accept binding carbon

emissions cuts which would affect its economic growth and reduce its capacity to

fight poverty. Japan welcomed commitments by the US and China but hinted that

Tokyo expected more from the Copenhagen global climate summit next month. "We

value the fact that each country, including the United States and China, has

submitted figures over the issue of global warming," Chief Cabinet Secretary

Hirofumi Hirano said.

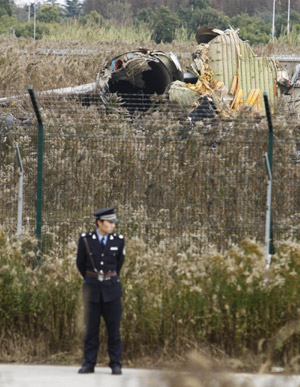

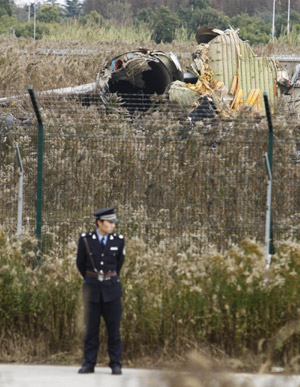

A security man guards near

the site where a cargo plane burnt at the Shanghai Pudong International Airport

in Shanghai of east China on Nov. 28, 2009. The cargo plane registered in

Zimbabwe caught fire when taking off at the Shanghai Pudong International

Airport. Four crew members are injured, 3 other dead. A security man guards near

the site where a cargo plane burnt at the Shanghai Pudong International Airport

in Shanghai of east China on Nov. 28, 2009. The cargo plane registered in

Zimbabwe caught fire when taking off at the Shanghai Pudong International

Airport. Four crew members are injured, 3 other dead.

Nov 29, 2009

Hong Kong*:

Henry Tang Ying-yen firmly donned his hat as chairman of the West Kowloon

Cultural District Authority yesterday and demanded that transport officials

scale down their intrusion into the arts hub when building the new cross-border

express rail link. Tang, who as chief secretary is the officials' boss, demanded

to know why five berths were needed along 1,000 metres of the cultural district

waterfront to carry away soil excavated for the railway, which will terminate at

West Kowloon. He called for them to be reduced to two to avoid spoiling the view

for cultural activities to be held at the site while the arts hub was being

built, saying transport officials should have known their use of the reclaimed

land would be restricted. "I've said, time and again, that West Kowloon starts

now, meaning we want to put temporary structures and facilities there so we'll

get groups to hold activities there as well as people going there for

activities," Tang said. He was speaking at a meeting of the authority's board, a

day after transport secretary Eva Cheng said the railway works would occupy 14

hectares, or one-third, of the arts hub area. The land would be handed over in

phases and by 2014, a year before the arts hub opened, the occupation would

shrink to three hectares. Tang said the berthing area was too long. Urging

officials to reduce the berthing points to two, he suggested they approach the

Marine Department to see if the China Ferry Terminal in Tsim Sha Tsui could

accommodate the others. But deputy secretary for transport Philip Yung Wai-hing

said a long stretch of harbor front would be needed so that five barges, each up

to 150 metres long, could stop at five berths and pick up spoil to be delivered

to Taishan . Yung said the area and time for temporary works would be kept to

the minimum, but if fewer berthing points were used the construction would take

longer. Hong Kong*:

Henry Tang Ying-yen firmly donned his hat as chairman of the West Kowloon

Cultural District Authority yesterday and demanded that transport officials

scale down their intrusion into the arts hub when building the new cross-border

express rail link. Tang, who as chief secretary is the officials' boss, demanded

to know why five berths were needed along 1,000 metres of the cultural district

waterfront to carry away soil excavated for the railway, which will terminate at

West Kowloon. He called for them to be reduced to two to avoid spoiling the view

for cultural activities to be held at the site while the arts hub was being

built, saying transport officials should have known their use of the reclaimed

land would be restricted. "I've said, time and again, that West Kowloon starts

now, meaning we want to put temporary structures and facilities there so we'll

get groups to hold activities there as well as people going there for

activities," Tang said. He was speaking at a meeting of the authority's board, a

day after transport secretary Eva Cheng said the railway works would occupy 14

hectares, or one-third, of the arts hub area. The land would be handed over in

phases and by 2014, a year before the arts hub opened, the occupation would

shrink to three hectares. Tang said the berthing area was too long. Urging

officials to reduce the berthing points to two, he suggested they approach the

Marine Department to see if the China Ferry Terminal in Tsim Sha Tsui could

accommodate the others. But deputy secretary for transport Philip Yung Wai-hing

said a long stretch of harbor front would be needed so that five barges, each up

to 150 metres long, could stop at five berths and pick up spoil to be delivered

to Taishan . Yung said the area and time for temporary works would be kept to

the minimum, but if fewer berthing points were used the construction would take

longer.

Anthony Bolton wants to take advantage

of China's growth, which he says will be much faster than in the United States

or Europe. Fidelity International's investment president Anthony Bolton, who is

arguably Britain's most successful mutual fund manager of the past two decades,

is relocating to Hong Kong. Bolton, who ran Fidelity's popular British-based

Special Situations fund from 1979 to 2007, is following in the footsteps of HSBC

Holdings (SEHK: 0005) chief executive Michael Geoghegan, who announced in

September he would move his office here from London. In the first quarter of

next year, Bolton will start managing a new equity fund that invests in mainland

companies. "The center of economic gravity is shifting from West to East,"

Bolton said, echoing a comment HSBC made in its announcement that Geoghegan

would relocate to Hong Kong. The Fidelity president's Warren Buffett-inspired

value investing and meticulous stock-picking would have turned £1,000 invested

when he began running the Special Situations fund in 1979 to £148,200 when he

stepped down in 2007. But he has not directly managed money at Fidelity for the

past two years. Bolton said yesterday he wanted to return to full-time investing

to take advantage of the mainland's growth. "I want very much to be part of

that," he said, adding that Western economies were expected to grow much more

slowly than China in the next few years. He said the United States and British

governments had "mortgaged the future" in paying their way out of the financial

crisis. Anthony Bolton wants to take advantage

of China's growth, which he says will be much faster than in the United States

or Europe. Fidelity International's investment president Anthony Bolton, who is

arguably Britain's most successful mutual fund manager of the past two decades,

is relocating to Hong Kong. Bolton, who ran Fidelity's popular British-based

Special Situations fund from 1979 to 2007, is following in the footsteps of HSBC

Holdings (SEHK: 0005) chief executive Michael Geoghegan, who announced in

September he would move his office here from London. In the first quarter of

next year, Bolton will start managing a new equity fund that invests in mainland

companies. "The center of economic gravity is shifting from West to East,"

Bolton said, echoing a comment HSBC made in its announcement that Geoghegan

would relocate to Hong Kong. The Fidelity president's Warren Buffett-inspired

value investing and meticulous stock-picking would have turned £1,000 invested

when he began running the Special Situations fund in 1979 to £148,200 when he

stepped down in 2007. But he has not directly managed money at Fidelity for the

past two years. Bolton said yesterday he wanted to return to full-time investing

to take advantage of the mainland's growth. "I want very much to be part of

that," he said, adding that Western economies were expected to grow much more

slowly than China in the next few years. He said the United States and British

governments had "mortgaged the future" in paying their way out of the financial

crisis.

China's ballooning stock market

bubble, fueled by excessive liquidity, is likely to burst in the first half of

2010, punctured by economic concerns arising from higher-than-expected

inflation, Morgan Stanley Asia executive director Jerry Lou said yesterday. The

benchmark Shanghai Composite Index may peak around 4,000 points, as banks

continue to lend massively to infrastructure projects initiated this year under

the government's 4 trillion yuan (HK$4.54 trillion) stimulus package, Lou said

in Shanghai. The Shanghai index ended yesterday down 3.62 percent at 3,170.979

points. "An asset price bubble is forming in China, but that process hasn't

finished yet," Lou said. "There's little room to reduce lending next year. Too

much money boosts gross demand, which would translate into inflation." Lou

suggested investors should buy energy and consumer-related stocks which would

benefit from inflation next year, but should avoid property, steel and banking

stocks. But not everyone is cautious on China. Anthony Bolton, a leading UK

asset manager, said he plans to return to managing money next year, with a focus

on China. Bolton, who retired from active fund management in 2007, said he would

move to Hong Kong early next year to manage a new China investment portfolio.

The centre of gravity is shifting to this part of the world and I want to play a

part in it while I can," said Bolton.

Ten

dollars might not be enough for an MTR ride from Causeway Bay to Mong Kok, but

that's all you will pay there for the cheapest Michelin star dish in the world.

Hong Kong has become the home of the world's cheapest Michelin star restaurants

as inexpensive local eateries have earned star status for the first time

in the culinary bible's second Hong Kong and Macau edition. After criticism over

the lack of representation of genuine local gourmet fare and the focus on pricey

restaurants in last year's debut edition, Michelin's four anonymous inspectors -

one English, one French and two Chinese - who worked on this year's guide

appeared to have listened to public opinion. Among the 205 Hong Kong restaurants

selected this year, 78 are new entries. The guide has more than doubled the

number of simple shop restaurants, from last year's 11 to 29. Among the starred

restaurants - two three-stars, eight two-stars and 32 one-star - three one-star

restaurants are the most wallet-friendly. Mong Kok's dim sum outlet Tim Ho Wan,

a first time entry, serves the world's cheapest star dishes. Just HK$10 is

enough for a serving of osmanthus cake, beef balls or turnip cake. The popular

little joint's signature dish, puff pastry with "char siu" filling, costs a mere

HK$12. Mak Kwai-pui, the former dim sum director at three-star restaurant Lung

King Heen, opened Tim Ho Wan after quitting his job in March. The shop sells

2,000 bamboo baskets of dim sum every day. Ten

dollars might not be enough for an MTR ride from Causeway Bay to Mong Kok, but

that's all you will pay there for the cheapest Michelin star dish in the world.

Hong Kong has become the home of the world's cheapest Michelin star restaurants

as inexpensive local eateries have earned star status for the first time

in the culinary bible's second Hong Kong and Macau edition. After criticism over

the lack of representation of genuine local gourmet fare and the focus on pricey

restaurants in last year's debut edition, Michelin's four anonymous inspectors -

one English, one French and two Chinese - who worked on this year's guide

appeared to have listened to public opinion. Among the 205 Hong Kong restaurants

selected this year, 78 are new entries. The guide has more than doubled the

number of simple shop restaurants, from last year's 11 to 29. Among the starred

restaurants - two three-stars, eight two-stars and 32 one-star - three one-star

restaurants are the most wallet-friendly. Mong Kok's dim sum outlet Tim Ho Wan,

a first time entry, serves the world's cheapest star dishes. Just HK$10 is

enough for a serving of osmanthus cake, beef balls or turnip cake. The popular

little joint's signature dish, puff pastry with "char siu" filling, costs a mere

HK$12. Mak Kwai-pui, the former dim sum director at three-star restaurant Lung

King Heen, opened Tim Ho Wan after quitting his job in March. The shop sells

2,000 bamboo baskets of dim sum every day.

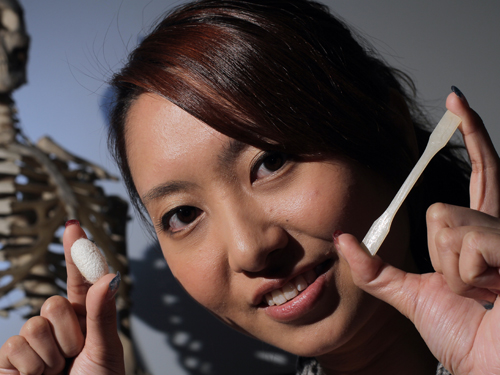

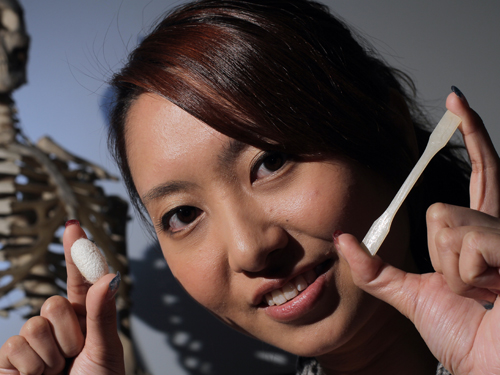

Mak

Kwai-pui shows off one of the HK$10 dishes available at Michelin-starred Tim Ho

Wan. Mak

Kwai-pui shows off one of the HK$10 dishes available at Michelin-starred Tim Ho

Wan.

An injured woman is taken by stretcher

to an ambulance after yesterday's crash. Most of the 41 people injured were able

to go home after receiving treatment. Forty-one people were injured in a rare

accident yesterday when two trams collided head-on at a busy junction in

Causeway Bay on Thursday. The injured, many of them elderly, suffered bruises

and abrasions when they were hurled to the floor by the impact at the junction

of Percival Street and Hennessy Road just before 2.30pm. Police were

investigating whether one of the trams jumped a red light. Only two of the

injured passengers needed to be admitted to hospital. The rest were treated and

sent home. An injured woman is taken by stretcher

to an ambulance after yesterday's crash. Most of the 41 people injured were able

to go home after receiving treatment. Forty-one people were injured in a rare

accident yesterday when two trams collided head-on at a busy junction in

Causeway Bay on Thursday. The injured, many of them elderly, suffered bruises

and abrasions when they were hurled to the floor by the impact at the junction

of Percival Street and Hennessy Road just before 2.30pm. Police were

investigating whether one of the trams jumped a red light. Only two of the

injured passengers needed to be admitted to hospital. The rest were treated and

sent home.

Cheung Kong (Holdings) (SEHK: 0001) will be the first to offer its residential

project in Tseung Kwan O for sale following the government's recently announced

regulations on property sales disclosures. The developer yesterday unveiled the

price list for 33 units at Le Prime, the second phase of the Le Prestige

development, which is being offered at HK$4,659 to HK$5,351 per square foot of

gross floor area. To comply with the new regulations, Cheung Kong also provided

a list of prices based on the saleable area (the internal flat area plus the

balcony and utility platform) that ranged from HK$6,131 to HK$7,067 per square

foot. That is about 30 per cent higher than the price per square foot of gross

floor area that includes common areas. To boost transparency in launches and

sales of unfinished flats, the government last week announced new rules that

require developers to state clearly the price per square foot or metre of

saleable area on the price lists. Other stricter regulations require that

transaction records of individual flats, including the prices and purchase

dates, be made public within five working days after the sale is confirmed,

instead of one month. The new rules also state that floor numbering must be made

very clear on the sales launch brochure, rather than showing it on the reference

page of the sales booklet. In yesterday's sales launch brochure, Cheung Kong

also mentioned nearby structures such as landfills and a sewage treatment plant.

"Basically, buyers do not care about the new price item [based on saleable

area]," said Crystal Tam, a sales director at Centaline Property Agency's Tseung

Kwan O branch. "They talk about clubhouse facilities and the living environment,

rather than the price per square foot of saleable area. When all developers

adopt the same practice, it will probably draw their attention." Agents said the

selling price was close to the secondary market level, with some even charging

less.

Cheung Kong (Holdings) (SEHK: 0001) will be the first to offer its residential

project in Tseung Kwan O for sale following the government's recently announced

regulations on property sales disclosures. The developer yesterday unveiled the

price list for 33 units at Le Prime, the second phase of the Le Prestige

development, which is being offered at HK$4,659 to HK$5,351 per square foot of

gross floor area. To comply with the new regulations, Cheung Kong also provided

a list of prices based on the saleable area (the internal flat area plus the

balcony and utility platform) that ranged from HK$6,131 to HK$7,067 per square

foot. That is about 30 per cent higher than the price per square foot of gross

floor area that includes common areas. To boost transparency in launches and

sales of unfinished flats, the government last week announced new rules that

require developers to state clearly the price per square foot or metre of

saleable area on the price lists. Other stricter regulations require that

transaction records of individual flats, including the prices and purchase

dates, be made public within five working days after the sale is confirmed,

instead of one month. The new rules also state that floor numbering must be made

very clear on the sales launch brochure, rather than showing it on the reference

page of the sales booklet. In yesterday's sales launch brochure, Cheung Kong

also mentioned nearby structures such as landfills and a sewage treatment plant.

"Basically, buyers do not care about the new price item [based on saleable

area]," said Crystal Tam, a sales director at Centaline Property Agency's Tseung

Kwan O branch. "They talk about clubhouse facilities and the living environment,

rather than the price per square foot of saleable area. When all developers

adopt the same practice, it will probably draw their attention." Agents said the

selling price was close to the secondary market level, with some even charging

less.

A headmistress has accused police of breaking their promise not to name her

school after it took part in an undercover anti-drugs operation. The incident

has added to worries about whether information will be divulged of students

participating in the Tai Po drug-testing scheme from December. CCC Kei San

Secondary School in Fan Ling joined the operation, codenamed "Iron Racer," in

which a 24-year-old undercover cop posed as a Secondary Three student. A total

of 36 people, including 23 students, were caught. Principal Joyce Kwok Yin-mei

said police promised to keep all school information confidential because the

operation itself was strictly hush-hush. But newspaper reports published the

school's name after a court hearing on Wednesday of warehouse worker Wong

Chun-kit, 17, who was sentenced to two years and eight months in jail by a

District Court judge. A few newspapers incorrectly reported that those arrested

attended the Fan Ling school. But Kwok said none of the 23 arrested students

were from her school. "[The reports] give a wrong impression to the public that

our school was involved in drug trafficking. Parents might question their

children as well," she said. "Now I regret taking part in the operation. I don't

know if there's any internal miscommunication [in the police]. It's just a big

mess." She urged police to clarify the incident immediately and the media to

apologize for misleading reports. After meeting with police representatives

yesterday, Kwok accepted their apology. For the time being, she will not lodge a

complaint, she said. Senior Superintendent of Crime New Territories North

Headquarters Leung Chin-wah confirmed that none of those arrested were students

at Kei San - but he did not say if there was any confidentiality agreement with

the school. "We will form a team to investigate if the information was revealed

by police or other parties, and we will cooperate with the school," he said.

Chairman of Hong Kong Police Inspectors' Association Tony Liu Kit- ming said all

undercover actions are strictly confidential. Commissioner for Narcotics Sally

Wong Pik-yee said the government has no restrictions against the media divulging

school information unless there are special circumstances.

A headmistress has accused police of breaking their promise not to name her

school after it took part in an undercover anti-drugs operation. The incident

has added to worries about whether information will be divulged of students

participating in the Tai Po drug-testing scheme from December. CCC Kei San

Secondary School in Fan Ling joined the operation, codenamed "Iron Racer," in

which a 24-year-old undercover cop posed as a Secondary Three student. A total

of 36 people, including 23 students, were caught. Principal Joyce Kwok Yin-mei

said police promised to keep all school information confidential because the

operation itself was strictly hush-hush. But newspaper reports published the

school's name after a court hearing on Wednesday of warehouse worker Wong

Chun-kit, 17, who was sentenced to two years and eight months in jail by a

District Court judge. A few newspapers incorrectly reported that those arrested

attended the Fan Ling school. But Kwok said none of the 23 arrested students

were from her school. "[The reports] give a wrong impression to the public that

our school was involved in drug trafficking. Parents might question their

children as well," she said. "Now I regret taking part in the operation. I don't

know if there's any internal miscommunication [in the police]. It's just a big

mess." She urged police to clarify the incident immediately and the media to

apologize for misleading reports. After meeting with police representatives

yesterday, Kwok accepted their apology. For the time being, she will not lodge a

complaint, she said. Senior Superintendent of Crime New Territories North

Headquarters Leung Chin-wah confirmed that none of those arrested were students

at Kei San - but he did not say if there was any confidentiality agreement with

the school. "We will form a team to investigate if the information was revealed

by police or other parties, and we will cooperate with the school," he said.

Chairman of Hong Kong Police Inspectors' Association Tony Liu Kit- ming said all

undercover actions are strictly confidential. Commissioner for Narcotics Sally

Wong Pik-yee said the government has no restrictions against the media divulging

school information unless there are special circumstances.

Hong Kong children risk becoming obese

because they sleep an hour less than children in developed countries, according

to a study. A Chinese University survey of 1,159 children aged between five and

15 in 13 primary schools shows children sleep, on average, nine hours a day

compared with the healthy norm of 10 hours. The study also indicates

insufficient sleep may lead to obesity. In general, local children go to bed

around 10pm and wake up between 7am and 7.30am on weekdays. They sleep about one

to 1.5 hours more during weekends and holidays. About 6 percent go to bed around

midnight. Psychiatry professor Wing Yun-kwok said children between five and 12

should get at least 10 hours' sleep, while those aged 16 or above need eight

hours. To ensure children get adequate sleep, he suggests schools start classes

up to one hour later. Wing also advises parents to ensure the duration of their

children's sleep is consistent. The university said children who regularly sleep

less than the norm are three times more likely to become overweight. Hong Kong children risk becoming obese

because they sleep an hour less than children in developed countries, according

to a study. A Chinese University survey of 1,159 children aged between five and

15 in 13 primary schools shows children sleep, on average, nine hours a day

compared with the healthy norm of 10 hours. The study also indicates

insufficient sleep may lead to obesity. In general, local children go to bed

around 10pm and wake up between 7am and 7.30am on weekdays. They sleep about one

to 1.5 hours more during weekends and holidays. About 6 percent go to bed around

midnight. Psychiatry professor Wing Yun-kwok said children between five and 12

should get at least 10 hours' sleep, while those aged 16 or above need eight

hours. To ensure children get adequate sleep, he suggests schools start classes

up to one hour later. Wing also advises parents to ensure the duration of their

children's sleep is consistent. The university said children who regularly sleep

less than the norm are three times more likely to become overweight.

Gruesome animation based on

real-life violence and sex crimes on a newspaper website is causing outrage.

Parents and women's organizations are particularly worried about online content

offered by Hong Kong media mogul Jimmy Lai Chi-ying. Matters came to a head

yesterday for the second time this week as the Taipei city government levied a

NT$1 million (HK$240,000) penalty on Taiwan Apple Daily and banned its

distribution to all secondary and primary schools, citing over-explicit coverage

of violent crime in its animated news service. And readers must be at least 18

to view copies in public libraries. The paper was fined NT$500,000 on Monday

after complaints, and Taipei's Mayor Hau Lung-bin warned that fines will

continue to be imposed until there is a change for the better. "Although the

most controversial parts have been removed, some descriptions on what happened

during a sexual assault could still be seen in the animated news service," Hau

said yesterday after imposing the additional fine. But animations of a gang

murder, a traffic accident and a female student being sexually assaulted remain

on the Taiwan Apple Daily website. In Hong Kong yesterday, the Apple Daily

website depicted horrific abuse suffered by an infant, with a depiction of a

21-year throwing heavy punches. The animation effort was launched on November

16, and a clamor for it to be pulled started almost immediately. Gruesome animation based on

real-life violence and sex crimes on a newspaper website is causing outrage.

Parents and women's organizations are particularly worried about online content

offered by Hong Kong media mogul Jimmy Lai Chi-ying. Matters came to a head

yesterday for the second time this week as the Taipei city government levied a

NT$1 million (HK$240,000) penalty on Taiwan Apple Daily and banned its

distribution to all secondary and primary schools, citing over-explicit coverage

of violent crime in its animated news service. And readers must be at least 18

to view copies in public libraries. The paper was fined NT$500,000 on Monday

after complaints, and Taipei's Mayor Hau Lung-bin warned that fines will

continue to be imposed until there is a change for the better. "Although the

most controversial parts have been removed, some descriptions on what happened

during a sexual assault could still be seen in the animated news service," Hau

said yesterday after imposing the additional fine. But animations of a gang

murder, a traffic accident and a female student being sexually assaulted remain

on the Taiwan Apple Daily website. In Hong Kong yesterday, the Apple Daily

website depicted horrific abuse suffered by an infant, with a depiction of a

21-year throwing heavy punches. The animation effort was launched on November

16, and a clamor for it to be pulled started almost immediately.

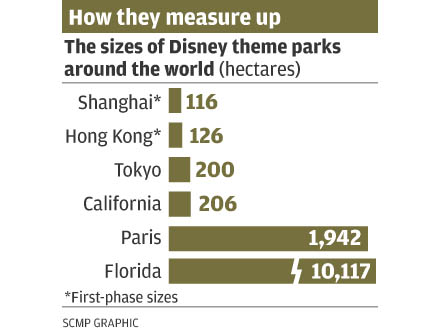

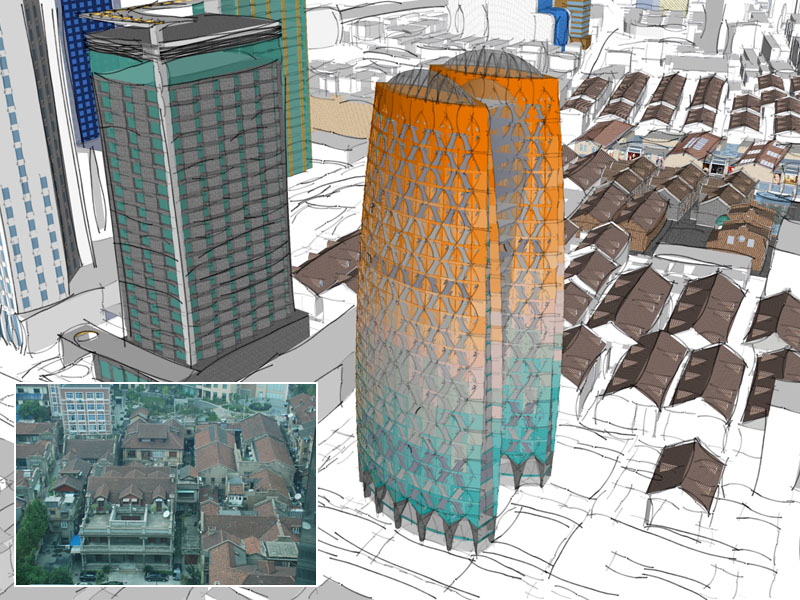

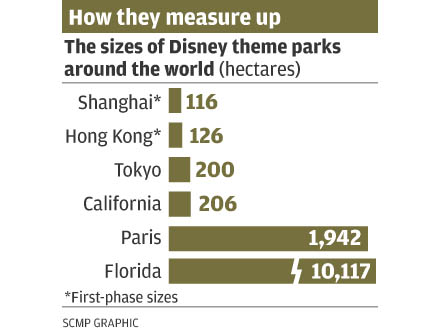

China*: Shanghai

authorities, already in a tailspin following confirmation that the city's

Shanghai Disneyland is to be the smallest of the entertainment giant's six theme

parks worldwide, have received a fresh blow, with the National Development and

Reform Commission appearing to rule out any hope of future expansion. The city

government is remaining tight-lipped over the size of the site reserved for the

theme park after the project was confirmed this week to be less than a third of

its expected size. The NDRC announced on Monday that the project would be

allotted a 116-hectare site. That first official confirmation put the size of

the project at less than 30 per cent of the 400-plus-hectare plot the Shanghai

government has set aside in Chuansha, a semi-rural suburb close to Pudong

International Airport. There has been speculation that the reduced size in the

NDRC announcement refers only to the first phase of the project. A Pudong

government official told the South China Morning Post (SEHK: 0583,

announcements, news) this week that there would be two further phases, with the

park ultimately being larger than the one in Hong Kong. However, Shanghai's

Oriental Morning Post quoted an NDRC official as saying: "I'm not clear what you

mean by first phase, second phase or third phase. This [116 hectares] is the

area of the site for the project." The project has been on the negotiating table

for more than a decade, and the announcement three weeks ago that it had finally

been given the go-ahead was heralded as a triumph by local media. But then came

the news that the site is actually 10 hectares smaller than Hong Kong Disneyland

- currently the smallest - which turned a public relations coup into a major

embarrassment. No official explanation has been offered as to the massive

discrepancy between the two sizes - or how the rest of the set-aside land will

be used. Queries to the Shanghai municipal government this week were directed to

the Pudong district administration. "A lot of media have been asking about the

project's size, but the whole matter is being handled by them. We cannot comment

on the situation," a municipal spokeswoman said yesterday. However, Pudong

district also professed total ignorance. "We only found out about the size of

the project from the internet," a district spokeswoman said yesterday. "At

present, we have no new information." The spokeswoman also declined to confirm

the current status of the Chuansha plot and whether demolition work had begun.

Local media has reported that work began in recent weeks to clear "temporary

construction" in the district, apparently put up by land owners in an attempt to

boost property compensation payments. Local residents told the South China

Morning Post, however, they had received no formal notification about the Disney

project and had not entered into negotiations with the government about

compensation. Media reports have said the park is projected to open in 2013 or

2014. A Walt Disney spokesman said final details of the project - including

size, facilities and its completion date - were still being negotiated with the

Shanghai government. "At the moment we have no new information to add," he said.

"We hope that we will be able to announce further details within the next few

months."

China*: Shanghai

authorities, already in a tailspin following confirmation that the city's

Shanghai Disneyland is to be the smallest of the entertainment giant's six theme

parks worldwide, have received a fresh blow, with the National Development and

Reform Commission appearing to rule out any hope of future expansion. The city

government is remaining tight-lipped over the size of the site reserved for the

theme park after the project was confirmed this week to be less than a third of

its expected size. The NDRC announced on Monday that the project would be

allotted a 116-hectare site. That first official confirmation put the size of

the project at less than 30 per cent of the 400-plus-hectare plot the Shanghai

government has set aside in Chuansha, a semi-rural suburb close to Pudong

International Airport. There has been speculation that the reduced size in the

NDRC announcement refers only to the first phase of the project. A Pudong

government official told the South China Morning Post (SEHK: 0583,

announcements, news) this week that there would be two further phases, with the

park ultimately being larger than the one in Hong Kong. However, Shanghai's

Oriental Morning Post quoted an NDRC official as saying: "I'm not clear what you

mean by first phase, second phase or third phase. This [116 hectares] is the

area of the site for the project." The project has been on the negotiating table

for more than a decade, and the announcement three weeks ago that it had finally

been given the go-ahead was heralded as a triumph by local media. But then came

the news that the site is actually 10 hectares smaller than Hong Kong Disneyland

- currently the smallest - which turned a public relations coup into a major

embarrassment. No official explanation has been offered as to the massive

discrepancy between the two sizes - or how the rest of the set-aside land will

be used. Queries to the Shanghai municipal government this week were directed to