|

Newsletter

Seminar Material

Biz:

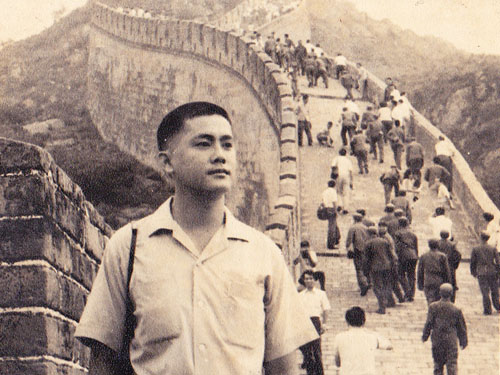

China

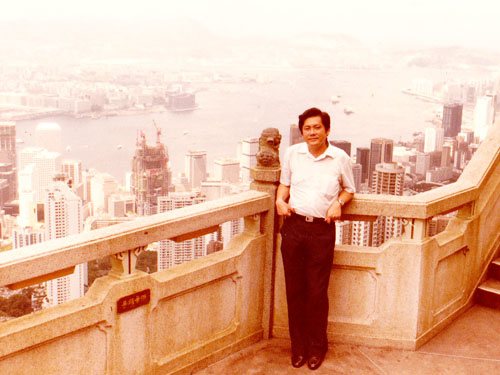

Hong

Kong Hawaii

What people

said about us

China

Earthquake Relief

Tax &

Government

Hawaii Voter Registration

Biz-Video

Biz-Video

Hawaii's

China Connection Hawaii's

China Connection

CDP#1780962

CDP#1780962

Doing Business in

Hong Kong & China

Doing Business in

Hong Kong & China

| |

Hong Kong, China & Hawaii Biz*

Skype - FREE

Voice Over IP Skype - FREE

Voice Over IP  View Hawaii's China Connection

Video Trailer

View Hawaii's China Connection

Video Trailer

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our event page to find out more!

After

attended a China/Hong Kong Business/Trade Seminar in Hawaii...still unsure what

to do next, contact us, our Officers, Directors and Founding Members are

actively engaged in China/Hong Kong/Asia trade - we can help!

Are you ready to export your product or

service? You will find out in 3 minutes with resources to help you -

enter

to give it a try

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

(approximate $ exchange rates: US$1 = HK$7.8, US$1 = RMB$6.8)

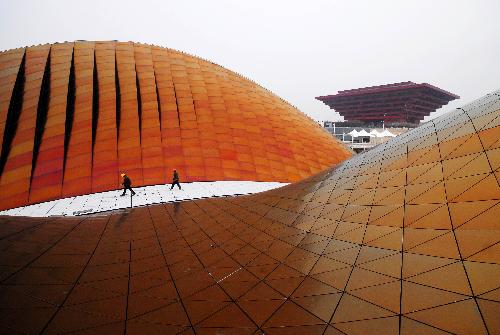

View China 60th

Anniversary Video and Photo online View China 60th

Anniversary Video and Photo online

Chinese New Year - Year of the Tiger

- February 14 2010

Chinese New Year - Year of the Tiger

- February 14 2010

Holidays Greeting from President Obama & Johnson Choi

Holidays Greeting from President Obama & Johnson Choi

http://www.youtube.com/watch?v=pNk4Z4lUV-k

http://www.youtube.com/watch?v=pNk4Z4lUV-k

http://www.facebook.com/video/video.php?v=219896871983&ref=mf

http://www.facebook.com/video/video.php?v=219896871983&ref=mf

Feb 28, 2010

Hong Kong*:

Hong Kong’s Chow Tai Fook Jewellery Co has paid US$35.3 million for a 507-carat

diamond, breaking a record as the highest price ever paid for a rough diamond. Hong Kong*:

Hong Kong’s Chow Tai Fook Jewellery Co has paid US$35.3 million for a 507-carat

diamond, breaking a record as the highest price ever paid for a rough diamond.

Manulife (International), the regional arm of Manulife Financial (0945), is

looking to sell yuan-denominated policies, but there is not yet a timetable and

it is subject to the regulators' approval. Manulife (International) Hong Kong

chief executive Michael Huddart said the company hopes to tap the yuan-related

business through the Qualified Foreign Institutional Investor license, but the

size and capital involved will be modest. Commenting on rival Zurich Life and

AXA introducing the franchise model to expand their distribution network in Hong

Kong, Huddart said the model has had a sparse impact on the local insurance

market. Manulife plans to boost agent manpower to 5,000 this year from the 4,443

agents as at December 31. Manulife owns 17 percent of Hong Kong's Mandatory

Provident Fund market, with assets of HK$52.55 billion. The Hong Kong insurer

posted a record net income of HK$3.05 billion last year, 53 percent higher than

2008. Funds under management surged 40 percent to HK$165 billion last year due

to the rebound in stock markets.

Manulife (International), the regional arm of Manulife Financial (0945), is

looking to sell yuan-denominated policies, but there is not yet a timetable and

it is subject to the regulators' approval. Manulife (International) Hong Kong

chief executive Michael Huddart said the company hopes to tap the yuan-related

business through the Qualified Foreign Institutional Investor license, but the

size and capital involved will be modest. Commenting on rival Zurich Life and

AXA introducing the franchise model to expand their distribution network in Hong

Kong, Huddart said the model has had a sparse impact on the local insurance

market. Manulife plans to boost agent manpower to 5,000 this year from the 4,443

agents as at December 31. Manulife owns 17 percent of Hong Kong's Mandatory

Provident Fund market, with assets of HK$52.55 billion. The Hong Kong insurer

posted a record net income of HK$3.05 billion last year, 53 percent higher than

2008. Funds under management surged 40 percent to HK$165 billion last year due

to the rebound in stock markets.

Jacky Cheung introduces Crossing

Hennessy, a romantic comedy in which he stars that is one of two local films

opening the film festival. With the budget having put funding for arts groups on

a surer footing, lovers of culture can expect to see more world-class shows in

the coming few years leading up to the launch of the West Kowloon Cultural

District. The arts community welcomed the additional funding, news of which came

on the eve of two of the city's cultural high points: the Hong Kong Arts

Festival, which began yesterday, and the Hong Kong International Film Festival,

the line-up for which was announced yesterday. They had been fearing a cut in

funding this year while the government reviews its criteria for funding the

arts. Representatives of some of the nine major arts groups subsidised by the

government said the promise of an additional HK$486 million over five years - to

allow groups and artists to develop signature performances - would allow them to

plan over a longer term and secure for Hong Kong big-name performers who need

booking a few years in advance. The money is in addition to annual funding which

in the 2009-10 financial year was expected to total HK$272.5 million. Although

the government has yet to say how the additional funds will be split between the

groups, Chan Kin-bun, executive director of the Hong Kong Repertory Theatre,

says it will allow for longer-term planning. "Now we can make plans for our

development in the next five years," Chan said. "Some artists, such as famous

musicians or soloists, you have to book them three to four years in advance. If

we want to invite world-class theatre directors to work with us, we need to make

arrangements two to three years in advance. We are more confident about doing

this now with the extra funding." Chan said the money would also help groups

keep artists in full-time work, which would help the development of signature

performances. Katy Cheng, marketing director of the Arts Festival, said it was

normal to book performances featuring top artists three to four years in

advance. The additional funding would help with planning of the festival and

foster the the growth of the whole sector. As well as big groups, smaller ones

and independent artists would benefit, she said. Cheng said that up to

yesterday, 90 per cent of the 93,000 tickets for the festival's 116 performances

had been sold, up from 88 per cent at the same point last year. Half the

performances have sold out. Meanwhile, organisers of the Hong Kong International

Film Festival announced Roman Polanski's latest film, The Ghost Writer, which

won the Silver Bear for best director at the Berlin International Film Festival

this week, will be added to this year's line-up of films, which includes two by

Hong Kong women directors that will open the festival. They are Ivy Ho Pik-man's

Crossing Hennessy and Clara Law's Like a Dream. The festival will feature 70

local films, 30 per cent more than last year. It will also feature a 12-film

retrospective of the work of Greek director, and Palme d'Or winner at the Cannes

festival, Theo Angelopoulos. The festival runs from March 21 to April 6. Advance

online and postal booking opens on February 28. Jacky Cheung introduces Crossing

Hennessy, a romantic comedy in which he stars that is one of two local films

opening the film festival. With the budget having put funding for arts groups on

a surer footing, lovers of culture can expect to see more world-class shows in

the coming few years leading up to the launch of the West Kowloon Cultural

District. The arts community welcomed the additional funding, news of which came

on the eve of two of the city's cultural high points: the Hong Kong Arts

Festival, which began yesterday, and the Hong Kong International Film Festival,

the line-up for which was announced yesterday. They had been fearing a cut in

funding this year while the government reviews its criteria for funding the

arts. Representatives of some of the nine major arts groups subsidised by the

government said the promise of an additional HK$486 million over five years - to

allow groups and artists to develop signature performances - would allow them to

plan over a longer term and secure for Hong Kong big-name performers who need

booking a few years in advance. The money is in addition to annual funding which

in the 2009-10 financial year was expected to total HK$272.5 million. Although

the government has yet to say how the additional funds will be split between the

groups, Chan Kin-bun, executive director of the Hong Kong Repertory Theatre,

says it will allow for longer-term planning. "Now we can make plans for our

development in the next five years," Chan said. "Some artists, such as famous

musicians or soloists, you have to book them three to four years in advance. If

we want to invite world-class theatre directors to work with us, we need to make

arrangements two to three years in advance. We are more confident about doing

this now with the extra funding." Chan said the money would also help groups

keep artists in full-time work, which would help the development of signature

performances. Katy Cheng, marketing director of the Arts Festival, said it was

normal to book performances featuring top artists three to four years in

advance. The additional funding would help with planning of the festival and

foster the the growth of the whole sector. As well as big groups, smaller ones

and independent artists would benefit, she said. Cheng said that up to

yesterday, 90 per cent of the 93,000 tickets for the festival's 116 performances

had been sold, up from 88 per cent at the same point last year. Half the

performances have sold out. Meanwhile, organisers of the Hong Kong International

Film Festival announced Roman Polanski's latest film, The Ghost Writer, which

won the Silver Bear for best director at the Berlin International Film Festival

this week, will be added to this year's line-up of films, which includes two by

Hong Kong women directors that will open the festival. They are Ivy Ho Pik-man's

Crossing Hennessy and Clara Law's Like a Dream. The festival will feature 70

local films, 30 per cent more than last year. It will also feature a 12-film

retrospective of the work of Greek director, and Palme d'Or winner at the Cannes

festival, Theo Angelopoulos. The festival runs from March 21 to April 6. Advance

online and postal booking opens on February 28.

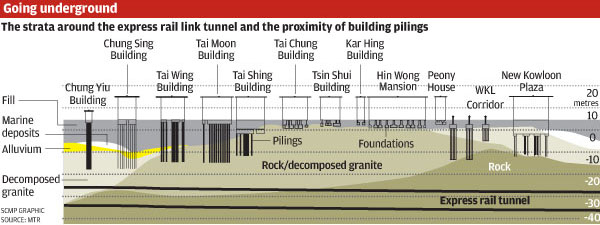

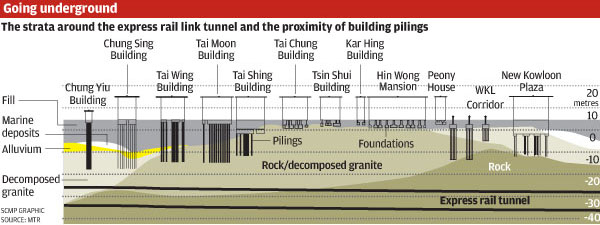

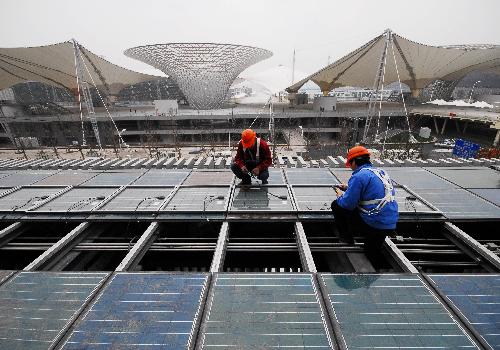

Secretary for Development Carrie Lam Cheng

Yuet-ngor said on Friday the government would provide new subsidies for training

courses to attract young workers to the construction industry. Lam said each

person taking the courses would receive a monthly subsidy of HK$5,000. On

finishing a course, a job with minimum salary of HK$8,000 per month would be

guaranteed for six months, she said. If trainees perform well, they can expected

to receive a minimum salary of HK$10,000 per month for a six month period. The

Development Bureau estimated the subsidies could attract 6,000 workers to the

training courses within three years. Lam said that government’s HK$49.6-billion

investment in infrastructure could create 62,500 jobs this financial year. “This

would boost the confidence of the construction industry,” she added. Among the

62,500 construction jobs, 6,600 will require professional skills and the

remaining 55,900 are for general workers. This is an overall increase of 15,400

jobs compared with last year. The unemployment rate for the industry in January

was 7.4 per cent, a year-on-year decreased of 5.3 per cent from last January

when it stood at 12.7 per cent. The increase in construction jobs is mainly due

to new infrastructure projects. They include the Kai Tak Cruise Terminal

Building, the Hong Kong-Zhuhai-Macau Bridge boundary crossing facilities and

other projects. Permanent Secretary for Development Mak Chai-kwong said the

industry still faced challenges. “There is an ageing problem and a misallocation

of human resources in the construction industry,” he said. There is also a need

for skilled workers to work on these new infrastructure projects. Among 278,100

registered workers, 60 per cent are registered as unskilled, Mak noted. Lam said

providing uniforms for construction workers and improving the work environment

might also attract young people. “We will hire local workers. We do not want to

import external workers if possible,” she said. Construction Industry Council

chairman Lee Shing-lee said he welcomed the government’s new measures. Secretary for Development Carrie Lam Cheng

Yuet-ngor said on Friday the government would provide new subsidies for training

courses to attract young workers to the construction industry. Lam said each

person taking the courses would receive a monthly subsidy of HK$5,000. On

finishing a course, a job with minimum salary of HK$8,000 per month would be

guaranteed for six months, she said. If trainees perform well, they can expected

to receive a minimum salary of HK$10,000 per month for a six month period. The

Development Bureau estimated the subsidies could attract 6,000 workers to the

training courses within three years. Lam said that government’s HK$49.6-billion

investment in infrastructure could create 62,500 jobs this financial year. “This

would boost the confidence of the construction industry,” she added. Among the

62,500 construction jobs, 6,600 will require professional skills and the

remaining 55,900 are for general workers. This is an overall increase of 15,400

jobs compared with last year. The unemployment rate for the industry in January

was 7.4 per cent, a year-on-year decreased of 5.3 per cent from last January

when it stood at 12.7 per cent. The increase in construction jobs is mainly due

to new infrastructure projects. They include the Kai Tak Cruise Terminal

Building, the Hong Kong-Zhuhai-Macau Bridge boundary crossing facilities and

other projects. Permanent Secretary for Development Mak Chai-kwong said the

industry still faced challenges. “There is an ageing problem and a misallocation

of human resources in the construction industry,” he said. There is also a need

for skilled workers to work on these new infrastructure projects. Among 278,100

registered workers, 60 per cent are registered as unskilled, Mak noted. Lam said

providing uniforms for construction workers and improving the work environment

might also attract young people. “We will hire local workers. We do not want to

import external workers if possible,” she said. Construction Industry Council

chairman Lee Shing-lee said he welcomed the government’s new measures.

The developer of

a low density housing project in Yuen Long is under fire again for filling in

part of three fish ponds that are zoned as wetland conservation areas. The

ponds, outside the boundary of the Wo Shang Wai development, have been filled

with soil in what Henderson Land (SEHK: 0012) calls a "temporary solution" to

allow hoardings to be put up around the site to protect the ecology. But the

work worried a resident in Palm Spring, who accuses the developer of not taking

steps to minimise disturbance. Up to 50 rare black-faced spoonbills regularly

visited the ponds earlier this month. Nine days ago three excavators and eight

trucks were working near one of the ponds, while a flock of birds, including

spoonbills, were feeding at another pond. The resident, Daphne Ma Ngar-yin, has

filed a complaint with the Environmental Protection Department in which she

questions whether the filling-in work is legal and whether planning rules had

been breached. She has previously complained of construction noise frightening

away the birds. Under town planning laws, approval is needed in advance to fill

fish ponds. In some cases such work is strictly forbidden. A spokeswoman for the

Planning Department said yesterday it was still gathering details about the

case. Ma said: "I am concerned that this filling-in work has caused a direct

reduction in the wetland conservation area, which is part of the important

wetland habitat of the Mai Po reserve for migratory birds." Ma said the

department should say whether penalties could be imposed on developers who

damage such sites and the developer should be more transparent about its work

and communicate with residents. A spokeswoman for the developer said it had to

fill part of the ponds to consolidate the banks so that the hoardings could be

firmly built. "This is rather an unforeseeable move that we have to take

temporarily for the construction of the hoardings. Once the hoardings are built,

we will dig out the [filling] material," she said. The hoardings are part of the

requirements of an environmental impact assessment for the project and have to

be in place before actual construction starts next month. More than 170 low-rise

houses and 180 duplex units in four-storey buildings will be built on the

21-hectare site. About 4.7 hectares of land will be restored to wetland

afterwards. The spokeswoman said the developer had an "understanding" with the

pond owners and the environment department was "aware of" the temporary move.

However, she could not say if a formal application for filling the ponds had

been lodged with the Planning Department. To ease concerns about the threatened

spoonbills, she said they had hired an ecological consultant to monitor the

birds. "If they have found the birds were around and the work might impact them,

the contractor might be advised to stop the work or move their machinery farther

away from the work," she said. The spokeswoman stressed the spoonbills were only

attracted to the ponds because the water level had been lowered and fish were

exposed to the birds. She said it was not usually a hot spot for the birds to

winter. A spokesman for the environment department did not directly comment on

the complaint. He only said they had started to investigate the complaint and

would follow up with the developer. He said the developer was required to meet

conditions laid down in the environmental permit issued it in September 2008,

including setting up a wetland restoration area before houses were built and

minimizing disturbances to the ecology by erecting hoardings and barriers. The developer of

a low density housing project in Yuen Long is under fire again for filling in

part of three fish ponds that are zoned as wetland conservation areas. The

ponds, outside the boundary of the Wo Shang Wai development, have been filled

with soil in what Henderson Land (SEHK: 0012) calls a "temporary solution" to

allow hoardings to be put up around the site to protect the ecology. But the

work worried a resident in Palm Spring, who accuses the developer of not taking

steps to minimise disturbance. Up to 50 rare black-faced spoonbills regularly

visited the ponds earlier this month. Nine days ago three excavators and eight

trucks were working near one of the ponds, while a flock of birds, including

spoonbills, were feeding at another pond. The resident, Daphne Ma Ngar-yin, has

filed a complaint with the Environmental Protection Department in which she

questions whether the filling-in work is legal and whether planning rules had

been breached. She has previously complained of construction noise frightening

away the birds. Under town planning laws, approval is needed in advance to fill

fish ponds. In some cases such work is strictly forbidden. A spokeswoman for the

Planning Department said yesterday it was still gathering details about the

case. Ma said: "I am concerned that this filling-in work has caused a direct

reduction in the wetland conservation area, which is part of the important

wetland habitat of the Mai Po reserve for migratory birds." Ma said the

department should say whether penalties could be imposed on developers who

damage such sites and the developer should be more transparent about its work

and communicate with residents. A spokeswoman for the developer said it had to

fill part of the ponds to consolidate the banks so that the hoardings could be

firmly built. "This is rather an unforeseeable move that we have to take

temporarily for the construction of the hoardings. Once the hoardings are built,

we will dig out the [filling] material," she said. The hoardings are part of the

requirements of an environmental impact assessment for the project and have to

be in place before actual construction starts next month. More than 170 low-rise

houses and 180 duplex units in four-storey buildings will be built on the

21-hectare site. About 4.7 hectares of land will be restored to wetland

afterwards. The spokeswoman said the developer had an "understanding" with the

pond owners and the environment department was "aware of" the temporary move.

However, she could not say if a formal application for filling the ponds had

been lodged with the Planning Department. To ease concerns about the threatened

spoonbills, she said they had hired an ecological consultant to monitor the

birds. "If they have found the birds were around and the work might impact them,

the contractor might be advised to stop the work or move their machinery farther

away from the work," she said. The spokeswoman stressed the spoonbills were only

attracted to the ponds because the water level had been lowered and fish were

exposed to the birds. She said it was not usually a hot spot for the birds to

winter. A spokesman for the environment department did not directly comment on

the complaint. He only said they had started to investigate the complaint and

would follow up with the developer. He said the developer was required to meet

conditions laid down in the environmental permit issued it in September 2008,

including setting up a wetland restoration area before houses were built and

minimizing disturbances to the ecology by erecting hoardings and barriers.

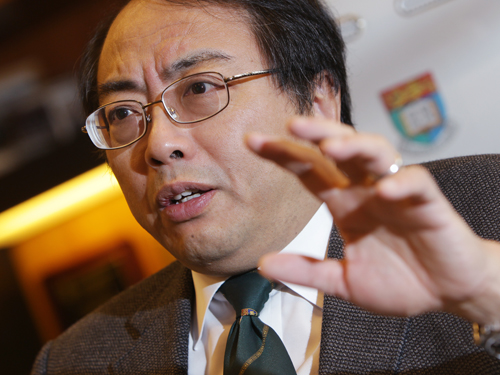

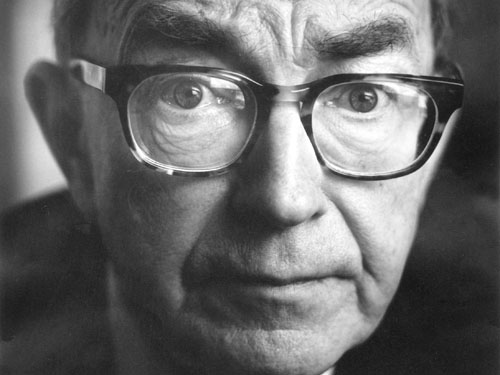

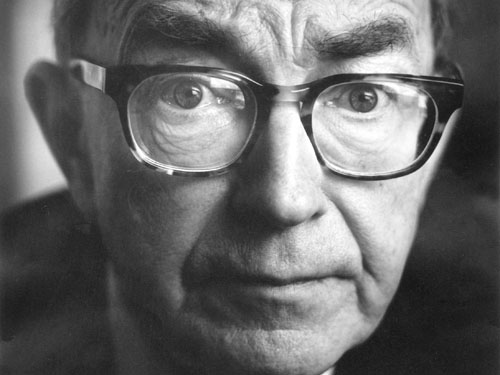

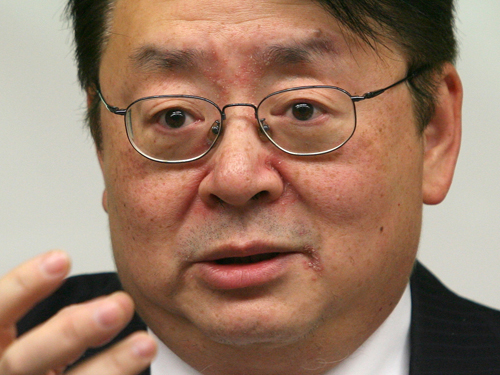

The United States' former de facto envoy

to Taiwan was named yesterday as the new US consul general in Hong Kong.

Ambassador Stephen Young (pictured), who served as director of the American

Institute in Taiwan between 2006 and last year, fills the position vacated by

Joseph Donovan in August. Donovan left Hong Kong a year into office to become

principal deputy assistant secretary of state, one of Washington's key envoys

dealing with East Asian affairs. Young, who will take up office next month, has

extensive experience in Chinese affairs. Born in Washington, he spent two years

of his childhood in the Taiwanese port city of Kaohsiung. He was educated at

Wesleyan University and later the University of Chicago, where he received a

master's degree and PhD in history. Since joining the State Department in 1980,

Young has held positions including director of the office of Chinese and

Mongolian affairs, and headed offices responsible for Pakistan, Afghanistan and

Bangladesh. He was ambassador to Kyrgyzstan Republic from 2003 to 2005. He has

been posted to Beijing and twice to Moscow. Most recently, he was a faculty

member at the National Defense University's Industrial College of the Armed

Forces in Washington. During his time as de facto envoy in Taiwan, Young saw the

downfall of former president Chen Shui-bian and the warming of ties between

Beijing and Taipei after Ma Ying-jeou took power. A fluent Putonghua speaker,

Young is married to Barbara Finamore, a lawyer who heads the China program at

the US Natural Resources Defence Council. Some Hong Kong politicians considered

the extended delay in filling the vacancy a reason why the US consulate has

taken a relatively low profile in the recent debate over constitutional reform.

But they did not expect any major policy change with the arrival of the new

consul general, pointing to the delicate relations between Washington and

Beijing. The United States' former de facto envoy

to Taiwan was named yesterday as the new US consul general in Hong Kong.

Ambassador Stephen Young (pictured), who served as director of the American

Institute in Taiwan between 2006 and last year, fills the position vacated by

Joseph Donovan in August. Donovan left Hong Kong a year into office to become

principal deputy assistant secretary of state, one of Washington's key envoys

dealing with East Asian affairs. Young, who will take up office next month, has

extensive experience in Chinese affairs. Born in Washington, he spent two years

of his childhood in the Taiwanese port city of Kaohsiung. He was educated at

Wesleyan University and later the University of Chicago, where he received a

master's degree and PhD in history. Since joining the State Department in 1980,

Young has held positions including director of the office of Chinese and

Mongolian affairs, and headed offices responsible for Pakistan, Afghanistan and

Bangladesh. He was ambassador to Kyrgyzstan Republic from 2003 to 2005. He has

been posted to Beijing and twice to Moscow. Most recently, he was a faculty

member at the National Defense University's Industrial College of the Armed

Forces in Washington. During his time as de facto envoy in Taiwan, Young saw the

downfall of former president Chen Shui-bian and the warming of ties between

Beijing and Taipei after Ma Ying-jeou took power. A fluent Putonghua speaker,

Young is married to Barbara Finamore, a lawyer who heads the China program at

the US Natural Resources Defence Council. Some Hong Kong politicians considered

the extended delay in filling the vacancy a reason why the US consulate has

taken a relatively low profile in the recent debate over constitutional reform.

But they did not expect any major policy change with the arrival of the new

consul general, pointing to the delicate relations between Washington and

Beijing.

Former Macau chief executive Edmund Ho Hau-wah looks likely to follow in Tung

Chee-hwa's footsteps. It has been rumored widely that Ho, 55, who ran Macau

between December 1999 and 2009, will become a vice chairman of the National

Committee of the Chinese People's Political Consultative Conference. Zhao

Qizheng, spokesman for the National Committee of the CPPCC, refused to comment

in Beijing on the possible appointment, only saying suitable candidates must be

influential and representative. Chan Wing-kee, a standing committee member of

the CPPCC, said he has not heard anything concrete about the appointment, but he

personally believes Ho would be a suitable candidate and worthy of support. Chan

said Ho had contributed a lot to Macau during the last 10 years, making the

former Portuguese enclave an international city and bringing wealth to its

people. He had earlier praised Ho's success in implementing the legislation on

Article 23 of the Basic Law. Currently, Ma Man-kei is the only Macau member who

is a vice chairman of the national committee. But Chan said Hong Kong used to

have two vice chairmen at the same time, which created no issue. The CPPCC

standing committee members are expected to discuss whether they will have new

delegates during a meeting from today until Sunday. A list of new delegates

nationwide will be endorsed by the standing committee early next month. If the

former Macau CE is on the list, it will bring him a step closer to becoming vice

chairman of the top advisory body. Former Hong Kong CE Tung Chee- hwa's name was

listed in March 2005, shortly before his appointment as vice chairman was

confirmed. But his appointment was followed by his resignation as CE on March

10, 2005, citing health problems.

Former Macau chief executive Edmund Ho Hau-wah looks likely to follow in Tung

Chee-hwa's footsteps. It has been rumored widely that Ho, 55, who ran Macau

between December 1999 and 2009, will become a vice chairman of the National

Committee of the Chinese People's Political Consultative Conference. Zhao

Qizheng, spokesman for the National Committee of the CPPCC, refused to comment

in Beijing on the possible appointment, only saying suitable candidates must be

influential and representative. Chan Wing-kee, a standing committee member of

the CPPCC, said he has not heard anything concrete about the appointment, but he

personally believes Ho would be a suitable candidate and worthy of support. Chan

said Ho had contributed a lot to Macau during the last 10 years, making the

former Portuguese enclave an international city and bringing wealth to its

people. He had earlier praised Ho's success in implementing the legislation on

Article 23 of the Basic Law. Currently, Ma Man-kei is the only Macau member who

is a vice chairman of the national committee. But Chan said Hong Kong used to

have two vice chairmen at the same time, which created no issue. The CPPCC

standing committee members are expected to discuss whether they will have new

delegates during a meeting from today until Sunday. A list of new delegates

nationwide will be endorsed by the standing committee early next month. If the

former Macau CE is on the list, it will bring him a step closer to becoming vice

chairman of the top advisory body. Former Hong Kong CE Tung Chee- hwa's name was

listed in March 2005, shortly before his appointment as vice chairman was

confirmed. But his appointment was followed by his resignation as CE on March

10, 2005, citing health problems.

Hong Kong factory owners on the

mainland say they are desperate for migrant workers as millions so far have yet

to return following the Lunar New Year break.

Taiwan will allow brokerages and

retail investors to buy Hong Kong red chip shares directly in a further easing

of business ties with mainland, authorities said in Taipei.

Macau's famous Ho clan will take center stage today when the divorce tussle

between Michael Hotung and former TVB actress Katie Chan Fok-sang goes to court.

Hotung is the son of Winnie Ho Yuen-ki, the estranged sister of gaming tycoon

Stanley Ho Hung-sun. Chan and Hotung are expected to appear at the family court

in Wan Chai, but have the right to be represented by their lawyers without

showing up. The case is scheduled to be heard privately before Judge Chan Chan-kok

this afternoon. Custody of the couple's 15-year-old daughter and 12-year-old

son, as well as alimony payments, are believed to be at the center of their

legal argument. Chan filed for divorce last year in a bid to end her 20-year

marriage to Hotung, citing his "unreasonable behavior." The news shocked Hong

Kong as the pair appeared to be a perfect couple in public. In December, Chan

held a press conference and revealed that Hotung's lawyer had demanded she

return three diamond rings or face a lawsuit. But Chan said she would rather go

to court, if only to find out why Hotung wants the rings back. The former

actress also said she doesn't know where her mother-in-law is, because Hotung

would not allow her to meet Winnie Ho. "I tried to see her but Michael wouldn't

allow it. He even told the maids not to pass my phone calls to my

mother-in-law," she said. Appearing on TVB's My Guest last month, Chan said

ending her marriage would be a relief. She said her relationship was not as

happy as it seemed, as the family of four was not living together. Their

children are living with their grandmother, but their father rarely visits, and

neither she nor the children have his mobile number, she said. Chan added she

has no income after separating from Hotung and has to use her savings to cover

daily expenses for herself and the children. Asked by TVB general manager

Stephen Chan Chi-wan during the interview if she hates Hotung, Chan replied: "I

have to thank Michael - he helped me end this 20-year marriage."

Macau's famous Ho clan will take center stage today when the divorce tussle

between Michael Hotung and former TVB actress Katie Chan Fok-sang goes to court.

Hotung is the son of Winnie Ho Yuen-ki, the estranged sister of gaming tycoon

Stanley Ho Hung-sun. Chan and Hotung are expected to appear at the family court

in Wan Chai, but have the right to be represented by their lawyers without

showing up. The case is scheduled to be heard privately before Judge Chan Chan-kok

this afternoon. Custody of the couple's 15-year-old daughter and 12-year-old

son, as well as alimony payments, are believed to be at the center of their

legal argument. Chan filed for divorce last year in a bid to end her 20-year

marriage to Hotung, citing his "unreasonable behavior." The news shocked Hong

Kong as the pair appeared to be a perfect couple in public. In December, Chan

held a press conference and revealed that Hotung's lawyer had demanded she

return three diamond rings or face a lawsuit. But Chan said she would rather go

to court, if only to find out why Hotung wants the rings back. The former

actress also said she doesn't know where her mother-in-law is, because Hotung

would not allow her to meet Winnie Ho. "I tried to see her but Michael wouldn't

allow it. He even told the maids not to pass my phone calls to my

mother-in-law," she said. Appearing on TVB's My Guest last month, Chan said

ending her marriage would be a relief. She said her relationship was not as

happy as it seemed, as the family of four was not living together. Their

children are living with their grandmother, but their father rarely visits, and

neither she nor the children have his mobile number, she said. Chan added she

has no income after separating from Hotung and has to use her savings to cover

daily expenses for herself and the children. Asked by TVB general manager

Stephen Chan Chi-wan during the interview if she hates Hotung, Chan replied: "I

have to thank Michael - he helped me end this 20-year marriage."

Wynn Macau said on Friday that the

extension of its current casino resort will open in April, helping it to

increase its market share to 15 per cent. Shares in Wynn Macau, a unit of Wynn

Resorts, soared to a one-month high, a day after the casino operator posted

quarterly results that beat analysts’ expectations, boosted by a strong economy

and strict cost controls. The casino operator, whose rivals include Sands China

and Melco Crown Entertainment, reported a near doubling of fourth-quarter

earnings before interest, taxes, depreciation and amortisation (EBITDA) on

Thursday to US$142 million. The figure was 4 per cent ahead of JPMorgan’s

expectations. Shares in Wynn Macau soared 5.4 per cent to a more than one-month

high and ended the day up 1.7 per cent. “The fourth-quarter results are very

solid,” said Billy Ng, an analyst with JPMorgan. “The outlook should be good.

They are the only ones expanding and putting in capacity in 2010. They should

gain some market share.” “The bigger question is how the overall market is

doing, with the tightening of liquidity from China. There will be some impact,

but it will be limited.” Wynn Macau reiterated that the extension of its current

casino resort in Macau, “Encore,” will open in April. The project is expected to

cost about US$600 million, the firm said. Ng said he expects Wynn Macau’s market

share to grow to 15 per cent after the extension’s opening, from its current

12-13 per cent share now. In a separate statement on Friday, Wynn Macau said it

expects its profit for last year to hit HK$2.07 billion, exceeding its original

forecast of HK$1.47 billion but largely in line with analysts’ consensus

expectations of HK$2.12 billion according to Thomson Reuters I/B/E/S. Last week,

Las Vegas Sands said the firm has done well in Macau – where earnings before

interest, taxes, depreciation, amortisation and rent (EBITDAR) rose a “whopping”

48 per cent in the fourth quarter – by focusing on mass gaming, hotel and retail

businesses, while controlling costs. Sands China is due to report its

fourth-quarter results on March 1. Wynn Macau said on Friday that the

extension of its current casino resort will open in April, helping it to

increase its market share to 15 per cent. Shares in Wynn Macau, a unit of Wynn

Resorts, soared to a one-month high, a day after the casino operator posted

quarterly results that beat analysts’ expectations, boosted by a strong economy

and strict cost controls. The casino operator, whose rivals include Sands China

and Melco Crown Entertainment, reported a near doubling of fourth-quarter

earnings before interest, taxes, depreciation and amortisation (EBITDA) on

Thursday to US$142 million. The figure was 4 per cent ahead of JPMorgan’s

expectations. Shares in Wynn Macau soared 5.4 per cent to a more than one-month

high and ended the day up 1.7 per cent. “The fourth-quarter results are very

solid,” said Billy Ng, an analyst with JPMorgan. “The outlook should be good.

They are the only ones expanding and putting in capacity in 2010. They should

gain some market share.” “The bigger question is how the overall market is

doing, with the tightening of liquidity from China. There will be some impact,

but it will be limited.” Wynn Macau reiterated that the extension of its current

casino resort in Macau, “Encore,” will open in April. The project is expected to

cost about US$600 million, the firm said. Ng said he expects Wynn Macau’s market

share to grow to 15 per cent after the extension’s opening, from its current

12-13 per cent share now. In a separate statement on Friday, Wynn Macau said it

expects its profit for last year to hit HK$2.07 billion, exceeding its original

forecast of HK$1.47 billion but largely in line with analysts’ consensus

expectations of HK$2.12 billion according to Thomson Reuters I/B/E/S. Last week,

Las Vegas Sands said the firm has done well in Macau – where earnings before

interest, taxes, depreciation, amortisation and rent (EBITDAR) rose a “whopping”

48 per cent in the fourth quarter – by focusing on mass gaming, hotel and retail

businesses, while controlling costs. Sands China is due to report its

fourth-quarter results on March 1.

China*: China

is conducting “stress tests” in the country’s labour-intensive export sectors to

see how much yuan appreciation firms can withstand, a report said on Friday.

China*: China

is conducting “stress tests” in the country’s labour-intensive export sectors to

see how much yuan appreciation firms can withstand, a report said on Friday.

China COSCO Holdings Co and nine

other shipping firms are planning to increase rates for hauling containers to

Asia from the US in a bid to stem losses on transpacific routes.

China National Petroleum Corp (CNPC),

the country's largest oil and gas producer, plans to build 10 natural gas

storage facilities between 2011 and 2015 to stockpile the fuel in the face of

rising demand, said a company executive. The 10 storage sites will be able to

store 22.4 billion cu m of natural gas, the 21st Century Business Herald

reported yesterday, quoting CNPC Vice-President Liao Yongyuan. The facilities

will be located in regions which have rich gas sources and major consuming

areas, including the Xinjiang Uygur autonomous region and northern China. The

storage facility construction project, part of the government's 12th Five-Year

Plan (2011-2015), will account for 8 to 10 percent of the company's total

natural gas sales volume, said Liao. At present, the figure is only 3 percent,

he added. CNPC President Jiang Jiemin said that the company had decided to build

12 billion cu m of gas storage in its Changqing oil and gas field, which is

located in Erdos in Inner Mongolia. The facility will be China's largest

gas-storage facility. In order to meet rapidly rising demand for natural gas,

China should speed up its construction of storage facilities to better prepare

for potential shortages, said analysts. The country should plan more gas storage

in eastern regions, as they are high-consumption areas, they said. Compared with

Western countries, China started gas storage efforts late. Now global volume of

gas storage facilities accounts for around 10 percent of total gas consumption.

"There is a lot of room for us to improve," said Yang Lei, an official with the

oil and gas department under the National Energy Administration (NEA). Compared

with the construction of crude oil storage, which has drawn much attention in

recent years, construction of natural gas storage should be treated with equal

importance, as the consumption of natural gas will see faster growth than other

fossil fuels, said analysts. The country's natural gas market is promising, as

the use of the clean energy fits well with China's efforts to build an

environmentally friendly economy, said Zhuang Rongjin, director of the natural

gas department of the Guangdong Oil and Gas Association. As a clean energy

source, natural gas now accounts for only about 3 percent of China's total

energy consumption. The government plans to increase the use of natural gas to 5

percent of total energy consumption in 2010. According to a report by the

International Energy Agency (IEA), China may be dependent on imports for more

than one-third of its total natural gas consumption by 2030. In 2004, China

completed first west-east pipeline. The project exclusively uses domestically

produced natural gas. China is also building the second west-east gas pipeline.

The 9,000-km-long line is the largest of its kind in the world. The pipeline

will carry natural gas produced in Central Asia and Xinjiang to the country's

eastern and southern regions. China National Petroleum Corp (CNPC),

the country's largest oil and gas producer, plans to build 10 natural gas

storage facilities between 2011 and 2015 to stockpile the fuel in the face of

rising demand, said a company executive. The 10 storage sites will be able to

store 22.4 billion cu m of natural gas, the 21st Century Business Herald

reported yesterday, quoting CNPC Vice-President Liao Yongyuan. The facilities

will be located in regions which have rich gas sources and major consuming

areas, including the Xinjiang Uygur autonomous region and northern China. The

storage facility construction project, part of the government's 12th Five-Year

Plan (2011-2015), will account for 8 to 10 percent of the company's total

natural gas sales volume, said Liao. At present, the figure is only 3 percent,

he added. CNPC President Jiang Jiemin said that the company had decided to build

12 billion cu m of gas storage in its Changqing oil and gas field, which is

located in Erdos in Inner Mongolia. The facility will be China's largest

gas-storage facility. In order to meet rapidly rising demand for natural gas,

China should speed up its construction of storage facilities to better prepare

for potential shortages, said analysts. The country should plan more gas storage

in eastern regions, as they are high-consumption areas, they said. Compared with

Western countries, China started gas storage efforts late. Now global volume of

gas storage facilities accounts for around 10 percent of total gas consumption.

"There is a lot of room for us to improve," said Yang Lei, an official with the

oil and gas department under the National Energy Administration (NEA). Compared

with the construction of crude oil storage, which has drawn much attention in

recent years, construction of natural gas storage should be treated with equal

importance, as the consumption of natural gas will see faster growth than other

fossil fuels, said analysts. The country's natural gas market is promising, as

the use of the clean energy fits well with China's efforts to build an

environmentally friendly economy, said Zhuang Rongjin, director of the natural

gas department of the Guangdong Oil and Gas Association. As a clean energy

source, natural gas now accounts for only about 3 percent of China's total

energy consumption. The government plans to increase the use of natural gas to 5

percent of total energy consumption in 2010. According to a report by the

International Energy Agency (IEA), China may be dependent on imports for more

than one-third of its total natural gas consumption by 2030. In 2004, China

completed first west-east pipeline. The project exclusively uses domestically

produced natural gas. China is also building the second west-east gas pipeline.

The 9,000-km-long line is the largest of its kind in the world. The pipeline

will carry natural gas produced in Central Asia and Xinjiang to the country's

eastern and southern regions.

China appears to be secretly buying

bonds via third locations to hide its importance as a major creditor to

Washington, experts told a congressional forum on Thursday.

Huatai Securities’ modest gains on

debut fell short of expectations after it raised US$2.3 billion in mainland’s

largest IPO this year, and could set a trend for upcoming listings.

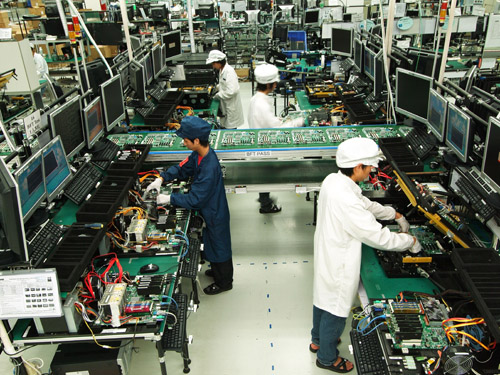

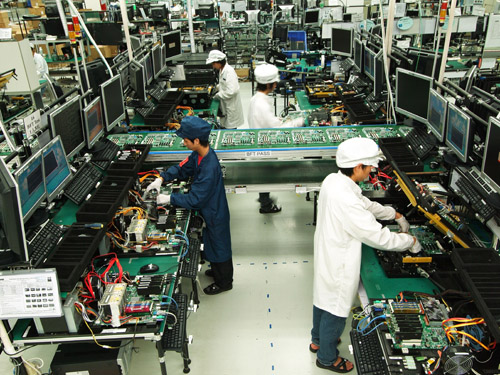

Quanta Computer, the world's

largest contract laptop maker, will raise salaries of its mainland production

workers by about 10 per cent to fend off a labor shortage as demand picks up for

its products. "We estimate salaries will climb by about 100 yuan, or about 10

per cent," said Elton Yang, Quanta's Taipei-based vice-president for finance.

Other technology companies have also expressed concern at labour shortages on

the mainland, with Acer, the world's No 2 personal computer brand, saying

recently that it has been giving orders to its contract manufacturers up to six

months ahead to allow them to plan their staffing needs. Quanta currently

employs about 40,000 production-line workers around the Shanghai region, Yang

said. The company manufactures goods for some of the world's top personal

computer brands such as Apple, Hewlett-Packard and Dell. "For Quanta, the impact

may not be that big because we're fairly well known," Yang said. "But our

suppliers may have some issues with manpower, and if things worsen, we may even

step in to send some of our workers over to help them tide through this time."

Quanta's suppliers include component manufacturers such as battery maker Simplo,

laptop hinge maker Shin Zu Shing and adaptor manufacturer Delta Electronics, all

of which manufacture laptop parts. UBS analyst Edward Yen estimates that about 5

per cent of the company's cost goes to labor, and the current labour shortage

should ease by May. "We're probably going through the worst right now," said

Yen. "Things should ease when China's school year ends in May, and that's when

we may see a new batch of people entering the workforce," The salary increase is

unlikely to have an impact on Quanta's margins since salaries make up only a

small percentage of the company's cost, Yang said, and the firm is further

pushing towards automation for its production line. Most major technology brands

do some or all of their own design work in-house, but outsource the

manufacturing process to firms such as Quanta, Hon Hai and Flextronics, which

run large facilities in lower-cost countries. Quanta Computer, the world's

largest contract laptop maker, will raise salaries of its mainland production

workers by about 10 per cent to fend off a labor shortage as demand picks up for

its products. "We estimate salaries will climb by about 100 yuan, or about 10

per cent," said Elton Yang, Quanta's Taipei-based vice-president for finance.

Other technology companies have also expressed concern at labour shortages on

the mainland, with Acer, the world's No 2 personal computer brand, saying

recently that it has been giving orders to its contract manufacturers up to six

months ahead to allow them to plan their staffing needs. Quanta currently

employs about 40,000 production-line workers around the Shanghai region, Yang

said. The company manufactures goods for some of the world's top personal

computer brands such as Apple, Hewlett-Packard and Dell. "For Quanta, the impact

may not be that big because we're fairly well known," Yang said. "But our

suppliers may have some issues with manpower, and if things worsen, we may even

step in to send some of our workers over to help them tide through this time."

Quanta's suppliers include component manufacturers such as battery maker Simplo,

laptop hinge maker Shin Zu Shing and adaptor manufacturer Delta Electronics, all

of which manufacture laptop parts. UBS analyst Edward Yen estimates that about 5

per cent of the company's cost goes to labor, and the current labour shortage

should ease by May. "We're probably going through the worst right now," said

Yen. "Things should ease when China's school year ends in May, and that's when

we may see a new batch of people entering the workforce," The salary increase is

unlikely to have an impact on Quanta's margins since salaries make up only a

small percentage of the company's cost, Yang said, and the firm is further

pushing towards automation for its production line. Most major technology brands

do some or all of their own design work in-house, but outsource the

manufacturing process to firms such as Quanta, Hon Hai and Flextronics, which

run large facilities in lower-cost countries.

Shanghai Shipping Exchange,

based in China's busiest port, intends to set up a container-shipping

derivatives market by year-end as the city tries to challenge London as a global

center for shipping finance. The forward freight agreements, or FFAs, which help

guard against fluctuations in shipping rates, will be targeted at small- and

medium-sized exporters, who don't have the volumes needed for long-term shipping

contracts, said Yao Weifu, a director at the shipping exchange. The plan is

awaiting government approval. Morgan Stanley last month backed the first FFA

tied to a Shanghai container index, as the shipping exchange attempts to

persuade the sector to adopt futures. Unlike in the dry-bulk and tanker

segments, container-shipping has rarely used FFAs because the wide variety of

cargos and customers using each ship makes it more difficult to accurately track

rates, said Jay Ryu, an analyst at Mirae Asset Securities Co in Hong Kong.

"There is some need for hedging because rates recently have been very volatile,"

said Ryu. "Still, the trading volume will not be as huge as for dry bulk or

tankers." Clarkson Plc, which led the development of FFAs in 1991, helped devise

the four-month-old Shanghai Containerized Freight Index to act as a benchmark

for container-shipping futures. The securities arm of the world's largest

shipbroker also organized the container FFA between Morgan Stanley and shipping

line Delphis NV. The trial deal covered a total of 10 cargo boxes to be shipped

this month and next, according to the Shanghai Shipping Exchange's official

magazine. "The first trade has shown that the index is acceptable to global

markets and that it can be used for futures," said Yao. "Now it's time to move

on and launch derivatives in Shanghai." Shanghai Shipping Exchange,

based in China's busiest port, intends to set up a container-shipping

derivatives market by year-end as the city tries to challenge London as a global

center for shipping finance. The forward freight agreements, or FFAs, which help

guard against fluctuations in shipping rates, will be targeted at small- and

medium-sized exporters, who don't have the volumes needed for long-term shipping

contracts, said Yao Weifu, a director at the shipping exchange. The plan is

awaiting government approval. Morgan Stanley last month backed the first FFA

tied to a Shanghai container index, as the shipping exchange attempts to

persuade the sector to adopt futures. Unlike in the dry-bulk and tanker

segments, container-shipping has rarely used FFAs because the wide variety of

cargos and customers using each ship makes it more difficult to accurately track

rates, said Jay Ryu, an analyst at Mirae Asset Securities Co in Hong Kong.

"There is some need for hedging because rates recently have been very volatile,"

said Ryu. "Still, the trading volume will not be as huge as for dry bulk or

tankers." Clarkson Plc, which led the development of FFAs in 1991, helped devise

the four-month-old Shanghai Containerized Freight Index to act as a benchmark

for container-shipping futures. The securities arm of the world's largest

shipbroker also organized the container FFA between Morgan Stanley and shipping

line Delphis NV. The trial deal covered a total of 10 cargo boxes to be shipped

this month and next, according to the Shanghai Shipping Exchange's official

magazine. "The first trade has shown that the index is acceptable to global

markets and that it can be used for futures," said Yao. "Now it's time to move

on and launch derivatives in Shanghai."

China CNR Corp, one of the two largest

train manufacturers in the country, is expanding its business in the urban rail

transit equipment sector, which is expected to generate 900 billion yuan by 2015

- benefiting from a speed-up in the development of urban rail transportation

systems. China CNR Corp has won a 950 million yuan contract to supply subway

cars for the No 8 Subway Line in Shanghai, according to a filing to Shanghai's

stock exchange yesterday. China CNR has agreed to purchase a 44.79 percent

equity stake in Shanghai Rail Traffic Equipment Development Co from Shanghai

Electric Group for 365 million yuan. China CNR will also directly inject 85

million yuan into Shanghai Rail Traffic, making it a 50-50 joint venture between

Shanghai Electric Group and China CNR. So far, China CNR controls 55 percent of

China's subway car manufacturing market, a senior official of Shanghai Rail

Traffic said. Shanghai-based Shanghai Rail - a railway traffic equipment maker -

designs, manufactures, distributes and maintains urban mass transit equipment.

Shanghai Electric said cooperating with China CNR in urban rail transit

equipment would help boost the expansion of Shanghai Rail in the city's urban

rail market and offer the firm access to new markets at home and abroad.

Shanghai Rail's sales are likely to reach 5 billion yuan by 2014, up from the

current 2 billion yuan, as a result of the cooperation, local media reported.

Acquiring Shanghai Rail will help Beijing-based China CNR enlarge its market

share in southern China, where the company has a weaker market position compared

with its chief rivals China South Locomotive and Rolling Stock Corp, which has a

62 percent share of Shanghai's subway car market, according to a research note

by Sinolink Securities. The fastest growth in the urban rail transit system will

be seen in the Yangtze River Delta and Pearl River Delta regions, both in

southern China, the research note said. China CNR, which has won contracts to

supply bullet trains for the now under-construction high-speed railway line

between Shanghai and Beijing, now generates less than 5 percent of its business

from urban rail. China's urban rail transit sector is expected to reach a total

length of 2,500 km by 2016, creating huge demand for railway-related business.

The country's urban railways will span 1,500 km by the end of 2010, generating

36 billion yuan in demand for railway cars, according to statistics provided by

China CNR. China's investment in the railway sector is likely to reach 900

billion yuan by 2015, said Cui Dianguo, chairman of China CNR. China CNR Corp, one of the two largest

train manufacturers in the country, is expanding its business in the urban rail

transit equipment sector, which is expected to generate 900 billion yuan by 2015

- benefiting from a speed-up in the development of urban rail transportation

systems. China CNR Corp has won a 950 million yuan contract to supply subway

cars for the No 8 Subway Line in Shanghai, according to a filing to Shanghai's

stock exchange yesterday. China CNR has agreed to purchase a 44.79 percent

equity stake in Shanghai Rail Traffic Equipment Development Co from Shanghai

Electric Group for 365 million yuan. China CNR will also directly inject 85

million yuan into Shanghai Rail Traffic, making it a 50-50 joint venture between

Shanghai Electric Group and China CNR. So far, China CNR controls 55 percent of

China's subway car manufacturing market, a senior official of Shanghai Rail

Traffic said. Shanghai-based Shanghai Rail - a railway traffic equipment maker -

designs, manufactures, distributes and maintains urban mass transit equipment.

Shanghai Electric said cooperating with China CNR in urban rail transit

equipment would help boost the expansion of Shanghai Rail in the city's urban

rail market and offer the firm access to new markets at home and abroad.

Shanghai Rail's sales are likely to reach 5 billion yuan by 2014, up from the

current 2 billion yuan, as a result of the cooperation, local media reported.

Acquiring Shanghai Rail will help Beijing-based China CNR enlarge its market

share in southern China, where the company has a weaker market position compared

with its chief rivals China South Locomotive and Rolling Stock Corp, which has a

62 percent share of Shanghai's subway car market, according to a research note

by Sinolink Securities. The fastest growth in the urban rail transit system will

be seen in the Yangtze River Delta and Pearl River Delta regions, both in

southern China, the research note said. China CNR, which has won contracts to

supply bullet trains for the now under-construction high-speed railway line

between Shanghai and Beijing, now generates less than 5 percent of its business

from urban rail. China's urban rail transit sector is expected to reach a total

length of 2,500 km by 2016, creating huge demand for railway-related business.

The country's urban railways will span 1,500 km by the end of 2010, generating

36 billion yuan in demand for railway cars, according to statistics provided by

China CNR. China's investment in the railway sector is likely to reach 900

billion yuan by 2015, said Cui Dianguo, chairman of China CNR.

Feb 27, 2010

Hong Kong*:

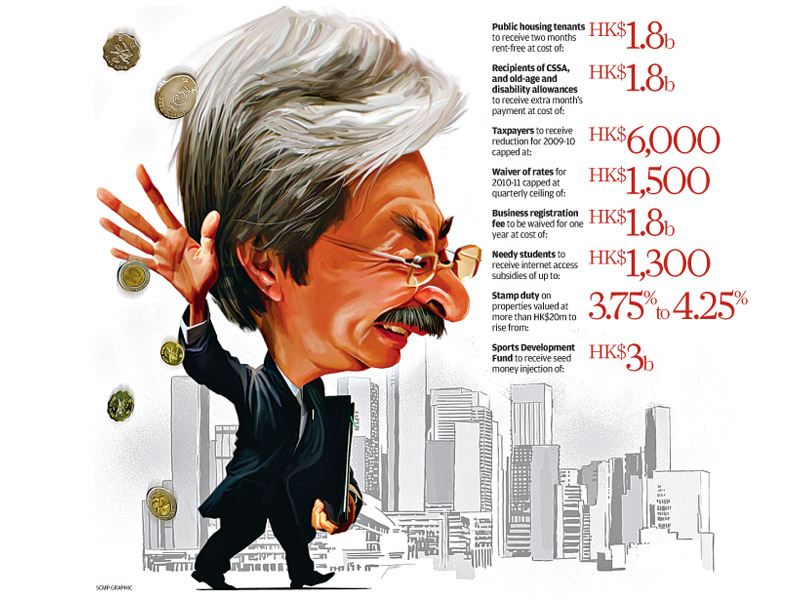

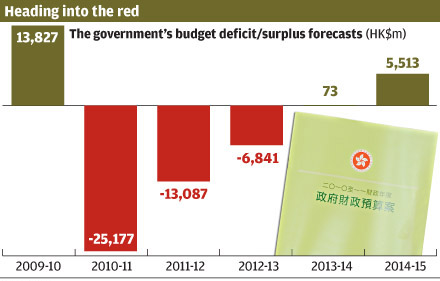

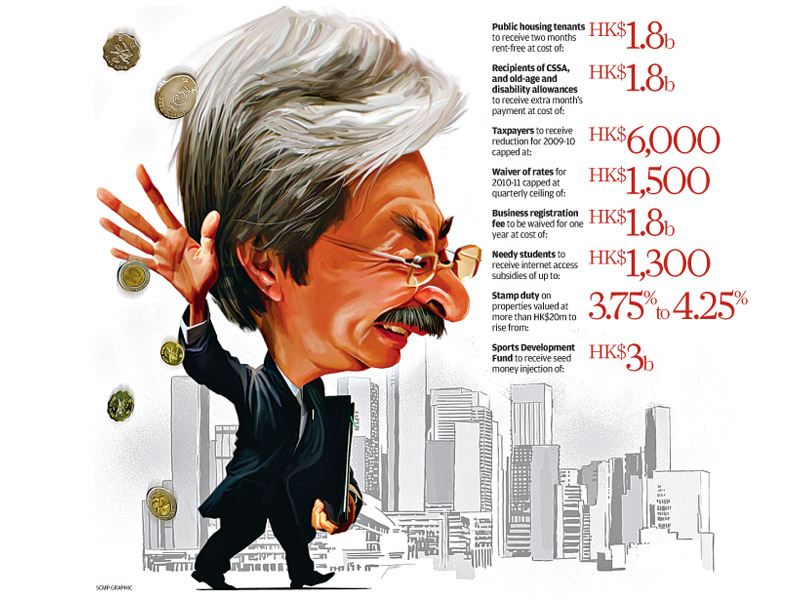

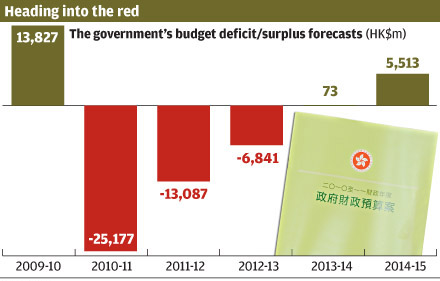

A new study found that 60.8 per cent of people surveyed approved of Financial

Secretary John Tsang Chun-wah’s 2010 budget – six per cent higher than after

last year's budget. Hong Kong*:

A new study found that 60.8 per cent of people surveyed approved of Financial

Secretary John Tsang Chun-wah’s 2010 budget – six per cent higher than after

last year's budget.

The High Court on Thursday approved an extension

for Tony Chan Chun-chuen to file an appeal after he lost his court battle for

Nina Wang Kung Yu-sum's fortune in February.

More yuan investment products

will be encouraged and incentives offered for investors to trade Exchange-Traded

Funds and bond products. The measures are part of the government's efforts to

promote Hong Kong as a testing ground for offshore yuan services. Financial

Secretary John Tsang Chun-wah said the government hoped the 6 billion yuan

(HK$6.8 billion) sovereign bond launched by the Ministry of Finance in October

would be the first of many. "We hope to further promote the development of the

yuan bond business in Hong Kong, such as expanding the issuance size of the

bonds and increasing the types of bond issuers and the classes of qualified

investors," Tsang said. The Hong Kong Monetary Authority announced this month

that any local firm could issue yuan bonds. Previously, only mainland financial

firms could do so. Hong Kong Exchanges and Clearing (SEHK: 0388) has indicated

it plans to launch more yuan-denominated stocks and futures products in the next

three years. The Chinese Gold and Silver Exchanges Society also wants to launch

yuan-denominated gold products. Tsang proposed measures to boost Hong Kong's

stock and bond markets, including extending stamp duty exemption to

exchange-traded funds (ETFs), as long as no more than 40 per cent of their

assets are composed of Hong Kong stocks. At present, only ETFs that exclusively

trace overseas markets are exempt from stamp duty. ETFs are index funds that

allow investors to trade a unit of the fund instead of trading a basket of

stocks in a certain market. At present, the government collects a 0.1 per cent

stamp duty from both buyers and sellers on the value of stocks traded. Brokers

said these measures could attract international traders but were of little use

to local investors. "If the government really wants to benefit local investors,

it should abolish the stamp duty for all stocks," said Louis Tse Ming-kong,

director of VC Brokerage. A government official said this could not be done

because stamp duty on stocks was a major source of government income. Investors

paid HK$25.6 billion in stamp duties to the government last year, representing

10.2 per cent of total government revenue. Chim Pui-chung, lawmaker for the

financial services sector, said most international markets had abolished the

stamp duty. "Hong Kong should follow this international trend," he said. More yuan investment products

will be encouraged and incentives offered for investors to trade Exchange-Traded

Funds and bond products. The measures are part of the government's efforts to

promote Hong Kong as a testing ground for offshore yuan services. Financial

Secretary John Tsang Chun-wah said the government hoped the 6 billion yuan

(HK$6.8 billion) sovereign bond launched by the Ministry of Finance in October

would be the first of many. "We hope to further promote the development of the

yuan bond business in Hong Kong, such as expanding the issuance size of the

bonds and increasing the types of bond issuers and the classes of qualified

investors," Tsang said. The Hong Kong Monetary Authority announced this month

that any local firm could issue yuan bonds. Previously, only mainland financial

firms could do so. Hong Kong Exchanges and Clearing (SEHK: 0388) has indicated

it plans to launch more yuan-denominated stocks and futures products in the next

three years. The Chinese Gold and Silver Exchanges Society also wants to launch

yuan-denominated gold products. Tsang proposed measures to boost Hong Kong's

stock and bond markets, including extending stamp duty exemption to

exchange-traded funds (ETFs), as long as no more than 40 per cent of their

assets are composed of Hong Kong stocks. At present, only ETFs that exclusively

trace overseas markets are exempt from stamp duty. ETFs are index funds that

allow investors to trade a unit of the fund instead of trading a basket of

stocks in a certain market. At present, the government collects a 0.1 per cent

stamp duty from both buyers and sellers on the value of stocks traded. Brokers

said these measures could attract international traders but were of little use

to local investors. "If the government really wants to benefit local investors,

it should abolish the stamp duty for all stocks," said Louis Tse Ming-kong,

director of VC Brokerage. A government official said this could not be done

because stamp duty on stocks was a major source of government income. Investors

paid HK$25.6 billion in stamp duties to the government last year, representing

10.2 per cent of total government revenue. Chim Pui-chung, lawmaker for the

financial services sector, said most international markets had abolished the

stamp duty. "Hong Kong should follow this international trend," he said.

China*: Police

have detained 18 people on suspicion of assaulting several artists in a Beijing

art zone that is slated for demolition, state media said on Thursday.

China*: Police

have detained 18 people on suspicion of assaulting several artists in a Beijing

art zone that is slated for demolition, state media said on Thursday.

Chinese tourists spend lots of money

abroad - The Chinese Lunar New Year is not only a gala for domestic retail

sales, but a feast for overseas retailers, too. Some 1,200 Chinese tourists

celebrated the lunar New Year in New York between Feb 14 and 20, spending an

estimated $6 million in the United States, said Zheng Wenqing, a public

relations manager for New York Tourism Board's China office. Japanese retailers

also reaped gains from Chinese tourists during the week. A local home appliance

retailer, Bic Camera, reported that its store in Akihabara, Tokyo, saw its sales

increase by 20 to 30 percent thanks to Chinese tourists, Japan-based Chinese

language newspaper Jnocnews reported. The newspaper quoted a salesman as saying

that a Chinese tourist pointed to and bought cameras and lenses worth more than

70,000 yuan ($10,500) at one time. Another Chinese tourist bought 20 rice

cookers at one shot. In Berlin, half of eight counters selling luxury watches in

KaDeWe department store on Feb 15 were receiving Chinese tourists, Xiao Yun, a

tourist who just came back from Europe told Beijing Youth Daily. He also saw the

counters of top cosmetic brands crowded by Chinese tourists at the Munich

airport, and one of them bought five bottles of a toning lotion priced at 2,000

yuan each. Chinese consumers have become the No 1 spender in more and more

countries, studies and experts said. The latest report by Global Refund, a

company specializing in tax-free shopping for tourists, said Chinese tourists

outspent the Russians in France last year. Chinese tourists spent 155 million

euros ($220.2 million) in 2009, followed by the Russians who spent 112 million

euros and the Japanese who spent 99 million euros, the report said. The

Galleries Lafayette in Paris reported that a typical Chinese tourist spent 1,000

euro in two hours last year, topping tourists from other countries. Some 87

percent of the Chinese's average total bill was on fashion items, including

shoes and handbags, and 93 percent of their shopping was done in and around the

French capital. Purchases made by the Chinese represented 15 percent of total

spending by tourists in France in 2009 and their total bill rose 47 percent from

2008, it said. Chinese tourists are also among the top five spenders in

countries like Singapore and South Korea, reports said. Insiders said the

shopping craze is mainly due to two reasons - a booming economy in China, and a

price gap caused by a high tax levied on luxury goods. "People have more spare

money to spend now. I traveled to France a decade ago, and I didn't buy any

luxury goods simply because I couldn't afford them," said Cui Xiaoping, in his

50s, who traveled around Europe, including France, with his wife in January. But

during the January trip, he bought so many things, including designer handbags

and clothes, that he needed to buy an extra suitcase to carry them home.

"Chinese people these days are more informed about the luxury brands. For me, I

buy luxury brands because they offer quality. Buying them in Europe is a lot

cheaper than in China due to the competitive exchange rate between euros and

renminbi, plus there is no import tax," he said. In addition, Chinese tourists

are impulsive shoppers, said Li Meng, deputy general manager of the outbound

department with the China International Travel Service head office. "Chinese

tourists are different from the Japanese tourists, who would make shopping lists

beforehand. Many Chinese tourists bought everything they thought is cheaper than

at home," he said. Chinese tourists spend lots of money

abroad - The Chinese Lunar New Year is not only a gala for domestic retail

sales, but a feast for overseas retailers, too. Some 1,200 Chinese tourists

celebrated the lunar New Year in New York between Feb 14 and 20, spending an

estimated $6 million in the United States, said Zheng Wenqing, a public

relations manager for New York Tourism Board's China office. Japanese retailers

also reaped gains from Chinese tourists during the week. A local home appliance

retailer, Bic Camera, reported that its store in Akihabara, Tokyo, saw its sales

increase by 20 to 30 percent thanks to Chinese tourists, Japan-based Chinese

language newspaper Jnocnews reported. The newspaper quoted a salesman as saying

that a Chinese tourist pointed to and bought cameras and lenses worth more than

70,000 yuan ($10,500) at one time. Another Chinese tourist bought 20 rice

cookers at one shot. In Berlin, half of eight counters selling luxury watches in

KaDeWe department store on Feb 15 were receiving Chinese tourists, Xiao Yun, a

tourist who just came back from Europe told Beijing Youth Daily. He also saw the

counters of top cosmetic brands crowded by Chinese tourists at the Munich

airport, and one of them bought five bottles of a toning lotion priced at 2,000

yuan each. Chinese consumers have become the No 1 spender in more and more

countries, studies and experts said. The latest report by Global Refund, a

company specializing in tax-free shopping for tourists, said Chinese tourists

outspent the Russians in France last year. Chinese tourists spent 155 million

euros ($220.2 million) in 2009, followed by the Russians who spent 112 million

euros and the Japanese who spent 99 million euros, the report said. The

Galleries Lafayette in Paris reported that a typical Chinese tourist spent 1,000

euro in two hours last year, topping tourists from other countries. Some 87

percent of the Chinese's average total bill was on fashion items, including

shoes and handbags, and 93 percent of their shopping was done in and around the

French capital. Purchases made by the Chinese represented 15 percent of total

spending by tourists in France in 2009 and their total bill rose 47 percent from

2008, it said. Chinese tourists are also among the top five spenders in

countries like Singapore and South Korea, reports said. Insiders said the

shopping craze is mainly due to two reasons - a booming economy in China, and a

price gap caused by a high tax levied on luxury goods. "People have more spare

money to spend now. I traveled to France a decade ago, and I didn't buy any

luxury goods simply because I couldn't afford them," said Cui Xiaoping, in his

50s, who traveled around Europe, including France, with his wife in January. But

during the January trip, he bought so many things, including designer handbags

and clothes, that he needed to buy an extra suitcase to carry them home.

"Chinese people these days are more informed about the luxury brands. For me, I

buy luxury brands because they offer quality. Buying them in Europe is a lot

cheaper than in China due to the competitive exchange rate between euros and

renminbi, plus there is no import tax," he said. In addition, Chinese tourists

are impulsive shoppers, said Li Meng, deputy general manager of the outbound

department with the China International Travel Service head office. "Chinese

tourists are different from the Japanese tourists, who would make shopping lists

beforehand. Many Chinese tourists bought everything they thought is cheaper than

at home," he said.

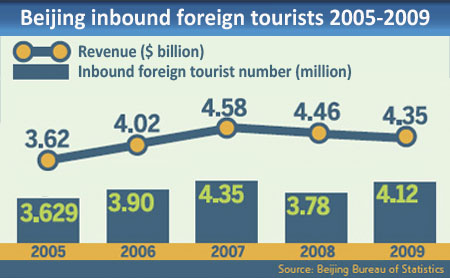

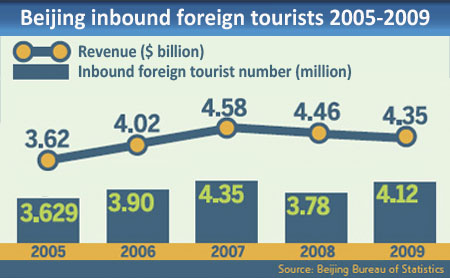

The tourism

administration has joined Beijing Capital International Airport (BCIA) to apply

to extend the current 24-hour Transit Without Visa (TWOV) policy to seven days,

after the head of the airport raised the proposal in the municipal people's

congress in late January. As many as 4.5 million international travelers are

expected to be affected, the tourism administration said. Statistics on spending

among travelers said the local tourism industry should benefit from an extra

$4.5 billion due to the extension, according to the Beijing News yesterday. Wang

Meng, a travel agent for China Wonderful Tour, which receives about 300,000

international travelers annually, said a longer TWOV would attract more

international travelers. However, he is not optimistic of a high quantity. "Most

of our customers are from the US, Australia, Canada and the UK. They seldom have

the chance to travel to China because of the long distance, so they always enjoy

themselves when they do. Seven days is not enough," Wang said, from his 10 years

of experience in the field. He added that his clients usually stay 10 to 15 days

in China to visit the three must-go cities: Beijing, Shanghai and Xi'an. "I

think a seven-day TWOV will only attract 10 to 15 percent more international

travelers," he said. Kempinski Hotel Beijing welcomed the proposal, believing it

would benefit the hotel business and local economy. "We had 170,000 customers

last year and 60 percent of them were international visitors," said Li Bo,

Kempinski's regional manager of China. Li said a seven-day TWOV could save

travelers a mountain of paperwork. However, a police officer from the exit and

entry administration of the Beijing public security bureau, who asked not to be

named, expressed concern. "This plan will put a lot of pressure on national

security," he said, stating that many countries have tighter TWOV rules than in

Beijing. In 2009, Beijing received 4.12 million inbound travelers, contributing

$4.35 billion. The goal set by the Beijing Tourism Administration in 2010 is

4.25 million trips and $4.8 billion. The tourism

administration has joined Beijing Capital International Airport (BCIA) to apply

to extend the current 24-hour Transit Without Visa (TWOV) policy to seven days,

after the head of the airport raised the proposal in the municipal people's

congress in late January. As many as 4.5 million international travelers are

expected to be affected, the tourism administration said. Statistics on spending

among travelers said the local tourism industry should benefit from an extra

$4.5 billion due to the extension, according to the Beijing News yesterday. Wang

Meng, a travel agent for China Wonderful Tour, which receives about 300,000

international travelers annually, said a longer TWOV would attract more

international travelers. However, he is not optimistic of a high quantity. "Most

of our customers are from the US, Australia, Canada and the UK. They seldom have

the chance to travel to China because of the long distance, so they always enjoy

themselves when they do. Seven days is not enough," Wang said, from his 10 years

of experience in the field. He added that his clients usually stay 10 to 15 days

in China to visit the three must-go cities: Beijing, Shanghai and Xi'an. "I