|

Newsletter

Seminar Material

Biz:

China

Hong

Kong Hawaii

What people

said about us

China

Earthquake Relief

Tax &

Government

Hawaii Voter Registration

Biz-Video

Biz-Video

Hawaii's

China Connection Hawaii's

China Connection

CDP#1780962

CDP#1780962

Doing Business in

Hong Kong & China

Doing Business in

Hong Kong & China

| |

Hong Kong, China & Hawaii Biz*

Skype - FREE

Voice Over IP Skype - FREE

Voice Over IP  View Hawaii's China Connection

Video Trailer

View Hawaii's China Connection

Video Trailer

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our event page to find out more!

After

attended a China/Hong Kong Business/Trade Seminar in Hawaii...still unsure what

to do next, contact us, our Officers, Directors and Founding Members are

actively engaged in China/Hong Kong/Asia trade - we can help!

Are you ready to export your product or

service? You will find out in 3 minutes with resources to help you -

enter

to give it a try

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

(approximate $ exchange rates: US$1 = HK$7.8, US$1 = RMB$6.8)

View China 60th

Anniversary Video and Photo online View China 60th

Anniversary Video and Photo online

Holidays Greeting from President Obama & Johnson Choi

Holidays Greeting from President Obama & Johnson Choi

http://www.youtube.com/watch?v=pNk4Z4lUV-k

http://www.youtube.com/watch?v=pNk4Z4lUV-k

http://www.facebook.com/video/video.php?v=219896871983&ref=mf

http://www.facebook.com/video/video.php?v=219896871983&ref=mf

Wine-Biz

- Hong Kong

Wine-Biz

- Hong Kong

Brand Hong Kong

Video

Brand Hong Kong

Video

March 31, 2010

Hong Kong*:

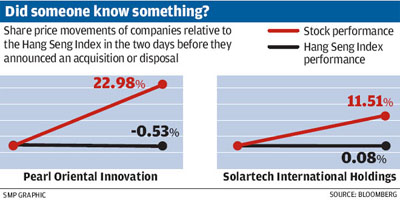

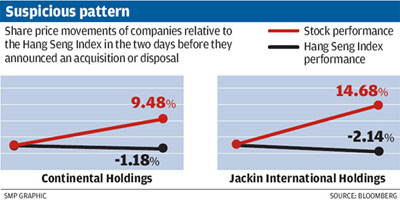

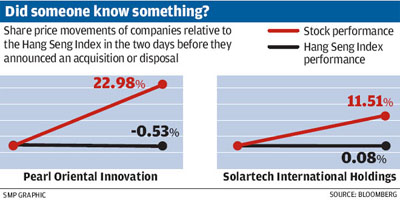

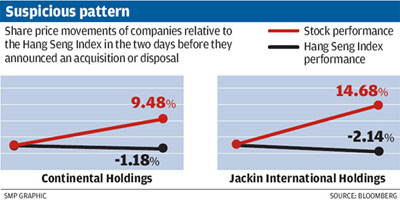

Hong Kong on Monday announced plans to introduce laws that ensure listed firms

disclose price-sensitive information, with those who fail to do so being fined

up to US$1 million. Hong Kong*:

Hong Kong on Monday announced plans to introduce laws that ensure listed firms

disclose price-sensitive information, with those who fail to do so being fined

up to US$1 million.

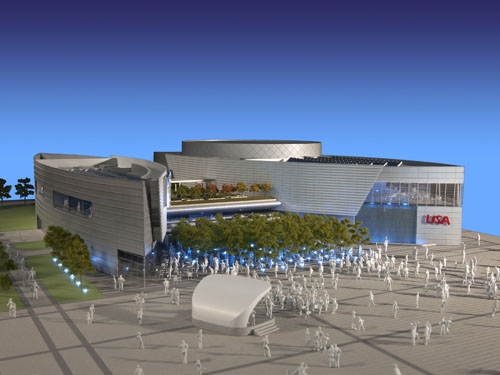

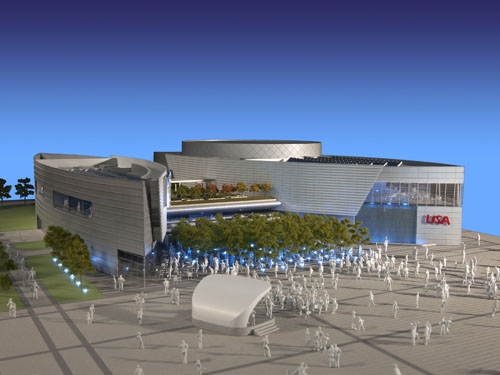

Lord Foster, who designed the HSBC

headquarters in Central, says the arts hub has to be a magnet drawing people to

the site. Lord Foster has pledged more surprises in his West Kowloon arts hub

design, with open space better than that in Central Park, New York. He said his

winning design involving a controversial giant canopy in 2001 was already

"history". The globally acclaimed Foster, one of three architects competing in

the West Kowloon Cultural District design competition, said of the canopy: "It

was rooted in its time." He was speaking on the topic for the first time after

the design was scrapped under public pressure four years ago. "Lots has happened

in 10 years. Everybody has moved on. I think there is a need for much greater

flexibility in terms of phasing and in terms of a multiplicity of

possibilities," he said in an interview. Foster said that this time he would

give Hong Kong something even more surprising. Apart from creating an open space

"better than Central Park" in New York, he said he had already figured out a

"cure" for the site, which is cut off from Canton Road and neighbouring

districts. He flew into Hong Kong last week to meet his team of local and

overseas experts advising him on the best way to handle the project again. This

summer, his design will be rolled out for public comment along with plans by the

other two selected architects - Dutchman Rem Koolhaas and Hongkonger Rocco Yim

Sen-kee. The design of the 40-hectare arts hub went back to the drawing board in

February 2006 after competition outcomes in 2001 and 2003 failed to gain support

from lawmakers and the public. Having secured funding of HK$21.6 billion in July

2008, the government again invited designs from three selected architects.

Foster said he was about to submit his third sketch. His first, the enormous

canopy covering more than half of the arts hub areas and housing an avenue of

shops and restaurants leading to a man-made lagoon, won the first competition

but led to controversy. It was abandoned partly because the size of the canopy

prompted the need for a single tendering process, which could lead to

monopolisation of the site by a single developer. It was also ditched partly

because of the high estimated maintenance cost. This time,he has brought

together 25 brains from Hong Kong and overseas to ensure the design is what

Hongkongers want. Of the 25 advisers, some are familiar faces, including Kevin

Thompson, the director of the Academy of Performing Arts; Jane Cheung, associate

professor in cultural and creative arts of the Institute of Education; and

Johnson Chang, a respected curator on Chinese contemporary art and co-founder of

the Asia Art Archive in Hong Kong. "We've been very good listeners. We will

continue to be good listeners," Foster said. "We believe we have a fantastic

basis for designing at this point. It's not about the design of an individual

building. It's about really how you create a quarter. We will do justice to the

design that it has to be the best of its kind in the world. We are totally

dedicated to that course." In the interview, he repeatedly stressed his strength

- his early presence in Hong Kong. "I came here in 1979. It's 31 years and we've

been back ever since," he said, adding that his work, including the HSBC (SEHK:

0005) headquarters and the airport at Chek Lap Kok, had become symbols of the

city. "The Hong Kong airport totally rewrote the rules about what an airport

might be. Everybody has tried to copy it since, but there is only one original.

In terms of our submission on this project, again it will have elements of

surprise," he said. "It's a surprise of something totally different - not what

you would expect." Acknowledging the isolated site in West Kowloon had posed a

challenge to his design, he said he has sought out a solution. "The arts hub has

to be a magnet drawing people there. But the first priority is for the community

here in Hong Kong. In that sense, it will belong to them ... It [the arts hub]

will be linked to the existing communities, and improve them." While aware that

he cannot disclose design details due to rules of the competition, he said he

would seize on the opportunity provided by the decision to build the

Guangzhou-Shenzhen-Hong Kong express rail link station in West Kowloon. Foster

said was aware of the recent controversy about the station being located next to

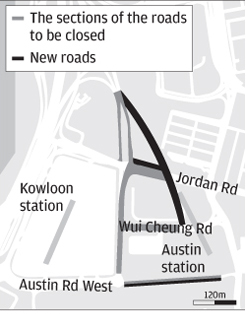

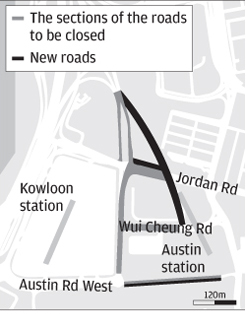

the arts hub. Under the government's plan, Austin Road will be sunk below ground

so that people visiting the hub can walk directly there from the station. Six

bridges and two tunnels connecting the station to Jordan were also proposed by

the MTR Corporation (SEHK: 0066) in its plan submitted to the Town Planning

Board this month. Apart from taking advantage of the station, Foster said he was

also mindful of other transport opportunities, incorporating design elements for

pedestrians, cyclists and drivers. He said he knows what Hong Kong people want.

"It has taken a long time. People would expect to see that time has been well

spent. They want something fantastic. They deserve it and they will get it. "The

opportunity to have a new start ... will be justified by the quality of the end

result," he said while commenting on the open space. "It's not just about size.

It's about quality. It's got to be better than Central Park." Foster said

architecture for the 21st century was about needs of the people. "Their material

needs, spiritual needs. It's about creating places which are warm, friendly,

welcoming, which make you feel good and make you want to go back," he said.

"It's also about something memorable. All the things you can measure and all the

things you can't measure." Koolhaas, meanwhile, vowed to integrate the arts hub

into the Pearl River Delta - his company has won the design competition for the

express rail link's second station, in Futian. Yim's works are local landmarks,

including the new government headquarters at Tamar named "The Door". How

confident is Foster of winning the third competition? "That will be very

presumptuous," he said with a laugh. "You cannot as an architect ever be

complacent. What you can do is do your best and strive for excellence. That's

the most important aspect of what we do." Lord Foster, who designed the HSBC

headquarters in Central, says the arts hub has to be a magnet drawing people to

the site. Lord Foster has pledged more surprises in his West Kowloon arts hub

design, with open space better than that in Central Park, New York. He said his

winning design involving a controversial giant canopy in 2001 was already

"history". The globally acclaimed Foster, one of three architects competing in

the West Kowloon Cultural District design competition, said of the canopy: "It

was rooted in its time." He was speaking on the topic for the first time after

the design was scrapped under public pressure four years ago. "Lots has happened

in 10 years. Everybody has moved on. I think there is a need for much greater

flexibility in terms of phasing and in terms of a multiplicity of

possibilities," he said in an interview. Foster said that this time he would

give Hong Kong something even more surprising. Apart from creating an open space

"better than Central Park" in New York, he said he had already figured out a

"cure" for the site, which is cut off from Canton Road and neighbouring

districts. He flew into Hong Kong last week to meet his team of local and

overseas experts advising him on the best way to handle the project again. This

summer, his design will be rolled out for public comment along with plans by the

other two selected architects - Dutchman Rem Koolhaas and Hongkonger Rocco Yim

Sen-kee. The design of the 40-hectare arts hub went back to the drawing board in

February 2006 after competition outcomes in 2001 and 2003 failed to gain support

from lawmakers and the public. Having secured funding of HK$21.6 billion in July

2008, the government again invited designs from three selected architects.

Foster said he was about to submit his third sketch. His first, the enormous

canopy covering more than half of the arts hub areas and housing an avenue of

shops and restaurants leading to a man-made lagoon, won the first competition

but led to controversy. It was abandoned partly because the size of the canopy

prompted the need for a single tendering process, which could lead to

monopolisation of the site by a single developer. It was also ditched partly

because of the high estimated maintenance cost. This time,he has brought

together 25 brains from Hong Kong and overseas to ensure the design is what

Hongkongers want. Of the 25 advisers, some are familiar faces, including Kevin

Thompson, the director of the Academy of Performing Arts; Jane Cheung, associate

professor in cultural and creative arts of the Institute of Education; and

Johnson Chang, a respected curator on Chinese contemporary art and co-founder of

the Asia Art Archive in Hong Kong. "We've been very good listeners. We will

continue to be good listeners," Foster said. "We believe we have a fantastic

basis for designing at this point. It's not about the design of an individual

building. It's about really how you create a quarter. We will do justice to the

design that it has to be the best of its kind in the world. We are totally

dedicated to that course." In the interview, he repeatedly stressed his strength

- his early presence in Hong Kong. "I came here in 1979. It's 31 years and we've

been back ever since," he said, adding that his work, including the HSBC (SEHK:

0005) headquarters and the airport at Chek Lap Kok, had become symbols of the

city. "The Hong Kong airport totally rewrote the rules about what an airport

might be. Everybody has tried to copy it since, but there is only one original.

In terms of our submission on this project, again it will have elements of

surprise," he said. "It's a surprise of something totally different - not what

you would expect." Acknowledging the isolated site in West Kowloon had posed a

challenge to his design, he said he has sought out a solution. "The arts hub has

to be a magnet drawing people there. But the first priority is for the community

here in Hong Kong. In that sense, it will belong to them ... It [the arts hub]

will be linked to the existing communities, and improve them." While aware that

he cannot disclose design details due to rules of the competition, he said he

would seize on the opportunity provided by the decision to build the

Guangzhou-Shenzhen-Hong Kong express rail link station in West Kowloon. Foster

said was aware of the recent controversy about the station being located next to

the arts hub. Under the government's plan, Austin Road will be sunk below ground

so that people visiting the hub can walk directly there from the station. Six

bridges and two tunnels connecting the station to Jordan were also proposed by

the MTR Corporation (SEHK: 0066) in its plan submitted to the Town Planning

Board this month. Apart from taking advantage of the station, Foster said he was

also mindful of other transport opportunities, incorporating design elements for

pedestrians, cyclists and drivers. He said he knows what Hong Kong people want.

"It has taken a long time. People would expect to see that time has been well

spent. They want something fantastic. They deserve it and they will get it. "The

opportunity to have a new start ... will be justified by the quality of the end

result," he said while commenting on the open space. "It's not just about size.

It's about quality. It's got to be better than Central Park." Foster said

architecture for the 21st century was about needs of the people. "Their material

needs, spiritual needs. It's about creating places which are warm, friendly,

welcoming, which make you feel good and make you want to go back," he said.

"It's also about something memorable. All the things you can measure and all the

things you can't measure." Koolhaas, meanwhile, vowed to integrate the arts hub

into the Pearl River Delta - his company has won the design competition for the

express rail link's second station, in Futian. Yim's works are local landmarks,

including the new government headquarters at Tamar named "The Door". How

confident is Foster of winning the third competition? "That will be very

presumptuous," he said with a laugh. "You cannot as an architect ever be

complacent. What you can do is do your best and strive for excellence. That's

the most important aspect of what we do."

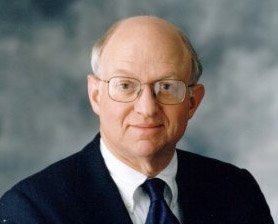

As

HSBC Holdings (0005) shifts its focus to the East, the lender believes its

mainland business will make the most of its comprehensive international network

to help Chinese enterprises expand overseas. HSBC (China) chairman Vincent Cheng

Hoi- chuen told Sing Tao Daily, sister publication of The Standard, that the

lender does not have any special advantage over mainland banks. Its well- funded

mainland competitors have plenty of outlets, where service has improved, he

noted. "But this doesn't mean we will stop expansion," Cheng said. "Instead, we

will do more to suit the development of our customers." HSBC is to utilize its

international network to help mainland companies expand or invest overseas.

Staff at its branches in Australia, Malaysia and the Middle East can provide

additional assistance. Cheng said the bank will keep cooperating with its

strategic partners and increase its outlets, including rural banks. It will also

expand the range of products and strive to have a larger share of the mortgage

market. Cheng is confident of meeting all development targets set for this year.

HSBC China turned in a US$1.63 billion (HK$12.71 billion) profit last year,

mostly from jointly controlled companies. The lender's core business - which

reflected organic growth - contributed only US$111 million. Cheng attributed the

unsatisfactory results to a narrower net interest margin. "[HSBC] lends only 70

yuan out of 100 yuan, 30 yuan is spent on stable bonds for interest income."

Cheng said the low-interest-rate environment encouraged many aggressive peers to

lend and make easy profits in the interbank market. He noted this encourages

banks to be shortsighted and highly leveraged, so the practice is not good for

long-term financial development. As HSBC's loans are all backed by deposits,

there is no pressure to change its short-term strategies in the mainland, Cheng

said. He said interest rates will go only "one way - up," which will gradually

improve the bank's operating environment. As

HSBC Holdings (0005) shifts its focus to the East, the lender believes its

mainland business will make the most of its comprehensive international network

to help Chinese enterprises expand overseas. HSBC (China) chairman Vincent Cheng

Hoi- chuen told Sing Tao Daily, sister publication of The Standard, that the

lender does not have any special advantage over mainland banks. Its well- funded

mainland competitors have plenty of outlets, where service has improved, he

noted. "But this doesn't mean we will stop expansion," Cheng said. "Instead, we

will do more to suit the development of our customers." HSBC is to utilize its

international network to help mainland companies expand or invest overseas.

Staff at its branches in Australia, Malaysia and the Middle East can provide

additional assistance. Cheng said the bank will keep cooperating with its

strategic partners and increase its outlets, including rural banks. It will also

expand the range of products and strive to have a larger share of the mortgage

market. Cheng is confident of meeting all development targets set for this year.

HSBC China turned in a US$1.63 billion (HK$12.71 billion) profit last year,

mostly from jointly controlled companies. The lender's core business - which

reflected organic growth - contributed only US$111 million. Cheng attributed the

unsatisfactory results to a narrower net interest margin. "[HSBC] lends only 70

yuan out of 100 yuan, 30 yuan is spent on stable bonds for interest income."

Cheng said the low-interest-rate environment encouraged many aggressive peers to

lend and make easy profits in the interbank market. He noted this encourages

banks to be shortsighted and highly leveraged, so the practice is not good for

long-term financial development. As HSBC's loans are all backed by deposits,

there is no pressure to change its short-term strategies in the mainland, Cheng

said. He said interest rates will go only "one way - up," which will gradually

improve the bank's operating environment.

The Department of Health would

inspect about 500 manufacturers of Chinese medicine in Hong Kong, Director of

Health Dr Lam Ping-yan said on Monday.

French cosmetics retailer L’Occitane en Provence has received approval from the

listing committee of Hong Kong’s stock exchange for a US$400 million to US$600

million initial public share offering, a source close to the deal said.

L’Occitane, which sells body care products and fragrances in more than 70

countries including Britain, China, France, Japan, South Korea and the United

States, will become the first French company to list in Hong Kong. Founded in

1976 by Olivier Baussan, the company originally planned to launch its IPO in

2008, but postponed the plan because of the financial crisis. The company chose

Hong Kong over Paris for its listing because Asia was its fastest-growing

market, the source said, adding that the company planned to start pre-marketing

for the offering in early April. CLSA, HSBC (SEHK: 0005) and UBS are

underwriting L’Occitane’s deal. Bourse operator Hong Kong Exchanges and Clearing

(SEHK: 0388) , which faces a slowing pipeline of IPOs from mainland, is looking

to attract listings from overseas markets to diversify its listing sources.

Russia’s Rusal, the world’s biggest aluminium producer, floated around 10 per

cent of its stock amid great fanfare in late January, raising US$2.2 billion to

pay down debt.

French cosmetics retailer L’Occitane en Provence has received approval from the

listing committee of Hong Kong’s stock exchange for a US$400 million to US$600

million initial public share offering, a source close to the deal said.

L’Occitane, which sells body care products and fragrances in more than 70

countries including Britain, China, France, Japan, South Korea and the United

States, will become the first French company to list in Hong Kong. Founded in

1976 by Olivier Baussan, the company originally planned to launch its IPO in

2008, but postponed the plan because of the financial crisis. The company chose

Hong Kong over Paris for its listing because Asia was its fastest-growing

market, the source said, adding that the company planned to start pre-marketing

for the offering in early April. CLSA, HSBC (SEHK: 0005) and UBS are

underwriting L’Occitane’s deal. Bourse operator Hong Kong Exchanges and Clearing

(SEHK: 0388) , which faces a slowing pipeline of IPOs from mainland, is looking

to attract listings from overseas markets to diversify its listing sources.

Russia’s Rusal, the world’s biggest aluminium producer, floated around 10 per

cent of its stock amid great fanfare in late January, raising US$2.2 billion to

pay down debt.

The Octopus card should also accept

yuan to integrate the city's rail services with the mainland system, says MTR

Corp chairman Raymond Chien Kuo- fung.

Personal loss puts student - in frontline of cancer fight - Student Clara Lee

On-ki lost her grandmother to liver cancer about six years ago. Her loss

motivated her to study the relationship between oolong tea and prostate cancer

and for which she received a young scientist award yesterday. Lee, a student at

the Shun Tak Fraternal Association Yung Yau College in Tin Shui Wai, discovered

that oolong tea, if consumed at a certain concentration, is helpful in

suppressing prostate cancer. For her work she was awarded the Individual

Researcher Award, the Best Project Award and Intel ISEF The Society for In Vitro

Biology Award in the Hong Kong Youth Science and Technology Invention

Competition 2009-10. "My grandmother passed away when I was in primary four or

five," said Secondary Four student Lee, tears welling in her eyes. "It was then

I decided to develop a career in medical science to save others like her."

Building on another research on tea's function as an antioxidant, Lee discovered

that oolong has more uses than most types of tea. Joining a scheme organized by

the Hong Kong New Generation Cultural Association, Lee conducted research on

condensed oolong tea and the effect of a chemical contained in it on prostate

cancer with assistance of a professor at City University. The research, which

began last Christmas, found that a concentration of tea polyphenol in oolong tea

at 0.25 milligram per milliliter can suppress prostrate cancer cell activity to

below 10 percent. However, if the tea density is lower, it does not inhibit cell

activity. On the other hand, tea polyphenol becomes less effective if the

concentration is too low. "Currently, there is very little research on prostate

cancer. The reason I chose this direction is because the cell division is

relatively slower than other types of cancer," Lee said. Lee told The Standard

her family members are tea lovers. "Drinking tea is a habit for many Chinese,

and it is for my family," Lee said. "Luckily my dad is still healthy, but as a

result of my research I have advised them to drink more oolong tea." Lee plans

to continue her research on tea polyphenol.

Personal loss puts student - in frontline of cancer fight - Student Clara Lee

On-ki lost her grandmother to liver cancer about six years ago. Her loss

motivated her to study the relationship between oolong tea and prostate cancer

and for which she received a young scientist award yesterday. Lee, a student at

the Shun Tak Fraternal Association Yung Yau College in Tin Shui Wai, discovered

that oolong tea, if consumed at a certain concentration, is helpful in

suppressing prostate cancer. For her work she was awarded the Individual

Researcher Award, the Best Project Award and Intel ISEF The Society for In Vitro

Biology Award in the Hong Kong Youth Science and Technology Invention

Competition 2009-10. "My grandmother passed away when I was in primary four or

five," said Secondary Four student Lee, tears welling in her eyes. "It was then

I decided to develop a career in medical science to save others like her."

Building on another research on tea's function as an antioxidant, Lee discovered

that oolong has more uses than most types of tea. Joining a scheme organized by

the Hong Kong New Generation Cultural Association, Lee conducted research on

condensed oolong tea and the effect of a chemical contained in it on prostate

cancer with assistance of a professor at City University. The research, which

began last Christmas, found that a concentration of tea polyphenol in oolong tea

at 0.25 milligram per milliliter can suppress prostrate cancer cell activity to

below 10 percent. However, if the tea density is lower, it does not inhibit cell

activity. On the other hand, tea polyphenol becomes less effective if the

concentration is too low. "Currently, there is very little research on prostate

cancer. The reason I chose this direction is because the cell division is

relatively slower than other types of cancer," Lee said. Lee told The Standard

her family members are tea lovers. "Drinking tea is a habit for many Chinese,

and it is for my family," Lee said. "Luckily my dad is still healthy, but as a

result of my research I have advised them to drink more oolong tea." Lee plans

to continue her research on tea polyphenol.

Workers at Macau International

Airport help Viva Macau passengers stranded by the budget airline's financial

difficulties. Macau's government ended the operating contract of Viva Macau

yesterday after the cash-strapped budget airline did not offer to help

passengers whose flights were cancelled due to its failure to pay fuel bills.

Travellers have been warned against buying any more tickets from Viva Macau -

whose online ticketing service was still available yesterday. Officials said any

further sales by the airline would amount to fraud. Hundreds of passengers who

only knew their flights were cancelled upon arrival at Macau's airport vented

their anger on police. Dozens of mainland tourists formed a human blockade to

stop other passengers from boarding their planes in a bid to attract the

authorities' attention. Meanwhile, hundreds of tourists in Hong Kong face

disruption to their Easter holiday because travel agencies said tickets had sold

out. Macau's Civil Aviation Authority ordered the city's franchised airline, Air

Macau, to terminate Viva Macau's operating licence in a bid to protect the

public interest and the city's image as a tourism hub. "[Viva Macau] has been

most unhelpful," authority president Simon Chan Weng-hong said. "It failed even

to provide us with a passenger list when the government tried to resolve the

problem over the past two days. Its lack of co-operation has slowed down our

efforts. We don't see that it has any sincerity in solving the problems." Workers at Macau International

Airport help Viva Macau passengers stranded by the budget airline's financial

difficulties. Macau's government ended the operating contract of Viva Macau

yesterday after the cash-strapped budget airline did not offer to help

passengers whose flights were cancelled due to its failure to pay fuel bills.

Travellers have been warned against buying any more tickets from Viva Macau -

whose online ticketing service was still available yesterday. Officials said any

further sales by the airline would amount to fraud. Hundreds of passengers who

only knew their flights were cancelled upon arrival at Macau's airport vented

their anger on police. Dozens of mainland tourists formed a human blockade to

stop other passengers from boarding their planes in a bid to attract the

authorities' attention. Meanwhile, hundreds of tourists in Hong Kong face

disruption to their Easter holiday because travel agencies said tickets had sold

out. Macau's Civil Aviation Authority ordered the city's franchised airline, Air

Macau, to terminate Viva Macau's operating licence in a bid to protect the

public interest and the city's image as a tourism hub. "[Viva Macau] has been

most unhelpful," authority president Simon Chan Weng-hong said. "It failed even

to provide us with a passenger list when the government tried to resolve the

problem over the past two days. Its lack of co-operation has slowed down our

efforts. We don't see that it has any sincerity in solving the problems."

Towngas – the largest energy

supplier in Hong Kong – said on Monday it would not raise its tariffs again over

the next two years following an announcement last week of an increase.

Jonathan Wong displays genuine

organic vegetables. He said price was the main clue for consumers. Cheap organic

veg is too good to be true, survey warns - More vendors say they are selling

organic vegetables in wet markets but lack of certification means their quality

is questionable. A survey by the Hong Kong Organic Resource Centre of Baptist

University found that one in five vegetable vendors in wet markets claimed to be

selling organic produce, double the number last year. But only 10 per cent of

those vendors could show proof of certification. Centre director Jonathan Wong

Woon-chung said it was bad news for consumers because it was difficult to

distinguish organic produce. The survey, which covered 706 stalls in 74 wet

markets, showed that almost two-thirds of what vendors claimed were organic

vegetables were sold for less than HK$10 a catty (600 grams), while all

certified organic vegetables were sold for more than HK$10, with those from

local farms priced above HK$20. The difference called into question the

authenticity of unaccredited organic vegetables, Wong said. "Organic vegetables

should be more expensive. How some vendors can sell what they claim to be

organic vegetables for such a cheap price is the question to ask," Wong said.

"Shoppers should be alert when they see very cheap organic vegetables." Early

this month, a vegetable stall owner was fined HK$2,500 for supplying vegetables

falsely claimed to have been certified as organic by Baptist University. When

asked the source of their produce, half of those selling organic vegetables

without a certificate refused to answer. Eighty per cent of vendors selling what

they claimed were organic vegetables also sell inorganic ones. Some 45 per cent

would store organic and inorganic vegetables together, a practice that might

contaminate organic vegetables. But this did not happen at stalls selling

accredited products. Wong said at Tsuen Wan Market, most "organic" vegetables

were likely to be inorganic. Isaac Ma, who spent HK$200 on organic vegetables in

a bazaar in Central yesterday, said: "I have no way of telling whether they are

really organic or not ... not many vendors can show their certificates in wet

markets. So I prefer to buy them from supermarkets, which I think is more

credible." He said organic vegetables from supermarkets usually cost double

those from wet markets. Winnie Woo, a housewife, said: "I distinguish organic

vegetables from others by seeing whether there are holes on the leaves." But

that method was rejected by Wong, who said improvements in agricultural methods

had solved the bug problem associated with organic vegetables. Wong said people

were gaining confidence in organic produce from local farms. More than 70 per

cent of certified organic vegetables sold in the market came from local farms

and the rest from the mainland. "Organic vegetables from local farms are good

for the environment because reduced transportation means less carbon dioxide is

emitted," Wong said. According to the centre, organic foods are those that have

been grown without the use of conventional pesticides, herbicides, artificial

fertilisers, human waste or sewage sludge. They are processed without food

additives and are not subjected to genetic engineering. All organic food

certification in Hong Kong is developed by the private sector. The centre is one

of two independent certification bodies for organic products in Hong Kong. Jonathan Wong displays genuine

organic vegetables. He said price was the main clue for consumers. Cheap organic

veg is too good to be true, survey warns - More vendors say they are selling

organic vegetables in wet markets but lack of certification means their quality

is questionable. A survey by the Hong Kong Organic Resource Centre of Baptist

University found that one in five vegetable vendors in wet markets claimed to be

selling organic produce, double the number last year. But only 10 per cent of

those vendors could show proof of certification. Centre director Jonathan Wong

Woon-chung said it was bad news for consumers because it was difficult to

distinguish organic produce. The survey, which covered 706 stalls in 74 wet

markets, showed that almost two-thirds of what vendors claimed were organic

vegetables were sold for less than HK$10 a catty (600 grams), while all

certified organic vegetables were sold for more than HK$10, with those from

local farms priced above HK$20. The difference called into question the

authenticity of unaccredited organic vegetables, Wong said. "Organic vegetables

should be more expensive. How some vendors can sell what they claim to be

organic vegetables for such a cheap price is the question to ask," Wong said.

"Shoppers should be alert when they see very cheap organic vegetables." Early

this month, a vegetable stall owner was fined HK$2,500 for supplying vegetables

falsely claimed to have been certified as organic by Baptist University. When

asked the source of their produce, half of those selling organic vegetables

without a certificate refused to answer. Eighty per cent of vendors selling what

they claimed were organic vegetables also sell inorganic ones. Some 45 per cent

would store organic and inorganic vegetables together, a practice that might

contaminate organic vegetables. But this did not happen at stalls selling

accredited products. Wong said at Tsuen Wan Market, most "organic" vegetables

were likely to be inorganic. Isaac Ma, who spent HK$200 on organic vegetables in

a bazaar in Central yesterday, said: "I have no way of telling whether they are

really organic or not ... not many vendors can show their certificates in wet

markets. So I prefer to buy them from supermarkets, which I think is more

credible." He said organic vegetables from supermarkets usually cost double

those from wet markets. Winnie Woo, a housewife, said: "I distinguish organic

vegetables from others by seeing whether there are holes on the leaves." But

that method was rejected by Wong, who said improvements in agricultural methods

had solved the bug problem associated with organic vegetables. Wong said people

were gaining confidence in organic produce from local farms. More than 70 per

cent of certified organic vegetables sold in the market came from local farms

and the rest from the mainland. "Organic vegetables from local farms are good

for the environment because reduced transportation means less carbon dioxide is

emitted," Wong said. According to the centre, organic foods are those that have

been grown without the use of conventional pesticides, herbicides, artificial

fertilisers, human waste or sewage sludge. They are processed without food

additives and are not subjected to genetic engineering. All organic food

certification in Hong Kong is developed by the private sector. The centre is one

of two independent certification bodies for organic products in Hong Kong.

Visual arts centre proposed

for old police station - Jockey Club due to unveil plan for monument's

transformation. The Central Police Station compound is set to become a

contemporary visual arts centre to show off collections owned by the city's

residents. A person working on the project said the Jockey Club, which is

responsible for the plan, would hand over management of the site to a third

party, such as a non-governmental organisation. The club had previously

considered managing the declared monument through a company formed under its

charities trust. The shift towards visual arts means an auditorium and a

black-box theatre for the performing arts in the club's original proposal would

be scaled down or dropped. The person said many local artists and collectors

lacked proper space to store or showcase their pieces. The compound on Hollywood

Road was well situated to serve the purpose, given its proximity to the art

galleries in SoHo. Some space, such as the courtyards, would provide for small

and medium-sized performances to add vibrancy to the venue. The visual arts

centre could include a range of forms including photography, installations,

digital art, multimedia works in addition to painting and sculpture, another

person familiar with the proposal said. Some shops and restaurants would be

opened at affordable prices to generate revenue with the goal of making it

self-financing. The latest proposal, being prepared by consultants including

Asia Art Archive executive director Claire Hsu, who is stepdaughter of former

Jockey Club chairman Ronald Arculli; and former director of Swire Properties

Michael Moir, who runs a consultancy in property management and investment. The

consultants came on board after the club's former executive director for

charities William Yiu Yan-pui, who had steered it since 2007, departed in

January. The Asia Art Archive was set up by Hsu, Arculli and curator Chang

Tsong-zung in 2000 to promote contemporary Asian art by documentation and

research. The person working on the project said it had yet to be decided which

organisation would take over the operation. As for the design of a new

structure, he said no significant new building would be added and that its

height would be lower than the 77-metre restriction suggested by the Antiquities

Advisory Board in 2004. But Hall F, a prison cell that is not designated as

monument but which held a local poet, Dai Wangshu, as a political prisoner

during the Japanese occupation, would either be kept or be "re-created" within

the site, the person said, without giving details. "We need to keep the whole

story of the police station, and Hall F is part of it," the person said.

Historians and district councillors had lobbied for the hall's preservation. The

Jockey Club has undertaken to finance the HK$1.8 billion renovation work of the

compound. The club reached an agreement with the government in 2008 to

revitalise the site as a cultural complex with commercial elements. It later

scrapped the initial design of a 160-metre-high transparent tower, by Swiss

architects Herzog and de Meuron, amid public unease over its height and bulk. A

six-month public consultation for the design and the use was then launched and

local architect Rocco Yim Sen-kee was invited to join the design team. The club

is expected to release its latest design in the next few weeks before taking it

to the Town Planning Board. Alexander Hui yat-chuen, director of the Heritage

Hong Kong Foundation, questioned why contemporary visual arts were considered

the best option for the monument, and whether other options on public programmes

were evaluated. He said the club should make public the research questions and

parameters given to the consultants. Benny Chia Chung-heng, director of the

Fringe Club, said the shift towards visual arts was a natural outcome given the

consultants' background, but he hoped the site would still stage some performing

arts activities so that it would be eventful, especially at night. Visual arts centre proposed

for old police station - Jockey Club due to unveil plan for monument's

transformation. The Central Police Station compound is set to become a

contemporary visual arts centre to show off collections owned by the city's

residents. A person working on the project said the Jockey Club, which is

responsible for the plan, would hand over management of the site to a third

party, such as a non-governmental organisation. The club had previously

considered managing the declared monument through a company formed under its

charities trust. The shift towards visual arts means an auditorium and a

black-box theatre for the performing arts in the club's original proposal would

be scaled down or dropped. The person said many local artists and collectors

lacked proper space to store or showcase their pieces. The compound on Hollywood

Road was well situated to serve the purpose, given its proximity to the art

galleries in SoHo. Some space, such as the courtyards, would provide for small

and medium-sized performances to add vibrancy to the venue. The visual arts

centre could include a range of forms including photography, installations,

digital art, multimedia works in addition to painting and sculpture, another

person familiar with the proposal said. Some shops and restaurants would be

opened at affordable prices to generate revenue with the goal of making it

self-financing. The latest proposal, being prepared by consultants including

Asia Art Archive executive director Claire Hsu, who is stepdaughter of former

Jockey Club chairman Ronald Arculli; and former director of Swire Properties

Michael Moir, who runs a consultancy in property management and investment. The

consultants came on board after the club's former executive director for

charities William Yiu Yan-pui, who had steered it since 2007, departed in

January. The Asia Art Archive was set up by Hsu, Arculli and curator Chang

Tsong-zung in 2000 to promote contemporary Asian art by documentation and

research. The person working on the project said it had yet to be decided which

organisation would take over the operation. As for the design of a new

structure, he said no significant new building would be added and that its

height would be lower than the 77-metre restriction suggested by the Antiquities

Advisory Board in 2004. But Hall F, a prison cell that is not designated as

monument but which held a local poet, Dai Wangshu, as a political prisoner

during the Japanese occupation, would either be kept or be "re-created" within

the site, the person said, without giving details. "We need to keep the whole

story of the police station, and Hall F is part of it," the person said.

Historians and district councillors had lobbied for the hall's preservation. The

Jockey Club has undertaken to finance the HK$1.8 billion renovation work of the

compound. The club reached an agreement with the government in 2008 to

revitalise the site as a cultural complex with commercial elements. It later

scrapped the initial design of a 160-metre-high transparent tower, by Swiss

architects Herzog and de Meuron, amid public unease over its height and bulk. A

six-month public consultation for the design and the use was then launched and

local architect Rocco Yim Sen-kee was invited to join the design team. The club

is expected to release its latest design in the next few weeks before taking it

to the Town Planning Board. Alexander Hui yat-chuen, director of the Heritage

Hong Kong Foundation, questioned why contemporary visual arts were considered

the best option for the monument, and whether other options on public programmes

were evaluated. He said the club should make public the research questions and

parameters given to the consultants. Benny Chia Chung-heng, director of the

Fringe Club, said the shift towards visual arts was a natural outcome given the

consultants' background, but he hoped the site would still stage some performing

arts activities so that it would be eventful, especially at night.

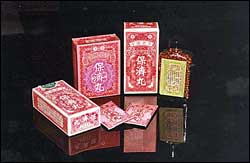

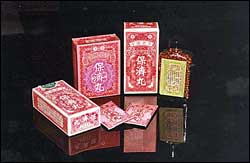

The maker of Po Chai Pills has

expanded its recall to parallel imports of the popular Chinese medicine. This

comes as the Department of Health investigates whether the manufacturer, Li

Chung Shing Tong, has broken any laws. The company also announced that, from

today, consumers can now go to 22 pharmacies, instead of just four, to surrender

the product - including parallel imports - and ask for refunds. No outdated

pills will be accepted. This was an update to recall advice from earlier

yesterday which had said parallel imports could only be accepted at its offices

in North Point. The company said around 302,500 packs of the pills have been

returned. Anyone with more than 20 packs will have to contact the North Point

head office. The manufacturer apologized on Thursday after the department

pointed out that it failed to report a product recall it initiated as early as

January. The Po Chai Pills' capsule form, which the manufacturer said was sold

in Singapore and not Hong Kong and Macau, was found to contain cancer-causing

drugs and restricted substances. The pill form, which is widely circulated in

the city, is also subject to the recall order. At a pharmacy located in Sha Kok

Estate, Sha Tin, consumers flocked to seek refunds. But some were frustrated

that they had been asked to travel to North Point to surrender parallel imports.

An elderly woman said: "It would cost a lot if I travel to North Point." An

elderly man who resides in the estate said: "I can't walk very well. There's no

way I can make it to North Point so I have to throw the 10 packs away." Other

consumers complained that pharmacies will only repay HK$13 a pack when the

listed refund price is HK$15. Wong Wai-man, sales manager of Man Tak Pharmacy,

said it can only offer a refund for HK$13 a pack as it is the price that

retailers are charged. Deputy Director of Health Gloria Tam Lai-fan said the

department has not ruled out taking legal action. "Li Chung Shing Tong

(Holdings) is a holder of a manufacturer's licence. We have to further

investigate to see if it had breached any ordinance," Tam said. The Chinese

medicine was found to contain phenolphthalein, banned in 2001 for its cancer-

causing effect, and sibutramine, a controlled substance that can raise blood

pressure and heart rates. The maker of Po Chai Pills has

expanded its recall to parallel imports of the popular Chinese medicine. This

comes as the Department of Health investigates whether the manufacturer, Li

Chung Shing Tong, has broken any laws. The company also announced that, from

today, consumers can now go to 22 pharmacies, instead of just four, to surrender

the product - including parallel imports - and ask for refunds. No outdated

pills will be accepted. This was an update to recall advice from earlier

yesterday which had said parallel imports could only be accepted at its offices

in North Point. The company said around 302,500 packs of the pills have been

returned. Anyone with more than 20 packs will have to contact the North Point

head office. The manufacturer apologized on Thursday after the department

pointed out that it failed to report a product recall it initiated as early as

January. The Po Chai Pills' capsule form, which the manufacturer said was sold

in Singapore and not Hong Kong and Macau, was found to contain cancer-causing

drugs and restricted substances. The pill form, which is widely circulated in

the city, is also subject to the recall order. At a pharmacy located in Sha Kok

Estate, Sha Tin, consumers flocked to seek refunds. But some were frustrated

that they had been asked to travel to North Point to surrender parallel imports.

An elderly woman said: "It would cost a lot if I travel to North Point." An

elderly man who resides in the estate said: "I can't walk very well. There's no

way I can make it to North Point so I have to throw the 10 packs away." Other

consumers complained that pharmacies will only repay HK$13 a pack when the

listed refund price is HK$15. Wong Wai-man, sales manager of Man Tak Pharmacy,

said it can only offer a refund for HK$13 a pack as it is the price that

retailers are charged. Deputy Director of Health Gloria Tam Lai-fan said the

department has not ruled out taking legal action. "Li Chung Shing Tong

(Holdings) is a holder of a manufacturer's licence. We have to further

investigate to see if it had breached any ordinance," Tam said. The Chinese

medicine was found to contain phenolphthalein, banned in 2001 for its cancer-

causing effect, and sibutramine, a controlled substance that can raise blood

pressure and heart rates.

China*:

China risks growing social instability and even violence if the government does

not take effective action to address anger about forced evictions and

demolitions, a new report says.

China*:

China risks growing social instability and even violence if the government does

not take effective action to address anger about forced evictions and

demolitions, a new report says.

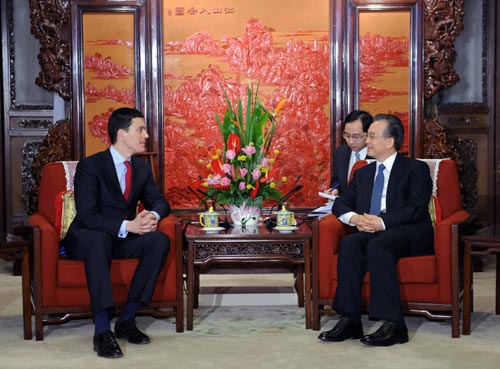

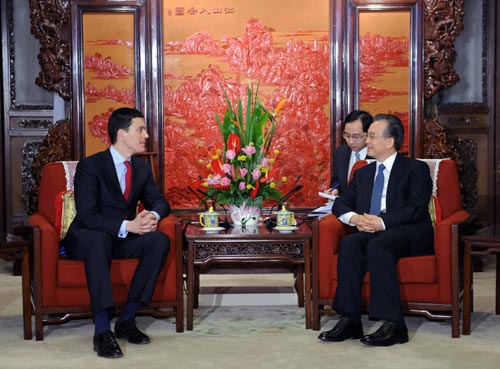

Chinese Vice President Xi Jinping on Sunday visited an industry hub in southwest

Sweden and met with Vastra Gotaland County Governor Lars Backstrom. In his

meeting with Lars Backstrom and Swedish Deputy Prime Minister Maud Olofsson, Xi

said that this year marks the 60th anniversary of the establishment of

diplomatic relations between China and Sweden and that his on-going visit to

Sweden is aimed at further promoting friendly cooperation between the two

countries through celebrating the anniversary. Both the city of Gothenburg and

Vastra Gotaland County with an important place in Sino-Swedish friendly

exchanges and cooperation have played an irreplaceable role in the development

of ties between the two countries, Xi said. A replica of the 18th century wooden

merchant ship Gotheborg, which reached the southern Chinese city of Canton

several times in the late 1730s and early 1740s, is an important symbol for the

friendly exchanges between China and Sweden, said Xi. The 2006 return of the

reconstructed Gotheborg to Canton and Shanghai has enhanced the friendship

between the Chinese and Swedish peoples and thus helped a lot in promoting the

growth of the bilateral relationship, Xi said.

Chinese Vice President Xi Jinping on Sunday visited an industry hub in southwest

Sweden and met with Vastra Gotaland County Governor Lars Backstrom. In his

meeting with Lars Backstrom and Swedish Deputy Prime Minister Maud Olofsson, Xi

said that this year marks the 60th anniversary of the establishment of

diplomatic relations between China and Sweden and that his on-going visit to

Sweden is aimed at further promoting friendly cooperation between the two

countries through celebrating the anniversary. Both the city of Gothenburg and

Vastra Gotaland County with an important place in Sino-Swedish friendly

exchanges and cooperation have played an irreplaceable role in the development

of ties between the two countries, Xi said. A replica of the 18th century wooden

merchant ship Gotheborg, which reached the southern Chinese city of Canton

several times in the late 1730s and early 1740s, is an important symbol for the

friendly exchanges between China and Sweden, said Xi. The 2006 return of the

reconstructed Gotheborg to Canton and Shanghai has enhanced the friendship

between the Chinese and Swedish peoples and thus helped a lot in promoting the

growth of the bilateral relationship, Xi said.

Number of outbound tourists

soaring - Two Beijingers study a New York travel offering at a travel agency

office in Beijing. The latest outbound tourism report by the China Tourism

Academy said China will the fourth largest source of outbound tourism in the

world by 2020. According to statistics from travel search engine Qunar.com, top

destinations for travelers departing from Beijing were Hong Kong, Tokyo, Seoul,

Singapore, Bangkok, New York, Paris, Kuala Lumpur, London and Sydney. China

Tourism Academy estimates as many as 54 million tourists will go abroad this

year, up from 47 million in 2009, reports Yu Tianyu from Beijing. Number of outbound tourists

soaring - Two Beijingers study a New York travel offering at a travel agency

office in Beijing. The latest outbound tourism report by the China Tourism

Academy said China will the fourth largest source of outbound tourism in the

world by 2020. According to statistics from travel search engine Qunar.com, top

destinations for travelers departing from Beijing were Hong Kong, Tokyo, Seoul,

Singapore, Bangkok, New York, Paris, Kuala Lumpur, London and Sydney. China

Tourism Academy estimates as many as 54 million tourists will go abroad this

year, up from 47 million in 2009, reports Yu Tianyu from Beijing.

Gold council predicts huge jump in mainland demand - Currently the world's

second-largest gold consumer after India, mainland has seen its gold demand grow

at an average rate of 13 per cent per year over the past five years. Mainland’s

gold demand is expected to double over the next decade from current levels due

to jewellery consumption and investment needs, the World Gold Council (WGC) said

in report released on Monday. Currently the world’s second-largest gold consumer

after India, mainland has seen its gold demand grow at an average rate of 13 per

cent per year over the past five years. Demand from mainland’s two largest

sectors – jewellery and investment – reached a combined total of 423 tonnes last

year, with 314 tonnes supplied by domestic mines. “This shortfall creates a

snowball effect as China’s gold industry may not be able to keep pace with the

annual leap in domestic consumption despite rising to be the world’s largest

gold producer since 2007,” WGC said in the report. The mainland per capita

consumption of gold jewellery is one of the lowest, at 0.26 grams, compared with

other major gold consuming countries. If gold were consumed at the same rate per

capita as in India, Hong Kong or Saudi Arabia, annual mainland demand could

increase by at least 100 tonnes or as much as 4,000 tonnes in the sector alone,

it said. If the central bank boosts gold holdings to 2.2 per cent of forex

reserves, a peak level seen in 2002, from the current 1.6 per cent, mainland’s

total incremental demand would rise by 400 tonnes at the current gold price, the

report added. Mainland’s share of global gold demand doubled from 5 per cent in

2002 to 11 per cent last year, and the council predicted that mainland’s

domestic gold mines could be exhausted within six years. “The Chinese gold

industry is simply not responding fast enough to bring in new supply,” it said.

Gold council predicts huge jump in mainland demand - Currently the world's

second-largest gold consumer after India, mainland has seen its gold demand grow

at an average rate of 13 per cent per year over the past five years. Mainland’s

gold demand is expected to double over the next decade from current levels due

to jewellery consumption and investment needs, the World Gold Council (WGC) said

in report released on Monday. Currently the world’s second-largest gold consumer

after India, mainland has seen its gold demand grow at an average rate of 13 per

cent per year over the past five years. Demand from mainland’s two largest

sectors – jewellery and investment – reached a combined total of 423 tonnes last

year, with 314 tonnes supplied by domestic mines. “This shortfall creates a

snowball effect as China’s gold industry may not be able to keep pace with the

annual leap in domestic consumption despite rising to be the world’s largest

gold producer since 2007,” WGC said in the report. The mainland per capita

consumption of gold jewellery is one of the lowest, at 0.26 grams, compared with

other major gold consuming countries. If gold were consumed at the same rate per

capita as in India, Hong Kong or Saudi Arabia, annual mainland demand could

increase by at least 100 tonnes or as much as 4,000 tonnes in the sector alone,

it said. If the central bank boosts gold holdings to 2.2 per cent of forex

reserves, a peak level seen in 2002, from the current 1.6 per cent, mainland’s

total incremental demand would rise by 400 tonnes at the current gold price, the

report added. Mainland’s share of global gold demand doubled from 5 per cent in

2002 to 11 per cent last year, and the council predicted that mainland’s

domestic gold mines could be exhausted within six years. “The Chinese gold

industry is simply not responding fast enough to bring in new supply,” it said.

Thousands of visitors crowd the Bund,

which was renovated as part of Shanghai's preparations for the World Expo. New

Bund wins good reviews from visitors - Shanghai happy with its 4b yuan (US$882

million) attraction. The curtains drew back on Shanghai's front window yesterday

when the city's best-known landmark, the Bund, reopened after a refit costing

billions of yuan. The iconic strip of colonial buildings has been a chaotic

construction site for nearly three years as part of the city's immense

development drive ahead of the World Expo, due to open on May 1, but yesterday

it was mobbed by nostalgic locals and wide-eyed tourists. "It's awesome. This is

an awesome city," one visitor from the US state of Nebraska said. "We're here on

a business trip and we had just one day left for sightseeing, and I'm just

amazed. I'd never even heard of this place before." Even the weather - a highly

unpredictable factor in recent weeks - decided to co-operate, as the riverfront

promenade was bathed in glorious spring sunshine. The riverfront promenade is

now 40 per cent wider than before, and extended by almost a kilometre southwards

to 2.6 kilometres in length. New fountains, floral displays and seating areas

now line the stretch between the raised walkway and Zhongshan East Road,

although the precinct's extensive shopping areas remain empty. The four billion

yuan (HK$4.54 billion) project involved digging a 3.3 kilometre double-deck

tunnel to divert most vehicle traffic underground. But not every hint of the

past has been erased. The new-look Bund has kept at least one thing which earned

it a fond place in locals' hearts - a section of low wall known as the lovers'

wall. Speaking at a press conference last week, however, officials were keen to

stress that this was an attempt to preserve the area's community memory, and was

not intended to condone illicit behaviour. Along the widened riverfront walkway,

visitors numbered in their tens of thousands. Officials claimed last week the

new park would accommodate more than one million visitors per day, and it

appeared to have been given a thorough test. Everywhere was packed with

visitors, keen to have their photos taken against the grand row of colonial

structures or the shining towers of glass and steel in the financial district

across the river in Pudong. Feng Yuehong, a 70-year-old Shanghai pensioner,

posed with his two-year-old granddaughter on one of the area's brand-new fleet

of electric cleaning vehicles. "It's nice to see the place open at last," he

said. "My wife and I used to come here every day after work so we felt we had to

take a look on the first day it reopened. "I like the new look. It feels

comfortable and very clean. It's much wider and there are a lot more open spaces

for people to walk." The only obvious source of stress was around vans selling

drinks at bargain-basement prices - just three yuan for a bottle of name-brand

soft-drinks. Around lunchtime, they were so overwhelmed with thirsty tourists

they were having trouble handling the demand. Vehicle traffic was noticeably

reduced along the street after the opening of the road tunnel designed to handle

the majority of medium-sized cars travelling along the important north-south

corridor. But with the thoroughfare shrunk from 11 lanes to just six, the

remaining traffic was only a little safer for pedestrians. "I'm generally happy

with the park, but do think it would have been better with some pedestrian

bridges or subways," Ma Jingming, a Shanghai retiree who was trying to get home

after riding his unicycle on the waterfront, said. "They have really improved

the promenade - I think it could easily accommodate twice as many people as

today - but when you come back down to the road I think it is still a bit

chaotic and dangerous. "There is a very long wait at the crossings, and I think

that could be a problem when there are high numbers of visitors." The Bund's

massive redevelopment project represents just a tiny fraction of the city's

preparations for the six-month World Expo. The mainland's biggest international

event since the Beijing Olympics in 2008 is expected to draw upwards of 70

million visitors, and the municipal government is pulling out all stops to show

off the city as vibrant and modern. The expo's budget is already estimated to be

twice that of the Olympics and has involved a massive drive to upgrade the

city's transport network and other infrastructure. But Shanghai has rejected

plans for a massive opening extravaganza featuring performances spanning the

Huangpu River. As probably the city's most famous attraction, the Bund is

playing its part in promoting the event. A large, temporary stage has also been

erected for use in celebrations to mark the one-month countdown to the expo

tomorrow night. But the view did not win over everybody who visited yesterday.

"It's just a river," Liu Jinwei, a visitor from Suzhou , Jiangsu province, said.

"I think it's nice, but nothing so amazing as I'd expected. There are too many

people." Thousands of visitors crowd the Bund,

which was renovated as part of Shanghai's preparations for the World Expo. New

Bund wins good reviews from visitors - Shanghai happy with its 4b yuan (US$882

million) attraction. The curtains drew back on Shanghai's front window yesterday

when the city's best-known landmark, the Bund, reopened after a refit costing

billions of yuan. The iconic strip of colonial buildings has been a chaotic

construction site for nearly three years as part of the city's immense

development drive ahead of the World Expo, due to open on May 1, but yesterday

it was mobbed by nostalgic locals and wide-eyed tourists. "It's awesome. This is

an awesome city," one visitor from the US state of Nebraska said. "We're here on

a business trip and we had just one day left for sightseeing, and I'm just

amazed. I'd never even heard of this place before." Even the weather - a highly

unpredictable factor in recent weeks - decided to co-operate, as the riverfront

promenade was bathed in glorious spring sunshine. The riverfront promenade is

now 40 per cent wider than before, and extended by almost a kilometre southwards

to 2.6 kilometres in length. New fountains, floral displays and seating areas

now line the stretch between the raised walkway and Zhongshan East Road,

although the precinct's extensive shopping areas remain empty. The four billion

yuan (HK$4.54 billion) project involved digging a 3.3 kilometre double-deck

tunnel to divert most vehicle traffic underground. But not every hint of the

past has been erased. The new-look Bund has kept at least one thing which earned

it a fond place in locals' hearts - a section of low wall known as the lovers'

wall. Speaking at a press conference last week, however, officials were keen to

stress that this was an attempt to preserve the area's community memory, and was

not intended to condone illicit behaviour. Along the widened riverfront walkway,

visitors numbered in their tens of thousands. Officials claimed last week the

new park would accommodate more than one million visitors per day, and it

appeared to have been given a thorough test. Everywhere was packed with

visitors, keen to have their photos taken against the grand row of colonial

structures or the shining towers of glass and steel in the financial district

across the river in Pudong. Feng Yuehong, a 70-year-old Shanghai pensioner,

posed with his two-year-old granddaughter on one of the area's brand-new fleet

of electric cleaning vehicles. "It's nice to see the place open at last," he

said. "My wife and I used to come here every day after work so we felt we had to

take a look on the first day it reopened. "I like the new look. It feels

comfortable and very clean. It's much wider and there are a lot more open spaces

for people to walk." The only obvious source of stress was around vans selling

drinks at bargain-basement prices - just three yuan for a bottle of name-brand

soft-drinks. Around lunchtime, they were so overwhelmed with thirsty tourists

they were having trouble handling the demand. Vehicle traffic was noticeably

reduced along the street after the opening of the road tunnel designed to handle

the majority of medium-sized cars travelling along the important north-south

corridor. But with the thoroughfare shrunk from 11 lanes to just six, the

remaining traffic was only a little safer for pedestrians. "I'm generally happy

with the park, but do think it would have been better with some pedestrian

bridges or subways," Ma Jingming, a Shanghai retiree who was trying to get home

after riding his unicycle on the waterfront, said. "They have really improved

the promenade - I think it could easily accommodate twice as many people as

today - but when you come back down to the road I think it is still a bit

chaotic and dangerous. "There is a very long wait at the crossings, and I think

that could be a problem when there are high numbers of visitors." The Bund's

massive redevelopment project represents just a tiny fraction of the city's

preparations for the six-month World Expo. The mainland's biggest international

event since the Beijing Olympics in 2008 is expected to draw upwards of 70

million visitors, and the municipal government is pulling out all stops to show

off the city as vibrant and modern. The expo's budget is already estimated to be

twice that of the Olympics and has involved a massive drive to upgrade the

city's transport network and other infrastructure. But Shanghai has rejected

plans for a massive opening extravaganza featuring performances spanning the

Huangpu River. As probably the city's most famous attraction, the Bund is

playing its part in promoting the event. A large, temporary stage has also been

erected for use in celebrations to mark the one-month countdown to the expo

tomorrow night. But the view did not win over everybody who visited yesterday.

"It's just a river," Liu Jinwei, a visitor from Suzhou , Jiangsu province, said.

"I think it's nice, but nothing so amazing as I'd expected. There are too many

people."

Mainland’s central bank, facing a

tough job steering monetary policy, appointed three new academic members to its

policy-making panel on Monday. The announcement by the People’s Bank of China,

made on its website (www.pbc.gov.cn ), confirmed an earlier report in the China

Business News. Three prominent economists will replace Fan Gang, the only

academic member of the monetary policy committee, which plays a pivotal role in

framing policy advice on issues such as interest rates and the currency. The new

members include Zhou Qiren, head of the China Center for Economic Research at

Peking University. His predecessor, Justin Lin, is now chief economist at the

World Bank. The other new members are Xia Bin, head of the financial institute

of the Development Research Centre, a think-tank under the State Council and Li

Daokui at Tsinghua University. The China Business News said the trio would

attend their first monetary policy committee meeting on Tuesday. An assistant to

Zhou at Peking University said the economist would attend a central bank meeting

on Tuesday but declined to give further details. The appointments mark a

continued effort by the PBOC to shore up its policy-making process as it strives

to strike a balance between sustaining growth and keeping inflation tame. The

panel is chaired by Zhou and includes senior officials from the cabinet, the

Finance Ministry, planning agency and financial regulatory agencies. Xia, a

former central bank official, is considered an expert on monetary policy and

financial reforms. Li is held in high regard as a macroeconomic analyst. Zhou,

who has a PhD in economics from the University of California, has been focusing

on economic restructuring. “This shows the central bank is more willing to

listen to opinions from external experts and listen to different views,” said

Qing Wang, China economist at Morgan Stanley in Hong Kong. “The central bank is

well ahead of state agencies in promoting policy transparency and opening up to

external experts’ views, which are more balanced and far-sighted,” he said.

Mainland’s cabinet retains the final say on key policy changes, including

interest rates and the exchange rate, but the central bank has been fighting for

more decision-making authority. Previous academic members of the committee,

which holds meetings on a quarterly basis, include Yu Yongding and Li Yang, both

from the Chinese Academy of Social Sciences, another top government think-tank. Mainland’s central bank, facing a

tough job steering monetary policy, appointed three new academic members to its

policy-making panel on Monday. The announcement by the People’s Bank of China,

made on its website (www.pbc.gov.cn ), confirmed an earlier report in the China

Business News. Three prominent economists will replace Fan Gang, the only

academic member of the monetary policy committee, which plays a pivotal role in

framing policy advice on issues such as interest rates and the currency. The new

members include Zhou Qiren, head of the China Center for Economic Research at

Peking University. His predecessor, Justin Lin, is now chief economist at the

World Bank. The other new members are Xia Bin, head of the financial institute

of the Development Research Centre, a think-tank under the State Council and Li

Daokui at Tsinghua University. The China Business News said the trio would

attend their first monetary policy committee meeting on Tuesday. An assistant to

Zhou at Peking University said the economist would attend a central bank meeting

on Tuesday but declined to give further details. The appointments mark a

continued effort by the PBOC to shore up its policy-making process as it strives

to strike a balance between sustaining growth and keeping inflation tame. The

panel is chaired by Zhou and includes senior officials from the cabinet, the

Finance Ministry, planning agency and financial regulatory agencies. Xia, a

former central bank official, is considered an expert on monetary policy and

financial reforms. Li is held in high regard as a macroeconomic analyst. Zhou,

who has a PhD in economics from the University of California, has been focusing

on economic restructuring. “This shows the central bank is more willing to

listen to opinions from external experts and listen to different views,” said

Qing Wang, China economist at Morgan Stanley in Hong Kong. “The central bank is

well ahead of state agencies in promoting policy transparency and opening up to

external experts’ views, which are more balanced and far-sighted,” he said.

Mainland’s cabinet retains the final say on key policy changes, including

interest rates and the exchange rate, but the central bank has been fighting for

more decision-making authority. Previous academic members of the committee,

which holds meetings on a quarterly basis, include Yu Yongding and Li Yang, both

from the Chinese Academy of Social Sciences, another top government think-tank.

China Construction Bank (0939) said

net profit last year rose 15.3 percent from the previous year to 106.8 billion

yuan (HK$121.42 billion) on improved fee and commission income and lower

impairment losses on assets.

March 30, 2010

Hong Kong*:

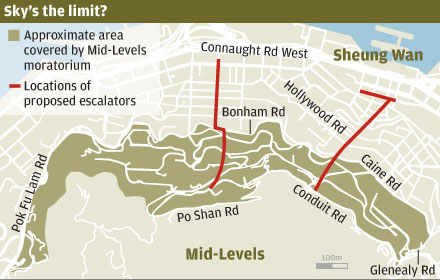

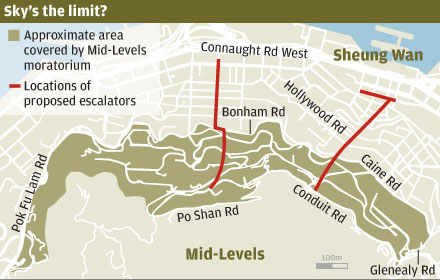

The Lands Department has been asked to summon senior management of Henderson

Land (SEHK: 0012) to explain in person why the sales of 24 flats in its luxury

Mid-Levels development could not be completed five months after it claimed they

were sold. At a special Finance Committee meeting yesterday, some legislators

criticised the department for failing to press harder. Henderson said in October

that 25 flats in the development at 39 Conduit Road had been sold, including one

five-bedroom duplex for a world record of HK$439 million - or HK$88,000 a square

foot. But Land Registry records show only one flat has been sold. This sparked

criticism that the developer might have released misleading information to shore

up market sentiment or prices. Henderson Group chairman Lee Shau-kee said last

week that he was willing to bet that no transaction for apartments at the block

was faked. He said some buyers had asked to delay payments, so the sale of some

flats had yet to be completed. The department has written to the developer for

information. In a reply earlier this week, Henderson said it had entered into a

verbal agreement with the 24 buyers to extend the transaction date for two to

four months, adding that this might be further extended. The department wrote to

the developer again to request further information. Legislator Lee Wing-tat, of

the Democratic Party, said: "The department does not seem to have been too

afraid to act. Why must you write letters? Can you not summon the company

management to explain to you in person?" Director of Lands Annie Tam Kam-lan

argued she had followed the proper procedure. "After we receive the reply from

the developer, we shall consult the [Development] Bureau and the Department of

Justice on what to do next," Tam said. Lee said the department should initiate

an investigation when it spotted an abnormality in a transaction. Sales at the

46-floor residential building in Mid-Levels West have been dogged by controversy

after Henderson Land skipped 48 floor numbers so it could market the top two