|

Newsletter

Seminar Material

Biz:

China

Hong

Kong Hawaii

What people

said about us

China

Earthquake Relief

Tax &

Government

Hawaii Voter Registration

Biz-Video

Biz-Video

Hawaii's

China Connection Hawaii's

China Connection

CDP#1780962

CDP#1780962

Doing Business in

Hong Kong & China

Doing Business in

Hong Kong & China

| |

Share Hong Kong, China & Hawaii Biz*

Skype - FREE

Voice Over IP Skype - FREE

Voice Over IP  View Hawaii's China Connection

Video Trailer

View Hawaii's China Connection

Video Trailer

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our event page to find out more!

After

attended a China/Hong Kong Business/Trade Seminar in Hawaii...still unsure what

to do next, contact us, our Officers, Directors and Founding Members are

actively engaged in China/Hong Kong/Asia trade - we can help!

Are you ready to export your product or

service? You will find out in 3 minutes with resources to help you -

enter

to give it a try

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

(approximate $ exchange rates: US$1 = HK$7.8, US$1 = RMB$6.8)

View China 60th

Anniversary Video and Photo online View China 60th

Anniversary Video and Photo online

Holidays Greeting from President Obama & Johnson Choi

Holidays Greeting from President Obama & Johnson Choi

http://www.youtube.com/watch?v=pNk4Z4lUV-k

http://www.youtube.com/watch?v=pNk4Z4lUV-k

http://www.facebook.com/video/video.php?v=219896871983&ref=mf

http://www.facebook.com/video/video.php?v=219896871983&ref=mf

Wine-Biz

- Hong Kong

Wine-Biz

- Hong Kong

Brand Hong Kong

Video

Brand Hong Kong

Video

Mainland and Hong

Kong Closer Economic Partnership Arrangement (CEPA)

http://www.tid.gov.hk/english/cepa/index.html

Mainland and Hong

Kong Closer Economic Partnership Arrangement (CEPA)

http://www.tid.gov.hk/english/cepa/index.html

May 31, 2010

Hong Kong*:

Prudential Plc halted trading in its

Hong Kong listed shares on Friday as the British insurer sought to cut the

US$35.5 billion price tag it originally negotiated for AIG’s main Asian assets.

Prudential is trying to lower the price of the planned deal to purchase American

International Assurance (AIA) amid rising pressure from investors, a source

familiar with the situation said on Thursday. Prudential in Hong Kong declined

to comment on the reason for the suspension in trading, but the company was

likely to issue a clarification statement to the HK exchange in the due course,

one source told reporters. Hong Kong*:

Prudential Plc halted trading in its

Hong Kong listed shares on Friday as the British insurer sought to cut the

US$35.5 billion price tag it originally negotiated for AIG’s main Asian assets.

Prudential is trying to lower the price of the planned deal to purchase American

International Assurance (AIA) amid rising pressure from investors, a source

familiar with the situation said on Thursday. Prudential in Hong Kong declined

to comment on the reason for the suspension in trading, but the company was

likely to issue a clarification statement to the HK exchange in the due course,

one source told reporters.

A month after university graduates

were told to expect up to HK$2,000 less on joining the civil service from

October, civil servants are being told they can expect pay hikes of up to 1.6

percent.

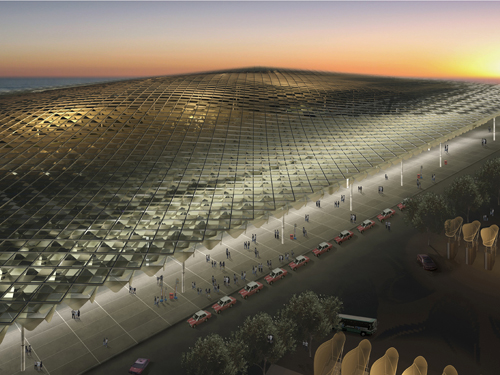

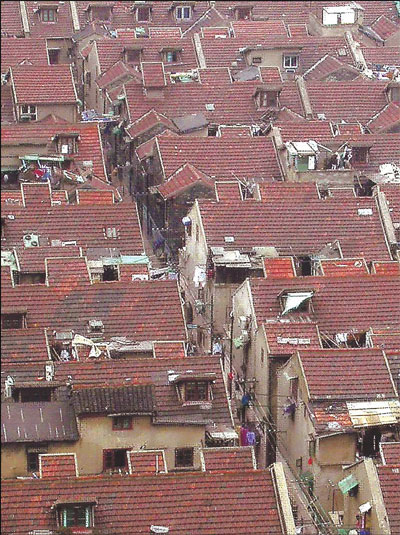

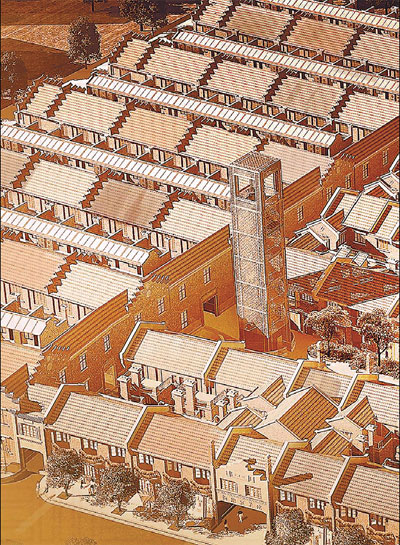

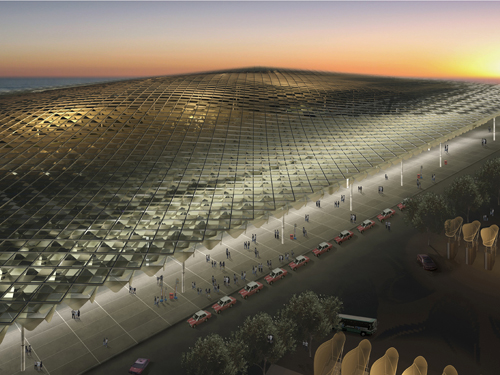

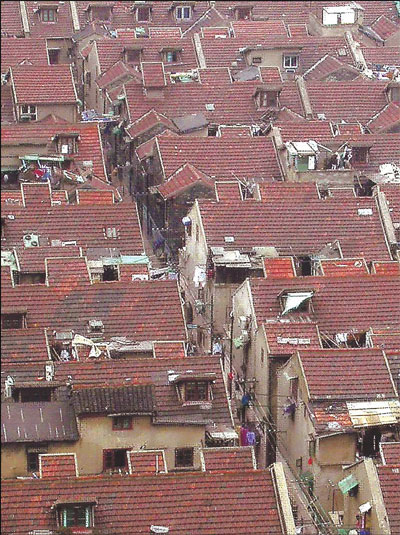

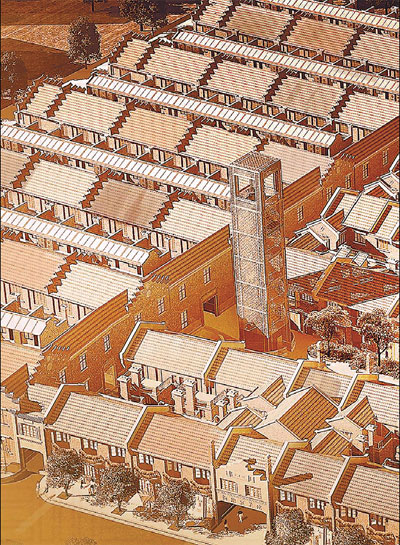

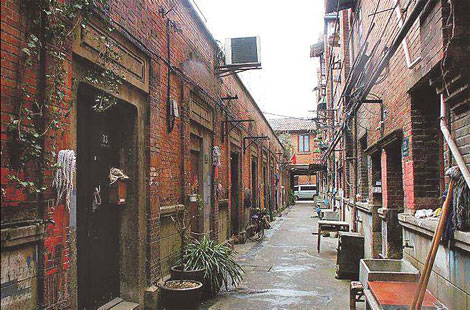

An artist's impression of the

interior design of a suite in the TwoTwoSix project at Hollywood Road. A nearly

50-year-old tenement building on Hollywood Road in Sheung Wan is due to get a

new lease of life. Rather than knock down the vintage residential building or

tong lau and replace it with what he calls a "toothpick skyscraper", new owner

Alan Lo, a co-founder and executive director of developer Blake's, says he will

refurbish it into a "hip" development with just five large-sized apartments.

"One of the biggest draws of the area is its sense of community and village-like

quality. Walk the streets and you find a mix of neighbourhood restaurants,

cafes, antique shops, high-end stores and boutiques," Lo said. "I would like to

do something that will maintain that character rather than build a toothpick

skyscraper." Lo and his partner Darrin Woo acquired the old five-storey building

in 2008 for HK$50 million and their project, named TwoTwoSix after its street

address on Hollywood Road, will be their first development. Lo, 30, an architect

by training, and Woo, 33, a town planner, set up the firm in 2007 with a vision

of reviving local neighbourhoods by celebrating an area's history and character,

and incorporating this rich heritage into their properties. Their company's

name, Blake's, reflects this philosophy and is derived from Blake Garden, the

name of a Sheung Wan park. "It is an old building and we will need to make

extensive structural changes to ensure the safety, and add a lift, which is a

basic requirement for modern users. The refurbishing cost will be as much as

creating a new building," Lo said. Lo is also a co-founder of Press Room Group,

which opened the Pawn restaurant in Wan Chai. The restaurant was established in

a renovated pawnshop. Woo, executive director of the company, said the Hollywood

Road building was formerly owned by a single landlord, who leased out 15 units -

three on each floor. Given the demographics, the area was dominated by smaller

flats of about 500 sqft. "Our project will be in a good position, supplying

larger units." With only one residence per floor and only five in the building,

the partners believe the development will appeal to like-minded individuals who

share an appreciation for beauty and design integrity. They have teamed up with

Ilse Crawford - who heads Studioilse in London with clients such as Gucci Group,

Volvo and Marks & Spencer - to design TwoTwoSix. Woo said the units would have

an efficiency rate of 70 per cent, as the building only had five units and each

would have to share a higher proportion of common area. But with one unit per

floor and an area of 1,280 to 1,450 sqft each, the five apartments would be

spacious, he said, with enough room for a second bedroom. Given its proximity to

Central, the project will target young couples who work in the core business

district and couples from overseas looking for a second home in Hong Kong. Lo

said the units were expected to be available for sale in November and would be

priced in line with deals done at new projects in the surrounding area. In

March, units at nearby Island Crest sold for between HK$11,000 and HK$19,000 per

square foot, which would price the units at TwoTwoSix at about HK$14 million. An artist's impression of the

interior design of a suite in the TwoTwoSix project at Hollywood Road. A nearly

50-year-old tenement building on Hollywood Road in Sheung Wan is due to get a

new lease of life. Rather than knock down the vintage residential building or

tong lau and replace it with what he calls a "toothpick skyscraper", new owner

Alan Lo, a co-founder and executive director of developer Blake's, says he will

refurbish it into a "hip" development with just five large-sized apartments.

"One of the biggest draws of the area is its sense of community and village-like

quality. Walk the streets and you find a mix of neighbourhood restaurants,

cafes, antique shops, high-end stores and boutiques," Lo said. "I would like to

do something that will maintain that character rather than build a toothpick

skyscraper." Lo and his partner Darrin Woo acquired the old five-storey building

in 2008 for HK$50 million and their project, named TwoTwoSix after its street

address on Hollywood Road, will be their first development. Lo, 30, an architect

by training, and Woo, 33, a town planner, set up the firm in 2007 with a vision

of reviving local neighbourhoods by celebrating an area's history and character,

and incorporating this rich heritage into their properties. Their company's

name, Blake's, reflects this philosophy and is derived from Blake Garden, the

name of a Sheung Wan park. "It is an old building and we will need to make

extensive structural changes to ensure the safety, and add a lift, which is a

basic requirement for modern users. The refurbishing cost will be as much as

creating a new building," Lo said. Lo is also a co-founder of Press Room Group,

which opened the Pawn restaurant in Wan Chai. The restaurant was established in

a renovated pawnshop. Woo, executive director of the company, said the Hollywood

Road building was formerly owned by a single landlord, who leased out 15 units -

three on each floor. Given the demographics, the area was dominated by smaller

flats of about 500 sqft. "Our project will be in a good position, supplying

larger units." With only one residence per floor and only five in the building,

the partners believe the development will appeal to like-minded individuals who

share an appreciation for beauty and design integrity. They have teamed up with

Ilse Crawford - who heads Studioilse in London with clients such as Gucci Group,

Volvo and Marks & Spencer - to design TwoTwoSix. Woo said the units would have

an efficiency rate of 70 per cent, as the building only had five units and each

would have to share a higher proportion of common area. But with one unit per

floor and an area of 1,280 to 1,450 sqft each, the five apartments would be

spacious, he said, with enough room for a second bedroom. Given its proximity to

Central, the project will target young couples who work in the core business

district and couples from overseas looking for a second home in Hong Kong. Lo

said the units were expected to be available for sale in November and would be

priced in line with deals done at new projects in the surrounding area. In

March, units at nearby Island Crest sold for between HK$11,000 and HK$19,000 per

square foot, which would price the units at TwoTwoSix at about HK$14 million.

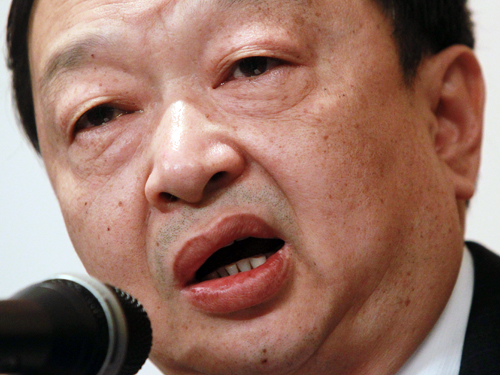

Li

Ka-shing, chairman of Hutchison Whampoa (SEHK: 0013), is confident the Hong

Kong-based conglomerate's business this year will be better than 2009 despite

the European debt crisis. "The world is getting smaller and any nation failing

will have an impact on the rest of the world," he said after the general

meetings of his two corporate flagships - Cheung Kong (Holdings) (SEHK: 0001)

and Hutchison. "But I am not overly pessimistic." He said the company's "retail

operations in Europe will see profit slightly affected by the weakening euro,

but the impact will not be significant as it is made up by the Asia operations".

"I remain confident that the businesses [of Hutchison] this year are highly

likely to be better than last year," he said. Hutchison Whampoa operates in 54

countries with investments in ports, telecommunications, retail and

infrastructure businesses. Li, Hong Kong's richest man, said he might buy shares

in Agricultural Bank of China's initial public offering and more land in the

city, betting China would withstand the impact of Europe's debt crisis. China's

economy is "looking good" and the Hong Kong property market is a safe long-term

bet for homebuyers, the 81-year-old billionaire said. Li, known as "Superman"

for his investment acumen, correctly forecast in 2007 that China's stock- market

bubble would burst and last year predicted the rally in Hong Kong home prices.

Li said Husky Energy, the Calgary oil producer of which he is a controlling

shareholder, planned to spin off its Asian operations for a separate listing in

Hong Kong. "The plan is not yet finalised but it would be a benefit on all

fronts if the Asian business is listed," he said. In March, Hutchison managing

director Canning Fok Kin-ning indicated Husky could complete the separate

listing of its Asian assets this year. Oil prices would pick up when the economy

stabilised, Li said, adding that Husky would continue to develop the oil sands

business. Commenting on the Hong Kong property market, Li said people who could

afford to buy, could consider buying. Inflation would follow after the European

debt crisis stabilised. Cheung Kong sold HK$12.5 billion worth of flats in the

city during the first four months of the year, Li said. Shares of Cheung Kong

rose 2.28 per cent to HK$87.5 yesterday while Hutchison climbed 3.11 per cent to

HK$48.1. Li

Ka-shing, chairman of Hutchison Whampoa (SEHK: 0013), is confident the Hong

Kong-based conglomerate's business this year will be better than 2009 despite

the European debt crisis. "The world is getting smaller and any nation failing

will have an impact on the rest of the world," he said after the general

meetings of his two corporate flagships - Cheung Kong (Holdings) (SEHK: 0001)

and Hutchison. "But I am not overly pessimistic." He said the company's "retail

operations in Europe will see profit slightly affected by the weakening euro,

but the impact will not be significant as it is made up by the Asia operations".

"I remain confident that the businesses [of Hutchison] this year are highly

likely to be better than last year," he said. Hutchison Whampoa operates in 54

countries with investments in ports, telecommunications, retail and

infrastructure businesses. Li, Hong Kong's richest man, said he might buy shares

in Agricultural Bank of China's initial public offering and more land in the

city, betting China would withstand the impact of Europe's debt crisis. China's

economy is "looking good" and the Hong Kong property market is a safe long-term

bet for homebuyers, the 81-year-old billionaire said. Li, known as "Superman"

for his investment acumen, correctly forecast in 2007 that China's stock- market

bubble would burst and last year predicted the rally in Hong Kong home prices.

Li said Husky Energy, the Calgary oil producer of which he is a controlling

shareholder, planned to spin off its Asian operations for a separate listing in

Hong Kong. "The plan is not yet finalised but it would be a benefit on all

fronts if the Asian business is listed," he said. In March, Hutchison managing

director Canning Fok Kin-ning indicated Husky could complete the separate

listing of its Asian assets this year. Oil prices would pick up when the economy

stabilised, Li said, adding that Husky would continue to develop the oil sands

business. Commenting on the Hong Kong property market, Li said people who could

afford to buy, could consider buying. Inflation would follow after the European

debt crisis stabilised. Cheung Kong sold HK$12.5 billion worth of flats in the

city during the first four months of the year, Li said. Shares of Cheung Kong

rose 2.28 per cent to HK$87.5 yesterday while Hutchison climbed 3.11 per cent to

HK$48.1.

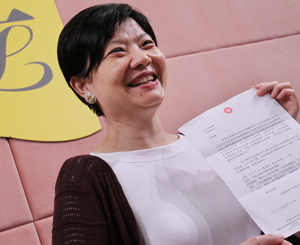

Elsie Leung warns of crisis over trade

seats - A former top government legal official has warned of a possible

constitutional crisis over moderate pan-democrats' proposals to reform the

functional constituencies as the proposals sparked intense debate in the

Beijing-friendly camp. Former justice minister Elsie Leung Oi-sie, now a

vice-chairwoman of the Basic Law Committee, said the proposal, for the public to

elect six seats designated for district councils, would "upset the 50-50

balance" between directly and indirectly elected seats. If the government bowed

to pressure from lawmakers threatening to veto its political reform package

unless the proposal was included, there was a real possibility the package could

be vetoed by the national legislature, which would "trigger a constitutional

crisis and undermine social stability", she said. Leung was speaking a day after

former committee member Ng Hon-mun said in a newspaper article that the proposal

would not contravene the National People's Congress Standing Committee's 2007

decision, which set a timetable for election of the chief executive and the

legislature by universal suffrage. In the Ming Pao Daily article, Ng said the

decision stipulated only that the 50:50 ratio of directly and indirectly elected

seats should remain in 2012 and did not lay down any rules for functional

constituencies. "Election of district council functional constituency seats by

'one man, one vote' does not contravene the NPC decision," Ng said. But Leung

said she agreed with the views of Li Gang, a deputy director of the central

government's liaison office in Hong Kong, that the proposal would trigger doubts

over whether it was in line with the NPC's decision. The Democratic Party, which

met Li on Monday, proposes increasing the number of Legco seats from the present

60 to 70 in 2012, with six seats for district councils that would be nominated

by district councillors and elected by all registered voters. The Alliance for

Universal Suffrage, a coalition formed by 13 moderate pan-democratic groups,

suggests increasing the number of seats from 60 to 80, with 11 seats for

district council functional constituencies. "The NPC's decision in 2007 stated

that functional constituencies and those elected by direct election should be

equal in number. By having six seats designated for district councils directly

elected, then you upset the 50:50 balance," Leung said. The Standing Committee

was empowered not to register legislative amendments to Basic Law Annex II,

which governs the Legco elections, if the changes deviated from the policies and

principles set out in the mini-constitution, she said. "If the electoral package

is vetoed by the Standing Committee, it would trigger a constitutional crisis

and undermine social stability," she said. Leung added that the pan-democrats'

demand for reassurances of "genuine" universal suffrage for election of the

chief executive and the legislature in 2017 and 2020 as a precondition for

supporting the Hong Kong government's proposal for 2012 was also unacceptable to

Beijing. Former Legco president Rita Fan Hsu Lai-tai, a member of the Standing

Committee, also said the proposal was not in line with the NPC's decision. "The

proposal cannot be implemented for the 2012 election but there is room for

further discussion after 2012," she said. Basic Law Committee member Albert Chan

Hung-yee said the proposal amounted to a de-facto direct election and was not in

line with the NPC's decision. "The NPC decision aims at maintaining the existing

methods for electing Legco in 2012 and does not authorise the invention of new

electoral methods," said Chan, a professor at the University of Hong Kong's

faculty of law. Functional constituencies - electorates based on trade and

professional sectors - were introduced by the colonial government in 1985. They

were at the centre of a massive row between the colonial administration and

Beijing after then- governor Chris Patten pushed through amendments for the

1994-95 elections - dismantled after the handover - that turned the trade-based

seats into de-facto directly elected seats by giving everyone in the sectors a

vote. In early 1994 - a few months after talks on the issue broke down - Beijing

declared that the Chinese and British sides had an understanding that the

functional constituencies were a form of indirect election and they must not be

turned into de-facto direct elections on an occupational basis. Elsie Leung warns of crisis over trade

seats - A former top government legal official has warned of a possible

constitutional crisis over moderate pan-democrats' proposals to reform the

functional constituencies as the proposals sparked intense debate in the

Beijing-friendly camp. Former justice minister Elsie Leung Oi-sie, now a

vice-chairwoman of the Basic Law Committee, said the proposal, for the public to

elect six seats designated for district councils, would "upset the 50-50

balance" between directly and indirectly elected seats. If the government bowed

to pressure from lawmakers threatening to veto its political reform package

unless the proposal was included, there was a real possibility the package could

be vetoed by the national legislature, which would "trigger a constitutional

crisis and undermine social stability", she said. Leung was speaking a day after

former committee member Ng Hon-mun said in a newspaper article that the proposal

would not contravene the National People's Congress Standing Committee's 2007

decision, which set a timetable for election of the chief executive and the

legislature by universal suffrage. In the Ming Pao Daily article, Ng said the

decision stipulated only that the 50:50 ratio of directly and indirectly elected

seats should remain in 2012 and did not lay down any rules for functional

constituencies. "Election of district council functional constituency seats by

'one man, one vote' does not contravene the NPC decision," Ng said. But Leung

said she agreed with the views of Li Gang, a deputy director of the central

government's liaison office in Hong Kong, that the proposal would trigger doubts

over whether it was in line with the NPC's decision. The Democratic Party, which

met Li on Monday, proposes increasing the number of Legco seats from the present

60 to 70 in 2012, with six seats for district councils that would be nominated

by district councillors and elected by all registered voters. The Alliance for

Universal Suffrage, a coalition formed by 13 moderate pan-democratic groups,

suggests increasing the number of seats from 60 to 80, with 11 seats for

district council functional constituencies. "The NPC's decision in 2007 stated

that functional constituencies and those elected by direct election should be

equal in number. By having six seats designated for district councils directly

elected, then you upset the 50:50 balance," Leung said. The Standing Committee

was empowered not to register legislative amendments to Basic Law Annex II,

which governs the Legco elections, if the changes deviated from the policies and

principles set out in the mini-constitution, she said. "If the electoral package

is vetoed by the Standing Committee, it would trigger a constitutional crisis

and undermine social stability," she said. Leung added that the pan-democrats'

demand for reassurances of "genuine" universal suffrage for election of the

chief executive and the legislature in 2017 and 2020 as a precondition for

supporting the Hong Kong government's proposal for 2012 was also unacceptable to

Beijing. Former Legco president Rita Fan Hsu Lai-tai, a member of the Standing

Committee, also said the proposal was not in line with the NPC's decision. "The

proposal cannot be implemented for the 2012 election but there is room for

further discussion after 2012," she said. Basic Law Committee member Albert Chan

Hung-yee said the proposal amounted to a de-facto direct election and was not in

line with the NPC's decision. "The NPC decision aims at maintaining the existing

methods for electing Legco in 2012 and does not authorise the invention of new

electoral methods," said Chan, a professor at the University of Hong Kong's

faculty of law. Functional constituencies - electorates based on trade and

professional sectors - were introduced by the colonial government in 1985. They

were at the centre of a massive row between the colonial administration and

Beijing after then- governor Chris Patten pushed through amendments for the

1994-95 elections - dismantled after the handover - that turned the trade-based

seats into de-facto directly elected seats by giving everyone in the sectors a

vote. In early 1994 - a few months after talks on the issue broke down - Beijing

declared that the Chinese and British sides had an understanding that the

functional constituencies were a form of indirect election and they must not be

turned into de-facto direct elections on an occupational basis.

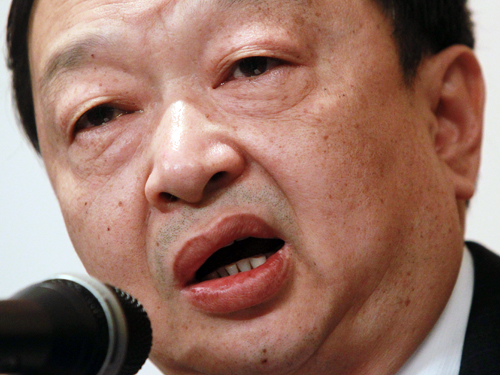

Li Gang, the deputy director of the central government’s liaison office in Hong

Kong, attends a book launch at the Hong Kong Central Library in Causeway Bay on

Friday after meeting with members of the Association for Democracy and People’s

Livelihood.

Li Gang, the deputy director of the central government’s liaison office in Hong

Kong, attends a book launch at the Hong Kong Central Library in Causeway Bay on

Friday after meeting with members of the Association for Democracy and People’s

Livelihood.

Veteran politician Rita Fan Hsu Lai-tai is not confident that the Legislative

Council will pass the 2012 political reform package. The National People's

Congress Standing Committee member and former Legco president hopes the rapport

between pan-democrats and the central government will continue, but doubts a

consensus can be reached within a month, with the scrapping of functional

constituencies the main sticking point. Fan also said it is hard for the central

government to accept the pan-democrat idea of allowing people to choose

lawmakers directly from district councils in 2012. "How can the central

government ask the National People's Congress to eat its words?" Fan said. She

said the proposal is not viable at this stage, but could be considered for

election methods beyond 2012. Fan noted the pan-democrats' views on the Legco

election methods are still very different from the government's though the

proposals regarding the election of the chief executive are less controversial.

Earlier this week central government liaison office deputy director Li Gang said

the pan- democrats' proposal to let people choose lawmakers directly from

district councils in 2012 was against the Basic Law and could raise doubts as to

whether it was in line with the decision of the National People's Congress.

Basic Law Committee vice chairwoman Elsie Leung Oi-sie said that allowing

certain electors to choose some functional constituency lawmakers directly from

the district councils is against the 2007 National People's Congress Standing

Committee decision. Meanwhile, property tycoon Li Ka-shing, the chairman of

Cheung Kong (Holdings) and Hutchison Whampoa, weighed into the debate, saying

the functional constituencies should not be done away with without a lot of

thought.

Veteran politician Rita Fan Hsu Lai-tai is not confident that the Legislative

Council will pass the 2012 political reform package. The National People's

Congress Standing Committee member and former Legco president hopes the rapport

between pan-democrats and the central government will continue, but doubts a

consensus can be reached within a month, with the scrapping of functional

constituencies the main sticking point. Fan also said it is hard for the central

government to accept the pan-democrat idea of allowing people to choose

lawmakers directly from district councils in 2012. "How can the central

government ask the National People's Congress to eat its words?" Fan said. She

said the proposal is not viable at this stage, but could be considered for

election methods beyond 2012. Fan noted the pan-democrats' views on the Legco

election methods are still very different from the government's though the

proposals regarding the election of the chief executive are less controversial.

Earlier this week central government liaison office deputy director Li Gang said

the pan- democrats' proposal to let people choose lawmakers directly from

district councils in 2012 was against the Basic Law and could raise doubts as to

whether it was in line with the decision of the National People's Congress.

Basic Law Committee vice chairwoman Elsie Leung Oi-sie said that allowing

certain electors to choose some functional constituency lawmakers directly from

the district councils is against the 2007 National People's Congress Standing

Committee decision. Meanwhile, property tycoon Li Ka-shing, the chairman of

Cheung Kong (Holdings) and Hutchison Whampoa, weighed into the debate, saying

the functional constituencies should not be done away with without a lot of

thought.

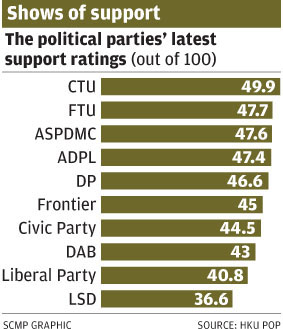

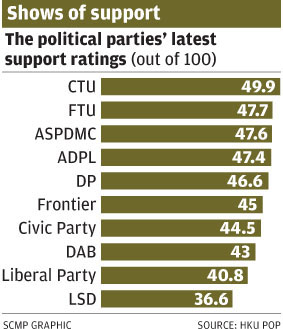

Public support for all major

political groups in the city has declined significantly amid the debate on

constitutional reforms, a university poll has found. In the latest random

telephone survey of 1,015 people by the University of Hong Kong's Public Opinion

Programme between Tuesday and Thursday last week, popularity ratings for all 10

of the most widely known political groups dropped compared with the previous

poll in February. The Beijing-friendly Democratic Alliance for the Betterment

and Progress of Hong Kong saw the largest slip in ratings by 5.1 points, from

48.1 to 43 on a zero-to-100 scale. The smallest drop was for the Hong Kong

Alliance in Support of Patriotic Democratic Movements in China, going down by

2.4 points to 47.6 from 50. The ratings for three organisations, the Civic Party

and the League of Social Democrats - both pan-democratic groups that launched

the "de facto referendum" movement - and the pro-business Liberal Party, dropped

to historic lows since they were formed. Their latest ratings were 44.5, 36.6

and 40.8, respectively. The pan-democrat Confederation of Trade Unions continued

to top the list as the most popular political group, with a rating of 49.9,

compared with 52.8 in February. Dr Robert Chung Ting-yiu, director of the

programme, said: "The ratings of all groups have dropped significantly. Many of

them are either at a new or record low. The row over political reform and

full-fledged by-elections has apparently taken its toll on all political

parties." The sampling error for the ratings was below plus or minus 1.9 points. Public support for all major

political groups in the city has declined significantly amid the debate on

constitutional reforms, a university poll has found. In the latest random

telephone survey of 1,015 people by the University of Hong Kong's Public Opinion

Programme between Tuesday and Thursday last week, popularity ratings for all 10

of the most widely known political groups dropped compared with the previous

poll in February. The Beijing-friendly Democratic Alliance for the Betterment

and Progress of Hong Kong saw the largest slip in ratings by 5.1 points, from

48.1 to 43 on a zero-to-100 scale. The smallest drop was for the Hong Kong

Alliance in Support of Patriotic Democratic Movements in China, going down by

2.4 points to 47.6 from 50. The ratings for three organisations, the Civic Party

and the League of Social Democrats - both pan-democratic groups that launched

the "de facto referendum" movement - and the pro-business Liberal Party, dropped

to historic lows since they were formed. Their latest ratings were 44.5, 36.6

and 40.8, respectively. The pan-democrat Confederation of Trade Unions continued

to top the list as the most popular political group, with a rating of 49.9,

compared with 52.8 in February. Dr Robert Chung Ting-yiu, director of the

programme, said: "The ratings of all groups have dropped significantly. Many of

them are either at a new or record low. The row over political reform and

full-fledged by-elections has apparently taken its toll on all political

parties." The sampling error for the ratings was below plus or minus 1.9 points.

SKH St. Simon’s Leung King Nursery

School in Tun Mun on Friday was advised to suspend classes for two weeks

starting from Saturday after a hand, foot and mouth disease (HFMD) outbreak

there. Centre for Health Protection director Thomas Tsang Ho-fai said six pupils

at the school had symptoms of HFMD. But he said their symptoms were relatively

mild. Tsang said a 34-year-old woman, whose three-year-old son was studying at

SKH St. Simon’s Leung King Nursery School, had also showed symptoms of the

disease. “She was now in a stable condition,”Tsang said. Another 43-year-old man

also showed symptoms of HFMD. He too was in a stable condition. The man’s

seven-year-old son also showed symptoms of HFMD. The boy was studying in the St

Francis of Assisi’s English Primary School in Sham Shui Po. The school was also

advised to suspend classes for two weeks from Friday. Tsang said it was now the

peak season for HFMD and that he expected more children would be infected with

the disease. “Children are particularly vulnerable to the disease. We will

continue to closely monitor the situation.... I want to stress that there has

been no mutation of the virus so far,” he said. The CHP has recorded over 200

HFMD cases since January.

China*:

Beijing will have more than 1,000 km of rail transit lines in operation by 2020

according to a new construction plan, Beijing vice mayor Huang Wei said

Thursday. The Chinese capital plans to have 15 rail transit lines in operation

with a total length of more than 561 km by 2015, Huang told a forum on urban

rail transit in Changchun, capital of northeast China's Jilin Province. Beijing

had 228 km of subway and light rail transit lines in operation by 2009, and

total rail length will exceed 330 km by the end of 2010 with five new lines

being put into operation this year, Huang said. China is witnessing a boom in

urban rail transit construction as many cities struggle to tackle traffic

congestion in wake of fast growth in private car ownership. Shanghai, the

nation's business and financial center, plans to have 970 km of rail transit

lines by 2020. Li Bingren, chief economist with the Ministry of Housing and

Urban-Rural Development, said: "The most effective way to ease traffic

congestion is by investing more in public transport, especially urban rail

transit lines, and by reducing the number of vehicles on the road." China had

962 km of rail transit lines in operation by 2009 and the total length will

exceed 2,500 km by around 2015, said Tan Qinglian, president of China Civil

Engineering Society.

China*:

Beijing will have more than 1,000 km of rail transit lines in operation by 2020

according to a new construction plan, Beijing vice mayor Huang Wei said

Thursday. The Chinese capital plans to have 15 rail transit lines in operation

with a total length of more than 561 km by 2015, Huang told a forum on urban

rail transit in Changchun, capital of northeast China's Jilin Province. Beijing

had 228 km of subway and light rail transit lines in operation by 2009, and

total rail length will exceed 330 km by the end of 2010 with five new lines

being put into operation this year, Huang said. China is witnessing a boom in

urban rail transit construction as many cities struggle to tackle traffic

congestion in wake of fast growth in private car ownership. Shanghai, the

nation's business and financial center, plans to have 970 km of rail transit

lines by 2020. Li Bingren, chief economist with the Ministry of Housing and

Urban-Rural Development, said: "The most effective way to ease traffic

congestion is by investing more in public transport, especially urban rail

transit lines, and by reducing the number of vehicles on the road." China had

962 km of rail transit lines in operation by 2009 and the total length will

exceed 2,500 km by around 2015, said Tan Qinglian, president of China Civil

Engineering Society.

China's fastest high speed train "380A" welcomes its first batch of visitors

when it comes off the production line in Changchun, northeast China's Jilin

province, May 27, 2010. China's fastest high speed train rolled off the

production line Thursday in Changchun, capital of the northeast China's Jilin

province, a company executive said. Dong Xiaofeng, chairman of Changchun Railway

Vehicles Co., Ltd., said the new generation train "380A" has the maximum

operating speed of 380 km per hour. Changchun Railway Vehicles Co., Ltd. is a

subsidiary of China CNR Corp, one of the country's two big train makers. The

trains, which China has the independent intellectual property rights of, will

run for the first time on the Beijing-Shanghai high speed railway that is to be

completed and opened in 2011. On March 16, China's Ministry of Railways signed a

contract to buy 100 new generation trains from China CNR Corp. High speed trains

with the maximum operating speed of 350 km have been running on three lines that

link Beijing and Tianjin, Wuhan and Guangzhou, Zhengzhou and Xi'an.

China's fastest high speed train "380A" welcomes its first batch of visitors

when it comes off the production line in Changchun, northeast China's Jilin

province, May 27, 2010. China's fastest high speed train rolled off the

production line Thursday in Changchun, capital of the northeast China's Jilin

province, a company executive said. Dong Xiaofeng, chairman of Changchun Railway

Vehicles Co., Ltd., said the new generation train "380A" has the maximum

operating speed of 380 km per hour. Changchun Railway Vehicles Co., Ltd. is a

subsidiary of China CNR Corp, one of the country's two big train makers. The

trains, which China has the independent intellectual property rights of, will

run for the first time on the Beijing-Shanghai high speed railway that is to be

completed and opened in 2011. On March 16, China's Ministry of Railways signed a

contract to buy 100 new generation trains from China CNR Corp. High speed trains

with the maximum operating speed of 350 km have been running on three lines that

link Beijing and Tianjin, Wuhan and Guangzhou, Zhengzhou and Xi'an.

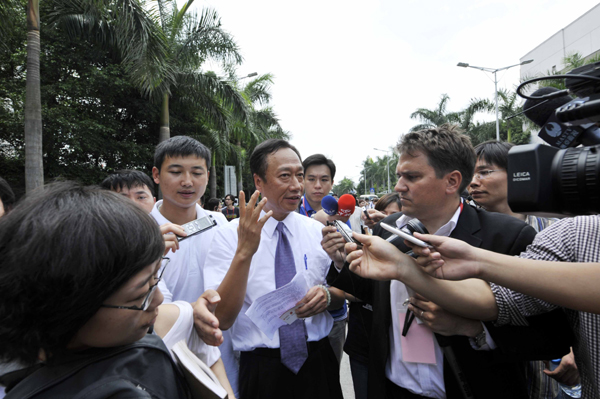

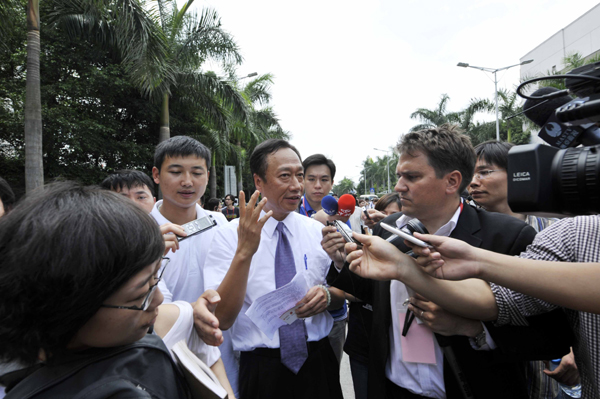

The Taiwanese electronics company

buffeted by a spate of suicides at its mainland factories said on Friday it will

raise workers' salaries by an average of 20 per cent.

Lending by Chinese banks may drop to

600 billion yuan (88 billion U.S. dollars) in May as the central government

winds down its stimulus program and cools the property market to prevent the

economy from overheating.

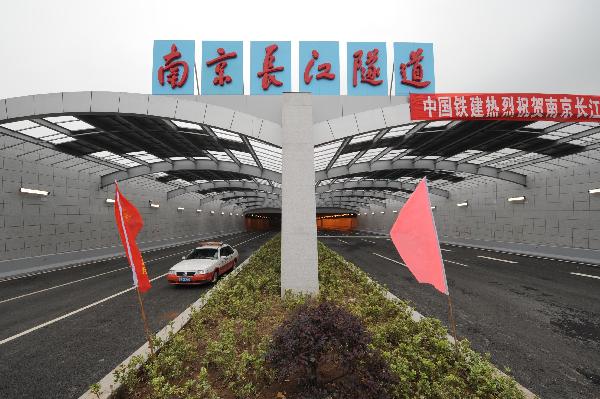

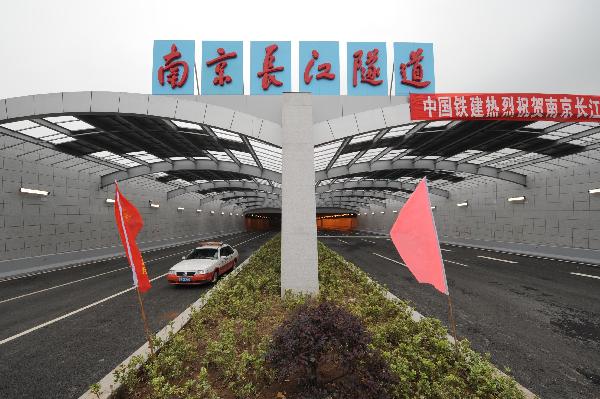

A car gets through the six-lane

traffic tunnel under the Yangtze River in Nanjing, east China's Jiangsu

Province, May 28, 2010. The tunnel, connecting the city of Nanjing on both sides

of the river, is the third traffic tunnel built under the Yangtze River, China's

longest river. The tunnel opened to traffic on Friday. A car gets through the six-lane

traffic tunnel under the Yangtze River in Nanjing, east China's Jiangsu

Province, May 28, 2010. The tunnel, connecting the city of Nanjing on both sides

of the river, is the third traffic tunnel built under the Yangtze River, China's

longest river. The tunnel opened to traffic on Friday.

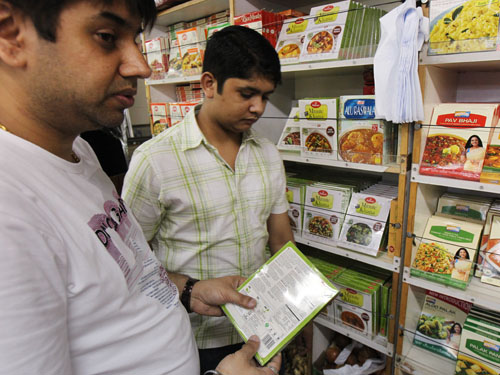

A variety of brews are on display at a

supermarket in Chengdu, Sichuan province. The average beer consumption per

person in southwestern China is 29 kilograms annually. The nights are certainly

getting longer and louder in Jinli. No, it is not any geographical phenomenon,

but the hustle and bustle of a typical summer night as more and more revelers

head to the streets to chill out. Loud banter, music and sounds of "ganbei" ring

the air in Jinli in Chengdu, one of the largest cities in southwestern China.

With the mercury sizzling, it is the chilled beverages that are selling like hot

cakes. And for several years now beer has been the most popular beverage in

Sichuan province. The taste for beer also has its roots in the relaxed and easy

life style of the region. So much so, that there is tremendous competition among

the beer majors to boost investments and corner bigger market shares in the

premium beer segment. The popularity of beer can also be seen in the clutter of

billboards displaying various brands dotting the streets. "Most of our clientele

come to have a drink after 7 pm, and we usually sell around 200 bottles of

premium beer, priced at 15 yuan each, every day, even though our main business

is food," said Xiao Li, a waiter at the Guan Jin bar in Jinli. Molson Coors, the

world's fifth-largest brewer is one of the biggest that have stepped up their

investment pace here. The company recently spent $40 million to buy a 51 percent

stake in a new joint venture with the Hebei Si'hai Beer Company. The joint

venture plans to launch premium beers with lower production cost in China. "Chengdu

and Chongqing are among the cities that had the best sales figures last year for

our premium brand Coors Light. We will consider making another new investment if

the market keeps on growing," said Peter H. Coors, chairman of Molson Coors.

Companies like Molson Coors are also encouraged to expand as premium beer sales

in southwestern China are five times larger than the Northern regions, said John

Zhang, general manager (operations), China of Molson Coors. The Guangzhou-based

Molson Coors has been selling its premium brand, Coors Light, mainly in bars and

night-clubs in southwestern China. The brand now accounts for 10 percent of

China's premium beer market. Molson Coors' competitor, Carlsberg, the world's

fourth-largest brewer, is also planning new investments in the southwest. The

brewer is currently waiting for the outcome of a bid to acquire 12.25 percent

stake in Chongqing Brewery Company. Carlsberg has also shown interest in the

nation's southwestern market. Jorgen Buhl Rasmussen, president of Carlsberg,

said he was planning to move the headquarters of Carlsberg China from Chengdu to

Chongqing. With competition heating up, there is also a price war. Both

Carlsberg and Coors Light are priced the same, and sell at around 180 yuan per

dozen in Guan Jin bar. "Carlsberg and Coors Light are the two best-selling

brands due to their reasonable price and good taste," said Li. The world's

largest brewer Anheuser-Busch InBev's China arm started work on a new brewery in

Ziyang, Sichuan province, this year. Fu Meikai, president of Anheuser-Busch

Asia-Pacific region, said: "Anheuser's production in southwestern China will

mainly focus on the premium restaurants and bars. Average beer consumption per

person in southwestern China is 29 kilograms annually, below that of northern

cities like Beijing, where beer consumption is 91 kilograms, according to China

Jianyin Investment Securities. "The beer industry in southwestern China is

focused on premium beer due to the more relaxed and easy lifestyle here. In

addition, the local economic growth and relatively low consumption base

signifies huge growth potential," Huang Wei, a food and beverage analyst with

China Jianyin Investment Securities, said. A variety of brews are on display at a

supermarket in Chengdu, Sichuan province. The average beer consumption per

person in southwestern China is 29 kilograms annually. The nights are certainly

getting longer and louder in Jinli. No, it is not any geographical phenomenon,

but the hustle and bustle of a typical summer night as more and more revelers

head to the streets to chill out. Loud banter, music and sounds of "ganbei" ring

the air in Jinli in Chengdu, one of the largest cities in southwestern China.

With the mercury sizzling, it is the chilled beverages that are selling like hot

cakes. And for several years now beer has been the most popular beverage in

Sichuan province. The taste for beer also has its roots in the relaxed and easy

life style of the region. So much so, that there is tremendous competition among

the beer majors to boost investments and corner bigger market shares in the

premium beer segment. The popularity of beer can also be seen in the clutter of

billboards displaying various brands dotting the streets. "Most of our clientele

come to have a drink after 7 pm, and we usually sell around 200 bottles of

premium beer, priced at 15 yuan each, every day, even though our main business

is food," said Xiao Li, a waiter at the Guan Jin bar in Jinli. Molson Coors, the

world's fifth-largest brewer is one of the biggest that have stepped up their

investment pace here. The company recently spent $40 million to buy a 51 percent

stake in a new joint venture with the Hebei Si'hai Beer Company. The joint

venture plans to launch premium beers with lower production cost in China. "Chengdu

and Chongqing are among the cities that had the best sales figures last year for

our premium brand Coors Light. We will consider making another new investment if

the market keeps on growing," said Peter H. Coors, chairman of Molson Coors.

Companies like Molson Coors are also encouraged to expand as premium beer sales

in southwestern China are five times larger than the Northern regions, said John

Zhang, general manager (operations), China of Molson Coors. The Guangzhou-based

Molson Coors has been selling its premium brand, Coors Light, mainly in bars and

night-clubs in southwestern China. The brand now accounts for 10 percent of

China's premium beer market. Molson Coors' competitor, Carlsberg, the world's

fourth-largest brewer, is also planning new investments in the southwest. The

brewer is currently waiting for the outcome of a bid to acquire 12.25 percent

stake in Chongqing Brewery Company. Carlsberg has also shown interest in the

nation's southwestern market. Jorgen Buhl Rasmussen, president of Carlsberg,

said he was planning to move the headquarters of Carlsberg China from Chengdu to

Chongqing. With competition heating up, there is also a price war. Both

Carlsberg and Coors Light are priced the same, and sell at around 180 yuan per

dozen in Guan Jin bar. "Carlsberg and Coors Light are the two best-selling

brands due to their reasonable price and good taste," said Li. The world's

largest brewer Anheuser-Busch InBev's China arm started work on a new brewery in

Ziyang, Sichuan province, this year. Fu Meikai, president of Anheuser-Busch

Asia-Pacific region, said: "Anheuser's production in southwestern China will

mainly focus on the premium restaurants and bars. Average beer consumption per

person in southwestern China is 29 kilograms annually, below that of northern

cities like Beijing, where beer consumption is 91 kilograms, according to China

Jianyin Investment Securities. "The beer industry in southwestern China is

focused on premium beer due to the more relaxed and easy lifestyle here. In

addition, the local economic growth and relatively low consumption base

signifies huge growth potential," Huang Wei, a food and beverage analyst with

China Jianyin Investment Securities, said.

A 10-day-old strike at a key Honda

component factory outside Guangzhou has forced Japan's No 2 carmaker to suspend

production in China, the world's largest and fastest-growing car market. A 10-day-old strike at a key Honda

component factory outside Guangzhou has forced Japan's No 2 carmaker to suspend

production in China, the world's largest and fastest-growing car market.

Prime Minister Wen Jiabao waves

upon his arrival at the Seoul Military Airport in Seongnam, South Korea on

Friday. Premier Wen Jiabao told South Korean President Lee Myung-bak on Friday

that he condemned all acts that threaten peace and stability on the Korean

peninsula and would not "harbour" anyone over the sinking of a South Korean

naval ship in March. “China objects to and condemns any act that destroys the

peace and stability of the Korean peninsula,” Wen said during a meeting with Lee

in Seoul, according to a South Korean official citing the Chinese leader’s

comments. Wen is on a three-day visit to South Korea. Prime Minister Wen Jiabao waves

upon his arrival at the Seoul Military Airport in Seongnam, South Korea on

Friday. Premier Wen Jiabao told South Korean President Lee Myung-bak on Friday

that he condemned all acts that threaten peace and stability on the Korean

peninsula and would not "harbour" anyone over the sinking of a South Korean

naval ship in March. “China objects to and condemns any act that destroys the

peace and stability of the Korean peninsula,” Wen said during a meeting with Lee

in Seoul, according to a South Korean official citing the Chinese leader’s

comments. Wen is on a three-day visit to South Korea.

A landmark China-Taiwan trade deal

scheduled to be signed in June could be pushed back as the two sides wrangle

over import tariffs, the government and analysts said on Friday.

China's one-time richest man and the

founder of a major retail chain has appealed his 14-year jail sentence for

bribery and insider trading, the Legal Daily reported on Friday.

Jinjiang residents can travel to

Xiamen in 30 minutes and Fuzhou in an hour on the 250km/h high-speed rail

service. Just 12 months ago, the railway station in Jinjiang, Fujian province,

part of the mainland's new high-speed rail network, was an untidy construction

site. On April 26, when the inaugural high-speed train from Xiamen in the south

to Fuzhou in the north passed through Jinjiang, the station was still far from

completed, with its unpaved entrance area, stationary escalators and blank

television information panels. But every day the train service runs, it is

weaving Jinjiang - the country's shoe capital - closer into the economic fabric

of the rest of the province. The city is the production base for 40 per cent of

the nation's sports shoes - or 20 per cent of the world's total. The 250 km/h

rail service has cut the journey time between Jinjiang and Xiamen to only 30

minutes whereas before it took one-and-a-half hours by road; and it is only an

hour to Fuzhou, previously a two-and-half-hour road trip away. Adding to the

Jinjiang's makeover was the opening of its first international hotel in March -

Hong Kong conglomerate Wharf Group's 296-room Marco Polo Hotel. Jinjiang residents can travel to

Xiamen in 30 minutes and Fuzhou in an hour on the 250km/h high-speed rail

service. Just 12 months ago, the railway station in Jinjiang, Fujian province,

part of the mainland's new high-speed rail network, was an untidy construction

site. On April 26, when the inaugural high-speed train from Xiamen in the south

to Fuzhou in the north passed through Jinjiang, the station was still far from

completed, with its unpaved entrance area, stationary escalators and blank

television information panels. But every day the train service runs, it is

weaving Jinjiang - the country's shoe capital - closer into the economic fabric

of the rest of the province. The city is the production base for 40 per cent of

the nation's sports shoes - or 20 per cent of the world's total. The 250 km/h

rail service has cut the journey time between Jinjiang and Xiamen to only 30

minutes whereas before it took one-and-a-half hours by road; and it is only an

hour to Fuzhou, previously a two-and-half-hour road trip away. Adding to the

Jinjiang's makeover was the opening of its first international hotel in March -

Hong Kong conglomerate Wharf Group's 296-room Marco Polo Hotel.

Mission Hills Group, owner of the

world's largest golf club in Shenzhen, will boost investment sixfold in a

golfing complex on Hainan island which is undergoing a tourism and property

boom. Mission Hills will spend a further 25 billion yuan (HK$28.5 billion) by

adding more golfing, retail and community facilities at its five billion yuan

club in Haikou, the island's capital, vice- chairman Ken Chu said. "We have

confidence in the rise in Chinese consumption and them having a holiday

mentality," Chu said. Mission Hills is switching its focus from foreigners to

Chinese golfers as the nation's newly wealthy seek aspirational leisure

pursuits, he added. Mission Hills opened a 12-course club, the world's largest,

in 1992 in Shenzhen.

May 29 - 30, 2010

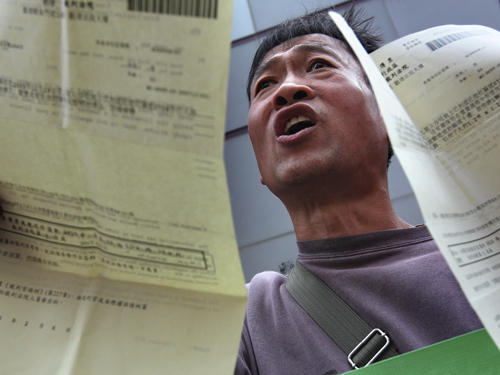

Hong Kong*:

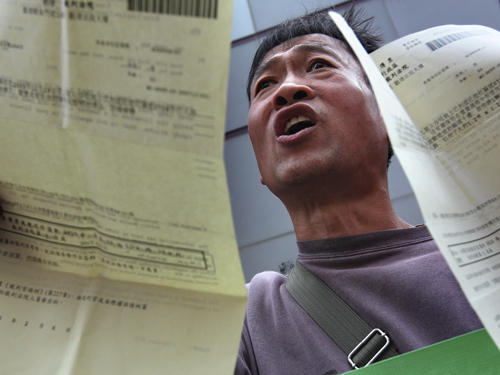

An application for compensation by four mainland parents whose babies fell ill

in China’s tainted-milk scandal two years ago was rejected by the Small Claims

Tribunal on Thursday. Hong Kong*:

An application for compensation by four mainland parents whose babies fell ill

in China’s tainted-milk scandal two years ago was rejected by the Small Claims

Tribunal on Thursday.

The Octopus company has set a December

launch for a new smart card for use in both Hong Kong and Shenzhen Tong

networks. The cutting-edge card integrates the functions of both smart cards but

works in separate accounts for Hong Kong dollar and yuan. The card will contain

no personal information like names of cardholders, said Octopus chief executive

director Prudence Chan Bik-wah. "Hong Kong transactions will only be settled in

Hong Kong and it is the same case for Shenzhen. The two systems are currently

disconnected," Chan said. "Therefore inter-transaction is not available.

Cardholders can only add value to the account with relevant currency." The

Octopus company said talks are still underway with Shenzhen Tong on card repairs

and deposit amounts. Octopus is widely used on public transport in Hong Kong, as

well as in convenience stores and restaurants. It is also accepted in over 10

outlets operated by Cafe de Coral and Fairwood in Shenzhen, as well as in

Shenzhen Dutyfree Group's outlets at Huanggang and Luohu ports. Shenzhen Tong

can be used on Metro lines and public buses in Shenzhen, as well as in 10

retailers including Jusco and Vanguard. So far, Octopus is available in three

major types: on-loan cards, sold cards and bank-issued cards. On-loan

cardholders have to pay a refundable deposit, while a sold card requires no

deposit. Chan expects the new card's selling price will not be higher than the

current cost of Octopus cards. However, one passenger expressed concern over

possible charging errors while another said he was worried about its security

features. The Octopus company issued over 20 million cards last year, a 10

percent increase compared with 2008. It handled 11 million daily transactions

worth HK$100 million a day, or around HK$36.5 billion a year, an 8 percent

increase from 2008. Meanwhile, the Octopus PC Reader service will be available

next month. Octopus cardholders can check their 10 latest transactions by

connecting the reader - worth HK$210 - to a personal computer. Visually impaired

users can also check their records with screen- reading software. The Octopus company has set a December

launch for a new smart card for use in both Hong Kong and Shenzhen Tong

networks. The cutting-edge card integrates the functions of both smart cards but

works in separate accounts for Hong Kong dollar and yuan. The card will contain

no personal information like names of cardholders, said Octopus chief executive

director Prudence Chan Bik-wah. "Hong Kong transactions will only be settled in

Hong Kong and it is the same case for Shenzhen. The two systems are currently

disconnected," Chan said. "Therefore inter-transaction is not available.

Cardholders can only add value to the account with relevant currency." The

Octopus company said talks are still underway with Shenzhen Tong on card repairs

and deposit amounts. Octopus is widely used on public transport in Hong Kong, as

well as in convenience stores and restaurants. It is also accepted in over 10

outlets operated by Cafe de Coral and Fairwood in Shenzhen, as well as in

Shenzhen Dutyfree Group's outlets at Huanggang and Luohu ports. Shenzhen Tong

can be used on Metro lines and public buses in Shenzhen, as well as in 10

retailers including Jusco and Vanguard. So far, Octopus is available in three

major types: on-loan cards, sold cards and bank-issued cards. On-loan

cardholders have to pay a refundable deposit, while a sold card requires no

deposit. Chan expects the new card's selling price will not be higher than the

current cost of Octopus cards. However, one passenger expressed concern over

possible charging errors while another said he was worried about its security

features. The Octopus company issued over 20 million cards last year, a 10

percent increase compared with 2008. It handled 11 million daily transactions

worth HK$100 million a day, or around HK$36.5 billion a year, an 8 percent

increase from 2008. Meanwhile, the Octopus PC Reader service will be available

next month. Octopus cardholders can check their 10 latest transactions by

connecting the reader - worth HK$210 - to a personal computer. Visually impaired

users can also check their records with screen- reading software.

A senior TVB (0511) official

yesterday sought to discourage more free-to-air stations, saying any new

operators are likely to face tough limitations. Cheong Shin-keong, broadcasting

general manager, said new FTA broadcasters will have to carve out niche markets

in order to secure advertisements. "If they can come up with targeted programs

or what the existing market lacks, and gain support from advertisers, then there

is probably boundless space," Cheong said. "But honestly, such [niche] space is

limited." Multiple broadcasters offering similar programs cannot co-exist

easily, he said. He said TVB's focus on local and drama productions faces no

direct competition but it will be ready to take on newcomers. City Telecom

(1137) chairman Ricky Wong Wai-kay expects the government to issue FTA licenses

in the fourth quarter at the earliest and sees much room for cross-media

integration. TVB will spend hundreds of millions of dollars on a new studio

covering 140,000 square feet in Tseung Kwan O, said group general manager Mark

Lee Po-on. Cheong said there will be a mix of paid and free online services in

the market in time. He noted all media groups recorded high double-digit growth

in advertising income, adding TVB outperformed the market average as advertising

rates returned to the level before the global economic crisis. "Many clients

have been investing in their brand image, for which television has an edge,"

Cheong said. Lee said general manager Stephen Chan Chi-wan remains an

"executive" at the station but cannot carry out his duties, pending further

investigations into bribery allegations. TVB will review its internal system and

evaluate the results of the ICAC probe, he said. He added that the broadcaster

has always told its employees to abide by the law. A senior TVB (0511) official

yesterday sought to discourage more free-to-air stations, saying any new

operators are likely to face tough limitations. Cheong Shin-keong, broadcasting

general manager, said new FTA broadcasters will have to carve out niche markets

in order to secure advertisements. "If they can come up with targeted programs

or what the existing market lacks, and gain support from advertisers, then there

is probably boundless space," Cheong said. "But honestly, such [niche] space is

limited." Multiple broadcasters offering similar programs cannot co-exist

easily, he said. He said TVB's focus on local and drama productions faces no

direct competition but it will be ready to take on newcomers. City Telecom

(1137) chairman Ricky Wong Wai-kay expects the government to issue FTA licenses

in the fourth quarter at the earliest and sees much room for cross-media

integration. TVB will spend hundreds of millions of dollars on a new studio

covering 140,000 square feet in Tseung Kwan O, said group general manager Mark

Lee Po-on. Cheong said there will be a mix of paid and free online services in

the market in time. He noted all media groups recorded high double-digit growth

in advertising income, adding TVB outperformed the market average as advertising

rates returned to the level before the global economic crisis. "Many clients

have been investing in their brand image, for which television has an edge,"

Cheong said. Lee said general manager Stephen Chan Chi-wan remains an

"executive" at the station but cannot carry out his duties, pending further

investigations into bribery allegations. TVB will review its internal system and

evaluate the results of the ICAC probe, he said. He added that the broadcaster

has always told its employees to abide by the law.

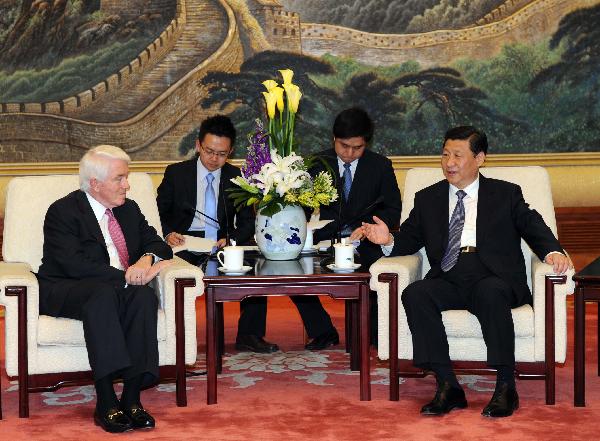

Li Gang, a deputy director of the central government's liaison office in Hong

Kong, remains optimistic in his talks with pan-democrats on the city's

constitutional reform. A Beijing representative in Hong Kong held his latest

groundbreaking negotiations on constitutional reform yesterday - and rejected a

proposal by moderate pan-democrats to allow the public to elect district council

sector lawmakers in 2012. Li Gang, a deputy director of the central government's

liaison office in Hong Kong, told the Alliance for Universal Suffrage in their

first meeting that its suggestion was inconsistent with the legislative intent

of the Basic Law regarding functional constituencies. He also made it clear that

neither his office nor the Hong Kong government had the power to handle

electoral arrangements beyond 2012, unless there was another decision by the

central government. The alliance said the talks ended in stalemate because of

substantial differences between the two sides. Under two proposals earlier

released by the Democratic Party and the alliance, the number of seats in Legco

would be increased from the present 60 to 70 or 80, with six or 11 seats for the

district council sector respectively. Both groups suggested that candidates for

the sector should be nominated by district councillors and elected by all

registered voters in the city.

Li Gang, a deputy director of the central government's liaison office in Hong

Kong, remains optimistic in his talks with pan-democrats on the city's

constitutional reform. A Beijing representative in Hong Kong held his latest

groundbreaking negotiations on constitutional reform yesterday - and rejected a

proposal by moderate pan-democrats to allow the public to elect district council

sector lawmakers in 2012. Li Gang, a deputy director of the central government's

liaison office in Hong Kong, told the Alliance for Universal Suffrage in their

first meeting that its suggestion was inconsistent with the legislative intent

of the Basic Law regarding functional constituencies. He also made it clear that

neither his office nor the Hong Kong government had the power to handle

electoral arrangements beyond 2012, unless there was another decision by the

central government. The alliance said the talks ended in stalemate because of

substantial differences between the two sides. Under two proposals earlier

released by the Democratic Party and the alliance, the number of seats in Legco

would be increased from the present 60 to 70 or 80, with six or 11 seats for the

district council sector respectively. Both groups suggested that candidates for

the sector should be nominated by district councillors and elected by all

registered voters in the city.

Rita Fan Hsu Lai-tai said on Thursday she did not think the government’s latest

political reforms would be passed by the Legislative Council this year. Fan was

speaking after Li Gang, a deputy director of the central government’s Liaison

Office in Hong Kong, met representatives of the Democratic Party and the

Alliance for Universal Suffrage on Monday and Wednesday. She said the meetings

between the pan-democrats and Li would help improve relations. “But I am not

optimistic the 2012 electoral reform package could be passed by a majority of

the members in the Legco,’’ said Fan, who is a member of the Standing Committee

of the National People’s Congress of the People’s Republic of China. “Based on

my own dialogue with the pan-democrats, they want the central government to

assure them that functional constituencies would be abolished. But this is not

something the central government can do,’’ she explained. “So under these

circumstances, it would be very difficult for the pan-democrats to support the

government’s reform package,” said Fan. Asked whether she believed the central

government was trying to divide the pan-democratic camp by only meeting some of

its representatives, Fan said she did not think this was the case. She said the

meetings ultimately showed the central government was willing to communicate

with political parties, who respected the Basic Law and constitutional

development in Hong Kong. On Friday, Li will continue with the consultation

process and meet with members of the Hong Kong Association for Democracy and

People’s Livelihood, including legislator Frederick Fung Kin Kee.

Rita Fan Hsu Lai-tai said on Thursday she did not think the government’s latest

political reforms would be passed by the Legislative Council this year. Fan was

speaking after Li Gang, a deputy director of the central government’s Liaison

Office in Hong Kong, met representatives of the Democratic Party and the

Alliance for Universal Suffrage on Monday and Wednesday. She said the meetings

between the pan-democrats and Li would help improve relations. “But I am not

optimistic the 2012 electoral reform package could be passed by a majority of

the members in the Legco,’’ said Fan, who is a member of the Standing Committee

of the National People’s Congress of the People’s Republic of China. “Based on

my own dialogue with the pan-democrats, they want the central government to

assure them that functional constituencies would be abolished. But this is not

something the central government can do,’’ she explained. “So under these

circumstances, it would be very difficult for the pan-democrats to support the

government’s reform package,” said Fan. Asked whether she believed the central

government was trying to divide the pan-democratic camp by only meeting some of

its representatives, Fan said she did not think this was the case. She said the

meetings ultimately showed the central government was willing to communicate

with political parties, who respected the Basic Law and constitutional

development in Hong Kong. On Friday, Li will continue with the consultation

process and meet with members of the Hong Kong Association for Democracy and

People’s Livelihood, including legislator Frederick Fung Kin Kee.

Billionaire and Cheung Kong

(Holdings) (SEHK: 0001) chairman Li Ka-shing said on Thursday his company and

foundation might underwrite a total of US$200 million (HK$1.5 billion) of

Prudential’s rights issue. “My foundation and the company (Cheung Kong) may set

aside US$100 million each for the [Prudential] deal,” Li said . “It was a deal

proposed by our finance manager and would be very small in dollar value,” he

said, referring to the potential investment in Prudential’s US$21 billion rights

issue.

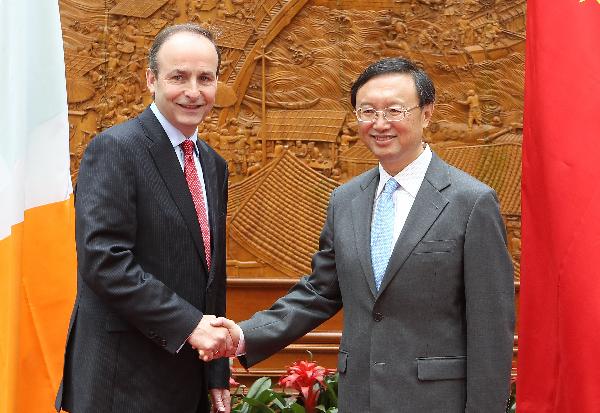

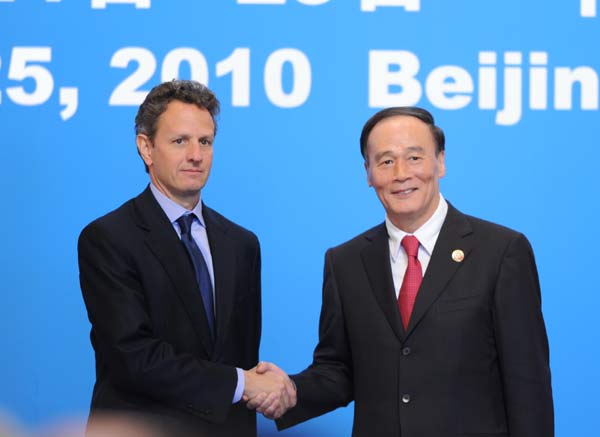

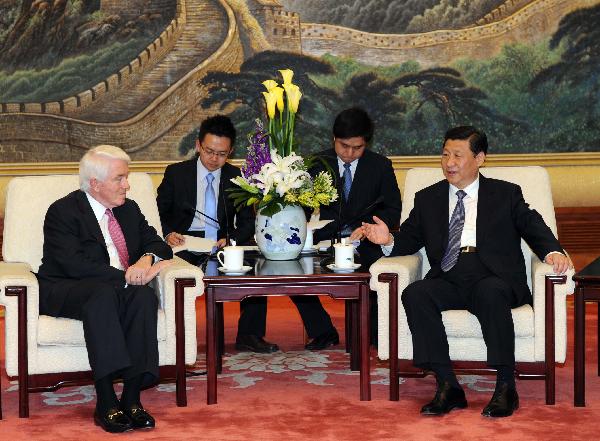

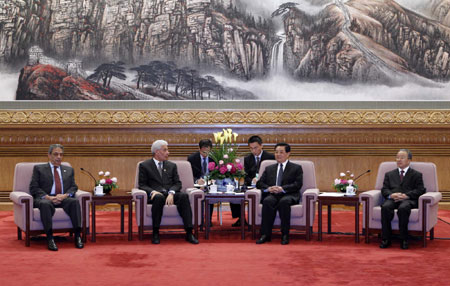

Hong Kong signs latest Cepa deals -

Financial Secretary John Tsang Chun-wah (left) and the Vice-Minister of Commerce

Jiang Zengwei (right), exchange documents after signing the seventh supplement

to the Closer Economic Partnership Arrangement (CEPA) on Thursday. The seventh

supplement to the Closer Economic Partnership Arrangement (Cepa) between Hong

Kong and the mainland, was signed at the Central Government Offices in Hong Kong

on Thursday. The supplement was signed by Financial Secretary John Tsang Chun-wah

and China's Vice-Minister of Commerce Jiang Zengwei, with Chief Executive Donald

Tsang Yam-kuen and other guests as witnesses. Thirty five measures will come

into effect next year to improve cross-border trade. The new supplement also

relaxes market access conditions in 14 service sectors, such as medical

services, tourism, banking and air transportation. The supplement will enable

Hong Kong service industries to develop in the mainland market and allow

professional exchanges between the two sides. More information on Cepa is

available on the Trade and Industry Department’s CEPA website

http://www.tid.gov.hk/english/cepa/index.html. Hong Kong signs latest Cepa deals -

Financial Secretary John Tsang Chun-wah (left) and the Vice-Minister of Commerce

Jiang Zengwei (right), exchange documents after signing the seventh supplement

to the Closer Economic Partnership Arrangement (CEPA) on Thursday. The seventh

supplement to the Closer Economic Partnership Arrangement (Cepa) between Hong

Kong and the mainland, was signed at the Central Government Offices in Hong Kong

on Thursday. The supplement was signed by Financial Secretary John Tsang Chun-wah

and China's Vice-Minister of Commerce Jiang Zengwei, with Chief Executive Donald

Tsang Yam-kuen and other guests as witnesses. Thirty five measures will come

into effect next year to improve cross-border trade. The new supplement also

relaxes market access conditions in 14 service sectors, such as medical

services, tourism, banking and air transportation. The supplement will enable

Hong Kong service industries to develop in the mainland market and allow

professional exchanges between the two sides. More information on Cepa is

available on the Trade and Industry Department’s CEPA website

http://www.tid.gov.hk/english/cepa/index.html.

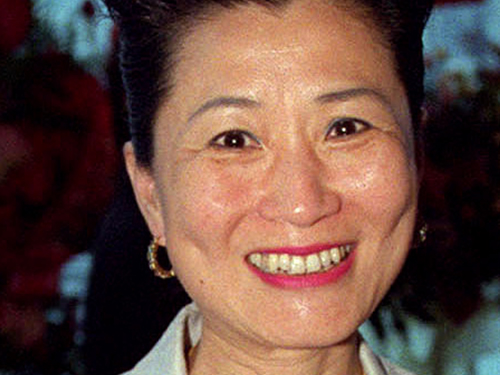

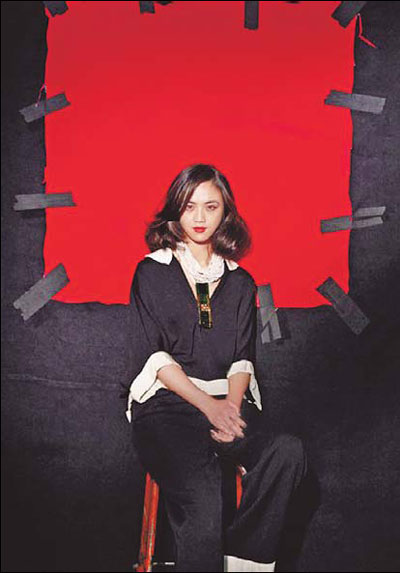

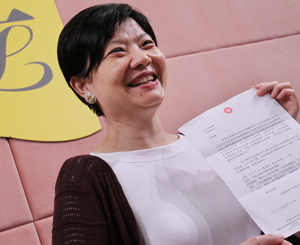

The ICAC could soon have its first woman chief of operations. Prominent graft

investigator Rebecca Li Bo-lan, who has led several high-profile cases, is set

to be promoted next week as one of two directors in the department. This makes

her one of two deputies to current chief Daniel Li Ming-chak, who is expected to

retire at the end of next year. The other director, Ryan Wong Sai-chiu, who

oversees government services, is expected to retire in 2012, leaving Rebecca Li

a strong candidate for the top post. Li, who is in her mid-40s, is now the

acting director for private-sector corruption, and is due to formally succeed

Francis Lee Chun-sang on June 1, when Lee begins his retirement leave. Li is

regarded as a high-flyer. In 2000, she became the first officer from the

anti-graft watchdog to be sent to the Federal Bureau of Investigation for

training, alongside crime fighters from around the world. She made her name

after leading the investigation of several high-profile corruption cases over

the past decade, including the arrest of Mo Yuk-ping, the wife of the jailed

Shanghai tycoon Chau Ching-ngai, who was convicted of manipulating the shares of

her husband's former company. Li was also in charge of the probe of former

deputy inland revenue commissioner Agnes Sin Law Yuk-lin, who was convicted of

defrauding the government of HK$330,000 in rental allowances. She also earned

acclaim for cracking an international fake passport syndicate. Li was promoted

to her current position of assistant director of operations in 2002. The

800-strong operations department is the core unit of the anti-graft agency and

its largest. It is its investigative arm, responsible for looking into various

corruption offences. Before she became acting director, Li was the most senior

among the four assistant directors. A senior officer at the agency said that Li

had a "very high chance" of taking up the directorship next week, and she is on

the path to be "the first female head of operations in ICAC history". The

departure of Lee, the outgoing director, signals the start of a wave of

retirement involving the first generation of graft investigators. Many had been

with the agency since it was set up in 1974. Lee took part in the investigation

into the infamous "Four Great Sergeant" case in the 1970s that targeted the

"HK$500 million Sergeant" Lui Lok. Lee was also involved in the probe into

notorious drug lord "Limpy Ho" Ng Sik-ho. It is understood that Lee intends to

enjoy his retirement in leisure and will not work in the private sector. A

spokeswoman for the Independent Commission Against Corruption said yesterday

that the appointment of operations director would be announced at an appropriate

time.

The ICAC could soon have its first woman chief of operations. Prominent graft

investigator Rebecca Li Bo-lan, who has led several high-profile cases, is set

to be promoted next week as one of two directors in the department. This makes

her one of two deputies to current chief Daniel Li Ming-chak, who is expected to

retire at the end of next year. The other director, Ryan Wong Sai-chiu, who

oversees government services, is expected to retire in 2012, leaving Rebecca Li

a strong candidate for the top post. Li, who is in her mid-40s, is now the

acting director for private-sector corruption, and is due to formally succeed

Francis Lee Chun-sang on June 1, when Lee begins his retirement leave. Li is

regarded as a high-flyer. In 2000, she became the first officer from the

anti-graft watchdog to be sent to the Federal Bureau of Investigation for

training, alongside crime fighters from around the world. She made her name

after leading the investigation of several high-profile corruption cases over

the past decade, including the arrest of Mo Yuk-ping, the wife of the jailed

Shanghai tycoon Chau Ching-ngai, who was convicted of manipulating the shares of

her husband's former company. Li was also in charge of the probe of former

deputy inland revenue commissioner Agnes Sin Law Yuk-lin, who was convicted of

defrauding the government of HK$330,000 in rental allowances. She also earned

acclaim for cracking an international fake passport syndicate. Li was promoted

to her current position of assistant director of operations in 2002. The

800-strong operations department is the core unit of the anti-graft agency and

its largest. It is its investigative arm, responsible for looking into various

corruption offences. Before she became acting director, Li was the most senior

among the four assistant directors. A senior officer at the agency said that Li

had a "very high chance" of taking up the directorship next week, and she is on

the path to be "the first female head of operations in ICAC history". The

departure of Lee, the outgoing director, signals the start of a wave of

retirement involving the first generation of graft investigators. Many had been

with the agency since it was set up in 1974. Lee took part in the investigation

into the infamous "Four Great Sergeant" case in the 1970s that targeted the

"HK$500 million Sergeant" Lui Lok. Lee was also involved in the probe into

notorious drug lord "Limpy Ho" Ng Sik-ho. It is understood that Lee intends to

enjoy his retirement in leisure and will not work in the private sector. A

spokeswoman for the Independent Commission Against Corruption said yesterday

that the appointment of operations director would be announced at an appropriate

time.

China*:

Lenovo returned to the black in its fiscal fourth quarter helped by strong

growth in its home market in the mainland, but its earnings lagged expectations

as its margins fell.

China*:

Lenovo returned to the black in its fiscal fourth quarter helped by strong