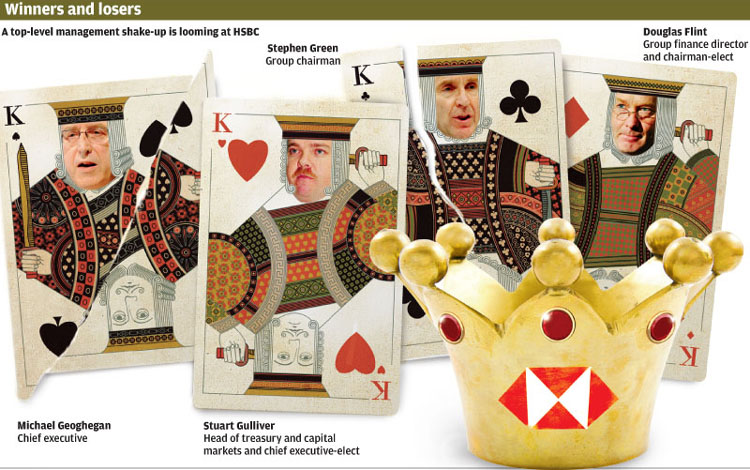

|

Newsletter

Seminar Material

Biz:

China

Hong

Kong Hawaii

What people

said about us

China

Earthquake Relief

Tax &

Government

Hawaii Voter Registration

Biz-Video

Biz-Video

Hawaii's

China Connection Hawaii's

China Connection

CDP#1780962

CDP#1780962

Doing Business in

Hong Kong & China

Doing Business in

Hong Kong & China

| |

Share Hong Kong, China & Hawaii Biz*

Skype - FREE

Voice Over IP Skype - FREE

Voice Over IP  View Hawaii's China Connection

Video Trailer

View Hawaii's China Connection

Video Trailer

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our event page to find out more!

After

attended a China/Hong Kong Business/Trade Seminar in Hawaii...still unsure what

to do next, contact us, our Officers, Directors and Founding Members are

actively engaged in China/Hong Kong/Asia trade - we can help!

Are you ready to export your product or

service? You will find out in 3 minutes with resources to help you -

enter

to give it a try

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

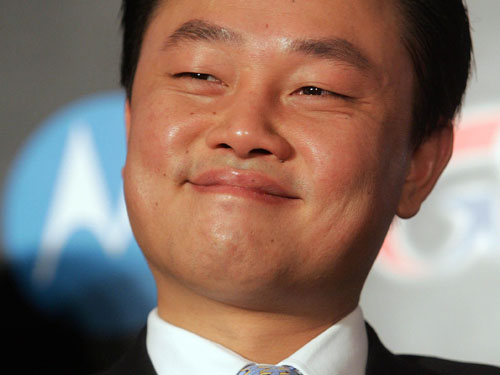

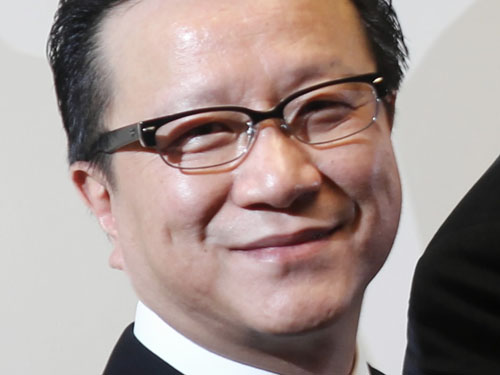

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading

Johnson Choi on Hong Kong

investments with Hawaii filmmakers - Asia in Review host Jay Fidell

in a discussion with Johnson Choi, President of the Hong Kong.China.Hawaii

Chamber of Commerce on his recent (July 2010) trip to Shanghai and Hong Kong and

on Hong Kong investments with Hawaii filmmakers

http://vimeo.com/13994279 or download

video click:

http://www.hkchcc.org/johnsonchoithinktec0710.mp4

Johnson Choi on Hong Kong

investments with Hawaii filmmakers - Asia in Review host Jay Fidell

in a discussion with Johnson Choi, President of the Hong Kong.China.Hawaii

Chamber of Commerce on his recent (July 2010) trip to Shanghai and Hong Kong and

on Hong Kong investments with Hawaii filmmakers

http://vimeo.com/13994279 or download

video click:

http://www.hkchcc.org/johnsonchoithinktec0710.mp4

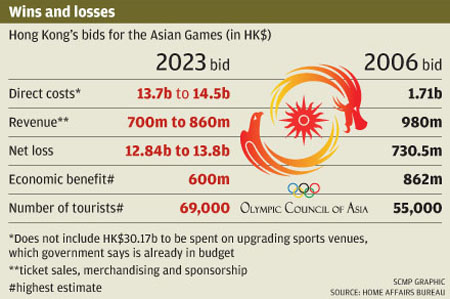

(approximate $ exchange rates: US$1 = HK$7.8, US$1 = RMB$6.8)

View China 60th

Anniversary Video and Photo online View China 60th

Anniversary Video and Photo online

Holidays Greeting from President Obama & Johnson Choi

Holidays Greeting from President Obama & Johnson Choi

http://www.youtube.com/watch?v=pNk4Z4lUV-k

http://www.youtube.com/watch?v=pNk4Z4lUV-k

http://www.facebook.com/video/video.php?v=219896871983&ref=mf

http://www.facebook.com/video/video.php?v=219896871983&ref=mf

Wine-Biz

- Hong Kong

Wine-Biz

- Hong Kong

Brand Hong Kong

Video

Brand Hong Kong

Video

Mainland and Hong

Kong Closer Economic Partnership Arrangement (CEPA)

http://www.tid.gov.hk/english/cepa/index.html

Mainland and Hong

Kong Closer Economic Partnership Arrangement (CEPA)

http://www.tid.gov.hk/english/cepa/index.html

About APEC

http://www.apec.org/apec/about_apec.html

About APEC

http://www.apec.org/apec/about_apec.html

APEC 2011 November

2011 Honolulu Hawaii USA

Presentation: Inside APEC

http://www.hkchcc.org/insideapechkchccpresentation080810.ppt

(Microsoft Power Point 16 Meg File Size)

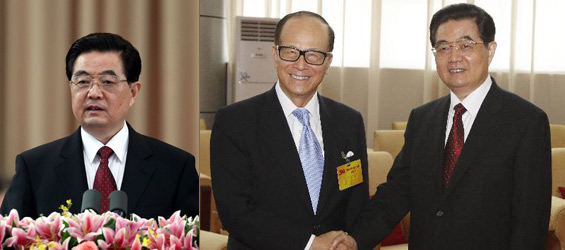

October 1, 2010

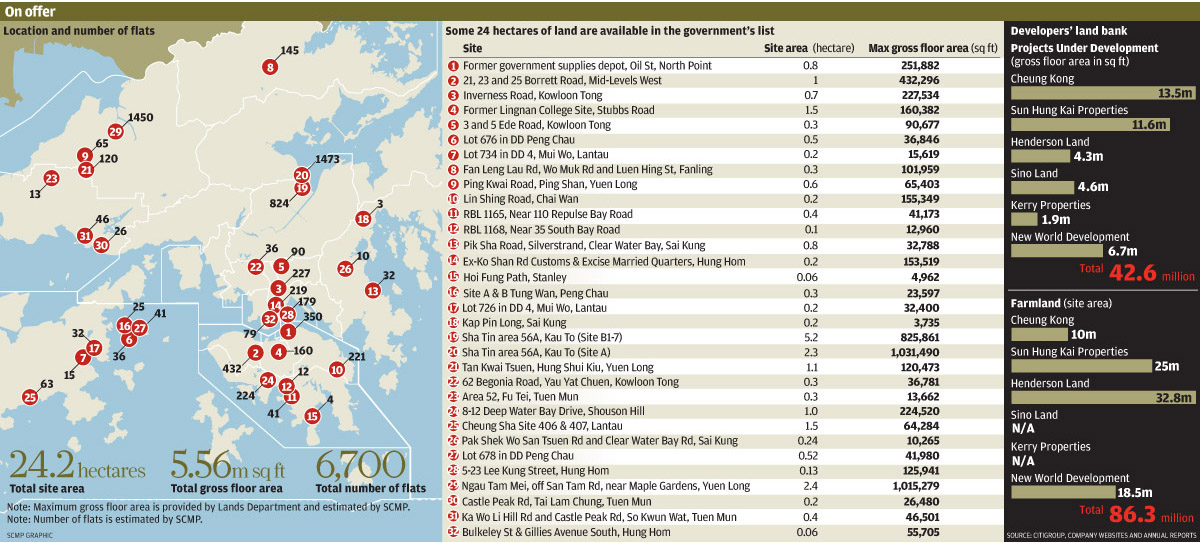

Hong Kong*:

The government land auction on Wednesday surprised the market after one

residential site in Chai Wan was withdrawn and another in Fanling was sold at a

record price. Hong Kong*:

The government land auction on Wednesday surprised the market after one

residential site in Chai Wan was withdrawn and another in Fanling was sold at a

record price.

Consumer confidence in Hong Kong

enjoyed a slight rebound in the third quarter, according to a new survey

released by the Bauhinia Foundation Research Centre on Wednesday.

HK film eyes Oscar nomination - A

local film that raised public concern about preserving the historic old Wing Lee

Street, in Sheung Wan, was picked yesterday to represent Hong Kong among films

from which five nominees will be chosen to battle for the Oscar for best

foreign-language film at next year's Academy Awards. Echoes of the Rainbow,

starring Simon Yam Tat-wah and Sandra Ng Kwan-yu, won a Crystal Bear Children's

Jury prize at February's Berlin Film Festival, in Germany, and also four prizes

- including best screenplay and best actor - at the 29th Hong Kong Film Awards.

The 1960s-set film - sponsored by the Hong Kong Film Development Council - tells

the story of a shoemaker and his family, whose eldest son becomes ill with

leukaemia. It was voted for unanimously by all 11 board members of the

Federation of Motion Film Producers of Hong Kong to run for the 83rd Oscars.

Plans to redevelop the rundown street used in the film were shelved following

the film's success. The American Academy of Motion Picture Arts and Sciences

will hold a screening of foreign films in the US next month before selecting the

five final nominees for the ceremony on February 27. Producer Mabel Cheung

Yuen-ting said: "I am very honoured the film will represent Hong Kong. But

there's still a long way to go." Federation chairman Crucindo Hung Cho-sing said

he was confident the film would be among the final five nominees. "It had good

box office, was well-received by audiences and did well at festivals. It

reflects the real life of lower classes in the 1960s and truly represents Hong

Kong," he said. HK film eyes Oscar nomination - A

local film that raised public concern about preserving the historic old Wing Lee

Street, in Sheung Wan, was picked yesterday to represent Hong Kong among films

from which five nominees will be chosen to battle for the Oscar for best

foreign-language film at next year's Academy Awards. Echoes of the Rainbow,

starring Simon Yam Tat-wah and Sandra Ng Kwan-yu, won a Crystal Bear Children's

Jury prize at February's Berlin Film Festival, in Germany, and also four prizes

- including best screenplay and best actor - at the 29th Hong Kong Film Awards.

The 1960s-set film - sponsored by the Hong Kong Film Development Council - tells

the story of a shoemaker and his family, whose eldest son becomes ill with

leukaemia. It was voted for unanimously by all 11 board members of the

Federation of Motion Film Producers of Hong Kong to run for the 83rd Oscars.

Plans to redevelop the rundown street used in the film were shelved following

the film's success. The American Academy of Motion Picture Arts and Sciences

will hold a screening of foreign films in the US next month before selecting the

five final nominees for the ceremony on February 27. Producer Mabel Cheung

Yuen-ting said: "I am very honoured the film will represent Hong Kong. But

there's still a long way to go." Federation chairman Crucindo Hung Cho-sing said

he was confident the film would be among the final five nominees. "It had good

box office, was well-received by audiences and did well at festivals. It

reflects the real life of lower classes in the 1960s and truly represents Hong

Kong," he said.

Following the lead of Hong Kong,

Beijing and other key mainland cities, Macau yesterday unveiled a string of

measures to rein in property speculation. The measures centre on increasing

housing supply as well as raising the transaction costs for speculators, Lau Si-lo,

Macau's Secretary for Transport and Public Works, said. Lau said land supply

would be increased and new sites would be designated solely for the building of

flats of 700 to 800 square feet. The government will help developers in

transforming industrial sites for residential development. From next month,

buyers of properties worth more than 3.3 million patacas will have to pay a

minimum down payment of 30 per cent of the purchase price. Monthly mortgage

payments should not be more than half of the buyer's income. The stringent down

payment requirement applies also to non-Macau residents. Transaction fees will

jump from 0.5 per cent to 3 per cent of the property's price.

Jewellery and watch retailer Chow Tai

Fook plans to double its outlets on the mainland to 2,000 in the next decade,

with half of the new shops located in small cities. The Hong Kong-based company,

which is privately held by tycoon Cheng Yu-tung, opened its 1,000th store on

Qianmen Street in Beijing yesterday. Managing director Kent Wong Siu-kei said

the jeweller would open another 1,000 outlets on the mainland before 2020. Half

of them will be in first- and second-tier cities, with the rest to be located in

third- and fourth-tier cities close to rural areas. "The market [in smaller

cities] is vast considering the growing revenue in rural areas and the central

government's continuous efforts to drive up domestic consumption," he said. Chow

Tai Fook, which began as a small jewellery shop in Macau, has become the biggest

jewellery retailer in the nation under the leadership of Cheng, who is also

chairman of New World Development. The company's closest competitor on the

mainland by sales is another Hong Kong jewellery retailer, Chow Sang Sang. Chow

Tai Fook already has a network established in the mainland's first- and

second-tier cities. It operates about a third of its shops directly, while the

rest are run as franchises. "We estimate the market for jewellery and gold

trading [on the mainland] will grow 20 per cent annually over the next five

years," Wong said. Jewellery and watches are among the most sought-after goods

for mainland tourists visiting Hong Kong. The company recorded double-digit

growth in same-store sales from January to August this year. It said its most

popular product by trade volume is gold, followed by gems, jade and pearls.

Asked if fast expansion on the mainland would affect the company's Hong Kong

business, Wong said it would likely benefit the brand. With more mainland

outlets, he expects more mainland customers to seek out the brand when they

visit Hong Kong. Tax-free goods and a good shopping environment would bring more

mainland customers to the retailer's Hong Kong outlets, he said. He noted the

culture of giving jewellery on the mainland was similar to that in Hong Kong.

Mainland couples exchange wedding rings, he said, while diamond rings and

accessories made of gold are given to mark an engagement. "Cheap prices are no

longer the most important thing to lure buyers here. Mainland tourists are

paying more attention to the shopping environment and services," Wong said. Chow

Tai Fook's new shop in Beijing has a floor area of 28,000 square feet, the

biggest of all its mainland shops. It spans two adjoining four-storey buildings,

with one for jewellery and the other for watches. As well as its outlets on the

mainland, the company also owns almost 100 shops in Hong Kong, Macau, Taiwan and

Malaysia. It plans to enter the Singapore market soon. Jewellery and watch retailer Chow Tai

Fook plans to double its outlets on the mainland to 2,000 in the next decade,

with half of the new shops located in small cities. The Hong Kong-based company,

which is privately held by tycoon Cheng Yu-tung, opened its 1,000th store on

Qianmen Street in Beijing yesterday. Managing director Kent Wong Siu-kei said

the jeweller would open another 1,000 outlets on the mainland before 2020. Half

of them will be in first- and second-tier cities, with the rest to be located in

third- and fourth-tier cities close to rural areas. "The market [in smaller

cities] is vast considering the growing revenue in rural areas and the central

government's continuous efforts to drive up domestic consumption," he said. Chow

Tai Fook, which began as a small jewellery shop in Macau, has become the biggest

jewellery retailer in the nation under the leadership of Cheng, who is also

chairman of New World Development. The company's closest competitor on the

mainland by sales is another Hong Kong jewellery retailer, Chow Sang Sang. Chow

Tai Fook already has a network established in the mainland's first- and

second-tier cities. It operates about a third of its shops directly, while the

rest are run as franchises. "We estimate the market for jewellery and gold

trading [on the mainland] will grow 20 per cent annually over the next five

years," Wong said. Jewellery and watches are among the most sought-after goods

for mainland tourists visiting Hong Kong. The company recorded double-digit

growth in same-store sales from January to August this year. It said its most

popular product by trade volume is gold, followed by gems, jade and pearls.

Asked if fast expansion on the mainland would affect the company's Hong Kong

business, Wong said it would likely benefit the brand. With more mainland

outlets, he expects more mainland customers to seek out the brand when they

visit Hong Kong. Tax-free goods and a good shopping environment would bring more

mainland customers to the retailer's Hong Kong outlets, he said. He noted the

culture of giving jewellery on the mainland was similar to that in Hong Kong.

Mainland couples exchange wedding rings, he said, while diamond rings and

accessories made of gold are given to mark an engagement. "Cheap prices are no

longer the most important thing to lure buyers here. Mainland tourists are

paying more attention to the shopping environment and services," Wong said. Chow

Tai Fook's new shop in Beijing has a floor area of 28,000 square feet, the

biggest of all its mainland shops. It spans two adjoining four-storey buildings,

with one for jewellery and the other for watches. As well as its outlets on the

mainland, the company also owns almost 100 shops in Hong Kong, Macau, Taiwan and

Malaysia. It plans to enter the Singapore market soon.

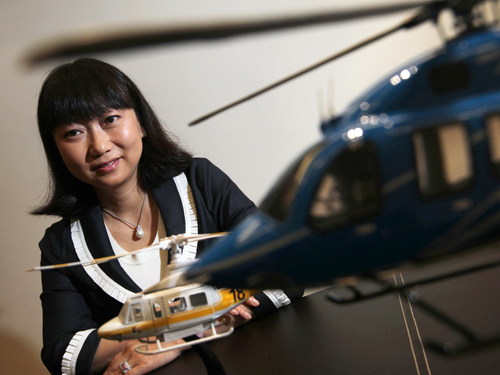

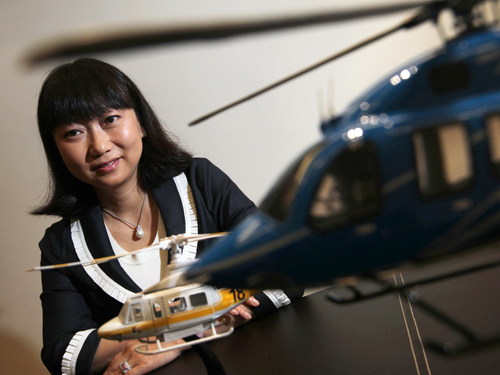

US brand to target China riches via auctions from Hong Kong - Sotheby's realty

arm eyes luxury market - Samson Law, managing director of Sotheby's

International Realty in Hong Kong. A surge in demand for luxury homes and

apartments in Hong Kong has lured US-based estate agency franchise Sotheby's

International Realty to enter the market. Local property broker Samson Law Lai-choi,

owner of estate agency Hong Kong Homes, has secured a 25-year master franchise

agreement to develop the Sotheby's brand in Hong Kong. "Everyone knows the name

Sotheby's," Law said. "We have already recruited 20-plus sales staff and aim to

increase this to 40 within one year." Local rivals said they were not in awe of

their new big-brand international competitor. "Hong Kong is a mature market. It

will prove difficult for a newcomer to make an impact. It is going to be a tough

job for them," said Joseph Tsang Hon-ping, international director and head of

capital markets at Jones Lang LaSalle's Hong Kong office. "We had been

approached by the US company for business co-operation opportunities a few years

ago. But we did not feel comfortable with the business model." Other property

agents said they did not feel threatened by the newcomer. "We have more than 10

branches in the Mid-Levels and Island South. Can a company with only an office

address compete with us? It will not be easy," Vincent Chan Kwan-hing, executive

director of Midland Realty, said. Louis Chan Wing-kit, executive director of

Centaline Property Agency, said there was room in the market for more players,

and new entrants would not affect its leading position. He said Centaline was

responsible for settling some 25 per cent of luxury transactions valued at HK$20

million or above. "We have established a very strong network of street shops and

a database. That results in an operational cost of more than HK$100 million

every month." Data from Centaline shows there were 5,913 properties sold for

HK$10 million or above in the first eight months. This represented an increase

of 63.34 per cent compared with the same period last year. The value of

properties sold amounted to HK$132.8 billion, up 78.85 per cent. With

commissions on luxury sales of 1 to 2 per cent, sales in the first eight months

were worth HK$1.3 billion to HK$2.65 billion for the agents. Law, who also owns

Proway, a company providing relocation services, said his contract with New

Jersey-based Realogy Corp, which owns Sotheby's franchising rights, was signed

in April but it will be officially opened next month. The opening was delayed,

he said, because of lengthy negotiations with the franchise owner over

differences in business operation between Hong Kong and the United States. He

said he would continue running Hong Kong Homes and Proway but looked forward to

adding the Sotheby's franchise to his stable. "We will not try to follow the

approach of local agents such as Centaline and Midland and open street shops as

it would not be easy to compete with them on this basis," he said. Instead, he

planned to build on Sotheby's high-profile auctions to market the firm's

property services to wealthy clients. "More than 60 per cent of buyers at

Sotheby's auctions are mainlanders. We will be allowed to set up a booth in the

auction hall areas to market our service. That will help us reach out to the

market," he said. Law said there would be no conflict of interest between Hong

Kong Homes and the Sotheby's franchise since the former would focus on leasing

while Sotheby's would focus on sales. He declined to provide details of the

total investment he would make to support the franchise. The path to next

month's opening has not been easy, Law said. "We had targeted to begin operating

the business in July but were delayed because we were obliged to have a long

negotiation with the franchise owner about operating styles in Hong Kong," Law

said. "For example, we wanted all photos of properties that we publish to carry

a watermark to prevent other agents from using the photos and breaking our

copyright over them." But this is not the practice in the US, where an agent

gets exclusive rights to market a property and then subcontracts the selling

rights with others that share the commission if they sell the property, he said.

But in Hong Kong, vendors can appoint several agents to sell a property. They

compete with each other and do not have to share commission, he said. "There are

differences in how the business operates and it took time to explain this," Law

said. "Can we do it? Ask me again in three years and I'll tell you."

US brand to target China riches via auctions from Hong Kong - Sotheby's realty

arm eyes luxury market - Samson Law, managing director of Sotheby's

International Realty in Hong Kong. A surge in demand for luxury homes and

apartments in Hong Kong has lured US-based estate agency franchise Sotheby's

International Realty to enter the market. Local property broker Samson Law Lai-choi,

owner of estate agency Hong Kong Homes, has secured a 25-year master franchise

agreement to develop the Sotheby's brand in Hong Kong. "Everyone knows the name

Sotheby's," Law said. "We have already recruited 20-plus sales staff and aim to

increase this to 40 within one year." Local rivals said they were not in awe of

their new big-brand international competitor. "Hong Kong is a mature market. It

will prove difficult for a newcomer to make an impact. It is going to be a tough

job for them," said Joseph Tsang Hon-ping, international director and head of

capital markets at Jones Lang LaSalle's Hong Kong office. "We had been

approached by the US company for business co-operation opportunities a few years

ago. But we did not feel comfortable with the business model." Other property

agents said they did not feel threatened by the newcomer. "We have more than 10

branches in the Mid-Levels and Island South. Can a company with only an office

address compete with us? It will not be easy," Vincent Chan Kwan-hing, executive

director of Midland Realty, said. Louis Chan Wing-kit, executive director of

Centaline Property Agency, said there was room in the market for more players,

and new entrants would not affect its leading position. He said Centaline was

responsible for settling some 25 per cent of luxury transactions valued at HK$20

million or above. "We have established a very strong network of street shops and

a database. That results in an operational cost of more than HK$100 million

every month." Data from Centaline shows there were 5,913 properties sold for

HK$10 million or above in the first eight months. This represented an increase

of 63.34 per cent compared with the same period last year. The value of

properties sold amounted to HK$132.8 billion, up 78.85 per cent. With

commissions on luxury sales of 1 to 2 per cent, sales in the first eight months

were worth HK$1.3 billion to HK$2.65 billion for the agents. Law, who also owns

Proway, a company providing relocation services, said his contract with New

Jersey-based Realogy Corp, which owns Sotheby's franchising rights, was signed

in April but it will be officially opened next month. The opening was delayed,

he said, because of lengthy negotiations with the franchise owner over

differences in business operation between Hong Kong and the United States. He

said he would continue running Hong Kong Homes and Proway but looked forward to

adding the Sotheby's franchise to his stable. "We will not try to follow the

approach of local agents such as Centaline and Midland and open street shops as

it would not be easy to compete with them on this basis," he said. Instead, he

planned to build on Sotheby's high-profile auctions to market the firm's

property services to wealthy clients. "More than 60 per cent of buyers at

Sotheby's auctions are mainlanders. We will be allowed to set up a booth in the

auction hall areas to market our service. That will help us reach out to the

market," he said. Law said there would be no conflict of interest between Hong

Kong Homes and the Sotheby's franchise since the former would focus on leasing

while Sotheby's would focus on sales. He declined to provide details of the

total investment he would make to support the franchise. The path to next

month's opening has not been easy, Law said. "We had targeted to begin operating

the business in July but were delayed because we were obliged to have a long

negotiation with the franchise owner about operating styles in Hong Kong," Law

said. "For example, we wanted all photos of properties that we publish to carry

a watermark to prevent other agents from using the photos and breaking our

copyright over them." But this is not the practice in the US, where an agent

gets exclusive rights to market a property and then subcontracts the selling

rights with others that share the commission if they sell the property, he said.

But in Hong Kong, vendors can appoint several agents to sell a property. They

compete with each other and do not have to share commission, he said. "There are

differences in how the business operates and it took time to explain this," Law

said. "Can we do it? Ask me again in three years and I'll tell you."

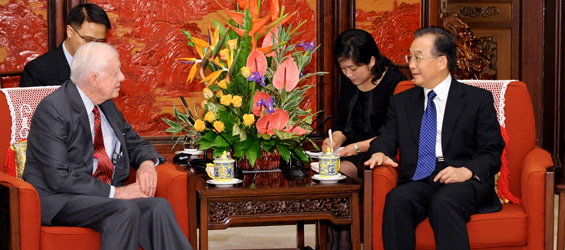

China*:

China's central bank on Wednesday pledged to increase flexibility of the yuan

exchange rate as US lawmakers were set to vote on legislation that could punish

Beijing for alleged currency manipulation. The People’s Bank of China promised

to continue to implement an “appropriately loose monetary policy” and “increase

currency flexibility”, according to a statement on its website. The statement

also vowed to “gradually improve the exchange rate setting mechanism”. The

central bank’s wording was almost identical to that used in a similar pledge in

June, since when the yuan has strengthened less than two per cent against the

greenback. The US House of Representatives was to vote later Wednesday on

legislation to expand the powers of the US Commerce Department by allowing it to

impose tariffs when another nation is found to be manipulating its currency’s

value. The measure enjoyed strong support from President Barack Obama’s

Democratic allies and their labour union supporters, as well as his Republican

foes, and was expected to win approval, according to several leadership aides.

US lawmakers have redoubled their accusations that Beijing keeps the yuan – and

therefore Chinese exports – artificially cheap, driving US manufacturers out of

business and costing thousands of US jobs. If the measure clears the House, the

Senate could take up a companion bill. The vote comes after weeks of intense

lobbying by Washington for Beijing to let the currency appreciate, with Obama

making his case to Premier Wen Jiabao on the sidelines of the UN General

Assembly last week. Before its June vow to let the yuan trade more freely, the

currency had been effectively pegged at about 6.8 to the dollar since mid-2008.

China*:

China's central bank on Wednesday pledged to increase flexibility of the yuan

exchange rate as US lawmakers were set to vote on legislation that could punish

Beijing for alleged currency manipulation. The People’s Bank of China promised

to continue to implement an “appropriately loose monetary policy” and “increase

currency flexibility”, according to a statement on its website. The statement

also vowed to “gradually improve the exchange rate setting mechanism”. The

central bank’s wording was almost identical to that used in a similar pledge in

June, since when the yuan has strengthened less than two per cent against the

greenback. The US House of Representatives was to vote later Wednesday on

legislation to expand the powers of the US Commerce Department by allowing it to

impose tariffs when another nation is found to be manipulating its currency’s

value. The measure enjoyed strong support from President Barack Obama’s

Democratic allies and their labour union supporters, as well as his Republican

foes, and was expected to win approval, according to several leadership aides.

US lawmakers have redoubled their accusations that Beijing keeps the yuan – and

therefore Chinese exports – artificially cheap, driving US manufacturers out of

business and costing thousands of US jobs. If the measure clears the House, the

Senate could take up a companion bill. The vote comes after weeks of intense

lobbying by Washington for Beijing to let the currency appreciate, with Obama

making his case to Premier Wen Jiabao on the sidelines of the UN General

Assembly last week. Before its June vow to let the yuan trade more freely, the

currency had been effectively pegged at about 6.8 to the dollar since mid-2008.

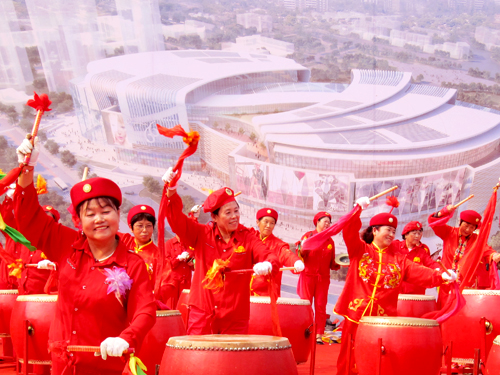

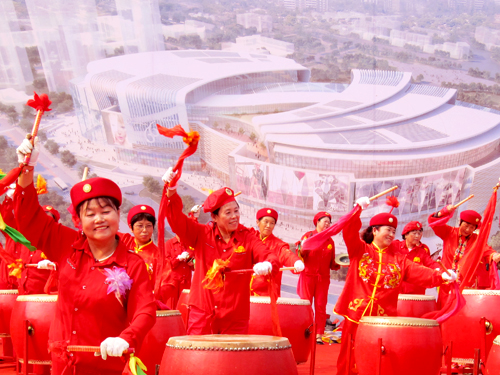

Hang Lung plays 'green' card in shopping malls - Developer seeks certification

on energy features - A drum dance marks the groundbreaking ceremony for the

environmentally friendly Olympia 66 centre in Dalian, Liaoning, on Monday.

Building "green" features into new shopping centres on the mainland is becoming

standard practice for developers seeking a selling edge in the highly

competitive market, consultants say. Among the drawcards of such environmentally

sensitive projects is a big reduction in energy bills, achieved by using special

glazing that controls heat transfer through windows, as well as improved

insulation methods. "In dollar terms, we will achieve savings of about 10

million yuan (HK$11.57 million) on electricity bills at the Olympia 66

development in Dalian," said Vincent Tse, managing director of buildings for

China at Parsons Brinckerhoff, which is a consultant to the project. Hang Lung

Properties (SEHK: 0101) appointed Parsons Brinckerhoff as a consultant on its

mega shopping centre in Dalian, Liaoning, to help it qualify for gold-level

certification under the Leadership in Energy and Environmental Design (Leed)

scheme. The international benchmark for sustainable architecture is issued by

the US Green Building Council. A gold-level certification assures tenants and

property portfolio managers that the building uses resources more efficiently

when compared to conventional buildings and may also provide healthier work and

living environments, which contributes to higher productivity and improved

employee health and comfort. Olympia 66 would be equipped with ground-source

water heat pumps that extract and dissipate heat from the building into the

ground in summer and vice versa in winter, Tse said. "As Dalian is a port city,

temperatures often drop below zero in winter. Using ground-source water [heat

pumps] will help consume less energy," he said. The seven-storey, 221,900 square

metre Olympia 66 will be completed in 2015. Last week, Hang Lung announced that

its Palace 66, which opened on July 26 in Liaoning's Shenyang, had attained a

gold-level Leed Core and Shell Development Certification. It is the first

completed shopping centre on the mainland to have attained such certification.

The developer has embarked on a HK$40 billion plan to build seven shopping

centres outside Shanghai. That includes malls in Jinan, Shenyang, Tianjin and

Wuxi. In Shanghai, it owns Plaza 66, which was completed in 2001, and The Grand

Gateway, which was opened in 2005. To improve access to Olympia 66, the

developer is in talks with the city government to build an underground tunnel to

link the mall with the nearest station along the metro system, now under

construction. "We have made the suggestion to the city government and reserved

an exit for future use," said Chapman Lam, divisional director for transport

engineering at MVA Hong Kong. MVA is the transport consultant for Olympia 66.

Lam said the metro was due to open in 2013. "Without the tunnel, shoppers would

have to walk for several minutes on the ground level from the metro station to

Olympia 66. It would be an unpleasant walk in winter, even for a short distance,

as temperatures in Dalian are freezing." William Ko, executive director of Hang

Lung, said it was too early to estimate the volume of shopping traffic likely to

be attracted to Olympia 66. By way of example, he said, its 130,000 sqmetre The

Grand Gateway in Shanghai drew about 500,000 visitors last weekend.

Hang Lung plays 'green' card in shopping malls - Developer seeks certification

on energy features - A drum dance marks the groundbreaking ceremony for the

environmentally friendly Olympia 66 centre in Dalian, Liaoning, on Monday.

Building "green" features into new shopping centres on the mainland is becoming

standard practice for developers seeking a selling edge in the highly

competitive market, consultants say. Among the drawcards of such environmentally

sensitive projects is a big reduction in energy bills, achieved by using special

glazing that controls heat transfer through windows, as well as improved

insulation methods. "In dollar terms, we will achieve savings of about 10

million yuan (HK$11.57 million) on electricity bills at the Olympia 66

development in Dalian," said Vincent Tse, managing director of buildings for

China at Parsons Brinckerhoff, which is a consultant to the project. Hang Lung

Properties (SEHK: 0101) appointed Parsons Brinckerhoff as a consultant on its

mega shopping centre in Dalian, Liaoning, to help it qualify for gold-level

certification under the Leadership in Energy and Environmental Design (Leed)

scheme. The international benchmark for sustainable architecture is issued by

the US Green Building Council. A gold-level certification assures tenants and

property portfolio managers that the building uses resources more efficiently

when compared to conventional buildings and may also provide healthier work and

living environments, which contributes to higher productivity and improved

employee health and comfort. Olympia 66 would be equipped with ground-source

water heat pumps that extract and dissipate heat from the building into the

ground in summer and vice versa in winter, Tse said. "As Dalian is a port city,

temperatures often drop below zero in winter. Using ground-source water [heat

pumps] will help consume less energy," he said. The seven-storey, 221,900 square

metre Olympia 66 will be completed in 2015. Last week, Hang Lung announced that

its Palace 66, which opened on July 26 in Liaoning's Shenyang, had attained a

gold-level Leed Core and Shell Development Certification. It is the first

completed shopping centre on the mainland to have attained such certification.

The developer has embarked on a HK$40 billion plan to build seven shopping

centres outside Shanghai. That includes malls in Jinan, Shenyang, Tianjin and

Wuxi. In Shanghai, it owns Plaza 66, which was completed in 2001, and The Grand

Gateway, which was opened in 2005. To improve access to Olympia 66, the

developer is in talks with the city government to build an underground tunnel to

link the mall with the nearest station along the metro system, now under

construction. "We have made the suggestion to the city government and reserved

an exit for future use," said Chapman Lam, divisional director for transport

engineering at MVA Hong Kong. MVA is the transport consultant for Olympia 66.

Lam said the metro was due to open in 2013. "Without the tunnel, shoppers would

have to walk for several minutes on the ground level from the metro station to

Olympia 66. It would be an unpleasant walk in winter, even for a short distance,

as temperatures in Dalian are freezing." William Ko, executive director of Hang

Lung, said it was too early to estimate the volume of shopping traffic likely to

be attracted to Olympia 66. By way of example, he said, its 130,000 sqmetre The

Grand Gateway in Shanghai drew about 500,000 visitors last weekend.

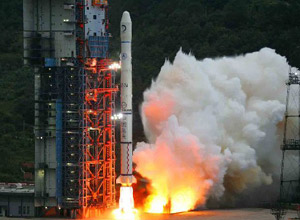

Photo taken on Sept. 29, 2010 shows the

exterior appearance of the Canton Tower in Guangzhou, south China's Guangdong

Province. The 600-meter-high Canton Tower began its business operations on

Wednesday. Photo taken on Sept. 29, 2010 shows the

exterior appearance of the Canton Tower in Guangzhou, south China's Guangdong

Province. The 600-meter-high Canton Tower began its business operations on

Wednesday.

A photomontage shows the

610-meter-high new Guangzhou TV Tower illuminated in Guangzhou, South China's

Guangdong province, Sept 19, 2010. The tower, officially called “Guangzhou

Tower”, with a 450-meter tower and a 160-meter mast, formally opened to the

tourists on Sept 29. A photomontage shows the

610-meter-high new Guangzhou TV Tower illuminated in Guangzhou, South China's

Guangdong province, Sept 19, 2010. The tower, officially called “Guangzhou

Tower”, with a 450-meter tower and a 160-meter mast, formally opened to the

tourists on Sept 29.

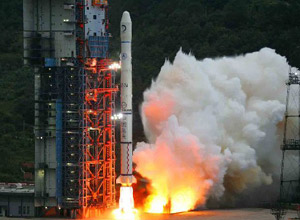

A staff member shows two

commemorative gold bars for Chang'e-2 lunar probe in Beijing, capital of China,

Sept. 28, 2010. A press conference for the commemorative gold bars for Chang'e-2

lunar probe was held here Tuesday. China is preparing for the launch of

Chang'e-2 lunar probe. A staff member shows two

commemorative gold bars for Chang'e-2 lunar probe in Beijing, capital of China,

Sept. 28, 2010. A press conference for the commemorative gold bars for Chang'e-2

lunar probe was held here Tuesday. China is preparing for the launch of

Chang'e-2 lunar probe.

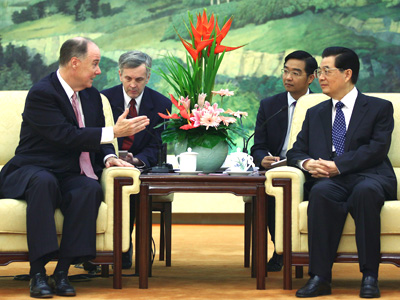

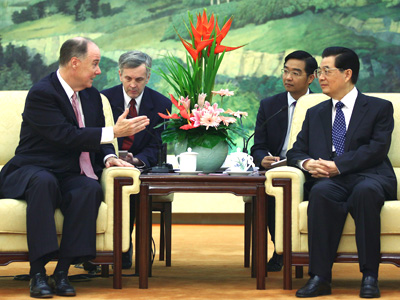

China's BYD shares up on talks on

Warren Buffett stake - American billionaire Warren Buffett waves as they receive

a gifts from Tibetan women at an event by Chinese carmaker BYD in Beijing on

Wednesday. Billionaire investor Warren Buffett has discussed the possibility of

raising his 10 per cent stake in car and battery maker BYD, a Chinese newspaper

reported on Wednesday, sending BYD shares up over 4 per cent. In the past week,

analysts and investors have speculated that Buffett, who is making a closely

watched tour of China with former Microsoft Chairman Bill Gates, might instead

sell down his stake after the automaker hit several bumps on the road. That

included sliding sales, delayed plans to export its electric cars and a legal

dispute with the Chinese government over land it wants to develop. “We wouldn’t

comment on what we are going to do,” Buffett said on the sidelines of an event

in Beijing when asked about the prospect of increasing his BYD stake. BYD shares

rose as much as 4.4 per cent in Hong Kong, outpacing the broader Hang Seng

Index’s 1.3 per cent rise. China Business News cited BYD sources as saying

Buffett had a closed-door meeting on Tuesday night with BYD officials in which

the possibility of increasing the 10 per cent stake in BYD held by Buffett’s

Berkshire Hathaway was the major topic. But it was unknown whether they had

reached any conclusion, the report added. “This is a good thing for BYD,” said

Zhang Jing, an analyst at Phillip Securities (HK) Ltd. “If Buffett raises his

stake at the current high price levels, that would be a vote of confidence, for

sure.” Gates and Buffett, the world’s second- and third-richest men,

respectively, have travelled to several Chinese cities this week, meeting with

Chinese businessmen and researchers, and will attend a dinner on Wednesday

evening during which the two will speak to some of China’s growing crop of rich

entrepreneurs about charity. Buffett, 80, is visiting China almost two years

after Berkshire’s affiliate MidAmerican Energy bought 10 per cent of BYD. That

investment has yielded enviable returns, with the stake now worth US$1.45

billion, over six times the original US$230 million purchase price. Still, that

value is far below the peak of US$2.5 billion reached last October. Buffett and

Gates were in Beijing on Wednesday to attend a BYD ceremony for the launch of

the company’s first premium multipurpose vehicle (MPV). The car, the M6, will

allow the car maker to tap the fast-growing premier MPV market, now dominated by

General Motors and Honda Motor. BYD’s portfolio now includes sedans only. BYD

shares have risen about 19 per cent in the past two weeks on Buffett’s visit.

The stock’s performance lags that of its main rivals, however. Earlier on

Wednesday, car maker Brilliance China (SEHK: 1114) hit a record of HK$5.52 on

expectations of higher car sales in the coming months, Geely rose nearly 4 per

cent and Dongfeng Motor Group (SEHK: 0489) surged nearly 7 per cent. “The stock

looks expensive but Coca-Cola also grew up from a small company,” said Zhang.

Shares of BYD, which stands for “Build Your Dreams”, are trading at around 25

times this year projected earnings. China's BYD shares up on talks on

Warren Buffett stake - American billionaire Warren Buffett waves as they receive

a gifts from Tibetan women at an event by Chinese carmaker BYD in Beijing on

Wednesday. Billionaire investor Warren Buffett has discussed the possibility of

raising his 10 per cent stake in car and battery maker BYD, a Chinese newspaper

reported on Wednesday, sending BYD shares up over 4 per cent. In the past week,

analysts and investors have speculated that Buffett, who is making a closely

watched tour of China with former Microsoft Chairman Bill Gates, might instead

sell down his stake after the automaker hit several bumps on the road. That

included sliding sales, delayed plans to export its electric cars and a legal

dispute with the Chinese government over land it wants to develop. “We wouldn’t

comment on what we are going to do,” Buffett said on the sidelines of an event

in Beijing when asked about the prospect of increasing his BYD stake. BYD shares

rose as much as 4.4 per cent in Hong Kong, outpacing the broader Hang Seng

Index’s 1.3 per cent rise. China Business News cited BYD sources as saying

Buffett had a closed-door meeting on Tuesday night with BYD officials in which

the possibility of increasing the 10 per cent stake in BYD held by Buffett’s

Berkshire Hathaway was the major topic. But it was unknown whether they had

reached any conclusion, the report added. “This is a good thing for BYD,” said

Zhang Jing, an analyst at Phillip Securities (HK) Ltd. “If Buffett raises his

stake at the current high price levels, that would be a vote of confidence, for

sure.” Gates and Buffett, the world’s second- and third-richest men,

respectively, have travelled to several Chinese cities this week, meeting with

Chinese businessmen and researchers, and will attend a dinner on Wednesday

evening during which the two will speak to some of China’s growing crop of rich

entrepreneurs about charity. Buffett, 80, is visiting China almost two years

after Berkshire’s affiliate MidAmerican Energy bought 10 per cent of BYD. That

investment has yielded enviable returns, with the stake now worth US$1.45

billion, over six times the original US$230 million purchase price. Still, that

value is far below the peak of US$2.5 billion reached last October. Buffett and

Gates were in Beijing on Wednesday to attend a BYD ceremony for the launch of

the company’s first premium multipurpose vehicle (MPV). The car, the M6, will

allow the car maker to tap the fast-growing premier MPV market, now dominated by

General Motors and Honda Motor. BYD’s portfolio now includes sedans only. BYD

shares have risen about 19 per cent in the past two weeks on Buffett’s visit.

The stock’s performance lags that of its main rivals, however. Earlier on

Wednesday, car maker Brilliance China (SEHK: 1114) hit a record of HK$5.52 on

expectations of higher car sales in the coming months, Geely rose nearly 4 per

cent and Dongfeng Motor Group (SEHK: 0489) surged nearly 7 per cent. “The stock

looks expensive but Coca-Cola also grew up from a small company,” said Zhang.

Shares of BYD, which stands for “Build Your Dreams”, are trading at around 25

times this year projected earnings.

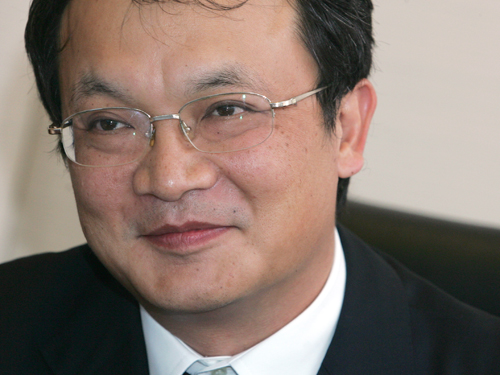

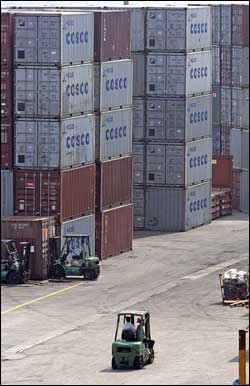

China Telecom (SEHK: 0728) is stepping

up its expansion across Asia, ahead of its two bigger mainland rivals, with a

slate of new infrastructure investments in Hong Kong and Singapore. Deng

Xiaofeng looks to growth in data centres. China Telecom (SEHK: 0728) is stepping

up its expansion across Asia, ahead of its two bigger mainland rivals, with a

slate of new infrastructure investments in Hong Kong and Singapore. The

country's leading fixed-line network operator has made an initial investment

worth HK$200 million to build two new internet data centres in the two cities,

and link these to its existing network of 260 data centres across the mainland,

according to Deng Xiaofeng, chairman and chief executive of subsidiary China

Telecom (Hong Kong) International. Data centres are specialised facilities,

where operators house large enterprises' server computers and storage systems,

with dedicated power, cooling, security, technical support and high-speed

internet connections. "With the current growth in e-commerce, China Telecom is

committed to connecting Chinese enterprises to the world and supporting

multinational corporations develop their business in the Asia-Pacific region,

especially in China," Deng said. Its target customers include enterprises in the

banking and financial services, transport and logistics, internet and media

sectors. According to research firm Frost & Sullivan, total revenue from the

data centre co-location and managed hosting services market in the Asia-Pacific

will amount to US$9.18 billion this year and reach US$10.68 billion next year.

Leading data centre hubs in the region are Japan, Australia, Singapore, Hong

Kong and, to a lesser degree, mainland China, India and Malaysia. The largest of

these hubs, Japan, accounted for more than 71 per cent of the estimated US$8

billion in data centre services revenue in the region last year. The internet,

media, telecommunications and information technology industries together account

for up to 45 per cent of data centre services demand in the Asia-Pacific. These

sectors are expected to continue to be the biggest users of data centre space

over the next four to five years. Demand for data centre hosting currently

exceeds supply, according to Frost & Sullivan. "In fact, over 80 per cent of the

major data centres in the Asia-Pacific are running at close to 90 per cent

capacity and space is at a premium," it said. Amid the growing regional

opportunity, Deng said China Telecom "will increase investments in designing and

building data centres". He said there could be further expansion first in Hong

Kong and Singapore, before China Telecom decides to invest in new data centres

in other Asian countries. China Telecom has set up a 27,000 square foot data

centre in Chai Wan, at premises run by iAdvantage, a unit under Sun Hung Kai

Properties (SEHK: 0016)' technology arm SUNeVision. In Singapore, the carrier

has established a 3,500 square foot operation inside a facility run by data

centre partner Equinix. Following the 2008 telecommunications industry

restructuring on the mainland, China Telecom, China Mobile (SEHK: 0941) and

China Unicom (SEHK: 0762) are all to become integrated fixed-line and wireless

network operators. Deng said China Mobile and China Unicom are also keen to

expand their services outside the mainland, but China Telecom has been well

ahead in developing its business across Asia. China Telecom (SEHK: 0728) is stepping

up its expansion across Asia, ahead of its two bigger mainland rivals, with a

slate of new infrastructure investments in Hong Kong and Singapore. Deng

Xiaofeng looks to growth in data centres. China Telecom (SEHK: 0728) is stepping

up its expansion across Asia, ahead of its two bigger mainland rivals, with a

slate of new infrastructure investments in Hong Kong and Singapore. The

country's leading fixed-line network operator has made an initial investment

worth HK$200 million to build two new internet data centres in the two cities,

and link these to its existing network of 260 data centres across the mainland,

according to Deng Xiaofeng, chairman and chief executive of subsidiary China

Telecom (Hong Kong) International. Data centres are specialised facilities,

where operators house large enterprises' server computers and storage systems,

with dedicated power, cooling, security, technical support and high-speed

internet connections. "With the current growth in e-commerce, China Telecom is

committed to connecting Chinese enterprises to the world and supporting

multinational corporations develop their business in the Asia-Pacific region,

especially in China," Deng said. Its target customers include enterprises in the

banking and financial services, transport and logistics, internet and media

sectors. According to research firm Frost & Sullivan, total revenue from the

data centre co-location and managed hosting services market in the Asia-Pacific

will amount to US$9.18 billion this year and reach US$10.68 billion next year.

Leading data centre hubs in the region are Japan, Australia, Singapore, Hong

Kong and, to a lesser degree, mainland China, India and Malaysia. The largest of

these hubs, Japan, accounted for more than 71 per cent of the estimated US$8

billion in data centre services revenue in the region last year. The internet,

media, telecommunications and information technology industries together account

for up to 45 per cent of data centre services demand in the Asia-Pacific. These

sectors are expected to continue to be the biggest users of data centre space

over the next four to five years. Demand for data centre hosting currently

exceeds supply, according to Frost & Sullivan. "In fact, over 80 per cent of the

major data centres in the Asia-Pacific are running at close to 90 per cent

capacity and space is at a premium," it said. Amid the growing regional

opportunity, Deng said China Telecom "will increase investments in designing and

building data centres". He said there could be further expansion first in Hong

Kong and Singapore, before China Telecom decides to invest in new data centres

in other Asian countries. China Telecom has set up a 27,000 square foot data

centre in Chai Wan, at premises run by iAdvantage, a unit under Sun Hung Kai

Properties (SEHK: 0016)' technology arm SUNeVision. In Singapore, the carrier

has established a 3,500 square foot operation inside a facility run by data

centre partner Equinix. Following the 2008 telecommunications industry

restructuring on the mainland, China Telecom, China Mobile (SEHK: 0941) and

China Unicom (SEHK: 0762) are all to become integrated fixed-line and wireless

network operators. Deng said China Mobile and China Unicom are also keen to

expand their services outside the mainland, but China Telecom has been well

ahead in developing its business across Asia.

China has decided to suspend bank

loan for third home buyers as the government rolled out further measures to

check soaring property prices, saying officials will be held responsible if they

fail to implement the policies.

Japan Foreign Minister

Seiji Maehara said Wednesday that China had revealed its "essential character"

to the world in a bitter territorial dispute with Tokyo. Maehara said: “The

escalated action China has taken... is quite regrettable”, referring to the

dispute, which started with Japan’s arrest of a fishing boat captain in disputed

waters on September 8. A Japanese coastguard vessel and a Chinese fisheries

patrol ship sail side by side in the waters near disputed Senkaku or Daioyu

Islands in southern Japan. “I think not only the Japanese, but people in the

whole world saw a part of China’s essential character,” the recently appointed

foreign minister told a small group of reporters, without elaborating. Since the

spat started, Beijing has issued diplomatic protests and snubs but also taken

economic steps, such as slowing trade and tourism and, according to industry

sources, the exports of crucial rare earth metals. “It is harmful to the world

that the world’s second- and third-largest economies are clawing at each other’s

throats as economic activity contracts,” said Maehara, who took his post less

than two weeks ago. “It’s important that the two countries build a win-win

situation while considering the mutual benefits in a cool-headed way,” he said.

“Over the long term, I’m optimistic, although I don’t know how much time it will

take” to restore ties, added Maehara, a China hawk who has also warned about the

level of China’s defence spending. Maehara reiterated that the disputed islets –

called Senkaku in Japan and Diaoyu in China – “are Japan’s own territory”. To

back up his point, he referred to a 1953 article by China’s state-run People’s

Daily that said Japan’s Okinawa islands “include the Senkaku islands” and an

official map of China from 1960 that excluded the islands. Amid the spat between

the Asian giants, their worst in years, and before Japan released the skipper

last week, China detained four Japanese nationals, accusing them of illegally

filming a military facility. Maehara repeated Japan’s position that the arrests

are unrelated to the wider row, but added: “What I am most interested in is

about the situation of the four Japanese.” He said that Japanese diplomats were

due to hold their second meeting with them later in the day. Japan Foreign Minister

Seiji Maehara said Wednesday that China had revealed its "essential character"

to the world in a bitter territorial dispute with Tokyo. Maehara said: “The

escalated action China has taken... is quite regrettable”, referring to the

dispute, which started with Japan’s arrest of a fishing boat captain in disputed

waters on September 8. A Japanese coastguard vessel and a Chinese fisheries

patrol ship sail side by side in the waters near disputed Senkaku or Daioyu

Islands in southern Japan. “I think not only the Japanese, but people in the

whole world saw a part of China’s essential character,” the recently appointed

foreign minister told a small group of reporters, without elaborating. Since the

spat started, Beijing has issued diplomatic protests and snubs but also taken

economic steps, such as slowing trade and tourism and, according to industry

sources, the exports of crucial rare earth metals. “It is harmful to the world

that the world’s second- and third-largest economies are clawing at each other’s

throats as economic activity contracts,” said Maehara, who took his post less

than two weeks ago. “It’s important that the two countries build a win-win

situation while considering the mutual benefits in a cool-headed way,” he said.

“Over the long term, I’m optimistic, although I don’t know how much time it will

take” to restore ties, added Maehara, a China hawk who has also warned about the

level of China’s defence spending. Maehara reiterated that the disputed islets –

called Senkaku in Japan and Diaoyu in China – “are Japan’s own territory”. To

back up his point, he referred to a 1953 article by China’s state-run People’s

Daily that said Japan’s Okinawa islands “include the Senkaku islands” and an

official map of China from 1960 that excluded the islands. Amid the spat between

the Asian giants, their worst in years, and before Japan released the skipper

last week, China detained four Japanese nationals, accusing them of illegally

filming a military facility. Maehara repeated Japan’s position that the arrests

are unrelated to the wider row, but added: “What I am most interested in is

about the situation of the four Japanese.” He said that Japanese diplomats were

due to hold their second meeting with them later in the day.

China has ended a de facto ban on

exports to Japan of rare earth minerals, a Japanese trading firm source said on

Wednesday, easing concerns about fallout from an ongoing feud.

More than 200,000 Apple iPhone 4s have

been snapped up in China within days of going on sale while waiting lists

stretch to the end of October, state media reported on Wednesday. More than 200,000 Apple iPhone 4s have

been snapped up in China within days of going on sale while waiting lists

stretch to the end of October, state media reported on Wednesday.

Sept 30, 2010

Hong Kong*:

The Executive Council yesterday approved a medical insurance scheme that will

bring fundamental change to private and public health care. Hong Kong*:

The Executive Council yesterday approved a medical insurance scheme that will

bring fundamental change to private and public health care.

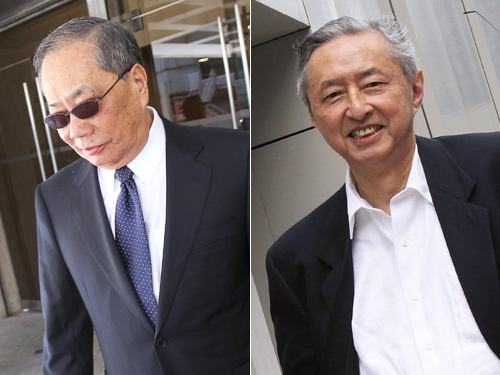

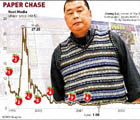

Wong fails to win back control of Gome board - Retailer's shareholders reject

removal of chairman, director - A video image of Gome chairman Chen Xiao

addressing shareholders yesterday. The resolution to remove Chen was rejected by

51.89 per cent of shareholders. Jailed billionaire Wong Kwong-yu's bid to regain

management control of Gome Electrical Appliances Holding (SEHK: 0493) failed

yesterday, with shareholders rejecting a bid to sack the company's chairman and

install Wong's sister. Wong's attempt to remove Chen Xiao as well as another

director and replace them with his sister Huang Yanhong and lawyer Zou Xiaochun

were voted down by shareholders of the nation's second-largest electrical

appliance retailer. The failure by Wong to get his nominees on the board is seen

as a victory for US private equity fund Bain Capital, the second-largest

shareholder of the company, which supported the board. The resolution to remove

Chen was rejected by 51.89 per cent of shareholders in a Hong Kong meeting. The

move further shores up Bain's presence in the company, in which it now holds a

stake of nearly 10 per cent, but has raised concerns on the mainland about

foreign influence over one of the country's top retail brands. Wong did not lose

all the battle. A general mandate that would have allowed the current board to

issue new shares without shareholder approval was voted down. Issuing new shares

would dilute Wong's 32.5 per cent stake in Gome and threaten his position as the

company's largest shareholder. More than 100 investors attended the meeting in a

Causeway Bay hotel, while others cast their votes by proxy. Votes representing

1.6 billion shares or 81 per cent of the total shareholdings were cast.

Shareholders rejected Wong's proposal to remove Chen and executive director Sun

Yiding as executive directors from the board and supported the re-election of

the three representatives of Bain Capital as non-executive directors. Wong's

family issued a statement saying it was disappointed to lose the fight over the

directors. "We remain resolute in our belief that without the contributions of

the founding shareholders [the Wong family], the company has strayed from the

path of profitable growth," the family said. "Nothing has changed about our

concerns regarding the unrepresentative nature of the board, and we reserve all

our rights to take appropriate action to protect our interest and those of other

shareholders." Gome's board said the result was "a clear endorsement of the

management's track record over the past two years" and trust in the ability of

the management. It said stability was in the best interest of all shareholders

and it would maintain dialogue with all shareholders including Wong.

Wong fails to win back control of Gome board - Retailer's shareholders reject

removal of chairman, director - A video image of Gome chairman Chen Xiao

addressing shareholders yesterday. The resolution to remove Chen was rejected by

51.89 per cent of shareholders. Jailed billionaire Wong Kwong-yu's bid to regain

management control of Gome Electrical Appliances Holding (SEHK: 0493) failed

yesterday, with shareholders rejecting a bid to sack the company's chairman and

install Wong's sister. Wong's attempt to remove Chen Xiao as well as another

director and replace them with his sister Huang Yanhong and lawyer Zou Xiaochun

were voted down by shareholders of the nation's second-largest electrical

appliance retailer. The failure by Wong to get his nominees on the board is seen

as a victory for US private equity fund Bain Capital, the second-largest

shareholder of the company, which supported the board. The resolution to remove

Chen was rejected by 51.89 per cent of shareholders in a Hong Kong meeting. The

move further shores up Bain's presence in the company, in which it now holds a

stake of nearly 10 per cent, but has raised concerns on the mainland about

foreign influence over one of the country's top retail brands. Wong did not lose

all the battle. A general mandate that would have allowed the current board to

issue new shares without shareholder approval was voted down. Issuing new shares

would dilute Wong's 32.5 per cent stake in Gome and threaten his position as the

company's largest shareholder. More than 100 investors attended the meeting in a

Causeway Bay hotel, while others cast their votes by proxy. Votes representing

1.6 billion shares or 81 per cent of the total shareholdings were cast.

Shareholders rejected Wong's proposal to remove Chen and executive director Sun

Yiding as executive directors from the board and supported the re-election of

the three representatives of Bain Capital as non-executive directors. Wong's

family issued a statement saying it was disappointed to lose the fight over the

directors. "We remain resolute in our belief that without the contributions of

the founding shareholders [the Wong family], the company has strayed from the

path of profitable growth," the family said. "Nothing has changed about our

concerns regarding the unrepresentative nature of the board, and we reserve all

our rights to take appropriate action to protect our interest and those of other

shareholders." Gome's board said the result was "a clear endorsement of the

management's track record over the past two years" and trust in the ability of

the management. It said stability was in the best interest of all shareholders

and it would maintain dialogue with all shareholders including Wong.

Hong Kong's MTR Mass Transit

Construction blasting is so quiet tai chi classes can go on - Construction of

the new shaft at Sai Ying Pun MTR station. A new technique using water to dampen

the impact of underground blasting for a new MTR station has ensured people

exercising and practising tai chi up above every morning in King George V

Memorial Park, in Sai Ying Pun, on Hong Kong Island, have been left - literally

- unmoved. Every week since last August, the MTR has carried out two or three

underground explosions - as part of plans to blast about 400 small holes

alongside the park to help build a shaft for the new Sai Ying Pun station. Yet

Walter Lam Wai-tak, MTR senior construction engineer for West Island Line, said

the new technique of using water - instead of old tyres and sand - to absorb and

cushion the effect of vibrations and dust had proved so successful that people

up above in the park had been hardly able to feel the impact of the blast. "We

put a glass of water on the ground the other day during the blasting; we thought

there might be some ripples, but there was none," Lam said. "The best thing

about using water is that, except for noise, it greatly reduces dust and dirt,

which mix in the water for easy discharge." He said the new blast-dampening

method cost about the same as old methods. But blasting, which would finish next

month, took 2-1/2 hours to fill the shaft with water, and 11 hours to pump out

the water afterwards. Reuben Chu Pui-kwan, president of the Hong Kong

Institution of Engineers, said: "Contractors are struggling to come up with

environmentally-friendly construction methods when they bid for the contracts;

they can't cost too expensive either; the market is now very price-sensitive." Hong Kong's MTR Mass Transit

Construction blasting is so quiet tai chi classes can go on - Construction of

the new shaft at Sai Ying Pun MTR station. A new technique using water to dampen

the impact of underground blasting for a new MTR station has ensured people

exercising and practising tai chi up above every morning in King George V

Memorial Park, in Sai Ying Pun, on Hong Kong Island, have been left - literally

- unmoved. Every week since last August, the MTR has carried out two or three

underground explosions - as part of plans to blast about 400 small holes

alongside the park to help build a shaft for the new Sai Ying Pun station. Yet

Walter Lam Wai-tak, MTR senior construction engineer for West Island Line, said

the new technique of using water - instead of old tyres and sand - to absorb and

cushion the effect of vibrations and dust had proved so successful that people

up above in the park had been hardly able to feel the impact of the blast. "We

put a glass of water on the ground the other day during the blasting; we thought

there might be some ripples, but there was none," Lam said. "The best thing

about using water is that, except for noise, it greatly reduces dust and dirt,

which mix in the water for easy discharge." He said the new blast-dampening

method cost about the same as old methods. But blasting, which would finish next

month, took 2-1/2 hours to fill the shaft with water, and 11 hours to pump out

the water afterwards. Reuben Chu Pui-kwan, president of the Hong Kong

Institution of Engineers, said: "Contractors are struggling to come up with

environmentally-friendly construction methods when they bid for the contracts;

they can't cost too expensive either; the market is now very price-sensitive."

Mercedes enjoys 67pc rise in

sales as demand for luxury cars returns in Hong Kong - Michael Lee, the chief

executive of Zung Fu, and Claus Weidner officiate at a ceremony yesterday to

launch a promotion program. Mercedes-Benz is riding the post-financial crisis

rebound in demand for luxury cars in Hong Kong and Macau, with sales up 67 per

cent in the first eight months to almost 3,000 units. "When the crisis hit, the

competition became quite tough, resulting in a situation where everybody was

focused on price," Mercedes-Benz Hong Kong chief operating officer Claus Weidner

said yesterday. "Now we're seeing a good development, where people are focusing

again on quality and related factors," he said. Mercedes-Benz Hong Kong, a unit

of Daimler established in 2006, is the exclusive importer and wholesaler of the

luxury cars to the local market, while Jardine Matheson's Zung Fu is the sole

authorised retail dealer for the brand. Hongkongers' renewed appetite for

top-end cars is good news for Mercedes, whose best-selling E-class vehicles

retail locally from HK$465,000 to HK$1.48 million. The German marque's most

expensive model, the CL65 AMG, touts a 12-cylinder engine and sells for HK$3.75

million. Mercedes' market share in Hong Kong and Macau is around 13 per cent in

the year to date, according to sales figures provided by the company. Weidner

said local sales of luxury car brands like Mercedes weathered the crisis better

than "volume" brands, which have likewise benefited strongly in this year's

rebound. New car registrations in Hong Kong rose to 22,359 units in the first

seven months of the year, up 65 per cent on a year ago, Transport Department

data show. By value, sales of cars and car parts rose 57 per cent to HK$7.95

billion between January and July, up from HK$5.07 billion a year ago, Census and

Statistics Department figures show. Hong Kong and Macau remain small but rich

markets for luxury carmakers, where they enjoy much higher penetration rates

than most regions. But the bigger growth opportunities are on the mainland.

Mercedes has been manufacturing selected models locally in China for five years,

via a 50-50 joint venture between Daimler and Beijing Automotive Industry Corp.

But imports still account for the majority of the German brand's mainland sales.

Mercedes-Benz sold 87,400 units on the mainland in the first eight months of the

year, up 131 per cent from the same period a year earlier. However, unlike in

Hong Kong, the brand's market share stood at less than 1 per cent. The majority

of passenger car sales on the mainland are those with engines smaller than 1.6

litres. Mercedes enjoys 67pc rise in

sales as demand for luxury cars returns in Hong Kong - Michael Lee, the chief

executive of Zung Fu, and Claus Weidner officiate at a ceremony yesterday to

launch a promotion program. Mercedes-Benz is riding the post-financial crisis

rebound in demand for luxury cars in Hong Kong and Macau, with sales up 67 per

cent in the first eight months to almost 3,000 units. "When the crisis hit, the

competition became quite tough, resulting in a situation where everybody was

focused on price," Mercedes-Benz Hong Kong chief operating officer Claus Weidner

said yesterday. "Now we're seeing a good development, where people are focusing

again on quality and related factors," he said. Mercedes-Benz Hong Kong, a unit

of Daimler established in 2006, is the exclusive importer and wholesaler of the

luxury cars to the local market, while Jardine Matheson's Zung Fu is the sole

authorised retail dealer for the brand. Hongkongers' renewed appetite for

top-end cars is good news for Mercedes, whose best-selling E-class vehicles

retail locally from HK$465,000 to HK$1.48 million. The German marque's most

expensive model, the CL65 AMG, touts a 12-cylinder engine and sells for HK$3.75

million. Mercedes' market share in Hong Kong and Macau is around 13 per cent in

the year to date, according to sales figures provided by the company. Weidner

said local sales of luxury car brands like Mercedes weathered the crisis better

than "volume" brands, which have likewise benefited strongly in this year's

rebound. New car registrations in Hong Kong rose to 22,359 units in the first

seven months of the year, up 65 per cent on a year ago, Transport Department

data show. By value, sales of cars and car parts rose 57 per cent to HK$7.95

billion between January and July, up from HK$5.07 billion a year ago, Census and

Statistics Department figures show. Hong Kong and Macau remain small but rich

markets for luxury carmakers, where they enjoy much higher penetration rates

than most regions. But the bigger growth opportunities are on the mainland.

Mercedes has been manufacturing selected models locally in China for five years,

via a 50-50 joint venture between Daimler and Beijing Automotive Industry Corp.

But imports still account for the majority of the German brand's mainland sales.

Mercedes-Benz sold 87,400 units on the mainland in the first eight months of the

year, up 131 per cent from the same period a year earlier. However, unlike in

Hong Kong, the brand's market share stood at less than 1 per cent. The majority

of passenger car sales on the mainland are those with engines smaller than 1.6

litres.

Shares in Television Broadcasts (SEHK:

0511) saw their biggest drop in 17 months yesterday as investors digested news

that 102-year-old Sir Run Run Shaw would sell his stake in the broadcaster he

co-founded more than 40 years ago. Shares in the city's biggest free-to-air

broadcaster dived as much as 11.8 per cent before closing with a loss of 5.8 per

cent at HK$43.80 on concern about the company's future after Shaw. The stock

surged 16.8 per cent before its suspension on Monday on speculation Henderson

Land Development (SEHK: 0012) vice-chairman Peter Lee Ka-kit, the elder son of

billionaire founder Lee Shau-kee, was planning to buy the stake. Shanghai Media

Group (SMG), the mainland's second-largest media company, is also reportedly

eyeing the broadcaster, partly because of TVB's lucrative production of Chinese

television programmes. The broadcaster has confirmed that Shaw Holdings, owned

by the family of Shaw, is in talks regarding a possible sale of shares. Peter

Lee had earlier confirmed he was studying a plan to buy a stake in TVB. TVB, one

of the world's biggest distributors of Chinese-language television programmes,

has operations in more than 30 countries. Its Taiwan branch, TVBS, saw revenue

of HK$347 million in the first half of this year, an increase of 16 per cent

from a year earlier. For SMG, acquiring a controlling stake in TVB would give it

access to the Taiwan market. Following the signing of the economic co-operation

framework agreement between Taiwan and the mainland, there has been speculation

the mainland will attempt to acquire media companies on the island. Shaw gave up

his executive duties last year to become the non-executive chairman. He is the

biggest shareholder in TVB with a 32.5 per cent stake, comprising shares held

personally and the 26 per cent holding owned by Shaw Brothers (Hong Kong). Two

years ago, Lee Shau-kee offered HK$3 billion to support Yeung Kwok-keung, the

chairman of Country Garden Holdings, in an acquisition of Shaw Brothers. The

plan was scuttled by the global financial crisis. Lee said to the press then:

"Shaw will sell the stake in TVB sooner or later. That's for sure." Peter Lee

might pay up to HK$9.2 billion to acquire the 26 per cent shareholding of Shaw

Brothers, according to reports. SMG is said to have made an offer of up to HK$10

billion to TVB managing director and wife of Shaw, Mona Fong Yat-wah, who is in

charge of the broadcaster's day-to-day operations. Rita Lau Ng Wai-lan, the

secretary for commerce and economic development, said under the regulations, any

transfer of shares should be submitted to the Broadcasting Authority within 14

days. Earlier this year, the government lifted the ban on the number of free

television programme service licences. There are now only two free-to-air

broadcasters in the city, TVB and Asia Television. Shares in Television Broadcasts (SEHK:

0511) saw their biggest drop in 17 months yesterday as investors digested news

that 102-year-old Sir Run Run Shaw would sell his stake in the broadcaster he

co-founded more than 40 years ago. Shares in the city's biggest free-to-air

broadcaster dived as much as 11.8 per cent before closing with a loss of 5.8 per

cent at HK$43.80 on concern about the company's future after Shaw. The stock

surged 16.8 per cent before its suspension on Monday on speculation Henderson

Land Development (SEHK: 0012) vice-chairman Peter Lee Ka-kit, the elder son of

billionaire founder Lee Shau-kee, was planning to buy the stake. Shanghai Media

Group (SMG), the mainland's second-largest media company, is also reportedly

eyeing the broadcaster, partly because of TVB's lucrative production of Chinese

television programmes. The broadcaster has confirmed that Shaw Holdings, owned

by the family of Shaw, is in talks regarding a possible sale of shares. Peter

Lee had earlier confirmed he was studying a plan to buy a stake in TVB. TVB, one

of the world's biggest distributors of Chinese-language television programmes,

has operations in more than 30 countries. Its Taiwan branch, TVBS, saw revenue

of HK$347 million in the first half of this year, an increase of 16 per cent

from a year earlier. For SMG, acquiring a controlling stake in TVB would give it

access to the Taiwan market. Following the signing of the economic co-operation

framework agreement between Taiwan and the mainland, there has been speculation

the mainland will attempt to acquire media companies on the island. Shaw gave up

his executive duties last year to become the non-executive chairman. He is the

biggest shareholder in TVB with a 32.5 per cent stake, comprising shares held

personally and the 26 per cent holding owned by Shaw Brothers (Hong Kong). Two

years ago, Lee Shau-kee offered HK$3 billion to support Yeung Kwok-keung, the

chairman of Country Garden Holdings, in an acquisition of Shaw Brothers. The

plan was scuttled by the global financial crisis. Lee said to the press then:

"Shaw will sell the stake in TVB sooner or later. That's for sure." Peter Lee

might pay up to HK$9.2 billion to acquire the 26 per cent shareholding of Shaw

Brothers, according to reports. SMG is said to have made an offer of up to HK$10

billion to TVB managing director and wife of Shaw, Mona Fong Yat-wah, who is in

charge of the broadcaster's day-to-day operations. Rita Lau Ng Wai-lan, the

secretary for commerce and economic development, said under the regulations, any

transfer of shares should be submitted to the Broadcasting Authority within 14

days. Earlier this year, the government lifted the ban on the number of free

television programme service licences. There are now only two free-to-air

broadcasters in the city, TVB and Asia Television.

Government-subsidised housing may be

revived by redeveloping old public estates now under the management of the

Housing Society, Eva Cheng said yesterday.