|

Newsletter

Seminar Material

Biz:

China

Hong

Kong Hawaii

What people

said about us

China

Earthquake Relief

Tax &

Government

Hawaii Voter Registration

Biz-Video

Biz-Video

Hawaii's

China Connection Hawaii's

China Connection

CDP#1780962

CDP#1780962

Doing Business in

Hong Kong & China

Doing Business in

Hong Kong & China

| |

Bauhinia News© &

Newsletter©

Bauhinia News© Share

For Current Information,

Please Visit our EVENT,

HK & CHINA BIZ

and PHOTO ALBUM

PAGES

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our event page to find out more!

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our event page to find out more!

After

attended a China/Hong Kong Business/Trade Seminar in Hawaii...still unsure what

to do next, contact us, our Officers, Directors and Founding Members are

actively engaged in China/Hong Kong/Asia trade - we can help!

Share Are you ready to export your product or

service? You will find out in 3 minutes with resources to help you -

enter

to give it a try

May 25 2011

Selling Strategic Marketing

Eddie Choi is a firm believer in the power of social media. The Managing Director of Frontiers Digital Agency and four partners moved their boutique digital-strategy agency from the United Kingdom to Hong Kong three years ago to tap the booming online consumer market on the Chinese mainland.

In 2009, the Hong Kong-based agency expanded into the mainland, where Mr Choi said the number of online users is growing exponentially. China’s Internet penetration rate ranks fourth in the world, and is expected to reach 50 per cent by 2014. In Six Questions, Eddie Choi talks about the impact of social media on online marketing.

Tell us about your company.

Frontiers Digital Agency is a boutique digital strategy agency, offering marketing and advertising services to primary and multinational companies on the Chinese mainland, including such companies as Michelin and Make Up For Ever. Working with online media, we do media planning. Most of the work we do is strategy work.

Unlike traditional advertising agencies, which do more media buying, we provide pre-media-buying services, including coming up with a plan and strategies that tell clients why they need to buy that media. So there is a difference between a strategy agency like us and a media agency. We plan, investigate and research to help our clients decide whether to buy the media advertising.

Where did your company get its start?

We started as a United Kingdom-based agency, but moved to Hong Kong in 2008. I have four UK partners. One is former Myspace Managing Director of UK & Europe David Fischer. Another, Luke Townsend, was former Head of Agency Sales at AOL UK. I had done a lot of B2B work, and my background is in search marketing, mainly in Hong Kong, but also elsewhere in Asia.

We came together with our accumulated experience to start this business because we didn’t see a lot of strategy work being done in Hong Kong, where not many companies provide international online marketing services.

The Hong Kong market is so small that if you were to count the number of online media, you would find that there are no more than 10. So we started our first Asian office in Hong Kong in 2008 and expanded into the mainland in 2009 because of the market shift. We have a lot more media and resources plans for our clients there, and strategy work only works in places where you have a lot of resources.

What’s the latest development in online marketing on the mainland?

China has become the biggest market, with more opportunities, more budget and more media compared to Hong Kong. But the Internet is only partially open. The first decision we made was to have a fully local team, because everything was different when we went to the mainland. People are not on Facebook; they have their own version of Facebook. Online behaviour on the mainland is totally different, the demographic is different, even the search engine is different.

But everyone is into social media and it’s a natural behaviour. In China, you can find more people are staying with social media rather than search engines. Of course, search engines are still more commonly used, particularly for those in the B2B business. You rely on search engines for business information. If you are in B2C, you do a lot of product search.

In China, there are three major components in online marketing: search engines, social media and online shopping. The three platforms are connected. A typical cycle goes like this: people search online for a shopping site. They then shop on the site and share their shopping experience through social media. If you are planning online marketing strategy on Google search, you should know that it will end up having something to do with social media.

Why is social media such an important component of e-business on the mainland?

Social media connects people in different parts of China. Unlike Hong Kong, where you can see your friends every day, on the mainland the situation is a little bit like in the United States, where the population is dispersed.

The information circulation within a friend group is powerful because it involves trust. You can do even more powerful word-of-mouth marketing on social media because it involves trust. I call social media marketing “second-opinion” marketing.

For example, when you need to make an important (buying) decision, which information will you believe? Are you going to believe the first-hand information from a sales brochure? You will take that information and verify it with your friends for a second opinion. So that second opinion becomes important and circulates among people on social media. People rely on social media for information that they can trust or verify. That’s what makes social media so powerful in China.

What is the main difference between China and Hong Kong’s online shopping behaviour?

Online commerce will grow bigger because of market demand. Hong Kong people remain sceptical about paying or shopping online, but online marketing is more acceptable on the mainland. I believe Chinese consumers are more open to advertising, which they see as trustworthy information. But in Hong Kong, advertising is advertising, which they don’t trust 100 per cent.

Geographically, Hong Kong also is very small. People can shop at physical stores and see products for themselves. But in third- or fourth-tier mainland cities, people rely on a campaign picture or a website to shop for what they want. Also, the logistics development, shipping and customer service are improving. In future, when people continue spending money online, they will become more cautious and will want more information to justify their spending.

Why did you choose to base your business in Hong Kong when the majority of services you provide are on the mainland?

Hong Kong is a good place to build a company with good management. We have better information flow from the East and West. It’s a unique location, where we can get and process information freely. I’ve worked in the United States, but I couldn’t get much information about China there. Second, is Hong Kong’s proximity to the mainland. Third, Hong Kong still has free trade. That’s why we decided to position the company here, where all the resources are within reach.

May 12 2011

The Move Inland

Enterprises in the garment industry have indicated plans to set up new production bases in the next three years Enterprises in the garment industry have indicated plans to set up new production bases in the next three years

The shortage of mainland migrant workers hit the headlines after the Lunar New Year, with reports describing the problem as even more acute this year. Shanghai reportedly dispatched hundreds of buses to bring workers back from provinces that were large sources of migrant workers. Preliminary estimates suggested that Guangdong Province alone would be short one million workers after the New Year.

To all manufacturers operating in the Pearl River Delta (PRD), labour shortages are a chronic problem, and raising wages to retain workers is often deemed inevitable. The PRD’s labour shortages are attributed to structural changes in society and the economy. Given the changing structure of the region’s population, the number of people joining the workforce overall has dropped. By contrast, job opportunities in the central and western regions are surging, prompting more migrant workers to find jobs in places nearer their hometown.

Cost Advantages

The labor issue is only one of many changes in the coastal investment environment. Other factors, including local industrial and land policies, are also putting pressure on manufacturers.

Given this changing business environment, most Hong Kong manufacturers are trying to upgrade their operations, improving production technology, raising product quality, launching new products or developing their own brands. Other companies are choosing to relocate part of their production lines to the inland regions that have more plentiful labour. Some large-scale major OEM enterprises, such as Taiwan-headquartered Foxconn and Inventec, have moved some of their production lines inland as far away as Chongqing.

With relatively lower land, water, electricity and labour costs, inland regions hold strong cost advantages. There is still a gap between some central and western regions and the coastal areas, in terms of average worker salaries. For instance, workers’ average wages in Jiangxi Province from January to September 2010 were only about 70 per cent of their counterparts’ in Guangdong Province.

Decentralising Production

Manufacturers generally don’t hold out much hope that the difficulty in recruiting workers can be overcome by moving inland. Yet, as more migrant workers seek jobs in their own neighbourhoods, some enterprises, particularly in such labour-intensive sectors as the garment industry, have begun to decentralise.

Certain cities in inland provinces have proven attractive to foreign investment Certain cities in inland provinces have proven attractive to foreign investment

Production processes are carried out at smaller production points located across regions with sufficient labour supply, instead of operating a large production base in the PRD or other locations. By doing so, manufacturers hope they can recruit more workers.

Choi Koon-shum, Chairman of the Chinese General Chamber of Commerce in Hong Kong, said that Hong Kong investors relocating their production facilities share a common trait: their operations are not relocated in one go.

Instead, most investors tend to move gradually, with some production processes relocated first. Mr Choi added that subsidiary factories may also be set up in other provinces, a process he described as “relocation with increased production activities.”

Enterprises adopting this strategy will retain the PRD as their main production base. Some of the high-tech processes and packaging activities, particularly for products where transport costs differ significantly before and after packaging, are carried out in the PRD. Low-tech processes are moved elsewhere, usually near Guangdong, where transport links are more convenient, minimising time and cost.

Likely Movers

A survey by the HKTDC revealed that, although there had not been a massive wave of relocations among Hong Kong companies with PRD production facilities, some were considering expanding production to other mainland regions.

Among companies with ongoing production activities in the PRD, 6.2 per cent said they planned to embark on new mainland production activities over the next three years. The PRD was their main choice of location, followed by areas in Guangdong Province (other than the PRD) and inland provinces near Guangdong.

Among sectors selected, a higher proportion of labour-intensive industries plans to start new production activities in other regions. The garment industry is one example, with 14.3 per cent of surveyed enterprises indicating a plan to establish new production bases over the next three years.

Among them, more than 30 per cent would choose a location in Guangdong other than the PRD or in such neighbouring provinces as Jiangxi and Hunan.

In the electronics industry, which has higher technology content, only 5.7 per cent of respondents said they planned to establish new production bases over the next three years. Textiles and printing and packaging are two other industries where a relatively higher ratio of respondents planned to set up new production bases. These two sectors typically have to follow their clients on relocation.

Inland Relocation

China’s Ministry of Commerce recently designated alternate locations in a bid to coordinate regional economic development and promote the transformation and upgrading of processing trades in the central and western regions. To encourage industries in the coastal areas to move inland, the Central Government announced 44 pilot sites for relocating processing trade activities in the central and western regions.

After years of development, the PRD has grown into one of the world’s most efficient industrial clusters, and relocation on a massive scale within a short period will not be easy. Macro-statistics in the past few years reveal that, in addition to the northern, eastern and western flanks of Guangdong, some inland provinces, particularly those in the central region and close to Guangdong, have been successful in attracting relocated industries.

Average pay for workers still lags in central and western regions compared to their counterparts in coastal areas Average pay for workers still lags in central and western regions compared to their counterparts in coastal areas

Some manufacturers have noted that northern Guangdong, along with Jiangxi and Hunan provinces, could assume an increasingly important role as “the factory at the back” for Hong Kong’s manufacturing sector.

Figures for the actual growth of foreign direct investment in recent years also show that regions in the proximity of Guangdong, such as Jiangxi, Hunan and Guangxi, have performed extremely well, while central regions such as Hubei and Henan have also recorded reasonably good growth.

These regions outperformed the entire nation – and even Guangdong – in soliciting foreign direct investment. Certain cities in these inland provinces were particularly good in wooing foreign investment. For instance, Chenzhou in Hunan Province is relatively close to Guangdong, and its foreign investment soared by an annual average 17 per cent from 2006 to 2010, making it Hunan’s second-largest city for attracting foreign investment.

Ganzhou in Jiangxi Province, another city near Guangdong, was second to Nanchang, Jiangxi’s provincial capital, for luring foreign investment. There are signs of foreign investment penetrating further north in their entry to inland provinces.

Yongzhou, in Hunan Province, registered a 25 per cent average annual growth rate for foreign investment in 2008 and 2009; this climbed a further 39.5 per cent in the first nine months of 2010.

Similarly, Ganzhou in Jiangxi Province witnessed a 20 per cent increase in foreign investment in the first 11 months of 2010. Ji’an, another city further north, recorded a 16.7 per cent foreign investment growth rate in 2009, and a 17.8 per cent increase in the first 11 months of 2010. In Shangrao, a city even further north, a 30 per cent increase in foreign investment was reported over the same period. Hong Kong companies could benefit from watching these trends closely.

March 18 2011

Here’s the Plan - China's 12th Five-Year Plan: Hong Kong's Advantage

Hong Kong has a significant role in the Central Government’s latest Five-Year Plan, unveiled this month Hong Kong has a significant role in the Central Government’s latest Five-Year Plan, unveiled this month

View Video Presentation Online http://www.vimeo.com/21160300 View Video Presentation Online http://www.vimeo.com/21160300

It used to be said that highly flexible economies like Hong Kong’s didn’t “do” five-year plans. But given the impressive achievements of the Chinese mainland’s economic reforms, Hong Kong would do well to reconsider that idea.

Hong Kong’s advantages, with its fine natural port and international levels of trade and finance, are well-suited as a platform for the mainland. It has attracted investment and capital and served as a mighty anchor for the entire country’s export drive.

Hong Kong’s economy has flourished by keeping pace with the mainland’s economic development – and it’s been in lock step for years. The many opportunities offered by the mainland market have also provided early opportunities to key Hong Kong industries, including banking, logistics and professional services.

While manufacturing now accounts for only 2.5 per cent of Hong Kong’s economy, local manufacturers have not vanished, but simply changed position. They have seized the moment, taking full advantage of the Pearl River Delta’s (PRD) proximity and low production costs. They have expanded vigorously while fuelling the growth of Hong Kong’s services sectors and export trade.

The 12th Five-Year Plan (FYP), which runs until 2015, is designed to deepen the mainland’s economic reforms, introducing fundamental changes to the country’s development model. Under the FYP, strategic adjustment of the economy will get underway. The FYP will boost domestic consumer demand, raise the contribution of the services sector and lift the level of urbanisation.

Green technology is one of the seven strategic industries set out by the Central Government’s latest Five-Year Plan Green technology is one of the seven strategic industries set out by the Central Government’s latest Five-Year Plan

The mainland intends to develop one of the world’s largest domestic markets and, at the same time, construct seven strategic emerging industries, as well as a services sector and a sustainable economic model. Those seven key industries are green technology; next-generation information technology; biotechnology; high-end equipment manufacturing; alternative energy; alternative materials; and alternative-energy vehicle industries. Hong Kong’s future may well depend on its ability to capitalise on these opportunities, and keep pace as the mainland moves to another level of reform.

Changing Consumer Patterns

As many leading commentators have noted, the world’s economic centre of gravity is shifting to Asia. So, too, is consumption growth. Personal consumption in Asian countries has risen markedly over the past 10 years; on the mainland alone, total personal consumption as a percentage of world consumption climbed to five per cent in 2009 from 2.8 per cent in 2000.

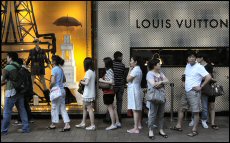

The scale of the mainland’s personal consumption is only one-sixth that of the United States, but the increase in its share will produce significant effects. For example, the mainland became the world’s largest car consumer market and the second-largest luxury market in 2009, attracting large-scale development by many retailers and brands from Europe, the US and Japan, as well as South Korea and Taiwan.

Hong Kong companies have always considered the mainland a manufacturing heartland, producing goods mainly for export. But with the expansion of the mainland consumer market, spending power is rising, and Hong Kong should adjust to take advantage of it.

Global brands are drawn to the growing spending power of Chinese mainland consumers Global brands are drawn to the growing spending power of Chinese mainland consumers

Consumer awareness and concepts are maturing on the mainland, giving Hong Kong companies new opportunities to develop domestic sales, build sales channels and establish brand names that will magnify value-added goods and services.

HKTDC surveys have found that mainland middle-class consumers have a particularly good impression of Hong Kong products, rating them highly for quality and design. Hong Kong is seen as a fashion centre, giving it an edge over mainland markets. Fast-growing mainland towns and cities are conducive to better-run regional distribution networks, helping solve the scattered distribution channel problems of the past. On a broader level, urbanisation continues to drive opportunities for investment and employment growth, raising people’s incomes and spending power.

Judging from consumer figures in the coastal cities, urbanisation will bring changes in the demand for goods, and the development of towns and cities will stimulate consumption of services. These services will include catering and entertainment. And urbanisation will create demand for other services such as property management, cold chain logistics, mass transportation and garbage disposal.

Adjusting Strategies

Hong Kong’s diversified financial services can provide the necessary capital for mainland technology projects Hong Kong’s diversified financial services can provide the necessary capital for mainland technology projects

China’s young population is likely to peak in 2011, with the overall labour force expected to decline from 2015 on. The continuing arc of the mainland’s urban growth, increases in employment opportunities in the central and western regions, and rural workers’ lower incentive to seek employment outside their home provinces are other developing trends.

All this will mean continuing labour shortages in the PRD, which already faces other challenges, particularly rising production costs and competition from inland provinces and cities. These factors should see increased investment by multinationals and large Chinese enterprises in the central and western regions, gradually resulting in the formation of new manufacturing clusters.

Whether approached from the point of view of the production chain or from domestic sales considerations, there is but one conclusion: there will be increasing incentives for Hong Kong manufacturing enterprises to move inland from the PRD.

Nevertheless, there may well be renewed interest in the PRD or, more broadly, on the mainland, for Hong Kong services. Much depends on their level of expertise and applicability. The expertise to steer high-end industrial chains, set up regional headquarters, R&D and distribution centres and form services sectors in major coastal cities pose strong competition to Hong Kong’s professionals in these areas.

Indeed, it’s worth considering whether Hong Kong’s services can cope with the development needs of the mainland’s seven strategic emerging industries. In any case, Hong Kong companies should brace themselves for these changes as early as possible.

Importing Technology

Under the FYP, advanced technology and innovation will serve as a cornerstone for changing China’s economic development model. Hence the seven strategic emerging industries all focus on fostering and developing scientific and technology content.

In certain technology areas, the mainland is level with or even ahead of mature economies. But in terms of overall scientific research activity, it lags behind advanced countries. As a result of the technology gap, the mainland still needs to bring in key technology to support its industrial development.

For instance, if the mainland achieves its target of building a resource-efficient, environmentally friendly society, it would need a lot of environmental technology. According to a United Nations research report, the mainland needs 62 key specialised and general technology to undertake energy-saving and emission-reduction tasks. But in about 70 per cent of these areas, it still has not mastered the core technology and will have to rely on imports.

Hong Kong is the mainland’s window for procuring technological products and possesses extensive experience in assembling technological cooperation overseas. Coupled with well-regarded intellectual property rights laws, the city is able to introduce foreign technology through technology transfers, licensing and other means. Hong Kong’s diversified financial services, such as venture capital funds, can also provide the necessary capital for mainland technology projects.

During the FYP period, increasing numbers of mainland companies will seek listings and funding in Hong Kong as the mainland transforms its manufacturing industries and steps up its “going out” strategy.

The Framework Agreement on Hong Kong/ Guangdong Cooperation, signed last year, will likely be used to help implement various pilot cooperation projects. The Agreement suggests setting up a financial cooperation zone, with Hong Kong as a leader. In addition, Hong Kong is emerging as an offshore renminbi centre. Both initiatives would be favourable to Hong Kong’s continuing development as an international financial centre.

January 4 2011

Hawaii's Brain Drain - Isles lose many of ‘the best and brightest’ The mainland offers graduates more money, opportunities and prestige

By Lavonne Leong Special to the Star-Bulletin (3-24-1999) Hawaii's Brain Drain - Isles lose many of ‘the best and brightest’ The mainland offers graduates more money, opportunities and prestige

By Lavonne Leong Special to the Star-Bulletin (3-24-1999)

An article almost 12 years ago could change the date and still apply to Hawaii today...100s

of our smartest and brightest continue to leave Hawaii monthly.

Recent University of Hawaii graduates in finance were asked, "What advice would you offer current and soon-to-be graduating students in your major?"

Almost 25 percent responded, "Move to the mainland."

More students are taking that advice as they survey Hawaii's economic landscape. While a lot of the perception of a "brain drain" is anecdotal, numbers back it up.

Census reports released late last year show that in a 1997 and 1998 period almost 17,000 more people moved from Hawaii to the mainland than moved from the mainland to Hawaii.

Hawaii's population growth rate is third-lowest in the United States, extraordinary given Hawaii's high birthrate and high foreign immigration.

And Hawaii Data Book figures show a gradual rise in the average age of Hawaii's citizens, indicating that those who leave are disproportionately young.

"In the earlier days, I think that everybody pretty much wanted to stay home," said Dr. Eleanor Len, director of career services at UH. "Now I think they're beginning to say, 'I'm willing to go to the mainland.' "

Some experts are reluctant to use the term "brain drain."

Nicholas Ordway, professor of financial economics and institutions at UH, would rather talk about the "education drain." Nicholas Ordway, professor of financial economics and institutions at UH, would rather talk about the "education drain."

Ira Rohter, UH associate professor of politics, preferred to talk about the "soul drain," but added, "I think there is a real brain drain in Hawaii if you mean ... that the best and the brightest are leaving." Ira Rohter, UH associate professor of politics, preferred to talk about the "soul drain," but added, "I think there is a real brain drain in Hawaii if you mean ... that the best and the brightest are leaving."

Ordway described the typical mainland-mover as young and well educated. "Many of the recently educated or soon-to-be educated college-age students are leaving and probably will never come back to Hawaii, except to visit with family," he said.

The economy is the reason cited most often for the exodus, but not always for the obvious reasons. Statistics first started showing more workers leaving for the mainland than coming here in 1987 -- a year the economy was booming. Every year since then has recorded a deepening trend toward people leaving.

Ordway said the brain drain has become an issue "because of a series of dynamics that came together and created high-housing prices, low-paying jobs and a lack of opportunity. We can place any graduate from UH in any major job any place except in Hawaii."

Yet the economy is only one of a number of reasons why people leave and stay away.

About 5 percent of Waipahu High's graduates attend mainland colleges. About 10 to 15 percent of Roosevelt High's college-bound students go to the mainland. And although UH is the single school that receives the most Punahou students, 87 percent of the Punahou class of 1998 left Hawaii to attend college.

"A large number of kids (nationally) go to college within a 500-mile radius," said Myron Arakawa, Punahou's director of college counseling. "Well, for Hawaii kids, 500 miles is in the middle of the Pacific. It's not abnormal for Hawaii students to want an adventure away from home. Unfortunately, 'away from home' is awaaay from home." "A large number of kids (nationally) go to college within a 500-mile radius," said Myron Arakawa, Punahou's director of college counseling. "Well, for Hawaii kids, 500 miles is in the middle of the Pacific. It's not abnormal for Hawaii students to want an adventure away from home. Unfortunately, 'away from home' is awaaay from home."

That's not necessarily bad. Students who go to the mainland for college "have so many different and new positive experiences that they feel that those who stay back may not have had the chance to get involved in," said Lillian Yonamine, counselor for Waipahu High. "They feel, 'Oh wow, my friends (who stayed in Hawaii), they seem like they're still in high school.' " That's not necessarily bad. Students who go to the mainland for college "have so many different and new positive experiences that they feel that those who stay back may not have had the chance to get involved in," said Lillian Yonamine, counselor for Waipahu High. "They feel, 'Oh wow, my friends (who stayed in Hawaii), they seem like they're still in high school.' "

That's fine, said Rohter. "The problem is coming back."

Most high-schoolers leaving for college on the mainland intend to return. Rory Padeken, a sophomore at Punahou, thinks he might want to go to Stanford. "It's away from home but not too far away," he said. "Hawaii's home."

But Roosevelt High counselor Nancy Scarci said that intending to return when Hawaii is all you've ever known is one thing; actually returning, after building another life elsewhere, is another.

"I think 'eventually' is the key thing," she said. "They want to come back 'eventually.' A lot of them say 'I want to raise my family here,' or 'When I get married, I want to come home.' "

Passing milestones

Once they become tracked into mainland life, however, the urge to return diminishes.

"By that time -- this is maybe 10 years after they graduate -- (moving back) is a nice idea but then he looks at the size of the house, you look at job opportunities ..." Scarci said.

Those who put down roots on the mainland are least likely to return. Putting down a root can mean passing any of the big milestones: marrying, buying a house, having children. Students who are waiting for the right career opportunity to surface in Hawaii have found it difficult to postpone building a life wherever they are.

"They've bought homes. They're raising their kids," said UH's Len.

State Rep. Brian Schatz, 27, said many of Hawaii's children leave before they have had a chance to participate in an adult Hawaii: "When you're 18, 21, you go to other people's events. As you get older, you start giving them -- you are the party, you are the community organization." State Rep. Brian Schatz, 27, said many of Hawaii's children leave before they have had a chance to participate in an adult Hawaii: "When you're 18, 21, you go to other people's events. As you get older, you start giving them -- you are the party, you are the community organization."

For those who have moved to the mainland, Hawaii has often become just a distant place to go for food, sun, and a quick shot of ohana -- a vacation spot, fraught with rumors of a bad economy and gridlocked politics.

"When I went to school in Texas," said Ronald Atienza, "I built enough of a life there that I missed Hawaii less and less. People leave Hawaii for one reason, then become attached to their new home for another."

Hawaii can fall victim to its own easygoing image as a tourist escape from the real world.

"I think people equate staying here with a lack of drive," said Kippen Chu. After graduating from the American University in Paris, Chu returned to Hawaii and now works in the state Legislature. "It's like, 'Oh you just want to stay here so you can go beach every day.' " "I think people equate staying here with a lack of drive," said Kippen Chu. After graduating from the American University in Paris, Chu returned to Hawaii and now works in the state Legislature. "It's like, 'Oh you just want to stay here so you can go beach every day.' "

The fashion lag -- the feeling that Hawaii finds fads just as the mainland is abandoning them -- contributes to the peripheral feeling, said Vu Van, a junior at UH. "New York sets the trends, then they move down to Los Angeles, and then Hawaii gets it six months afterwards."

"We believe, and we've always believed, that we're five steps behind," said nationally acclaimed author Lois-Ann Yamanaka. "It's the 'You're only good [enough] to be on this rock' mentality. It's ingrained. And when your neighbor's kid goes to Stanford and you had to stay in Hilo College -- I mean, heaven forbid! To me it's sad because I felt that way." "We believe, and we've always believed, that we're five steps behind," said nationally acclaimed author Lois-Ann Yamanaka. "It's the 'You're only good [enough] to be on this rock' mentality. It's ingrained. And when your neighbor's kid goes to Stanford and you had to stay in Hilo College -- I mean, heaven forbid! To me it's sad because I felt that way."

Many assume that it's impossible or unambitious to live in Hawaii, and they leave even before they have looked for jobs here. "Part of it is the economic situation in our state, but there's also a psychology among young entrepreneurial people about different cities," Schatz said. "People are very fickle about what cities they think are hip. Sure, there are more jobs in San Francisco, but part of the reason that there are more jobs there is that everyone is going there to start businesses, to be entrepreneurial."

The heady "playing with the big boys now" feeling associated with a mainland job can make a job in Hawaii seem less desirable. "When it comes to class reunion time," said Chu, a Punahou '83 graduate, "it's much more prestigious to say that you're a communications consultant for Boeing in Seattle than a marketing specialist for Bank of Hawaii."

Schatz said the media's magnifying glass on economic woes can augment the problem: "I think the media does a disservice to local kids sometimes by exaggerating our economic problems and focusing on what's not possible rather than focusing on what's possible."

The brain drain can be a vicious circle: A perceived lack of opportunity makes people look elsewhere for jobs. They leave, so the skilled work force diminishes. Then companies coming in decry the lack of a skilled work force and fill skilled positions with non-Hawaii employees.

"We would be able to keep more of our people here if some of the captains of our industry here made it a point to hire people from here rather than bring people in," said Gov. Ben Cayetano. "We would be able to keep more of our people here if some of the captains of our industry here made it a point to hire people from here rather than bring people in," said Gov. Ben Cayetano.

Financially, said Ordway, the brain drain "probably reinforces a single-industry state, i.e. tourism, which doesn't depend on that many well-educated individuals. It is probably making Hawaii less attractive to high-tech industries."

Lack of innovation

Ordway also said he thinks the brain drain is partly responsible for a dearth of innovation here. Given Hawaii's wealth of scientific natural resources, scientific breakthroughs like Ryuzo Yanagimachi's cloned mice should not be isolated incidents.

"Hawaii is producing about one-fourth to one-fifth the number of patents it should, given the size of its population," said Ordway, "and despite the fact that we have a comparative advantage in astronomy, biology, botany." Ordway also said he thinks the brain drain is partly responsible for a dearth of innovation here. Given Hawaii's wealth of scientific natural resources, scientific breakthroughs like Ryuzo Yanagimachi's cloned mice should not be isolated incidents.

"Hawaii is producing about one-fourth to one-fifth the number of patents it should, given the size of its population," said Ordway, "and despite the fact that we have a comparative advantage in astronomy, biology, botany."

The total population will also get older. "The migration is not symmetrical; it's asymmetrical towards the younger ages. So what is happening is that the overall population in Hawaii is aging," said Ordway.

If Hawaii continues on this path, UH Law professor Randall Roth's projections for five years down the road are grim. He described a changed Hawaii, with less aloha spirit and fewer people with roots in Hawaii. People have continued to move to Hawaii from elsewhere, but "their life experiences and values are not identical to those of the folks whose places they took. If Hawaii continues on this path, UH Law professor Randall Roth's projections for five years down the road are grim. He described a changed Hawaii, with less aloha spirit and fewer people with roots in Hawaii. People have continued to move to Hawaii from elsewhere, but "their life experiences and values are not identical to those of the folks whose places they took.

Typical case: Wed outside Hawaii; may never return

Lavonne Leong is a 1993 graduate of Punahou. She received a bachelor's degree in English from Barnard College and is now in the third year of a doctoral program in English literature at Oxford University in England.

In many ways, she is the embodiment of Hawaii's brain drain. Asked about her future plans, she said: Lavonne Leong is a 1993 graduate of Punahou. She received a bachelor's degree in English from Barnard College and is now in the third year of a doctoral program in English literature at Oxford University in England.

In many ways, she is the embodiment of Hawaii's brain drain. Asked about her future plans, she said:

"Do I want to move back to Hawaii? The answer is yes, but I guess I'm your typical case. I spent several years building a life away from Hawaii, and married an Englishman, who agreed to move back to the U.S. with me, but feels Hawaii would be an ocean too far unless there was something really good there for both of us.

"So I guess you could say something like, 'After her doctorate, she plans to move somewhere in the western half of the United States with her husband to pursue an academic and writing career.' "

December 2 2010

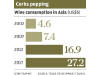

簽證貴 團費高 缺直航機 中國人到夏威夷觀光障礙多

州長林格曾積極爭取直航機往來中國與夏威夷,但未有結果。

州長林格曾積極爭取直航機往來中國與夏威夷,但未有結果。

北京居民王先生(Benny Wang)和妻子趙氏(Echo

Zhao)想去海邊旅遊時,由於進出韓國比較容易,因此選擇韓國。其實,兩人一直夢想來夏威夷旅遊,只是受到旅行限制和成本高昂而無法成行。

據《檀香山星廣告人報》報道,他們不是唯一有這種做法的旅客。夏威夷雖是世界頂級觀光地點,在爭取中國旅客的工作上,也遭逢現實世界的諸多阻礙。

2009 年中國外遊旅客人數增長至

4,000 萬人,其中僅約

45,000

人到夏威夷。據夏威夷觀光局表示,雖然中國觀光人數迅速大幅增長,估計今年和明年來夏威夷的旅客人數大概仍只有

63,000 萬人和

85,000 萬人。

在北京美國大使館對面的

Pegasus & Taihe

國際娛樂公司工作的趙女士嘆氣說:「到夏威夷實在很困難。」她說,美國政策規定,旅客必須親自接受面試才能取得旅遊簽證,每天從早上到晚上

6

時前,使館外面都有申請人排成長龍等候面試。

縱使費盡千辛萬苦取得簽證,還有另一障礙:沒有直航班機。旅遊業者指出,目前到夏威夷必須在首爾、東京或三藩市轉機,頗費周章,原本的5日遊結果只剩3天可用來觀光。

此外,由於變數頗多,組織旅行團的公司很難保證中國海南航空或其他航空公司會提供到夏威夷的機位。業者透露,目前有2、3

家公司可包機直飛夏威夷,但成本一般來說相當高,單程價格就高達

40 萬元。

業界原本預期海南航空今年第二季會開闢北京直飛檀香山的航班,但最後落空,海南航空改而開闢直飛新加坡、河內、曼谷和布吉島等其他旅遊地點的航線。海南航空將重點放在新興旅遊市場,甚至使得該公司原來直飛夏威夷的包機服務受到影響。

爭取中國直飛夏威夷的航空服務,曾被林格州長視作優先考量工作,她四度到中國訪問,促進雙方的了解,並與海南航空管理層在夏威夷見面,討論他們提出的著陸費等費用打折的要求。但雙方未達成共識,預料在林格州長於下月卸任時,此事仍將懸而未決。

中國有旅遊業界人士稱,美國簽證費太高也是令人不想來夏威夷的原因,目前申請美簽的費用大約220美元,澳大利亞簽證只要

117 美元,日本簽證

44

美元,俄羅斯簽證 29

美元,歐洲簽證

73 美元。

在成本方面,平均5天3夜的夏威夷觀光團,包含機票、住宿及交通等的團費為

2,924 美元。與之相比,馬來西亞7日遊只需

548 美元。

November 2 2010

Hong Kong US$5.16 billion Cultural Vision

“Iconic, world class and for everyone – that is our mission,” said Sir Norman

Foster, acclaimed architect, chairman and founder Foster + Partners, of his

vision for Hong Kong’s groundbreaking West Kowloon Cultural District (WKCD).

Described as the world’s most ambitious

cultural project, the plan to transform 40 hectares of prime waterfront land on

Hong Kong’s iconic harbor to an arts and leisure precinct housing a modern art

museum, theatres, concert halls and other performance venues, has gained

worldwide attention.

Following an open tender process, three firms were commissioned in July 2009 as

conceptual plan consultants:

Foster + Partners of London, led by Sir Norman; Dutch firm Office for

Metropolitan Architecture (OMA), led by principal Rem Koolhaas; and Hong Kong

firm Rocco Design Architects Ltd, led by Rocco Yim.

Foster + Partners of London, led by Sir Norman; Dutch firm Office for

Metropolitan Architecture (OMA), led by principal Rem Koolhaas; and Hong Kong

firm Rocco Design Architects Ltd, led by Rocco Yim.

Graham Sheffield, CEO, West Kowloon

Cultural District Authority Graham Sheffield, CEO, West Kowloon

Cultural District Authority

With their conceptual plans now open for public comment, Graham Sheffield,

formerly of London’s Barbican Centre, has taken up his new position at the West

Kowloon Cultural District Authority. As CEO, Mr Sheffield will lead and manage

the artistic and operational initiatives related to the development of the WKCD.

The scale of the three firms’ involvement is

immense. In addition to a 30-plus strong team in Hong Kong and London, Foster +

Partners set up a 25-member advisory board especially for this project, made up

of leading practitioners and thinkers from the world of art and culture,

including visual and performance artists, curators, film-makers, academics,

media and management experts. “Together with the project team, the advisory

board provides informed and independent judgement, critical to a project of this

scale and ambition,” said Colin Ward, Architect and Partner, Foster + Partners.

OMA dedicated a team of 20 members in Hong Kong, led by David Gianotten, General

Manager, OMA Asia. Rem Koolhaas was in Hong Kong one week each month during the

design process, assisted by a team member working from the Rotterdam

headquarters. “But next to the OMA team, we had a large team of sub-consultants

of expert cultural, financial, technical and political advisors, with more than

60 people in total,” said Mr Gianotten.

Benchmark for Asia

Rocco Design’s concept comprises three

integrated layers: Green Terrain, City Link, Cultural Core Rocco Design’s concept comprises three

integrated layers: Green Terrain, City Link, Cultural Core

The architects said the project will lift Hong Kong’s international profile and

set a new benchmark as the cultural hub of Asia.

“West Kowloon Cultural District is the world’s most ambitious cultural project,”

said Mr Ward of Foster + Partners. “International visitors will experience

unrivalled cultural venues as Hong Kong is projected onto the global stage,

reaffirming its unique culture and position as Asia’s World City. Importantly,

it will also provide Hong Kong with an unprecedented opportunity to enhance

home-grown talents in the arts by nurturing the artists of tomorrow and

inspiring a new generation of arts managers and performers.”

The OMA’s Mr Gianotten agreed. The OMA’s Mr Gianotten agreed.

David Gianotten, General Manager, OMA Asia “West Kowloon Cultural District is a

unique project of its kind in the world, in terms of both size and amount of

investment by the government,” he said. “The project provides an opportunity for

Hong Kong to recognise the city’s local arts and culture, and to elevate the

public’s appreciation towards arts and culture.”

The scale and scope of the project also

highlights opportunities for Hong Kong-based and overseas firms to contribute a

wide range of specialized expertise.

Opportunities Across the Board

OMA’s plan is for three villages nurturing

all aspects of the creative process OMA’s plan is for three villages nurturing

all aspects of the creative process

Mr Gianotten said that the two major components of the project – 40 per cent

cultural facilities and 60 per cent commercial – opened business opportunities

not only related to arts and culture, but in urban planning , design,

construction, green energy, curatorship, art administration, education, art

production, retail dining and entertainment, tourism and transport. “These

opportunities will be local, regional and international,” he said, adding that

the project would play a key role in the city’s economy.

“It is foreseeable that a large number of experts from both local and overseas

are needed. Since everything on this 40-hectare site will be new, it needs a

collective effort from around the world to realise all the ambitions. It is a

good time to get as much expertise as possible involved now, in the early stages

of the project.”

Colin Ward, Architect and Partner, Foster +

Partners Colin Ward, Architect and Partner, Foster +

Partners

Mr Ward said the Foster + Partner project team illustrates the diverse range of

disciplines required for a project of this magnitude; namely architecture,

engineering, landscape design, town planning, retail design, property

management, financial management, theatre design, arts and cultural advisory,

public relations and marketing. “Another key area – because our City Park will

be the world’s first carbon neutral cultural district – is green energy and

environmental technology for renewal energy waste and water,” he said, adding

that the WKCD will be “an example to the world on how a cultural district should

be created.”

“It is vast on every scale, including opportunities for overseas firms with the

right skills, technology and expertise. From the hardware: design, construction,

infrastructure – to the software: arts programming, education, management – the

HK$21.6 billion cultural district is one of the most ambitious projects in the

world,” he said.

Public Consultation

The three conceptual plans are open for public opinion until 20 November 2010.

One of the three plans will be selected by the West Kowloon Cultural District

Authority, taking into account the public’s feedback, and potentially

incorporating components of the other two plans. The selected plan will form the

basis for the preparation of a detailed master plan, tentatively scheduled to be

unveiled in 2011.

Following further public consultation, the detailed master plan will be

fine-tuned and submitted to the Town Planning Board for consideration.

October 27 2010

Tracking Corporate Sustainability - Hong Kong Launching the Hang Seng

Corporate Sustainability Index Series

(Left to right) Vincent Kwan,

Director and General Manager of Hang Seng Indexes Company Ltd; Hong Kong

Financial Secretary John Tsang; Margaret Leung, Hang Seng Bank Vice Chairman and

Chairman of the Hang Seng Indexes Advisory Committee; Peter Wong, Chairman of

RepuTex (HK) Ltd (Left to right) Vincent Kwan,

Director and General Manager of Hang Seng Indexes Company Ltd; Hong Kong

Financial Secretary John Tsang; Margaret Leung, Hang Seng Bank Vice Chairman and

Chairman of the Hang Seng Indexes Advisory Committee; Peter Wong, Chairman of

RepuTex (HK) Ltd

The Hang Seng Corporate Sustainability Index Series joins the FTSE4Good Index

and the Dow Jones Sustainability Index in tracking the stock price and ethical

performance of Hong Kong and Chinese mainland stocks.

“With the launch of the Corporate

Sustainability Index Series, we are providing an objective and highly visible

platform to be used by the investment community to promote socially responsible

investment products,” said Vincent Kwan, Director and General Manager of Hang

Seng Indexes Company Ltd, a wholly owned subsidiary of Hang Seng Bank.

The Hang Seng Corporate Sustainability Index Series comprises three indexes: the

Hang Seng Corporate Sustainability Index (HSSUS), Hang Seng (China A) Corporate

Sustainability Index (HSCASUS), and Hang Seng (mainland and Hong Kong) Corporate

Sustainability Index (HSMHSUS).

The HSSUS and HSCASUS indexes are made up of the top 30 high-performing

environmental, social and governance (ESG) companies in Hong Kong and the top 15

mainland companies. A total of 538 companies – 274 Hong Kong firms and 264

mainland A-share companies – were analysed by RepuTex Hong Kong Ltd, an

independent analytics and advisory firm that specialises in sustainable risk

analysis, from December 2009 to April 2010.

Hugh Grossman, Executive Director,

RepuTex Hugh Grossman, Executive Director,

RepuTex

Hugh Grossman, Executive Director of RepuTex, an Australian company

headquartered in Hong Kong, said only the top ESG companies and those that met

the Hang Seng Indexes (HSI) market capitalisation, turnover and listing history

criteria were eligible. Stringent assessment was also carried out in the four

key categories of corporate governance, environmental impact, social impact and

workplace practice.

“The selection criteria of identifying the best sustainability performers based

on the environment, social and governance factors is on par with the Dow Jones

Sustainability Index and the FTSE4Good constituent companies, while providing

the market with highly liquid exposure to Hong Kong and China markets,” said Mr

Grossman.

He added that companies with good corporate governance are likely to have better

risk processes in place and a more effective management. “These proactive

companies are best positioned to take advantage of new market opportunities and

generate more positive returns for their stakeholders with lower risk.”

Sustainable Shipping

Global shipping giant Orient

Overseas (International) Ltd - (OOIL) is one of the 30 constituents in the Hang

Seng Corporate Sustainability Index Global shipping giant Orient

Overseas (International) Ltd - (OOIL) is one of the 30 constituents in the Hang

Seng Corporate Sustainability Index

Orient Overseas (International) Ltd (OOIL) is one of the 30 constituents in the

HSSUS Index. It owns one of the world’s largest international integrated

container transport business, which trades under the name OOCL. OOIL’s Chief

Financial Officer, Ken Cambie, said the Group has always performed well in ESG

issues. “OOIL’s corporate social responsibility (CSR) policy states that we

recognise that businesses must take responsibility for their industry’s effects

on the environment.”

“As we are a shipping and transportation company,” Mr Cambie added, “we believe

that saving fuel is the best way to save both money and emissions.”

CSR, he said, is very important for any company’s bottom line. “Some of our

customers only choose environmentally friendly carriers, so carriers like OOCL,

with good environmental performance strategies, will benefit in the long term.”

While it’s early days yet to predict on the success of the new socially

responsible investment (SRI) funds, Mr Grossman predicted that they will catch

on just as they have in Western financial markets.

“The reality is that this is a new investment concept in Asia,” he said. “The

FTSE4Good and Dow Jones Sustainability Indexes were launched in 2001 and 1999

respectively, and it has taken a decade to take off. But local Asian investors

are very astute in their desire to identify a good risk/returns story, so no

doubt, funds will grow as performance builds.”

SRI funds have expanded over time with expectation and have reached almost US$7

trillion, according to the Eurosif SRI Survey 2008. “The sustainability concept

will surely grow in Asia, so Hong Kong and China must get their feet in the door

first,” Mr Grossman said. “Already, we have 30 companies in HSSUS with global

best practices from an investment point of view and that is a great start.”

Ken Cambie, Chief Financial Officer,

Orient Overseas (International) Ltd Ken Cambie, Chief Financial Officer,

Orient Overseas (International) Ltd

Mr Cambie agreed. “Hong Kong, New York and London are likely to remain powerful

financial centres in the foreseeable future. We believe the number of

constituents in HSSUS will expand further and Hong Kong can develop to a level

on par with New York and London.”

Fund managers are expected to be cautious with the new index, at least

initially. “It would take time to come up with new financial products, and

investors would have to see how these companies perform or out-perform in HSSUS

over a period of time,” said Mr Kwan.

Sally Wong, CEO, Hong Kong Investment Funds Association, pointed out that in

Asia, particularly in the retail sector, the uptake of SRI products is

“relatively muted.” In Hong Kong, there have not been many green funds launched.

“A possible reason is that investors traditionally don’t associate the two,” Ms

Wong said. “People may readily take up ethical or socially responsible causes,

but instead of doing through investments, they tend to go down the route of

charity initiatives or other channels. They tend to see these not in keeping

with investments.”

Caring Investors

According to the Association for Sustainable & Responsible Investment in Asia,

many people fit the profile of SRI investors. “US and European market experience

indicates that SRI investors are often caring professionals, NGO workers and

charity foundations,” Mr Cambie said. “In Hong Kong, there is a sizeable pool of

potential SRI investors.”

Ms Wong said it’s an area where more investors, especially pension funds and

institutional investors, are attaching greater importance. “The approach has

evolved from a negative one to a positive one. In the past, the focus had been

primarily to screen out companies that are pollution-related or associated with

sweatshops or weaponry. But increasingly, the industry has moved on to one of

‘engagement overlay,’ that is, to proactively engage the company to factor in

social and ecological needs, such as a more eco-friendly approach in purchasing

and waste disposal, or implement policies for a better work-life balance.”

Ms Wong believes that more data should be available to show the causal

relationships between the ethical activity and the financial outcome. “As more

cases illustrate how these causes and outcomes are correlated, investors will

appreciate the value and warm to the idea. But, it probably takes time,” she

said.

Education, it appears, is the key. Hang Seng Indexes Company Ltd is taking part

in seminars in Hong Kong and around the region to raise greater awareness.

Mr Kwan said he is encouraged by the number of smaller firms that have been

enquiring about how they could be considered for inclusion in the HSSUS Index.

“I tell them to embrace the standards set up by the Index. RepuTex will do an

annual review of participating companies and if there is a chance, we might

include more companies,” he said.

October 13 2010

Blueprint for a New China

Urbanization on the Chinese mainland is advancing at an annual rate of one per

cent, which means that about 13 million people move from rural areas to cities

each year. The enormous changes to the country’s urban blueprint in the years

ahead are expected to create huge demand in the construction and engineering

sectors.

With more than 10 million people settling

into mainland cities every year, the demand for housing will be pressing. Based

on an average family of four, about 3.2 million mainly low-cost housing units

will be required every year.

Of the Rmb4 trillion economic stimulus rolled out by the Central Government at

the end of 2008, Rmb400 billion was earmarked for housing and the reconstruction

of shanty towns. The development of small- and medium-sized cities is intended

to strengthen the larger cities’ economic hinterland, spurring demand for

high-end consumption, housing, hotels and office buildings in smaller satellite

communities.

Fixed-asset investments in

the mainland’s transport infrastructure and real estate sectors by Hong Kong,

Macau, Taiwan and foreign companies have more than doubled in the four years to

2008 Fixed-asset investments in

the mainland’s transport infrastructure and real estate sectors by Hong Kong,

Macau, Taiwan and foreign companies have more than doubled in the four years to

2008

Hong Kong architectural firms, which excel at projects requiring advanced

technical requirements and complexity, are very much involved in the

construction boom, designing landmark buildings and multi-purpose complexes in

major cities. They’ve also drawn up blueprints for upmarket residential

developments and green buildings in smaller cities. One example is Hong Kong’s

Ronald Lu & Partners, which is working on Lake Dragon, a plush ranch-style

apartment and villa complex in Guangzhou, as well as luxury, residential houses

in Chengdu’s Splendid City and Dalian’s Maritime.

Transport Network Boost

Rural and urban differences, the mobility of rural migrant workers and urban

traffic congestion already pose big problems in mainland cities. Communities

have to upgrade their transportation networks to meet the needs of the Central

Government’s plan for coordinated urban and rural development, particularly

since the migration of the rural population to the cities is expected to

aggravate transportation demands.

Ministry of Transport data reveals that urban residents make eight to nine times

more trips than their rural counterparts. This makes planning for sound road and

railway networks vital for the development of small- and medium-sized cities and

wider strategic aims.

As greater numbers of people migrate to

the cities, there’s a corresponding increase in demand for public utilities such

as power, sewage treatment and garbage disposal As greater numbers of people migrate to

the cities, there’s a corresponding increase in demand for public utilities such

as power, sewage treatment and garbage disposal

Several Hong Kong companies are currently participating in mainland transport

projects. Most notably, Hopewell Highway Infrastructure Ltd, a unit of Hong

Kong’s Hopewell Holdings, built and is now operating the Guangzhou-Shenzhen

Superhighway and phases one and two of the Western Delta Route. Hong Kong’s Mass

Transit Railway Corp is participating in the construction of the Shenzhen Metro

Line 4 and the Beijing Metro Line 4.

Utilities Surge

With the increasing numbers migrating to cities, there’s a corresponding rise in

demand for public utilities, including power, sewage treatment and garbage

disposal.

China’s urbanization looks set to advance rapidly in the next few years,

exerting enormous pressure on public utilities. To meet demand, the Central

Government issued a set of opinions in 2002 aimed at accelerating municipal

public utility programmes and introducing capital-market financing to assist the

construction and operational effort.

Hong Kong Link

Hong Kong’s construction and engineering sectors have been participating in the

mainland market since the 1980s, bringing huge profits, particularly with the

continued growth in infrastructure and real estate investments.

Hong Kong players have evolved with the demands of the market: they have both an

international perspective and an intimate knowledge of the mainland. These are

key advantages when it comes to vying for projects financed by either Hong Kong

or foreign capital.

The mainland’s urbanisation programme is sure to attract more investment from

Hong Kong, Macau, Taiwan and overseas. In fact, in the four years to 2008,

fixed-asset investment in the mainland’s transport infrastructure and

real-estate sectors by Hong Kong, Macau, Taiwan and foreign companies more than

doubled, hitting Rmb10.9 billion and Rmb416.1 billion respectively. Fixed-asset

investment in public facilities also grew almost 30 per cent.

Projects in small- and medium-sized cities generally don’t feature high

technical requirements, but the Central Government has said that there should be

“rational layout” and “intensive development” among cities. In other words, the

development of these smaller cities will also drive the development of large

cities, forming hubs linking regions to the international arena. In turn, this

is expected to boost demand for upmarket commercial and residential projects by

people from the mega cities, offering new business opportunities for Hong Kong

companies.

Most Hong Kong firms, particularly SMEs, are concentrated in first-tier coastal

cities like Guangzhou, Shenzhen, Shanghai and Beijing. But lately, Hong Kong

players have undertaken more projects in second-tier cities such as Chongqing,

Tianjin, Wuhan, Nanjing and Chengdu.

Where competition is concerned, there are going to be stiff challenges from

mainland and overseas firms. Since China’s accession to the World Trade

Organization, there have been increased exchanges between mainland and foreign

firms. With decades of experience, mainland companies are now more

technologically advanced, while their costs remain considerably lower than Hong

Kong’s.

The huge size of the mainland market has also attracted plenty of top

international construction and engineering firms, all competing at the high end

of the market. Hong Kong firms face competitive pressures from all sides.

Some Hong Kong firms emphasise localization, setting up subsidiaries on the

mainland and sub-contracting work to these subsidiaries to reduce costs. Hong

Kong companies are also actively pursuing higher professional standards and

offering premium-value services targeting clients at the upper end of the

market. For example, Hong Kong firms are able to apply environmental concepts to

projects and help clients cut costs through suitable design and planning.

The massive urbanization underway on the mainland will reward Hong Kong

construction and engineering firms that can offer the best concepts, technology

and management. Liberalization measures under the Closer Economic Partnership

Arrangement (CEPA) allow Hong Kong firms to capitalize on their relative

strengths to secure mainland contracts amid the country’s ongoing urban

development.

Hong Kong SAR Updated on Oct 1 2010 -

Tax Information : Hotel Accommodation Tax

"waived" Effective July 1 2008

By virtue of the Hotel

Accommodation Tax Ordinance, Cap 348 (“HATO”), Hotel Accommodation Tax (“HAT”)

is imposed on hotel and guest house accommodation. By virtue of the Hotel

Accommodation Tax Ordinance, Cap 348 (“HATO”), Hotel Accommodation Tax (“HAT”)

is imposed on hotel and guest house accommodation.

"Hotel" means any establishment, the proprietor of which holds out to the extent

of his accommodation that he will provide, accommodation to any person

presenting himself who is able and willing to pay a reasonable sum for the

services and facilities provided and is in a fit state to be received.

"Accommodation" means any furnished room or suite of rooms hired by the

proprietor of the hotel to guests, or for the use of guests, for lodging and

includes such furnishings, appliances and fittings as are normally provided

therein.

"Accommodation charge" means the sum payable by or on behalf of guests for

accommodation received.

Effective from 1 July 2008, the Government waives the charge of HAT. The rate

of tax is reduced to 0% (the tax rate was at 3% for the period up to 30 June

2008) on all accommodation charges paid by the guests.

For the period during which the rate of HAT is 0%, hotels and guesthouses are

not required to impose HAT on accommodations hired by the guests and they do not

need to file the HAT return to the Collector.

Additional information please visit

http://www.ird.gov.hk/eng/tax/hat.htm

October 6 2010

Small is Big

Economic development zones across the Chinese mainland have risen rapidly over

the past 20 years, as has the migration of people to cities looking for work.

The pace of urbanization itself has accelerated the growth and number of medium-

and small-scale cities. Just two years ago there were 264 cities with

populations under 200,000, and the number is still rising. In 2008, there were

also 41 cities with populations of more than two million. This interdependent

urban network evolution is likely to precipitate the world’s fastest-growing

urban consumer market.

Economic interaction among cities has increased because of industrial division

and extended industrial chains. In places where cities are clustered, areas in

which people can travel within an hour have emerged, thanks to improvements in

intercity railway networks and highways.

City density for retail has far to

go City density for retail has far to

go

Currently, there are three extended urban

areas that deserve the “megalopolis” epithet: Beijing-Tianjin-Hebei in the

northeast of the country, the Yangtze River Delta in the east and the Pearl

River Delta in the southeast.

There are also what could be described as smaller “city clusters,” such as

central-southern Liaoning (encompassing Shenyang, Dalian and Anshan), the

pairing of Chengdu and Chongqing in Sichuan Province, the Shandong peninsula,

the central China plain, which brings together Zhengzhou, Luoyang and Kaifeng,

as well as Changsha-Zhuzhou-Xiangtan in Hunan Province and Wuhan in Hubei

Province.

Spurring Regional Distribution

Urban consumer spending is

on the rise Urban consumer spending is

on the rise

One of the factors limiting growth in the mainland’s distribution industry has

been the marked disparities in economic development between cities and towns,

and between first-tier, second- and third-tier cities.

There are wide differences in consumer income and spending; the degree of market

homogeneity is low, and retail enterprises within the same region struggle to

expand and develop chain-store networks and franchises.

Retail chain Parkson, for example, has 40 mainland outlets, the largest number

nationally among department-store groups. Compared with European and American

department stores such as M&S, with more than 600 stores in the United Kingdom,

and JC Penney, with more than 1,100 stores in the US, mainland department stores

fall short in overall size and regional development density.

When it comes to large-scale supermarkets, Wal-Mart has the most outlets among

foreign-invested enterprises on the mainland, but even it counts only 180

stores. That’s very different in scale to the 4,364 Wal-Mart stores in the US.

Intense market competition has prompted more retail enterprises to expand into

second-and third-tier cities

Similarly, there are 2,270 Carrefour stores in France and 2,482 Tesco outlets in

the UK. In terms of size or development density, their mainland presence is only

at the starting line.

Granted, some mainland-invested small-and mid-sized supermarkets have seen

significant growth in store numbers and density, but the operational scale of

these enterprises remains relatively small compared to mature markets in Europe

and the US. Since the operational scale and purchasing volume of retail

enterprises are not high, their purchasing costs and gross-profit margins can’t

compare to those of large-scale chain stores in Europe, the US and Japan.

By the end of 2009, Wal-Mart’s US market operation had 1.4 million employees

working in 4,364 stores, with a turnover of US$255.7 billion and a gross profit

of 23.7 per cent. In comparison, Lianhua Supermarket, China’s largest local

retailer, has 4,930 stores across the country, with about 53,000 employees; yet

turnover was about US$3.5 billion in 2009 on gross profits of 13.1 per cent.

Spending on the Rise

Nevertheless, consumer spending is on the rise, led by the development of areas

surrounding first-tier cities as well as second- and third-tier cities.

Expansion towards district-level commercial centers is now more feasible for

chain store and franchise operations, including supermarkets, convenience stores

and household appliance stores.

For the three mainland megalopolis, for example, the 2008 per capita GDP in

cities at and above the prefecture level stood at Rmb37,494, Rmb56,566 and

Rmb56,000 respectively, showing robust spending power.

The non-agricultural populations in cities under the jurisdiction of the three

major megalopolis were, respectively, 20.3 million for Beijing-Tianjin-Hebei,

30.9 million for the Yangtze River Delta and 18 million for the Pearl River

Delta in 2008.

Government initiatives such as the “thousands of villages’ market project,” the

“appliances to the countryside” and the “connecting farms with supermarkets”

campaigns have also created huge development opportunities for some large retail

enterprises and their suppliers.

Retail Enterprise Expansion

Urbanization has enabled megalopolis circles and city clusters to break free

from regional administrative restrictions, forming huge economic zones. These,

in turn, promote close collaboration between urban and rural areas.

Retail enterprises have been opening chain stores and franchises in peripheral

locations in recent years. Such groups and wholesale distributors are fast

expanding across geographic regions and in greater scale.

Carrefour is a case in point. In 2004, the French retail giant opened two stores

in Beijing, located on the Third Ring Road and Fourth Ring Road respectively.

Since 2006, Carrefour has expanded its business reach in Beijing towards large,

distant residential areas such as Tongzhou and Tiantongyuan.

New World Shopping Mall is another example. The retailer saw the saturation of

department stores in Beijing’s city centre and decided to expand operations into

the neighboring areas of Beijing – at the Apple Community on East Third Ring

Road, to attract new customers.

Intense market competition has also

prompted more retail enterprises to expand into second- and third-tier cities.

According to data from the China General Chamber of Commerce, trends for mergers

and acquisitions on a regional basis and expansion towards second- and

third-tier cities were well defined among the top 100 retail enterprises in

2009. Intense market competition has also

prompted more retail enterprises to expand into second- and third-tier cities.

According to data from the China General Chamber of Commerce, trends for mergers

and acquisitions on a regional basis and expansion towards second- and

third-tier cities were well defined among the top 100 retail enterprises in

2009.

For retail enterprises intending to expand within a region, chain store

and franchise operations boost operational efficiencies of scale, but also raise

cost efficiencies in logistical support as the number and density of stores

continue to grow.

Most retailers use centralized purchasing, which helps boost operational scale,

market coverage and the capacity of regional wholesale distributors. Although

there are only a few nationwide wholesale distributors on the mainland, regional

wholesale distributors show tremendous potential. Compared to nationwide

wholesale distributors, regional distributors are more knowledgeable about local

markets and have better relations with them. This is particularly useful for

further development and expansion.

Urbanization Promotes Consumerism

As the economy continues to grow rapidly, so, too, does the development of

tertiary industries, particularly services, in cities.

The value-added ratio of primary, secondary and tertiary industries in cities

above prefecture-level stood at 3.2:50.6:46.2 respectively in 2008. Compared to

1990, the ratio of tertiary industry has shown a 13.2 percentage point increase.

Increased work opportunities in the cities translate to tremendous income rise

for salaried workers. The per-capita disposable income of urban households rose

to Rmb15,781 in 2008, 9.5 times greater than 1990; even after adjusting for

inflation, the increase was eight-fold.

The theory of 19th century economist Ernst Engel comes into play when analysing

living standards on the mainland. Engel’s Law states that, with a given set of

tastes and preferences, as income rises, the proportion spent on food falls even

if the actual expenditure on food rises, propounding income elasticity of

demand.

This reflects the higher living standards of urban households, as supported by

Engel’s Coefficient, which falls as living standards rise, showing a drop on the

mainland, from 54.2 per cent in 1990 to 37.9 per cent in 2008.

Engel’s Coefficient for rural households also dropped, from 58.8 per cent in

1990 to 43.7 per cent in 2008. This shows an increase in income for the rural

labour workforce as it migrated towards non-agricultural sectors in the cities,

sparking a rise in rural living standards to a “moderately well-off standard of

living.”

Although there’s been continual growth in the actual expenditure on food,

including dining out, there’s also been a noticeable drop in average personal

expenditure. In contrast to the cost of food, expenditure on clothing and

essential daily supplies has shown a downward trend in households where total

incomes or total expenditure continued to rise.

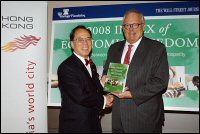

September 20 2010

Hong Kong SAR September 20 2010 - Hong

Kong remains the world’s freest economy according to the findings of the

Economic Freedom of the World: 2010 Annual Report released on September 20, 2010

by the Cato Institute. This marks the 14th consecutive year Hong Kong has topped

the ranking.

Hong Kong SAR September 20 2010 - Hong

Kong remains the world’s freest economy according to the findings of the

Economic Freedom of the World: 2010 Annual Report released on September 20, 2010

by the Cato Institute. This marks the 14th consecutive year Hong Kong has topped

the ranking.

Hong Kong Commissioner to the United

States, Donald Tong, welcomed the findings of the report, saying: “I am

delighted that the Cato Institute, in conjunction with other prominent research

institutions, once again recognizes Hong Kong’s staunch commitment to free trade

and the rule of law. Hong Kong Commissioner to the United

States, Donald Tong, welcomed the findings of the report, saying: “I am

delighted that the Cato Institute, in conjunction with other prominent research

institutions, once again recognizes Hong Kong’s staunch commitment to free trade

and the rule of law.

“Our adherence to the free-market philosophy has enabled us to weather the

global economic crisis and better position the city as an international

financial, business and logistics center.”

The Economic Freedom of the World report uses 42 different measures to create an

index ranking economies around the world based on policies that encourage

economic freedom.

Economic freedom is measured in five different areas: (1) size of government;

(2) legal structure and security of property rights; (3) access to sound money;

(4) freedom to trade internationally; and (5) regulation of credit, labor and

business.

The 2010 report ranks 141 economies using data from 2008, the most recent year

for which comprehensive data was available.

According to the report,

Hong Kong’s rating for economic freedom is 9.05 out of 10, followed by Singapore

with a rating of 8.70. The United States is the sixth-freest economy in the

world with a rating of 7.96. According to the report,

Hong Kong’s rating for economic freedom is 9.05 out of 10, followed by Singapore

with a rating of 8.70. The United States is the sixth-freest economy in the

world with a rating of 7.96.

The first Economic Freedom of the World report, published in 1996, was the

result of a decade of research by a team which included several Nobel Laureates

and over 60 other leading scholars in a broad range of fields, from economics to