|

Newsletter

Seminar Material

Biz:

China

Hong

Kong Hawaii

What people

said about us

China

Earthquake Relief

Tax &

Government

Hawaii Voter Registration

Biz-Video

Biz-Video

Hawaii's

China Connection Hawaii's

China Connection

CDP#1780962

CDP#1780962

Doing Business in

Hong Kong & China

Doing Business in

Hong Kong & China

| |

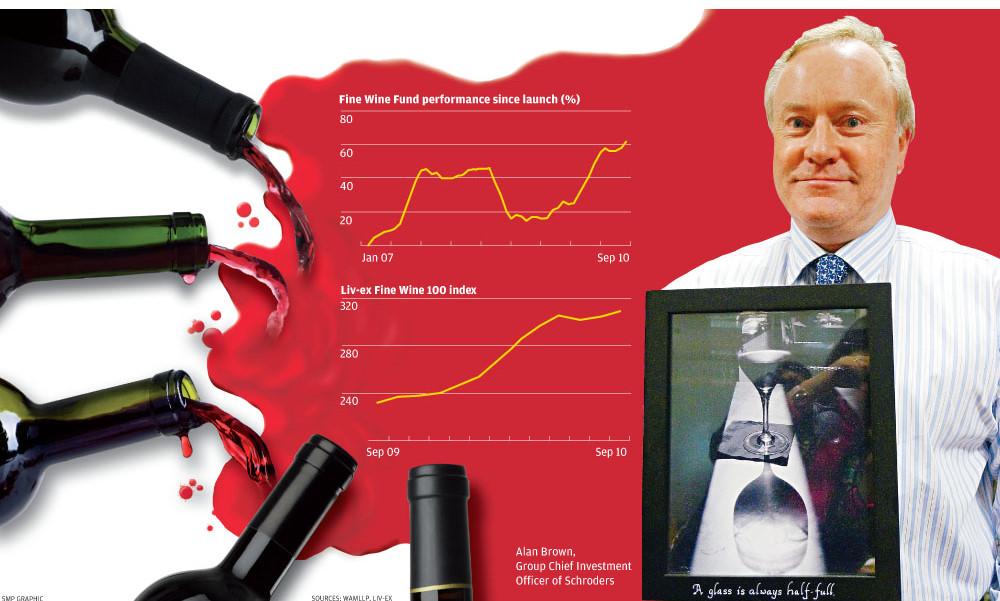

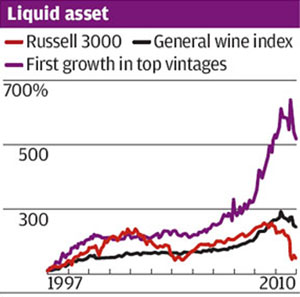

Wine Biz - Hong Kong

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our

event page to find out more! Wine Biz - Hong Kong

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our

event page to find out more!

Brand

Hong Kong Video Brand

Hong Kong Video

Basic Law of Hong Kong SAR Guaranteed One Country Two System for 50 Years

Hong Kong International Wine & Spirits Fair

- November 2011 - Contact

johnsonwkchoi@yahoo.com for more

information. Share

Hong Kong Reduce Wine Duties from 80%

to 0%: Beer, liquor, other than wine, with an alcoholic strength of not more

than 30% by volume measured at a temperature of 20 C 0% duties and

Wine 0% duties - for complete information: United States

Department of Agriculture (USDA) GAIN Report#1 Hong Kong Imports of U. S. Wine

Expected to Set New Record (Report#HK9013)

www.hkchcc.org/winegainreporthk9013.pdf and

Report#2 Export Guide Annual (Report#HK9022)

www.hkchcc.org/winegainreporthk9022.pdf

Contact DutyFreeWine@gmail.com

for

more information.

Wine Varietals Chart | Wine Types | Know Your Wines

http://www.winecountrygetaways.com/chart.html

Wine Varietals Chart | Wine Types | Know Your Wines

http://www.winecountrygetaways.com/chart.html

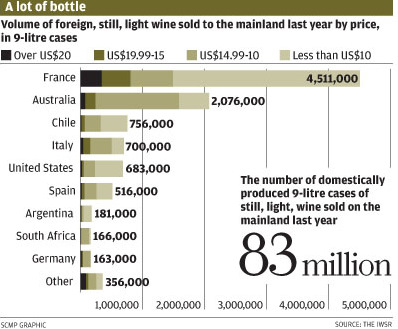

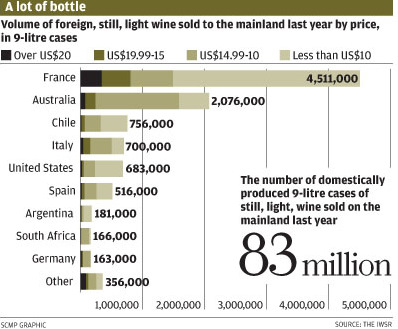

Wine Exports to China via Hong Kong

http://www.tid.gov.hk/english/import_export/nontextiles/wine/index.html

Wine Exports to China via Hong Kong

http://www.tid.gov.hk/english/import_export/nontextiles/wine/index.html

Natalie MacLean Wines http://www.nataliemaclean.com/ http://www.casamiawines.com Natalie MacLean Wines http://www.nataliemaclean.com/ http://www.casamiawines.com

Video - Hong Kong - the Wine Capital

of Asia Video - Hong Kong - the Wine Capital

of Asia

别以葡萄酒干杯

Don't Bottom-up on Red Wines http://vimeo.com/31761980 别以葡萄酒干杯

Don't Bottom-up on Red Wines http://vimeo.com/31761980

Pairing Food with Wines - Chinese wine making with Grapes http://vimeo.com/32361877 Pairing Food with Wines - Chinese wine making with Grapes http://vimeo.com/32361877

別以葡萄酒干坏 Red Wines are not meant to be bottom up (click on the picture to view the full

size article) 別以葡萄酒干坏 Red Wines are not meant to be bottom up (click on the picture to view the full

size article)

November 15, 2011

Penfolds Chooses Shanghai for Bin 620 Release By Gavin Lower

Penfolds’s Bin 620 will sell for more than $1,000

The last time Australian wine producer Penfolds made its Bin 620, a special blend of Cabernet Sauvignon and Shiraz grapes from the Coonawarra area, it was 1966, and it was partially foot-crushed.

Penfolds waited more than 40 years before it decided conditions were right to produce it again, and it is now gearing up to sell the 2008 vintage at 1,000 Australian dollars (US$1,018) a bottle, about double the price of the recent Grange, its most famous wine that’s produced every year. Thanks to rapidly growing Chinese demand, it’s launching the wine at Shanghai’s Waldorf Astoria on Wednesday.

“In Coonawarra we were blessed with a great vintage when the earlier-ripening Shiraz could be blended with the later-ripening Cabernet to highlight the best of both varieties, and their synergistic union,” Peter Gago, Penfolds’ chief winemaker, said in a statement.

Penfolds says it only releases limited bottlings of rare, “special bin” wines from exceptional vintages and only when the quality of its flagship Grange and Bin 707 wines are not compromised.

Special bin wines were first released in the 1950s during a time of research and experimentation at Penfolds. They are not produced annually and are only released if they offer “something extra, different and unique,” according to Penfolds.

So how does the Bin 620 taste?

Steve Lienert, senior winemaker, said it is “balanced as a young wine, but has serious cellaring potential, reflecting authenticity, scarcity and exceptional quality from a standout Coonawarra vintage.”

Nov 9 2011

California Dreaming

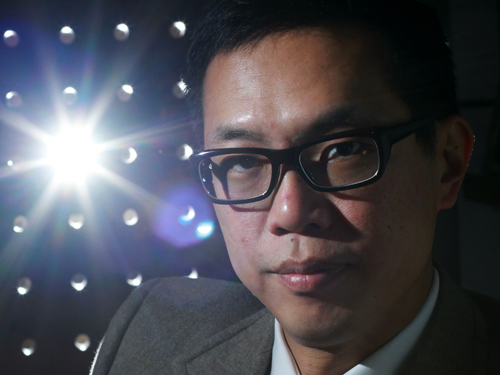

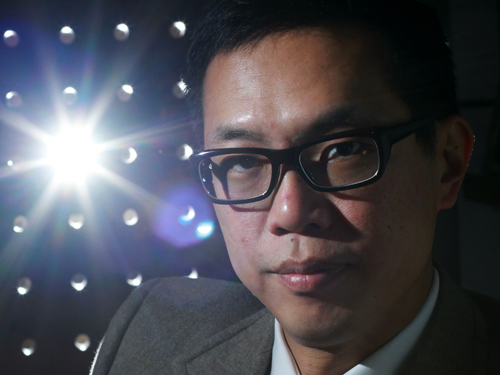

Caleb Ng (centre) set up Angeleno Wine Merchant with his brother, Joshua (right), and friend, Jason Ho

The abolition of Hong Kong’s wine tax three years ago has brought countless new business opportunities for local entrepreneurs with a passion for wine. Among them is Hong Kong-born, United States-educated Caleb Ng, who decided to meet an untapped demand for fine California wine.

“I found there weren’t very many choices of quality American wine in Hong Kong, so I came up with the idea of importing special wine products from California,” said Mr Ng, who initially planned to go into investment banking soon after graduating from the University of California in Los Angeles.

Instead, he set up Angeleno Wine Merchant in 2009 with his brother Joshua, and friend, Jason Ho, starting with HK$20,000 in seed money. Exhibiting at the HKTDC International Wine & Spirits Fair later that year, the entrepreneur said he met many new clients at the event. “That’s when I realised that being a banker might not be suitable for me. I had a great interest in the wine business, which looked very promising,” Mr Ng said.

California Drinking

Angeleno sources high-quality California wine, mainly from Napa Valley. Only an eighth the size of Bordeaux, the county is home to more than 350 wineries, producing about 10 million cases a year. Boutique wineries, however, produce only a few thousand cases a year.

Mr Ng focused on building partnerships with smaller wineries, such as Peterson Winery, which was started by a retired navy soldier who Mr Ng said insists on selling only high-quality vintage. “The wine produced in 2006 to 2008 did not live up to his expectation, so he didn’t export any wine from those years. I thought, ‘this is exactly the kind of partner I want to find,’” Mr Ng said.

Angeleno Wine Merchant retails wine from California’s famous Napa Valley

Other wine carried by Angeleno comes from vineyards and wineries located in nearby St Helena and Dry Creek Valley in Sonoma County. They include Zinfandel, Cabernet Sauvignon, Meritage (Bordeaux Blend), Chardonnay, Pinot Noir and other popular varietals. Angeleno now distributes 30 brands from eight wineries.

“I prefer to work with smaller wineries because they go through every process themselves, from selecting the soil, to planting, viticulture, harvest and marketing. To a certain extent, this is something that major wineries cannot compete with,” Mr Ng said, adding that smaller wine producers always put quality first.

China Strategy

Like many in the wine business, Angeleno has its eye on the fast-growing Chinese mainland market, where an expanding middle class no longer sees wine necessarily as a luxury. Mr Ng said the average price people are willing to pay there now has doubled, to about Rmb150 per bottle. But with American wine fairly new to mainland consumers, pricing is important when promoting new wine.

“It is difficult to sell a bottle of American wine for a few hundred Hong Kong dollars to someone who has never tasted this kind of wine,” he said. “But if the price range is between HK$100 and HK$200, they are willing to try.”

Consumers usually get double the value for the price of a fine American wine, according to Mr Ng. “In most cases, if you bought a $200 bottle, you are actually getting a $400 quality. For instance, one wine I sell, Eloge, is a really elegant, balanced and yummy wine. While I can't say it's cheap [at HK$660], you are definitely getting more than what you are paying for,” Mr Ng said.

Elvis and The Beatles

Caleb Ng, Director of Angeleno Wine Merchant, said wine start-ups should sample a variety of wine from as many countries as possible

Mr Ng promotes American wine by holding blind-tasting sessions. The company also reaches customers through social media, including Facebook and blogs; an iPhone app is being developed.

Mr Ng added that American wine pairs well with Asian cuisine. “Zinfandel, a signature grape grown in California, goes well with Cantonese cuisine,” he said.

While there will always be customers who prefer wine from other parts of the world, Mr Ng is philosophical when he says, “If they like Elvis Presley or The Beatles, we can’t force them to listen to pop music,” he said.

Staying in Business

The local market is set to get more competitive for distributors like Angeleno, as more US wineries come to Hong Kong to promote their products. But the company offers such extras as free delivery for any purchase above HK$1,000 and will make an effort to deliver for even less if it’s along the delivery route. The company also helps customers to source wines from small operators in countries such as Spain.

Two years on, Mr Ng has some advice for those who want to go into the potentially lucrative business: “Don’t ride on new brands without doing your homework. For me, research involves trying as many kinds of wine as possible, no matter if it’s from Thailand, Switzerland or Israel. That’s how I keep up with new trends, tastes and markets around the world.”

November 6 2011

Wine lovers toast record-breaking imports - HK$7.3 billion worth poured into the city in 9 months, following HK$6.98 billion for the whole of last year

By Dennis Chong dennis.chong@scmp.com

Visitors toast a new German brand of sparkling wine on offer at a booth yesterday. A total of 930 exhibitors set up shop at the Wine and Spirits Fair.

The curtain fell on Hong Kong's biggest wine and spirits fair yesterday as figures emerged showing that the city had already brought in a record-breaking HK$7.3 billion worth of wine in the first nine months of the year alone. It beats the HK$6.98 billion worth of wine imported for the whole of last year, the highest market-value figure at the time. Year on year, the third quarter results showed a 57 per cent increase.

The rise is put down to Hong Kong's development as a regional hub in the industry at a time when an increasing number of mainlanders are becoming wine drinkers and collectors.

Wine re-exported this year is expected to exceed 50 per cent of the overall imported wine in terms of volume, according to figures provided by dealer ASC Fine Wines, one of 930 exhibitors at the International Wine and Spirits Fair. Re-export volume has tripled since 2007 from 5.1 million bottles to 16 million last year - out of a total of 51 million bottles imported into the city.

"Hong Kong is edging towards becoming a hub for the alcohol trade," said Hong Kong Trade Development Council deputy executive director Chau Kai-leung.

The three-day wine fair at the Convention and Exhibition Centre also set its own records: 19,403 retail buyers - a 37 per cent increase from last year - and more than 19,690 visitors on the final day.

One of them, Christopher Britton, who was about to enter an Italian fine wine tasting session, said: "By tonight, we will probably be a little bit worse for wear."

Rich Xu, who runs a wine trading firm in Shenzhen, had some specific shopping in mind. "I have spent about 2 million yuan [HK$2.5 million] on wine futures, but here I am looking for some vintage wine," he said.

David Andrews, ASC Fine Wines general manager for Hong Kong and Macau, said that robust growth in the mainland market had been an enormous help for wine dealers based in Hong Kong.

The company's Hong Kong office is set to expand by 50 per cent in terms of manpower, he said.

Mainland demand is "higher than the amount the French can produce", Andrews said. Last year, Hong Kong imported 35 million bottles of wine for local consumption.

Andrews cited a study by wine expert Debra Meiburg showing that more than half the wine consumed in Hong Kong is priced at less than HK$300 per bottle.

October 3 2011

Burgundy Outshines Bordeaux at Auction By Jake Lee

Twelve bottles of Domaine de la Romanée-Conti sold for more than $100,000.

Move over Lafite: Burgundy is the new star of Asia.

Sotheby’s rounded out a monthlong slew of wine auctions in Hong Kong this weekend, beating estimates and selling 99.1 million Hong Kong dollars (US$12.7 million) over two days.

The very highest prices went to Burgundy’s Domaine de la Romanée-Conti, increasingly treasured by Asia’s top collectors. In contrast, prices of Bordeaux’s Château Lafite-Rothschild fell, and some lots didn’t even sell, ending a record-breaking run for Sotheby’s in Hong Kong. Over the past two years, the auction house has scored 16 consecutive sold-out sales, also known as “white glove” auctions.

“Prices are coming off for sure in Lafite,” said Jason Ginsberg, who attended the auctions and is owner of Ginsberg+Chan, a fine wine merchants based in Hong Kong. “The shift in buying patterns is changing very quickly.”

Domaine de la Romanée-Conti, or DRC, “is the one name really recognized in China,” he added, “and when they think of Burgundy, the first thing they think of is DRC.”

While Sotheby’s was primarily selling top red Bordeaux, traditionally Asia’s favorite, Mr. Ginsberg said, collectors are quickly diversifying.

The top four lots at Sotheby’s were individual cases of 1988 DRC Romanée-Conti, with the first set of 12 bottles won for HK$907,500, followed by a case of Château Pétrus 2005 sold for HK$532,400.

“We’ve seen a steep rise in prices and now a small decline, and we’ll now see a more stable market with more consistent prices,” said Sotheby’s auctioneer Jamie Ritchie, adding that the room was full on both days of sales. “Bordeaux is a staple of auctions — though we love selling Burgundy, there’s just less of it around.”

Mr. Ritchie said it will be hard to sell more Burgundy, given its rarity, and expects overall supply of wine at auctions to slow as prices moderate.

Saturday’s sales were part of an auction called “The Classic Cellar From a Great American Collector,” while Sunday’s sale included “The Ultimate Nine From The Bordeaux Winebank Collection.” Those are bottles with guaranteed provenance coming from the five so-called First Growths — Lafite, Mouton Rothschild, Margaux, Latour and Haut-Brion — plus Pétrus, Ausone, Cheval Blanc and D’Yquem.

September 6 2011

Chateau Lafite Sale Tops $500,000 By Jake Lee

A phone bidder from China took home 300 bottles of Château Lafite-Rothschild, the most expensive single lot this year.

Bundled into a single lot, 300 bottles of Château Lafite-Rothschild sold over the weekend for $539,280 to an anonymous Chinese phone bidder at a Christie’s auction in Hong Kong, making it the most expensive single lot this year and boding well for a slew of autumn sales in the city.

While normal lots in top-tier wine auctions are typically made up of around a case, Lot 44 comprised 25 cases of Lafite from every year between 1981 and 2005, averaging around $1,800 a bottle. The entire two-day sale raised $7.6 million, with Burgundy’s Domaine de la Romanée-Conti, Moët & Chandon champagne from 1911, and Bordeaux’s ultra-rare 1982 Le Pin making up other top slots.

“It was an extraordinary Lafite collection, and the seller actually trades wine for a living,” said Christie’s Charles Curtis, head of wine for Asia, who estimated the vendor received a 20% premium by selling it as a multi-year collection, or vertical. “We had several bidders, and they were all from China, and they are just getting into wine.”

Zachys kicks off next with a two-day sale this weekend at the Mandarin Hotel, forecast to raise $10 million, and joins Christie’s in selling verticals (also called instant collections), albeit on a lesser scale than the 300-bottle Lafite extravaganza. Examples include a set of 48 bottles from various years of Bordeaux’s Château La Mission Haut Brion, and 28 bottles plus a magnum from Napa Valley’s Shafer Vineyards.

These bottles can be used to “host a lavish evening with an incredible wine tasting, expand your palate into truly understanding the depth and breadth of some of the best wineries, or highlight these verticals as a centerpiece in your collection,” says Zachys.

Acker Merrall & Condit is holding a two-day, $10 million-plus sale on Sept. 16 and 17, with Burgundy wines ranking as the most expensive lots. It will sell an extensive array from Champagne’s tiny producer Salon, including a single 1955 bottle valued at up to $3,000 — an unusual offer for Hong Kong, which tends to prefer red wines.

The auction house is also selling sets of highly collectable Château Mouton Rothschild, which selects different artists each year to design its label. Lot 799 offers a single bottle from almost every year between 1958 and 2007, for a top estimate of $45,000.

Similar to other auctions, a champagne brunch awaits bidders attending the Grand Hyatt for Spectrum Wine Auctions’ sale on Sept. 23 and 24, featuring Bordeaux and Burgundy.

Ending the monthlong series of sales is Sotheby’s two-day, $11 million sale in early October, with highlights including a sale of Bordeaux’s “Ultimate Nine” that uses the “Five Star Provenance” system — wines directly from the châteaux, stored in professional storage throughout their lifetime, and kept in original wooden cases with tamper-proof seals.

August 23, 2011

Luxury Wine Site Launches By Jay McInerney

This past May, Gilt.com, the highly addictive discount luxury shopping site, launched Gilt Taste, featuring a selection of artisanal and specialty foods like Murray’s Cheese, D’Artagnan Serrano Ham and wild morel mushrooms.

The editorial director of the site, which features food journalism, videos and recipes is none other than Ruth Reichl, the former Gourmet Editor in chief and New York Times Restaurant critic.

Now comes Gilt Taste Wines, a selection of bottlings from small estates in France and California, including some mailing-list rarities like the 2008 Bryant Family Cabernet Sauvignon.

Gilt Taste Wines launches today with some sixty wines selected by a tasting panel that included Reichl and Master Sommelier Laura Maniec and Joe Campanale, owner and beverage director of L’Artusi, dell’anima and Anfora.

Among the offerings from the initial list that caught my eye: the 2006 Derenoncourt Napa Valley Cabernet Sauvignon, as well as the ’06 Cabernet Franc and Merlot from famed Bordeauz winemaker Stéphane Derenoncourt, his first American wines. Only 100 cases of the cab were made.

Two other rarities are the 2004 and 2005 Chateau Valandraud Blanc de Valandraud, from the garagiste St. Emilion producer known for its merlot-based reds.

Although the initial list seems heavy on Napa cabs, there are at least two serious Pinot Noirs, the 2009 Freeman Keefer Ranch Pinot Noir as well as the 2009 Freeman Sonoma Coast Pinot Noir—which have been featured on the wine list at Daniel and the French Laundry.

The list skews toward the expensive and rare end of the spectrum, although there is a $12 rose from Chateau de la Selve among the initial offerings.

The Gilt Taste editorial team will offer suggested food pairings for each of the wines on offer.

August 13 2011

Rosé the Royals (and Obamas) Drink By Jake Lee

Britain’s Queen Elizabeth, center, Prince Philip, right, and U.S. President Barack Obama, left, toasted during a banquet in London.

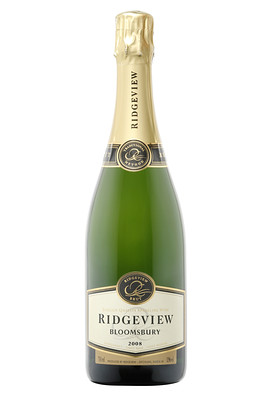

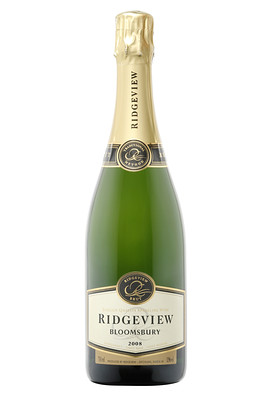

It was friends, not Buckingham Palace, who first told English winemaker Simon Roberts that his sparkling rosé was going to be served to U.S. President Barack Obama earlier this year at a state banquet hosted by Queen Elizabeth II.

“We got an email and a text saying congratulations,” said Mr. Roberts. “We had no idea. Then we saw everyone was saying it on the news.”

Then a little worry set in: The wine to be served was 2004 Ridgeview Cuvée Merret Fitzrovia Rosé from the Royal cellars, which Mr. Roberts had sold out of two years ago and typically recommends be drunk within five years. “We were all thinking, ‘What was it going to taste like?’ But it was excellent, and it did hold up well,” he said.

Based in the rolling hills with chalky soil of the south of England, between London and Brighton, Ridgeview is one of six main English sparkling producers riding high, garnering serious praise and awards. Many producers use identical grapes and methods to Champagne and even share similar soils, but are unable to use the name given legal restrictions.

“The quality equals Champagne, and we’re emulating somebody else but putting our own stamp on it,” Mr. Roberts, who emphasizes tastes of strawberry notes in his wines compared to red currants in Champagne, said this week while visiting Hong Kong. “A lot of people look at it and say ‘It is like New Zealand 25 years ago.’”

Less than a year before Mr. Obama was sipping the fizz at Buckingham Palace alongside royalty and other VIPs, the family-owned-and-run winery had won Decanter’s 2010 world’s best sparkling wine award, beating top Champagne names such as Charles Heidsieck and Taittinger.

England’s strength in sparkling rather than still wines appears entirely apt, given English scientist Christopher Merret documented sparkling wine’s invention in the 17th century, years before the date French marketers now credit French Benedictine monk Dom Perignon with the invention of Champagne.

Ahead of the 2012 London Olympics, likely to boost demand for English wines, Mr. Roberts is eager to cement the reputation of his wines abroad. In Asia, the Japanese are showing particular interest, with tourists regularly turning up at the picturesque Sussex tasting room overlooking vineyards that produce some 350,000 bottles annually. Berry Bros. & Rudd in Hong Kong has begun stocking a range of three wines, starting at 230 Hong Kong dollars (US$29) a bottle.

Unlike many other visiting winemakers in Hong Kong and Asia who push the wines’ matching ability with Asian food, Mr. Roberts says his are a lighter, refreshing style, and work best as an aperitif given the high acidity that makes them dry.

Still, of all wines, fizz is the most versatile with food, and Mr. Roberts says Ridgeview’s Cavendish, a blend of the three Champagne grapes, works well with Thai food, while the entire range works well with Japanese.

August 12 2011

Is the World Ready for Chinese Baijiu? By Kristiano Ang

Diageo wants to expand the audience for Shui Jing Fang, a premium Chinese liquor, beyond China.

Baijiu isn’t for the easily tipsy. Richard Nixon’s advisers famously tried to keep the president away from the strong Chinese liquor (baijiu translates as “white spirit”) at state dinners during his first visit to China in 1972.

That didn’t stop Diageo, the world’s largest spirits producer, from in June acquiring a majority stake in Shui Jing Fang, a premium baijiu label. Now Diageo is seeking to modernize the brand and take it beyond China and Hong Kong.

It’s starting with Singapore, where it launched Shui Jing Fang last month. It has found distributors in Los Angeles and will be launching in Australia next year, says Lee Harle, Diageo’s general manager for Chinese white spirits.

Even outside China, Diageo is focused on the overseas Chinese community, he says, pointing out that Diageo also sells Shui Jing Fang at duty-free shops in 14 airports around the world. “We’re planning to go where [Chinese] business travelers go,” he says.

But will baijiu be a hit abroad, where it is much less common at banquet tables and with the second- and third-generation customers that Diageo is targeting in its overseas expansion?

Mr. Harle is confident it will. “Baijiu hasn’t been explained or distributed well” outside of mainland China, he says.

“Just like people will not accept factory-made mapo tofu,” a popular Chinese dish, he says, “they no longer want the Disneyland version of [baijiu].”

Some experts agree. Ron Taylor, an independent tutor who lectures at the Fine Wine Centre in Hong Kong, has seen some interest in rare Maotais, but it “stays within the Chinese community,” he says. “There is a big gap in explaining the complexity of the various baijiu in a serious manner.”

Shui Jing Fang, which traces its history back to 1408, has deep roots in China. In 2000, one of its distilleries was named China’s first by the Chinese National Cultural Relics Bureau. But the company holds only a 1% stake in China’s $41 billion baijiu market, trailing better-known competitors like Moutai. (Shui Jing Fang has a higher market share in the premium baijiu market, which only a fraction of China’s 18,000 baijiu makers belong to.)

Shui Jing Fang’s makers have taken tentative steps to expand its audience in the past. In 2009, Diageo teamed up with Shui Jing Fang to produce Shanghai White, a vodka made with Russian and Chinese techniques. Around the same time, it started selling variants of Shui Jing Fang baijiu in Hong Kong. In Singapore, a 500-millileter bottle of its main Wellbay 52% collection retails for about 168 Singapore dollars (US$138).

The volume of Shui Jing Fang baijiu sold in duty-free outlets in Asia has quadrupled in the last two years, Mr. Harle says. “International sales are meaningful now,” he adds, and make up 10% of all the spirit’s sales.

One thing’s for sure: Diageo will be facing stiff competition. In 2007, luxury group LVMH Moet Hennessy bought a 55% stake in Wen Jun, a baijiu distillery, for 960 million yuan. Pernod Ricard also has a stake in a Chinese baijiu maker.

August 6 2011

The Tasting Room: Your Golden Opportunity By Blender of Premier Wine Blends

Often winery owners have chosen to get into the business because they are passionate about wine and making wine, but interestingly they haven’t stopped to think and plan how to sell the wine AND make the winery profitable. It takes more than a good winemaker to establish a success winery. There are multiple facets to consider: growing grapes and harvest, making wines you can sell (not necessarily that you like), branding, marketing, the tasting room, sales (possibly different channels), distribution, events, etc.

Today, we are talking about the Tasting Room. Occasionally, you, the winery owner, realizes that the tasting room is your golden opportunity to welcome guests, show off your wines and send them home happily with a few bottles, a memory worth talking about with friends and a reason to revisit. However, more often what happens is that the passionate winemaker turned winery owner, looks at the tasting room as something that “just goes with the territory” of owning a winery. It’s an after thought without a real plan for success. Wherever you may fall between love and perhaps a laissez faire attitude toward the tasting room, this point of interaction with your customer is critical for your success. The tasting room is your biggest opportunity to expose guests to your wine, make an impression and gain customer loyalty for years to come. Either you can do it right and create a business of abundance or you can take on the “make it and they will come” model, which will result in lots of great wine, but with minimal market exposure and low sales. This blog is directed to those who are up to making good wine…AND money!

We caught up with Paul Wagner, author of “Wine Marketing & Sales” and president of Balzac Communications, to discuss tasting rooms and creating a market for your wine. “The tasting room is only second to the label in branding your wine. The biggest mistake owners make regarding their tasting room is making do with what they have instead of creating what they need.” The plan many owners have is to sell wine, make money and add on or remodel as they grow. However, Mr. Wagner argues that every time the tasting room needs to be updated or changed, the message being sent to your customers is: you don’t know what you are doing. Yet you still expect them to buy your wine!

And of course, they will buy your wine. They will love it and come back! The wine is good and that is why they are visiting, right? Well…not so fast. You may be surprised to find out that people do not actually visit wineries to find great wine. “They come for the experience,” states Mr. Wagner. From the drive up to the tasting room to the greeting, ambiance of the room to having an authentic interaction with the servers, “Your customers should feel like guests in your home, rather than religious disciples. A tasting room is a business, and everyone’s job in the tasting room is to sell wine – not just entertain people. Measure the success of your tasting room by sales, not by the smiles on their faces. Each customer goes to a winery with a certain amount of money in mind that they are willing to spend. Did you listen to what they wanted? Did they buy your wine? If not, why not? Whose DID they buy and why?”

Most prospective winery owners take viticulture and enology classes, and later realize they should have taken their marketing class first! Now they have all these grapes and bottled wine and don’t know how to sell them.” Paul Wagner

Now, let’s look at a winery that was conceived and built from the beginning to be a viable business – Flat Creek Estate in the Texas Hill Country. Madelyn and Rick Naber, opened their winery in 1998 with the intention that the winery be successful and profitable. As Madelyn said “Deciding to open a winery wasn’t romantically involved. It was the business plan that made sense.” Located in Lago Vista, 45 minutes away from any other winery, they had to create a destination for the visitor. Madelyn says they joined the Texas Hill Country Wine Trail to gain exposure to those looking for wineries. From there, they started building their winery with the customer experience in mind. The road winds through the vineyards up to the winery built from Texas limestone and river rock, creating anticipation for what is yet to come. Guests are welcomed within 30 seconds of arrival and the warm colors of golds, reds and browns make them feel right at home as their experience begins. Focused on fun, customer service, education and quality wine, guests are guided down the stair case overlooking the production area and tasting room, where they are paired with wine pourer who visits with guests about what they like and are then able to suggest wines to suit their palates.

When asked what sets Flat Creek apart from other wineries, Madelyn states “Attention to a quality wine, personal customer service and building relationships. We strive to make everyone feel very welcome. We want them to come back again and again. One way we do that is to have them participate in the winery, such as planting and harvest. We also host a wine dinner the first Saturday of every month. Guests were soon asking to hold special events out here on the grounds. Next we needed a backup for inclement weather, so we built a pavilion for private events and weddings, along with a little bistro for them to continue their enjoyment of the day.”

“The people are not a part of the story. They ARE the story. What allows us to be here, is you (the customer) being here. Our success is about others.” Madelyn Naber

When asked what it takes to build a successful winery, Madelyn says “It’s really common sense. Have a business plan and know where you are going. Every year review where you are now, where you want to be, and how you are going to make that happen. From a financial side, we are always looking at the bottom line. Fifteen years later, the plan still has to work.”

Paul and Madelyn have aptly shown us that establishing a successful winery with continued increase in sales and customer loyalty is directly correlated to the experience your customers enjoy while visiting your tasting room. Before you build is the best time to ask yourself some important questions. See a previous blog “Ask the Right Questions” to lay the foundation for your success. But if you are one of the many who did not build your tasting room and winery with the customer experience in mind, there is no time like the present and we would be happy to assist.

7 Points to Take Away From the Experts

1. It takes more than a good wine maker to establish a successful winery.

2. The tasting room is only second to the label in branding your wine.

3. Creating a memorable experience is imperative to distinguish yourself.

4. Listen to what your customers want.

5. Measure the success of your tasting room by sales, not by smiles.

6. Your customers are THE story.

7. Have a business plan and know where you are going.

Premier Wine Blends provides custom solutions for your winery.

Finely crafted wine blends, consulting and local premium bulk wine sourcing Premier Wine Blends

888-767-7442

July 26 2011

Bottle of White Sells for Record $117,000 By Jason Chow

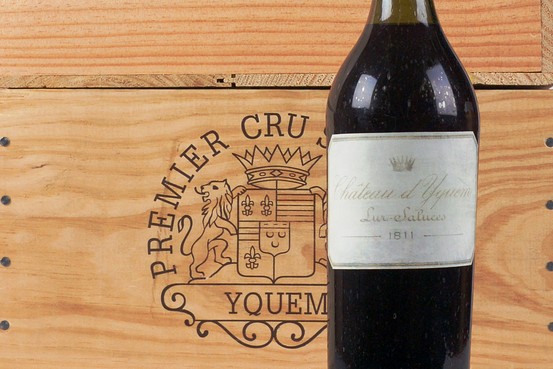

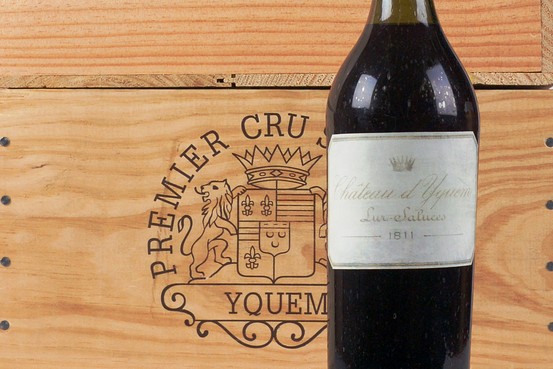

A 1787 Chateau d’Yquem sold for $117,000, a new record.

Christian Vanneque fulfilled a long-held dream today by finally getting his hands on a bottle of 1811 Chateau d’Yquem. It just so happens that his $117,000 purchase has also put him in the history books.

His prized bottle is the most expensive white wine ever purchased, breaking the previous record of $100,000 in 2006 for a bottle of 1787 Chateau d’Yquem. Mr. Vanneque’s bottle is also a sweet Sauternes from the same Bordeaux chateau, though his purchase was produced in 1811, a year also known as the “comet year.” Oenophiles throughout history attribute the appearance of a comet for the reason why wines were extraordinary that year.

Mr. Vanneque is a former sommelier at the Paris restaurant La Tour d’Argent and one of the experts at the Judgment of Paris wine tasting in 1976 that pitted the top French and California wines against each other. He unveiled the bottle at a London press conference on Tuesday, jointly held with Steven Williams from the Antique Wine Co., which sold the wine.

“For sure, it’s the most expensive bottle I’ve ever bought,” Mr. Vanneque said in an interview.

He now lives in Bali, Indonesia, where he runs SIP Wine Bar. He said that he plans on using the bottle of D’Yquem as a promotional tool for his new venture, SIP Sunset Grill, which is due to open later this summer.

“It will be featured and displayed in a bulletproof showcase, like a painting, so people can see it easily,” Mr. Vanneque said. “This showcase will be temperature- and humidity-controlled. It’ll be a mini-Fort Knox, impossible to open.”

Antique Wine’s Mr. Williams said the bottle came into his possession in 2007 after he bought the entire cellar of a major European private collector. His firm took pains to verify the wines’ authenticity, focusing on the glass of the bottle, the color of the wine, the label, the cork and capsule surrounding the cork. The wine was also inspected by the Chateau, where it was taken for recorking in 2007.

“We looked at the components, and they all compared exactly to [the originals],” he said. “It’s in immaculate condition, which is quite remarkable given that it’s already 200 years old.”

Mr. Vanneque said he doesn’t plan on selling the bottle at his new restaurant, but has marked in his calendar to drink it in 2017 at La Tour d’Argent in Paris to mark the 50th anniversary of his career.

Christian Vanneque, who runs a wine bar in Indonesia, said he’ll never resell the bottle.

The wine is still very drinkable, he added, unlike a red wine of that age. The same 1811 vintage has received accolades in modern times: The U.S. wine critic Robert Parker tasted the wine in 1996 and gave it a 100-point rating, saying it tasted like “liquefied crème brûlée.”

“I will never resell it, even if a wealthy Chinese gentleman or a rich man from the Middle East offers to buy it,” said Mr. Vanneque. “I’m not a fancy collector. I’m not rich. I work very hard. This is important that it’s not connected to investing. I’m a sommelier. Wine is for drinking.”

July 24 2011

How to Read a Wine Label By Will Lyons

Wine labels can be a little like cryptic crosswords: unfathomable, infuriating and intimidating.

Browsing the shelves of one of my favorite local wine merchants, a cozy little shop in London where the wines are stacked in bins that stretch from the floor to the ceiling, I was faced with a scrambled collage of labels. There were wines with chickens on the label, wines with etched drawings of Neo-Gothic houses, brightly colored Impressionist-style labels, watercolors depicting far-off vineyards or simply the name of a French village written in attractive, bold font. Some wines had the name of the grape variety clearly marked across the label, but on the whole the display presented a pretty mysterious picture.

Perrin & Fils, Rhône Valley, France; Vintage: 2007; Alcohol: 14.5%; Price: About £16, or €18; To those unfamiliar, this label is wonderfully cryptic. Let me talk you through it. Vacqueyras is the name of the appellation that lies between the villages of Sarrians and Vaison la Romaine in southeastern France. The producer is Perrin & Fils, who made their name with the famous Châteauneuf-du-Pape wine, Château de Beaucastel. In short, they are one of the most reliable wine producers in the Rhône and a name to look out for. The blend is 75% Grenache and 25% Syrah, and it is exquisite. The nose is joyous, with supple notes of raspberry, blueberry and blackberry, while the finish is intense and powerful. A wonderful wine to accompany roast meats, stews and hearty foods.

No wonder most people were wandering around in silence, I thought, afraid to reveal their lack of knowledge. The subject of wine can reward a lifetime of study, but for those coming to it for the first time, it must feel like a puzzle.

The good news is that armed with just a few simple rules, you can decipher the most complicated of wine labels, helping you avoid the pitfalls of confusing a sweet with a dry wine or a full-bodied red with a light, fruity Beaujolais.

Of course, there are myriad exceptions. But when it comes to European wine, the first puzzle to solve is that wine producers use location as the descriptor of the taste, style and character of a wine, and not grape variety. If it says Burgundy on the label, it will be a Chardonnay if it is white, or a Pinot Noir if red.

As a rule of thumb, the more specific the location, the higher the quality of wine. For example, Meursault in Burgundy is the name of a village with a particularly strong reputation for producing Chardonnay. Saint-Émilion is a village outside of Bordeaux, whose neighboring vineyards are known for producing blends of Merlot-dominated red wine. So a wine with Saint-Émilion on the label will be more interesting than one that is labeled as a generic Bordeaux. Every region uses a specific blend of grape varieties, which, with a little application, one can learn.

The year the wine is made is referred to as the vintage. Most wine is made to be drunk straight away, certainly within five years of its bottling. Fine wine benefits from bottle age, as it develops tertiary characteristics and more mature, complex flavors. These wines can be cellared for 10 to 20 years.

The numbers on the bottom right-hand corner of the label are the alcohol percentage. Labeling rules can vary by country, granting the winemaker a tolerance of around 0.5%. So it's worth remembering that if it is as high as, say, 14%, it could actually be 14.5%. Regular readers will know that I favor drinking wines with an alcohol level of 11%-13.5%, which sadly, due to modern viticultural practices that favor a fuller, riper style, are becoming harder to find.

Labels also offer a slew of other information, from the name of the individual vineyard and the winemaker, to whether the wine has been bottled at the winery, to whether it has been produced from old vines, or "vieilles vignes" (older vines produce fewer grapes, with more concentration and flavor). All of these tend to suggest the wine has been made by an individual winemaker from fruit grown in the estate's vineyards.

Aside from the label, one can also identify European wine by looking at the shape of the bottle. All Bordeaux wines come in a high-shouldered, straight bottle. The glass is green for red wine and clear for white. Speaking generally, outside of France, these high-shouldered bottles are used for a plethora of styles, including Cabernet Sauvignon, Merlot and Malbec.

Gently shouldered bottles are found in Burgundy, the Loire and the Rhône. Outside of France, these are also—but not without exception—used for bottling Pinot Noir and Chardonnay.

Long, thin bottles are used in Germany and Alsace. These invariably contain Riesling, Pinot Gris, Pinot Blanc and Gewürztraminer. In Germany, green bottles indicate the wine comes from the Mosel, and brown from the Rhine, where the wines tend to be drier.

These general guidelines will help in understanding a wine label and, more importantly, take you a step toward solving the perennial puzzle—how good is this wine?

July 20 2011

Hong Kong Wine Buyers Look Online for Lafite and Latour By Jake Lee

Traditional wine auctions remain popular in Hong Kong and elsewhere in Asia, but online sales are making inroads

As Hong Kong’s glitzy hotels play host to ever more wine auctions, with furious paddle-waving and Asian bidders showered with samples of expensive bottles, a new battle for sales is taking place online.

Anonymous bidders, identified by screen names like “LAFITE4EVER” (referring to Asia’s favorite, Château Lafite-Rothschild) are buying from the near-constant Internet-only sales offered by the likes of Acker Merrall & Condit, America’s oldest wine shop, and California-based Spectrum Wine Auctions.

Compared with traditional sales events, Internet auctions typically offer smaller units of sale (a single bottle, for example, rather than a case) and less-expensive wines. That means online bidders are unlikely to be the trade buyers and investors that crowd live sales.

“It’s the drinking man’s auction, and it’s a great way to get educated,” said John Kapon, president of New York-based Acker, which runs monthly online-only sales. “There’s still a lot of overlap between the Internet and live, but the Internet sales allow us to offer items we can’t offer in the live auctions.”

Spectrum runs online-only sales every two weeks, with bottles sold for as little as $1 and as much as $10,000 for a case of Bordeaux’s Château Latour. Still, that price pales in comparison with live-auction hauls like the case of Lafite 1982 sold for $77,675 at Spectrum’s wine auction last month in Hong Kong.

For those unable to attend live sales in Hong Kong or elsewhere, most other houses offer real-time online bidding during the auctions, sometimes with streaming video of the auctioneer. Online-only sales, however, allow bidders to buy between the live sales.

“We have a continuous flow of wine always online,” said Spectrum President Jason Boland, who noted that Spectrum’s last online auction garnered 5,000 bids for around 2,230 lots offered.

Spectrum and Acker both said it’s faster to send wine to online buyers than the winners of live sales because of easier logistics. Spectrum plans to launch an application for Apple’s iPhone by the end of the summer so people can bid while away from their computers, and Acker expects to overhaul its website later this year to accommodate increasing demand.

Live sales aren’t going away any time soon. Acker plans to raise a record $10 million from the Internet this year, yet a single live sale can exceed that. Spectrum said Internet sales are growing fast but account for only 5% of its business so far.

July 15 2011

Buyers Beware of Wine Gone Bad By Jay McInerney

I love white burgundy, and Meursault, which I write about in this week’s column, is perhaps the easiest of all white burgs to love. It’s fleshy, nutty and generally less austere than Puligny or Chassagne.

However, it’s no longer possible to ignore the fact that, with regard to the white wines, something’s rotten in the Cotes de Beaune.

One of the great glories of white burgundy is its ability to develop with age, or at least that was what we always used to love about it.

But starting with the 1995 vintage, many white burgundies began to age prematurely, developing sherry-like oxidative flavors and color after just a few years in bottle. The 1996 vintage was supposed to be a great, high-acid, long-lived vintage, but in fact many whites from that vintage turned out to be over the hill long before they were supposed to be hitting their peak.

Unfortunately, I bought a quite a few, and I have poured quite a few of those down my sink. I’ve also had trouble with the 1999 and 2002 vintages, as have many of my burg-loving friends.

At a wealthy friend’s invitation I recently attended a dinner at which a 2002 Domaine Romanée Conti Montrachet was poured. DRC Montrachet is the most coveted and expensive white wine in the world. Unfortunately, at least two of the bottles served, including the one at my table, was oxidized, although several of the sommeliers and collectors present chose to pretend otherwise.

Starting with the 1995 vintage, many white burgundies began to age prematurely.

Perhaps if I’d actually paid for my ticket, I might have tried to convince myself the wine was just fine. (Of course, “fine” isn’t good enough for a bottle that sells for about $5,000).

After years of denial, many white burgundy makers are beginning to face up to the problem. Unfortunately, multiple explanations have been put forth, and there doesn’t seem to be a single simple solution. Among the possible culprits are the following:

Decreased use of SO2. In the mid-nineties, there was a movement toward so-called natural wine-making, and many white wine makers decreased their use of sulphur, which has been used for centuries as a preservative, i.e., an anti-oxidant in white wine.

Increased practice of batonnage: Batonnage is the practice of stirring the lees, or sediment in the bottom of the barrel. Some winemakers say it creates a richer wine, but now others are questioning whether it doesn’t introduce too much oxygen into the wines Cork defects: Allegedly, some cork makers changed the coatings and treatments of their corks in the mid-nineties. According to several winemakers, the manufactures switched their antibacterial regimen, substituting hydrogen peroxide for chlorine in an attempt to counter TCA, a bacterial taint. This theory has it that hydrogen peroxide in the cork interacts with the wine and oxidizes it. Others say that the cork industry switched coatings, from paraffin to silicon.

Bladder presses: About the same time that the problem appeared, many white wine makers were switching to more gentle presses, which extracted less of the anti-oxidative solids (phenols) in the grapes.

Here’s a comprehensive look at some of the latest thinking from some of the most knowledgeable drinkers.

Many wine makers have been changing and refining their practices. We can only hope that the problem will eventually be solved once and for all.

In the meantime, caveat emptor.

July 8 2011

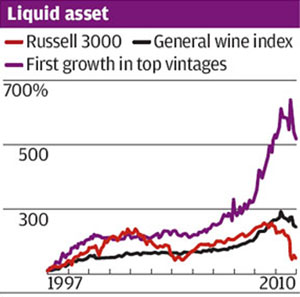

The Rising Price of Bordeaux By Will Lyons

It's been 12 years since I started taking a serious interest in Bordeaux's en primeur market. Back then, when I was just starting out in the wine trade, the top wines—Château Lafite, Latour, Mouton Rothschild—were around £90 a bottle, or £1,080 a case.

If the price increases in Bordeaux have become too much, one region to switch to is the Rhône Valley, where luscious reds made from predominantly Syrah and Grenache still offer compelling buying. The Côtes du Vivarais is a case in point. A small appellation, it sits in the northwest of southern Rhône, where blends favor the Grenache grape. Notre Dame de Cousignac is a historic property, with a 16th-century chapel nestled among its vineyards. Their red wine is unoaked, so the palate isn't overwhelmed. In the glass, it sits dark, with juicy, supple fruit that has immediate appeal and is gloriously easy to drink.

As a young graduate, I remember thinking that £90 was an awful lot of money to spend on a bottle of wine and used to suggest splitting the cost with a handful of friends in order to "educate our palates," as we rather pompously referred to it. At the time, this exercise would only require six of us putting in £15 each for a glass of one of Bordeaux's best wines. Today, that same practice would cost us around £85 each.

Since April, when I first wrote about Bordeaux's much lauded 2010 vintage, most of the prices have been released. To buy a bottle of Château Lafite Rothschild 2010, one now needs £1,000, or £12,000 for a case. If we wanted to taste a comparable vintage with bottle age, say the 2000 vintage, we would have to pay around £2,000 a bottle, or £23,000 a case.

I'm not sure any of my friends, then or now, would want to stump up the required £333 for a glass—even if it is reputed to be one of the greatest wines produced by one of the region's most distinguished châteaux.

Reading through the press coverage of Bordeaux vintages over the past 12 years, I was struck not only by the phenomenal price increases but also by the consistency of outrage expressed by the British wine trade. In 2002, the Times of London said U.K. wine traders were threatening to boycott the en primeur campaign if the Bordelais didn't reduce their prices. This came on the back of anger over the price of the 1997 vintage and has been followed by similar complaints, forming a predictable pattern that even now falls true to form.

Unlike previous years, such as 1997, the 2010 Bordeaux is unquestionably a great vintage, certainly holding its own against other good years such as 2000, 2005 and 2009.

It is a vintage with high levels of alcohol, tannin and acidity. The Cabernet Sauvignon and Cabernet Franc handled last summer's heat well, giving the wines extra lift and freshness. And now we have the prices to match.

After the increases of 2005 and 2009, many buyers and critics thought that prices couldn't go higher. But guess what? They have, and in some cases by nearly 40%. Château Margaux's second wine, Pavillon Rouge, has risen from an opening price of £54 a bottle in 2009 to £97 a bottle. With the top wines now hovering around the £1,000-a-bottle mark, the lesser Cru Classé wines find themselves in the £200-a-bottle mark.

We've experienced such increases before, but one buyer told me that prices have now risen beyond what he thought was possible. The relatively recent influx of wealthy Asian buyers, coupled with a finite supply of the very top wines, has driven the prices higher. A number of other factors could also be coming into play. It's possible that traditional buyers are propping up the market, having seen the value of their cellars soar in the past decade, or that the wines are finding homes in various investment portfolios. But there is also a chance that with the new interest from Asian buyers, the Bordeaux market has undergone a correction and these prices are here to stay.

I recently spoke with one negociant, a merchant who buys directly from the châteaux and sells to restaurants and the trade, who told me that 10 years ago an affluent Asian client told him that nobody could imagine the effect the Asian market was going to have on the price of Bordeaux. Even he couldn't quite believe how far prices have risen this year.

Amid this, though, there is still value to be found, particularly at the lower end. Château Lacoste Borie, the second wine of Grand-Puy-Lacoste, is a splendid Pauillac, at £180 a case. In Saint-Emilion, Château Teyssier made a good wine and is selling it for only £130 a case. While Château Capbern-Gasqueton, made by the same producers of Saint Estephe's Calon-Ségur, at around £140 a case, could be one of the best buys of the vintage.

July 3 2011

中國人敬酒的玄機

中國人說無酒不成席,所以酒席多,敬酒的機會更多。敬酒很有講究,要看是什麼人敬酒,給什麼人敬酒,在什麼場合敬酒。中國人敬酒時,往往都想對方多喝點酒,以表示自己盡到了主人之誼,客人喝得越多,主人就越高興,說明客人看得起自己,如果客人不喝酒,主人就會覺和有失面子。有人總結到,勸人飲酒有如下幾種方式:“文敬”、“武敬”、“ 罰敬”。

“文敬”,是傳統酒德的一種體現,也即有禮有節地勸客人飲酒。

酒席開始,主人往往在講上幾句話後,便開始了第一次敬酒。這時,賓主都要起立,主人先將杯中的酒一飲而盡,並將空酒杯口朝下,說明自己已經喝完,以示對客人的尊重。客人一般也要喝完。在席間,主人往往還分別到各桌去敬酒。

“回敬”:這是客人向主人敬酒。

“互敬”:這是客人與客人之間的“敬酒”,為了使對方多飲酒,敬酒者會找出種種必須喝酒理由,若被敬酒者無法找出反駁的理由,就得喝酒。在這種雙方尋找“論據”實則完成了交流的過程。

“代飲”:即不失風度,又不使賓主掃興的躲避敬酒的方式。本人不會飲酒,或飲酒太多,但是主人或客人又非得敬上以表達敬意,這時,就可請人代酒。代飲酒的人一般與他有特殊的關係。在婚禮上,男方和女方的伴郎和伴娘往往是代飲的首選人物,故酒量必須大。

“罰酒”:這是中國人“敬酒”的一種獨特方式。“罰酒”的理由也是五花八門。最為常見的可能是對酒席遲到者的“罰酒三杯”。有時也不免帶點開玩笑的性質。

一般情況下,敬酒應以年齡大小、職位高低、賓主身份為先後順序,一定要充分考慮好敬酒的順序,分明主次。即使和不熟悉的人在一起喝酒,也要先打聽一下身份或是留意別人對他的稱號,避免出現尷尬或傷感情。

給長輩或者上級敬酒,自己的敬意表達到了即可,不能勉強甚至督促、監督人家要喝幹喝盡,因為長輩、上級往往略微比自己大,年紀不饒人,身體可能不適,而且應酬較多。

給平輩、朋友敬酒,應該誠懇,但是也不可以勉強人家喝酒。

給晚輩敬酒,不能倚老賣老,態度照樣要誠懇,心意到了,禮節到了為止,也不可以勉強人家喝酒。

在中餐裏,乾杯前,可以象徵性地和對方碰一下酒杯;碰杯的時候,應該讓自己的酒杯低於對方的酒杯,表示對對方的尊敬。用酒杯杯底輕碰桌面,也可以表示和對方碰杯。當你離對方比較遠時,完全可以用這種方式代勞。

品味生活 如何打造一场私家品酒晚宴

或许你已经参加了无数场品酒晚宴,对品酒的门道已经管窥一二,转而开始想由自己一试身手,邀约若干好友举办一场私家品酒晚宴,这岂非正应和了美酒的主题——分享?

葡萄酒迷们都有热衷穿梭于各种品酒会的阶段,等稍有经验,兴趣高手们就已经按捺不住,自己也要来办一场品酒晚宴,这正如葡萄酒的特质之一,那就是—分享。那如何才能办一场完美又令人难忘的私人品酒会?这当然是有章可循的,只要你事先稍作准备,一场难忘的私人品酒聚会就隆重登场了。

做好选酒主题

自己办个家庭品酒会其实并不复杂,不过要想做得别开生面,那就要提前做点功课了。品酒会,酒是主题,而家庭品酒晚餐正是体验美妙葡萄酒世界的最好方式,酒是最马虎不得的,档次和数量都要考虑周到。选酒一定要清楚自己的客人是属于懂酒的、不懂酒的、半懂半不懂的哪类型客人,要针对性地选酒。对于不太懂酒的客人,建议你备一些比较大众化的红、白葡萄酒,口味应以清淡适中、较易搭配食物为主。如果客人多是懂酒之人,可以根据他们的口味、兴趣来决定,比如新老世界的酒各备几款。若至爱是旧世界波尔多的美酒,那就不妨筛选几款不同口味、年份的酒作为晚会主题;若至爱是阿尔萨斯的白葡萄酒,那除了口味之外,品酒温度的知识也是酒会的亮点之一。

当然如果你自己并不是品酒高手,只是想举办个品酒会,那就邀请几个品酒高手,趁聚会之际,自己也收获一些知识。建议你不妨采取另一种方案,选出几款你也不熟悉的酒,设置一个盲品环节,让大家品尝并评论以显示嘉宾们的知识才干,品尝后还可以把答案写出来,最终揭晓谁的评价,做个奖励环节给最接近的那位嘉宾一个小奖励,(如果有这个环节,揭晓谜底可以放在晚会最后,将给客人更多的惊喜。)也可以选取不同产地的葡萄酒,比如澳洲、加州或智利等地的酒,让大家在所选取的葡萄酒中评出酒的共性与不同。酒的主题与环节定好,你的这场生动、趣味、互动,能够让家人、朋友体会到不同葡萄品种、风格以及不同种植区域、不同特点的品酒晚宴就成功了一半。

美酒配美食

葡萄酒迷人的地方当然是它的讲究,它永远都喜欢搭配,是配烤肉还是海鲜?品酒会中最简单的食物就是奶酪,但是更多的美食会让品酒会更加活色生香,也是成功举办品酒会的重要环节,当你确定了酒的品种,那么就可以计划一下前菜以及主菜的风格了。

制定搭配极致的美食详单后,你如果不能自己来完成所有的东西,可以列出采购表,也可以要求朋友们带上他们认为可以搭配的美食来,但你自己一定要知道那些基本的搭配原则。比如:红酒要配味道重一些的奶酪,或者是红肉以及烤蔬菜、番茄烧制的菜肴、黑巧克力等等。对于白葡萄酒,最好是柔和一些的奶酪、鱼、沙拉等等。黑比诺是种相对比较柔和的葡萄品种,基本上可以红白通吃。但搭配食物并不是要将事情搞得复杂,如果你自己没什么经验,那准备几种奶酪、意大利香肠、橄榄为首选,简单但准没错。可品酒晚宴中无论如何,请你务必将食物准备充分,以免英雄没有美人配的尴尬。

环境与物品准备

私人品酒会一般选在宽敞的客厅,能容纳十几个人的小型会所,这样大家注意力比较集中,也比较亲密。这虽然是私人品酒会,但灯光不需要太柔暗,(毕竟不是单独的情侣约会,也不适合观看酒的颜色)以明亮舒适为主,环境装潢不必太过花俏,简洁大方,颜色柔和即好。当然你也可以独揽一家小会所作为临时场地,只要符合你的要求就好了。

既然做主题品酒会,那准备品酒记录的文件也非常必要,比如酒单、品酒记录、厂家的背景故事等等。上述资料要给每位客人一份,(盲品可以放在最后发)好让他们在品酒的时候有个参考。另外,来的都是懂酒的高手,那就加上客人评分环节,这将会使品酒活动更加有参与性,也让嘉宾们更多的表达他们自己的喜好。

器皿的准备也一定要充分,如果你只准备了红葡萄酒,那就备足红酒杯就可以了,但你的品酒会如果从下午就开始,那无论是香槟杯还是威士忌酒杯,还有白葡萄酒杯一种都不能少。更要提前把酒杯清洗干净,悬空晾干,保持光洁无任何异味,保证品酒的酒质。品酒会酒杯的选择至关重要,但还有必不可缺一件物品,那就是吐酒桶,品酒吐酒如大师Jancis Robinson曾说,在大众面前吐酒是每一个葡萄酒品尝家必须学习的第一件事情。当然这类私人品酒晚宴,主要以搭配美食为主的,可以根据自己的酒量来决定是否要吐酒,但如果有集中品评环节,正确的选择是应该吐酒的。

品酒次序与学问

选好了美酒,制定好了美食,基本的工作也已经到位,那就再给酒的品用安排个次序。当有客人早到你家时,你可以为他倒上一杯威士忌白兰地加冰块或苏打水。整个品酒晚宴进餐前,你可以安排以饮用一些淡味的开胃酒,诸如味美思等作为开始。品酒的次序攸关酒品质的品鉴,一定提前就确定好。为了减少先品的酒对后品的酒造成干扰,通常是较清淡的酒放在前面,味道略重、香甜浓郁的酒尽量留在后面,从色泽上先白后红;从甜度上先干后甜;从酒度上先低后高。一般遵循干红和干白葡萄酒在甜葡萄酒之前饮,白酒要在红酒之前饮,新酒要在陈酒之前饮,淡薄的酒要在浓厚的酒之前饮,二级酒在一级酒之前饮的原则。

品酒的最佳温度也要了解一些,红酒开瓶时的温度不应超过室温。没有一种葡萄酒可在超过20℃中久存。酒温超过20℃尝不出真味。白酒要冷饮但非冰冻,在10—12℃之间最好;玫瑰红酒和白酒的饮用温度一样,酒质淡薄的红酒在13-15℃之间较好;勃艮第酒14-17℃之间饮用,波尔多酒在15-18℃之间饮用最好,香槟该在7—8℃左右。晚宴中以饮用几种干红或干白葡萄酒为主,餐后可以再来一些甜点或奶酪,加上一瓶上好的甜酒,如:雪利酒、波特酒等,那你的私人品酒晚宴就可以完美收官了。

总之,只要你稍稍用些心思,一场愉快的品酒晚宴就呈现了。如有假期,你不妨与家人朋友实践一回,为自己的生活更添趣味与品位。

July 2 2011

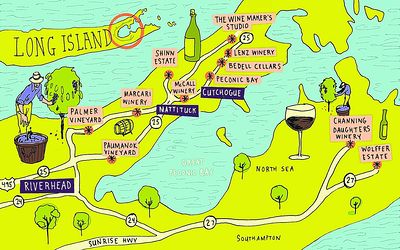

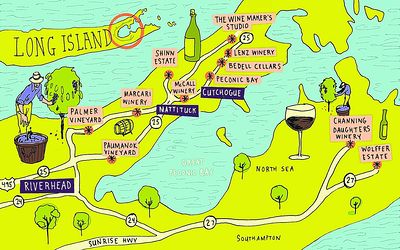

Long Island Risk Takers Reap Rewards By Lettie Teague

THE OLD VINES AND THE SEA - Paumanok Vineyards in Aquebogue, N.Y.

There may be no word more insulting than "potential" when it's attached to a person or place. After all, its application suggests a certain deficiency of present circumstance. I was reminded of this recently by David Page, a vintner on the North Fork of New York's Long Island, a winemaking region that's been heralded for its "potential" since Alex and Louisa Hargrave planted the first vitis vinifera grape back in 1973.

"The word 'potential' implies there haven't been profound wines from this region to date," said Mr. Page, after I mentioned the word. We were standing in Mr. Page's modest but attractively rustic tasting room on Oregon Road in Cutchogue. "Our wines are served in some of the best restaurants of the world," he added.

Admittedly, I had raised the question of potential about four years before, on my last tasting tour of the North and South Forks. (The South Fork is better known in non-winemaking circles as the Hamptons.) On my previous tour, I'd found pockets of accomplishment and some good wines, though not many that seemed likely to excite the interest of the world. Or, for that matter, New York sommeliers.

According to Kareem Massoud, winemaker of Paumanok Vineyards in Aquebogue, interest in Long Island wines was limited until quite recently. "Four years ago, Long Island winemakers were complaining, 'Why doesn't New York City support us?' " he said. Today, Mr. Massoud counts 50 Manhattan restaurants as his clients, including top dining spots like Prune and Gramercy Tavern, where wine director Juliette Pope features 11 wines from Long Island on her list.

What changed, the quality of the wines or New Yorkers' minds?

Shinn Estate winemaker Anthony Nappa, who came to the North Fork about four years ago, believes it began with the former. "People were actually selling faulty wines four years ago," he said of the region's producers. "Wines that were stinky or poorly made—oxidative or reductive. You don't see that anymore." (I myself didn't encounter many seriously flawed wines four years ago—though I did find quite a few that failed to excite me very much.)

Roman Roth, a German native who has been the winemaker at Wölffer Estate in Bridgehampton on the South Fork for almost 20 years, says he has witnessed a profound shift in the status of Long Island wines during his tenure. "In the beginning we were outsiders," he said. "Now we are trendy."

Perhaps the trendiest wine Mr. Roth makes today is a rosé—a wine that was not well received when it debuted in 1992. "People thought we were crazy," said Mr. Roth. (No one was drinking dry rosé in those days.) Today Wölffer produces more dry rosé (9,500 cases) than anything else, though Mr. Roth also makes notable Merlots and an excellent sparkling wine. "People come in Bentleys and buy four cases of rosés," said Mr. Roth. (It is the Hamptons, after all.)

Rosé is a big success on both forks today, as is Sauvignon Blanc, which was just beginning to show up in tasting rooms when I visited a few years ago. While I had a few good Sauvignons then, I was struck this time by how many good examples I found, from wineries like Macari, Shinn Estate, Paumanok, Palmer Vineyards and Channing Daughters.

Channing Daughters's winemaker Christopher Tracy makes several Sauvignon Blancs and four rosés (and several Chardonnays and a Tocai). Mr. Tracy believes that Long Island is a "world-class region" for white, rosé and "orange" wines (white wines made with a bit of skin contact—he also makes those).

He's not as bullish about the region's reds, however, especially its signature grapes, Cabernet and Merlot. "They don't always ripen fully in this climate," said Mr. Tracy, alluding to the region's maritime location. The resulting wines could often be green and herbaceous. (The great 2010 vintage was a notable exception—just about everything ripened well.)

Most of Mr. Tracy's reds are made from early-ripening varietals such as Lagrein, Refosco, Dornfelder and Blaufränkisch, aka Lemberger, more commonly found in Italy and Austria. I was particularly pleased by the 2009 Channing Daughters Lagrein and 2009 Channing Daughters Blaufränkisch—both were bright, juicy wines with lots of lively acidity.

As I tasted reds from other Long Island wineries, I began to wish that more winemakers shared Mr. Tracy's fondness for obscure grapes—and his misgivings about Cabernet and Merlot. While I had a few good examples, I had more wines that were under-ripe or overoaked or both—all of which left me longing for a Lagrein.

This sentiment didn't just apply to reds. Indeed, the more wines I tasted, the more I wondered why no one else wanted to try making a Gewürztraminer as good as Eric Fry's 2007 Lenz Winery bottling or the bright and lively Albariño made by Spanish-born winemaker Miguel Martin at Palmer Vineyards. The minerally 2010 Riesling from Peconic Bay was unrivaled by any other Riesling I tasted from either fork (though Roman Roth's 2009 Grapes of Roth Riesling came close). I also tasted an impressive 2007 Reserve Pinot Noir from McCall and a lithe Viognier at Bedell. There was the singular Pinot Noir Blanc Anomaly from Anthony Nappa and an intriguingly slightly oxidative Pinot Blanc from Shinn Estate.

Why weren't more winemakers willing to try something different? To Mr. Page, the answer was easy: In a place where land is so expensive, "it didn't make financial sense to risk a vineyard planted to something obscure," he said.

Mr. Tracy of Channing Daughters predictably disagreed. "The whole money thing is precarious no matter what varietal you're planting," he said. "I think most people are unwilling to take risks."

Perhaps that's the answer to the irksome "potential" question. Long Island wines will likely remain in a state of "becoming" if only a few producers choose to live a little on the edge. In the meantime, there are big rewards for the winemakers—and wine drinkers—who will.

July 1 2011

Break for the Bordeaux - The once shabby city is back on the tourism map after a massive facelift helps it reclaim its link to the famous vineyards beyond

By Jane Anson

Clockwise from top: a panoramic view of the ancient city of Bordeaux; Saint-Emilion Premier Grand Cru wine barrels in the chateau's new winery designed by French architect Christian de Portzamparc; learning about blending Bordeaux wines; people walking on the docks during last year's ''Fête du vin''

For all its 18th-century splendour, there is a fresh-air feel to Bordeaux right now. Take a stroll along the waterfront during the early morning or late afternoon, when the limestone façades of the buildings - tightly packed beside the croissant-shaped Garonne River - are gently glowing in the sunshine, and the air of renewal is overwhelming. The quays hum with cafes and shoppers at the quayside organic market. The city is pretty enough now that the biennial wine fair Vinexpo, which closed last week, can attract over 48,000 visitors.

This tiny corner of France has long been a favored spot. It's short distance from the Atlantic Ocean has given its famous wines access to world markets for more than 2,000 years and helped to make Bordeaux one of France's busiest ports.

All this ground to a halt in the 20th century, as the city center moved into a slow decline. But an extensive and much-needed investment programme means that Bordeaux today is clean and sparkling to the point of smugness. Not only is it busy reclaiming its link with the vineyards, but it's also dictating the conversation.

Signs of this are everywhere, from the new Guggenheim-style wine cultural centre, which is due to open its doors in 2013, to the many innovative ways to experience its most famous product.

At Max Bordeaux, 48 of the region's top wines can be tried by the glass. Lining up Bordeaux First Growth wines for a comparative tasting is not usually an experience open to anyone besides a few wealthy collectors. But at this tasting bar, you are able to do just that, as Lafite, Latour, Margaux, Mouton, Haut-Brion, Yquem, Ausone and Cheval Blanc are all available by the glass. Just buy a pre-paid credit card, and choose your tasting size, from 25ml to 75ml. Buying a bottle of each one would cost you upwards of €20,000 (HK$221,000), but you can try a tasting glass of them all for just over €200.

"Bordeaux is changing," says Henning Thoresen, owner of Max Bordeaux. "As its wines become ever more sought after internationally, so the city has stepped up its game. Even the smart chateaux are starting to

realize that, as they charge higher prices for their wines, they need to work on their welcome to customers who have travelled to Bordeaux."

The first Max Bordeaux tasting gallery opened in Bordeaux in 2009, and it remains the only place where you can try this many exceptional wines so reasonably priced. It is also due for expansion, with 50 tasting galleries planned over the next five years. By the end of this year, Taipei, Beijing, Shanghai and Tokyo will have their own Max Bordeaux, then New York and London next year.

There are plenty of other ways to experience the wines of Bordeaux without leaving the city

center. One of the most luxurious is to attend a wine dinner held at the Regent Hotel, the city's most upscale hotel, located opposite the 18th-century Grand Theatre. The two buildings form a pair, as the hotel itself was built in 1779 by the same architect, Victor Louis, as a private resident. Apparently, it was an attempt to outdo the theatre.

The wine dinners are held once a month at the Regent's Michelin-star-rated restaurant, Le Pressoir d'Argent, and are hosted by leading chateaux from both Bordeaux and farther afield - almost always a pair of one white and one red producer.

Recent examples have included Chateau Cheval Blanc and Chateau d'Yquem, California Napa Valley's Opus One and Ailes d'Argent (Mouton Rothschild's white wine), and Chateau Haut-Bailly with Burgundy's Maison Faiveley. Both Lafite Rothschild and Chateau Pichon Baron de Longueville are hosting dinners later this year.

The directors or owners of the estates introduce the wines, and match them with the cuisine, prepared by chef Pascal Nibaudeau.

If you are heading out to the vineyards, recent months have seen the launch of a new way to do so. River tourism, for a city whose wealth and influence were almost entirely the result of its location on the Garonne and Dordogne rivers, has been surprisingly slow to catch on. Bordeaux is a land of water, with 3,200 kilometres of rivers, 650

kilometers of which are navigable, but until the recent restorations, the quays in central Bordeaux were run-down and blackened from years of neglect. Boats offering taxi services or day trips have operated for a few years and, in March, a five-day river cruise was launched.

The Princesse d'Aquitaine - which has spent the past decade cruising along the Danube and the Rhone - will run 45 cruises each year, from March to November. The boat holds up to 130 people and sails along Bordeaux's two main rivers. The boat's course steers you up through the Medoc vineyards towards the Atlantic Estuary, then over to the 17th-century Citadelle de Blaye, down to the pretty village of Cadillac and the sweet wines vineyards of Sauternes, and finally eastwards to the medieval village of Saint-Emilion. Each day guests visit different chateaux, villages and other cultural sights, then return to sleep onboard.

The view from the water is totally different from the road, and a sense of romance is restored. You'll never see the port of Pauillac look more beautiful than when approached by water. There is something magical about discovering Bordeaux's vineyards by using the same waterways that first took its wines to market. It is clearly answering a gap in the market - the river cruises are already almost sold out for this season, and a second boat is joining the fleet next year.

Although the boat is billed as a luxury river cruise, the fittings inside are more functional than luxurious. If you want a truly exclusive boat trip, it is better to hire your own pinasse (a traditional flat-bottomed boat) for oyster-tasting in the Arcachon Bay, a pretty coastal resort 50 kilometres west of Bordeaux. This is the

favored summer destination of locals. It is the only way to dip your toes in the water and stop off at local beaches along the way.

Almost all these private hire boats will organize wine tastings on board, ideally of crisp local whites to complement the sunshine and the locally farmed oysters. As you sail around Arcachon, you will pass dozens of exclusive villas owned by local wine families - part of the fun is listening to the stories recounted by your skipper, who will be only too happy to identify the owners of each one, and to share his knowledge of the coastline. That's the beauty of visiting Bordeaux today.

Conversations used to begin and end with the wine, but today it is the perfect introduction to a city with its eyes firmly fixed on pleasure.

Le Pressoir d'Argent, The Regent Hotel, 2-5 Place de La Comedie www.theregentbordeaux.fr

The Princesse d'Aquitaine www.croisieurope.com

Max Bordeaux 14 Cours de l'Intendance www.maxbordeaux.com

Les Pinasses du Bassin www.pinasse-bassin-arcachon.com

(In French only)

WINE AND DINE

Bordeaux wine estates are offering more and more unusual and hands-on experiences to take part in. Although open for most of the year, many properties close in August. It is advisable to call ahead, especially on weekends. Harvest also used to be a difficult time to visit, but in recent years more estates are opening their doors during this busy period. Sometimes they even invite visitors to join the pickers for their harvest lunch. All the suggestions below need to be booked in advance.

Picnics at Chateau Kirwan, Margaux A classified chateau in the commune of Margaux, about 30 minutes from downtown Bordeaux, Chateau Kirwan offers picnics over the summer months. There are local cheeses and hams from a wicker basket served with crusty breads and a choice of their wines. Known as a 'Déjuner sur l'herbe', this is an effortlessly elegant way to enjoy eating at a wine estate.

www.chateau-kirwan.com

Vineyard walks at Chateau Soutard, Saint Emilion A renovated classified chateau five minutes' walk from the centre of Saint Emilion that offers a wide range of excellent tourism opportunities. One of the best is the self-guided "vineyard safari" where you take a map and head out into the vines on a trail of discovery. Particular emphasis here is given to biodiversity and the rich wildlife hidden in the hedgerows.

www.chateau-soutard.com

Make your own wine at Chateau Malleret, Medoc Beginning this summer, the cru bourgeois chateaux is offering visitors the chance to taste the grapes, and blend and make their own wine. Called B Winemaker, you also get to bottle, label and cork your creation. Book through the Bordeaux Tourist Office.

www.bordeaux-tourisme.com

Visit a tonnellerie with Nadalie cooperage, Medoc Bordeaux red wines are almost always aged in the barrel, and nothing quite makes you appreciate the time, effort and skill that goes into producing them as visiting a barrel maker. Try to visit in the morning, when the barrels are being toasted over an open fire. You will fully appreciate this ancient art, which continues today as it did centuries ago.

www.nadalie.fr

Son et lumière (sound and light show) at Chateau Villemaurine, Saint Emilion With its amazing location on the edge of the medieval city, this makes for a theatrical visit. Created by Eric le Collen, famous for the recreation of the Battle of Castillon that is held nearby every summer, the quarries underneath the chateau have been turned into a sound and light show telling the history of the property and of Saint Emilion itself.

June 29 2011

The World’s Oldest Champagne By Kristiano Ang

The cork of the Veuve Cliquot Champagne.

Singapore is hardly a friendly place to those who like to knock back a tipple – liquor taxes can run up to 70 Singapore dollars (US$57) per liter of wine.

That makes it even more surprising that Julia Sherstyuk, a Singapore-based restaurateur, recently paid a world record €30,000 (US$42,758) for a bottle of Veuve Cliquot Champagne. The bottle, which dates back to 1841, is said to be the oldest bottle of champagne in existence. Ms. Sherstyuk bought the bottle at an online auction held by fine-wines auction house Acker Merrall & Condit on June 3.

The bubbly comes with a story. Along with 144 other bottles from champagne houses like Juglar and Heidsieck, the 1841 Veuve Cliquot was salvaged last year from a 19th-century shipwreck in the Baltic Sea. The auction house believes the wines were on their way to the court of the Russian czsar in St. Petersburg when they were lost at sea.

The Russian link inspired Ms. Sherstyuk, who runs Buyan, a Russian haute-cuisine restaurant in Singapore’s Duxton Hill district, to foot the bill. “It was [purchased] due to [its] historical significance,” she said, adding that it helps the restaurant “convey a sense of Russian history and culture.”

Those hoping to taste the bottle, which is being shipped to Singapore, will have to wait. Ms. Sherstyuk plans to exhibit it for a yet-to-be determined period of time in her restaurant’s S$5 million wine collection. It’ll sit alongside a €24,000 bottle of Jugler Ms. Sherstyuk also purchased at the online auction, as well as an 1854 bottle of Lafite Rotschild and an 1859 bottle of Mouton Rothschild, among others. Buyan resells these rare wines at prices ranging from S$8,950 (US$7,210) to S$88,888.

Ms. Sherstyuk said she was surprised that the 1841 Veuve Cliquot went for only €30,000. “It took a long while [for us] to decide to put in the winning bid,” she said. “We were extremely surprised it did not sell for a much higher price.”

But how will these wines taste after all these years?

It’s a gamble. “It’s dependent on the wine and more importantly, the vintage, but just because the wine is expensive doesn’t mean that it will last for decades,” says Marcus Boyle, the sommelier at Tippling Club, an upscale bar in Singapore. “Personally, I couldn’t justify paying thousands [of dollars] for a bottle of wine. But such wines are very small productions from the best vineyard plots in the world and are in high demand.”

June 28 2011

Baijiu All Around as Diageo Wins Bid Approval By Isabella Steger

Workers package China Kweichow Moutai Distillery Co. baijiu liquor, at the company’s facility in the Maotai section of the Renhuai District in Zunyi, Guizhou Province, China, on Thursday, April 7, 2011.

A few celebratory shots of baijiu may have been guzzled in London Monday night as Diageo PLC finally won regulatory approval for its bid for a Chinese producer of the firewater.

Diageo said Chinese regulators have approved its bid to take control of Sichuan Chendu Quanxing Group Co. Ltd., lifting its stake from 49% to 53%. Quanxing has a 40% stake in baijiu brand Shui Jing Fang, which is listed on the Shanghai Stock Exchange.

Sixteen months after Diageo’s bid was first announced, it’s taken no less than some help from Chinese Premier Wen Jiabao and U.K. Prime Minister David Cameron to get the ball rolling as the two heads of state met in London for a trade summit. So far, US$2.23 billion worth of deals have been inked.

Even if the spirit isn’t everyone’s poison (some liken it to paint thinner), there’s no denying that it’s going to be an important source of revenue for the world’s big spirit makers.

A few celebratory shots of baijiu may have been guzzled in London Monday night as Diageo PLC finally won regulatory approval for its bid for a Chinese producer of the firewater.

Diageo said Chinese regulators have approved its bid to take control of Sichuan Chendu Quanxing Group Co. Ltd., lifting its stake from 49% to 53%. Quanxing has a 40% stake in baijiu brand Shui Jing Fang, which is listed on the Shanghai Stock Exchange.

Sixteen months after Diageo’s bid was first announced, it’s taken no less than some help from Chinese Premier Wen Jiabao and U.K. Prime Minister David Cameron to get the ball rolling as the two heads of state met in London for a trade summit. So far, US$2.23 billion worth of deals have been inked.

Even if the spirit isn’t everyone’s poison (some liken it to paint thinner), there’s no denying that it’s going to be an important source of revenue for the world’s big spirit makers. According to Euromonitor International research, baijiu makes up 32% of China’s alcoholic-drinks market, with sales in 2010 up 13% from the previous year to 805.8 billion yuan (US$124.5 billion). Top-end brands like Moutai can retail at as much as US$200 a bottle. LVMH Moet Hennessy Louis Vuitton SA and Pernod Ricard SA have already taken stakes in local baijiu makers.

The potential of the Chinese alcohol market also prompted KKR & Co. and New Horizon Capital to jointly invest in VATS Liquor Store Co., which operates stores across China selling premium Chinese and international brands.

And baijiu makers can’t make the stuff fast enough. As Dow Jones Investment Banker writes:

Not only is baijiu the tipple drunk by a growing Chinese population (which grants pricing power to the distillers), but the producers – especially market leader Moutai and No. 2 Wuliangye – can’t make enough of it. Moutai, for instance, has plans to double output by 2020.

Of course, Diageo is also keen to push its own products to the Chinese consumer. At an investor day in Shanghai in May, Diageo said it would focus on promoting scotch in the country, which accounts for more than 80% of Diageo’s sales in China. In 2009 Diageo and Shui Jing Fang also teamed up to launch Shanghai White, a vodka distilled with baijiu methods, for the Chinese market.

June 25 2011

How to Succeed in the Wine Business (and How Not To) By Lettie Teague

The Napa Valley is the wine region of first resort for many would-be vintners who also happen to be famous or enormously wealthy (or both).

But sometimes more obscure places like Ontario or Washington State show up on the labels of celebrity offerings.

In the case of television and movie star Kyle MacLachlan the choice was easy: he decided to make wine in Washington because it was the state where he was born.

Indeed, Washington wine seems to inspire those with true connections to the state.

Jeff Bezos, the founder of the Seattle-based Amazon, is an investor in JM Cellars, a winery located in Woodinville while footballer Drew Bledsoe (Washington State Cougars) has a winery in Walla Walla called Doubleback.