|

Newsletter

Seminar Material

Biz:

China

Hong

Kong Hawaii

What people

said about us

China

Earthquake Relief

Tax &

Government

Hawaii Voter Registration

Biz-Video

Biz-Video

Hawaii's

China Connection Hawaii's

China Connection

CDP#1780962

CDP#1780962

Doing Business in

Hong Kong & China

Doing Business in

Hong Kong & China

| |

Biz Opportunities - China -

Partnership

with China Government Agencies

Do you know our dues

paying members attend events sponsored by our collaboration partners worldwide

at their membership rates - go to our event page to find out more!

|

|

Listen to MP3 “Business Beyond the Reef” to discuss

the problems with imports from China, telling all sides of the story and then

expand the discussion to revitalizing Chinatown -

Special Guest: Johnson Choi, MBA, RFC. President - Hong Kong.China.Hawaii

Chamber of Commerce (HKCHcc) and Danny Au, Manager, Bo Wah Trading |

Shanghai World Expo 2010

http://www.expo.cn

http://en.expo2010.cn/

May 1 - Oct

31 2010 Share

Shanghai World Expo 2010

http://www.expo.cn

http://en.expo2010.cn/

May 1 - Oct

31 2010 Share

Shanghai World Expo highlight Videos

on YouTube in Mandarin and Cantonese - it will give you a complete history of

World Expo including Shanghai World Expo Highlights - the information is very

helpful prior to your arrival in China

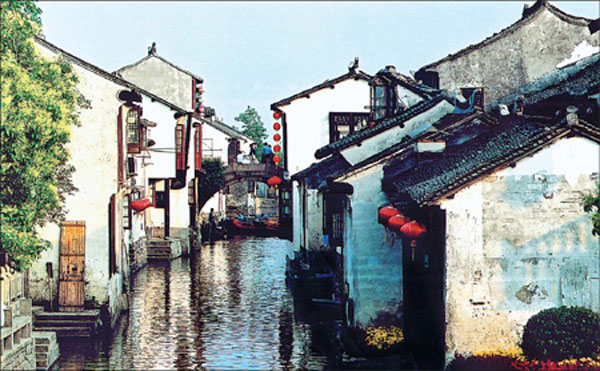

世博年漫遊長三角

Video#1A/1B

http://www.youtube.com/watch?v=chlK-rjWZVI

http://www.youtube.com/watch?v=vn6avEYY-qU

Video#2A/2B

http://www.youtube.com/watch?v=ZqStd1T0CVU

http://www.youtube.com/watch?v=nRK4mJQRvWg

Video#3A

http://www.youtube.com/watch?v=os7sk7c7PFQ

Video#4A/4B

http://www.youtube.com/watch?v=RDU7G4pFb8c

http://www.youtube.com/watch?v=U4qCs9_iMuc Video#5A/5B

http://www.youtube.com/watch?v=Zpn1nyDA5W4

http://www.youtube.com/watch?v=y4Fb30GW65o Video#6A/6B

http://www.youtube.com/watch?v=GdP-vGyNkHk

http://www.youtube.com/watch?v=s1Er_gD9iq0 Video#7A/7B

http://www.youtube.com/watch?v=x565IqgAlk4

http://www.youtube.com/watch?v=nBSOqiFAx2s Video#8A/8B

http://www.youtube.com/watch?v=7fkhSmwDRhg

http://www.youtube.com/watch?v=KgdKwJHhKRI Video#9A/9B

http://www.youtube.com/watch?v=MeR3F4PO980

http://www.youtube.com/watch?v=gzN00sgOax8 Video#10A/10B

http://www.youtube.com/watch?v=H-j7KCZUW0o

http://www.youtube.com/watch?v=FOkjesRMuH8 Video#11A/11B

http://www.youtube.com/watch?v=SEBZyeV3ydE

http://www.youtube.com/watch?v=a7nEgVBq6AQ Video#12A/12B

http://www.youtube.com/watch?v=l3WGE9eQj7A

http://www.youtube.com/watch?v=4rPPfmdjkJY

Video#13A/13B http://www.youtube.com/watch?v=5Ap8EFL6gjo http://www.youtube.com/watch?v=dR0nk6rCPUI Video#14A/14B http://www.youtube.com/watch?v=YVgbviB1Ueg

http://www.youtube.com/watch?v=JNWoygJAu5w

Video#15A/15B http://www.youtube.com/watch?v=yKlZi1MfvPo

http://www.youtube.com/watch?v=lzRFGDa4okU Video#16A/16B

http://www.youtube.com/watch?v=_AdFGwbwDc8 http://www.youtube.com/watch?v=veVq0Hv-8P4 Shanghai World Expo highlight Videos

on YouTube in Mandarin and Cantonese - it will give you a complete history of

World Expo including Shanghai World Expo Highlights - the information is very

helpful prior to your arrival in China

世博年漫遊長三角

Video#1A/1B

http://www.youtube.com/watch?v=chlK-rjWZVI

http://www.youtube.com/watch?v=vn6avEYY-qU

Video#2A/2B

http://www.youtube.com/watch?v=ZqStd1T0CVU

http://www.youtube.com/watch?v=nRK4mJQRvWg

Video#3A

http://www.youtube.com/watch?v=os7sk7c7PFQ

Video#4A/4B

http://www.youtube.com/watch?v=RDU7G4pFb8c

http://www.youtube.com/watch?v=U4qCs9_iMuc Video#5A/5B

http://www.youtube.com/watch?v=Zpn1nyDA5W4

http://www.youtube.com/watch?v=y4Fb30GW65o Video#6A/6B

http://www.youtube.com/watch?v=GdP-vGyNkHk

http://www.youtube.com/watch?v=s1Er_gD9iq0 Video#7A/7B

http://www.youtube.com/watch?v=x565IqgAlk4

http://www.youtube.com/watch?v=nBSOqiFAx2s Video#8A/8B

http://www.youtube.com/watch?v=7fkhSmwDRhg

http://www.youtube.com/watch?v=KgdKwJHhKRI Video#9A/9B

http://www.youtube.com/watch?v=MeR3F4PO980

http://www.youtube.com/watch?v=gzN00sgOax8 Video#10A/10B

http://www.youtube.com/watch?v=H-j7KCZUW0o

http://www.youtube.com/watch?v=FOkjesRMuH8 Video#11A/11B

http://www.youtube.com/watch?v=SEBZyeV3ydE

http://www.youtube.com/watch?v=a7nEgVBq6AQ Video#12A/12B

http://www.youtube.com/watch?v=l3WGE9eQj7A

http://www.youtube.com/watch?v=4rPPfmdjkJY

Video#13A/13B http://www.youtube.com/watch?v=5Ap8EFL6gjo http://www.youtube.com/watch?v=dR0nk6rCPUI Video#14A/14B http://www.youtube.com/watch?v=YVgbviB1Ueg

http://www.youtube.com/watch?v=JNWoygJAu5w

Video#15A/15B http://www.youtube.com/watch?v=yKlZi1MfvPo

http://www.youtube.com/watch?v=lzRFGDa4okU Video#16A/16B

http://www.youtube.com/watch?v=_AdFGwbwDc8 http://www.youtube.com/watch?v=veVq0Hv-8P4

Shanghai World Expo Pictures

on Facebook

http://www.facebook.com/album.php?aid=108961&id=562941983&l=d01c8a8eda

Shanghai World Expo Pictures

on Facebook

http://www.facebook.com/album.php?aid=108961&id=562941983&l=d01c8a8eda

Thing to do in Shanghai

by our Director Yen Chun

http://www.hkchcc.org/shanghai.pdf

- information deemed reliable but

not guaranteed (the $ listed on the tour guide is Chinese $Yuan US$1 = 6.8

$Yuan)

http://www.b2bchinadirect.com/shanghaibiz.htm

AmCham Shanghai launches latest Viewpoint - U.S. Export

Competitiveness in China - on the 2010 Washington, D.C. Doorknock - Please

download report in PDF format:

http://www.hkchcc.org/viewpointusexport.pdf

AmCham Shanghai launches latest Viewpoint - U.S. Export

Competitiveness in China - on the 2010 Washington, D.C. Doorknock - Please

download report in PDF format:

http://www.hkchcc.org/viewpointusexport.pdf

成功之道

武进制造 Wujin

- Changzhou - Jiangsu Province - China http://www.hkchcc.org/wujin.htm

China President Hu Jintao USA State Visit

January 19 - 21 2011 http://www.b2bchinadirect.com/hujintaousavisit.htm China President Hu Jintao USA State Visit

January 19 - 21 2011 http://www.b2bchinadirect.com/hujintaousavisit.htm

USCBC Special Report: Hu Jintao State Visit USCBC Special Report: Hu Jintao State Visit

November 15 2011 Share

Amy Tan on China, Then and Now - the divide between China and America through novels that examine the emotional minefields of families and the clashes that come from cultural misunderstandings

By Debra Bruno

Novelist Amy Tan has spent most of her life examining the divide between China and America through novels that examine the emotional minefields of families and the clashes that come from cultural misunderstandings.

Now the writer — whose novels “The Joy Luck Club,” “The Kitchen God’s Wife” and “The Bonesetter’s Daughter” all tackle the conundrum of Chinese-American identity — is applying her perspective on that divide to this week’s U.S.-China Forum on the Arts and Culture.

Ms. Tan reflected on what she hopes will come of the forum, and what it means to be an American with emotional connections to China.

What do you think of China today?

It’s unbelievable. What strikes me as funny, though, is how many people in the U.S. still believe it’s so repressive that you can’t carry a camera around. I tell them the biggest danger is that someone will try to sell you a cheaper camera. They think it’s hard to do anything. They think of it as Shangri-la, with Byzantine ways to get around. They ask me, how do I come here? You take a flight. There’s a knowledge gap in the U.S.

What was it like the first time you visited China?

It was in 1987. Pudong and the Shanghai skyline were unbuilt. You look at the skyline now, it’s unbelievable. It’s a symbol of the degree and rapidity of change.

At a certain point, China seemed to have changed every six months. But I don’t come here often enough to keep abreast (of the changes). When I came in ’87, there were no private cars, just those for government officials. Everyone used a bicycle. The streets were just filled with bicycles and carts and these Stalinist-patterned trucks.

When I met my sisters (Tan’s mother had left children in China when she emigrated), they were wearing very bland blue suits, kind of a transition between the old blue uniforms. My uncle was wearing a nice tan wool Mao jacket; he looked very dignified.

Your mother plays such a large role in everything you write. What do you think your mother would think of today’s China?

She would say, “Maybe I could live here part-time.” She used to threaten me, “Maybe I go back to China — you don’t care.” When we were here together (in 1987), she focused on the cleanliness. She came and stayed for a couple of months. But now she would have been complaining about the prices.

Would you say you’ve spent your career bridging the gap between the U.S. and China?

At the beginning of my career as a writer, I felt I knew nothing of Chinese culture. I was writing about emotional confusion with my mother related to our different beliefs. Hers was based in family history, which I didn’t know anything about. I always felt hesitant in talking about Chinese culture and American culture.

Listen, I am an American, steeped in American values. But I know on an emotional level what it means to be of the Chinese culture.

You’re on a panel with Yo Yo Ma. What do you hope will come of the conversation?

I think it will be interesting to those of us with the forum, for one thing. We’ll have our eyes opened to how we view art and culture. But for the Chinese people on the panel and audience, it will be more, because they’ll open the eyes of the American side.

I think many in the States think Chinese people have no voice whatsoever, no means of expressing themselves. I think the forum participants are more knowledgeable, but I think they will be surprised at the degree of the individuality of the art.

Do you think the question of censorship will come up?

Chinese artists have been subversive over thousands of years, taking what they think of the government and embedding it in their art. There might be censorship of not going as far as they might.

But the thing that people don’t realize when they criticize the government is that the consequences are not necessarily good. They do not necessarily lead to positive change on this side. I’ve heard people say, “They must be listening to us because they just increased the sentence of an artist.” But that’s not a good outcome.

That’s why I’m happy to be part of a group like this. [Director of the Asia Society’s Center on US-China Relations] Orville Schell (one of the principal organizers of the conference) understands this; he said that the relationship has to move beyond a lack of trust and build on something more constructive. But it’s not starting with the most controversial or abrasive.

When I think of building relationships, I use my mother as a metaphor. If I disagreed with her, would yelling at her lead to any kind of change? No. Would building a relationship? Yes.

Speaking of your mother, we’re approaching the anniversary of her death. Do you mark the occasion?

We have the family over, and it’s always around Thanksgiving. We make potstickers and criticize them. We say, “no one could make them as she did.”

But for me, it’s not just once a year. She’s in my mind all the time. I hear her voice every day.

October 13 2011 Share

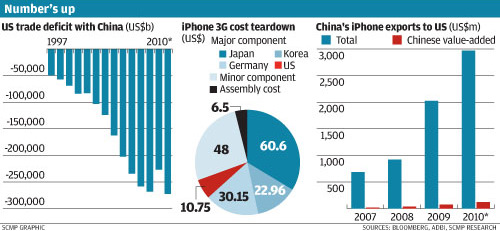

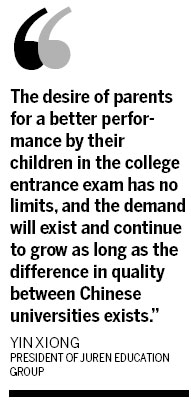

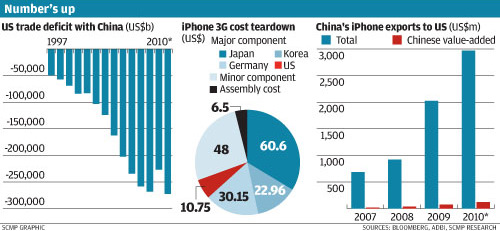

United State's reality gap on trade deficit - about US$10 to firms who assemble the iPhone in China

A student holds up Apple iPads outside Apple's flagship store in Beijing. The impact of the yuan on trade is under scrutiny.

Economic arguments may have little impact in Washington, but US efforts to put pressure on China are unlikely to create American jobs.

For every Apple iPad sold in the US, that nation's trade deficit with China increases by about US$275.

Yet by far the most value embedded in the device accrues to Apple and sustains thousands of well-paid design, software, management and marketing jobs in the United States.

By contrast, the value captured in China by the laborers who assemble Apple's products is only about US$10 or so, according to researchers led by Kenneth Kraemer of the University of California, Irvine, who collated the data.

Viewed through this prism, offshore manufacturing of electronic products such as the iPad is a solution, not a problem, for the US, and seeking to punish China for its purportedly undervalued exchange rate is wide of the mark.

"Without China, Apple could not be so successful and Apple products would not be so affordable," Yao Shujie, professor of economics at the University of Nottingham in England, said.

In the case of the iPad, China is the final assembly point for components imported from economies including South Korea, Japan, Taiwan, the European Union and the US. There are no Chinese suppliers for the iPad.

"China is sitting in the middle. It is processing goods for rich countries," Yao said. As such, he argued, it would be more accurate to allocate most of China's bilateral "iPad trade surplus" to those supplier countries.

Kraemer agreed that trade data could mislead as much as inform.

Statistical agencies are working on more accurate breakdowns of the origins of traded goods by value added, which would be attributed based on the location of processing, not on the location of ownership, he said.

"This will eventually provide a clearer picture of who our trading partners really are, but, while this lengthy process unfolds, countries will still be arguing based on misleading data," Kraemer and fellow authors Greg Linden and Jason Dedrick said in a recent paper.

Such economic niceties have little impact on US politicians. The US Senate on Tuesday passed a bill aimed at getting China to raise the value of the yuan in an effort to save American jobs. The legislation now heads for the House of Representatives, where its fate is uncertain.

The bill would allow the US government to impose duties on products from countries found to be subsidising their exports by undervaluing their currencies.

Fred Bergsten, director of the Washington-based Peterson Institute for International Economics, reckons a US$100 billion improvement in the US current account deficit would translate into 600,000 jobs.

But Fredrik Erixon, director of the European Centre for International Political Economy, a think tank in Brussels, said America's trade deficit had deep demographic and other structural roots. As such, even a substantial rise in the yuan would lead to only a marginal increase in US jobs.

"Multinational firms that think currency appreciation is going to have a big effect on their export capacity from China to the United States are going to shift to other countries, not to the United States," he said.

Indeed, manufacturers are already abandoning low-margin sectors in response to the steady rise in the yuan, which is up 30 per cent in nominal terms against the US dollar since 2005, plus fast-rising costs for labour, land, energy and other inputs.

Jonathan Anderson, chief emerging-markets economist for UBS in Hong Kong, said US and EU trade data showed that China's share of total low-end light manufacturing imports had peaked over the past 24 months and was falling outright in the US.

Gaining at China's expense were its even cheaper neighbours, including Vietnam, Bangladesh and Indonesia, as well as Mexico, Anderson said.

Strikingly, while overall US imports of apparel and furniture have continued to increase over the past two years, domestic production has plummeted. Foreigners have gained, not lost, market share.

Anderson said it made perfect sense that US workers were not the beneficiaries of rising Chinese wages.

"If US$300 per month for a 65-plus hour working week is too rich for, say, basic toy manufacturers, do they go to the US and pay US$1,200 a month plus benefits for a 40-hour week at the minimum wage, or do they go to Bangladesh or Cambodia, where workers put in Chinese-style hours for less than US$100 a month?" he wrote in a recent report.

Only by forcing a massive rise in the yuan or imposing implausibly high tariffs could such a cost gap be closed. The threat of trade and currency wars, which is likely to be a refrain at this weekend's meeting of Group of 20 finance ministers in Paris, could then become a reality.

"The gradual concentration of electronics manufacturing in Asia over the past 30 years cannot be reversed in the short to medium term without undermining the relatively free flow of goods, capital, and people that provides the basis for the global economy," Kraemer, Linden and Dedrick wrote.

They said they did not want to imply that there was no hope for US manufacturing, but it was design, computing and marketing, not snapping a moulded plastic case in place, that created high-wage jobs. In any case, Mexico could handle final assembly at a relatively low cost.

"Bringing high-volume electronics assembly back to the US is not the path to `good jobs' or economic growth," they wrote.

September 19 2011 Share

How foreign shores lost their luster? Many Chinese who have been educated and lived abroad return to the motherland - some affected by the September 11 attacks, others by the bad economy

By Ed Zhang in Beijing

Many Chinese who have attended graduate school and worked in the West are moving back to their homeland to start up their own enterprises or serve international companies. They are commonly called haigui, literally "sea turtles", or overseas returnees.

Some from the United States carry with them the memories of the September 11 terrorist attacks 10 years ago, as well as a deeper and more complex understanding of their former host country.

Eugene Sun, a corporate communications consultant, said that even though he and his family moved back to his hometown of Beijing six years ago, he still missed New York.

"That's why we got our apartment near the Chaoyang Park. It makes me feel as if we're overlooking Central Park," he said.

His return was partly because of September 11, Sun said, calling the US Patriot Act, passed a month after the attacks, "a reproach to democracy". The law led to a tightening of immigration controls in the US.

"To think that one man could screw up the strongest country in the world like this," he said, referring to Osama bin Laden.

Sun was a day trader back then. He was on a cigarette break with a Russian friend near their office a few blocks from the Empire State Building when they saw the first World Trade Centre tower collapse.

Xiao Yan agrees that September 11 changed everything. Xiao, who now works for an international financial services company on the mainland, said tighter immigration policies and cuts in financial aid made things difficult for foreign students for a time.

But Joe Xia - working for the New York edition of a Hong Kong-based Chinese-language newspaper at the time - said the damage from September 11 was only on the surface.

"It produced a great visual impact, an effective piece of propaganda work," said Xia, now working in the energy industry in Beijing.

"The aftermath was only brief, by which you could tell that [the US] was a very strong and resilient society - with strong industry and creative people."

In fact, he said, nothing had harmed the US more than the "reckless behavior of Wall Street" - referring to the toxic securities that led to a global financial meltdown and the subsequent government bailouts, in which the public paid for losses incurred by a few people.

Xia returned to China only recently, partly because of the rapid change in the media industry and partly because of the 2008 recession, he said.

In contrast, Daniel Hu made up his mind to return to work in China a long time ago.

"From the time of the Oklahoma City bombing [on April 19, 1995], I learned how they would treat foreigners, even in primary school," he said. "For days, people thought the suspect must be some sort of foreign die-hard, and even kids in our school were separated into different groups - American kids, Muslim kids, non-Muslim foreign kids.

"Then it turned out that the suspect was just a local man. And it turned me off so much. Anything happens, they blame foreigners. And bin Laden was just smart in using this to lure the US into fighting two costly wars and not attending to their own economy."

Hu is now between jobs after working for a state-owned company for three years.

For most Chinese returnees, the primary reason for coming home is economic opportunity. That was why the emigration wave did not crest right after September 11, but only after the economy showed danger signs.

There are two career tracks for the most successful returnees: They either work in universities, or for the China operations of a reputable international company.

Wang Shufeng, a chemical physicist, said he was satisfied with working at a top-notch university in China. He has a laboratory, students, assistants and grants from the government.

"I have no problem with any of these," he said, although he acknowledged that he was still at a loss in dealing with all of the red tape.

Among the 86 candidates listed this year for membership of the Chinese Academy of Science, 71 have had overseas educational and work experience and 30 obtained their doctorates at universities in other countries.

Xu Heng, who works for a leading international firm in Beijing, said that when she graduated in the US, it was obvious that the job market there had dried up and China still had plenty of opportunities. "The horizon for personal development looks much broader here," she said.

Partly because of the economic difficulties in the US, more than 80 per cent of returnees say they believe there are more business opportunities in China right now, according to

www.People.com.cn, a subsidiary of the official People's Daily.

Figures from mainland education authorities show that from 1978 to last year, 1.9 million students went abroad, in contrast to only 130,000 during the previous 106 years.

The number returning to China after their study overseas increased steadily in the mid-2000s, from fewer than 34,900 in 2005; to 70,000 in 2008; 100,000 in 2009; and 135,000 last year.

Because of relaxed student-visa policies and an increase in domestic household incomes in recent years, the number of outbound students has also seen a marked increase, from 229,000 in 2009 to 285,000 last year, official media reported.

For returnees, the welcome mat is out. The government is eager to recruit more overseas-trained professionals for its 12th five-year plan. It hopes to draw half a million or more returnees for the whole period, said Xia Wenfeng , an official familiar with "returnees' affairs" at the Ministry of Human Resources and Social Security, during a meeting of the Western Returned Scholars Association late last month.

The government aimed to recruit returned scholars for a few priority areas, including in new technologies, regional development, agriculture and social

programs.

September 9 2011 Share

Hiring employees from Hong Kong, Macau amd Taiwan for your China operation will save you 37% Social Security Tax

By Daniel Ren

Hongkongers may dodge new tax after U-turn - Mainland bosses could be stung for 37 per cent of expat salaries but Chinese nationals from HK, Macau and Taiwan likely to escape social security payment.

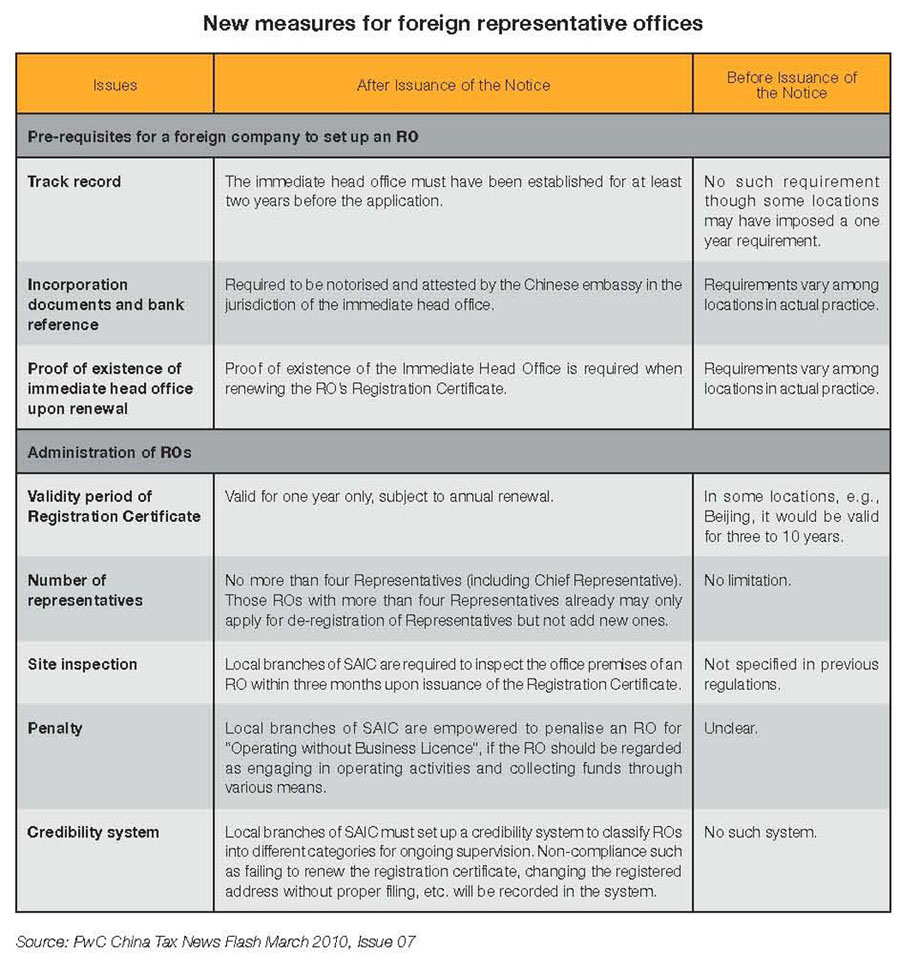

Chinese nationals from Hong Kong, Macau and Taiwan are likely to be exempt from the mainland's new social security tax going into effect next month. But all expats from countries that have not signed bilateral agreements with Beijing will have to pay up to 11 per cent of their income to social security funds.

Employers will be required to pay an extra 37 per cent of a foreign employee's salary to the social security accounts under the rule published by the Ministry of Human Resources and Social Security.

The new rule represents an about-face by Beijing, which previously planned to apply the tax to residents from Hong Kong, Macau and Taiwan. Two people who saw a draft copy of the rule said the ministry deleted the clauses involving residents from the three places in the final version. The ministry could not be reached for comment yesterday. "It's not clear why the rule was revised to exempt the Hong Kong workers," said one corporate official who is close to the regulators.

"But the authorities have to clarify many details of the new policy since the impact will be huge on thousands of companies."

The rule will take effect on October 15.

It is unknown whether non-ethnic Chinese who obtained ID cards in Hong Kong are exempt from the tax.

At least 10 countries - including the United States, Japan and Russia - have lobbied Beijing to sign bilateral agreements so that the rule could contain a waiver for their passport holders.

The ministry did not mention which countries had already signed the pacts.

Before, foreigners and Hong Kong people working on the mainland could voluntarily pay social security tax to local accounts if they hoped to receive pension income from the mainland accounts after retirement. The new rule "is designed to protect the legal rights of the foreigners so that they can benefit from the domestic social security system", the ministry said.

However, businesses and individuals thought otherwise.

"It doesn't seem to be a well considered rule," said David Lore, an American journalist who has been working on the mainland for more than a decade. "My concern is that our money would go into somebody's pockets."

All of the company officials interviewed by the South China Morning Post (SEHK: 0583, announcements, news) were critical of the new rule and said they were confused about the motivations behind the policy.

"This is another fresh example of the Chinese government spoiling the business environment for foreign businesses," said a human resources officer with a British consultancy. "We would choose not to abide by it initially since there's no mention of a penalty in the rule."

Hu Jingjing, a corporate lawyer at state-owned recruitment firm China International Intellectual Shanghai, said: "The rule will certainly have a negative impact on both domestic and foreign companies."

September 6 2011 Share

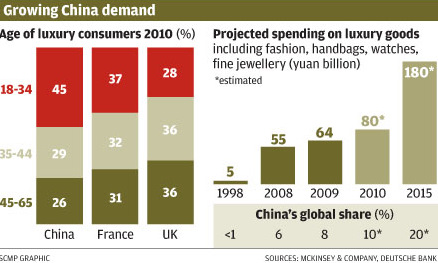

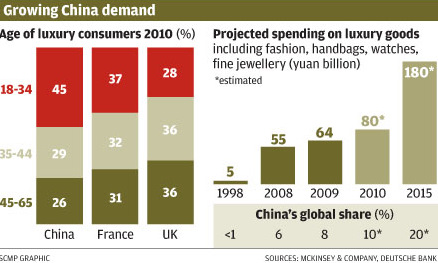

China to Overtake Japan in Luxury Demand

Shoppers look at an Emperor Watch & Jewellery display in Hong Kong.

China’s consumers are pushing the nation to the top once again.

It will overtake Japan this year to be the country with the biggest appetite for luxury goods, HSBC predicts in a research report issued late last week. The broker said that it expects China’s consumers to keep spending, even if their affluent counterparts in the West stop.

The reasons are, at least in part, cultural. “Displaying wealth has become a trend in China, and we think this will continue to translate into growing purchases of luxury goods for oneself, or as gifts,” HSBC said. “We think consumer habits may not necessarily always correspond to income levels due to the need to socially fit in and show off wealth.”

It added a historical note: “In Chinese and Russian communist societies, individual property was not allowed and private wealth was traditionally suspicious. With the liberalization of the economy, a new class system was created where your place on the ladder may depend on how much money one earns, and owning luxury goods can help display the level of one’s wealth.”

Social changes occurring around the world, such as people marrying later, women’s growing financial independence and increasing brand awareness, may also be fueling the growth in China, HSBC said.

Aug 31 2011

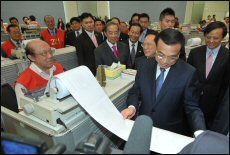

Hong Kong: China’s RMB Center

Speaking at a forum on China’s 12th Five-Year Program, China’s Vice Premier of the State Council Li Keqiang unveils new economic initiatives to strengthen Hong Kong’s developing role as the mainland’s renminbi

center

Beijing has unveiled a raft of new economic measures to boost Hong Kong’s status as an international financial centre, and help Hong Kong companies gain a stronger foothold into the Chinese mainland market. The mainland’s Vice Premier of the State Council Li Keqiang announced the latest Central Government initiatives during a visit to Hong Kong earlier this month.

Mr Li said it was in the interests of all concerned that Hong Kong continue “to bring out the unique advantages it has developed over the years and play its irreplaceable role in the mainland’s reform, opening-up and

modernization drive.”

The new initiatives will further open up the mainland market to Hong Kong’s services industry. It will also upgrade Hong Kong’s standing as an international financial capital, expanding Hong Kong’s role as an offshore renminbi centre.

Green Light for Mainland Equity Investors

More mainland companies will be allowed to sell renminbi bonds in Hong Kong under new measures announced by the Central Government

Of the measures unveiled, 12 are related to financial services and the development of the offshore renminbi market. One will allow mainland investors to invest in Hong Kong stocks through the long-awaited index-tracking Exchange Traded Fund, which will be launched this year. Another scheme, allowing companies to settle trade in renminbi in 20 provinces, will be expanded nationwide.

More mainland companies will also be allowed to sell renminbi bonds in Hong Kong. Mr Li, during his visit, officiated at the launch of the third issuance of Rmb20 billion worth of mainland sovereign bonds in Hong Kong, the largest to date.

Industry representatives believe the move will reinforce Hong Kong’s role as China’s renminbi centre. “Encouraging more mainland enterprises to issue yuan bonds in Hong Kong will help diversify yuan-denominated products in the city,” Standard Chartered Bank (Hong Kong) Chief Executive Benjamin Hung was quoted in The Standard, a Hong Kong daily newspaper.

“China is speeding up its pace of internationalising the currency by these new measures,” Andrew Fung, head of treasury and investment at the Hang Seng Bank, told the South China Morning Post. “Most importantly, the Vice-Premier has confirmed Hong Kong’s role as an offshore yuan trading centre for China.”

Free Trade by 2015

Vice Premier Li Keqiang checks out the day’s trading results during a visit to the Hong Kong Stock Exchange

In addition, the latest supplement of the Hong Kong-mainland Closer Economic Partnership Arrangement, expected to be signed in October, will broaden Hong Kong’s access to mainland services industries. “The target is to realise free service trade with Hong Kong by the end of the 12th five-year period,” Mr Li said at a Hong Kong forum on China’s 12th Five-Year

Program. Sectors to be opened up include banking and insurance, allowing Hong Kong companies to set up across the border.

“Taken as a whole, this comprehensive range of new measures will provide substantial opportunities across a wide spectrum of Hong Kong business activity,” said Hong Kong Chief Executive Donald Tsang. “This will help us maintain economic growth at a time when global economic conditions are fragile.”

Services Advantage

Financial Secretary John Tsang said that moves to open up the mainland services industry offer huge advantages to Hong Kong companies. He noted that Hong Kong’s services industry makes up 93 per cent of the city’s GDP.

“China lags far behind developed countries by 20 per cent, where the service industry on average accounts for about 70 per cent,” he said. “For those companies that want to tap the mainland’s market and help lift the industry standards higher, there is a huge and long-term opportunity for Hong Kong, as the services sector is one of our strengths.”

August 13 2011

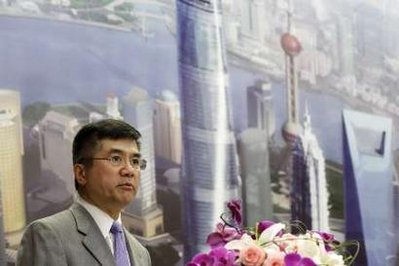

New US envoy Locke aims to cement ties - Internet users amazed at low-key arrival in Beijing of first Chinese-American ambassador

By Zhuang Pinghui

America's new ambassador to China, the first Chinese-American to hold the critical post, has arrived in Beijing amid speculation on how the new envoy will promote mutual trust while handling the many differences between the two countries.

Speaking at Beijing airport (SEHK: 0694) late on Friday night, Gary Locke expressed his excitement at taking up his new assignment and was confident he would be good bridge between the two nations.

"I am very excited to be here as US ambassador to the great country of China. The whole family is excited," said Locke during an interview with China Central Television. "The US and China have many areas of co-operation and great opportunities to improve our relations."

He said he would present his credentials and visit schools yesterday.

Locke's flight to Beijing itself has become an online sensation, with many internet users amazed that one of America's most important diplomats was seen flying in economy class, with no bodyguard or entourage and carrying his own luggage.

An internet user at weibo.com, Tang Zhaohui , a technology businessman, said he was standing in queue for coffee behind Locke at Seattle airport when the ambassador, who was carrying a backpack, handed what appeared to be a voucher to the cashier who later told Locke it could not be used.

"He didn't give the ambassador any face at all," Tang said. "But the ambassador wasn't angry and paid with his credit card instead." Tang posted a photo Locke at the coffee lounge online.

Locke's family were also seen on television carrying their own luggage.

Almost 7,000 internet users left comments at Tang's photo, with most praising the Locke's down-to-earth style.

Some joked that the ambassador, previously the US secretary for commerce and a former governor of Washington state, looked more like a petitioner in Beijing than "a typical township official from China who would be taking a far more extravagant trip than this".

Some also warned about holding too high expectations of Locke that, despite his Chinese roots and appearance, was an American who would stand up for the interests of his country.

The state-owned media welcomed Locke with reports urging him to help "rebuild" America's financial reputation.

"Amid the concerns over the gloomy economic future of the US, it is Locke's responsibility to relieve anxiety in China towards US debt after the downgrade of US government's credit rating," reported China Daily, citing Zhou Qi, a top researcher at the Chinese Academy of Social Sciences.

By far America's largest foreign creditor, China held US$1.16 trillion in US debt in May.

Locke has his work cut out for him, but boosting the credibility and stability of US debt and minimising the side effects brought by the US' recent credit rating downgrade were certainly important.

August 2 2011

United States has much to gain from China: Gary Locke - the new US ambassador to China

Hillary Rodham Clinton swears in former commerce secretary Gary Locke as the first Chinese-American US Ambassador to China

Gary Locke on Monday formally resigned as United States commerce secretary and became the new US ambassador to China, promising to reap benefits from a difficult and sensitive bilateral relationship.

Sworn in by US Secretary of State Hillary Rodham Clinton, who alluded to the challenges he will face, Locke, the first Chinese-American to hold the prestigious post, said both countries had much to gain from each other.

Locke said he would continue co-operative work to curb climate change, seek cleaner sources of energy and stop nuclear proliferation, as well as efforts he pursued as commerce secretary to open Chinese markets to US goods and services.

The new envoy succeeds Republican former Utah governor Jon Huntsman, who left Beijing three months ago to run against former boss, US President Barack Obama, in next year's election.

Locke also vowed to manage areas where he said the two countries have "differences" or "serious disagreement". These include Beijing's export-driven economic policies, and growing military spending.

Locke, 61, takes over at a time of tensions in U.S.-China relations, which have been fraught over a range of disputes including Beijing's export-driven economic policies, growing military spending and human rights record.

The two countries also have differences over U.S. arms sales to Taiwan, U.S. support for Tibet and China's pursuit of claims over potentially resource-rich islands in the South China Sea.

“I will work to keep the lines of communication open, to convey the administration's positions clearly and to engage with Chinese government officials at the highest levels,” Locke said, referring to “sensitive” areas.

He also hoped “to do more to communicate directly with the Chinese people to improve understanding between our two great nations.”

In May, Obama nominated John Bryson to serve as the next commerce secretary. Pending his confirmation, acting deputy commerce secretary Rebecca Blank will serve as acting commerce secretary.

In a Commerce Department statement announcing his resignation as commerce secretary, Locke touted what he said were increased exports, a reduced backlog for patent applications and a first step toward reforming export controls.

July 27 2011

Branding on the Mainland China

Alex Lau, Manager of the Intellectual Property Center at the Federation of Hong Kong Industries, is an IP advisor to the Hong Kong Trade and Industries Department. He recently spoke at a China Business Workshop,

organized by the Hong Kong Trade Development Council, on how to brand on the Chinese mainland.

What are the first steps for an enterprise that wants to set up on the Chinese mainland?

If you want to do business on the mainland, the first thing is to get a registered trademark and a registered domain name. The three: product, brand and trademark, should be one.

Companies should think of developing different brands if one brand has already been well accepted. Doing so increases the chance of being remembered and helps the company gain market share. It also raises the bar for other companies entering the market. Many such examples abound, including P&G, which has developed different hair-care brands under the names: Rejoice, VS Sassoon, Pantene Pro-V, Head & Shoulders, Wella and Clairol, to meet the diverse needs of consumers and to target different customers.

When does trademark ownership take effect on the mainland?

The protection of intellectual property is such an important issue including on the mainland. Due to different rules and regulations, trademark ownership is decided based on the time the brand was registered. In Hong Kong, trademark useage takes effect immediately. You are allowed to use the trademark before registering it. But on the mainland, a trademark is allowed to be used only after registration and if no other companies have registered the trademark before.

It also usually takes three months for a trademark to get registered in Hong Kong whereas on the mainland, it could take up to three years. If a company has no trademark, the brand name should be unique enough to stand out from others. Names such as Kodak and Revlon were especially designed in order to create brand awareness in a shorter period of time.

What are some of the little-known details businesses should be aware of when registering a trademark on the mainland?

The Nice Agreement is a classification of goods and services for the purpose of trademark registration, which has become international

practice since 45 classes were identified in France in 1957. It’s extremely important for applicants to specifiy what classes their trademarks belong to when planning to register.

Sometimes you get a situation when company A registers a trademark for classes 1 to 10, and company B registers the same trademark for classes 11 to 20. If that’s the case, it takes a great amount of time for the companies to succeed in the market. That’s why a trademark should always come with a suitable market strategy for brand promotion.

What are some of the pitfalls?

Businesses on the mainland should stay vigilant to all the products they sell under the trademark because they would be held accountable if there are quality concerns even in just one of the products.

A successful brandname does not come overnight. For example, McDonald’s slogan “I’m loving it” did not take off until 2006 after a three-year advertising campaign. And it took nearly a decade for Nokia’s “Connecting People” and Apple’s iPhone to start becoming household names.

What specific advice do you have for would-be franchisers and licensors?

Franchising and licensing are common strategies for companies to expand on the mainland. A franchisor or a licensor would be responsible for the quality of the products sold by their franchisees or licensees, which is clearly stated by mainland rules and regulations. However, these rules do not apply to franchisors or licensors in Hong Kong. The Chinese Trademark Law has clear provisions regarding this. There are other relevant provisions on other aspects regarding quality inspection and control, consumer protection and fair competition.

Are there any other unique rules specific to trademark registration?

Language is important. It is crucial to assign a Chinese name for an English brand when it comes to registration, because there could be homophonic Chinese names already in use.

Companies also need to pay attention to time limits on the mainland. For instance, a company might lose a registered trademark if it has been inactive for three consecutive years; and companies with a well-known trademark can’t sue a similar trademark for infringement if no action was taken within five years.

July 19 2011

Trading Progress With Beijing - The global trading system incentivized China to drop its "indigenous innovation."

If there's one bright spot in a financially unstable world, it's that the international trading system is proving more resilient. China won a World Trade Organization Appellate Body ruling on EU-imposed antidumping measures last week. And earlier this month Beijing avoided a possible WTO complaint and voluntarily rolled back measures that restricted foreign competition in its domestic markets.

Blades for wind turbines manufactured for Tang Energy Group in China are off-loaded for delivery to Tooele Army Depot in Tooele, Utah, at the Port of Long Beach, California, U.S., in 2010.

China eliminated three "indigenous innovation" rules that gave domestic companies preferential treatment to government contracts. During his visit to Washington in January, President Hu Jintao pledged to eliminate the protectionist rules, and Beijing carried through on that promise. However, the true test of whether this protectionist episode is in the past will be how the new policy is implemented at the local level.

The idea of promoting indigenous innovation surfaced in 2006, as Beijing directed several government agencies to come up with laws which would promote domestic products and technologies. This expanded into a regulatory framework that gave those domestic companies deemed sufficiently innovative access to tax benefits, financing, priority in receiving government contracts and other forms of preferential treatment.

The biggest component of "indigenous innovation" policies deals with the government procurement market. The American and European Chambers of Commerce in Beijing complained these polices shut out foreign companies from business with government at all levels. With three of the most irritating rules removed, foreign businesses are encouraged but warn not all their concerns have been allayed.

Among the biggest questions is how local governments will respond. City and provincial governments account for the bulk of the government procurement market. While the central government's Ministry of Finance has directed the changes at them, local government bureaucrats and politicians may still favor local companies when making purchasing decisions.

Many local governments have set up product catalogues which determine what they can buy, and these catalogues are now made up almost entirely of domestic products. The US-China Business Council found that of 523 products listed in Shanghai's "indigenous innovation" catalogue, just two were made by foreign companies. China has yet to direct local governments to eliminate these catalogues, which constitute a major barrier to foreign companies obtaining access to the government procurement market.

The Commerce Ministry expressed its satisfaction Saturday with its antidumping win at the WTO. That victory is a reminder that respect for trade agreements benefits all countries, but arguably none more than China. Beijing has plenty of incentive to make sure local governments live up to Mr. Hu's promises, and not to embark on more programs that let the protectionist genie out of the bottle.

July 18 2011

How to Marry Rich in China By Robert Frank

With wealth comes gold-diggers, and China now has a bounty of both.

Chinese now can learn how to shop for millionaires and billionaires.

A new school called in Beijing called the Moral Education Center for Women is offering courses in how to snag a billionaire or millionaire. The 30-hours of training, which costs $3,000, teaches them everything from proper make-up application to conversational skills and traditional tea-pouring techniques, according to this Reuters article. They also learn how to read a man’s character and status. (China has yet to launch an equal-opportunity school for male gold-diggers.)

The school has attracted 2,800 women.

As one student explained: “I thought to myself, if I can marry a rich man, at least I won’t have any worries.”

The school also serves as matchmaker between the gold and diggers. Rich bachelors can pay $4,500 for an “introductory fee” to the students.

July 13 2011

China’s Regional Boost

Spurred by galloping production of electronics goods in the Chinese mainland’s coastal regions – the traditional engine of mainland manufacturing over the past three decades – demand has grown for electronics production in the country’s central and western regions, forming new manufacturing and supply clusters.

The trend is expected to accelerate as development of the inner regions kicks off under the 12th Five-Year Programme (FYP). The FYP sets out to improve the inland region’s investment environment, through policy support,enhanced infrastructure, and by helping relocate supply chains inland. The moves are expected to draw foreign electronics investment from the coastal regions and overseas to the mainland’s inland region, where there’s an abundant supply of workers and technical personnel. The goal is to wean investors away from the coastal regions where labour shortages have become dire. The upside is that there are new domestic markets to explore and skilled workers are available.

While still based in the coastal province of Shandong, China’s largest home-appliances maker, Haier, produces electrical goods in inland Hubei province to tap the local and nearby markets

Chengdu, Chongqing and Xian, as well as the central provinces of Hubei and Hunan, make up the western regional triangle representing models for the gathering trend.

Electronics plants have been moving inland to meet the increasing input demand on the mainland. For example, Taiwan’s Foxconn, the largest producer of Apple’s iPhone and iPad, along with its parts and components suppliers, has been setting up production facilities in the central and western regions. Local giants such as Midea and Haier are more interested in expanding their production capacity in central China in order to capitalise on the logistics infrastructure there. Other multinationals are studying how to make the most of the western region’s skilled labour and engineering personnel.

The low export-to-sales ratios illustrate how industries in the inland regions rely heavily on domestic sales, with enterprises largely producing parts and semi-manufactures for further processing in coastal regions. These manufacturers have therefore benefited from the keen input demand on the mainland over the past few years. The number of manufacturers are expected to grow further during the FYP period, with the mainland determined to develop inland economies and industries.

Tapping Western China’s Advantages

Western China has nurtured a large number of electronics engineers and related technology personnel (photo: EPN)

To serve their global business needs, multinationals are increasingly “going west” to capitalise on western China’s advantages. Intel, for example, relocated its Shanghai production lines to Chengdu a couple of years ago. Half of its chips produced worldwide are now tested and packaged in its Chengdu plant, which flies against the general perception that western China is not a convenient export base.

Intel air-freights the wafers from its fabrication plants in the United States, Israel, Ireland and Dalian to Chengdu, and sends the packaged chips from Chengdu to domestic and global markets by air, primarily through Hong Kong.

IBM, on the other hand, has set up its service centre in the Chengdu Tianfu Software Park to perform IT outsourcing tasks for its clients on the mainland and overseas markets. IBM’s service centre is well-supported by Sichuan’s local workforce and returning software engineers, who are now less willing to work in the more congested coastal regions.

Western China has nurtured a large number of electronics engineers and related technology personnel. Its well-developed military industry is also a source of high-tech talent for electronics players, with the mainland now transforming more military technology for civilian applications.

Hewlett-Packard’s (HP’s) Chongqing facilities also started operations last year to assemble computers for the booming China and global markets. Apart from cost considerations, HP is capitalising on the abundant supply of local workers.

The movement of multinational electronics companies proves that western China is no longer an obscure region, with its talent, labour and markets conducive to the development of electronics clusters. Also, mainland giants and Taiwan players are increasingly keen to capitalise on the resources and market potential of the western region, while upstream suppliers have followed their clients to tap the increasing input demand there.

Central China Opportunities

The central Chinese mainland city of Wuhan is home to the so-called “Optics Valley of China,” the largest production base for optical fibre cable and optical apparatus

Foreign investors are attracted to set up production facilities in central China to take advantage of lower operational costs, tax benefits, the availability of engineering talent, as well as relatively abundant labour supplies.

But upstream electronics suppliers are also aware of the growing input demand stemming from production activities there. A natural distribution hub, Hubei, is one example. With its skilled labour force and developing supply chains, it has attracted a number of overseas electronics investments in recent years. Foxconn set up production lines in Wuhan, producing computers and electronic game devices for export, while TPV Display Technology makes LCD display monitors and televisions for distribution to domestic clients in the province and nearby.

China’s own Gree, Midea and Haier, on the other hand, produce electrical appliances in the province to tap the local and nearby markets. But Hubei’s electronics suppliers overall still only have limited capacity. Its enterprises need to rely on the Pearl River Delta (PRD) and Yangtze River Delta (YRD) for supplies, such as passive components and testing equipment, and imports for core components such as ICs and semiconductors from abroad.

Wuhan, in Hubei Province, is also home to the so-called “Optics Valley of China,” the largest production base for optical fibre cable and optical apparatus. It is also a leading mainland laser industry base whose businesses are mainly related to industrial laser and medical/consumer electronics applications. The swift expansion of the China opto-electronics market has sparked input demand in Optics Valley, where enterprises have been expanding their production to meet increasing orders.

Hunan Province is also an emerging industrial base. Cities such as Changsha, Hengyang and Chenzhou are eager to establish development zones to promote technology industries and take in processing production that have relocated from coastal regions. Given its proximity to Guangdong and its lower operation costs, Hunan could be an ideal destination for Hong Kong’s electronics companies to relocate or set up additional production facilities outside the PRD.

But Hunan will continue to rely on material supplies from other provinces, as its supply chain is not likely to be developed quickly enough in the short term to satisfy manufacturers. With the speed of development, the influx of foreign investment is likely to put pressure on the local labour market, while pushing up land costs in the medium term.

The availability of engineers and middle-level staff is another concern for newly established enterprises in Hunan. Some investors even need to transfer workers and staff from their PRD or YRD operations to help build their Hunan plants. But the upside to the development process is that some transferred staff may actually come from Hunan, and are keen to work in their home province. Hong Kong manufacturers should consider this when looking at Hunan as a potential alternative to the PRD.

July 12 2011

Bridge changes China's image By Wang Ying

Project success provides visibility, credibility in global infrastructure - "Made in China" used to be synonymous with cheap consumer goods, but one machinery maker wants to change the image of the nation's manufacturing sector by taking part in the world's most challenging infrastructure projects.

On Monday, China's Shanghai Zhenhua Heavy Industry Co Ltd (ZPMC), formerly known as Shanghai Zhenhua Port Machinery Co, finished the final four pieces of fabricated steel for the San Francisco-Oakland Bay Bridge.

A section of the San Francisco-Oakland Bay Bridge made by Shanghai Zhenhua Heavy Industry Co Ltd (ZPMC) being loaded onto a ship in Shanghai on Monday.

In 2006, the company beat strong rivals from Japan, South Korea and Western Europe to win the bid for the Bay Bridge project, due to be open for traffic in 2013.

The 50,000 tons of steel, with a contract value exceeding $350 million, are part of the $7.2 billion Bay Bridge project.

The project includes reconstruction of the eastern span, which was damaged in a 1989 earthquake.

The new section will be able to resist quakes of up to magnitude 8 on the Richter scale.

The Bay Bridge project has a global profile "and it is also a milestone for Zhenhua in entering the world's major bridge construction" sector, Kang Xuezeng, president of ZPMC, said during the steel fabrication completion ceremony on Monday.

"I am here to announce that we are qualified and confident of constructing more sophisticated steel bridges and building our presence in the world market," Kang said.

ZPMC, founded in 1992, now accounts for 75 percent of the global port equipment production market.

The construction company is entering the bridge sector and "I expect many more great things" from the company, said Steve Heminger, executive director of the San Francisco Bay area's metropolitan transportation commission.

"It is time to be confident, but not yet to be proud," said Xiang Haifan, a professor at Tongji University, who is also a member of the Chinese Academy of Engineering.

According to Xiang, ZPMC's chief competitive advantage over international rivals is cost.

A Japanese company wanted more than $600 million to undertake the project, while a South Korean company quoted more than $400 million.

"Our cost was about half that of Japan's, which makes Zhenhua outstanding with its high quality," Xiang said, adding that China's bridge construction abilities still lag behind those of Japan or South Korea, but the gap is likely to vanish in the next 10 to 20 years.

"Although the Bay Bridge project didn't bring Zhenhua substantial profit, it brought many large international contracts and gave the company fame in the global bridge sector," said Wang Hexu, an industrial analyst from Huachuang Securities Brokerage Co Ltd.

Since 1998, ZPMC has undertaken several major steel bridge projects in China and abroad, including the Shanghai Donghai Bridge and the Golden Ears Bridge in Vancouver, Canada.

Since it already dominates global port equipment production, ZPMC is finding it increasingly hard to expand in this sector, so it has decided to explore related industries.

"Steel fabrication has become our next goal. Through providing steel decks, we have driven into the world's high-end bridge construction market," said Huang Hongyu, vice-president of ZPMC.

"Currently, steel fabrication and marine engineering account for more than 40 percent of Zhenhua's total revenue, and by the end of 2015, the proportion will reach as much as 50 percent," said Kang.

July 11 2011

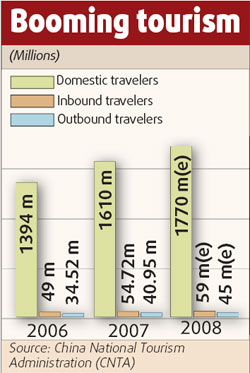

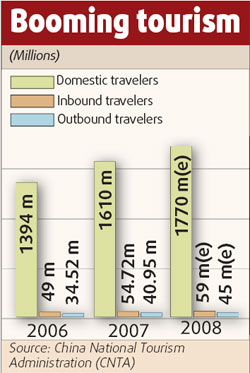

What a Chinese Hotel Guest Wants: Congee, Slippers and Tea By Jason Chow

Hoteliers are bending over backward to woo Chinese travelers these days, and hotel chain Hilton Worldwide thinks slippers and tea will do the trick.

The international chain unveiled on Monday a new program called “Hilton Huanying” (which means “welcome” in Mandarin) — what the company touted as “a tailored experience for Chinese travelers.” Thirty hotels in destinations around the world are part of the program, which, the hotel company says, has been backed by extensive research in the ethnic demographic.

So what does Hilton think Chinese travelers want from a hotel? First: a staffer to help them check into their room in their native Chinese language. Then, once in the room, travelers from China will have access to tea kettles, Chinese tea and slippers as well as a welcome letter in Chinese and TV channels dedicated to Chinese programming. But perhaps most telling is the breakfast buffet: Two varieties of congee, fried noodles, dim sum, fried fritters and soy milk will be on offer. (Scene Asia has also documented Chinese travelers’ breakfast obsession.)

The Chinese travel market is growing strong, and everybody in the travel industry – including state governors and mayors of middling Canadian cities – is trying to grab a share of it. As China becomes increasingly wealthy and as the Chinese government relaxes restrictions on outbound travel, the market has exploded over the past two years – Paris and Shangri-La hotels being the preferred destination and hotel of the Chinese jetset.

Still, Hilton’s efforts are just the latest among several chains, including Starwood Hotels & Resorts Worldwide and Marriott International Inc., the latter of which is also offering congee on its breakfast menu. The WSJ’s Alexandra Berzon on Monday wrapped up what various chains are doing to cater to the fast-growing Chinese market.

July 9 2011

China vs. America: Which Is the Developing Country? By Robert J. Herbold - retired COO of Microsoft

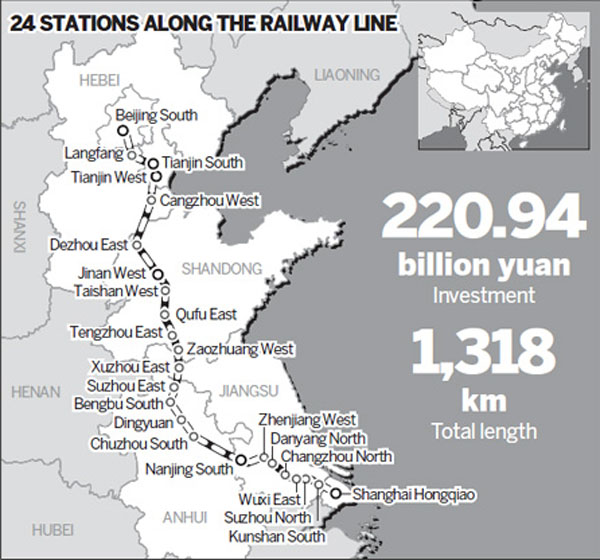

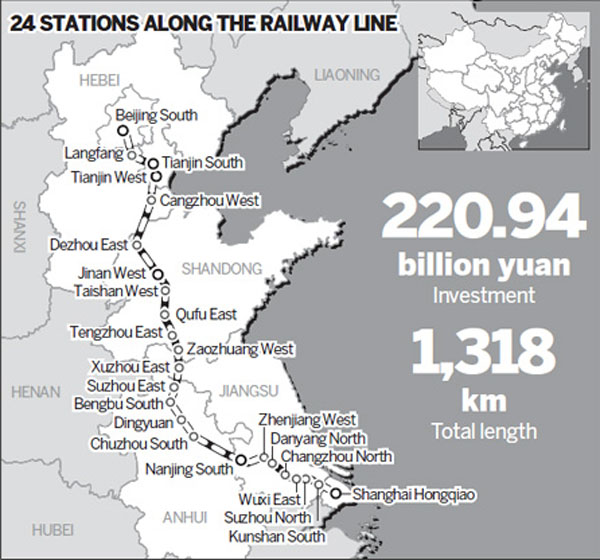

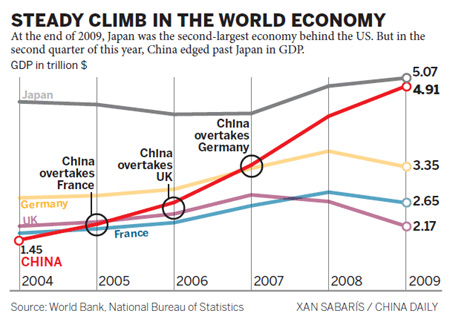

From new roads to wise leadership, sound financials and five-year plans, Beijing has the winning approach. The just-completed Beijing to Shanghai high-speed rail link is the crown jewel of China's current 5,000 miles of rail.

Recently I flew from Los Angeles to China to attend a corporate board-of-directors meeting in Shanghai, as well as customer and government visits there and in Beijing. After the trip was over, in thinking about the United States and China, it was not clear to me which is the developed, and which is the developing, country.

Infrastructure: Let's face it, Los Angeles is decaying. Its airport is cramped and dirty, too small for the volume it tries to handle and in a state of disrepair. In contrast, the airports in Beijing and Shanghai are brand new, clean and incredibly spacious, with friendly, courteous staff galore. They are extremely well-designed to handle the large volume of air traffic needed to carry out global business these days.

In traveling the highways around Los Angeles to get to the airport, you are struck by the state of disrepair there, too. Of course, everyone knows California is bankrupt and that is probably the reason why. In contrast, the infrastructure in the major Chinese cities such as Shanghai and Beijing is absolute state-of-the-art and relatively new.

The congestion in the two cities is similar. In China, consumers are buying 18 million cars per year compared to 11 million in the U.S. China is working hard building roads to keep up with the gigantic demand for the automobile.

The just-completed Beijing to Shanghai high-speed rail link, which takes less than five hours for the 800-mile trip, is the crown jewel of China's current 5,000 miles of rail, set to grow to 10,000 miles in 2020. Compare that to decaying Amtrak.

Government Leadership: Here the differences are staggering. In every meeting we attended, with four different customers of our company as well as representatives from four different arms of the Chinese government, our hosts began their presentation with a brief discussion of China's new five-year-plan. This is the 12th five-year plan and it was announced in March 2011. Each of these groups reminded us that the new five-year plan is primarily focused on three things: 1) improving innovation in the country; 2) making significant improvements in the environmental footprint of China; and 3) continuing to create jobs to employ large numbers of people moving from rural to urban areas. Can you imagine the U.S. Congress and president emerging with a unified five-year plan that they actually achieve (like China typically does)?

The specificity of China's goals in each element of the five-year plan is impressive. For example, China plans to cut carbon emissions by 17% by 2016. In the same time frame, China's high-tech industries are to grow to 15% of the economy from 3% today.

Government Finances: This topic is, frankly, embarrassing. China manages its economy with incredible care and is sitting on trillions of dollars of reserves. In contrast, the U.S. government has managed its financials very poorly over the years and is flirting with a Greece-like catastrophe.

Human Rights/Free Speech: In this area, our American view is that China has a ton of work to do. Their view is that we are nuts for not blocking pornography and antigovernment points-of-view from our youth and citizens.

Technology and Innovation: To give you a feel for China's determination to become globally competitive in technology innovation, let me cite some statistics from two facilities we visited. Over the last 10 years, the Institute of Biophysics, an arm of the Chinese Academy of Science, has received very significant investment by the Chinese government. Today it consists of more than 3,000 talented scientists focused on doing world-class research in areas such as protein science, and brain and cognitive sciences.

We also visited the new Shanghai Advanced Research Institute, another arm of the Chinese Academy of Science. This gigantic science and technology park is under construction and today consists of four buildings, but it will grow to over 60 buildings on a large piece of land equivalent to about a third of a square mile. It is being staffed by Ph.D.-caliber researchers. Their goal statement is fairly straightforward: "To be a pioneer in the development of new technologies relevant to business."

All of the various institutes being run by the Chinese Academy of Science are going to be significantly increased in size, and staffing will be aided by a new recruiting program called "Ten Thousand Talents." This is an effort by the Chinese government to reach out to Chinese individuals who have been trained, and currently reside, outside China. They are focusing on those who are world-class in their technical abilities, primarily at the Ph.D. level, at work in various universities and science institutes abroad. In each year of this new five-year plan, the goal is to recruit 2,000 of these individuals to return to China.

Reasons and Cure: Given all of the above, I think you can see why I pose the fundamental question: Which is the developing country and which is the developed country? The next questions are: Why is this occurring and what should the U.S. do?

Let's face it—we are getting beaten because the U.S. government can't seem to make big improvements. Issues quickly get polarized, and then further polarized by the media, which needs extreme viewpoints to draw attention and increase audience size. The autocratic Chinese leadership gets things done fast (currently the autocrats seem to be highly effective).

What is the cure? Washington politicians and American voters need to snap to and realize they are getting beaten—and make big changes that put the U.S. back on track: Fix the budget and the burden of entitlements; implement an aggressive five-year debt-reduction plan, and start approving some winning plans. Wake up, America!

Mr. Herbold, a retired chief operating officer of Microsoft Corporation, is the managing director of The Herbold Group, LLC and author of "What's Holding You Back? Ten Bold Steps That Define Gutsy Leaders" (Wiley/Jossey-Bass, 2011).

July 7 2011

China’s Retail Market, 2011

Overview

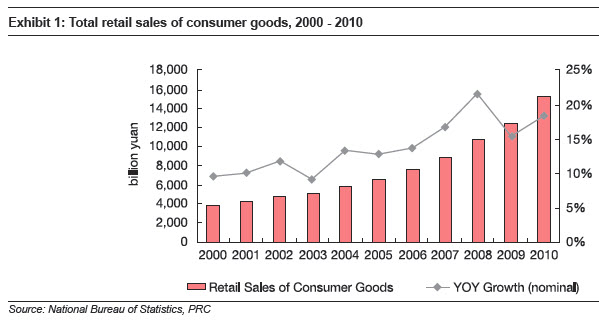

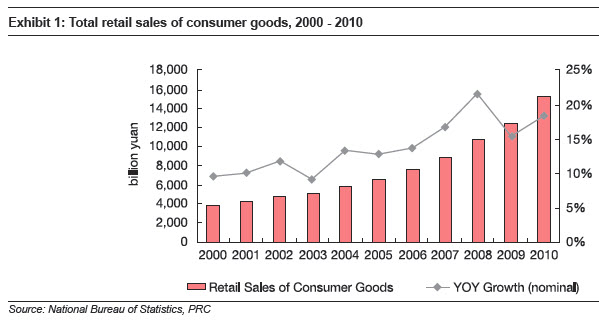

Real growth of retail sales of consumer goods moderated to 14.8% yoy in 2010; retail sales grew nominally by 16.6% yoy in the first five months of 2011

Retail sales are primarily urban-driven; urbanities contributed to 86.5% of China’s total retail sales in 2010

In 2010, eastern provinces and municipalities accounted for 59.9% of the national total retail sales of consumer goods; inland regions are expected to demonstrate better growth momentum in the years ahead

The declining trend of consumer confidence index was arrested in March 2011; entrepreneur confidence index of the wholesale and retail sector was significantly higher than the national average

Luxury sales in China registered strong growth in 2010

Boosting domestic private consumption is a major theme of China’s 12th Five-year plan (2011-2015)

Competitive landscape

The Top 100 retailers had around one-tenth of total market share; their sales revenue grew by 21.2% in 2010

Most domestic retailers are region-focused

Eyeing huge opportunities, foreign retailers continue to flock to China; nevertheless, winning in China is not an easy task

Multi-format operation is common, especially among domestic retailers

Franchise businesses are expanding

Latest developments

Retailers face climbing costs

Online retailing market continues its staggering growth

Retailers strive to improve competitiveness

Retailers extend their footprints to lower-tier cities and the rural market

More active retailers’ IPO activities

Retailer- supplier relationship continues to catch attention

Consumption safety remains a major concern; we expect retailers in China to pay more attention to compliance and quality issues

I. Overview

1. Real growth of retail sales of consumer goods moderated to 14.8% in 2010; retail sales grew nominally by 16.6% in the first five months of 2011

According to the National Bureau of Statistics (NBS), the total retail sales of consumer goods reached 15,455.4 billion yuan in 2010, up nominally by 18.4% year-on-year (yoy); real growth in 2010 was 14.8%, slower than the 16.9% real growth in 2009.

In the first five months of 2011, the retail sales of consumer goods grew nominally by 16.6% to reach 7,126.8 billion yuan. Exhibit 2 demonstrates the nominal monthly retail sales growth from April 2010 to May 2011. Nominal retail sales growth dropped to 11.6% in February 2011, before climbing to 17.4% in March 2011 and moderating to 17.1% and 16.9% in April and May 2011. The fact that the Lunar New Year holiday in 2011 was in early February and part of consumers’ holiday spending was realized in January partly explains the relatively lackluster growth in February.

June 10 2011

Selling Tea to China - Where do Chinese people go to purchase the best Chinese tea? Not China

By Ilaria Maria Sala

Mainland Chinese visitors to this former British colony are renowned for stocking up on luxury goods like Prada and Louis Vuitton handbags that are cheaper than at home, and less likely to be counterfeits. But now there's a new trend in trophy purchases to show off back home: top-quality Chinese tea.

Catherine Tam, shop manager at Fook Ming Tong, one of Hong Kong's best-known tea shops, explains that Chinese customers are buying up a variety called Da Hong Pao, or "Big Red Robe." From the oolong (or semi-fermented) family, it's grown in the fabled Wuyi mountains in northern Fujian province. Shrouded in mist during most of the year, this area comprised of 36 stony peaks has been used to cultivate "rock teas" since the Tang dynasty (A.D. 618-907).

Rock teas brew a dark, reddish liquor, with an initially bitter, slightly woody flavor, that quickly metamorphoses into a sweet and lingering aftertaste, with delicate hints of honey and fruit. The leaves, long and twisted, can be infused up to 15 times. As is common with many products in China, Da Hong Pao is believed to have health benefits: "It helps fight cholesterol, and has antioxidant properties," explains Ms. Tam.

As legend has it, Da Hong Pao derives its name not from the reddish hue of its leaves, or the tea liquor, but from an emperor's favor. The mother of a Ming dynasty emperor was cured of what today we would call high cholesterol by drinking Da Hong Pao. To thank the bushes that saved her, the filial emperor sent mandarin red silk robes to cover the tea trees—rewarding them, so to speak, by giving them scholar status.

The original handful of Da Hong Pao bushes, which have been harvested since the Song dynasty (A.D. 960-1279, a golden age for tea appreciation), are said to produce the very best Da Hong Pao, and a few grams of it can fetch hundreds of dollars. Until 2005, these leaves were reserved for the Chinese government. Then, the tea plantations on Wuyi mountain were privatized, some cultivars removed from the original bushes transplanted to other locations, and a lot of different grades of Da Hong Pao have since been hitting the market.

Tea connoisseurs appreciate Da Hong Pao's finer qualities, but it commands high prices for another reason: the thrill of enjoying something that used to be reserved for the most exclusive elite due to its rarity. Previously, other than imperial and Communist Party big shots, the tea was reserved for visiting dignitaries. An oft-quoted story recalls that Richard Nixon was given 50 grams of Da Hong Pao by Mao Zedong in 1972. Shortly afterward, Nixon quipped with his aides that the Chinese leader must be quite stingy to part with such a small amount of leaves, but he understood the value of the gift when someone told him that what he had been given was half of the whole harvest of top-grade Da Hong Pao for that year.

As with many other coveted products in the freewheeling Chinese marketplace, however, there are now plenty of counterfeits swirling around. Unscrupulous suppliers have been packaging lower-quality oolong as Da Hong Pao, or enhancing low-quality leaves with chemical additives. Which in turn explains why Hong Kong is so popular as a place to buy it.

"Mainland customers buy it from us in Hong Kong mainly because they trust our thoroughness with provenance," says Ms. Tam. "We have very strict quality controls, with our own personnel at every step of the way, which guarantees that what we market as Wuyi Da Hong Pao really is what it says. We only provide 70 boxes a year, and no more, as this is the amount we can guarantee to be pure, high-grade Da Hong Pao."

Farther afield, too, Chinese shoppers stop at the best tea retailers. In Paris, you might be surprised to see the flagship store and tea room of Mariage Freres, in the trendy Marais neighborhood, packed with excited Chinese tourists, but Laurent Sonnino, the shop manager, is not. "We stopped being surprised years ago. Chinese visitors just keep flocking in," he beams.

"They are very brand conscious, in particular for gifts to carry back home that show refinement and luxury," Mr. Sonnino explains. "Nowadays, a growing minority is buying the best teas imported from India and some of our mélanges, and, yes, increasingly, some of the top-grade Chinese tea as well."

As Chinese consumers remain weary of the countless food scandals that rock the country on a seemingly daily basis, tea, that commodity so coveted by foreign traders coming to China in the 18th century, is now making an unexpected round-trip journey.

June 2, 2011

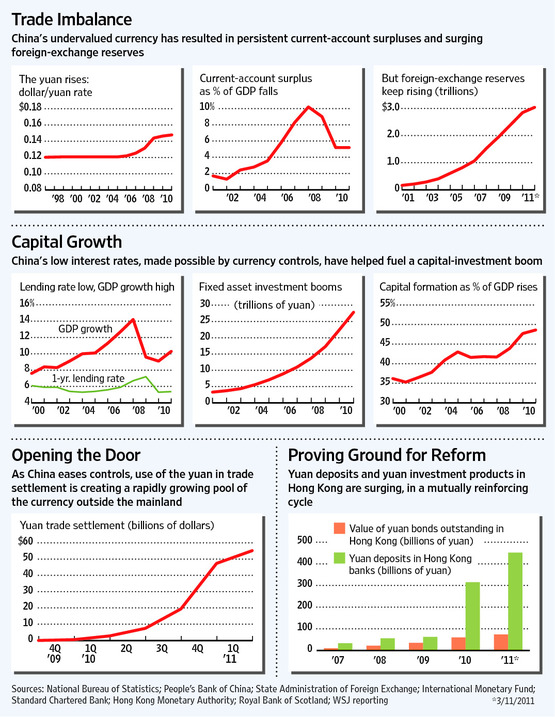

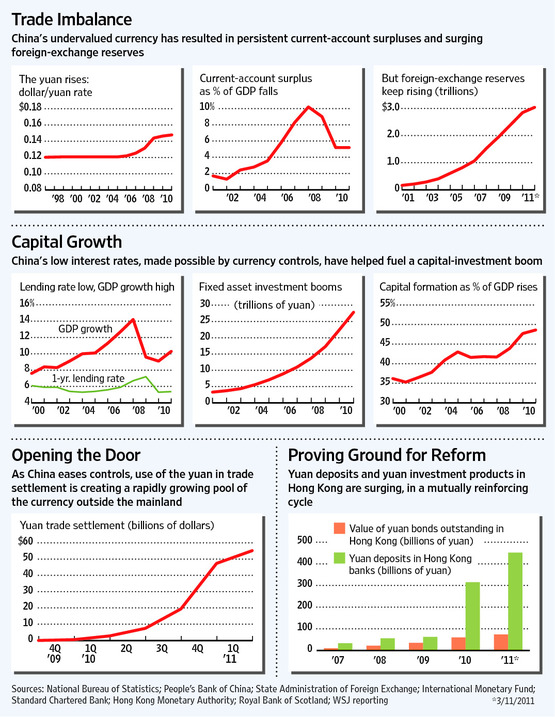

Get Ready: Here Comes the Yuan By Tom Orlik

The rise of China's currency could reshape the global monetary system— and fundamentally alter the world's main engine of growth.

The wall is starting to crack.

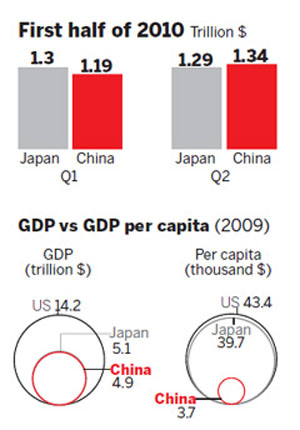

For years, China has made it tough for capital to flow to and from its economy, the second-largest in the world. Now, the government in Beijing is forging ahead with a campaign to bring the yuan onto the world stage—and breaches are appearing in that formidable financial barrier.

What's Ahead for the Yuan?

A yuan that's more widely used in international trade and investment could eventually challenge the dollar's supremacy, correct some of the imbalances that plague the Chinese and global economy, and force a profligate U.S. to live within its means.

It won't be an easy transition. There are powerful vested interests in China that are satisfied with the status quo and will try to put the brakes on any reform effort. But the changes China has made so far have generated momentum both at home and internationally—and may prove too strong to resist.

For more than a decade, China's closed capital account has been a defining feature of the global economy. It has insulated the mainland from international capital flows, enabling China to ride out the Asian financial crisis in 1997 and leaving its banks unscathed by the near-collapse of the U.S. financial system in 2008.

As important, denying foreign-exchange markets a role in setting the exchange rate has allowed the government to maintain the value of the yuan at an artificially low level—supporting a 30-year export boom. Since Chinese savers can't take their money overseas, banks have also gotten away with offering them low interest rates, keeping the cost of capital for industry at bargain-basement prices and underpinning an investment binge.

Take the example of Shenzhen—a fishing village in 1979, in 2011 a metropolis of 14 million built around the world's fourth-busiest port. Low-cost capital subsidized the construction of transport and power infrastructure, factories and production lines. An undervalued yuan, combined with low cost of labor, enabled companies to undercut their foreign rivals on price.

But manipulation of the exchange rate and repression of the interest rate comes at a cost. Cheap capital has resulted in overcapacity in the industrial sector and bubbles in the mainland's property market. Managing the exchange rate in the face of trade surpluses has resulted in the buildup of gargantuan foreign-exchange reserves—$3.04 trillion that China has little choice but to recycle as cut-price loans to the U.S.

One of the first cracks in China's restrictive policy came in July 2009, with a plan to allow settlement of import and export transactions in yuan. Wider international use of the yuan is intended to reduce transaction costs for China's importers and exporters, guard against the risk of a collapse in dollar trade financing—as occurred at the end of 2008—and fly the flag for a rising economic world power.

By the first quarter of 2011, $55 billion of China's trade—7% of the total—was settled in yuan. At the end of April 2011, yuan deposits in the Hong Kong banking system had risen to 511 billion, or $79 billion, up roughly ninefold from July 2009 when the settlement program was launched.

Restrictions on outbound flows are also being lifted. In the past month, the Shanghai government announced plans to allow residents of the city to make investments overseas.

But more substantial opening of the capital account will require progress in two areas: an exchange rate that is close to fair value and market-set interest rates. The yuan is still undervalued, but two factors suggest it's much closer to market value than it used to be: It has appreciated 20% in real terms against a trade-weighted basket of currencies since 2005, and China's current-account surplus fell to 5.2% of gross domestic product in 2010 from 10.1% in 2007.

If the yuan is approaching fair value, the Chinese government will be able to loosen controls on the capital account with less chance of triggering destabilizing speculative inflows.

China's interest rates, meanwhile, are still set by the government. But the People's Bank of China is attempting to make progress, by taking a leaf out of the mainland's economic history.

At the beginning of the reform era, China's government designated Shenzhen as a special economic zone where market-based policies could be tried before being expanded to the rest of the country. Hong Kong will serve as a similar site of experimentation for reform of the mainland's financial system. Yields on yuan-denominated debt trading in Hong Kong are already set by the market rather than with reference to the People's Bank of China's benchmark interest rate.